Trump Vs Harris: This Candidate Skyrockets in Election Forecast, Poised To Secure Victory In Four Swing States

In the race for the 2024 Presidential election, Vice President Kamala Harris is witnessing a significant boost in her election prospects.

What Happened: The Economist’s latest election forecast shows Harris with a 3 in 5 chance of securing the Electoral College in November, compared to Donald Trump‘s 2 in 5 chance.

This is the strongest position Harris has held since becoming the Democratic presidential candidate. The forecast also anticipates Harris to win 281 Electoral College votes, while Trump is expected to garner only 257.

Over the past three weeks, Harris’ odds have surged by 10 percentage points, improving from an even 50-50 split with Trump as of September 8.

Also Read: Voters Warm To Kamala Harris As Election Nears

According to a report by Newsweek, her overall probability of winning the election has grown by 6 percentage points, rising from 52% to 58%. In contrast, Trump’s chances have declined by 7 percentage points, dropping from 48% to 41% since the same date.

The forecast also suggests that Harris will secure victory in four swing states—Nevada, Pennsylvania, Michigan, and Wisconsin—while Trump is predicted to win in Georgia, North Carolina, and Arizona.

However, the margins in these swing states are so narrow that they are still considered competitive.

Despite varying polls, Harris continues to lead in every polling aggregator. For example, FiveThirtyEight’s polling tracker places Harris 2.8 points ahead, with 48.6 percent to Trump’s 45.7 percent.

Race to the White House gives Harris a 60 percent chance of winning the election, with 289 Electoral College votes to Trump’s 248.

However, data analyst Nate Silver‘s polling tracker puts Harris ahead by 3 points. But his Electoral College predictions were not as favorable for the Democrat. In his newsletter, Silver stated that his model showed the Electoral College is a toss-up.

Also Read: Trump Vs Harris: New Poll Reveals Post-Debate Swing Towards This Candidate In Key State

When asked about the election forecast, Trump’s spokesperson Steven Cheung criticized Harris’ campaign. “Kamala Harris is in desperation mode; that’s why she keeps lying about her positions. She knows her policies have led to skyrocketing inflation, an out-of-control border, and rampant crime that threatens every community,” Cheung told the outlet.

Why It Matters: The forecast, derived from a combination of polling data, historical election outcomes, and socio-economic trends, suggests that Harris is outperforming initial expectations.

This is significant as it reflects a broader acceptance and approval of her policies and leadership style, factors that are crucial as she potentially gears up for a presidential campaign.

Experts attribute this rise in Harris’s poll numbers to several key factors. Firstly, her visibility and active engagement in critical national issues have resonated well with the electorate.

Her advocacy for comprehensive healthcare reforms, her stance on climate change, and her vocal support for social justice initiatives have particularly stood out, aligning her closely with the priorities of a significant segment of the Democratic base.

Read Next

Trump Vs Harris: New Polls Reveal This Candidate Is Outperforming In Swing States

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: This AI Stock Will Be the Next Company to Reach a Trillion-Dollar Market Cap

There have officially been eight non-state-owned companies to have reached a market cap of $1 trillion. These include the “Magnificent Seven” technology companies and, most recently, Berkshire Hathaway, which just passed the threshold earlier this month. Of these companies, only Tesla and Berkshire Hathaway are below the $1 trillion threshold today.

A lot of wealth has been built betting on internet stocks, and, at least in recent years, the growing demand for artificial intelligence (AI). One company with a market cap of just under $1 trillion is a huge beneficiary of AI, Nvidia‘s key semiconductor supplier, and the dominant player in its sector. And yet, it doesn’t get nearly the same hype as other AI companies.

That company is Taiwan Semiconductor Manufacturing (NYSE: TSM). Here’s why I predict the computer chip giant will be the next company to surpass a trillion dollars in market capitalization.

Growth in AI

AI has seen an insatiable level of spending in the last few years. Collectively, companies are spending an estimated $200 billion annually, and that’s expected to rise to over $600 billion by 2028. A lot of this spending goes to semiconductor products from the likes of Nvidia and Advanced Micro Devices.

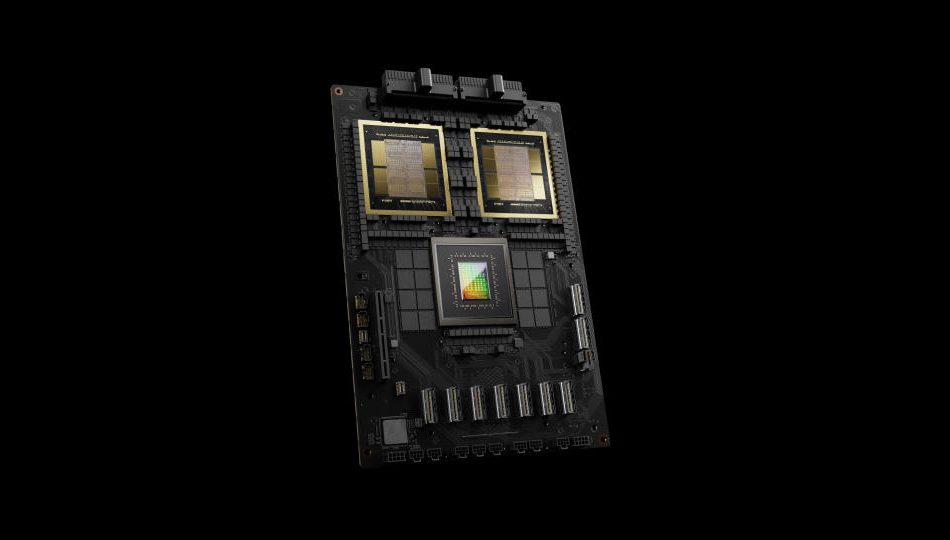

Taiwan Semiconductor (TSMC, for short) is the manufacturer that actually builds and assembles these semiconductors for third parties. It is one of the only companies in the world that can make semiconductors with ultrasmall transistor lengths, which leads to better speed when running complex AI computations. In fact, right now it is the only company with 3-nanometer semiconductors in production.

Technological superiority locks in customers such as Nvidia to the TSMC manufacturing platform. Last quarter, these advanced semiconductor types made up the majority of TSMC’s revenue, with the high-performance computing segment growing sales by 28% quarter over quarter. All this is due to the boom in AI spending. If the boom continues, it will lead to more revenue growth for TSMC.

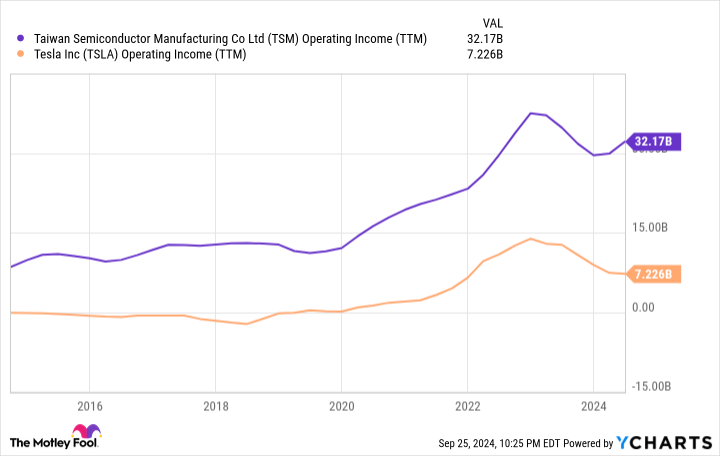

TSMC earnings are dwarfing Tesla

The key driver of market-cap gains and stock price appreciation over the long term is earnings growth, plain and simple. TSMC has grown its earnings at a substantial rate in the last few years. Over the last 10 years, operating income has grown by 277% and currently stands at $32 billion. That is four times the trailing earnings of Tesla, one of the few stocks ever to surpass a market cap of $1 trillion.

While that may say more about Tesla’s premium valuation than anything else, TSMC is definitely not a bubble stock. It currently has a price-to-earnings ratio (P/E) of 32.6, which is reasonable for a dominant company in a growing market. These earnings come from TSMC’s leading position in advanced semiconductors. Among foundry manufacturers — those that manufacture semiconductors for third parties — it has an estimated 60% market share.

TSM Operating Income (TTM) data by YCharts

Watch earnings grow, and market cap will follow

As long as TSMC keeps its technological edge in semiconductor manufacturing, operating earnings will grow over the long term. Demand for AI is growing along with other sectors that use semiconductors and computer chips in their processes. Ever since the transistor was invented in 1947, spending on semiconductors has grown. This puts TSMC in a great position as the leading manufacturer of advanced semiconductors.

Today. TSMC has a market cap of $968 billion, meaning its stock needs to go up by around 3% in order to reach rarified air and a market cap of $1 trillion. As its earnings keep marching higher, I predict TSMC will be the next stock to hit this milestone.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Berkshire Hathaway, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool has a disclosure policy.

Prediction: This AI Stock Will Be the Next Company to Reach a Trillion-Dollar Market Cap was originally published by The Motley Fool

Think You Know Altria? Here's 1 Little-Known Fact You Can't Overlook.

When most investors look at Altria (NYSE: MO) what they see is a huge 8% dividend yield backed by a dividend that has been increased for years. That is the type of story that most dividend investors will find attractive. But there’s a big risk here because the company’s core business is in long-term decline. That risk has to be understood, but there’s another subtle twist that you may have overlooked.

Altria’s business is slipping away

It shouldn’t come as any shock to Altria shareholders that the company’s most important business is making cigarettes. In the first half of 2024, the company generated roughly $11.8 billion in revenue. Its smokeable products division’s revenues were about $10.4 billion, or 88% of the company’s overall top line. Clearly, smokeable products is the driving force at Altria.

To be fair, the company sells a variety of smokeable products, including cigars. But when you look at volume, cigarettes account for just over 97% of the division’s volume. So cigarettes are the big story at Altria. But, as noted, most investors know that fact.

The important story here isn’t the largest business. It is the decline that’s taking place in the largest business. Through the first six months of 2024, cigarette volumes dropped 11.5%. That’s terrible and would likely be seen as shocking at any other consumer staples company — investors would run for the hills. Only that drop is just par for the course.

In 2023, cigarette volumes declined 9.9%. In 2022, volumes fell 9.7%. In 2021, the drop was 7.5%. You get the idea, this is a dying business.

One “little” problem that can’t be overlooked

How has a company with a business that’s in decline managed to maintain its dividend, let alone grow it? The answer is that, because of the nature of cigarettes, smokers tend to be very loyal. So Altria has been jacking up prices on a regular basis to offset the volume declines. That’s worked out well so far, but you can only milk a cash cow so hard before it runs dry. That’s a bigger risk for Altria than many may realize.

Of the cigarettes Altria sells, only about 4% or so fall into the discount category. That means Altria’s business is basically reliant on premium smokes. In the premium category, “other premium” brands make up about 4.5% of total volume. The remaining 91% of the company’s cigarette volume is all attributable to one brand, Marlboro.

Marlboro is a giant in the U.S. cigarette industry with a huge 42% market share. This could be viewed as a strength. But step back for a second and think about the big picture. Altria is basically a one-trick pony in a dying rodeo. And its pony is one of the most expensive around at a time when price competition from smoking alternatives is heating up. Altria itself notes that “the growth of illicit e-vapor products” is a big problem, which is largely because they are less costly.

Fixing the problem won’t be easy

There’s only so much Altria can do about its reliance on Marlboro as the cigarette business declines. In fact, being the biggest player in the industry is probably preferable to having a second rung brand. What it is doing is trying to broaden its reach beyond cigarettes. This is the right thing to do, but given the size of the company’s cigarette business it isn’t going to be easy to find a replacement. After a couple of failed attempts, including an investment in Juul and in a marijuana company, Altria is currently focused on growing its recent NJOY vape acquisition.

It is going well, with NJOY experiences rapid growth as it has been slotted into Altria’s impressive distribution system. To put a number on that, in the second quarter of 2024 NJOY’s shipment volume increased 14.7% from the first quarter and NJOY device shipments increased 80%. The problem is that NJOY is tiny, falling into Altria’s “all other products” revenue category which made up just $22 million in revenue in the first half of 2024 at a company with nearly $11.8 billion in revenue. So NJOY is barely even a rounding error. Marlboro is the key to Altria’s future and will likely remain the key for years to come.

If Altria hits a tipping point, it could get bad fast

A consumer staples company can only raise prices just so far before there’s a backlash from consumers. The easy switch with cigarettes is to buy cheaper smokes, which Altria really doesn’t sell. Then there’s alternatives to worry about, such as the company’s highlight of vaping. Although Marlboro has been holding its own, in 2021 its market share was 43.1%. That’s 1.1 percentage points above its current level.

If Marlboro falters, Altria could fall. This is a “little” fact that many investors probably aren’t considering as they look at the huge dividend yield. Basically, there’s greater concentration risk here than many people realize.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Think You Know Altria? Here’s 1 Little-Known Fact You Can’t Overlook. was originally published by The Motley Fool

China's Reluctance To Empower Corporations Could Undermine Economic Stimulus: Report

China’s latest economic stimulus is creating significant ripples in global markets. Following a series of bold actions by the People’s Bank of China (PBoC), including slashing the reserve requirement ratio (RRR) for banks and cutting key repo rates, the financial system is poised for an influx of liquidity.

The aim is to inject $140 billion into the economy and enhance lending to stimulate growth. Additionally, Reuters reports that China plans to issue 2 trillion yuan (approximately $284 billion) in special sovereign bonds this year to boost consumer spending.

However, Nick Colas, co-founder of DataTrek Research, cautioned about the challenges posed by the Chinese government’s approach. During a Bloomberg Surveillance podcast, he noted that while there are various monetary and fiscal policy measures, there exists a conflicting perspective among government regulators.

They want to improve the economy but are reluctant to restore too much power to the wealthy and corporations.

“And that tension has been really damaging for Chinese equity market investors sentiments,” Colas said in the podcast.

Colas emphasized that this tension has negatively impacted investor sentiment in the Chinese equity market.

Also Read: China’s Stimulus Sparks Optimism: 3 Large-Cap Stocks With Analyst Buy Ratings

Colas also drew a comparison between China and the United States regarding their resilience. He expressed that America, by its very nature, is psychologically “anti-fragile.”

“Americans are very optimistic people. They don’t worry about making mistakes. And they don’t criticize people that fail, at least in business,” Colas said on the Bloomberg Surveillance Podcast.

He remarked that American society allows for “second and third acts,” highlighting a cultural tendency to bounce back from setbacks.

When asked about China’s anti-fragility, Colas acknowledged that it exists but not to the same degree as in the U.S. He pointed out that the unique ability of Americans to recover from mistakes—whether in business or politics—sets the U.S. apart globally. This resilience, he concluded, is a hallmark of American exceptionalism.

A recent Bloomberg report highlighted that a growing group of prominent Chinese economists, including former central bank chief Yi Gang, has warned of the need to boost demand to prevent China from falling into a deflationary spiral.

Companies engaged in intense price wars are laying off workers, and college graduates are facing challenges in finding jobs, leading to a record youth unemployment rate last month, the report read.

While the new multi-faceted policy package has energized equity markets, it did not do much to tackle the fundamental issues affecting China’s long-term economic outlook.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Where Will Plug Power Be in 3 Years?

It’s not hard to paint a rosy picture for hydrogen stocks like Plug Power (NASDAQ: PLUG). According to a recent report by global consultancy McKinsey & Co, “global clean hydrogen demand is projected to grow significantly by 2050, but infrastructure scale-up and technology advancements are needed to meet projected demand.” As a company that provides that infrastructure and technology, Plug Power is in the driver’s seat to meet this growth in demand that could be sustained for decades.

With a market cap of just $1.8 billion, there is certainly plenty of upside potential to Plug Power stock. Deloitte, another global consultancy, predicts that the global market for hydrogen could reach $1.4 trillion by 2050. But what about the next three years? The true growth potential of Plug Power stock might surprise you.

Hydrogen demand is still in its infancy

While wind and solar power get most of the attention, hydrogen power has a large opportunity to help the world transition away from fossil fuels. That’s because hydrogen fuel is particularly good at decarbonizing what economists call “hard to abate” sectors. Asphalt, cement, steel, shipping, aviation — these are just a few areas where replacing fossil fuels with renewable energy remains very difficult.

Hydrogen fuel is a viable substitute for two reasons. First, it has a much higher energy density than batteries. This makes it a suitable option for trucking and aviation, where hauling voluminous, heavy batteries isn’t practical. Additionally, sectors like steelmaking, cement production, and petrochemical require very high temperatures to operate, sometimes in excess of 1,000 degrees. Hydrogen can create this level of high heat, whereas electricity — whether produced by clean or dirty forms of energy — struggles.

If we want to decarbonize hard-to-abate sectors of the economy, hydrogen has a strong case. But demand is still very much in its infancy. There’s a reason why research from Deloitte and McKinsey & Co focuses on timelines all the way out to 2050 — it will take that much time for the hydrogen economy to take off.

Hydrogen fuel in general still isn’t cost-competitive with fossil fuels. And hydrogen can be produced with cleaner or dirtier methods, meaning that a transition to hydrogen fuel won’t necessary decarbonize the sector in question. Plus, hydrogen requires a lot of infrastructure — everything from production and transportation to distribution. It also needs a fleet of end users ready to accept it as a fuel source.

Hydrogen fuel has a lot of promise. But there are clear hurdles that make this a multi-decade story. Don’t expect this equation to change over the next three years.

Will Plug Power be able to ride the clean energy tidal wave?

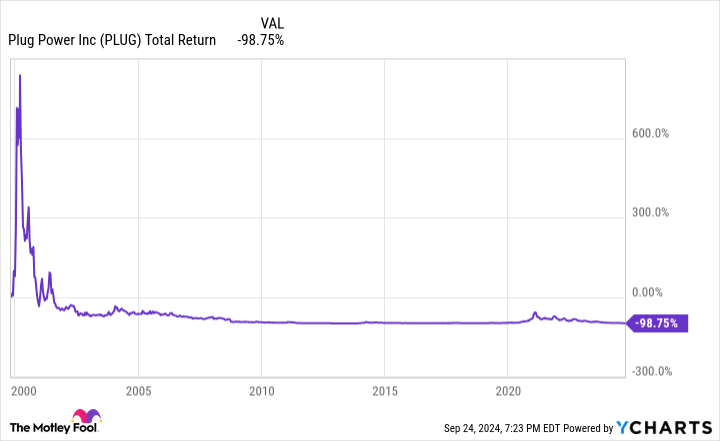

There’s no doubt that Plug Power has an early start. The company was started in 1997, and went public in 1999 at the height of the dot-com bubble. Suffice it to say, it’s been a long journey. Long-term investors haven’t been that satisfied. If you had invested in the company during its IPO, you’d have just 1.25% of your original capital left.

The issue facing Plug Power over the next few years is no different than the challenges that have plagued the company since its founding. Hydrogen power, for all its promise, is still ahead of its time, and an inflection point is nowhere close. Goldman Sachs estimates Plug Power’s equity duration — or the weighted average duration of its cash flows — to be roughly 26 years.

That’s a long time to be waiting. And during the interim, expect heavy dilution. Over the last few decades, Plug Power shares have struggled due to a lack of profitability, but also due to the massive share dilution necessary to keep the company afloat.

Over the next three years, there aren’t many major catalysts to look forward to. Raising capital will continue to be a challenge, and expect management to continue touting the potential of the hydrogen economy as a whole. But even if the hydrogen economy does unexpectedly take off, there’s no guarantee that Plug Power’s technology in particular will win.

Where will Plug Power be in three years? Likely in the same place it is today: Struggling for financing, hoping that a hydrogen inflection point arrives much sooner than expected.

Should you invest $1,000 in Plug Power right now?

Before you buy stock in Plug Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Plug Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Where Will Plug Power Be in 3 Years? was originally published by The Motley Fool

If You Bought 1 Share of Nvidia at Its IPO, Here's How Many Shares You Would Own Now

Since its IPO in January 1999, Nvidia (NASDAQ: NVDA) has established itself as one of the world’s most successful companies. It has been particularly adept at adapting its technology to expand into new markets.

The company pioneered the graphics processing units (GPUs) that revolutionized the gaming industry, turning boxy figures into lifelike images. The secret to its success was parallel processing, which allowed the chips to conduct a multitude of mathematical calculations simultaneously. Nvidia’s processors are now used for product design, autonomous systems, cloud computing, data centers, artificial intelligence (AI), and more.

The ability to adapt its technology has been a boon to shareholders. Even if investors didn’t get in on the IPO itself, Nvidia shares fell below their issue price numerous times in early 1999. For investors fortunate enough to get shares at (or below) the $12 IPO price, the stock has returned 493,940%.

Multiplying like rabbits

While a single share of stock might seem inconsequential at first glance, one share of the right stock can have a huge impact on an investor’s success. In Nvidia’s case, the company’s performance and soaring stock price have resulted in numerous stock splits, turning one share into many more.

Here’s a list of Nvidia’s stock splits over the years:

-

2-for-1 split, June 27, 2000

-

2-for-1 split, Sept. 12, 2001

-

2-for-1 split, April 7, 2006

-

3-for-2 split, Sept. 11, 2007

-

4-for-1 split, July 20, 2021

-

10-for-1 split, June 10, 2024

As a result of the multiple stock splits, an investor who bought just one share of Nvidia stock near its IPO in 1999 would now be the proud owner of 480 shares.

However, it took a great deal of discipline and self-control to hold Nvidia for more than 25 years and reap this windfall. The stock has lost more than half its value on numerous occasions, which sent fair-weather investors scrambling for the exits.

That said, consider this: A $1,000 investment in Nvidia made in early 1999 would now be worth more than $4.9 million.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Danny Vena has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

If You Bought 1 Share of Nvidia at Its IPO, Here’s How Many Shares You Would Own Now was originally published by The Motley Fool

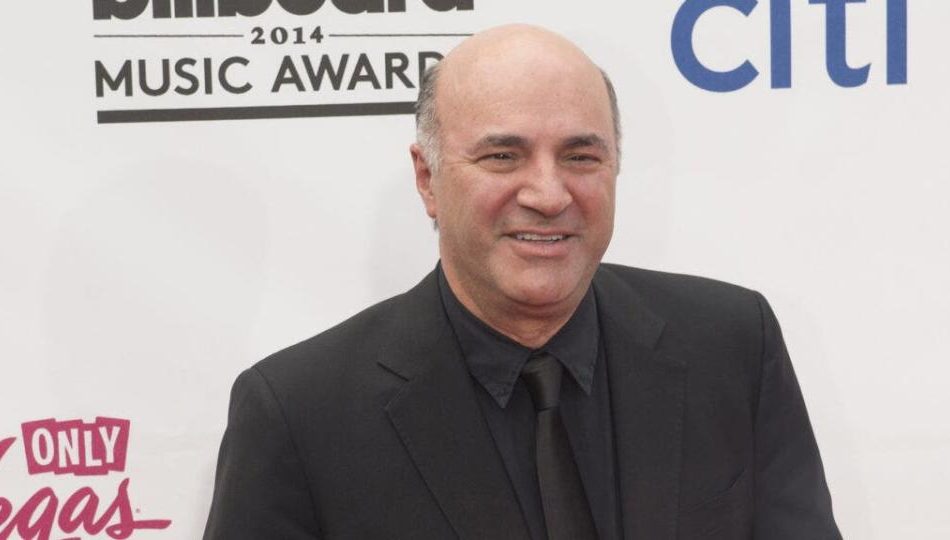

'You Never Ask Me for Money Again': Kevin O'Leary Explains Instead Of Investing In Family Members' Businesses, He Gifts Cash With A Caveat

Kevin O’Leary, a big-name investor known for his no-nonsense approach to business, has a unique strategy for dealing with family members who ask him for money. He’s had his fair share of relatives coming to him with big ideas and high hopes, looking for a hefty investment. And with O’Leary’s financial standing, it’s not surprising. The Canadian business owner and Shark Tank star has a net worth of around $400 million.

Don’t Miss:

But while he’s generous, he’s also got boundaries that help keep family and finances from clashing. In a short YouTube video, O’Leary explained his actions when family members ask him for money. He acknowledges the age-old truth: “More money, more problems.” O’Leary says, “It’s a fantastic thing because it buys you freedom but it makes your life complicated because many people want some of it from you for free – particularly family members. This is a huge issue.”

Trending: Amid the ongoing EV revolution, previously overlooked low-income communities now harbor a huge investment opportunity at just $500.

O’Leary clarifies that people come to expect something for nothing just because you have money. And to handle this, he’s developed a straightforward method that keeps things clear and avoids awkward Thanksgiving dinners.

When a family member approaches him for money – whether it’s to start a restaurant or launch a new business – he offers a one-time gift. In the case he mentions, it’s $50,000. Not a loan, not an investment, just a gift. But there’s a catch: “You never ask me for money again. Ever.” O’Leary’s rule is simple: after that check, there will be no more handouts, no future expectations, and no financial entanglements. As he humorously adds, he hands over the money and then “goes back to polishing his eggs.” It’s a clean break that leaves no room for future financial disputes or awkward family interactions.

Trending: Groundbreaking trading app with a ‘Buy-Now-Pay-Later’ feature for stocks tackles the $644 billion margin lending market – here’s how to get equity in it with just $500

For those who don’t have a portfolio like O’Leary’s, his approach still offers a valuable lesson. Setting clear boundaries is crucial when lending or gifting money to family. Getting caught up in the emotions and obligations that come with helping loved ones is easy, but things can get messy without clear rules. A good approach for the rest of us might be to only give what we can afford to lose – whether that’s $50, $500, or $5,000 – and make it clear that it’s a one-time deal. No loans, no strings, no awkward family gatherings.

Handling family and money can be tricky, but O’Leary’s approach shows that it’s all about setting expectations and sticking to them. And maybe, just maybe, it’s also about having a little humor to keep things from getting too tense.

It’s always smart to consult with a financial advisor before making big decisions, especially when family is involved. They can help you determine what makes the most sense for your situation and set the right boundaries. It’s not just about the money – it’s about keeping relationships intact while making choices that work for everyone. A little guidance can go a long way in ensuring your finances and family ties stay strong.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article ‘You Never Ask Me for Money Again’: Kevin O’Leary Explains Instead Of Investing In Family Members’ Businesses, He Gifts Cash With A Caveat originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaires Are Selling Costco. These 2 Retail Stocks Are Better Buys.

Costco Wholesale (NASDAQ: COST) has been one of the best-performing stocks in the retail sector.

Shares of the membership-based warehouse chain have jumped more than 600% over the last decade, and the company continues to expand both through new stores in the U.S., and by growing same-store sales and expanding its e-commerce business.

However, despite that success, there’s a good argument that Costco is now overvalued. The stock trades at a price-to-earnings(P/E) ratio of 56, about twice that of the S&P 500 index.

You don’t have to take my opinion on the valuation. Top billionaire investors have been selling the stock in the second quarter. That includes Ray Dalio’s Bridgewater Associates, which sold 94,000 shares of Costco in the second quarter, worth nearly $80 million at the time.

Meanwhile, Ken Griffin’s Citadel Capital dumped 124,000 shares, or roughly $100 million. Though Costco’s business looks strong, it’s likely those two hedge funds concluded that its valuation was getting stretched.

If you’re thinking of following them out of Costco, here are two retail stocks worth rotating into.

1. Home Depot

Home Depot (NYSE: HD) is the nation’s largest home improvement retailer.

While Costco stock has continued to climb since the pandemic, Home Depot has struggled with the slowdown in the housing market, and the stock is still trading below its all-time high from 2021.

However, Home Depot looks well positioned to move higher from here. First, the Federal Reserve has begun its rate-cutting cycle, cutting the benchmark federal funds rate by 50 basis points last week.

Falling interest rates should help reignite the housing market, lowering mortgage rates and monthly payments, and mitigating the lock-in effect from low mortgage rates. It will also lower rates for home equity loans and home equity lines of credit (HELOC), encouraging renovations and other home improvement projects.

Home Depot is also poised to capitalize on the recovery thanks to its acquisition earlier this year of SRS Distribution, a leading building materials distributor. That deal helps vertically integrate Home Depot further downstream, closer to its professional customers, and expands its addressable market by an estimated $50 billion.

Home Depot stock now trades at a P/E ratio of 27. That might seem expensive, but its earnings growth should rebound as the housing market bounces back.

2. Target

Target (NYSE: TGT) has also struggled of late, but for different reasons than Home Depot.

As primarily a discretionary retailer, Target has been hit with the slowdown in consumer spending as well as internal problems like theft, but the company now seems to be overcoming those, and the business is moving in the right direction.

Meanwhile, inflation now seems to be under control, and falling interest rates should also encourage consumer spending.

Target’s recent challenges have also set it up for a sharp rebound in profits, as its second-quarter results show. Gross margin jumped from 27% in the quarter a year ago to 28.9% due to cost improvements, a favorable category mix, and other factors.

That improvement in gross margin flowed through to make a significant difference on the bottom line as operating margin improved from 4.8% to 6.4%. In other words, if the company can continue making significant improvements in gross margin, profits could jump from here.

Like Costco, Target is continuing to open new stores, and the company enjoys a number of competitive advantages, including its multicategory business model, store-based fulfillment of online orders, and curbside pickup program.

Target is a stronger business than its recent performance has indicated, and it looks like a good buy at a P/E ratio of 16. Analysts also expect similar earnings growth next year from Target and Costco, showing that Target looks like a steal compared to the much more expensive Costco.

Should you invest $1,000 in Home Depot right now?

Before you buy stock in Home Depot, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Home Depot wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Jeremy Bowman has positions in Target. The Motley Fool has positions in and recommends Costco Wholesale, Home Depot, and Target. The Motley Fool has a disclosure policy.

Billionaires Are Selling Costco. These 2 Retail Stocks Are Better Buys. was originally published by The Motley Fool

China starts to reverse its 'uninvestible' image: Chart of the Week

This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

A cursory glance at the recent performance of China’s stock market shows a wild disconnect from the S&P 500, Germany’s DAX, the UK’s FTSE, and even le CAC.

Despite being a tech manufacturing powerhouse, you’d never know there’s been an artificial intelligence boom helping to power other major global markets to new record highs.

Since 2021, China’s stock market has been struggling thanks to a variety of factors: the country’s aggressive zero-COVID policies, a real estate crash and debt crisis, and more. The government has tried various strategies to reinvigorate the market, but little has had an impact.

The country unveiled its latest strategy on Tuesday, an aggressive suite of stimulus measures, prompting the classic question: Is this time different?

The latest wave of efforts, which mostly comprise monetary policy, aims to inject liquidity and make borrowing easier, if there’s demand for loans.

Our Chart of the Week shows that, so far at least, the market has an answer to that question: Yes, it will be different. The stimulus news sent Chinese stocks charting a vertical line for the first time in years, changing the downward line into the beginning of a V as investors judged they saw a fundamental change to China’s narrative.

“[Global] investors have deemed Chinese equities to be almost uninvestable, despite the obvious potential inherent in the world’s second-largest economy,” DataTrek’s Nicholas Colas wrote in a note to clients this week. “This week’s surprise announcement of aggressive fiscal and monetary policy action is spurring a reappraisal of that view.”

As billionaire David Tepper put it, it’s now time to buy “everything” in China.

The roots of that reappraisal stem from the government itself, which exerts economic control.

“China’s leadership has finally acknowledged that the country’s economy needs much more monetary and fiscal stimulus if it is to achieve its growth potential over time,” Colas wrote.

Some China experts, like Charles Schwab’s chief global investment strategist Jeffrey Kleintop, aren’t yet convinced that the measures announced this week will, in fact, work to reverse China’s fortunes, noting that the “jury is still out.”

But while the actions so far may not cure the economy’s woes, the sentiment that the patient has finally been driven to the hospital is enough for investors to hope, sending China’s stocks up and to the right.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

The WordPress vs. WP Engine drama, explained

The world of WordPress, one of the most popular technologies for creating and hosting websites, is going through a very heated controversy. The core issue is the fight between WordPress founder and Automattic CEO Matt Mullenweg and WP Engine, which hosts websites built on WordPress.

WordPress technology is open source and free, and it powers a huge chunk of the internet — around 40% of websites. Websites can host their own WordPress instance or use a solution provider like Automattic or WP Engine for a plug-and-play solution.

In mid-September, Mullenweg wrote a blog post calling WP Engine a “cancer to WordPress.” He criticized the host for disabling the ability for users to see and track the revision history for every post. Mullenweg believes this feature is at the “core of the user promise of protecting your data” and said that WP Engine turns it off by default to save money.

He also called out WP Engine investor Silver Lake and said they don’t contribute sufficiently to the open source project and that WP Engine’s use of the “WP” brand has confused customers into believing it is part of WordPress.

The legal battle

In reply, WP Engine sent a cease-and-desist letter to Mullenweg and Automattic to withdraw their comments. It also said that its use of the WordPress trademark was covered under fair use.

The company claimed that Mullenweg had said he would take a “scorched earth nuclear approach” against WP Engine unless it agreed to pay “a significant percentage of its revenues for a license to the WordPress trademark.”

In response, Automattic sent its own cease-and-desist letter to WP Engine, saying that they had breached WordPress and WooCommerce trademark usage rules.

The WordPress Foundation also changed its Trademark Policy page and called out WP Engine, alleging the hosting service has confused users.

“The abbreviation ‘WP’ is not covered by the WordPress trademarks, but please don’t use it in a way that confuses people. For example, many people think WP Engine is ‘WordPress Engine’ and officially associated with WordPress, which it’s not. They have never once even donated to the WordPress Foundation, despite making billions of revenue on top of WordPress,” the updated page reads.

WP Engine ban, community impact, and trademark battle

Mullenweg then banned WP Engine from accessing the resources of WordPress.org. While elements like plug-ins and themes are under open source license, providers like WP Engine have to run a service to fetch them, which is not covered under the open source license.

This broke a lot of websites and prevented them from updating plug-ins and themes. It also left some of them open to security attacks. The community was not pleased with this approach of leaving small websites helpless.

In response to the incident, WP Engine said in a post that Mullenweg had misused his control of WordPress to interfere with WP Engine customers’ access to WordPress.org.

“Matt Mullenweg’s unprecedented and unwarranted action interferes with the normal operation of the entire WordPress ecosystem, impacting not just WP Engine and our customers, but all WordPress plugin developers and open source users who depend on WP Engine tools like ACF,” WP Engine said.

Matt Mullenweg, CEO of Automattic, has misused his control of WordPress to interfere with WP Engine customers’ access to https://t.co/ZpKb9q4jPh, asserting that he did so because WP Engine filed litigation against https://t.co/erlNmkIol2. This simply is not true. Our Cease &…

— WP Engine (@wpengine) September 26, 2024

On September 27, WordPress.org lifted the ban temporarily, allowing WP Engine to access resources until October 1.

Mullenweg wrote a blog post clarifying that the fight is only against WP Engine over trademarks. He said Automattic has been trying to broker a trademark licensing deal for a long time, but WP Engine’s only response has been to “string us along.”

The WordPress community and other projects feel this could also happen to them and want clarification from Automattic, which has an exclusive license to the WordPress trademark. The community is also asking about clear guidance around how they can and can’t use “WordPress.”

The WordPress Foundation, which owns the trademark, has also filed to trademark “Managed WordPress” and “Hosted WordPress.” Developers and providers are worried that if these trademarks are granted, they could be used against them.

Developers have expressed concerns over relying on commercial open source products related to WordPress, especially when their access can go away quickly.

Open-source content management system Ghost’s founder John O’Nolan also weighed in on the issue and criticized control WordPress being with one person.

“The web needs more independent organizations, and it needs more diversity. 40% of the web and 80% of the CMS market should not be controlled by any one individual,” he said in an X post.