Decoding Marriott Intl's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bullish move on Marriott Intl. Our analysis of options history for Marriott Intl MAR revealed 9 unusual trades.

Delving into the details, we found 55% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $760,957, and 5 were calls, valued at $169,571.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $150.0 and $300.0 for Marriott Intl, spanning the last three months.

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Marriott Intl options trades today is 83.57 with a total volume of 3,515.00.

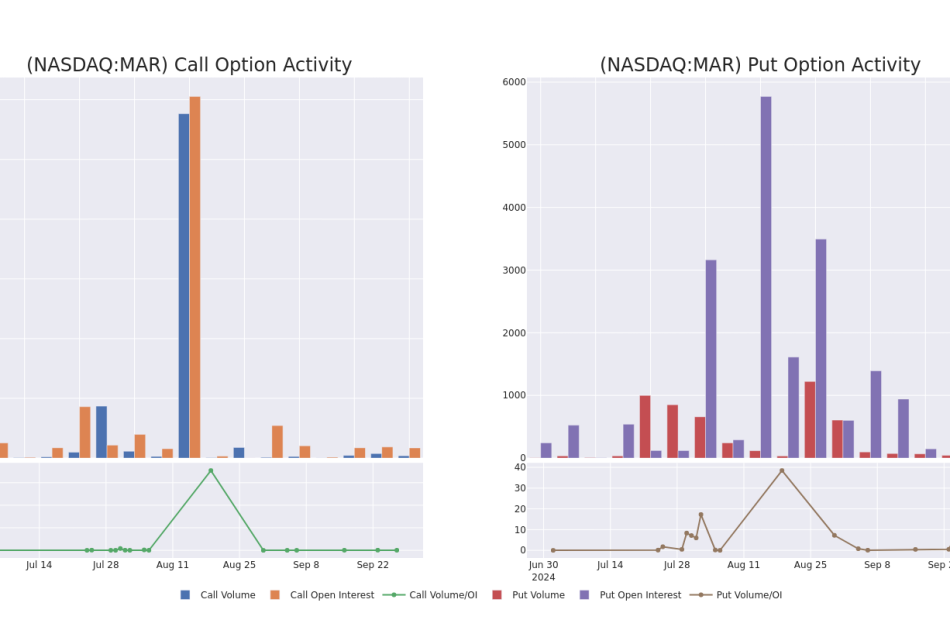

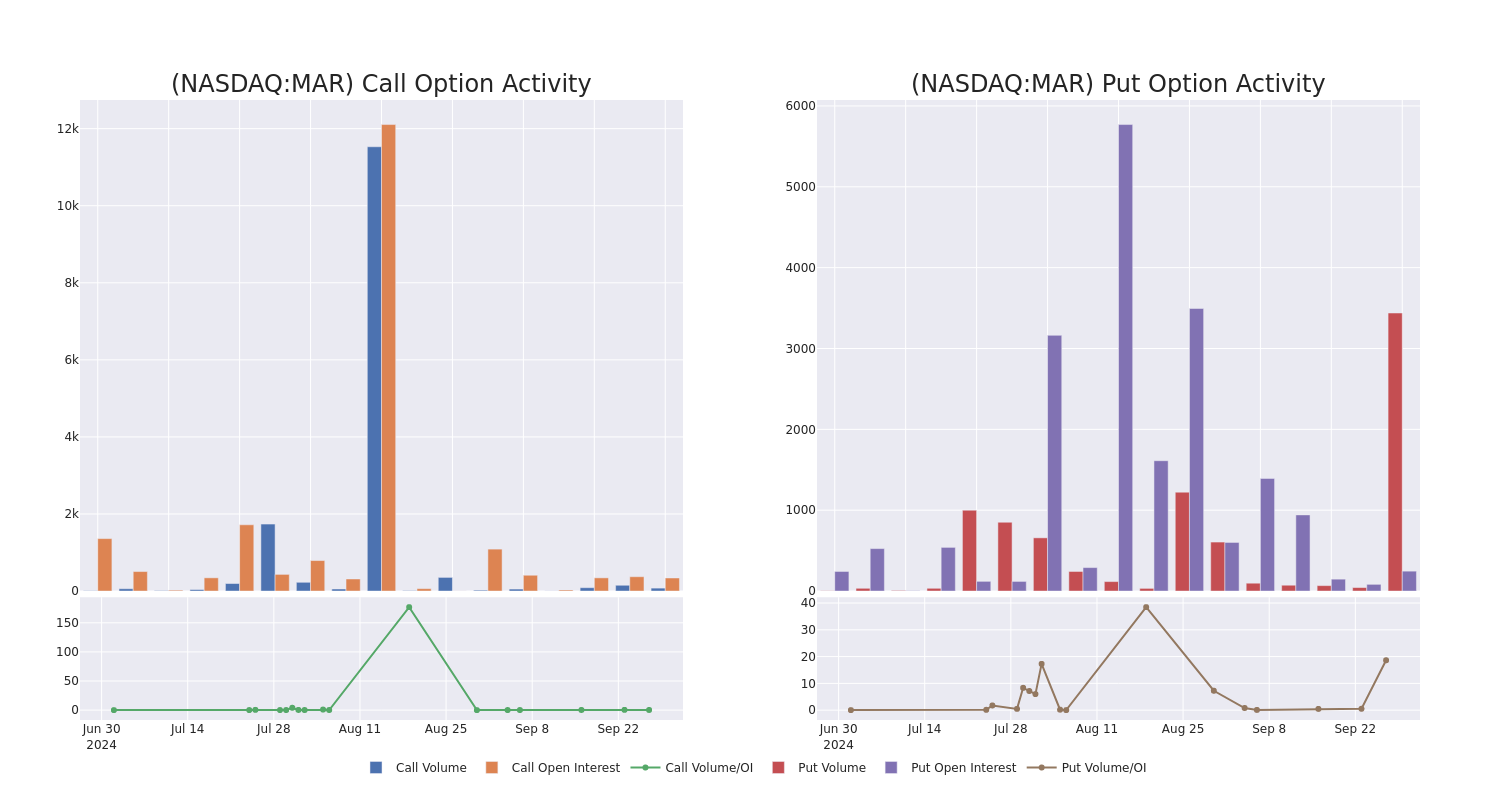

In the following chart, we are able to follow the development of volume and open interest of call and put options for Marriott Intl’s big money trades within a strike price range of $150.0 to $300.0 over the last 30 days.

Marriott Intl Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MAR | PUT | SWEEP | BULLISH | 12/20/24 | $6.0 | $5.9 | $5.9 | $240.00 | $338.1K | 226 | 663 |

| MAR | PUT | SWEEP | BULLISH | 12/20/24 | $6.1 | $5.8 | $5.8 | $240.00 | $308.0K | 226 | 1.3K |

| MAR | PUT | SWEEP | BEARISH | 04/17/25 | $10.9 | $10.1 | $10.9 | $240.00 | $81.7K | 20 | 75 |

| MAR | CALL | TRADE | BULLISH | 01/16/26 | $110.9 | $108.5 | $110.9 | $150.00 | $55.4K | 24 | 5 |

| MAR | PUT | SWEEP | BULLISH | 12/20/24 | $5.8 | $5.6 | $5.6 | $240.00 | $33.0K | 226 | 1.3K |

About Marriott Intl

Marriott operates 1.7 million rooms across roughly 30 brands. At the end of 2023, luxury represented roughly 10% of total rooms, premium 42%, select service was 46%, midscale 1%, and other 1%. Marriott, Courtyard, and Sheraton are the largest brands, while Autograph, Tribute, Moxy, Aloft, and Element are newer lifestyle brands. Managed and franchised represented 97% of total rooms as of Dec. 31, 2023. North America makes up 63% of total rooms. Managed, franchise, and incentive fees represent the vast majority of revenue and profitability for the company.

After a thorough review of the options trading surrounding Marriott Intl, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Marriott Intl’s Current Market Status

- With a trading volume of 1,235,041, the price of MAR is up by 0.93%, reaching $253.04.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 34 days from now.

Professional Analyst Ratings for Marriott Intl

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $264.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Goldman Sachs downgraded its action to Buy with a price target of $267.

* An analyst from Bernstein upgraded its action to Outperform with a price target of $262.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Marriott Intl with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Refurbished Laboratory Equipment Market Estimated to Reach USD 37.6 billion, Advancing at a CAGR of 5.1% by 2031: Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Sept. 27, 2024 (GLOBE NEWSWIRE) — As per the report published by Transparency Market Research, the global refurbished laboratory equipment market (개조된 실험실 장비 시장) was worth US$ 23.9 Bn in 2022 and is expected to reach US$ 37.6 Bn by the year 2031 at a CAGR of 5.1 % between 2023 and 2031.

Equipment and supplies for laboratories that have been previously owned and restored to full working order are referred to as refurbished equipment, and they tend to have brand-new specs. These equipment undergo a thorough refurbishment procedure that includes painstaking cleaning, replacing or repairing any worn-out or broken parts, re-calibration, and thorough quality control testing to guarantee that they satisfy the requirements set by the original manufacturers.

Refurbished Laboratory Equipment Market at a Glance

Refurbished laboratory equipment offer several key advantages such as cost savings. Refurbished equipment typically cost 30-70% less than brand-new models, thereby making advanced technology more accessible to smaller labs, research institutions, and start-ups. These systems undergo thorough testing and recalibration, ensuring they meet manufacturer specifications, and guarantee reliability and performance.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/refurbished-laboratory-equipment-market.html

Additionally, opting for refurbished equipment promotes sustainability by reducing waste and minimizing the demand for new resources, aligning with increasing focus on environmental responsibility across industries.

The rising costs of new laboratory equipment and tightening budgets in academic, clinical, and research labs have spurred the adoption of refurbished devices. Government funding for research institutions and healthcare systems in emerging markets is often limited, making affordable alternatives like refurbished equipment attractive.

The global increase in healthcare services, pharmaceutical research, and biotechnology development has expanded the number of diagnostic labs and research centers. As these facilities proliferate, there is a growing need for cost-effective solutions, driving demand for refurbished laboratory tools.

As technology evolves rapidly, the turnover rate of laboratory equipment increases, with many labs upgrading to the latest systems. This leads to a robust secondary market where slightly older yet advanced equipment are refurbished and resold. As the pace of innovation accelerates, more high-tech devices are becoming available for refurbishment.

The growing focus on environmental sustainability has pushed industries to explore more eco-friendly options, with many turning to refurbished products. By purchasing refurbished laboratory equipment, organizations can significantly reduce their carbon footprint, as fewer resources are needed to refurbish than to manufacture new devices.

Refurbished equipment provides an affordable alternative for laboratories in emerging economies, where the high cost of brand-new technology can be prohibitive. Countries in Asia-Pacific, Latin America, and Africa are experiencing a growing demand for laboratory equipment, and refurbished options are helping meet the needs of these cost-conscious markets.

These factors collectively fuel the expansion of the refurbished laboratory equipment market, helping laboratories balance cost, sustainability, and performance.

Refurbished Laboratory Equipment Market Report Scope:

| Report Coverage | Details |

| Forecast Period | 2022-2031 |

| Base Year | 2017-2021 |

| Size in 2022 | US$ 23.9 Bn |

| Forecast (Value) in 2031 | US$ 37.6 Bn |

| Growth Rate (CAGR) | 5.1% |

| No. of Pages | 182 Pages |

| Segments covered | By Product, By End-use. |

Refurbished Laboratory Equipment Market Regional Insights

- North America generated the largest market value in 2023. The region is expected to maintain its dominance during the forecast period as well.

According to the latest refurbished laboratory equipment market analysis, North America held the largest share in 2022. Increasing demand for diagnostic testing, growing focus on environmental sustainability, continuous advancements in technology leading to rapid obsolescence of laboratory equipment, well-established healthcare infrastructure, advanced diagnostic capabilities, and a high number of research and development activities are some of the factors driving the refurbished laboratory equipment market share in North America.

Prominent Players Operating in the Refurbished Laboratory Equipment Industry

Thermo Fisher Scientific, Inc., American Laboratory Trading, Inc., ARC Scientific LLC, American Instrument Exchange, SpectraLab Scientific, Inc., GenTech Scientific., International Equipment Trading Ltd., Copia Scientific, Inc., and Cambridge Scientific are some of the leading players operating in the sector.

In December 2022, American Laboratory Trading (ALT), America’s largest provider of premium and refurbished lab equipment, in conjunction with Heritage Global Partners (“HGP”), a worldwide leader in asset advisory and auction services, both subsidiaries of Heritage Global Inc. HGBL, announced that they would host an online auction of the laboratory equipment assets from Rubius Therapeutics in Cambridge, Massachusetts. The online-only auction opened on January 9 at 7:00 am ET and closed in sequential order at 10:00 am ET on January 11, 2023.

In February 2022, Purity Scientific LLC, a parent company of GenTech Scientific which is a leading provider and servicer of refurbished scientific instruments, announced that it had acquired Conquer Scientific to provide a robust service network and an unparalleled inventory of refurbished analytical instruments.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/refurbished-laboratory-equipment-market.html

Refurbished Laboratory Equipment Market Segmentation

Product

- Analytical Equipment/Clinical Equipment

- Chromatography Systems

- Spectroscopy Instruments

- Mass Spectrometers

- Thermal Analyzers

- Immunoassay Analyzers

- Blood Gas Analyzers

- Coagulation Analyzers

- Others (Elemental Analyzers, Particle Size Analyzers, etc.)

- General Equipment

- Centrifuges

- Incubators

- Ovens

- Autoclaves

- Safety cabinets

- Others (Balances & Scales, Shakers & Stirrers, etc.)

- Specialty Equipment

- DNA Sequencers

- PCR Instruments

- Flow Cytometers

- Microscopes

- Bioreactors

- Others (microplate readers, x-ray diffraction systems, etc.)

- Support Equipment

End-user

- Healthcare Facilities

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutions

- Others

More Trending Reports by Transparency Market Research –

Dental Suction Mirror Market (歯科用吸引ミラー市場) – The global industry is anticipated to expand at a CAGR of 4.8% during the forecast period.

Dental Cavity Filling Material Market (سوق مواد حشو تجويف الأسنان) – The market is estimated to expand at a 5.3% CAGR during the forecast period from 2022 to 2031.

Refurbished Dental Lab Equipment Market (Markt für generalüberholte Dentallaborgeräte) – The global Refurbished Dental Lab Equipment Market is likely to grow at a CAGR of 4.4% from 2022 to 2031.

Dental Polishing Machine Market (Marché des machines de polissage dentaire) – The global Dental Polishing Machine Market is anticipated to grow at a CAGR of 5.3% during the forecast period from 2022 to 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

FRO – Filing of Half Yearly Report

Frontline plc (the “Company”) announces the filing of its half yearly report for the six months ended June 30, 2024.

The half yearly report can be downloaded from the Company’s website www.frontlineplc.cy or from the link below.

September 27, 2024

Frontline plc

Limassol, Cyprus.

Questions should be directed to:

Lars H. Barstad: Chief Executive Officer, Frontline Management AS

+47 23 11 40 00

Inger M. Klemp: Chief Financial Officer, Frontline Management AS

+47 23 11 40 00

This information is subject to the disclosure requirements pursuant to section 5 -12 of the Norwegian Securities Trading Act

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Palantir Stock Joins the S&P 500; Is It Time to Buy?

Palantir Technologies Inc. PLTR began trading as a member of the S&P 500 index on September 23, 2024. Inclusion in the index was a long-time goal of Palantir. It’s also a significant milestone for retail investors who have largely driven the growth of PLTR stock since it went public via a direct listing in 2020.

Palantir is one of the most discussed, and polarizing, technology stocks in 2024. One reason for that is because PLTR stock is also one of the best-performing stocks in 2024. It’s up 114% as of this writing.

This has many investors who have been on the sidelines wondering if now is a good time to start a position. And if you already have a position, is now a time to “load the boat?” It’s not an easy question to answer, but with so much news circulating around the company, it’s a good time to assess where things stand.

Institutions Will Buy More PLTR Stock

One of the most significant benefits of inclusion in the S&P 500 is that institutional investors will have to start buying PLTR stock. To be fair, institutional buying has outpaced selling by an almost three-to-one margin in the last 12 months. However, any index fund manager using the S&P 500 as its benchmark must ensure PLTR stock is one of its holdings.

The PLTR stock chart shows a significant increase in the volume of shares bought on September 23. This is likely the beginning of institutional buying activity. However, it’s important to note that for every buyer, there has to be a seller, so the current buying activity may be more significant for defining a floor for PLTR shares.

Analysts Are Coming Around on PTLR Stock

But what about the ceiling? Dan Ives of Wedbush has been one of the most bullish analysts on PLTR over the past year. He currently has a price target of $38 on PLTR, but his bull case upside is $50.

That was the price target that was recently posted by Bank of America BAC. The bank also placed Palantir on its US-1 list, a compilation of its best investment ideas.

Two New Contracts Since the S&P 500 Announcement

One concern about Palantir is that the company’s future growth is already priced in. However, since the S&P 500 announced Palantir’s inclusion, the company has announced two significant contracts: one on the government side and one on the commercial side.

The commercial contract expands its current partnership with Nebraska Medicine, a multimillion-dollar contract paid out over several years. Healthcare is one of the company’s most intriguing verticals because of the possibilities Palantir’s software can provide in increasing the efficiency of this industry.

On the government side, the U.S. Army awarded Palantir with a five-year fixed-price contract of nearly $1 billion ($99.8 million) for user licenses for the Maven Smart System AI tool. That’s $40 million per year over the next five years that will go to Palantir’s topline number.

Palantir is a Strong Long-Term Buy, But Guard Against FOMO on the Upside

With the prospect of 35% stock price appreciation in the next 12 months, it may seem like the time to load up on PLTR stock. But you’ll want to beware of FOMO (i.e. fear of missing out). The stock is overvalued by almost every traditional fundamental metric. You may not put much weight on those metrics, but many investors do, which may keep a lid on the stock.

Simply put, Palantir has tremendous upside potential, but that growth may not come in a straight line. Although Palantir seems to make new positive headlines weekly, the next true catalyst will likely be its earnings report on November 7, 2024. That’s two days after the U.S. presidential election, so it could be a volatile time for stocks.

A better strategy right now may be to use a dollar-cost averaging (DCA) strategy and wait for significant pullbacks to increase the amount of your buys. If you’re unfamiliar with the concept of dollar-cost averaging, it simply means putting the same amount of money into a stock at regular intervals. Spreading out your purchases can reduce price risks.

Regarding a stock like Palantir, we look at it as a “trust but verify” strategy. If the stock will pull back, you’ll benefit from that. But if $36 is the new floor, you’ll buy the stock at the new “best price.”

The article “Palantir Stock Joins the S&P 500; Is It Time to Buy?” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Latest Inflation Data Cements Fed's Interest Rate Call, S&P 500 Hits All-Time High, Biden Adviser Backs China EV Ban At Detroit Economic Club: This Week In The Markets

The Federal Reserve’s preferred measure of inflation, the personal consumption expenditures index, grew less than economists expected in August at 2.2% year-over-year. The data comes on the heels of the Federal Reserve’s 0.5% interest rate cut issued Sept. 18, the first in more than four years.

The inflation data supports another 0.5% interest rate cut in November, RSM US LLP Chief Economist Joseph Brusuelas said in a Friday tweet. “This is what an economic expansion looks like at full employment,” he said.

The S&P 500 traded at all-time highs above the 5,700 level this week.

Lael Brainard, the director of the National Economic Council and a former Federal Reserve board member, spoke in favor of the Biden administration’s proposed ban on Chinese electric vehicles Monday at the Detroit Economic Club, the same day details of the proposal were released.

The U.S. Commerce Department aims to block the import and sale of Chinese-made vehicles with key communications and automated driving systems on the basis of national security concerns. Additionally, a 100% tariff on Chinese electric vehicles imposed by the Biden administration took effect Friday.

“We will not allow cars driving on U.S. roads if they are using Chinese software and hardware systems,” Brainard told the DEC. “We think this is very important from a national security point of view.”

Facebook parent company Meta Platforms Inc META announced its latest Quest 3S virtual reality headset at the Meta Connect 2024 conference Wednesday along with updates to its Llama artificial intelligence platform and Ray-Ban smart glasses. CEO Mark Zuckerberg introduced a prototype for Orion, Meta’s holographic augmented reality glasses.

“This isn’t passthrough. This is the physical world with holograms laid on it,” Zuckerberg said.

The People’s Bank of China announced stimulus measures this week that will inject approximately $140 billion (1 trillion yuan) in liquidity into the country’s banking system as well as a reduction in the mortgage rate, sending U.S.-traded China stocks and ETFs such as e-commerce giant Alibaba Group Holding Ltd – ADR BABA and electric vehicle manufacturer Nio Inc – ADR NIO higher.

Billionaire hedge fund manager David Tepper told CNBC’s “Squawk Box” that he’s building positions in Chinese stocks. “I didn’t know that they were going to bring out the big guns,” Tepper of the country’s stimulus plans.

Novo Nordisk A/S NVO CEO Lars Jorgensen faced questions from the Senate Health, Education, Labor and Pensions Committee Tuesday about the high prices of the drugs Ozempic and Wegovy.

Wegovy, the weight loss version of diabetes drug Ozempic, costs $1,349 monthly in the U.S. versus $186 in Denmark, $140 in Germany and $92 in the U.K., according to the committee.

“You’re making huge amounts of money in this country and you’re charging us far more and you haven’t given me an answer as to why,” Sen. Bernie Sanders, the committee’s chair, said to Jorgensen during the hearing.

The CEO said: “Anything that will help patients get access to affordable medicine, we’ll be happy to look into.”

Photo: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Media & Technology Group (DJT) Stock: Speculation-Driven Valuation Make it a Sell

Since Trump Media & Technology Group (DJT) debuted on the NASDAQ in March 2024, following a long and complex merger with a SPAC, its stock performance has been driven more by speculation surrounding former president Donald Trump—its largest shareholder—than by the company’s business fundamentals. Those fundamentals form the basis of my bearish outlook on DJT.

Given that DJT’s main asset is the social media platform Truth Social, with annual revenues less than $5 million, it’s hard to validate an enterprise value above $2 billion. While a potential Trump election victory could spark an ultra-bullish surge in the stock, that remains a highly speculative scenario with a risk-reward profile that I find unjustifiable.

DJT: A Bet on Trump Brand and Truth Social

Although I maintain a bearish position on DJT stock, it’s important to emphasize that a significant source of the hype and increased volatility in its share price stems from President Trump’s image, both as a politician and as a (allegedly) billionaire businessman.

The Trump name is a globally recognized brand, with DJT primarily tied to Truth Social, a social media platform that, amongst other things, opposes “cancel culture”. While brand recognition is hard to quantify, Trump Media & Technology Group is likely to expand beyond Truth Social. One potential growth avenue is the TMTG+ streaming service, which aims to promote free speech to a global audience, independent of major tech companies.

Despite the significant execution risks tied to these projects, especially Truth Social, it’s undeniable that Trump’s brand greatly boosts the business. However, Donald Trump’s track record as an entrepreneur is mixed. While he has achieved some success, particularly in media, he has also faced setbacks including real-estate and casino bankruptcies and significant debt problems.

DJT Stock Fluctuates with Election-Related Developments

Another reason for my skepticism about investing in DJT is the stock’s high volatility response to news and events linked to the upcoming presidential election in November.

Throughout this year, many abrupt movements in DJT’s stock price have coincided with election-related events. For instance, at the end of May, shares fell due to Trump’s felony conviction for business fraud. Following Trump’s dismissal of the federal case in Florida concerning classified documents on July 15, DJT shares surged 30% the next day, although this momentum quickly faded. DJT shares have seen several 50%+ pullbacks in the past year. Recently, DJT shares fell 12% following the Trump’s debate with Vice President Kamala Harris.

History suggests that DJT stock is more closely correlated with expectations about Trump’s potential return to the White House than with Truth Social’s business performance. While this association may not sustain itself in the long run, it creates the primary short-to-medium-term risk for the bearish thesis. An election victory could potentially propel DJT stock to a peak that surpasses previous levels.

The Disconnect Between DJT’s Fundamentals and Valuation

The primary reason for my bearish stance on DJT is the significant difficulty in trying to justify its valuation from business fundamentals.

DJT reported just $3.4 million in revenue over the past twelve months, accompanied by an operating loss of $125.4 million. Despite these weak figures, the company has an enterprise value of $2.2 billion and an astonishing price-to-sales ratio of nearly 500x. In the most recent quarter (Q2), revenues were minimal, totaling only $837,000. Furthermore, Truth Social’s user base declined to approximately 113,000 in April, representing a 19% drop year-over-year based on the available data.

On a positive note, DJT has a strong balance sheet, with $344 million in cash and no debt, which generates a meaningful amount of interest income. In fact, interest income accounted for the majority of the company’s inflows in the latest quarter. The firm’s large cash reserve is likely to diminish as the company expands beyond Truth Social, particularly with projects like its planned streaming service.

To a large degree, DJT’s valuation and trading resemble that of a meme stock. The share price is primarily influenced by volatility from momentum traders transacting on thin indicators. The absence of meaningful revenue makes it nearly impossible to estimate the company’s fair value right now. About 10.7% of DJT’s float is currently Short, which can make the stock vulnerable to a short-squeeze.

DJT’s Downtrend Is Likely to Remain

To further support my bearish stance on DJT stock, a technical analysis reveals that the stock is trading below its moving averages, lending additional reason to be pessimistic.

The share price downtrend has worsened in recent weeks, with DJT hitting all-time lows, largely due to the end of the restricted share lock-up period. That six-month lock-up period, following the stock’s debut in March, prevented former president Donald Trump and other early investors from selling their shares.

Trump has recently stated that he has no plans to sell his stake in Trump Media. As long as that remains the case, a sharp sell-off is unlikely, although DJT stock could continue to slowly lose more value.

Conclusions on DJT Stock

From a business fundamentals and valuation perspective, it’s nearly impossible to justify the current $2.75 billion market capitalization for Truth Social. The stock’s speculative nature has drawn significant interest from traders, resulting in volatility primarily tied to Trump’s presidential campaign developments rather than any business achievements. Given my view that DJT stock movements occur primarily on speculation, I’d advise investors against the temptation to catch this falling knife.

No Wall Street analysts cover Trump Media & Technology Group

ROSEN, LEADING INVESTOR COUNSEL, Encourages Moderna, Inc. Investors to Secure Counsel Before Important October 8 Deadline in Securities Class Action – MRNA

NEW YORK, Sept. 27, 2024 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of Moderna, Inc. MRNA between January 18, 2023 and June 25, 2024, both dates inclusive (the “Class Period”), of the important October 8, 2024 lead plaintiff deadline.

SO WHAT: If you purchased Moderna securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the Moderna class action, go to https://rosenlegal.com/submit-form/?case_id=27873 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than October 8, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, throughout the Class Period, defendants made false and/or misleading statements and/or failed to disclose that: (1) mRNA-1345, an mRNA respiratory syncytial virus (“RSV”) vaccine intended to protect adults aged 60 and above from lower respiratory tract disease cause by RSV infection, was less effective than defendants had led investors to believe; (2) accordingly, mRNA-1345’s clinical and/or commercial prospects were overstated; and (3) as a result, the Company’s public statements were materially false and misleading at all relevant times. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the Moderna class action, go to https://rosenlegal.com/submit-form/?case_id=27873 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chinese Cities Plan To Ease Home Buying Limits To Boost Struggling Real Estate Sector: Report

Major Chinese cities Shanghai and Shenzhen are poised to lift significant home purchase restrictions in the coming weeks, aiming to attract buyers and revitalize their struggling real estate markets.

What Happened: The changes will allow potential buyers to purchase homes without undergoing eligibility checks. Additionally, individuals from other regions in China will be permitted to buy properties in these cities, which were previously restricted due to concerns over excessive speculation, Reuters reported, citing four sources with knowledge of the matter.

The report revealed that both cities plan to eliminate limits on the number of homes one can purchase. This decision aligns with efforts by other Chinese cities that have abolished purchase restrictions over the past year to boost demand in the crisis-hit sector.

These developments follow broader monetary stimulus and property support measures announced by the central bank on Tuesday, which include liquidity injections and interest rate cuts. The goal is to restore confidence in the economy and achieve the 2024 economic growth target of approximately 5%.

China’s CSI 300 Real Estate Index saw a 7.8% rise in the morning session on Friday, further extending gains. The easing measures are part of a broader strategy to stabilize the troubled property sector, which has been in a prolonged downturn since mid-2021.

See Also: China’s Stimulus Sparks Optimism: 3 Large-Cap Stocks With Analyst Buy Ratings

Why It Matters: The decision by Shanghai and Shenzhen to lift home purchase restrictions comes amid a series of aggressive economic stimulus measures by the People’s Bank of China. On Monday, the PBoC cut a key short-term interest rate and injected over $10 billion into the financial system to boost the economy.

Following this, Chinese stocks surged to their highest levels in four months on Monday, driven by hopes for additional stimulus.

On Tuesday, Chinese stocks continued their upward trend as the PBoC unveiled further monetary stimulus, including cuts to the reserve requirement ratio for banks.

By Wednesday, the economic stimulus had sparked optimism among analysts, who identified several large-cap Chinese stocks with strong upside potential. The PBoC’s measures are expected to inject approximately $140 billion into the economy, encouraging more lending to boost growth.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SAGE, BIIB End Collaboration for Neurology Candidate SAGE-324

Sage Therapeutics, Inc. SAGE announced that partner Biogen BIIB has terminated its rights related to the investigational neurology candidate, SAGE-324. A phase II study on SAGE-324 for treating essential tremor failed to meet the primary endpoint in July.

The termination will be effective from Feb. 17, 2025.

Following the termination of the deal by BIIB, Sage Therapeutics will obtain full ownership and rights of SAGE-324. The company plans to study SAGE-324 for other indications, if any.

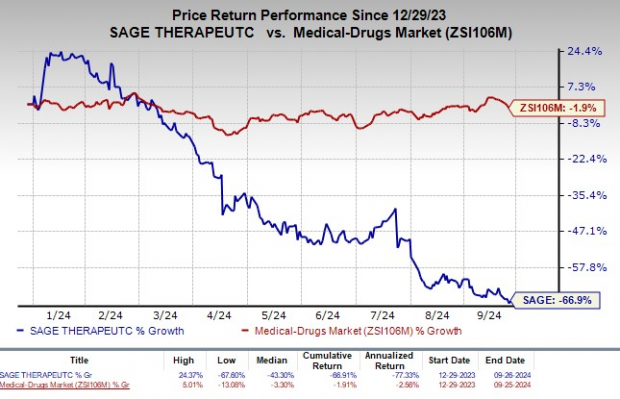

Year to date, shares of Sage Therapeutics have plunged 66.9% compared with the industry’s decrease of 1.9%.

Image Source: Zacks Investment Research

SAGE’s Licensing Agreement With BIIB

In July, Sage Therapeutics and Biogen announced top-line data from the phase II KINETIC 2 study, which evaluated SAGE-324 as a potential treatment for ET. The study failed to demonstrate a statistically significant dose-response relationship on the primary endpoint in participants with ET.

Based on the disappointing data, SAGE and BIIB decided to stop further clinical development of SAGE-324 in ET.

SAGE currently markets the depression drug Zurzuvae (zuranolone) in partnership with Biogen.

Zurzuvae, the first and only oral treatment indicated for adults with postpartum depression (PPD), was approved by the FDA in August 2023 and commercially launched in December.

Sage Therapeutics and Biogen, equally share profits and losses for the commercialization of Zurzuvae in the United States. In ex-U.S. markets, Biogen records product sales (excluding Japan, Taiwan and South Korea) and pays royalties to Sage Therapeutics.

Sage Therapeutics and BIIB are focused on establishing Zurzuvae as a first-line therapy and the standard of care for women with PPD.

The FDA issued a complete response letter for the new drug application (NDA) for zuranolone for treating adults with major depressive disorder in August 2023. Per the FDA, the data supporting the NDA filing did not provide substantial evidence of effectiveness to support a potential approval. It recommended conducting additional clinical studies.

The company is evaluating the necessary steps to address this CRL.

SAGE’s Zacks Rank & Stocks to Consider

Sage Therapeutics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are Krystal Biotech, Inc. KRYS and Fulcrum Therapeutics, Inc. FULC, each sporting a Zacks Rank #1 (Strong Buy) at present.

In the past 60 days, estimates for Krystal Biotech’s 2024 earnings per share have increased from $2.09 to $2.38. Earnings per share estimates for 2025 have improved from $4.33 to $7.31. Year to date, shares of KRYS have risen 43.8%.

KRYS’ earnings beat estimates in three of the trailing four quarters while missing on the remaining occasion, with the average surprise being 45.95%.

In the past 60 days, estimates for Fulcrum Therapeutics’ 2024 loss per share have narrowed from $1.33 to 28 cents. Loss per share estimates for 2025 have narrowed from $1.71 to $1.14. Year to date, shares of FULC have plunged 40.8%.

FULC’s earnings beat estimates in each of the trailing four quarters, with the average surprise being 393.18%.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cohen & Steers Quality Income Realty Fund, Inc. (RQI) Notification of Sources of Distribution Under Section 19(a)

NEW YORK, Sept. 27, 2024 /PRNewswire/ — This press release provides shareholders of Cohen & Steers Quality Income Realty Fund, Inc. RQI (the “Fund”) with information regarding the sources of the distribution to be paid on September 30, 2024 and cumulative distributions paid fiscal year-to-date.

In December 2012, the Fund implemented a managed distribution policy in accordance with exemptive relief issued by the Securities and Exchange Commission. The managed distribution policy seeks to deliver the Fund’s long-term total return potential through regular monthly distributions declared at a fixed rate per common share. The policy gives the Fund greater flexibility to realize long-term capital gains throughout the year and to distribute those gains on a regular monthly basis to shareholders. The Board of Directors of the Fund may amend, terminate or suspend the managed distribution policy at any time, which could have an adverse effect on the market price of the Fund’s shares.

The Fund’s monthly distributions may include long-term capital gains, short-term capital gains, net investment income and/or return of capital for federal income tax purposes. Return of capital includes distributions paid by the Fund in excess of its net investment income and net realized capital gains and such excess is distributed from the Fund’s assets. A return of capital is not taxable; rather, it reduces a shareholder’s tax basis in his or her shares of the Fund. In addition, distributions from the Fund’s investments in real estate investment trusts (REITs) may later be characterized as capital gains and/or a return of capital, depending on the character of the dividends reported to the Fund after year end by REITs held by the Fund. The amount of monthly distributions may vary depending on a number of factors, including changes in portfolio and market conditions.

At the time of each monthly distribution, information will be posted to cohenandsteers.com and mailed to shareholders in a concurrent notice. However, this information may change at the end of the year because the final tax characteristics of the Fund’s distributions cannot be determined with certainty until after the end of the calendar year. Final tax characteristics of all of the Fund’s distributions will be provided on Form 1099-DIV, which is mailed after the close of the calendar year.

The following table sets forth the estimated amounts of the current distribution and the cumulative distributions paid this fiscal year-to-date from the sources indicated. All amounts are expressed per common share.

|

DISTRIBUTION ESTIMATES |

September 2024 |

YEAR-TO-DATE (YTD) September 30, 2024* |

||

|

Source |

Per Share Amount |

% of Current Distribution |

Per Share Amount |

% of 2024 Distributions |

|

Net Investment Income |

$0.0639 |

79.88 % |

$0.2381 |

33.07 % |

|

Net Realized Short-Term Capital Gains |

$0.0000 |

0.00 % |

$0.0000 |

0.00 % |

|

Net Realized Long-Term Capital Gains |

$0.0161 |

20.12 % |

$0.4819 |

66.93 % |

|

Return of Capital (or other Capital Source) |

$0.0000 |

0.00 % |

$0.0000 |

0.00 % |

|

Total Current Distribution |

$0.0800 |

100.00 % |

$0.7200 |

100.00 % |

You should not draw any conclusions about the Fund’s investment performance from the amount of this distribution or from the terms of the Fund’s managed distribution policy. The amounts and sources of distributions reported in this Notice are only estimates, are likely to change over time, and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for accounting and tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. The amounts and sources of distributions year-to-date may be subject to additional adjustments.

*THE FUND WILL SEND YOU A FORM 1099-DIV FOR THE CALENDAR YEAR THAT WILL TELL YOU HOW TO REPORT THESE DISTRIBUTIONS FOR FEDERAL INCOME TAX PURPOSES.

The Fund’s Year-to-date Cumulative Total Return for fiscal year 2024 (January 1, 2024 through August 31, 2024) is set forth below. Shareholders should take note of the relationship between the Year-to-date Cumulative Total Return with the Fund’s Cumulative Distribution Rate for 2024. In addition, the Fund’s Average Annual Total Return for the five-year period ending August 31, 2024 is set forth below. Shareholders should note the relationship between the Average Annual Total Return with the Fund’s Current Annualized Distribution Rate for 2024. The performance and distribution rate information disclosed in the table is based on the Fund’s net asset value per share (NAV). The Fund’s NAV is calculated as the total market value of all the securities and other assets held by the Fund minus the total liabilities, divided by the total number of shares outstanding. While NAV performance may be indicative of the Fund’s investment performance, it does not measure the value of a shareholder’s individual investment in the Fund. The value of a shareholder’s investment in the Fund is determined by the Fund’s market price, which is based on the supply and demand for the Fund’s shares in the open market.

Fund Performance and Distribution Rate Information:

|

Year-to-date January 1, 2024 to August 31, 2024 |

|

|

Year-to-date Cumulative Total Return1 |

13.30 % |

|

Cumulative Distribution Rate2 |

5.14 % |

|

Five-year period ending August 31, 2024 |

|

|

Average Annual Total Return3 |

6.75 % |

|

Current Annualized Distribution Rate4 |

6.85 % |

|

1. |

Year-to-date Cumulative Total Return is the percentage change in the Fund’s NAV over the year-to-date time period including distributions paid and assuming reinvestment of those distributions. |

|

2. |

Cumulative Distribution Rate for the Fund’s current fiscal period (January 1, 2024 through September 30, 2024) measured on the dollar value of distributions in the year-to-date period as a percentage of the Fund’s NAV as of August 31, 2024. |

|

3. |

Average Annual Total Return represents the compound average of the Annual NAV Total Returns of the Fund for the five-year period ending August 31, 2024. Annual NAV Total Return is the percentage change in the Fund’s NAV over a year including distributions paid and assuming reinvestment of those distributions. |

|

4. |

The Current Annualized Distribution Rate is the current fiscal period’s distribution rate annualized as a percentage of the Fund’s NAV as of August 31, 2024. |

Investors should consider the investment objectives, risks, charges and expense of the Fund carefully before investing. You can obtain the Fund’s most recent periodic reports, when available, and other regulatory filings by contacting your financial advisor or visiting cohenandsteers.com. These reports and other filings can be found on the Securities and Exchange Commission’s EDGAR Database. You should read these reports and other filings carefully before investing.

Shareholders should not use the information provided here in preparing their tax returns. Shareholders will receive a Form 1099-DIV for the calendar year indicating how to report Fund distributions for federal income tax purposes.

Website: https://www.cohenandsteers.com

Symbol: CNS

About Cohen & Steers. Cohen & Steers is a leading global investment manager specializing in real assets and alternative income, including listed and private real estate, preferred securities, infrastructure, resource equities, commodities, as well as multi-strategy solutions. Founded in 1986, the firm is headquartered in New York City, with offices in London, Dublin, Hong Kong, Tokyo and Singapore.

Forward-Looking Statements

This press release and other statements that Cohen & Steers may make may contain forward looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which reflect the company’s current views with respect to, among other things, its operations and financial performance. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative versions of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties.

Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. The company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

![]() View original content:https://www.prnewswire.com/news-releases/cohen–steers-quality-income-realty-fund-inc-rqi-notification-of-sources-of-distribution-under-section-19a-302261494.html

View original content:https://www.prnewswire.com/news-releases/cohen–steers-quality-income-realty-fund-inc-rqi-notification-of-sources-of-distribution-under-section-19a-302261494.html

SOURCE Cohen & Steers, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.