U.S. Electricity Demand is Exploding: 3 Stocks to Play its Monster Growth

The two big trends for the rest of the decade will be artificial intelligence and electrification.

Behind both of those megatrends? Electricity … and lots of it.

In fact, electricity demand is growing in the U.S. at a rate we haven’t experienced in over 20 years. According to Goldman Sachs (NYSE: GS), U.S. electricity demand will grow at a 2.4% annualized rate through the end of this decade. While that doesn’t sound like much, consider that electricity demand growth for the past 10 years has been zero.

That growth will require some $50 billion of investment in new power production, not to mention billions more in connecting these sources of power to the grid. That massive investment should handsomely benefit the following three stocks.

Quanta Services

Quanta Services (NYSE: PWR) is a full-solutions provider for electricity infrastructure, including design, construction, and recurring maintenance and repair. The company serves the traditional electric power, renewable energy, and underground infrastructure industries.

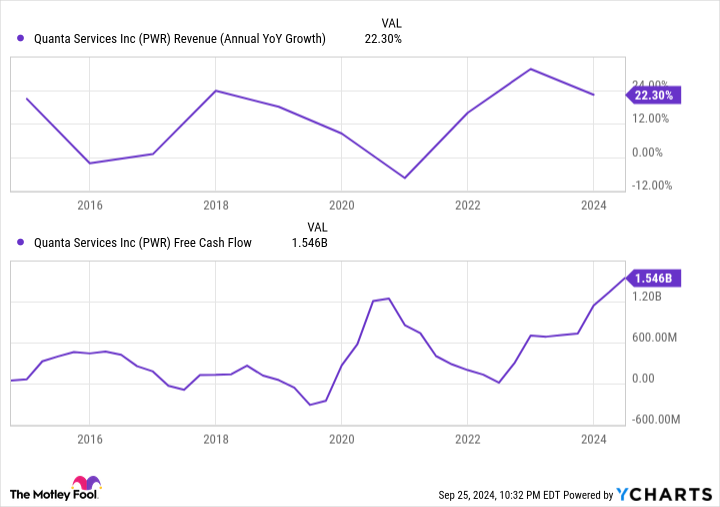

Quanta is a giant in the industry, with a $44 billion market cap and $22 billion in trailing 12-month revenue. But despite its already large size, growth has been solid, especially since the passage of the large infrastructure bills under the Biden administration in 2021 and 2022. Meanwhile, free cash flow has inflected higher with scale, surging to roughly $1.5 billion.

PWR Revenue (Annual YoY Growth) data by YCharts

Quanta has also been growing through acquisitions, with the most recent being its purchase of Cupertino Electric Inc. (CEI). CEI has a particular specialty in modular data center electrical systems, and it has a particularly close relationship with the technology industry.

Given that AI data centers are supposed to contribute 0.9% of the 2.4% electric power demand growth through 2030, the largest contributor to growth, this looks like a smart purchase by Quanta, giving it inroads into the fastest-growing part of the market.

Emcor Group

The Emcor Group (NYSE: EME) performs design, construction, and maintenance services like Quanta, but is a tad more diversified, operating both within and outside of the electrical power sector. No doubt, its electrical segment is a big one. Emcor’s electrical division not only handles power generation and distribution, but also installs solar modules and electric charging stations, and it provides electrical systems such as lighting and control automation to end customers.

Emcor serves other verticals outside of electricity that also have tailwinds behind them, thanks to the public-private investments spurred by the Bipartisan Infrastructure Act of 2021. These include installing manufacturing facilities, data centers, communications infrastructure, warehouses, roadway and traffic control, chemical and refining plants, water and wastewater systems, and others.

In addition, Emcor performs ongoing maintenance on all of these projects, with services accounting for about 30% of revenue, leading to relatively stable revenue and profit growth.

Like Quanta, Emcor has had an excellent few years of low-teens growth and surging free cash flow, which just exceeded $1 billion over the past 12 months. Revenue even accelerated last quarter to over 20% growth.

At just 25 times trailing earnings and 20 times cash flow, Emcor’s stock isn’t expensive for a company growing that fast and expanding margins. So, analysts appear to think growth will slow in the years ahead.

Yet with the AI and electrification buildouts still ongoing, stimulus still flowing through the economy, and interest rates beginning to fall, it’s quite possible Emcor keeps up better-than-expected growth.

American Superconductor Corp.

American Superconductor Corp. (NASDAQ: AMSC) is a small-cap player in electrical systems, with a market cap of just $920 million today. But the company is growing fast, with revenue up about 33% in its recent quarter.

For the grid, AMSC makes power systems, voltage control equipment, transformers, fast-switching equipment, and other systems that help make grid interconnects more efficient. Its equipment is installed both at the power source as well as through the distribution and transmission system.

American Superconductor’s secret sauce is its know-how of novel materials. The company pioneered the use of yttrium barium copper oxide to make its high-temperature superconductors. This material is able to conduct more electricity than traditional copper or aluminum wire, with minimal power loss. AMSC combines its equipment with full software and management systems, offering turnkey solutions for power generators and grid operators everywhere.

In addition to solutions for the grid, AMSC also has wind power solutions and turbine designs that it licenses to operators.

Finally, as a display of its technological process, AMSC sells power solutions to the U.S. Navy. One particularly interesting technology is its degaussing systems, which lower a ship’s magnetic signature, allowing naval ships to avoid detection by mines at sea.

AMSC just further bolstered its military business with the recent acquisition of NWL, which makes power supplies and controls to military and industrial customers. AMSC only paid about one times sales for NWL, and will likely garner substantial synergies from the deal.

With strong revenue growth and the company’s bottom line just about reaching breakeven, AMSC is a small-cap electrical stock that could do exciting things in the future.

Should you invest $1,000 in Quanta Services right now?

Before you buy stock in Quanta Services, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Quanta Services wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Billy Duberstein and/or his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group. The Motley Fool has a disclosure policy.

U.S. Electricity Demand is Exploding: 3 Stocks to Play its Monster Growth was originally published by The Motley Fool

Prospect of Second Big Fed Cut Hinges on Powell and Jobs Report

(Bloomberg) — The appetite of Federal Reserve policymakers for another large interest-rate cut in November may come into better focus in the coming week as Jerome Powell addresses economists and the government issues new employment numbers.

Most Read from Bloomberg

The Fed chair will discuss the US economic outlook at a National Association for Business Economics conference on Monday. At the end of the week, the September jobs report is expected to show a healthy, yet moderating, labor market.

Payrolls in the world’s largest economy are seen rising 146,000, based on the median estimate in a Bloomberg survey of economists. That’s similar to the August increase and would leave three-month average job growth near its weakest since mid-2019.

The jobless rate probably held at 4.2%, while average hourly earnings are projected to have risen 3.8% from a year earlier.

Recent labor unrest suggests Friday’s jobs report may be the last clean reading of the US employment market before Fed policymakers meet in early November. Boeing Co. factory workers walked off the job in mid-September, and dockworkers on the Atlantic and Gulf coasts are threatening to strike from Oct. 1.

In addition to the heavyweight monthly payrolls report, job openings data on Tuesday are expected to show August vacancies held close to the lowest level since the start of 2021. Economists will also focus on the quit rate and on dismissals to gauge the extent of cooling in labor demand.

What Bloomberg Economics Says:

“We expect a robust headline print for September nonfarm payrolls, which could even revive talk of “no landing” for the US economy. But we think the headline figure will overstate labor-market strength, partly because of overstatements related to the BLS’s ‘birth-death’ model, and partly due to temporary seasonal effects.”

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou and Chris G. Collins, economists. For full analysis, click here

Industry surveys will also help shed light on the private-sector hiring. The Institute for Supply Management releases its September manufacturing survey on Tuesday and services index two days later — both of which include measures of employment.

In Canada, home sales data for several of the nation’s largest cities — Toronto, Calgary and Vancouver — will offer a look at how the real estate market is faring after a series of rate cuts from the central bank.

Elsewhere, data predicted to show slowing global inflation — from the euro zone to Turkey to South Korea — as well as business surveys in China are among the highlights.

Click here for what happened in the past week, and below is our wrap of what’s coming up in the global economy.

Asia

China kicks things off on Monday with a slew of purchasing manager indexes, a week after authorities unleashed an unusually broad set of stimulus steps that sent stock prices soaring.

The official manufacturing PMI may tick higher while staying contractionary, and the Caixin gauges are seen holding steady just above the boom-or-bust iine.

Manufacturing PMI figures are due a day later from Indonesia, Malaysia, Thailand, Taiwan, Vietnam and the Philippines.

In Japan, Shigeru Ishiba is expected to be named prime minister in a parliamentary vote on Tuesday.

The Bank of Japan’s Tankan survey will probably show business sentiment at large firms remained optimistic in the third quarter while small manufacturers stayed slightly pessimistic. Companies are seen revising their capital spending plans a bit higher.

South Korea’s inflation is forecast to have cooled in September, giving the central bank an added incentive to consider pivoting to a rate cut in October, while price growth in Pakistan may have eased to the slowest pace since early 2021.

Trade data are due from Australia, Sri Lanka and South Korea, and Vietnam releases third-quarter gross domestic product and September inflation next weekend.

Europe, Middle East, Africa

Euro-zone data will take center stage. With inflation in France and Spain now below the European Central Bank’s 2% target, reports from German and Italy on Monday, followed by the overall result for the region on Tuesday, will be closely watched.

With traders now pricing in a rate cut at the October ECB meeting, and economists starting to shift forecasts to predict the same, the data will be crucial evidence for policymakers who’d earlier leaned toward December for their next move.

Industrial production numbers from France and Spain on Friday, meanwhile, will provide a glimpse of how weak manufacturing was during the quarter about to end.

The week features a multitude of ECB appearances, starting Monday with President Christine Lagarde’s testimony to the European Parliament and followed the next day by a conference in Frankfurt hosted by the central bank.

Monday will be the final day in office of Swiss National Bank President Thomas Jordan, who just oversaw a rate cut and the signal of more to come. His deputy, Martin Schlegel, will succeed him, and Thursday will see the release of the first inflation data under his watch.

In Sweden, minutes from the Riksbank’s Sept. 24 meeting on Tuesday will provide more insight into why policymakers there decided to cut rates last week and open the door to a faster pace of easing in the months ahead.

The UK has a relatively quiet week ahead, with appearances by Bank of England chief economist Huw Pill and policymaker Megan Greene among the highlights.

Turkish inflation due on Thursday probably slowed to 48% in September. That would be below the central bank’s key rate — currently at 50% — for the first time in years. While a sign of progress, officials still have work to do to reach a target of sub-40% inflation by the end of the year.

A number of monetary decisions are scheduled around the wider region:

-

On Monday, Mozambique’s central bank is set to cut borrowing costs for a fifth straight meeting, with price growth forecast to slow amid relative stability in the currency and a recent drop in oil prices. The spread between the benchmark and inflation is the widest among central banks tracked by Bloomberg.

-

Icelandic officials are expected to keep their rate at 9.25% on Wednesday, extending a hold on western Europe’s highest borrowing costs to more than a year. Local lenders Islandsbanki hf and Kvika banki hf predict the Sedlabanki will begin easing at the final meeting this year, scheduled for Nov. 20.

-

The same day, Polish officials are expected to leave borrowing costs unchanged as they start to coalesce around resuming cuts in the first quarter of 2025.

-

Thursday will likely see Tanzania’s central bank holding rates steady because of the inflationary impact of ongoing currency weakness. Its shilling has depreciated more than 3% against the dollar since July.

-

Romania’s central bank meets on Friday, and may further cut borrowing costs before a reshuffle of the nine-member board, with mandates expiring on Oct. 15.

Latin America

Colombian policymakers are all but certain to deliver a seventh consecutive reduction in rates on Monday, matching its longest easing cycle in over two decades.

Economists anticipate a fifth straight half-point cut, to 10.25%, and say the easing cycle still has room to run with inflation prints and expectations in decline. The bank posts the meeting’s minutes three days later.

Most analysts expect that Chile’s data dump — seven separate indicators including industrial production, retail sales, copper output and GDP-proxy data — should show that the economy is gaining momentum heading toward year-end.

Consumer prices in Peru’s capital city of Lima likely held just above the 2% mid-point of the central bank’s inflation target range in September.

Peru’s central bank chief Julio Velarde has said the year-end reading should be between 2% and 2.2%, and that the key rate can fall some 100 basis points below the Fed’s benchmark.

In Brazil, three purchasing manager indexes and industrial production data can be expected to show that Latin America’s biggest economy is running hot and above its potential growth rate.

Primary and nominal budget balance reports arrive as the nation’s public finances have once again become a hot button issue.

–With assistance from Robert Jameson, Jane Pong, Laura Dhillon Kane, Piotr Skolimowski, Monique Vanek, Niclas Rolander, Paul Wallace, Demetrios Pogkas, Ragnhildur Sigurdardottir and Brian Fowler.

(Updates with dockworkers after fifth paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Ginni Thomas Impersonated By Iranian Hackers in Targeted Scheme Against Trump Campaign, U.S. Indictment Alleges

Ginni Thomas, a conservative activist and the wife of Supreme Court Justice Clarence Thomas, was one of the notable political figures that Iranian hackers attempted to impersonate in their efforts to target individuals connected to former President Donald Trump.

According to an indictment unsealed in the U.S. District Court for the District of Columbia, three individuals are accused of a multi-year hacking campaign targeting current and former U.S. officials and journalists, including a breach of the Trump campaign this summer, reported CNN.

The accused are members of Iran’s Revolutionary Guards Corps. They allegedly targeted the Nov. 5 election between Trump and Vice President Kamala Harris.

Iran dismissed the accusations as baseless. The Justice Department has also targeted Russian election interference, charging and sanctioning state media employees for funding pro-Trump influencers.

Also Read: US Charges Iranian Hackers For Interfering In 2024 Presidential Election

From June to August, the hackers gained access to a Trump campaign official’s personal email account, stealing “debate preparation” materials and information about potential vice presidential candidates.

According to the indictment and law enforcement officials, the hackers created a fake email account in Ginni Thomas’ name in April 2020, but they did not use it in their operations until four years later.

The charges against the Iranian hackers come amid heightened concerns over foreign interference in U.S. elections.

In August, Trump’s campaign confirmed a security breach, believed to be orchestrated by foreign entities hostile to the U.S. This breach included the theft of internal documents, which were later leaked to the media.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ME INVESTOR UPDATE: Shareholders of 23andMe Holding Co. are Alerted of Pending Investigation into the Company; Contact BFA Law if You Own Substantial Shares (Nasdaq:ME)

NEW YORK, Sept. 29, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces an investigation into 23andMe Holding Co. ME regarding whether the board of directors and the co-founder and current CEO Anne Wojcicki (“Wojcicki”) of 23andMe breached their fiduciary duties in connection with Wojcicki’s ongoing effort to purchase all 23andMe shares she does not already own.

If you are a holder of 23andMe, you are encouraged to submit your information at: https://www.bfalaw.com/cases-investigations/23andme-holding-co.

Investigation Details:

On July 29, 2024, CEO Wojcicki submitted a non-binding proposal to 23andMe to acquire all shares of 23andMe that were not already owned by Wojcicki or her affiliates.

By letter dated August 2, 2024, a Special Committee of the Board of Directors of 23andMe rejected that offer, noting that it “provide[d] no premium to the closing price per share on Wednesday, July 31st, it lack[ed] committed financing, and it [was] conditional in nature.”

In a letter dated September 17, 2024, all the independent directors of 23andMe resigned “effective immediately.” When resigning, the independent directors stated that “[a]fter months of work, we have yet to receive from you a fully financed, fully diligenced, actionable proposal that is in the best interests of the non-affiliated shareholders. We believe the Special Committee and the Board have provided ample time for you to submit such a proposal. That we have not seen any notable progress over the last 5 months leads us to believe no such proposal is forthcoming. . . . [I]t is also clear that we differ on the strategic direction for the Company going forward. Because of that difference and because of your [Wojcicki’s] concentrated voting power, we believe that it is in the best interests of the Company’s shareholders that we resign from the Board rather than have a protracted and distracting difference of view with you as to the direction of the Company.”

BFA is concerned that the board of directors of 23andMe and Wojcicki may have breached their fiduciary duties as part of these events for, among other reasons, failing to prioritize the value of the company, and engaging in potentially self-interested dealing. BFA intends to take all actions necessary to protect the interests of 23andMe stockholders and to ensure that the fiduciaries are held accountable for any and all breaches of their fiduciary duties.

Click here if you are a holder of 23andMe: https://www.bfalaw.com/cases-investigations/23andme-holding-co

What Can You Do?

If you are a current holder of 23andMe Holding Co. stock, you may have legal options and are encouraged to submit your information to the firm. All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The firm will seek court approval for any potential fees and expenses.

Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/23andme-holding-co

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/23andme-holding-co

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lennar Announces Grand Opening of Cortona in Camarillo, CA

CAMARILLO, Calif., Sept. 27, 2024 /PRNewswire/ — Lennar, one of the nation’s leading homebuilders, today announced the grand opening of Cortona, a new community of single-family homes in Camarillo, CA. Cortona offers four thoughtfully designed, two-story floorplans that strike the ideal balance of style and convenience. Interested homebuyers are invited to explore Cortona and tour three new model homes at a grand opening celebration on Saturday, September 28 from 10:00 a.m. to 2:00 p.m.

“We are delighted to introduce Cortona to the Camarillo market,” said John Lavender, Cal Coastal Division President for Lennar. “Situated in the heart of Ventura County, right off the 101 freeway, Cortona meets the growing demand for new single-family homes in a city with limited new construction. With access to excellent schools and onsite amenities, Cortona stands out as an exceptional community for families looking to make Southern California their home.”

Cortona offers a wide range of exterior styles including Spanish, Mission, Monterey, and Craftsman. Ranging from 2,038 to 2,484 square feet, the home designs at Cortona offer three to four bedrooms and two-and-one-half to three-and-one-half bathrooms, with two-bay garages and flexible loft and bonus spaces available in select plans. All homes feature bright and contemporary open concept interiors. Pricing starts in the mid $900,000s.

All homes also come with Lennar’s signature Everything’s Included® program, where the homebuilder’s most popular options and upgrades are built into the base price of the home. Every home at Cortona comes equipped with advanced home automation features, including the Schlage Encode™ Smart Wi-Fi Deadbolt, Ring Video Doorbell Pro, and Honeywell Home T6 Pro Z-Wave Smart Thermostat.

Cortona homeowners will enjoy access to a host of onsite community amenities including a private community pool, a public park featuring a two-acre field, playground, fitness equipment, pickleball courts, basketball court, dog park, and pavilion.

The community offers convenient proximity to Ventura Beach, Camarillo Premium Outlets, and popular destinations like Spanish Hills Country Club and Pleasant Valley Fields. Children living in the community will have the opportunity to attend Pleasant Valley School District and Oxnard Union High School District, with Los Posas Elementary, Monte Vista Middle School and Camarillo High School nearby.

For more information on these new home opportunities, visit the community website or call (888) 292-6593.

About Lennar Corporation

Lennar Corporation, founded in 1954, is one of the nation’s leading builders of quality homes for all generations. Lennar builds affordable, move-up and active adult homes primarily under the Lennar brand name. Lennar’s Financial Services segment provides mortgage financing, title and closing services primarily for buyers of Lennar’s homes and, through LMF Commercial, originates mortgage loans secured primarily by commercial real estate properties throughout the United States. Lennar’s Multifamily segment is a nationwide developer of high-quality multifamily rental properties. LENX drives Lennar’s technology, innovation and strategic investments. For more information about Lennar, please visit www.lennar.com.

Contact: Danielle Tocco

Vice President Communications

Lennar Corporation

Danielle.Tocco@Lennar.com

Direct Line: 949.789.1633

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/lennar-announces-grand-opening-of-cortona-in-camarillo-ca-302261514.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/lennar-announces-grand-opening-of-cortona-in-camarillo-ca-302261514.html

SOURCE Lennar

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Couple Makes $11,500 A Month But Only Has $3,000 Saved And No Retirement – Dave Ramsey Slams 'Asinine' Lifestyle: 'You're Freaking Broke!'

A recent call on The Ramsey Show posted to TikTok highlighted how fast even a solid income can vanish under the pressure of debt and overspending. Alyssa, a mental health therapist, called in to discuss her family’s financial struggles after recently getting remarried. Despite their combined income of $130,000 – well above the national average of $80,610 in 2023 – Alyssa and her husband barely make ends meet. With only $3,000 in savings and no contributions to retirement, they’re stuck in a cycle of paycheck-to-paycheck living.

Don’t Miss:

They owe $60,000 on cars, have a $240,000 mortgage, and are burdened by $140,000 in student loan debt –$90,000 from Alyssa’s schooling, and $40,000 from her husband, who has little to show for it. “Who’s the lawyer?” Dave Ramsey asked, pointing out how massive the debt seemed. Alyssa chuckled, responding, “I’m a mental health therapist.”

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

Ramsey’s co-host, George Kamel, questioned why they hadn’t aggressively tackled the debt yet. Alyssa explained that fear keeps holding them back while they’ve tried – particularly concerns about having enough for her 9-year-old daughter. Alyssa, who’s self-employed, and her husband, who works in construction, face income instability. She worries about catastrophic expenses wiping them out.

That didn’t sit well with Ramsey, who cut right to the chase. “You’re making $130,000 a year, and you’re freaking broke. That’s what I’m worried about. You’re driving cars you can’t afford, and you have a lifestyle that’s absolutely asinine.”

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

“And that’s got nothing to do with a 9-year-old,” Ramsey added. “What does she need that’s costing you thousands of dollars a month?” Alyssa admitted that it wasn’t the child’s expenses, more of a “just in case” mentality.

But while Ramsey’s blunt advice may sting, Alyssa’s situation isn’t all that uncommon. According to a 2023 survey by Payroll.org, 78% of Americans live paycheck to paycheck, a 6% increase from the previous year. Earning a good income is no longer a guarantee of financial security, especially when debt and overspending take over.

“You guys have no idea where this money goes,” Ramsey pointed out, urging Alyssa to look at their situation as if she were counseling another family. “If I hired you to look at this family objectively, you’d tell them to sell a car or two. You’re not going on vacation because you’re broke.”

Trending: Amid the ongoing EV revolution, previously overlooked low-income communities now harbor a huge investment opportunity at just $500.

Ramsey then got Alyssa to confront a hard truth. “You’ve got student loan debt hanging on so long you think it’s a pet,” he said. He laid a path for them to be debt-free in two to two and a half years – if they make serious sacrifices. That means no vacations, selling at least one car, cutting unnecessary spending, and finally facing the uncomfortable reality of their financial choices. “It won’t be comfortable,” Ramsey said. He added, “It’ll set you up for an awesome life for the rest of your lives.”

As tough as Ramsey’s advice may be, it offers a real shot at a better future. No matter how uncomfortable, making sacrifices now can set you up for financial freedom.

A financial advisor could be the next step to getting things on track. They can guide you on paying off debt and investing for retirement, helping you make decisions that benefit your present and future self.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Couple Makes $11,500 A Month But Only Has $3,000 Saved And No Retirement – Dave Ramsey Slams ‘Asinine’ Lifestyle: ‘You’re Freaking Broke!’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Warren Buffett Sold 11 Stocks in Q2. But 1 Is Still a No-Brainer Buy for Income Investors.

Warren Buffett has always liked stocks. However, there are periods when he’s liked them less. Now is one of those times.

The legendary investor has been a net seller of stocks for seven consecutive quarters. His Berkshire Hathaway sold 11 stocks in the second quarter of 2024. But one of them still looks like a great pick for income investors.

Stocks Buffett sold in Q2

Buffett’s biggest sale in Q2 was his slashing of nearly half of Berkshire Hathaway’s position in Apple. Despite the aggressive selling, though, Apple remains the largest holding in Berkshire’s portfolio.

Two financial services giants have also fallen out of Buffett’s favor to some extent. Berkshire continued to sell shares of Bank of America in Q2 and also sold 21% of its stake in Capital One Financial.

The 94-year-old investor reduced Berkshire’s position in Chevron (NYSE: CVX) by 3.6% in Q2. He also trimmed the conglomerate’s positions in Liberty Media Class A and Liberty Media Class C by less than 2% each.

Other relatively modest sales for Berkshire in Q2 included Floor & Decor, Louisiana-Pacific, and T-Mobile US. However, he completely exited Berkshire’s positions in Paramount Global and Snowflake.

Several dividend stocks in the mix

Income investors might say good riddance to some of the stocks Berkshire sold in Q2. Floor & Decor, Liberty Media, and Snowflake don’t pay any dividends.

Two others offer paltry dividends. Apple’s forward dividend yield is only 0.44%, while Louisiana-Pacific’s forward dividend yield is 0.97%.

Capital One Financial might be a little more appealing to income investors with its forward dividend yield of 1.63%. T-Mobile US and Paramount Global pay even better dividends with yields of 1.73% and 1.89%, respectively.

Buffett likes Bank of America less than he has in the past, however, he can’t have much to complain about with the big bank’s dividend. BofA’s forward dividend yield is 2.65%. The company recently increased its dividend payout by 8%.

The no-brainer buy for income investors

There’s one stock among those sold by Buffett in Q2, though, that I believe is a no-brainer buy for income investors. Chevron offers a juicy forward dividend yield of 4.58%. The company has increased its dividend for 37 consecutive years.

Chevron could be helped by several factors over the near term. Lower interest rates should boost the U.S. economy, potentially spurring increased oil and gas consumption. The tensions in the Middle East could keep oil prices up.

Looking a little further out, an arbitration panel is scheduled to conduct a hearing next year to address a challenge raised by ExxonMobil (NYSE: XOM) related to Chevron’s pending acquisition of Hess (NYSE: HES). Chevron CEO Mike Wirth said in the company’s Q2 earnings call that he’s confident in a positive outcome from this arbitration.

Assuming Wirth’s optimism proves to be justified, Chevron’s acquisition of Hess should significantly expand and diversify the company’s portfolio of oil and gas assets. Most importantly for income investors, the transaction should also lead to higher cash flow and dividend distributions to shareholders.

The demand for oil and gas is likely to remain strong for a long time to come, even with the increased adoption of renewable energy. Chevron is also investing heavily in carbon capture and storage technology. If these efforts are successful, the company’s long-term prospects will be especially bright.

Buffett still likes Chevron even though he sold some shares in Q2. Chevron wouldn’t be Berkshire’s fifth-largest holding if he didn’t. I think income investors should like this high-yield dividend stock, too.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Keith Speights has positions in Apple, Bank of America, Berkshire Hathaway, Chevron, and ExxonMobil. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, Chevron, and Snowflake. The Motley Fool recommends T-Mobile US. The Motley Fool has a disclosure policy.

Warren Buffett Sold 11 Stocks in Q2. But 1 Is Still a No-Brainer Buy for Income Investors. was originally published by The Motley Fool

Prediction: Apple's iPhone 16 Could Become a Runaway Hit, and Here Is 1 Stock to Buy Hand Over Fist Before That Happens

Initial reports that Apple‘s (NASDAQ: AAPL) latest batch of smartphones were witnessing weaker demand than last year’s models weighed on the stock recently. But it looks like those reports may not hold much water after all, as the company’s iPhone 16 lineup seems to be receiving a solid response from customers.

More importantly, a closer look at the potential sales prospects of the latest iPhone models indicates that Apple could witness a nice bump in sales going forward.

A big upgrade cycle could help Apple sell more iPhones

Counterpoint Research estimates that iPhone 16 models are witnessing robust demand in India, with sales reportedly jumping between 15% and 20% on the day the smartphones went on sale in that country. It is worth noting that Apple’s sales in India surged an impressive 35% in fiscal 2024 (which ended in March this year), and the strong start that the company’s latest devices are enjoying in that market suggests that the momentum is set to continue.

Meanwhile, T-Mobile CEO Mike Sievert also pointed out that the carrier is selling more iPhone 16 models this year as compared to last year. Though Sievert pointed out that the delayed rollout of Apple Intelligence could lead to a longer buying cycle, it is worth noting that the iPhone maker could eventually enjoy strong sales because of an aging installed base of iPhones.

Dan Ives of Wedbush Securities estimates that out of an installed base of 1.5 billion iPhones, 300 million have not been upgraded in four years. So, with generative artificial intelligence (AI) features set to make their way to the latest Apple iPhones, there is a good chance that a significant chunk of these older iPhones could be upgraded. Given that Apple sold just under 235 million iPhones last year, the stage seems set for a big jump in the company’s shipments going forward.

That’s why investors may want to buy shares of Apple, considering that the tech giant’s growth is set to improve thanks to the arrival of its AI-enabled smartphones. However, there is another stock that’s set to benefit big time from the iPhone 16’s potential success, and investors can buy that company at a cheaper valuation right now — Taiwan Semiconductor Manufacturing (NYSE: TSM).

A shot in the arm for TSMC thanks to the new iPhones

Taiwan Semiconductor Manufacturing, popularly known as TSMC, is the company that manufactures the processors that power Apple’s iPhones. The A18 and A18 Pro processors inside the iPhone 16 models are manufactured using TSMC’s 3-nanometer (nm) process node.

Apple claims that its iPhone Pro models can deliver 15% performance gains while consuming 20% less power than last year’s models. Meanwhile, the A18 chip found on the iPhone 16 and iPhone 16 Plus is reportedly 30% faster and consumes 35% less power than last year’s phones. The improved processing power and low consumption will play a key role in helping the new iPhones run the Apple Intelligence suite of AI features and help the company tap a fast-growing niche.

Apple reportedly began manufacturing its latest iPhones in June this year and ramped up their production subsequently before they hit the market this month. This is one of the reasons why TSMC has witnessed a significant bump in its revenue of late. The Taiwan-based foundry giant’s monthly revenue increased 33% year over year in June, followed by a 45% increase in July and a 33% increase in August.

Apple is TSMC’s largest customer and reportedly accounted for a fourth of the latter’s top line in 2023. So it is easy to see why TSMC’s revenue has been growing at impressive levels of late. Of course, Nvidia is another key TSMC customer, as the semiconductor giant has been tapping the latter’s foundries to manufacture its AI chips. However, Nvidia reportedly accounted for 11% of TSMC’s revenue last year, which means that Apple moves the needle in a more significant way for the foundry giant.

Ives expects the production of iPhone 16 models to hit 90 million units in 2024, up by 8 million to 10 million units from last year’s models. This estimated increase in production by Apple seems to be contributing to TSMC’s impressive growth in recent months. More importantly, we saw earlier that there is a huge installed base of users that could move to Apple’s AI-enabled iPhones in the future. As a result, TSMC’s largest customer could continue to play a central role in driving its growth.

Even better, reports suggest that Apple may have already purchased all of TSMC’s manufacturing capacity of 2-nm chips for its 2025 iPhone lineup. It is worth noting that Apple has done a similar thing in the past when it purchased all of TSMC’s 3nm manufacturing capacity for a year in 2023 so that it can make enough iPhones.

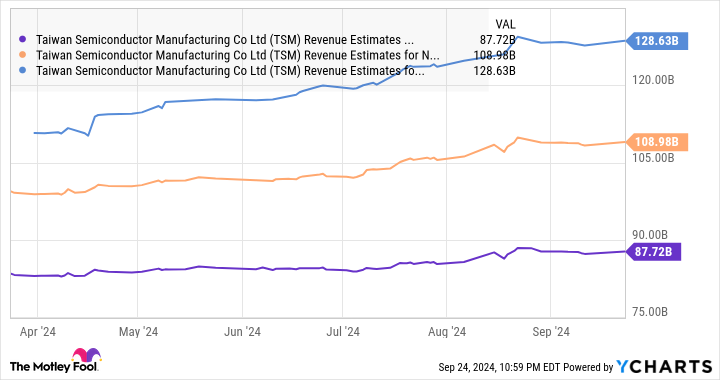

In all, TSMC’s growth prospects in the AI chip market thanks to customers such as Nvidia, along with its tight relationship with Apple, are the reasons why there has been a significant increase in the company’s revenue estimates for the next three years.

What’s more, TSMC is trading at 31 times trailing earnings and 21 times forward earnings right now. It is cheaper than Apple, which is trading at 34 times trailing earnings and 30 times forward earnings. So, TSMC stock gives investors a cheaper and more diversified way to capitalize on the potential growth in iPhone sales, as well as the secular growth of the AI chip market.

This is why investors should consider buying this semiconductor stock right now before it could fly higher following the 75% gains it has already clocked in 2024.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends T-Mobile US. The Motley Fool has a disclosure policy.

Prediction: Apple’s iPhone 16 Could Become a Runaway Hit, and Here Is 1 Stock to Buy Hand Over Fist Before That Happens was originally published by The Motley Fool

Citi warns some employees about misconduct by staff, contractors, memo says

NEW YORK (Reuters) – Citigroup warned some employees about fraud and unethical behavior and said it is considering tighter scrutiny on work done by contractors to ensure the company is billed accurately, according to a memo seen by Reuters on Friday.

Citi has struggled to fix weaknesses in its controls and risk management. It was fined $136 million by regulators in July for making insufficient progress on regulatory punishments dating back to 2020.

“Citi has zero tolerance for fraudulent and unethical behavior from our employees, non-employees and suppliers,” according to the internal Citi memo seen by Reuters.

“Citi is looking at heightening our controls on how we source work,” to ensure suppliers match its needs and that they are paid appropriate rates for the hours they work, the memo showed.

The bank declined to comment, and the memo provided no specific details on why it was being sent.

The memo was sent by Scott Sigal, Citi’s global head of procurement and third party management, and Erika Federico, its global head of non-employee staffing.

The lender also asked staff to report any potential misconduct or breaches of its policies. Suspected misuse of Citi resources for personal or professional gain would be investigated, it said.

(Reporting by Tatiana Bautzer, additional reporting by Elisa Martinuzzi, editing by Lananh Nguyen and Chizu Nomiyama)

35 Strangers Were Fraudulently Added To Her Card During A Cruise, But One U.S. Postal Service Was Key In Preventing A Possible Disaster

In August, Jodi Hayes and her spouse were leisurely cruising when things took an unanticipated and distressing turn. While they were still on board the ship, Jodi got an alert from the U.S. Postal Service’s Informed Delivery program. The email showed that 35 credit cards were on their way to her home – all in the names of people she had never heard of.

Don’t Miss:

Each of these 35 strangers was added as an authorized user to her Marriott Bonvoy Chase Bank credit card and they could each charge up to $19,000 on her card or withdraw $950 in cash, potentially leaving Jodi responsible for a massive debt.

“I know I have good credit, but I’ve never seen anything like this ever,” Jodi said, clearly frustrated. “This fiasco ruined the end of our vacation.”

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

As ABC7 reported, she quickly called Chase Bank while still on the cruise ship to report the issue. However, their response left much to be desired. They initially brushed it off as a possible glitch in the system and said they would stop the cards from being activated. They didn’t offer much more than a new card and account number without explanation or investigation.

When Jodi contacted ABC7, hoping to get more answers and help, the situation caught the attention of the U.S. Postal Inspection Service. Matthew Norfleet, a postal inspector, explained that this was likely an identity fraud scheme. Using the mail for such schemes is a serious crime that can carry up to 20 years in prison.

Trending: Teens may never need wisdom teeth removed thanks to this MedTech Company – Be an early investor for just $300 for 100 shares!

Nevertheless, the deception did not end with Chase. Jodi soon received credit applications from additional banks, including Capital One, Discover, and Citibank, all rejected because of insufficient credit history. The repeated use of the same fictitious names demonstrated these con artists’ persistence when they “smell” an opportunity.

Jodi protected herself in many correct ways despite the danger and absurdity of the situation. She kept an eye on her mail using the USPS Informed Delivery program and secured her mailbox with a lockbox to deter burglars. To further lower the chance of mail theft, the Postal Service even advises holding your mail at the post office while you’re on the road.

This situation demonstrates how essential it is to monitor your accounts and personal data. While Jodi’s quick actions and the use of Informed Delivery helped catch the problem before it got worse, not everyone is so lucky. Identity theft can happen to anyone, but tools like Informed Delivery can help spot potential problems early.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article 35 Strangers Were Fraudulently Added To Her Card During A Cruise, But One U.S. Postal Service Was Key In Preventing A Possible Disaster originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.