ROSEN, LEADING INVESTOR COUNSEL, Encourages Sprinklr, Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action – CXM

NEW YORK, Sept. 27, 2024 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of Sprinklr, Inc. CXM between March 29, 2023 and June 5, 2024, both dates inclusive (the “Class Period”), of the important October 15, 2024 lead plaintiff deadline.

SO WHAT: If you purchased Sprinklr securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the Sprinklr class action, go to https://rosenlegal.com/submit-form/?case_id=27960 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than October 15, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, statements made throughout the Class Period were false and/or materially misleading because defendants created the false impression that they possessed reliable information pertaining to Sprinklr’s projected revenue outlook and anticipated growth while also minimizing risk from seasonality and macroeconomic fluctuations. In truth, Sprinklr had significantly shifted its focus away from proven growth areas to focus aggressively on scaling a new business venture with Contact Center as a Service (“CCaaS”), resulting in artificially inflated short-term growth. Defendants misled investors by continually providing projections which failed to account for the difficulties in the implementation of scaling their new product and/or otherwise failed to adequately disclose the fact that Sprinklr at the current time did not have adequate forecasting processes. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the Sprinklr class action, go to https://rosenlegal.com/submit-form/?case_id=27960 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Week in Canadian Press Releases: 10 Stories You Need to See

A roundup of the most newsworthy press releases from Cision Distribution this week

TORONTO, Sept. 27, 2024 /CNW/ – With thousands of press releases published each week, it can be difficult to keep up with everything on Cision. To help journalists and consumers stay on top of the week’s most newsworthy and popular releases, here’s a recap of some major stories from the week that shouldn’t be missed.

The list below includes the headline (with a link to the full text) and an excerpt from each story. Click on the press release headlines to access accompanying multimedia assets that are available for download.

- Tell ’em with Tims: Tim Hortons celebrating National Coffee Day with limited-edition hot coffee cups to share a motivational message with family and friends

“For many of our guests, the simple act of treating their loved ones with a Tims coffee can mean so much – and we wanted to celebrate that power of connection and kindness with limited-edition cups that we’re serving in the leadup to National Coffee Day on Sept. 29,” said Hope Bagozzi, Chief Marketing Officer for Tim Hortons. Available while supplies last, there are five bilingual National Coffee Day cup designs that will be randomly served to guests who order a medium hot coffee starting tomorrow, including the messages: You Got This, Cheers, Here’s To You, You Do You, or XOXO. - Lightspeed Commerce Responds to Media Reports

Lightspeed Commerce Inc. LSPD (TSX: LSPD) (“Lightspeed” or the “Company“), today issued the following statement: While it is the long-standing policy of Lightspeed not to comment on market rumors, the Company notes the recent media reports concerning a potential transaction involving the Company. Lightspeed periodically undertakes, and is currently conducting, a strategic review of its business and operations with a view to realizing its full potential. In this context, the Company has engaged, and may continue to engage, in discussions relating to a range of potential strategic alternatives. - Prime Video Announces Trailer and Premiere Date of FACEOFF: Inside the NHL – the Highly Anticipated Docuseries from Box To Box and NHL Productions

Prime Video announced the trailer and premiere date for FACEOFF: Inside the NHL (6×45), the previously untitled docuseries from Box To Box and NHL Productions. Set to premiere globally October 4 on Prime Video, the series gives unprecedented access to the National Hockey League’s biggest teams and most compelling players, all at different stages of their careers, as they embark throughout the season on the ultimate pursuit of glory – winning the coveted Stanley Cup. FACEOFF: Inside the NHL joins Prime Monday Night Hockey, which will stream national regular season Monday night NHL games exclusively on Prime Video in Canada. - Royal Air Force Red Arrows Land in St. John’s for the Final Stop of the Canadian Tour

After a series of performances flying past some of Canada’s most renowned landmarks and partaking in several air shows in Halifax, Niagara Falls, Toronto, Ottawa, London, and Montreal, the Red Arrows’ journey comes to a close in Newfoundland and Labrador. Maple Hawk 2024 celebrates the deep bond between Canada and the UK, offering each city a chance to engage with both nations’ rich cultural and historical ties. Through partnerships with schools, training institutes and organisations such as Let’s Talk Science, the tour has also offered a hands-on look at advancements in aerospace technology and STEM initiatives all to help shape research and development for future generations. - New Tim Hortons Halloween collection includes glow-in-the-dark Timbits® Bucket and drinkware, plus visit TimShop.ca for Tims-themed costumes for kids and dogs!

This year’s glow-in-the-dark Timbits Bucket features a frightfully fun design including a spooky ghost and Timbit spider. The Timbits Bucket can also be purchased with 31 Timbits to share with family and friends. Participating Tims restaurants across Canada are also offering guests a 24oz/710mL straw tumbler that glows in the dark, plus a ghost-shaped ceramic mug with heat-activated details. TimShop.ca has even more Halloween items to purchase including a Timbits Box costume for kids and a Tims-themed lumberjack costume for dogs. There’s also a heat-activated Jack O’Lantern ceramic mug, and some fun ghost-themed items including a fluffy pillow, stainless steel tumbler and glow-in-the-dark straw tumbler. - ROYAL CANADIAN MINT LAUNCHES NEW SINGLE MINE GOLD MAPLE LEAF BULLION COIN ENTIRELY SOURCED FROM AGNICO EAGLE’S DETOUR LAKE MINE

The 2024 $50 1 oz. 99.99% Pure Gold Maple Leaf Single Mine bullion coin is entirely composed of gold from Canadian mining giant Agnico Eagle’s Detour Lake mine in Northern Ontario. This special gold bullion coin is now available at select Costco stores across Canada, as well as online at www.costco.ca. “The Royal Canadian Mint is known worldwide for its refining prowess and innovation, as well as its robust environmental, social and governance practices. We are proud to once more showcase the purity and responsibility of our Gold Maple Leaf bullion coin by partnering with Agnico Eagle’s Detour Lake mine to issue our newest Single Mine GML coin,” said Marie Lemay, President and CEO of the Royal Canadian Mint. - The Iconic Pret A Manger coffee is now available at A&W restaurants nationwide

All A&W locations in Canada are now serving Pret freshly brewed organic Classic Blend coffee all day long, offering guests a delicious and satisfying coffee experience with every visit. “Pret Coffee’s exceptional quality and taste have won over coffee lovers worldwide, and we’re thrilled to bring it to over 1,000 locations across Canada,” says Scott Darlow, Lead, Pret A Manger at A&W Canada. “We’ve tested Pret coffee in select A&W locations where it quickly became a favourite among guests, which led us to make it our official coffee at all A&W restaurants. We’re excited to bring this beloved coffee to more Canadians.” - Health Canada Grants Marketing Authorization of First CRISPR/Cas9 Gene-Edited Therapy, CASGEVY® (Exagamglogene Autotemcel), for the Treatment of Sickle Cell Disease and Transfusion-Dependent Beta Thalassemia

Vertex Pharmaceuticals Incorporated VRTX today announced Health Canada has granted Marketing Authorization for PrCASGEVY® (exagamglogene autotemcel), an autologous genome edited hematopoietic stem cell-based therapy, for the treatment of patients 12 years of age and older with sickle cell disease (SCD) with recurrent vaso-occlusive crises (VOCs) or transfusion-dependent beta thalassemia (TDT). There are an estimated 2,000 patients eligible for CASGEVY in Canada, the majority of whom are living with SCD. This approval is based on the positive interim results from two global and ongoing clinical trials, CLIMB-121 in SCD and CLIMB-111 in TDT. - Elysium Investments Surpasses $200M in Acquisitions, Closing in on 4,000 Units and $3B Under Development

Elysium Investments Inc., a Toronto-based real estate investment and development firm, has acquired a prime 1.23-acre development site at 21-29 Oakmount Road & 26-36 Mountview Avenue, near High Park. This acquisition brings Elysium’s total investments to over $200 million in just over a year. The firm is nearing 4,000 housing units and more than $3 billion in developments. The project will include two high-rise residential towers on a shared podium, providing much-needed rental housing in a transit-connected area. Elysium is partnering with Hepsor, an Estonian real estate developer, and Oikoi Living, marking their second collaboration. - Alanis Obomsawin: The Children Have to Hear Another Story

The Musée d’art contemporain de Montréal (MAC) launched its new exhibition, Alanis Obomsawin: The Children Have to Hear Another Story, on Wednesday at the MAC at Place Ville Marie. This major retrospective, a one-of-a-kind opportunity to celebrate more than 60 years of artistic creation by this exceptional Abenaki filmmaker, singer and activist, will be open to the public until January 26, 2025, in the MAC’s temporary space at Place Ville Marie. On the same day, Caroline Monnet’s mural Wàbigon was also unveiled; it will be on display until February 16, 2025, at the MAC at Place Ville Marie.

Read more of the latest releases from Cision, see our resources for journalists, and stay caught up on the top press releases by following @cnwnews.

About Cision Canada

Cision is a comprehensive communications platform enabling more than 100,000 public relations and marketing professionals around the world to understand, influence and amplify their stories. As the market leader, Cision enables the next generation of communication professionals to strategically operate in the modern media landscape where company success is directly impacted by public opinion. Cision has offices in 24 countries through the Americas, EMEA and APAC, and offers a suite of best-in-class solutions, including Newswire, Brandwatch, Cision Communications Cloud® and Cision Insights. To learn more, visit www.cision.ca and follow @CisionCA on Twitter.

SOURCE Cision Canada

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/27/c5009.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/27/c5009.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cohen & Steers Total Return Realty Fund, Inc. (RFI) Notification of Sources of Distribution Under Section 19(a)

NEW YORK, Sept. 27, 2024 /PRNewswire/ — This press release provides shareholders of Cohen & Steers Total Return Realty Fund, Inc. RFI (the “Fund”) with information regarding the sources of the distribution to be paid on September 30, 2024 and cumulative distributions paid fiscal year-to-date.

In December 2011, the Fund implemented a managed distribution policy in accordance with exemptive relief issued by the Securities and Exchange Commission. The managed distribution policy seeks to deliver the Fund’s long-term total return potential through regular monthly distributions declared at a fixed rate per common share. The policy gives the Fund greater flexibility to realize long-term capital gains throughout the year and to distribute those gains on a regular monthly basis to shareholders. The Board of Directors of the Fund may amend, terminate or suspend the managed distribution policy at any time, which could have an adverse effect on the market price of the Fund’s shares.

The Fund’s monthly distributions may include long-term capital gains, short-term capital gains, net investment income and/or return of capital for federal income tax purposes. Return of capital includes distributions paid by the Fund in excess of its net investment income and net realized capital gains and such excess is distributed from the Fund’s assets. A return of capital is not taxable; rather, it reduces a shareholder’s tax basis in his or her shares of the Fund. In addition, distributions from the Fund’s investments in real estate investment trusts (REITs) may later be characterized as capital gains and/or a return of capital, depending on the character of the dividends reported to the Fund after year-end by REITs held by the Fund. The amount of monthly distributions may vary depending on a number of factors, including changes in portfolio and market conditions.

At the time of each monthly distribution, information will be posted to cohenandsteers.com and mailed to shareholders in a concurrent notice. However, this information may change at the end of the year because the final tax characteristics of the Fund’s distributions cannot be determined with certainty until after the end of the calendar year. Final tax characteristics of all of the Fund’s distributions will be provided on Form 1099-DIV, which is mailed after the close of the calendar year.

The following table sets forth the estimated amounts of the current distribution and the cumulative distributions paid this fiscal year-to-date from the sources indicated. All amounts are expressed per common share.

|

DISTRIBUTION ESTIMATES |

September 2024 |

YEAR-TO-DATE (YTD) September 30, 2024* |

||

|

Source |

Per Share |

% of Current |

Per Share |

% of 2024 |

|

Net Investment Income |

$0.0495 |

61.88 % |

$0.2226 |

30.92 % |

|

Net Realized Short-Term Capital Gains |

$0.0000 |

0.00 % |

$0.1067 |

14.82 % |

|

Net Realized Long-Term Capital Gains |

$0.0305 |

38.12 % |

$0.3350 |

46.53 % |

|

Return of Capital (or other Capital Source) |

$0.0000 |

0.00 % |

$0.0557 |

7.73 % |

|

Total Current Distribution |

$0.0800 |

100.00 % |

$0.7200 |

100.00 % |

You should not draw any conclusions about the Fund’s investment performance from the amount of this distribution or from the terms of the Fund’s managed distribution policy. The Fund estimates that it has distributed more than its income and capital gains; therefore, a portion of your distribution may be a return of capital. A return of capital may occur, for example, when some or all of the money that you invested in the Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with ‘yield’ or ‘income’. The amounts and sources of distributions reported in this Notice are only estimates, are likely to change over time, and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for accounting and tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. The amounts and sources of distributions year-to-date may be subject to additional adjustments.

*THE FUND WILL SEND YOU A FORM 1099-DIV FOR THE CALENDAR YEAR THAT WILL TELL YOU HOW TO REPORT THESE DISTRIBUTIONS FOR FEDERAL INCOME TAX PURPOSES.

The Fund’s Year-to-date Cumulative Total Return for fiscal year 2024 (January 1, 2024 through August 31, 2024) is set forth below. Shareholders should take note of the relationship between the Year-to-date Cumulative Total Return with the Fund’s Cumulative Distribution Rate for 2024. In addition, the Fund’s Average Annual Total Return for the five-year period ending August 31, 2024 is set forth below. Shareholders should note the relationship between the Average Annual Total Return with the Fund’s Current Annualized Distribution Rate for 2024. The performance and distribution rate information disclosed in the table is based on the Fund’s net asset value per share (NAV). The Fund’s NAV is calculated as the total market value of all the securities and other assets held by the Fund minus the total liabilities, divided by the total number of shares outstanding. While NAV performance may be indicative of the Fund’s investment performance, it does not measure the value of a shareholder’s individual investment in the Fund. The value of a shareholder’s investment in the Fund is determined by the Fund’s market price, which is based on the supply and demand for the Fund’s shares in the open market.

Fund Performance and Distribution Rate Information:

|

Year-to-date January 1, 2024 to August 31, 2024 |

|

|

Year-to-date Cumulative Total Return1 |

10.16 % |

|

Cumulative Distribution Rate2 |

5.77 % |

|

Five-year period ending August 31, 2024 |

|

|

Average Annual Total Return3 |

5.61 % |

|

Current Annualized Distribution Rate4 |

7.70 % |

|

1. |

Year-to-date Cumulative Total Return is the percentage change in the Fund’s NAV over the year-to-date time period |

|

2. |

Cumulative Distribution Rate for the Fund’s current fiscal period (January 1, 2024 through September 30, 2024) |

|

3. |

Average Annual Total Return represents the compound average of the Annual NAV Total Returns of the Fund for |

|

4. |

The Current Annualized Distribution Rate is the current fiscal period’s distribution rate annualized as a percentage |

Investors should consider the investment objectives, risks, charges and expense of the Fund carefully before investing. You can obtain the Fund’s most recent periodic reports, when available, and other regulatory filings by contacting your financial advisor or visiting cohenandsteers.com. These reports and other filings can be found on the Securities and Exchange Commission’s EDGAR Database. You should read these reports and other filings carefully before investing.

Shareholders should not use the information provided here in preparing their tax returns. Shareholders will receive a Form 1099-DIV for the calendar year indicating how to report Fund distributions for federal income tax purposes.

Website: https://www.cohenandsteers.com/

Symbol: CNS

About Cohen & Steers. Cohen & Steers is a leading global investment manager specializing in real assets and alternative income, including listed and private real estate, preferred securities, infrastructure, resource equities, commodities, as well as multi-strategy solutions. Founded in 1986, the firm is headquartered in New York City, with offices in London, Dublin, Hong Kong, Tokyo and Singapore.

Forward-Looking Statements

This press release and other statements that Cohen & Steers may make may contain forward looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which reflect the company’s current views with respect to, among other things, its operations and financial performance. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative versions of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties.

Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. The company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

![]() View original content:https://www.prnewswire.com/news-releases/cohen–steers-total-return-realty-fund-inc-rfi-notification-of-sources-of-distribution-under-section-19a-302261485.html

View original content:https://www.prnewswire.com/news-releases/cohen–steers-total-return-realty-fund-inc-rfi-notification-of-sources-of-distribution-under-section-19a-302261485.html

SOURCE Cohen & Steers, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Adobe Chair and CEO Sold $13.04M In Company Stock

Disclosed on September 26, SHANTANU NARAYEN, Chair and CEO at Adobe ADBE, executed a substantial insider sell as per the latest SEC filing.

What Happened: NARAYEN’s recent move involves selling 25,000 shares of Adobe. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value is $13,039,414.

The latest update on Friday morning shows Adobe shares up by 0.17%, trading at $516.26.

Get to Know Adobe Better

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers for creating, managing, delivering, measuring, optimizing, and engaging with compelling content multiple operating systems, devices, and media. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products (less than 5% of revenue).

Understanding the Numbers: Adobe’s Finances

Revenue Growth: Adobe’s remarkable performance in 3 months is evident. As of 31 August, 2024, the company achieved an impressive revenue growth rate of 10.59%. This signifies a substantial increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Holistic Profitability Examination:

-

Gross Margin: The company excels with a remarkable gross margin of 89.76%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 3.78, Adobe showcases strong earnings per share.

Debt Management: Adobe’s debt-to-equity ratio is below the industry average at 0.42, reflecting a lower dependency on debt financing and a more conservative financial approach.

In-Depth Valuation Examination:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 43.65, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 11.17, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry benchmarks at 29.08, Adobe presents an attractive value opportunity.

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Illuminating the Importance of Insider Transactions

It’s important to note that insider transactions alone should not dictate investment decisions, but they can provide valuable insights.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

A Deep Dive into Insider Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Adobe’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AECOM Wins Contract to Support LA Metro's ZEB Transition

AECOM ACM won a contract from the Los Angeles County Metropolitan Transportation Authority (Metro) to provide program management, design and engineering services.

Banking on its Sustainable Legacies strategy, ACM will support Metro’s ambitious goal of transitioning its bus fleet to Zero Emission Buses. Also, it will focus on charging infrastructure conceptual design, specification, and procurement. Its expertise will help guide the seamless transition to zero-emission operations, offering innovative solutions to complex transportation challenges.

The sustainable and efficient transit system aims to reduce greenhouse gas emissions while improving air quality for Los Angeles County residents. On an impressive note, the initiative is one of the largest electric bus programs in the United States and is supported by the Infrastructure Investment and Jobs Act.

ACM’s Stock Performance

The company’s shares have gained 11.6% so far this year, which is nearly one-third of the Zacks Engineering – R and D Services industry’s 36.2% growth.

Image Source: Zacks Investment Research

This Zacks Rank #4 (Sell) company has been ailing from labor shortages, particularly in skilled trades. Inflationary pressures, particularly in raw materials and energy, could also be bothering margins. This apart, broader economic uncertainties, such as fears of a recession or global economic slowdown, might be impacting the infrastructure sector. Investors could be cautious about long-term infrastructure spending, especially if government funding slows down.

ACM’s Strong Backlog & Global Demand Drive Raises Hope

Mitigating the above-mentioned headwinds, AECOM has been experiencing robust growth across all its segments, backed by strong pipeline visibility for the upcoming quarters. Healthy state and local budgets, along with increased private sector investments in water and energy transitions, have contributed to this upward trend.

Additionally, the U.K. water market is expected to see accelerated growth over the next five years, driven by a near doubling of AMP8 funding. AECOM’s deep expertise with major water utilities positions it well to benefit from this expansion.

Global demand for infrastructure development is rising, further increasing the need for AECOM’s services. As of the fiscal third-quarter end, the total backlog was $23.36 billion compared with $23.21 billion reported in the prior-year period. The current backlog level includes 54.8% contracted backlog growth.

Ongoing contract wins are expected to boost prospects. Global infrastructure spending trends remain strong, providing further opportunities for AECOM’s continued expansion.

Key Picks

Some better-ranked stocks in the same space are:

Sterling Infrastructure, Inc. STRL presently sports a Zacks Rank #1 (Strong Buy). Sterling Infrastructure has a trailing four-quarter earnings surprise of 17.4%, on average.

The Zacks Consensus Estimate for STRL’s 2024 sales and earnings per share indicates a rise of 9.7% and 26.6%, respectively, from the prior-year levels.

Howmet Aerospace Inc. HWM presently carries a Zacks Rank #2 (Buy). HWM has a trailing four-quarter earnings surprise of 10.9%, on average.

The Zacks Consensus Estimate for HWM’s 2024 sales and EPS indicates a rise of 12.6% and 40.8%, respectively, from the prior-year levels.

M-tron Industries, Inc. MPTI currently carries a Zacks Rank #2. It has topped earnings estimates in three of the trailing four quarters and missed once, with an average surprise of 9.2%.

The Zacks Consensus Estimate for MPTI’s 2024 sales and EPS indicates a rise of 16.1% and 76.6%, respectively, from prior-year levels.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Nio Stock Surged More Than 20% This Week

Nio (NYSE: NIO) shares have been soaring this week. China has a plan for accelerating growth, and the electric vehicle (EV) maker could be one big beneficiary. But even prior to China’s economic stimulus making an impact, there are signs that Nio’s business is getting in better shape.

Investors recognized that this week and pushed Nio shares up by about 24% as of late morning Friday, according to data provided by S&P Global Market Intelligence.

Green shoots for EV demand

U.S.-listed Chinese stocks got a big boost this week when China’s central bank eased monetary policy and provided fiscal support for businesses and consumers. Steps taken to increase lending, support the real estate market, and provide homeowners more spending money should give the strong EV market even more of a tailwind.

Chinese consumers will get a break on existing mortgages and those savings might be spent on the popular domestic electric vehicle offerings. With the government also promising to aid the struggling property sector and increase fiscal support if necessary, investors are trying to get into EV names ahead of improving business results.

Nio has already announced deliveries of over 20,000 vehicles in each of the last four months for the first time. Investors are hoping to see that streak extend when the company reports September results next week.

At least one Wall Street analyst who follows EV leader Tesla is thinking that company will exceed expectations when it reports its third-quarter deliveries next week. In a Friday report, Wedbush analyst Dan Ives said his firm believes Tesla will report up to 470,000 EV deliveries for the quarter. Overall expectations are for 460,000 units.

Last year about one-third of Tesla’s vehicle sales came from China. Its Shanghai factory is its largest. A rebound from a slower first half of the year would bode well for Nio, too. If China does rebound, Nio stock might have more room to run even after its sharp spike this week.

Should you invest $1,000 in Nio right now?

Before you buy stock in Nio, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nio wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Howard Smith has positions in Nio and Tesla. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

Why Nio Stock Surged More Than 20% This Week was originally published by The Motley Fool

Is Stock-Split Stock Super Micro Computer Headed to $729 per Share?

Companies that decide to split their stock — increasing share count and decreasing per-share price — are usually doing quite well. Most companies don’t announce stock splits unless their shares have climbed significantly over time.

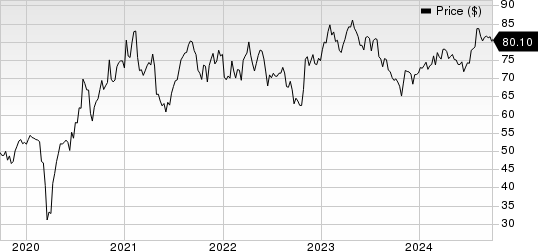

However, there are occasions when a stock split occurs during a rocky period for the company’s shares. This is the case for Super Micro Computer (NASDAQ: SMCI), whose stock is down 35% since its split announcement in early August.

Still, many analysts on Wall Street believe there is massive potential for Supermicro. So, is it time to buy?

Supermicro’s business is booming

On Sept. 25, a group of 16 analysts had an average one-year price target on Supermicro stock of $729.19. That represents around 60% upside from the stock’s closing price on Sept. 25, which was a day before a Wall Street Journal article helped fuel a 12% drop.

The optimism makes sense. Super Micro Computer manufactures components for computing servers. While this space is relatively crowded, Supermicro sets itself apart from the competition by offering highly customizable servers that can be tailored to any workload type or size. Its products are also some of the most energy-efficient ones out there, which can save on long-term operating costs.

With the massive spike in computing demand caused by the artificial intelligence (AI) arms race, Supermicro is benefiting from the same trends that sent Nvidia stock through the roof, though Supermicro’s ride has been a bit more bumpy.

Supermicro is not firing on all cylinders right now

Along with Supermicro’s 10-for-1 stock-split announcement on Aug. 6, the company released its fiscal 2024 fourth-quarter and full-year results for the period ended June 30. While the company delivered strong revenue growth of 143% year over year and provided excellent full-year 2025 guidance of 74% to 101% growth, there were some problems with its profitability.

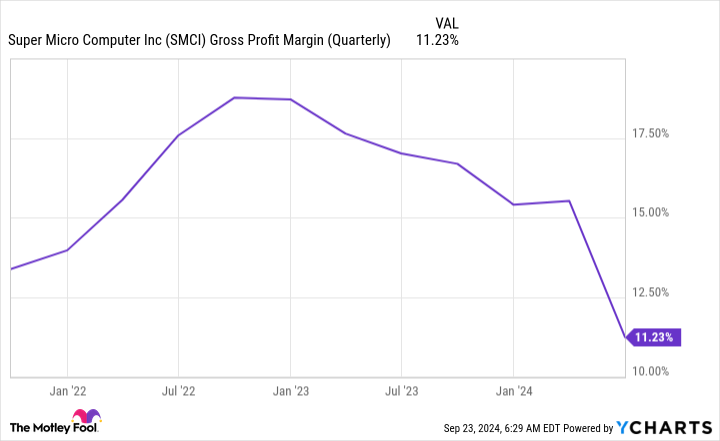

Because of its new liquid-cooling product line getting spun up, Supermicro’s gross margin has taken a hit.

This has caused significant concern among some investors as falling gross margin can also indicate increased competition. However, management believes its gross margin will recover throughout fiscal 2025.

Meanwhile, short-selling firm Hindenburg Research released a report on Supermicro on Aug. 27 alleging accounting manipulation. The SEC has fined Supermicro for accounting issues in the past. At the same time, because Hindenburg is a short-seller, it benefits when the stocks it reports on fall, so investors should proceed cautiously with this information. Supermicro responded that the short report “contains false or inaccurate statements.”

On Aug. 28, Supermicro delayed filing its end-of-year Form 10-K with the SEC, saying it needed more time to “complete its assessment of the design and operating effectiveness of its internal controls over financial reporting.”

After the delay, Supermicro received a letter of non-compliance from the Nasdaq exchange, stating it is in violation of listing rules because it hasn’t filed its 10-K in a timely fashion. After receiving the letter on Sept. 16, Supermicro has 60 days to comply or risk being delisted.

To further complicate matters, on Sept. 26, The Wall Street Journal reported that unnamed sources had said the Department of Justice had launched a probe into the company. If the reporting is correct, this is just a preliminary probe, so nothing may come out of it. However, there could be real issues with the company, which significantly increases the risk of investing in the stock. It will likely be a long time before the public gets full details, so investors will need to stay patient with the stock if they choose to buy it.

Clearly, the company is grappling with serious issues right now, and the stock has fallen over 60% from its 52-week high. However, the business case for its components and servers is undeniable.

The current stock is also valued fairly cheaply on a forward earnings basis.

If Supermicro can improve its gross margin over the next year and dispel concerns over its accounting practices, the stock has a ton of upside.

I recently bought the dip because I believe in the company. However, I kept the position size low (around 1% of my total portfolio value). That way, it won’t affect the portfolio too much if the stock tumbles further, but I can still benefit if Supermicro stages a recovery like some on Wall Street think it can in the near term. I was planning on buying more, but after the report of a potential DOJ probe, I’m comfortable with the current position size, as it represents the high risk, high reward associated with Super Micro Computer’s stock.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Keithen Drury has positions in Super Micro Computer. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Is Stock-Split Stock Super Micro Computer Headed to $729 per Share? was originally published by The Motley Fool

HOLX Stock Gains From New Offerings Despite Macro Issues

Hologic HOLX has been gaining from new strategic product launches across Diagnostics and Breast Health. However, macroeconomic issues and unfavorable FX headwinds continue to impede growth. The stock carries a Zacks Rank #3 (Hold) currently.

Major Factors Driving HOLX Stock Growth

Among Hologic’s advanced diagnostic products, primary revenue-generating ones are molecular diagnostic assays, which run on advanced instrumentation systems (Panther, Panther Fusion and Tigris), ThinPrep cytology system and the Rapid Fetal Fibronectin Test. With solid 10.5% growth, excluding COVID-19 sales in the fiscal third quarter of 2024, the Molecular Diagnostics business has consistently maintained high-single to double-digit gains in 13 of the last 15 quarters. Growth continues to be driven by the ongoing adoption and utilization of the broad menu in the Panther platform.

In Breast Health, Hologic expanded its product offering from imaging to cover the continuum of breast cancer care, including biopsy and surgery. The business is thriving primarily in the burgeoning spaces of radiology, breast surgery, pathology and treatment, with key profitable offerings such as 3D digital mammography systems, image analytics software utilizing artificial intelligence, ultrasound imaging and minimally invasive breast biopsy guidance systems. In the third quarter of fiscal 2024, revenues increased 7.1% (excluding the divested SSI business), driven by domestic and international growth of 7.2% and 12.1%, respectively.

The company’s international sales have been a major catalyst in the past few years, growing 5.1% year over year in the third quarter of fiscal 2024. Molecular STI testing, cytology and MyoSure experienced strong growth in the global markets. However, the company perceives it as still in the early phase of utilizing its expanded Panther installed base. Similarly, while international cytology and STI testing have more dominant U.S. revenues, they are expected to become meaningful revenue drivers in the international markets with time.

In order to streamline its operations and reduce the cost of revenues, Hologic has adopted a few significant strategies over the past few years. The company has invested deliberately and opportunistically in commercial areas where management has recognized a good return. These include Hologic’s Genius marketing campaign in Breast Health, cervical cancer co-testing initiatives in Diagnostics, along with efforts to gain competitive market share with NovaSure.

The stock has gained 12.2% year to date, compared with the industry’s 7.6% rise. With the company currently focusing on the expansion of diagnostics assay and breast health offerings in global markets, we expect the stock to continue its upward movement in the coming days.

Major Downsides for HOLX

Continued concerns about the systemic impact of potential long-term and widespread recession have added to market volatility and diminished expectations for economic growth. The effect of the worldwide political and social uncertainty, including the impact on trade regulations and tariffs, economic disruptions as well as the ongoing supply chain constraints, have reportedly hampered the costs and sales of Hologic’s products in certain countries in recent times. In the third quarter of fiscal 2024, Hologic’s cost of revenues (product, service and other) rose about 1.9% year over year, while selling, general and administration expenses increased 4.2%.

These uncertainties surrounding global economic conditions and financial markets may cause medical equipment purchasers to decrease their medical health insurance premiums and procurement activities. Additionally, higher unemployment rates and health insurance premiums, co-payments and deductibles may result in cost-conscious consumers making fewer trips to their physicians and specialists, affecting the demand for the company’s products and procedures.

We remain worried about the significant challenges Hologic faces owing to unfavorable foreign currency impact that has been adversely impacting the company’s overall performance in the past few quarters. The company’s international sales are often denominated in foreign currencies, including the euro, UK pound and renminbi. Changes in currency exchange rates, particularly the increase in the value of the dollar against any such foreign currencies, may reduce the reported value of Hologic’s revenues outside the United States and associated cash flows. The company expects about $3 million adverse currency impact in the fourth quarter.

For several quarters in a row, declining COVID-19 assay revenues have been a headwind to some of the company’s key performance metrics. Although the company returned to growth in the fiscal third quarter, the potential impact of the COVID-19 sales downturn still lingers.

Hologic’s fiscal 2024 guidance assumes $70 million from COVID-19 assay sales, including $7 million in the fourth quarter of fiscal 2024. Overall, revenues from COVID-19-related items are expected to be approximately $105 million in fiscal 2024.

Key Picks

Some better-ranked stocks in the broader medical space are TransMedics Group TMDX, AxoGen AXGN and OrthoPediatrics KIDS. While TransMedics sports a Zacks Rank #1 (Strong Buy) at present, AxoGen and OrthoPediatrics carry a Zacks Rank #2 (Buy) each.

Estimates for TransMedics’ 2024 earnings per share have moved up 2.5% to $1.23 in the past 30 days. Shares of the company have soared 156.5% in the past year compared with the industry’s 17.5% growth. TMDX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 287.50%. In the last reported quarter, it delivered an earnings surprise of 66.67%.

Estimates for AxoGen’s 2024 loss per share have remained constant at 1 cent in the past 30 days. Shares of the company have surged 165.9% in the past year, compared with the industry’s 17.6% growth. AXGN’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 96.5%. In the last reported quarter, it delivered an earnings surprise of 200%.

Estimates for OrthoPediatrics’ 2024 loss per share have declined to 92 cents from 96 cents in the past 30 days. In the past year, shares of KIDS have lost 17.1% against the industry’s 20.8% growth. In the last reported quarter, it delivered an earnings surprise of 25.81%. Its earnings surpassed estimates in each of the trailing four quarters, the average surprise being 26.81%.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Strategic Sale: Williamson Laura B Decides To Exercise Options Worth $425K At Darden Restaurants

In a new SEC filing on September 26, it was revealed that B, President at Darden Restaurants DRI, executed a significant exercise of company stock options.

What Happened: A Form 4 filing with the U.S. Securities and Exchange Commission on Thursday revealed that B, President at Darden Restaurants in the Consumer Discretionary sector, exercised stock options for 4,939 shares of DRI stock. The exercise price of the options was $81.99 per share.

Darden Restaurants shares are currently trading up by 0.07%, with a current price of $168.06 as of Friday morning. This brings the total value of B’s 4,939 shares to $425,104.

Discovering Darden Restaurants: A Closer Look

Darden Restaurants is the largest restaurant operator in the US full-service space, with consolidated revenue of $11.4 billion in fiscal 2024 resulting in 3%-4% full-service market share (per NRA data and our calculations). The company maintains a portfolio of 10 restaurant brands: Olive Garden, LongHorn Steakhouse, Cheddar’s Scratch Kitchen, Ruth’s Chris, Yard House, The Capital Grille, Seasons 52, Eddie V’s, Bahama Breeze, and The Capital Burger. Darden generates revenue almost exclusively from company-owned restaurants, though a small network of franchised restaurants and consumer-packaged goods sales through the traditional grocery channel contribute modestly. As of the end of its fiscal 2024, the company operated 2,031 restaurants in the US.

Darden Restaurants: Financial Performance Dissected

Revenue Growth: Darden Restaurants’s revenue growth over a period of 3 months has faced challenges. As of 31 August, 2024, the company experienced a revenue decline of approximately -6.77%. This indicates a decrease in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Key Insights into Profitability Metrics:

-

Gross Margin: The company faces challenges with a low gross margin of 20.41%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Darden Restaurants’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 1.75.

Debt Management: With a below-average debt-to-equity ratio of 2.48, Darden Restaurants adopts a prudent financial strategy, indicating a balanced approach to debt management.

Financial Valuation Breakdown:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 19.37 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: With a lower-than-average P/S ratio of 1.77, the stock presents an attractive valuation, potentially signaling a buying opportunity for investors interested in sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 13.87 is below the industry average, indicating that it may be relatively undervalued compared to peers.

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Navigating the Impact of Insider Transactions on Investments

In the complex landscape of investment decisions, investors should approach insider transactions as part of a comprehensive analysis, considering various elements.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Cracking Transaction Codes

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Darden Restaurants’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

My husband’s pension was $8,000 a month. As his survivor, I only get $1,800. Can I fight this?

Dear MarketWatch,

My husband and I were married for 10 months before he passed away. But we were together for eight years. He had a very healthy pension, probably about $8,000 a month. We called to find out what the rules were for the spouse getting the pension after his death and were told it was only a nine-month requirement.

That was quite a few years before he passed away. Once he passed, I filed for his pension. I was sent $1,800 a month, and told that was all I was getting because we did not pay into the pension fund so I was not eligible. At no time did they ever tell us that we had to pay into it and we did not know. Do I have any legal claim to that pension?

Most Read from MarketWatch

Left Short

Dear Left Short,

I’m very sorry you are receiving so much less than what you expected to receive. That’s a terrible surprise during an already upsetting time in your life.

Unfortunately, this is an area where mistakes can easily be made, said David Haas, a certified financial planner and president of Cereus Financial Advisors.

“You have to choose up front when you start taking the pension what the survivor’s benefit is,” he said, and that varies by the company. Pensions are basically annuities, and as such, they follow actuarial calculations with life expectancies in mind.

For example, if your husband had the option for a 100% joint payout and he chose that, he’d have gotten the lowest amount in payments at first, but those payments would have continued as-is after his death.

A 50% joint payment would result in the surviving spouse getting a 50% cut to the payment after the first spouse’s death (but the payment would have been higher while both individuals were still alive).

Comparatively, a 0% joint payout would mean getting the highest amount of money while the employee spouse is alive, but then having all payments cease upon his or her death, Haas explained.

Related: Should you share your pension payout with your spouse, even if it means less money?

Pensions also vary considerably based on the employer who provides them, or if they are private versus public. The rest of the responsibility lies on the employee, who must decide how they receive their pension, or the way in which they structure their benefit for their spouse.

“If you want more benefits for survivors, you will have to pay more into it upfront, while alive,” said Emmanuel Eliason, a certified financial planner and president of Eliason Wealth Management.

“For example, for federal employees, their pension stipulates that they can choose either a partial survival benefit at 25% costing 5% of their pension, full survival benefit at 50% costing 10% of their pension or choose no survival benefit, hence no cost.

For other retirees whose companies offer pensions with survival benefits, it’s important for them to be properly educated, to understand their options, cost and benefits available in their plans.”

When it comes to pensions, planning is crucial, which makes your situation especially frustrating as you and your husband did make calls years ago to understand how it works. The company may not change anything about your payments, but it is still important that you have the clarity you need.

“I cannot imagine that the pension company would do anything different than what she is getting now,” said Jeremy Keil, a certified financial planner at Keil Financial Partners. Still, call the pension company and ask for a copy of the original paperwork, he added. “Perhaps there is a small chance she can find an error.”

Just so you know, pension decisions are often a one-time deal, and in some cases, they can’t be altered no matter what major life event occurs, Keil said. “The survivorship option is the most important decision when you take your pension,” he said. “It’s basically a one-and-done lifetime decision. You generally can’t change the option, or change the beneficiary even in the case of a divorce.”

If you felt that you weren’t told accurate or full details about your husband’s pension payout options, you may be able to file a complaint, said Melissa Caro, a certified financial planner and founder of the newsletter My Retirement Network. “If she believes there was a lack of communication or transparency about the pension plan’s terms, she might consider filing a complaint with the relevant regulatory body.”

A few places to look into this include the Employee Benefits Security Administration, the Pension Benefit Guaranty Corporation or perhaps your state’s comptroller’s office.

Whatever the outcome, now is the best time to get ahead of your future retirement plans. If you expect to have more income to rely on in your older age, make sure you can still pay the bills. If you haven’t started taking Social Security yet, look at what your options are at various claiming ages (such as before, at or after Full Retirement Age). You can do that on the Social Security Administration’s website by creating an account.

Review all of your finances, including your assets and debts, and see how you can take distributions from any retirement accounts or savings so that the money is able to stretch over your lifetime. A qualified and trustworthy financial planner can help you with that. These aren’t necessarily quick math exercises you can do, but they’ll make all the difference when you’re older.