Exxon director joins Elliott group seeking to acquire Citgo Petroleum

HOUSTON (Reuters) – Exxon Mobil board director Gregory Goff recently joined a newly formed Elliott Investment Management-backed company seeking to acquire control of Venezuela-owned oil refiner Citgo Petroleum.

Citgo and Exxon are rivals in the motor fuels and lubrications business. Exxon is the third-largest U.S. oil refiner by capacity and Citgo is the seventh-largest.

Goff, who joined Exxon in 2021 as part of a dissident slate of directors, was on Friday identified as CEO of Amber Energy, an Elliott affiliate, in a statement heralding its selection as the successful bidder in a U.S. court auction of shares in Citgo parent PDV Holding.

Exxon had no immediate comment on Goff’s status at the company. The company’s board of directors webpage lists Goff as chairman of its audit committee and member of its executive and finance committees.

A spokesperson for Amber Energy declined to comment.

Amber’s bid puts an up to $7.28 billion enterprise value on the Houston-based oil refiner. Shares in a Citgo parent whose only asset is the refiner are being auctioned to repay up to $21.3 billion in claims against Venezuela and state oil firm PDVSA for expropriations and debt defaults.

Citgo owns refineries in Texas, Louisiana and Illinois, an extensive fuel storage and pipeline network, and 4,200 independent retailers. It had 2023 net profit of $2 billion.

Amber’s disclosure of the Citgo bid describes Goff as having 40 years of experience in energy and energy-related businesses. It makes no mention his Exxon tenure, but does describe him as the former chairman and CEO of oil refiner Andeavor and CEO of Claire Technologies Inc.

He was a vice chairman at Marathon Petroleum until 2019. Elliott made billions of dollars after taking a stake in Marathon and prodding it to improve operations and hive off pieces of its business. Marathon sold its Speedway retail fuel business to 7-Eleven for $21 billion in 2021.

(Reporting by Gary McWilliams; Editing by Chizu Nomiyama)

Super Micro: Assessing the Potential Risk and Reward

Super Micro Computer (SMCI) got off to an incredible start this year as shares more than quadrupled from January to mid-March. This surge made Super Micro eligible for S&P 500 inclusion, with the technology hardware stock (with links to AI) being added to the index on March 18, 2024. In hindsight, that would have been a great time to take profits or Short the stock, as shares are down by more than 50% since then.

One of the major developments has been the report by Hindenburg Research, which contained worrying allegations about the company’s financial reporting. In assessing those allegations along with Super Micro’s fundamentals I hold a neutral rating on the stock.

Hindenburg Casts Doubts About Super Micro

The Hindenburg report is actually the main reason I am neutral instead of bullish on SMCI stock, and I believe it has caused hesitancy among many AI stock analysts and investors.

The accusations are pretty straightforward. According to Hindenburg, Super Micro engaged in accounting manipulation which included “sibling self-dealing and evading sanctions”. Anyone who thinks this sounds far fetched may wish to remember that the SEC charged Super Micro with widespread accounting violations in August 2020. Hindenburg’s report also argued that most of the people involved with that accounting malpractice are back on Super Micro’s team.

Hindenburg’s team interviewed several Super Micro salespeople and employees when compiling their report. It doesn’t help that Super Micro delayed its 10-K filing to assess internal controls shortly after Hindenburg went public with its concerns. While this might simply be a coincidence, the timing is worrisome. Looking back several years, Super Micro had failed to file financial statements in 2018 and was briefly delisted from the Nasdaq as a result.

Near the beginning of this month, Super Micro publicly issued a denial of the accusations, with CEO Charles Liang hitting back, stating that Hindenburg’s report contained, “misleading presentations of information”. Super Micro hasn’t provided any additional statements since then.

Artificial Intelligence Growth Is Undeniable

Super Micro’s status as part of the fast moving world of AI is one of the few reasons that I am neutral instead of bearish SMCI stock. The exciting prospects for the company’s business and the serious nature of the Hindenburg allegations basically offset each other.

It’s hard to know what’s real and what’s false here, but most people concede that the AI industry as a whole offers compelling growth prospects. Nvidia (NVDA) has been posting triple-digit year-over-year revenue growth for several quarters. Other tech giants have incorporated artificial intelligence into their core businesses and delivered impressive results for their shareholders. For instance, Alphabet (GOOGL) saw its cloud revenue rise by 28.8% year-over-year as many businesses rushed to create their own AI tools.

The artificial intelligence industry is also projected to maintain a 19.3% compounded annual growth rate from now until 2034, according to Precedence Research. The AI industry should continue to grow, and that should lift Super Micro. The company should benefit from Nvidia’s growth, which is why the company posted exceptional revenue and net income growth during Nvidia’s ascent. That’s what we saw for several quarters. We just don’t know how accurate all the numbers were, if the allegations targeting the firm have merit.

Super Micro Has Strong Financials at Face Value

While it’s impossible to overlook Hindenburg’s allegations against Super Micro, it’s still worthwhile assessing the company’s previous quarterly results. Shares were dropping even before Hindenburg released its report. While in March 2024 I argued that SMCI stock faced risks, I felt that shares presented a tremendous buying opportunity in late-summer, until Hindenburg muddied that optimism.

For its last reported quarter, Super Micro posted net sales of $5.31 billion, representing a 143% year-over-year jump. Meanwhile, net income rose by 82% year-over-year, reaching $353 million. At the time of the release, my primary concern was Super Micro’s declining net profit margin. Super Micro currently trades at a 20x trailing P/E ratio, seemingly enough to compensate for any further erosion in profit margins. SMCI stock has a ridiculously low 13.6x forward P/E ratio, but with the recent speedbumps (the Hindenburg report and DOJ investigation) investors seems reluctant to bid the valuation multiple any higher right now.

We don’t yet have tangible proof that Super Micro has engaged in any wrongdoing, as alleged by Hindenburg. Their report, however, has certainly cast a black eye on the stock. I expect that Super Micro would have significantly outperformed its fiscal 2023 results even excluding any misdealings.

The Department of Justice Is Probing Super Micro Computer

The Super Micro controversy added a new chapter on September 26, as news crossed the wires that the U.S. Department of Justice is now probing the company. SMCI stock tumbled an additional 12% on this news, and shares were recently trading at less than one-third of their all time high in March. There’s a high risk/reward on the shares at this point, but the elevated risks have relegated me to the sidelines with a neutral rating.

Super Micro shares bounced back by more than 4% on Friday, September 27, suggesting that many investors believe that the long-term potential for the business is worth the heightened uncertainty.

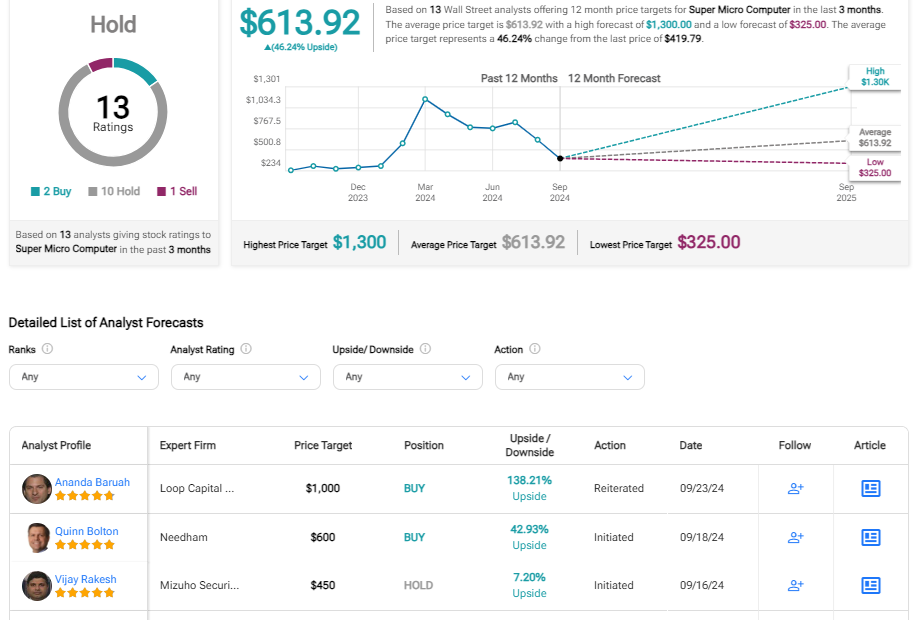

Is Super Micro Stock Rated a Buy?

Although the ratings for this stock could change quickly, Super Micro currently has 2 Buy ratings, 10 Hold ratings, and 1 Sell rating from the 13 analysts that cover the stock. The average price target for SMCI is $613.92, which implies potential upside of nearly 50%. Again though, it’s quite possible that several research brokerages have placed their SMCI ratings under review. SMCI stock does have a few low price targets including $454, $375 and $325 from CFRA, Wells Fargo (WFC), and Susquehanna respectively. All of these price targets were established before the DOJ probe was announced, so even they could drop lower.

The Bottom Line on SMCI Stock

There’s an old adage that suggests, “You either die a hero or live long enough to be the villain”. That quote seems apropos for this company. Super Micro earned many investors hefty profits during its rise above a stock price of $1,000 per share. Those who entered the story late, including after SMCI stock was added to the S&P 500, have not fared well. Many investors are sitting on significant losses right now. Depending on what those investors do, it’s hard to tell how much more downside Super Micro shares may have until more clarity on the ordeals is available.

If the company’s recent financials are accurate, SMCI shares look quite attractive here. Shares can surge quickly if the Hindenburg report loses relevance, although that outcome difficult to predict. I’m a big fan of Super Micro’s industry and business potential related to AI, which prevents me from being downright bearish. I have a neutral stance here. Meanwhile, I don’t expect shares of SMCI to rebound above $460 (the approximate price prior to news of the DOJ probe) without any resolution to the two main threats to shareholder value.

Digicann Ventures Signs Definitive Agreement for Proposed RTO Transaction with 3Win Corp.

/ Not for distribution to U.S. news wire services or for dissemination in the United States /

VANCOUVER, British Columbia, Sept. 28, 2024 (GLOBE NEWSWIRE) — Digicann Ventures Ltd. (“Digicann” or the “Company”) DCNN AGFAF, a company focused on opportunities within and outside of the cannabis industry, announces that, further to its news release dated August 2, 2024, it has signed a definitive Business Combination Agreement (the “Agreement“) dated September 28, 2024 with 3Win Corp. (“3Win“) in respect of a transaction that would result in the reverse take-over (the “RTO“) of Digicann by 3Win (the “Proposed Transaction“) to ultimately form the resulting issuer (the “Resulting Issuer“). If completed, it is expected that the Proposed Transaction will constitute a “fundamental change” pursuant to the policies of the Canadian Securities Exchange (the “Exchange“) and is expected to require the approval of Digicann shareholders. It will also be a non-arm’s length transaction and therefore subject to the necessary regulatory approvals, including final acceptance from the Exchange. All currency references herein are in Canadian currency unless otherwise specified.

The Business Combination

The Proposed Transaction is planned to be completed by way of a three-cornered merger pursuant to which, a wholly owned subsidiary of the Company incorporated in Nevada will merge with 3Win and 3Win will become a wholly owned subsidiary of Digicann under the laws of the State of Nevada. No finder’s fee of any kind shall be paid as a direct result of, or in association with, the Proposed Transaction. Following completion of the Proposed Transaction, the Resulting Issuer will carry on the business currently carried on by 3Win. However, should 3Win not complete the Proposed Transaction, then Digicann shall receive a variable cash exit fee, equal to the expenses incurred in connection with the Proposed Transaction by Digicann from August 1, 2024 until the date that the exit fee is triggered, pursuant to the terms of the Agreement.

Founded in 2015, 3Win is a global wholesale distributor of high-quality, research-backed CCELL® vape products to the cannabis and hemp industries. In addition, 3Win provides customers with stateside customization services and packaging. 3Win’s wholly owned subsidiary, 3Win Holdings (Canada) Corp. (“3Win Canada“), is one of the world’s first multi-disciplinary controlled substances companies. 3WIN Canada is a licensed cultivator and exporter of bulk cannabis and genetics to various countries around the world. Conscious Compounds Inc., a wholly owned subsidiary, has been granted a Controlled Substance Dealer’s License by Health Canada, which permits it to possess, produce, sell, transport, import, export and deliver psilocybin and psilocin in adherence to a series of Canadian government regulations. 3Win Canada operates through the following subsidiaries: Big League Cultivation Inc., Big League Genetics Inc., Conscious Compounds Inc., My Fungi Inc., Serenus Therapeutics Inc., and Sterilized Substrates Inc.

Mr. Nicholas Kuzyk, who is currently the Chief Executive Officer, a Director and a shareholder of Digicann, is also currently the Chief Strategy Officer, a Director and a shareholder of 3Win. Therefore, the Proposed Transaction, if completed, will be a related-party transaction pursuant to Multilateral Instrument 61-101- Protection of Minority Security Holders in Special Transactions (“MI 61-101“). A fairness opinion is expected to be sought in connection with the Proposed Transaction.

A sub-committee of Digicann’s board of directors (excluding Mr. Kuzyk) determined that the Agreement, including the transactions and other steps contemplated thereunder, is fair to holders of Digicann securities and is in the best interests of the Company. Accordingly, Digicann’s board of directors approved the Agreement and recommends that holders vote their shares in favour of the Proposed Transaction.

Shareholder Meetings and Record Date

Digicann and 3Win have each called special shareholder meetings to consider the Proposed Transaction and related matters on November 7, 2024. The Company has set October 8, 2024 as the record date for shareholders entitled to vote at the Company’s shareholder meeting. Accordingly, Digicann intends to mail a management information circular to its shareholders in October of 2024.

To be effective, the Proposed Transaction will require the following approvals from shareholders of the Company and 3Win: (i) at least two-thirds (66 2/3%) of the votes cast by shareholders of the Company present in person or represented by proxy and entitled to vote at the Company’s shareholder meeting, (ii) a simple majority (>50%) of the votes cast by shareholders of the Company present in person or represented by proxy and entitled to vote at the Company’s shareholder meeting excluding Digicann Shares (as defined below) held by persons described in items (a) through (d) of section 8.1(2) of MI 61-101, and [(iii) at least two-thirds (66 2/3%) of the votes cast by shareholders of 3Win present in person or represented by proxy and entitled to vote at 3Win’s shareholder meeting.

Summary of the Resulting Issuer’s Proposed Directors & Officers

In conjunction with and upon closing of the Proposed Transaction, the board of directors of the Resulting Issuer is expected to consist of the following directors, listed in alphabetical order:

- Mr. Frederic J. Buonincontri (Independent),

- Mr. Rodney Hu (Independent Chairperson),

- Mr. Nicholas Kuzyk,

- Ms. Julie Kiley (Independent), and

- Mr. Christopher J. Sinacori.

These directors shall hold office until the first annual meeting of the shareholders of the Resulting Issuer following closing, or until their successors are duly appointed or elected.

The first officers of the Resulting Issuer are expected to be:

- Mr. Nicholas Kuzyk (Chief Executive Officer),

- Mr. Kevin Cornish (Chief Financial Officer), and

- such other officers as determined and appointed by the Resulting Issuer.

Name Change

In connection with the Proposed Transaction, subject to receipt of applicable approvals, 3Win expects to effect a name change to “Serewin Corp.” with the symbol “SRWN”, if available.

Share Consolidation

Pursuant to the terms of the Agreement, the holders of Digicann’s issued and outstanding common shares (the “Digicann Shares“) shall receive a deemed value of $0.05 per pre-Consolidation (as hereinafter defined) Digicann Share. There are currently 22,055,294 Digicann Shares issued and outstanding.

Prior to the closing of the Proposed Transaction, Digicann will consolidate its Digicann Shares on the basis of one (1) post-Consolidation Digicann Share for each ninety-eight (98) pre-Consolidation Digicann Shares (the “Consolidation“), such that, prior to closing of the Proposed Transaction, Digicann will have approximately 225,054 Digicann Shares issued and outstanding on a non-diluted basis. No fractional Digicann Shares shall be issued as part of the Consolidation.

Post-Consolidation, Digicann Shares shall be issued to resolve various liabilities owed to the holders of the Company’s convertible debentures and to the officers of the Company. The independent directors of the board shall also be in receipt of Digicann Shares. Accordingly, there are expected to be approximately 549,976 Digicann Shares issued and outstanding on a post-Consolidation and post-settlement of liabilities basis.

Pro-Forma Capitalization

Upon completion of the Consolidation, and pursuant to the terms of the Agreement, the issued and outstanding shares of 3Win (“3Win Shares“) shall be exchanged on a one-for-one basis for Digicann Shares (the “Exchange Ratio“). The resulting holders of 3Win Shares shall hold approximately 97.3% of the issued and outstanding common shares of the Resulting Issuer, subject to the non-issuance of fractional Digicann Shares, any additional amounts invested by third parties into 3Win, and other 3Win Share-related adjustments under certain circumstances.

Additionally, it is anticipated that all securities convertible, exercisable or exchangeable for 3Win Shares will be converted or exchanged (or otherwise become convertible or exercisable in accordance with their terms) into similar securities of the Resulting Issuer on substantially similar terms and conditions based on the Exchange Ratio.

In connection with the Proposed Transaction, it is anticipated that all outstanding stock options and common share purchase warrants of Digicann will remain in effect on substantially the same terms, subject to customary anti-dilution adjustments in accordance with the terms thereof.

Conditions & Cautions

Completion of the Proposed Transaction is subject to a number of conditions precedent, including but not limited to, Digicann having a minimum amount of cash at closing of the Proposed Transaction, as well as receipt of all required shareholder, regulatory, and other approvals. There can be no assurance that the Proposed Transaction will be completed as proposed or at all.

None of the Digicann Shares to be issued in connection with the Proposed Transaction have been, or will be, registered under the United States Securities Act of 1933, as amended (the “1933 Act“), or any state securities laws, and may not be offered or sold within the United States or to any U.S. Person (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws or an exemption from such registration is available. This news release does not constitute an offer to sell or a solicitation of an offer to sell any securities of Digicann in any jurisdiction where such offer or solicitation would be unlawful, including the United States.

Investors are cautioned that, except as disclosed in the information circular or listing statement to be prepared in connection with the Proposed Transaction, as applicable, any information released or received with respect to the Proposed Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of the Company should be considered highly speculative.

The Proposed Transaction and listing of the Resulting Issuer is subject to review by the Exchange and conditional approval has not yet been granted. Neither the Exchange nor the Market Regulator (as that term is defined in the policies of the Exchange) has in any way passed upon the merits of the Agreement, RTO or Proposed Transaction and neither of the foregoing entities accepts responsibility for the adequacy or accuracy of this news release or has in any way approved or disapproved of the contents of this news release.

About 3Win Corp.

3WIN Corp. (“3Win“) is a global wholesale distributor of high-quality, research-backed CCELL® vape products to the cannabis and hemp industry. CCELL® products are made by the leading vape hardware manufacture, Shenzhen Smoore Technology, Limited, and feature patented ceramic heating elements. In addition to CCELL® products, 3Win provides customers with stateside customization services and packaging to help brands stand out in the crowded marketplace. Visit www.3wincorp.com for more information.

3Win’s wholly owned subsidiary, 3Win Canada, which was formed upon the acquisition of Serenus Global Inc., is one of the world’s first multi-disciplinary controlled substances companies. 3Win Canada is a licensed cultivator and exporter of bulk cannabis and genetics to various countries around the world. Conscious Compounds Inc., a wholly owned subsidiary, has been granted a Controlled Substance Dealer’s License by Health Canada, which permits it to possess, produce, sell, transport, import, export and deliver psilocybin and psilocin in adherence to a series of Canadian government regulations. 3Win Canada operates through the following subsidiaries: Big League Cultivation Inc., Big League Genetics Inc., Conscious Compounds Inc., My Fungi Inc., Serenus Therapeutics Inc., and Sterilized Substrates Inc. Visit https://serenusglobal.com for more information.

For further information contact:

3Win Corp.

Rodney Hu, Executive Chairman

Email: ir@3wincorp.com

About Digicann Ventures Inc.

Digicann Ventures Inc. is a company focused on opportunities within and outside of the cannabis industry. For more information about Digicann Ventures Inc. please visit www.digicann.io and its profile page on SEDAR at www.sedarplus.ca.

ON BEHALF OF THE BOARD OF DIRECTORS

Fiona Fitzmaurice, CFO & Director

E: ir@digicann.io

T: (800) 783-6056

The CSE and Information Service Provider have not reviewed and does not accept responsibility for the accuracy or adequacy of this release.

Forward-looking Information Cautionary Statement

Except for statements of historic fact this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan” “expect” “project” “intend” “believe” “anticipate” “estimate” and other similar words or statements that certain events or conditions “may” or “will” occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward- looking statements including but not limited to delays or uncertainties with regulatory approvals including that of the CSE, shareholder approvals and other uncertainties inherent to a transaction of the nature of the Proposed Transaction. There are uncertainties inherent in forward-looking information including factors beyond the Company’s control. There are no assurances that the business plans for Digicann Ventures Inc. described in this news release will come into effect on the terms or time frame described herein. The Company undertakes no obligation to update forward-looking information if circumstances or management’s estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company’s filings with Canadian securities regulators which are available at www.sedarplus.ca .

SOURCE: Digicann Ventures Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Warren Buffett's $9 Billion Warning to Wall Street Has Become Deafening

There’s arguably not an investor on the planet who garners as much attention on Wall Street as Warren Buffett, CEO of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B). The reason investors cling to the aptly named “Oracle of Omaha’s” every word is because he’s crushed the broad-based S&P 500 over a span of almost six decades.

Since ascending to the role of CEO at Berkshire Hathaway in the mid-1960s, Buffett has overseen a cumulative return in his company’s Class A shares (BRK.A) that comfortably tops 5,400,000%. By comparison, the S&P 500 has returned around 38,000%, including dividends paid, over the same time frame. While this is a very respectable return in its own right, it doesn’t hold a candle to Buffett’s investing mastery.

Every quarter, investors eagerly await the filing of Berkshire Hathaway’s Form 13F with the Securities and Exchange Commission (SEC). This is a required filing for institutions and large-scale investors with at least $100 million in assets under management that provides a snapshot of which stocks were purchased and sold in the latest quarter. A 13F allows investors to effectively mirror Buffett’s buying and selling activity (after the fact).

While investors are predominantly seeking out Berkshire Hathaway’s 13Fs and SEC filings for ideas on which stocks to buy, Warren Buffett’s now-obvious warning to Wall Street has become absolutely deafening.

One of Wall Street’s most optimistic investors is a decisive seller of equities

Whether it’s been written in his annual letter to shareholders or stated during Berkshire Hathaway’s annual shareholder meetings, Warren Buffett’s message to the investment community has consistently been one of positivity and patience. He’s frequently opined that investors should never bet against America, which is precisely why you won’t see him or his investing lieutenants, Ted Weschler and Todd Combs, short-selling stocks or buying put options.

However, Buffett’s optimism isn’t blind. Although he fully understands that economic cycles aren’t linear and the U.S. economy spends a disproportionate amount of time expanding, relative to contracting, he’s not willing to chase stocks higher if he doesn’t see value or can’t locate plain-as-day bargains.

Over the previous seven quarters (Oct. 1, 2022 to June 30, 2024), Buffett has been a decisive net seller of equities to the tune of $131.6 billion. Although Berkshire won’t file its 13F with the SEC for the September-ended quarter until Nov. 14, SEC Form 4 filings provide strong evidence that this net selling activity is set to continue for an eighth straight quarter.

On Sept. 24, Buffett’s company filed a Form 4 showing that roughly 21.56 million shares of Bank of America (NYSE: BAC), worth about $862.7 million, were sold.

However, this sale of Berkshire Hathaway’s third-largest holding by market value wasn’t an isolated incident. Since July 17, Buffett has sold shares of Bank of America during 33 separate trading sessions, with the cumulative market value of these sales nearing $9 billion. A position that once stood at more than 1.03 billion shares owned has been whittled down to 814.35 million shares, as of Sept. 24.

It is possible that simple profit-taking is the motive behind this 21% reduction in Berkshire’s stake in Bank of America over the last 10 weeks. Buffett offered his opinion during Berkshire’s annual shareholder meeting in early May that corporate tax rates were likely going up in the future. Therefore, locking in sizable unrealized gains now is something investors can look back on and appreciate years down the road.

But there may be something far more menacing behind Buffett’s aggregate $9 billion in sales of BofA stock.

Stocks are exceptionally pricey and unattractive amid Wall Street’s “casino-like behavior”

Let me preface what I’m about to say by reminding you that Warren Buffett is an unabashed long-term optimist. He strongly believes in the U.S. economy and realizes that bull markets on Wall Street last considerably longer than bear markets. It’s why he’s constantly on the lookout for price dislocations in time-tested businesses with well-defined competitive advantages.

In spite of this unwavering long-term optimism for the U.S. economy and the stock market, what Buffett does with Berkshire Hathaway’s cash over shorter timelines isn’t always going to perfectly align with what he preaches. As Buffett himself said, “Price is what you pay. Value is what you get.”

As a deeply rooted value investor, the Oracle of Omaha won’t overpay for equities. He’ll simply sit on his proverbial hands and wait for the next emotion-driven event to create price dislocations he can take advantage of.

At the moment, the stock market is at one of its priciest valuations in history!

While there are a number of measures of “value,” and value is ultimately a subjective term, the S&P 500’s Shiller price-to-earnings (P/E) ratio does a particularly good job of illustrating just how outsized the current valuation is for stocks. The Shiller P/E ratio is also known as the cyclically adjusted price-to-earnings ratio, or CAPE ratio.

The Shiller P/E, which is based on average inflation-adjusted earnings over the prior 10 years, ended Sept. 24 at nearly 37. This is the third-highest reading during a continuous bull market dating back to January 1871, and is more than double its average reading dating back more than 150 years.

Over the last 153 years, there have only been six occasions, including the present, where the S&P 500’s Shiller P/E surpassed 30 during a bull market rally. Following the previous five instances, the S&P 500 and/or Dow Jones Industrial Average eventually lost between 20% and 89% of their value. Although timing when the music will stop is impossible for investors to do, the lesson history offers is that stock valuations don’t remain extended indefinitely.

Emotion-driven investing isn’t helping, either. In Buffett’s latest annual letter to Berkshire Hathaway’s shareholders, he cautioned of the “casino-like behavior” that’s now prevalent on Wall Street. Years of historically low interest rates, coupled with ease of access to information, has encouraged some retail investors to seek out volatility. This certainly clashes with Buffett’s long-term ethos, which he promotes by purchasing an exorbitant amount of his own company’s stock.

While Buffett won’t sit on the sidelines forever, he’s steadfast in his desire to get perceived value from his investments. Until such time as price dislocations become too tempting to ignore, we’re liable to see the Oracle of Omaha paring down key positions, such as Bank of America, and building up Berkshire’s $277 billion war chest.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Bank of America and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Warren Buffett’s $9 Billion Warning to Wall Street Has Become Deafening was originally published by The Motley Fool

Meet the 3 Supercharged Growth Stocks That Will Be Worth $4 Trillion by 2025, According to 1 Wall Street Analyst

One of the clearest secular tailwinds of the past couple of years is the advent of artificial intelligence (AI). Recent advances in the field have helped power the ongoing market rally, as these next-generation algorithms promise to increase productivity by handling mundane tasks and streamlining productivity.

It should come as no surprise then that many of the world’s most valuable companies are at the forefront of AI development and have embraced the potential of generative AI. One of the biggest debates in tech circles is which of these technology stalwarts will be the first to cross the $4 trillion market cap threshold.

Investors asking that question may be missing the point, according to Wedbush analyst Dan Ives, who argues that 12 months from now, the $4 trillion club might, in fact, have three members. Let’s take a look at the candidates and what might drive them there.

1. Apple

With the world’s largest current market cap, coming in at more than $3.4 trillion (as of this writing), Apple (NASDAQ: AAPL) is among the most likely contenders to be a founding member of the $4 trillion club. It would take a stock price increase of less than 17% to put Apple over the finish line, and there are plenty of drivers that could help propel the iPhone maker higher.

The most obvious potential catalyst is, of course, the recently unveiled iPhone 16. The latest version of the fan-favorite device comes with all the usual upgrades, including an improved camera, speedier processing, and increased battery life. One of the biggest draws, however, is the debut of Apple Intelligence, the company’s suite of generative AI-powered tools, which will likely attract technophiles in droves.

There’s more: The rampant inflation of the past couple of years had consumers hanging on to their iPhones a bit longer, and Ives estimates there are 300 million iPhones that haven’t been upgraded for four years or more, resulting in plenty of pent-up demand. He believes this will kick off the next supercycle and estimates Apple could sell as many as 240 million iPhones over the coming year.

Given improving macroeconomic conditions, I think the analyst is right: Throngs of consumers will pony up for the new AI-driven iPhone, helping push Apple over the $4 trillion mark.

2. Microsoft

Microsoft (NASDAQ: MSFT) is currently the world’s second-most valuable company. With a market cap of $3.2 trillion, the stock will only need to rise 24% to cross the $4 trillion threshold.

The company was quick to recognize the game-changing nature of generative AI and positioned itself for success. Microsoft took a stake in ChatGPT creator OpenAI and developed a suite of AI-driven productivity tools dubbed Copilot. It recently unveiled a line of Copilot-powered personal computers that will help increase Microsoft’s already expansive reach.

Just last month, the company announced that it would restructure the reporting of its business units to give a clearer picture of its success in AI. While investors don’t yet have the complete picture, the available evidence is compelling. During Microsoft’s fiscal 2024 fourth quarter (ended June 30), its Azure Cloud grew 29% year over year, and management noted that eight percentage points of that growth was the result of demand for its AI services. This helps illustrate that Microsoft’s AI strategy is paying off.

Ives seized on one point from management’s commentary, noting that Azure Cloud growth is expected to “accelerate in the second half.” He estimates that over the coming three years, 70% of Microsoft’s installed base will be using its AI solutions. He goes on to say this opportunity is not yet fully factored into the stock price.

I think the analyst hit the nail on the head. Given Microsoft’s extensive reach in both the consumer and enterprise markets, it won’t take much in terms of AI adoption to positively impact the company’s growth.

3. Nvidia

Nvidia (NASDAQ: NVDA) has become the de facto poster child for the AI revolution, sending its market cap to just over $3 trillion. As such, it would only take a stock price increase of 32% to take the chipmaker above $4 trillion.

The stock currently sits 10% off its peak, as investors contemplate the momentum of AI adoption, yet the evidence is incontrovertible. Nvidia’s largest customers — Microsoft, Meta Platforms, Amazon, and Alphabet — have been completely transparent about their plans to increase their capital expenditures for the remainder of the year and into 2025. They have also made it very clear that the vast majority of that spending will be dedicated to the data centers and servers needed to run AI.

Nvidia’s graphics processing units (GPUs) are the gold standard for running AI in data centers and controlled 98% of the data center GPU market last year. This illustrates why continued investment in the space stands to benefit Nvidia.

Ives cited surging chip demand, clarity on the upcoming release of its Blackwell chip, and robust outlook as proof that Nvidia stock has further to run.

I think the analyst’s assessment is spot on. Investors have been concerned that AI adoption could slow, which has weighed on Nvidia stock in recent months. However, while that will certainly happen one day, the available evidence suggests it won’t happen any time soon. In fact, some believe Nvidia will eventually be the world’s most valuable company.

A word on valuation

Excitement regarding the potential for AI since early last year has driven many stocks higher, resulting in a corresponding increase in their respective valuations. As such, each of these stocks is trading at a premium to the broader market. Microsoft and Apple are currently selling for roughly 33 times forward earnings, compared to a multiple of 30 for the S&P 500. Nvidia is the most egregious example, selling for 43 times forward earnings. That said, looks can be deceiving.

Analysts’ consensus estimates for Nvidia’s earnings per share for its 2026 fiscal year (which begins in January) is $4.02. On that basis, Nvidia is only trading for 30 times sales, so it isn’t as expensive as it might appear, particularly given the ongoing opportunity represented by AI. Using next fiscal year’s expectations yields similar results for Apple and Microsoft, which are selling for 30 times and 28 times next year’s expected earnings, respectively.

When viewed in that light, these tech titans are actually reasonably priced. That’s why each of these stocks is a must-own for the AI revolution.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 773% — a market-crushing outperformance compared to 168% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Apple made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of September 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Danny Vena has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Meet the 3 Supercharged Growth Stocks That Will Be Worth $4 Trillion by 2025, According to 1 Wall Street Analyst was originally published by The Motley Fool

I have $2.5 million and fear that I’ll never be able to retire. Am I being irrational?

Got a question about investing, how it fits into your overall financial plan and what strategies can help you make the most out of your money? You can write to me at . Please put “Fix My Portfolio” in the subject line.

Dear Fix My Portfolio,

Intellectually, I am feeling well prepared for retirement, but in my heart I have an irrational fear that I am not financially ready to retire. I think my fears center around uncertainty in the market and around not having an income stream (I have been working since I was 14). I am currently 57 and my wife is 60. I am looking to retire within three years at the most. My wife thinks she might want to work part time to keep herself busy, but I am pretty convinced I don’t want to spend my retirement working.

Most Read from MarketWatch

Are we actually going to be able to retire in a couple of years and live a reasonable lifestyle without running out of money? Do we need to change our portfolio setup? How should we draw down our retirement funds, especially while we wait for Social Security?

Our annual expenses, including expectations for having to buy health insurance, and our expenses for entertainment and travel are approximately $70,000 in 2024 dollars.

We have no debt, other than a $20,000 loan from a retirement account, listed below, which will be paid off within the year; two vehicles, each less than five years old; and a house and a cabin that together are worth approximately $650,000. Our combined Social Security income is projected to be $5,700 per month at age 67 and $7,400 per month at 70.

Here’s what we have:

Head vs. Heart

Dear Head vs. Heart,

You’re the kind of retirees the bucket strategy was made for. You have a lot of different accounts of different types, and it just looks like a big mess when you list them. It’s definitely hard to get a handle on things that way.

The bucket strategy is a type of mental accounting that lets you visualize your holdings in a way that might make more sense to you. Start by organizing your buckets according to tax efficiency: tax-deferred savings, tax-free growth and taxable savings. That will help you see if you’re saving in the right places for the next three years until you retire. The goal is to have a diversity of income streams, so you can choose where to pull money from in order to minimize your tax burden.

When you start to spend the money, you can shift to thinking about time-frame buckets — one for the short term that is mostly cash, one for the medium term that is more conservative and one for the longer term that is more aggressive. That’s when you’d want to adjust your investments to make them work for you. You wouldn’t want individual stocks in the short-term bucket and cash in the long-term bucket, for instance.

I’d suggest wiping that expected inheritance off your list. You never know what might happen, and it’s not something you can count on. If a sizable inheritance should come your way eventually, you can adjust your plans accordingly, without counting your chickens before they hatch.

Tax-deferred bucket

Group all of your tax-deferred retirement accounts into one bucket: the 457(b), the 403(b) and the employer-sponsored plan, all of which currently amounts to about $943,000. You have another two and a half years before you can touch that money without penalty, but your wife can already start drawing from her savings if she needs to. That being said, when you do start to tap that money, you’ll have to pay tax on it as ordinary income.

You will also have to start taking money out of these accounts when you are 73, under current required minimum distribution rules. By the time you reach that age in 16 years, those savings could be worth more than $2.5 million, assuming an average growth rate of 7%. You could keep adding to that bucket over the next few years or start to spend it down early, but that depends on you.

Tax-free bucket

Your Roth IRAs are for the bucket of tax-free growth. Those accounts are worth $260,000 now, and however much they grow, it will never affect your taxes, because you pay the tax on Roth contributions up front. You can take out the money that you put in at any time, but you have to wait until you’re 59½ to take out the growth without penalty.

That makes this bucket good if you need a cash infusion in the next few years, but otherwise, you might want to spend from this bucket last, because the growth is tax-free. If you leave that money alone, it could be worth $1.2 million by the time you are 80.

You didn’t mention heirs, but Roth accounts are also the most advantageous to leave behind when you die, because your beneficiaries do not have to pay tax on the balances for 10 years.

Taxable bucket

With your holdings in brokerage accounts and cash, it does not seem likely that you’ll need to touch that Roth money early. The goal is to have enough cash on hand to cover your expenses from the time you retire until Social Security kicks in, followed in short order by RMDs. For anything you need after that, you can choose which account works best.

If you retire at 60, that leaves roughly 10 years in which you’ll need to cover $70,000 in annual expenses.

This is when good financial-planning software comes into play, because it lets you run exact numbers and put in all these variables and time frames. But just by looking at the buckets, you can do a little back-of-the-envelope analysis and see that the $1.25 million you have now would certainly cover your projected expenses — in fact, you’d mostly be skimming off the top, meaning your accounts might actually grow over that period, even at a moderate 7% return.

Retirement spending projections are not an exact science, however. Maybe $70,000 a year is actually kind of low for you, especially if you are not taking into account future healthcare costs or other emergencies. Or perhaps once you retire, you will decide to spend a little more freely at first, while you are healthy and can enjoy it.

And when the time comes to hang up your spurs, you may decide that’s not what you want to do. Some kind of work could still be in your future, but it will be driven by your passion, not your bank balance.

You can also join the Retirement conversation in our .

Most Read from MarketWatch

More Fix My Portfolio

A Few Years From Now, You'll Wish You'd Bought This Undervalued High-Yield Stock

One of the biggest temptations for dividend investors is reaching for yield. Basically, that means taking on risky investments just to collect a larger income stream. You’ll be better off in the long run if you err on the side of caution, particularly if you need to live off of the income you are generating. That’s why Enterprise Products Partners (NYSE: EPD) is a high-yield investment you’ll wish you’d bought. A quick comparison to Altria (NYSE: MO) will help explain why.

Who wins the high-yield story, Altria or Enterprise?

When it comes to yield, Altria’s 8.1% dividend yield is a full percentage point higher than the distribution yield of Enterprise Products Partners’ 7.1%. Both have increased their dividends regularly, so many investors might default to the higher-yielding option. But that’s not necessarily the best plan.

Altria, a consumer staples company, comes with more risk than you may think despite operating in what is generally considered a reliable sector. That’s because its main product is cigarettes. This business has been in a secular decline for a long time. In the second quarter of 2024 alone, Altria’s cigarette volumes fell 13% year over year. That’s not a fluke. In the second quarter of 2023, volumes fell 8.7%. In the same quarter of 2022, cigarette volume was off by 11.1%. Any recent quarter and any recent full year would have shown the same terrible trend.

The company has offset volume declines with price increases, which has allowed it to continue growing its dividend despite the clearly terrible direction of its most important business line. There’s a very real chance that you will regret buying this high-yield dividend stock if it can’t stem the bleeding in some way.

Enterprise is a totally different story.

Enterprise’s lower yield comes with lower risk

You can easily argue that Enterprise comes with its own risks, given that it operates in the highly volatile energy sector. And its midstream business is directly tied to demand for oil and natural gas, which is being pressured by the move toward cleaner alternatives. Fair enough, but what does Enterprise actually do?

As a midstream provider, Enterprise owns vital infrastructure assets that help move oil and natural gas around the world. It generally charges fees for the use of its infrastructure, so the price of energy is less important than the demand for energy. Demand for energy tends to remain robust regardless of the price of oil and natural gas.

But here’s the big fact — despite all the hype around clean energy, demand for oil and natural gas is expected to remain robust for decades to come. In fact, demand will likely increase for these fuels, with far dirtier coal bearing the brunt of the clean energy switch.

In other words, Enterprise’s business isn’t as risky as it may seem. On top of that, it is one of the largest midstream players in North America with an investment-grade-rated balance sheet. While internal growth options are limited, it has long acted as an industry consolidator. It just announced plans to buy Pinon Midstream for $950 million, for example. Acquisitions are lumpy and impossible to predict, but they give Enterprise ample room for growth on top of the slow and steady price increases it will be able to extract from customers.

If you want a high yield from a growing business, Enterprise is the better option when compared to Altria and its declining core business. Sure, you’ll give up a percentage point of yield, but as Altria continues to struggle, that last point will allow you to sleep at night if you buy Enterprise.

Enterprise’s yield still looks cheap

Here’s the most interesting part: Enterprise’s 7.1% dividend yield is above its 10-year average yield of 6.3%. So despite the recovery from pandemic lows, it still appears to be undervalued. A growing business, a financially strong company, and an undervalued price all make Enterprise a high-yield stock you’ll regret missing out on. Especially when you compare it to other high-yield choices with similarly high, but far riskier, yields.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

A Few Years From Now, You’ll Wish You’d Bought This Undervalued High-Yield Stock was originally published by The Motley Fool

3 Stocks to Buy After the Chinese Stimulus Package

With its economy floundering, the Chinese government recently announced a number of measures to help give it a lift. They include decreasing banks’ required reserve ratios, lowering key interest rates, and reducing the required downpayment percentage on second homes.

In addition, China will allow institutions, including brokers, funds, and insurance companies, to use financing from the central bank to purchase stocks. There is also a plan to let companies and large shareholders use government financing to buy back their shares.

Against this backdrop, let’s look at three Chinese companies that trade in the U.S. that could benefit from this stimulus plan.

Baidu

Baidu (NASDAQ: BIDU) is a Chinese technology conglomerate that is most akin to Alphabet in the U.S. It is best known for its search engine, but like Alphabet, it also owns cloud computing and robotaxi businesses. The company also owns stakes in publicly traded Chinese travel company Trip.com and video subscription service iQIYI.

With the sluggish Chinese economy and increasing competition for ads, Baidu has seen its stock struggle this year, down about 20%. In the second quarter, its overall revenue was flattish, while its online ad revenue fell 2%. One area of strength was its cloud business, which saw revenue rise 14%.

In addition to the impact of the weak macro environment and competitive landscape, the company is also in the process of trying to transform its search experience through the integration of generative AI, which it says will provide more accurate and direct answers. In August, about 18% of search results content was created by generative AI, up from 11% in mid-May.

However, the company has said this transformation is currently leading to fewer ad impressions, which is hurting revenue in the near term. Longer term, though, the company thinks this is the right strategy and it will also explore other monetization models, such as moving from a cost-per-click model to a cost-per-sale model.

While Baidu is dealing with near-term internal and external headwinds, an improved Chinese economy and consumer could go a long way toward helping to improve its search ad business.

Alibaba

Wile Baidu resembles Alphabet, Alibaba (NYSE: BABA) is similar to Amazon in the U.S., with large e-commerce, logistics, and cloud computing businesses.

While Alibaba’s stock has performed well this year, up more than 20%, it’s still down more than 40% over the past five years. It too has struggled with increased competition and a weak Chinese economy. In Q2, its e-commerce revenue fell -1%, although the company is making strides attracting more customers, as its orders grew by double-digits and its gross merchandise value (GMV) rose by high single digits. Now that its Taobao and Tmall businesses have stabilized, it will look to increase monetization on the platforms.

And similar to Baidu, its cloud computing unit has recently been a standout. While its Q2 revenue only rose 6% last quarter, the segment’s adjusted EBITA (earnings before interest, taxes, and amortization) soared 155% as it lets lower-margin customers roll off. The company also just introduced over 100 AI models to help further push growth.

While Alibaba has been making strides in its turnaround efforts, an improvement in the weak Chinese economy could go a long way in helping with those efforts.

JD.com

Similar to Alibaba, JD.com (NASDAQ: JD) operates an e-commerce and logistics business in China. JD, however, sells more direct items, so its margin profile is much lower than Alibaba’s. Nearly half its total revenue comes from the sale of electronics and home appliances.

JD.com’s stock is up nearly 15% on the year, but up less than 10% over the past five years.

It too has been feeling pressure from a weak Chinese consumer and increased competition. Last quarter, its revenue rose just 1.2%, with retail revenue increasing 1.5%. It has also been seeing strength in its smaller grocery store business, but sales of electronics and home appliances fell 4.6%.

To help try to improve its business, the company has focused on trying to improve its supply chain capabilities to offer the most competitive prices while also working to create a better user experience. It said this strategy is showing some signs of working, with solid user growth momentum in both higher-tier and lower-tier markets.

While JD.com has been making strides to improve its business, given its ties to electronics and home appliances sales, it may be the biggest beneficiary of the three to an improved Chinese consumer.

Three cheap stocks

Baidu, Alibaba, and JD.com are all very cheap compared to their U.S. counterparts, with all three trading at under 10 times on a forward price-to-earnings (P/E) basis based on next year’s analyst estimates.

All three also carry a good amount of net cash on their balance sheets and generate solid free cash flow. Given this and their valuations, now could be a good time to add some exposure to these Chinese stocks, with the government looking to give the country’s economy a boost.

Should you invest $1,000 in Baidu right now?

Before you buy stock in Baidu, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Baidu wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alibaba Group and Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, Baidu, and JD.com. The Motley Fool recommends Alibaba Group and iQIYI. The Motley Fool has a disclosure policy.

3 Stocks to Buy After the Chinese Stimulus Package was originally published by The Motley Fool

You Can Do Better Than the S&P 500. Buy This ETF Instead.

There’s nothing wrong with the S&P 500 (SNPINDEX: ^GSPC) market index.

It reflects the overall health of the American stock market, with a quality filter based on market capitalization. Investing in this market tracker through exchange-traded funds (ETFs) like the SPDR S&P 500 Trust (NYSEMKT: SPY) gives you a ton of diversification and sets you up for robust long-term returns.

If you invested $1,000 in the SPDR fund 10 years ago and set the position up to reinvest dividend payments in more shares, you would have $3,500 today. That’s a compound annual growth rate (CAGR) of 13.2%, leaving inflation rates far behind. Many investors get started in a popular SPDR 500 fund and let it run for decades, building wealth with zero investor effort.

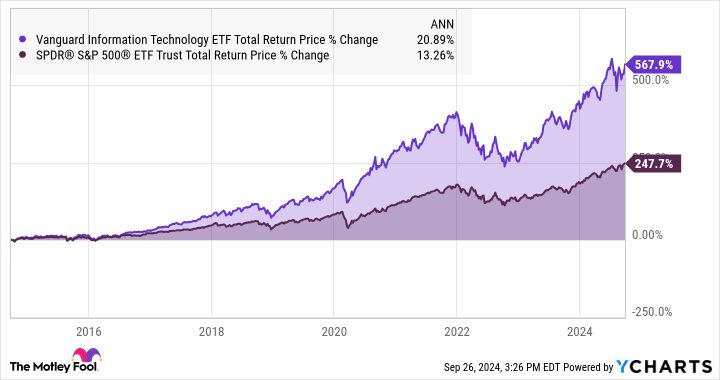

But what if I told you that there are ETFs with even better long-term returns? For instance, the Vanguard Information Technology ETF (NYSEMKT: VGT) tends to beat the S&P 500’s returns in the long haul. It’s one of my favorite ETFs. Let me show you how it works.

Why this Vanguard fund is one of my favorite ETFs for long-term growth

As you can see in the chart above, the Vanguard IT ETF has been crushing the S&P 500 and its index trackers over the last decade. The total returns work out to a CAGR of 20.9%. Over this period, a hypothetical $1,000 investment would have grown to $6,678.

And that’s just a simple one-time move with no further cash investments added over time. Let’s imagine an automated dollar-cost averaging plan instead, starting with just $100 in the fall of 2014 and adding another $100 to that Vanguard IT ETF position per month. Some investors can do this as a paycheck deduction, others might set up automatic transfers, and a few may prefer doing it by hand.

Whatever method you use, these fairly painless contributions would add up to $12,000 in a decade. The investment returns would be roughly $29,000, working out to a total investment value of $41,118.

Doing the same thing with the SPDR S&P 500 fund instead would have yielded respectable results, too. The same $12,000 investment should be worth $25,174 by now, more than doubling your money in 10 years.

Like I said, there’s nothing wrong with that. Still, I’d rather have the stronger returns from the IT market tracker.

There’s no reward without additional risks

Of course, I can’t promise market-stomping returns over every conceivable time period. The fund underperformed the S&P 500 in its first five years on the market, ending amid the subprime market meltdown of 2008-2009. The inflation crisis of 2022 was no fun for Vanguard IT ETF investors, either.

In challenging markets like these hand-picked examples, the ETF’s focus on high-growth investment ideas can result in deeply negative returns. I had to search for these unfavorable examples, and this ETF tends to beat the S&P 500 over long time periods.

Still, this might not be the fund for you if you can’t afford the occasional price drop along the way. The fund outperforms in most cases, but it can really hurt when growth stocks run into a brick wall.

How this ETF’s portfolio differs from the S&P 500

The fund follows a market index reflecting all American stocks in the information technology sector, resulting in a list of 317 names at the latest update.

They are weighted by market cap. Therefore, tech titans Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), and Nvidia (NASDAQ: NVDA) are the three largest holdings these days. These three stocks add up to roughly 48% of the total portfolio.

The same three companies also dominate the S&P 500, but their combined weight stops at just 20% right now. The IT index includes many stocks that are too small for the S&P 500.

So the IT-focused fund places a heavier load on the largest companies, but also lets smaller businesses contribute to the total score. It’s a different balancing act that raises market risks but also the potential returns.

Is the Vanguard Information Technology ETF right for you?

You’ve seen the long-term returns, and I showed you the potential downsides. I don’t mind if you prefer something like the SPDR S&P 500 ETF in the end. It will probably let you sleep better at night, at least in challenging periods like the market crises I highlighted earlier.

I’m just happy to have shown you a more exciting option. The Vanguard Information Technology ETF isn’t every investor’s cup of tea, and that’s OK. I highly recommend taking a sip, though. These thrilling high-growth ideas can be intoxicating over the long haul.

Should you invest $1,000 in Vanguard World Fund – Vanguard Information Technology ETF right now?

Before you buy stock in Vanguard World Fund – Vanguard Information Technology ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard World Fund – Vanguard Information Technology ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Anders Bylund has positions in Nvidia and Vanguard World Fund-Vanguard Information Technology ETF. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

You Can Do Better Than the S&P 500. Buy This ETF Instead. was originally published by The Motley Fool

2 Supercharged Growth Stocks to Buy Before They Soar as Much as 169% According to Select Wall Street Analysts

The rally that began early last year continues to push the market into the stratosphere. The S&P 500 hit a record high this week, while the Nasdaq Composite is within striking distance of a new all-time high, sitting roughly 2% below its peak (as of this writing). The market’s relentless rise has many stocks at or near new heights, leaving some investors to wonder if the rally still has room to run.

UBS analyst Mark Haefele remains bullish. “All-time highs often generate investor concern that markets have peaked. Such worries are not supported by history,” he wrote in a note to clients. XM Investment analyst Marios Hadjikyriacos agrees. “Stock markets are enjoying the best of all worlds, buoyed by a resilient U.S. economy and speculation that Fed rate cuts are just around the corner, helping to justify stretched valuations,” he wrote. It’s worth noting the Fed did, in fact, cut rates last week, helping propel the market to even greater heights.

Despite the ongoing rally, there are still opportunities to be had, including some stocks that have triple-digit upside, according to some veteran analysts. With that as a backdrop, here are two supercharged growth stocks with additional upside of 169% and 160% respectively.

Palantir Technologies: Implied upside 169%

One of the biggest roadblocks to the adoption of artificial intelligence (AI) is that many companies simply lack the know-how to implement this cutting-edge technology — while still getting their money’s worth. That isn’t surprising, particularly given the expertise needed to get these systems up and running. That’s where Palantir Technologies (NYSE: PLTR) comes in.

The company has a long and compelling track record for creating AI systems for the U.S. government defense and intelligence agencies. It wasn’t long before Palantir turned its focus and AI expertise to delivering actionable intelligence for enterprises.

The advent of generative AI early last year was right in the company’s wheelhouse, and Palantir quickly created a framework that businesses could use to deliver quantifiable results. The fruit of its labors is its Artificial Intelligence Platform (AIP), which provides customized solutions to everyday business dilemmas.

It was Palantir’s brilliant implementation strategy that helped bridge the knowledge gap. The company offers interactive sessions dubbed “boot camps.” These gatherings, which last from one to five days, pair Palantir engineers with business and government customers to help them solve company-specific challenges. The company has sponsored more than 1,300 boot camps since late last year, helping fuel robust sales.

In the second quarter, Palantir cited numerous examples of boot camps that resulted in seven-figure deals within weeks after attendance. In all, the company closed 96 deals worth more than $1 million during the quarter. Of those, 33 were worth at least $5 million, and 27 were worth at least $10 million, which helps illustrate the value of these sessions to customers.

Greentech Research investment analyst Hilary Kramer is the most bullish among her Wall Street colleagues, suggesting that Palantir “easily can be” a $100 stock over the next few years. That represents a potential upside for investors of 169% compared to Wednesday’s closing price. The analyst said Palantir is her “absolute 100% favorite,” citing the company’s ability to use data to supply “actionable decision-making.”

At 218 times earnings and 35 times sales, Palantir seems exorbitantly expensive. However, its forward price/earnings-to-growth (PEG) ratio, which factors in its accelerating growth, comes in at 0.35, when any number less than 1 is the benchmark for an undervalued stock.

Symbotic: Implied upside 160%

Given the growing importance of digital retail, one area ripe for disruption is warehouse automation, and Symbotic (NASDAQ: SYM) is an emerging power player in the space.

The company uses custom AI solutions to automate the processing of pallets and individual cases, helping to maximize every available inch of warehouse space. Symbotic pairs advanced algorithms with a cadre of smart robots that work together to load and unload trucks, stack pallets, and even isolate individual crates, squeezing more inventory into less space.

This increases efficiency, reduces labor costs, and decreases transportation and operating expenses, helping the system pay for itself over time. Symbotic estimates that over its useful life, each “module” can pay for itself multiple times over, saving businesses tens or even hundreds of millions of dollars. The company boasts a bevy of household names as customers, including Walmart, Target, Albertsons, and C&S Wholesales Grocers.

The company continues to generate robust results. For its fiscal 2024 third quarter (ended June 29), Symbotic generated record revenue that grew 58% year over year to $492 million, while the company slashed its losses by 71%, resulting in a loss per share of $0.02. That said, Symbotic has been consistently free cash flow positive, which suggests it’s on track for profitability.

In the wake of the company’s financial report, Cantor Fitzgerald analyst Derek Soderberg maintained his overweight (buy) rating and $60 price target on the stock. That represents a potential upside of 160% compared to Wednesday’s closing price. The analyst believes that, despite some deployment challenges, as the systems improve, Symbotic can generate 10% annual recurring revenue from its hardware.

It’s worth noting that an “anonymous” short report posted online alleges that Symbotic disclosures are misleading and most analysts on Wall Street are being duped. It’s interesting that none of the analysts who cover Symbotic have even bothered to acknowledge the report, which suggests it’s much ado about nothing. That said, it does add an element of the unknown — and by extension risk.

As with many high-growth stocks — particularly ones that don’t yet generate a profit — Symbotic stock is a bit riskier, so any position should be sized appropriately with that in mind. Furthermore, Symbotic isn’t cheap, currently selling for roughly 6 times next year’s expected sales. Those caveats aside, as a leader in an emerging industry, Symbotic has a long runway for growth ahead and could be a big winner in the AI revolution.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Danny Vena has positions in Palantir Technologies. The Motley Fool has positions in and recommends Palantir Technologies, Target, and Walmart. The Motley Fool has a disclosure policy.

2 Supercharged Growth Stocks to Buy Before They Soar as Much as 169% According to Select Wall Street Analysts was originally published by The Motley Fool