If You Bought 1 Share of Intel Stock at Its IPO, Here's How Many Shares You Would Own Now

Intel (NASDAQ: INTC) has struggled in recent years as Nvidia and longtime rival Advanced Micro Devices began to surpass it technically. So far, efforts to catch up have fallen short, taking its stock to multiyear lows.

Its recent performance may make investors forget that it developed the first commercially produced microprocessor and was the world’s largest semiconductor company for most of its history. Since its initial public offering (IPO), the stock has offered massive returns for its investors and a critical lesson for those not around to benefit.

Growth and lessons from Intel

When Intel launched its IPO on Oct. 13, 1971, it introduced the stock at a pre-split price of $23.50 per share. Since then, the stock has grown and resulted in multiple stock splits that would have turned that single $23.50 share into 1,215 shares valued at a split-adjusted $0.02 each. Doing some calculations, if you had bought a single share on the IPO day, that investment would be worth $28,990 today, not including dividends.

Unfortunately for its longest-term shareholders, all of Intel’s gains occurred between 1971 and 2000, the period when all 13 of Intel’s stock splits occurred.

If measured against the record closing price of $74.88 per share in August 2000, the one share from the IPO would have grown to a value of almost $91,000. The dot-com bust, the move toward smartphones, and ultimately, the loss of its technical lead undermined Intel in the 21st century, and many wonder what form it will take in today’s artificial intelligence (AI)-driven tech landscape.

Admittedly, this history makes the timing of selling Intel extremely difficult for even the most seasoned investors. Some stocks have recovered from more significant declines, while others later faced bankruptcy and dissolution.

Nonetheless, the story of Intel stock speaks to the growth potential that comes with spearheading and leading an industry for decades. Ultimately, even if Intel is not destined for a comeback, investors can learn from its story and seek companies leading the industries of the future.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Will Healy has positions in Advanced Micro Devices and Intel. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

If You Bought 1 Share of Intel Stock at Its IPO, Here’s How Many Shares You Would Own Now was originally published by The Motley Fool

DKILY or HOCPY: Which Is the Better Value Stock Right Now?

Investors looking for stocks in the Electronics – Miscellaneous Products sector might want to consider either Daikin Industries DKILY or Hoya Corp. HOCPY. But which of these two stocks is more attractive to value investors? We’ll need to take a closer look to find out.

Everyone has their own methods for finding great value opportunities, but our model includes pairing an impressive grade in the Value category of our Style Scores system with a strong Zacks Rank. The Zacks Rank is a proven strategy that targets companies with positive earnings estimate revision trends, while our Style Scores work to grade companies based on specific traits.

Currently, both Daikin Industries and Hoya Corp. are holding a Zacks Rank of # 2 (Buy). This means that both companies have witnessed positive earnings estimate revisions, so investors should feel comfortable knowing that both of these stocks have an improving earnings outlook. But this is only part of the picture for value investors.

Value investors are also interested in a number of tried-and-true valuation metrics that help show when a company is undervalued at its current share price levels.

The Value category of the Style Scores system identifies undervalued companies by looking at a number of key metrics. These include the long-favored P/E ratio, P/S ratio, earnings yield, cash flow per share, and a variety of other fundamentals that help us determine a company’s fair value.

DKILY currently has a forward P/E ratio of 22.16, while HOCPY has a forward P/E of 40.73. We also note that DKILY has a PEG ratio of 2.14. This metric is used similarly to the famous P/E ratio, but the PEG ratio also takes into account the stock’s expected earnings growth rate. HOCPY currently has a PEG ratio of 2.88.

Another notable valuation metric for DKILY is its P/B ratio of 2.18. The P/B ratio pits a stock’s market value against its book value, which is defined as total assets minus total liabilities. For comparison, HOCPY has a P/B of 7.76.

These are just a few of the metrics contributing to DKILY’s Value grade of B and HOCPY’s Value grade of D.

Both DKILY and HOCPY are impressive stocks with solid earnings outlooks, but based on these valuation figures, we feel that DKILY is the superior value option right now.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Immersive VR Market Growth to Surpass at $34.9 billion by 2029, at a CAGR of 28.0%

Delray Beach, FL, Sept. 27, 2024 (GLOBE NEWSWIRE) — The global immersive VR Market was valued at USD 10.1 billion in 2024 and is projected to reach USD 34.9 billion by 2029; it is expected to register a CAGR of 28.0% during the forecast period.

The growth in the immersive VR market can be ascribed to the technological advancement in VR hardware that requires lesser components to achieve full immersion, ease of content creation for immersive experiences, increasing adoption of digital methods for training and simulation purposes in various sectors such as enterprise (manufacturing) and aerospace & defense.

To know about the assumptions considered for the study

Major Immersive VR Companies Included:

- Meta (US),

- Sony Group Corporation (Japan),

- Samsung Electronics Co., Ltd. (South Korea),

- Microsoft (US), and

- Apple, Inc. (US).

Immersive VR Market Dynamics:

- Driver: Increasing use of VR HMDs in gaming sector

- Restraint: Technological limitations

- Opportunity: Continuous developments in 5G technology

- Challenge: High energy consumption and latency issues

Growth of Immersive VR Market in APAC Region:

Asia Pacific is projected to expand at the highest CAGR from 2024 to 2029.

Asia Pacific is anticipated to grow at the highest CAGR from 2024 to 2029. Immersive VR is becoming increasingly popular in the Asia Pacific region, owing to the training, entertainment, and gaming sectors. The region has a substantial and dedicated gaming community, particularly in China and South Korea. VR’s immersive experiences, which offer a whole new level of interaction, are ideal for this demographic. Furthermore, many Asia Pacific countries are also investing heavily in industrial training as the region recognizes the value of having a skilled labor force. Additionally, many countries in the region are using immersive virtual reality (VR) in the education sector since the immersive content helps simplify difficult concepts.

By Consumer Applications: Largest Share of Immersive VR Market

The consumer segment is expected to dominate the immersive VR industry from 2024 to 2029. Technology advancements have improved user experiences with immersive virtual reality (VR) headsets, making them more robust and comfortable to wear, as well as more affordable. Due to this, a wider range of people can use them in their activities, allowing everyone the chance to have thrilling experiences. Currently, one of the key drivers is still gaming, which attracts a sizable user base with immersive experiences that are unmatched by any other sector. However, in recent years, consumer applications have increased substantially. Virtual reality platforms, including social VR, are transforming digital interaction and opening up new channels for content consumption via virtual recreation and travel.

By Software Offerings: Highest CAGR Segment of Immersive VR Market

The software segment is projected to experience the highest CAGR between 2024 and 2029 in the immersive VR industry. There is a growing demand for engaging and varied content to populate virtual environments owing to the advancement and increasing availability of VR hardware, The software developers leading this digital revolution create anything from entertaining games to practical tools for sectors such as education, healthcare, and industrial training. Immersive VR software provides the content and interactions that make these virtual worlds come to life for the user. Because of the growing popularity of these solutions and the fact that they work with current hardware, it is expected that the market for immersive VR software will grow throughout the estimated period.

Scope of the Report:

By Offering

- Introduction

- Hardware

- Software

By Device Type

- Introduction

- Head-Mounted Displays

- Projectors & Display Walls

- Gesture-Tracking Devices

By Application

- Consumer

- Commercial

- Aerospace & Defense

- Healthcare

- Enterprise (Manufacturing)

Request for Sample Report Pages

Future Growth of Immersive VR Market

The future growth of the immersive VR market is expected to be robust, with a compound annual growth rate (CAGR) of 28%, projected to rise significantly in the coming years. Key drivers include the increasing use of VR in industries beyond entertainment, such as healthcare for surgical training and mental health therapies, and education for immersive learning experiences. The gaming industry will continue to be a major growth factor, supported by technological advancements in graphics, motion sensors, and haptic feedback. Additionally, the integration of 5G technology will enhance the scalability and accessibility of VR applications, enabling smoother, real-time experiences. As consumer adoption expands and enterprise use cases grow, the immersive VR market is set to see accelerated adoption across the globe.

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ask an Advisor: Why Does an Advisor Get a 1% Fee Even if My Portfolio Doesn't Perform? It's 25% of My Return

Why does a financial advisor get a fee of 1% or more? That seems really high. If my return is only 4% (for example, in dividends), I am giving away 25% of my return, which is even worse with a bear market. How about charging 1% contingent on the increase in the value of dividend income?

-Drex

It’s completely understandable to view your investment returns as a measure of how much value your financial advisor is providing. Most people want to make sure their money is put to good use.

I’m also not going to tell you that your advisor should be charging 1% or more. There are many different types of financial advisors with many different types of fee arrangements. The right partnership for you will depend on your goals and circumstances.

That said, I would encourage you to look beyond comparing your investment returns against your fees when considering whether your financial advisor is worth the cost. (This tool can help match you with an advisor who might meet your needs.)

Recent Investment Terms Aren’t a Good Gauge of Value

A good financial advisor will work to understand your investment goals and your personal risk tolerance. He or she will help you construct a portfolio that gives you a good chance of reaching those goals, based on the best research available.

But even the best financial advisors are at the whim of the market.

Most professional investors who try to beat the market actually underperform it over a given time period. And those who do manage to outperform the market over one time period can rarely outperform it again over the subsequent time period. For an in-depth illustration of this, see S&P Global’s recent “Persistence Scorecard.”

In other words, even professionals can’t beat the market with consistency. That means that the right expectation is typically to target a portfolio that tracks the market as closely as possible with a balance between risk (stocks) and stability (bonds) that matches your goals and risk tolerance.

And even when that portfolio delivers the long-term returns you need, there will always be good years and bad years. Sometimes, your portfolio will be way up. Sometimes, it will be down. That’s just the way the market works.

Unless your financial advisor is promising to outperform the market, which might actually be a good reason to reconsider the relationship, recent investment returns are often not a good gauge of their value.

If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

The Real Value of a Financial Advisor

Good financial advisors provide value far beyond the percent return in your investment accounts. Here are a few services a good advisor may provide:

-

Taking the time to understand your goals and values, and helping you construct a plan that allows you to reach them.

-

Determining how much you need to save and which accounts you should be contributing to in order to reach your goals.

-

Helping you understand exactly what you can afford and creating withdrawal strategies that maximize tax efficiency, so your money lasts as long as possible.

-

Making sure you have the right insurance in place.

-

Coordinating with an attorney to ensure that you have an estate plan aligned with the rest of your financial plan.

-

Guiding you if you want to buy a house, make a charitable contribution, or help your child or grandchild through college.

And yes, they are there to create, implement and maintain an investment portfolio that should provide the long-term returns you need to fund your biggest goals. But even then, there’s far more than the return to consider in terms of what your financial advisor is providing.

Quantifying the Value of a Financial Advisor

A good financial advisor can increase net returns by up to, or even exceeding, 3% per year over the long term, according to Vanguard research.

The most significant portion of that value comes from behavioral coaching, which means helping investors stay disciplined through the ups and downs of the market. That value won’t be easy to see from year to year, especially in years when the market is down. But over the long term, that consistency will do a lot for your bottom line.

Now, this doesn’t mean that you should expect your portfolio to exceed market returns by 3% every year. Instead, 3% is a long-term number. It’s a comparison to how the average investor would perform on her own, not a comparison to market returns.

But it does mean that a good financial advisor is usually providing significant value, even when your portfolio isn’t performing the way you’d like.

How to Evaluate Your Financial Advisor

Evaluating financial advisors is challenging, especially when there aren’t easy numbers you can use to measure their performance.

So what should you be looking at? Here are some key questions I would consider:

-

Do they listen well?

-

Do their recommendations align with your personal goals and values?

-

Do you understand your financial plan and how it is helping you reach your goals?

-

Are they responsive and helpful when you have questions?

-

Are they helping you with your entire financial situation and not just your investment portfolio?

-

Are your investment returns in line with market returns, given your personal balance between risk and return?

-

Are they proactive in helping you anticipate and plan for future needs?

-

Do you trust them?

-

Do you feel more secure because of their guidance?

If you have questions or concerns, I would bring them to your financial advisor. This relationship hinges on trust and communication. This is absolutely something you should be able to discuss.

What to Do Next

Remember that short-term returns are often not a good way to measure your financial advisor’s value. Those returns are almost always out of our control, and a good financial advisor is doing a lot more to help you reach your goals.

Investing and Retirement Planning Tips

-

If you have questions specific to your investing and retirement situation, a financial advisor can help. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

As you plan for retirement, keep an eye on Social Security. Use SmartAsset’s Social Security calculator to get an idea of what your benefits could look like in retirement.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Matt Becker, CFP®, is a SmartAsset financial planning columnist and answers reader questions on personal finance and tax topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Please note that Matt is not a participant in the SmartAsset AMP platform, nor is he an employee of SmartAsset, and he has been compensated for this article.

Photo credit: ©iStock.com/Natee Meepian, ©iStock.com/AndreyPopov

The post Ask an Advisor: ‘I Am Giving Away 25% of My Return.’ Why Does a Financial Advisor Earn a 1% Fee, Even in a Bear Market? appeared first on SmartAsset Blog.

This Telecom Stock Just Declared a Massive Dividend Raise. Should You Buy?

Typically, a dividend raise from a large-cap stock isn’t very massive. Such companies typically have a great many shares outstanding, so even a modest hike in the shareholder payout could mean additional expenses of millions, possibly even billions, of dollars. So for the most part, whenever one of these titans declares a dividend raise, it’s more of a bump than a jump.

That sure wasn’t the case with telecom T-Mobile US (NASDAQ: TMUS) earlier this month, when it enacted a 35% dividend raise. That’s quite the generous hike; let’s take a closer look at it and figure out if it helps make the stock a buy.

Improving results and a FCF windfall

In mid-September, T-Mobile’s board of directors declared that its upcoming quarterly dividend is to be $0.88 per share. That was surely pleasing to shareholders who had previously earned a payout of “merely” $0.65. For investors who like to take advantage of such situations, there’s still plenty of time to hop on this dividend raise, as it is going to be paid on Dec. 12 to investors of record as of Nov. 27.

T-Mobile is likely feeling flush because its cash waterfall is flowing robustly. Scrolling through its second-quarter earnings release from the end of July, one line item stands out sharply — non-GAAP (adjusted) free cash flow (FCF). At $4.4 billion, this was a whopping 54% higher year over year and notched an all-time high for the company. Other financial metrics rose nicely, but not as steeply, with its core services revenue advancing 4% to $16.4 billion, and headline net income increasing a chunky 32% to $2.9 billion.

FCF growth is the motor that drives dividend raises, hence the company’s confidence in boosting the payout more than one-third higher. T-Mobile has actually had quite a bit of gas in the tank for raises even before the second-quarter FCF pop, as the quarterly spend on its few rounds of dividends — it only initiated its payout at the end of 2023 — was $769 million at most.

Happily for the company’s shareholders, management raised its FCF guidance for full-year 2024. This should help management meet its goal of roughly 10% annual dividend growth.

Playing catch-up

T-Mobile management might feel it’s in catch-up mode. After all, the two rivals it’s always compared to — Verizon Communications and AT&T — have been steady and reliable dividend payers for years. Not only that, but the pair long ago wandered into high-yield dividend territory and stayed there (despite significant changes in corporate structure, as in AT&T’s case). Verizon keeps its investors sweet with a payout that yields over 6%, while AT&T isn’t far behind at 5.1%.

Although ever-scrappy T-Mobile’s 35% raise is impressive on a number of levels, even at the enhanced new level its distribution would only yield 1.7%.

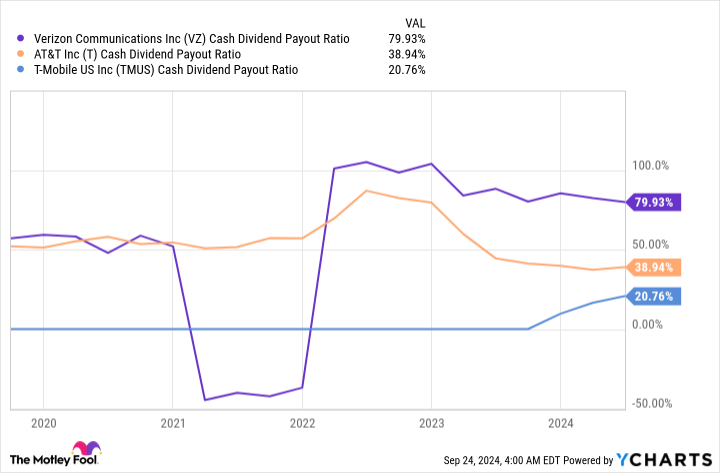

But we can expect this difference in yields to narrow before long, assuming T-Mobile keeps roaring along. Taking a glance at its cash dividend payout ratio — that’s the percentage of FCF it devotes to those dividend payouts — reveals a notably lower figure than that of AT&T or (especially) Verizon:

VZ Cash Dividend Payout Ratio data by YCharts

Meanwhile, in next-generation mobile technology T-Mobile is better positioned than its two peers. It has managed to build out its 5G infrastructure to the point where it’s a leader; according to a July analysis from telecom researcher OpenSignal, the company is “untouchable” for 5G availability, with T-Mobile 5G service subscribers connected to the tech almost 68% of the time when online. That percentage is nearly six times that of AT&T, and roughly nine times the rate of Verizon.

In fact, of the 15 categories tracked by OpenSignal, T-Mobile took the gold in nine of them, including 5G coverage experience and consistency of quality.

AT&T and Verizon are clearly determined to close these gaps, but 5G isn’t cheap or easy to build out. AT&T plans to spend $11.5 billion to $12.5 billion throughout the second half of this year on capital expenditures, and you can bet large chunks of that are being poured into 5G. In the same period last year, AT&T’s outlays totaled $11.2 billion. Verizon is also spending more, to the tune of $8.9 billion to $9.4 billion against second-half 2023’s $8.7 billion. Is it any wonder that the two are heavily indebted?

Make no mistake, T-Mobile has to spend to earn, too, but its burden isn’t nearly as burdensome. The company estimates its second-half capex will come in at $4.2 billion, up from $4 billion in the year-ago period.

So in short, T-Mobile operates in a business considered indispensable to many consumers, it’s improving its fundamentals effectively while not being as weighed down by spending goals as others, and it has a dividend with room to grow at inspiring rates. All that makes its stock rather compelling, in my opinion.

Should you invest $1,000 in T-Mobile US right now?

Before you buy stock in T-Mobile US, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and T-Mobile US wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $756,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool recommends T-Mobile US and Verizon Communications. The Motley Fool has a disclosure policy.

This Telecom Stock Just Declared a Massive Dividend Raise. Should You Buy? was originally published by The Motley Fool

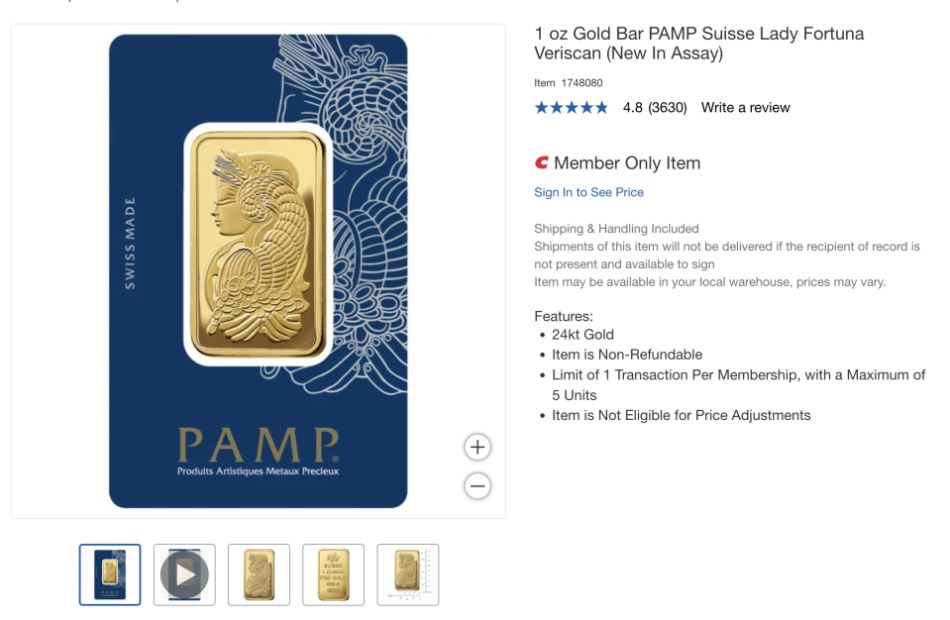

Costco still selling gold bars like hotcakes as prices surge

Costco (COST) is slinging a lot of gold bars as prices for the yellow metal continue to surge.

Sales of gold were up “double digits” in the most recent quarter, Costco CFO Gary Millerchip told analysts on its earnings call Thursday evening. Millerchip went on to add that gold was a “meaningful tailwind” to e-commerce sales in the quarter.

Costco began selling gold bars in the fall of 2023. Wells Fargo analysts have estimated Costco is selling $100 million to $200 million in gold bars each month.

The most recent gold performance led to a tongue-in-cheek moment as Costco’s call was nearing its end.

Veteran Evercore ISI analyst Greg Melich asked executives, “Given the nonfood, the success there, … I’m just curious, are there any plans to maybe bring Kirkland Signature into the gold bullion market?”

Kirkland Signature is Costco’s large private-label business.

“No plans at this time,” Costco CEO Ron Vachris said.

The gold rush at the warehouse club comes as futures for the metal hit (GC=F) record highs at $2,708.70 an ounce during Thursday’s trading session. Year to date, gold is up 30%, with the Fed’s decision to cut rates by a half percentage point last week giving it another boost.

Top gold stocks such as Freeport McMoRan (FCX) and Barrick Gold (GOLD) have gained a cool 22% and 18%, respectively, in 2024.

On its website, Costco sells its 1 oz gold bar for $2,679.99. You have to be a member to buy the bullion. It’s also non-refundable, and there’s a limit of five total units per membership.

It’s likely that Costco’s gold business will stay lucrative in the near term, pros suggest.

IDX CIO Ben McMillan told Yahoo Finance this week that after years of gold being “sleepy,” it’s now firing on all cylinders as investors look to de-risk their portfolios.

“Gold historically has been … kind of associated with very risk-off, very flight to safety type trades like hard landing recessions,” McMillan said.

Despite the hefty sales of gold, Costco’s bread and butter is still hawking products like, well, bread and butter to cost-conscious shoppers.

Its fiscal fourth quarter same-store sales growth came in at 6.9%, compared to estimates of 6.4%. E-commerce sales jumped 19.5%, slightly lower than the 19.63% growth rate Wall Street was projecting.

Sales were powered by growth in appliances, food health and beauty aids, tires, toys, and gift cards, among other items.

Shares of Costco fell 1.5% in premarket trading on Friday.

“In total, we think strong comparable sales and membership growth, and solid member retention rates indicate the company’s value proposition continues to appeal, with strong share gains across most of the company’s businesses. We anticipate the recently enacted membership fee increase will be largely reinvested, further aiding sales, comp, and traffic growth over the next 12-18 months,” Stifel analyst Mark Astrachan wrote in a client note.

Astrachan maintained a Buy rating on the stock.

Brooke DiPalma is a senior reporter for Yahoo Finance. Follow her on Twitter at @BrookeDiPalma or email her at bdipalma@yahoofinance.com.

MGX Investors Have Opportunity to Lead Metagenomi, Inc. Securities Fraud Lawsuit with the Schall Law Firm

LOS ANGELES, Sept. 27, 2024 (GLOBE NEWSWIRE) — The Schall Law Firm, a national shareholder rights litigation firm, announces the filing of a class action lawsuit against Metagenomi, Inc. (“Metagenomi” or “the Company”) MGX for violations of the federal securities laws.

Investors who purchased the Company’s securities pursuant and/or traceable to the Company’s Offering Documents in connection with its initial public offering (“IPO”) conducted on or about February 9, 2024, are encouraged to contact the firm before November 25, 2024.

If you are a shareholder who suffered a loss, click here to participate.

We also encourage you to contact Brian Schall of the Schall Law Firm, 2049 Century Park East, Suite 2460, Los Angeles, CA 90067, at 310-301-3335, to discuss your rights free of charge. You can also reach us through the firm’s website at www.schallfirm.com, or by email at bschall@schallfirm.com.

The class, in this case, has not yet been certified, and until certification occurs, you are not represented by an attorney. If you choose to take no action, you can remain an absent class member.

According to the Complaint, the Company made false and misleading statements to the market. Metagenomi its business relationship with Moderna throughout the IPO period. The Company based its claims on a Strategic Collaboration and License Agreement entered into on October 29, 2021, including multiple four-year research programs and a subsequent licensed product-by-licensed product agreement. The Company announced just months after the IPO that it and Moderna had “mutually agreed to terminate their collaboration.” Based on these facts, the Company’s public statements were false and materially misleading throughout the class period. When the market learned the truth about Metagenomi, investors suffered damages.

Join the case to recover your losses.

The Schall Law Firm represents investors around the world and specializes in securities class action lawsuits and shareholder rights litigation.

This press release may be considered Attorney Advertising in some jurisdictions under the applicable law and rules of ethics.

CONTACT:

The Schall Law Firm

Brian Schall, Esq.,

www.schallfirm.com

Office: 310-301-3335

info@schallfirm.com

SOURCE:

The Schall Law Firm

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Minister Vandal announces federal investment for revitalization and economic reconciliation in downtown Winnipeg

PrairiesCan funding of $10 million for TN-SCO Housing 92 Inc. (TN-SCO) will help develop new community spaces within a redeveloped Portage Place

WINNIPEG, MB, Sept. 27, 2024 /CNW/ – The revitalization of Portage Place represents a significant opportunity to address Winnipeg’s housing needs while advancing Indigenous reconciliation and creating welcoming spaces which are essential for healthy communities. Today, the Honourable Dan Vandal, Minister responsible for PrairiesCan, announced $10 million in federal support for the creation of retail, food, and community spaces within the broader redevelopment of Portage Place. These spaces will be available to entrepreneurs from diverse backgrounds who are seeking to start new businesses, and to not-for-profits offering social and wellness services to the community.

This project is an important piece of a larger vision for Winnipeg’s downtown, one where all people are welcome, connected and supported. The full scope of the project includes a multi-story Health Care Centre of Excellence, an affordable housing complex, community spaces, and support for local businesses.

Winnipeg is home to Canada’s largest population of urban Indigenous Peoples and a vibrant newcomer community. Providing supportive locations for entrepreneurship such as new restaurants, retail businesses or services is part of a larger effort to renew downtown. This project complements the vision for the new Portage Place and Wehwehneh Bahgahkinahgohn and aims to transform the former Hudson’s Bay Company building into a social and economic housing complex and cultural hub that honours Indigenous Peoples and welcomes all.

Quotes

“A vibrant downtown Winnipeg is vital for a strong Manitoba economy and healthy community for all. I am pleased that our government is supporting True North and the Southern Chiefs’ Organization to redevelop Portage Place and revitalize our downtown. This project is a national example of reconciliation in action and will have an impact for generations to come.”

–The Honourable Dan Vandal, Minister responsible for PrairiesCan

“The effort to reimagine Portage Place is an unprecedented step for downtown Winnipeg redevelopment and economic reconciliation in our country. True North Real Estate Development and our partners at the Southern Chiefs’ Organization are grateful to the Government of Canada for its assistance and to the Province of Manitoba and City of Winnipeg for their contributions to revitalize our downtown.”

–Jim Ludlow, President, True North Real Estate Development

“Economic Reconciliation is the cornerstone of Project 92, one of the Calls to Action coming out of the Truth and Reconciliation Commission of Canada. This project will lift many relatives out of poverty, provide meaningful jobs, and a good life. Project 92 is a shining example of how we can work together on revitalizing our city and building a future with hope and opportunity for all through meaningful reconciliation.”

–Grand Chief Jerry Daniels, Southern Chiefs’ Organization Inc.

Quick facts

- The Community Economic Development and Diversification (CEDD) program supports economic development initiatives that contribute to the economic growth and diversification of communities across the prairie provinces and enables communities to leverage their capacity and strengths to respond to economic opportunities and challenging economic circumstances.

- Downtown Winnipeg is a significant economic driver in Manitoba. It makes up 17 per cent of the commercial property tax, 14 per cent of the business tax, and 70 per cent of the office space while taking up less than one per cent of the total land area.

- Winnipeg is home to the largest Indigenous population in Canada. According to the 2021 census, there were 102,080 Indigenous people living in Winnipeg. Approximately 45,000 of whom are part of SCO member First Nations.

Associated links

Stay connected

Follow PrairiesCan on X (formerly Twitter) and LinkedIn

Toll-Free Number: 1-888-338-9378

TTY (telecommunications device for the hearing impaired): 1-877-303-3388

SOURCE Prairies Economic Development Canada

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/27/c8273.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/27/c8273.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Witnessing An Insider Decision, Madonna John W Exercises Options Valued At $288K At Darden Restaurants

In a new SEC filing on September 26, it was revealed that W, SVP at Darden Restaurants DRI, executed a significant exercise of company stock options.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Thursday showed that W, SVP at Darden Restaurants, a company in the Consumer Discretionary sector, just exercised stock options worth 4,735 shares of DRI stock with an exercise price of $107.05.

Darden Restaurants shares are currently trading up by 0.07%, with a current price of $168.06 as of Friday morning. This brings the total value of W’s 4,735 shares to $288,882.

Get to Know Darden Restaurants Better

Darden Restaurants is the largest restaurant operator in the US full-service space, with consolidated revenue of $11.4 billion in fiscal 2024 resulting in 3%-4% full-service market share (per NRA data and our calculations). The company maintains a portfolio of 10 restaurant brands: Olive Garden, LongHorn Steakhouse, Cheddar’s Scratch Kitchen, Ruth’s Chris, Yard House, The Capital Grille, Seasons 52, Eddie V’s, Bahama Breeze, and The Capital Burger. Darden generates revenue almost exclusively from company-owned restaurants, though a small network of franchised restaurants and consumer-packaged goods sales through the traditional grocery channel contribute modestly. As of the end of its fiscal 2024, the company operated 2,031 restaurants in the US.

Key Indicators: Darden Restaurants’s Financial Health

Decline in Revenue: Over the 3 months period, Darden Restaurants faced challenges, resulting in a decline of approximately -6.77% in revenue growth as of 31 August, 2024. This signifies a reduction in the company’s top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Key Profitability Indicators:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 20.41%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): Darden Restaurants’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 1.75.

Debt Management: With a below-average debt-to-equity ratio of 2.48, Darden Restaurants adopts a prudent financial strategy, indicating a balanced approach to debt management.

Financial Valuation Breakdown:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 19.37 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 1.77 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a lower-than-industry-average EV/EBITDA ratio of 13.87, Darden Restaurants presents a potential value opportunity, as investors are paying less for each unit of EBITDA.

Market Capitalization Highlights: Above the industry average, the company’s market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

Insider transactions serve as a piece of the puzzle in investment decisions, rather than the entire picture.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Transaction Codes To Focus On

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Darden Restaurants’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Rocket Lab Stock Soars: Should Investors Chase the Rally?

Rocket Lab USA Inc. RKLB shareholders recently saw RKLB stock hit a new 52-week high of $8.98 per share. As of this writing, it’s pulled back a little to $8.69 per share but is still one of the best-performing stocks in 2024 and over the last 12 months. Many analysts believe that RKLB stock is a long-term buy, but is this a stock for investors to chase at this price?

Rocket Lab is one of the top names in the red-hot space economy. Many companies like Space-X and Rocket Lab aim to be an end-to-end space company that can help customers build the infrastructure needed to make space travel a common reality. Rocket Lab generates revenue from its launch business and its space services business, which account for about 70% of the company’s current revenue.

The bullish case can begin with the idea that Rocket Lab is still standing. That can’t be said for other companies in this space. However, it’s also important to note that the company isn’t turning a profit…yet. That makes it difficult to give the stock an accurate valuation.

Launch Activity Has the Stock Ready for Liftoff

The current reason for Rocket Lab’s stock’s performance comes from its product launches. On September 20, Rocket Lab successfully launched its 53rd Electron rocket. Electron is the company’s flagship product, designed for small satellite launches, for which there is massive demand. Rocket Lab estimates that by 2030, there will be demand for over 10,000 satellites to be launched.

The Electron is only the beginning. The company is also developing its Neutron rocket, which is designed to handle medium payloads. This will open a new revenue stream for the company.

That will be a key factor in addressing the one issue that could be holding Rocket Lab stock from going “to the moon.” That issue is the lack of profitability and negative free cash flow. This isn’t unusual for a company like Rocket Lab, which is still in the growth stage. The company’s proven track record will ensure that it will be able to borrow capital regardless of what’s happening with interest rates.

Don’t Discount the Short Interest Factor

RKLB stock has been one of the best-performing stocks over the last 12 months, climbing 103.3%. The stock is also up 55.8% in 2024, and investors who bought the dip in March have received an even larger gain.

Gains like that in an emerging growth stock like Rocket Lab brought out the short sellers. Short interest in RKLB stock is 18.7% of the float and has climbed 2.12% in the last 30 days. That means investors shouldn’t discount the idea that some of this recent rally may be due to short covering.

To support that thinking, on September 23, 2024, Cantor Fitzgerald reiterated its Overweight rating on RKLB stock and maintained its $7 price target. That’s above the consensus price target of $6.86, but it’s nearly 20% lower than the stock’s current price.

Moving Forward With RKLB Stock

Rocket Lab is one of the leading names among aerospace stocks, and there is a reason to believe it’s a long-term buy. However, it looks more than fairly valued at $8.82 per share, which is its price at the time of this writing. That said, if you were an investor in RKLB stock when it first went public, you may still be sitting on a loss. However, if you bought the stock after March 2022, you’re likely sitting on a profit.

If you’re approaching RKLB as a long-term investment, you could take some profit, but there’s nothing to suggest you should abandon your current approach. Holding RKLB stock and waiting for the next dip is a sound strategy.

But what if you’re looking to trade the stock? The Rocket Lab Options Chain on MarketBeat shows the heaviest call activity around $10 and the heaviest Put activity around $9.50 over the next 30 days. That means this rally could still have a 10% to 15% upside.

Thirty days also nearly track with the company’s next earnings report on November 7. At that time, investors may better understand Rocket Lab’s path to profitability.

The article “Rocket Lab Stock Soars: Should Investors Chase the Rally?” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.