Is Your 401(k) Balance Above Average? Find Out If You're Beating Most Savers

We all know that comparing ourselves to others can be a slippery slope, but when it comes to retirement savings, it’s hard not to wonder: Am I doing better or worse than the average saver? Checking where your 401(k) balance sits can give you some insight, but remember – your retirement is your own journey and no two paths are the same.

Don’t Miss:

What’s the Average 401(k) Balance?

According to Fidelity, the median 401(k) balance across their accounts is $28,900 as of early 2024.

On the other hand, the average balance sits much higher at $125,900. Before you start celebrating – or panicking – remember that averages can be skewed by those with particularly large or small balances.

The difference between median and average is simple: The median shows the middle saver, while a few million-dollar accounts might pull the average up. So if you’re sitting somewhere between these numbers, you’re likely in line with many other savers.

Trending: Unlock a $400 billion opportunity by investing in the future of EV infrastructure on this startup already valued at $50 million with just $500.

Here’s a breakdown by age, as reported by CNBC:

Fidelity reports that the median 401(k) balance for people over 65 is $88,488, while the average is $272,588.

If you’re behind these numbers, don’t sweat it too much – there’s still time to catch up.

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

How to Boost Your Retirement Savings

Saving for retirement isn’t a sprint; it’s more of a marathon. Even if you’re not exactly where you’d like to be, there are steps you can take to increase your savings and feel more secure about your future.

1. Automate Contributions

The easiest way to ensure you’re saving consistently is to automate it. Set up direct contributions from your paycheck into your retirement account. This way, you won’t even have to think about it. Automating helps you stick to your retirement savings goals by making saving part of your normal routine.

Trending: The number of ‘401(k)’ Millionaires is up 43% from last year — Here are three ways to join the club.

2. Increase Your Contributions

Try bumping it up yearly as you get comfortable with your current contribution rate. Even a small 1% increase can make a big difference over time. Automatically escalating contributions ensures your savings rate grows with your income without manual adjustments.

3. Max Out Employer Match

If your company offers a 401(k) match, ensure you contribute enough to get the full benefit. This is free money – essentially a 100% return on the portion your employer matches. It’s one of the best ways to boost your retirement savings.

See Also: How do billionaires pay less in income tax than you? Tax deferring is their number one strategy.

What to Avoid: Taking on Too Much Risk

It might be tempting to chase big returns by investing in high-risk investments, but that strategy can backfire. Retirement savings are best treated with patience.

Whether your balance is above or below the average, it’s important to keep your financial goals in mind. Retirement savings aren’t a competition – they’re about ensuring you’re set up for your desired lifestyle.

It might be worth chatting with a financial advisor if you’re not quite where you want to be with your savings or just want some reassurance that you’re on the right track.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Is Your 401(k) Balance Above Average? Find Out If You’re Beating Most Savers originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

From Market Bottom To Moon: How Bitcoin, Ethereum And Dogecoin Skyrocketed Since 2020

The market reached its pandemic-induced bottom on March 23, 2020, after a dramatic sell-off that wiped trillions of dollars from global markets. However, swift action by the Federal Reserve, including slashing interest rates to near-zero and launching aggressive asset-purchasing programs, helped instill confidence in financial markets.

The federal government also rolled out multi-trillion-dollar stimulus packages like the CARES Act, which included direct payments to Americans, expanded unemployment benefits and forgivable loans to businesses.

As a result, major U.S. stock indices began an extraordinary recovery. The SPDR S&P 500 ETF, which tracks the broader market, rebounded by a staggering 149.8% from its March 2020 low.

The Invesco QQQ Trust Series 1, which primarily tracks the tech-heavy Nasdaq-100 index, surged even higher, returning 185.2%, while the SPDR Dow Jones Industrial Average ETF Trust, reflecting the performance of the DJIA, saw a 120.4% gain over the same period. These remarkable returns have rewarded investors who remained patient during the unprecedented turmoil.

Tech Stocks and Retail Favorites Lead the Rally

The market recovery was largely driven by technology stocks, which benefited from the rapid acceleration of digital transformation during the pandemic. Companies like Apple, Amazon, Microsoft and Tesla experienced explosive growth as work-from-home trends and e-commerce dominated.

Meanwhile, stocks like GameStop and AMC Entertainment became poster children for retail investors, particularly those congregating on forums like Reddit’s WallStreetBets. These retail favorites skyrocketed in 2021, with price surges fueled by short squeezes and social media-driven trading, despite their companies facing significant fundamental challenges.

Read Also: Bitcoin Bull Arthur Hayes Predicts ‘Volatility Supercycle’

Cryptocurrency’s Meteoric Rise

As equities boomed, the cryptocurrency market experienced an even more dramatic rise. Investors who took positions in major digital assets at the March 2020 bottom saw historic gains. Bitcoin BTC/USD, for instance, surged from around $5,000 in March 2020 to all-time highs near $75,000 in early 2024. For those who invested $100 in Bitcoin at the market bottom, their investment would have grown to an astonishing $1,265.85 by the present day.

Ethereum ETH/USD, the second-largest cryptocurrency by market capitalization, experienced even more substantial growth. Its value increased from roughly $110 in March 2020 to over $4,800 at its peak in 2021. A $100 investment in Ethereum back then would now be worth $2,174.05, thanks to its growing use in decentralized finance (DeFi) applications and the popularity of non-fungible tokens (NFTs).

Dogecoin DOGE/USD, initially created as a joke, emerged as one of the biggest winners, fueled by celebrity endorsements and viral social media campaigns. Dogecoin’s value exploded, giving those who invested $100 at the market’s low a return of $7,463.60—a staggering 7,463% increase, highlighting the speculative fervor in the crypto markets.

What’s Next: As the debate over cryptocurrency regulation heats up, these topics will be further explored at Benzinga’s Future of Digital Assets event on Nov. 19, where key industry leaders and policymakers will gather to discuss the evolving role of digital assets in politics and finance.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Return-To-Office Mandates Ignite Housing Price Surge In Top 10 Cities–San Jose Leads The Charge

Remote work gave folks the freedom to live where they wanted – no more daily commutes, no more being stuck in a city just because the office was there. But now, companies are calling people back and that’s changing everything. People are moving closer to work again and the housing market in some cities is going wild.

Don’t Miss:

Take San Jose. It’s always been tough to find a home there, but now? It’s crazy. Buyers are fighting over the few homes available and paying way above the asking price. According to a Realtor.com analysis of 75 cities to see where homes sell the most over their asking prices, San Jose tops the list in the U.S., with homes selling 6.2% over the asking price. And get this – the median home price is a staggering $1.3 million.

Trending: Beating the market through ethical real estate investing’ — this platform aims to give tenants equity in the homes they live in while scoring 17.17% average annual returns for investors – here’s how to join with just $100

So, why is this happening? Well, San Jose is right near Silicon Valley. Big tech companies like PayPal and Adobe are there, pulling in tech pros from everywhere. Housing demand is through the roof. Lex Orosco, a real estate broker at Real Silicon Valley, told Business Insider that the market will only get hotter as more people move closer to work. And as interest rates drop, even more buyers will jump in, pushing prices higher.

It’s not just San Jose, though. Other cities, especially in the Northeast and California, see the same thing. Hannah Jones from Realtor.com said many of these places are “within commuting distance of the region’s major economic hubs.” With companies moving back to in-office or hybrid setups, these areas are feeling the pressure, too.

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

Look at San Francisco – homes are selling for 3.6% above asking. Hartford, Connecticut? Buyers are paying 4.8% more than the list price. Even Kansas City is getting hit, with homes going for 4.3% over asking.

And the recent interest rate cut by the Federal Reserve? It will lower mortgage rates, giving more people the power to buy. But with so few homes out there, prices might climb even more. Orosco thinks we might see more homes hit the market as rates fall, but it won’t be enough to cool things down.

As companies drag workers back to the office, cities like San Jose feel the heat. More people moving back means more competition for homes – and higher prices. It’s already tight and the return to office life is making it even tighter.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Rep. Anna Paulina Luna's Opponent Charged With Chilling Death Threat In 2022 Primary

An indictment was made public this week, accusing a Florida man of threatening to kill both his primary opponent in the 2021 election for Florida’s 13th Congressional District and a private citizen who is an acquaintance of that opponent.

The indictment states that William Robert Braddock III, 41, from St. Petersburg, and Victim 1 were candidates in the primary election for Florida’s 13th Congressional District in the U.S, the Department of Justice said. Victim 2 is identified as a private citizen and acquaintance of Victim 1.

In a shocking recorded call with a local activist, Braddock brazenly claimed he would unleash a hit squad of Russians and Ukrainians to take out Rep. Anna Paulina Luna (R-Fla.) during the heated 2022 primary for a Clearwater seat, per a report by Politico.

Braddock specifically threatened to “call up my Russian-Ukrainian hit squad” to make Victim 1 disappear, the regulatory authority said in a note. After making these threats, he left the U.S. and was later discovered living in the Philippines. Recently deported back to the U.S., Braddock made his first court appearance yesterday in Los Angeles.

Politico had earlier reported that a conservative activist recorded Braddock advising her not to back Luna—who had been defeated by Crist in 2020—because he claimed to have connections to assassins.

Per a recording received by Politico, he said, “I really don’t want to have to end anybody’s life for the good of the people of the United States of America.” Braddock expressed that it would break his heart, but if necessary, he believed it had to be done, referring to Luna as merely a “speed bump” and likening her to a dead squirrel that one runs over daily when leaving the neighborhood.

Braddock faces a charge of interstate transmission of a true threat to injure another individual.

If found guilty, he could face up to five years in prison. A federal district court judge will decide the sentence, taking into account the U.S. Sentencing Guidelines and other relevant factors, the Department of Justice added.

Read Next:

Image: Wikimedia Commons

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why China stocks are now a buy for U.S. investors

On Tuesday, People’s Bank of China Gov. Pan Gongsheng announced a slew of stimulus measures that one economist called that central bank’s most significant stimulus move since the Covid-19 pandemic. Then on Thursday, the Hang Seng Index HK:HSI hit a one-year high after China’s Politburo said additional measures were on the table to support economic growth, according to a state media report.

Through Friday, the Hang Seng Index was up 13% from a week earlier.

Most Read from MarketWatch

In this week’s ETF Wrap, Isabel Wang covered the renewed enthusiasm for exchange-traded funds that hold stocks in China and spoke to industry experts about what the stimulus efforts might mean for investors.

More coverage and reaction:

Another great year for U.S. stocks sets up a warning

Through Thursday, the S&P 500 SPX was up more than 20% for 2024, excluding dividends. This follows a gain of 24% last year. Joseph Adinolfi reported on the historical significance of this two-year run and what it might mean as investors look ahead.

More coverage of markets:

Acting HUD secretary talks about increasing housing supply

Aarthi Swaminathan interviewed Adrianne Todman, acting secretary of the U.S. Department of Housing and Urban Development, who talked about new government initiatives to increase availability of housing.

The Big Move: We’re empty-nesters. Should we buy a house with cash — or take on a mortgage and invest?

The soaring bond market

Declining interest rates provide a strong underpinning for bond prices.

Read on: Another reason Qualcomm shouldn’t buy Intel? Its bonds could reach junk status.

AT&T has been soaring — its chief operating officer explains

Above is a chart showing price movement for shares of AT&T Inc. T over the past three years. The stock closed at $21.65 Thursday and was up 29% for 2024, excluding dividends, and up 61% from the three-year closing low of $13.45 on July 18, 2023, according to FactSet. That low followed a dividend cut in 2022, when the company completed a complicated deal to spin off WarnerMedia, which was merged with Discovery to create Warner Bros. Discovery Inc. WBD.

AT&T pays a quarterly dividend of $0.2775 per common share, for a yield of 5.13% as of Thursday’s close. A declining interest-rate environment might bode well for a stock with an attractive dividend, but the company’s chief operating officer Jeff McElfresh said this business focus at AT&T was helping even more, in an interview with Emily Bary.

A different way to play the AI build-out

Nvidia Corp. NVDA dominates the financial media’s coverage of the deployment of hardware by data centers to support their corporate customers’ efforts to develop artificial intelligence technology. This is because Nvidia doesn’t yet face threatening competition for graphics processing units, which are large and expensive pieces of equipment with thousands of parts.

And that is where another opportunity lies for investors, according to Oppenheimer analyst Edward Yang. He recommended these two stocks of companies providing advanced chips needed by Nvidia and its competitors, amid a “severe, structural shortage” for these items.

Related coverage:

The Ratings Game

The Ratings Game column provides daily commentary from analysts who explain current market action while looking further out. Here are examples from this week:

Bank executive explains a high stock valuation

Steve Gelsi interviewed Dimitar A. Karaivanov, the chief executive of Community Financial System Inc. CBU of DeWitt, N.Y., who described the bank’s “unique” business model.

A look at CBU’s ratio share price to book value, within a group of 74 stocks in the KBW Nasdaq Bank Index BKX and the KBW Nasdaq Regional Banking Index XX:KRX, led to this screen: 11 favored bank stocks that still trade at cheap valuations.

Retirement and estate planning

You have probably heard of an irrevocable trust, which can be used as an estate planning tool and for other purposes. But that word “irrevocable” can be alarming, because things happen in life and changes may need to be made. Beth Pinsker explains how irrevocable trusts can be changed.

More on retirement and estate planning:

Is it possible for Musk to put humans on Mars in four years? How about six years?

SpaceX CEO Elon Musk left himself some wiggle room when he said in a posting on X that he was planning to launch “about five” uncrewed Starships sent to Mars in two years, with a crewed mission to land on the red planet in four years, or possibly in six years.

James Rogers interviewed Eileen Collins, who commanded the Space Shuttle Discovery in 2005 for NASA’s first shuttle flight following the 2003 Columbia disaster. She spoke about Musk’s timeline and how realistic it might be.

Most Read from MarketWatch

1 Spectacular Semiconductor Stock Down 21% You'll Wish You'd Bought on the Dip

When it comes to artificial intelligence (AI) chips, Nvidia is rightly the center of attention. Its graphics processing units (GPUs) for the data center are the best in the industry for developing AI models, and they have helped the company add a whopping $2.6 trillion to its market capitalization since the start of 2023.

But the AI landscape is rapidly expanding, and other semiconductor companies are also experiencing significant demand for their hardware. Micron Technology (NASDAQ: MU) is a leading supplier of memory and storage chips that are critical for developing AI in the data center, but also for processing AI workloads in computers and smartphones.

Micron just reported its latest financial results for its fiscal 2024 fourth quarter (ended Aug. 29), and it showed incredible growth across its entire business thanks to AI-driven demand. Its stock currently trades down 21% from its all-time high (set earlier this year), so here’s why now might be a great time to buy.

AI commands a growing amount of memory capacity

Memory chips are complementary to the data center GPUs supplied by Nvidia. They store information in a ready state so it can be called upon instantly, which is essential in data-intensive AI workloads. AI commands an extremely high capacity from memory chips, and Micron’s HBM3E (high-bandwidth memory) solutions are among the best in the industry.

In fact, Micron’s latest HBM3E 36-gigabyte (GB) units deliver up to 50% more capacity than anything else on the market, while consuming 20% less energy. The company is completely sold out of its data center memory solutions until 2026, which isn’t surprising because Nvidia is using its HBM3E in the new H200 GPU, and potentially also its upcoming Blackwell-based B200 GPU.

Micron believes it will maintain its technological supremacy in the HBM segment because it’s already working on HBM4E. It’s still a couple of years away from officially launching, but it will offer a substantial leap in capacity to power the next stage of the AI revolution. Staying ahead is crucial because the market for HBM in the data center was worth just $4 billion in 2023, but Micron expects it to top $25 billion in 2025 — a whopping 525% increase in just two years!

But Micron’s AI opportunity extends beyond the data center. Companies are racing to launch AI personal computers for consumers and enterprises, and Micron says most of them come with a minimum DRAM (memory) capacity of 16 gigabytes, with up to 64 GB for the premium models. Last year, the average DRAM content in the PC industry was 12 GB, so capacity requirements are surging, which is a direct tailwind for Micron’s revenue.

The smartphone industry is experiencing a similar shift. Most manufacturers of Android-based devices have recently launched AI-enabled models, and in many cases, they are fitted with twice the DRAM capacity of last year’s models. Micron’s LP5X memory is used by every tier-1 Android smartphone manufacturer in the world, so it’s the leader in this segment by a big margin.

Micron’s revenue is soaring

Micron generated $7.75 billion in revenue during Q4, which was a 93% increase from the year-ago period. It marked an acceleration from the company’s 81% revenue growth in the third quarter, which highlights how quickly demand is ramping up.

The result was even stronger beneath the surface because it was headlined by $3 billion in compute and networking (data center) revenue, which was up a whopping 152% year over year.

Tight supply of HBM chips for the data center also contributed to a sharp increase in Micron’s gross profit margin in Q4. It came in at 35.3%, which was a big increase from 26.9% just three months earlier, and an even bigger jump from a 10.8% decrease in the year-ago quarter (when the company was struggling with a supply glut).

As a result, Micron’s earnings per share (EPS) came in at $0.79, a big improvement from the $1.31 loss per share from the year-ago period.

Micron expects to deliver further strength across the board in the upcoming fiscal 2025 first quarter (ending Nov. 30). Its revenue is forecast to come in at $8.7 billion, which would represent 85% year-over-year growth, with $1.54 in EPS.

Micron stock looks like a great value right now

Micron generated just $0.70 in total EPS in fiscal 2024 because it lost money during the first half of the year. Therefore, it’s hard to value the company based on its trailing-12-month profit. But Wall Street expects Micron’s EPS to surge to $8.79 during fiscal 2025.

Based on Micron’s stock price of $110.64 as of this writing, that means it’s trading at a forward price-to-earnings (P/E) ratio of just 12.6. For some perspective, that’s a 60% discount to Nvidia’s forward P/E ratio of 31.3.

I’m not trying to compare Micron to one of the hottest semiconductor stocks in history, but if you believe Nvidia is going to sell more data center GPUs, then Micron should also experience parallel growth in its HBM3E solutions. Plus, Micron has the added benefit of a potential AI-driven demand wave in the personal computing and smartphone segments.

For those reasons, I think the valuation gap between the two stocks is likely to narrow. After all, Micron stock would have to gain 28% from here just to reclaim its all-time high of around $141, which was set in June. Plus, according to The Wall Street Journal, the consensus price target for Micron stock is $157.71, which implies even further upside beyond its record high.

Considering the strong results Micron just reported and its forecast for the upcoming quarter, now looks like a great time to buy its stock.

Should you invest $1,000 in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

1 Spectacular Semiconductor Stock Down 21% You’ll Wish You’d Bought on the Dip was originally published by The Motley Fool

A super-rare bullish signal with a perfect track record just flashed in the stock market, suggesting another year of record highs

-

The NYSE McClellan Summation Index suggests strong underlying breadth in the stock market.

-

The signal is thought to have a perfect record when it flashes while the stock market is soaring.

-

It had flashed 28 times since 1962, with the S&P 500 averaging 15% returns a year later.

A bullish signal that flashed in the stock market this week for only the 29th time since the 1960s suggests a year of record highs are ahead.

Data from SentimenTrader indicates the NYSE McClellan Summation Index completed a cycle from below 100 to above 1,000, suggesting that underlying breadth in the stock market is strong.

The index is derived from the McClellan Oscillator, a closely followed indicator that measures participation in the stock market. The tool helps traders determine the underlying strength or weakness of a market trend.

Dean Christians, a senior research analyst at SentimenTrader, says the bullish signal is worth following.

“Similar improvements in market breadth resulted in a 96% win rate over the following year,” Christians said in a note to clients on Tuesday.

But the signal has a perfect win rate when it flashes while the stock market is at or near record highs, as it did this week.

“Signals within 2% of a high have never experienced a loss over the next two, six, and twelve months,” Christians said.

SentimenTrader says this rare signal has flashed only 28 times since 1962, not including this week’s signal.

The last time it flashed was in December; since then, the S&P 500 has surged by about 20%.

Among the 28 instances, the S&P 500 has delivered an average return of 5%, 9%, and 15% in the following three, six, and 12 months.

A 15% gain from current levels would send the S&P 500 to about 6,600 by this time next year, meaning many record highs are likely ahead if the signal plays out.

“Typically, when stock indexes consolidate, as most have since July, market breadth weakens as lagging moving averages or pivot points catch up to price,” Christians said. “However, that’s not the case now, as breadth has remained firm and even improved depending on the index or exchange.”

The improvement in market breadth over the past few months is evidenced by the fact that the equal-weight S&P 500 index is trading at record highs and has been up by nearly 10% since July, while the mega-cap growth stocks have been about flat over the same period.

Read the original article on Business Insider

China Urges Local Companies to Stay Away From Nvidia’s Chips

(Bloomberg) — Beijing is stepping up pressure on Chinese companies to buy locally produced artificial intelligence chips instead of Nvidia Corp. products, part of the nation’s effort to expand its semiconductor industry and counter US sanctions.

Most Read from Bloomberg

Chinese regulators have been discouraging companies from purchasing Nvidia’s H20 chips, which are used to develop and run AI models, according to people familiar with the matter. The policy has taken the form of guidance rather than an outright ban, as Beijing wants to avoid handicapping its own AI startups and escalating tensions with the US, said the people, who asked not to be identified because the matter is private.

The move is designed to help domestic Chinese AI chipmakers gain more market share while preparing local tech companies for any potential additional US restrictions, the people said. The country’s leading makers of AI processors include Cambricon Technologies Corp. and Huawei Technologies Co. Earlier this year, Beijing also told local electric-vehicle makers to procure more of their supplies from local chipmakers, part of its campaign to reach self-sufficiency in critical technologies.

Nvidia shares fell as much as 3.9% to $119.26 on Friday, extending an earlier decline, after Bloomberg reported the news. The stock has more than doubled this year.

The US government banned Nvidia from selling its most advanced AI processors to Chinese customers in 2022, part of an attempt to limit Beijing’s technological advances. Nvidia, based in Santa Clara, California, modified subsequent versions of the chips so they could be sold under US Commerce Department regulations. The H20 line fits that criteria.

In recent months, several Chinese regulators, including the powerful Ministry of Industry and Information Technology, issued so-called window guidance — instructions without the force of law — to reduce the use of Nvidia, the people said. The notice was aimed at encouraging companies to rely on domestic vendors like Huawei and Cambricon, they added. Beijing also amplified the message via a local trade group, according to another.

At the same time, Chinese officials want local companies to build the best AI systems possible. If that means they need to buy some foreign semiconductors over domestic alternatives, Beijing will still tolerate that, according to people familiar with China’s AI policy.

Nvidia declined to comment. China’s Ministry of Commerce, Ministry of Information and Technology, and Cyberspace Administration didn’t respond to faxed requests for comment.

Separately, Nvidia Chief Executive Officer Jensen Huang said Friday that he’s doing his best to serve customers in China and stay within the requirements of US government restrictions.

“The first thing we have to do is comply with whatever policies and regulations that are being imposed,” he said in an interview with Bloomberg Television. “And, meanwhile, do the best we can to compete in the markets that we serve. We have a lot of customers there that depend on us, and we’ll do our best to support them.”

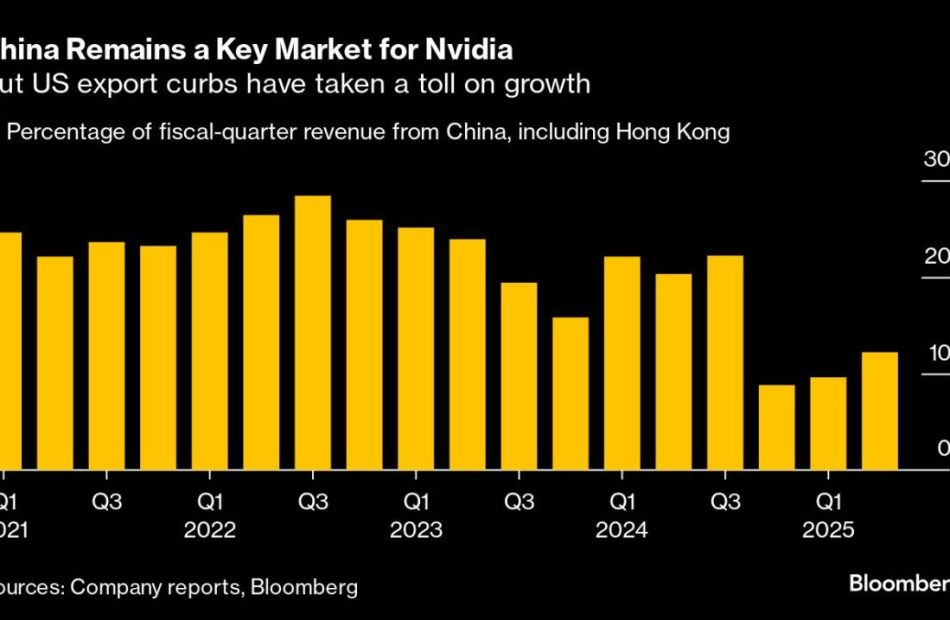

Nvidia, the world’s most valuable chipmaker, has seen sales soar as data center operators across the globe scramble to buy more of its processors. China continues to be part of that growth, though trade restrictions have taken a toll. In the July quarter, it got 12% of its revenue, or about $3.7 billion, from the country, including Hong Kong. That was up more than 30% from a year earlier.

“Our data center revenue in China grew sequentially in Q2 and is a significant contributor to our data center revenue,” Chief Financial Officer Colette Kress said during an earnings call in August. “As a percentage of total data center revenue, it remains below levels seen prior to the imposition of export controls. We continue to expect the China market to be very competitive going forward.”

Nvidia chips are the gold standard for companies looking to develop artificial intelligence services. The likes of Meta Platforms Inc., OpenAI and Alphabet Inc. have been racing to scoop up its most cutting-edge products so they can build leading AI models. Several Chinese tech companies, including ByteDance Ltd. and Tencent Holdings Ltd., stockpiled Nvidia’s chips before the export controls took effect.

Chinese chip designers and manufacturers, meanwhile, are working to introduce alternatives to Nvidia. Beijing has offered billions in subsidies to the semiconductor sector, but local AI chips remain well behind Nvidia’s fare.

China does have a burgeoning AI sector, though, despite the US restrictions. ByteDance and Alibaba Group Holding Ltd. have been investing aggressively, while a flock of startups are vying for leadership. There are six so-called tigers in developing large language models, the key technology behind generative AI: 01.AI, Baichuan, Moonshot, MiniMax, Stepfun and Zhipu.

Some of the companies are turning a blind eye to the Chinese decree to avoid H20 chips and rushing to buy more of them before an anticipated sanction from the US by the end of this year, one of the people said, though they are also buying homemade Huawei chips to please Beijing.

–With assistance from John Liu, Jessica Sui, Zheng Wu, Ian King and Tyler Kendall.

(Updates with Nvidia shares in fourth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Nvidia Stock (NVDA) Is Still a Long-Term Winner, No Matter the Noise

Artificial Intelligence (AI) prodigy Nvidia (NVDA), the world’s third-highest-valued stock, experienced a material decline in market capitalization following its Q2 earnings in late August. However, NVDA stock has shown some vigor again, rising 5% in the last week. After temporarily surpassing the $3 trillion milestone earlier this year, investors are wondering what the future will hold. My thesis remains unchanged — I’m bullish on NVDA shares as an investment due to its clear AI supremacy and exponential growth potential.

NVDA’s Long-Term AI-Driven Growth Trajectory Remains Intact

It is well known that NVDA is positioned for a long runway of growth with top-notch clients like Microsoft (MSFT), Alphabet (GOOGL), Meta (META), and Amazon (AMZN) bulking up on their AI efforts. However, beyond these leading customers, Nvidia’s AI penetration is still rising across all industries, increasing my optimism for NVDA stock. Enterprises across industries and geographies are eager to incorporate AI benefits into their operations. Likewise, NVDA continues to enter into collaborations with top businesses.

There’s a reason enterprises are flocking to NVDA for their AI ambitions. Beyond being the leader in AI GPU processors, NVDA provides a complete end-to-end AI infrastructure that supercharges productivity. That’s something that few, if any, of its global AI peers can deliver.

NVDA Remains a One-Stop AI Powerhouse with Margin Growth

Another reason for my optimism about NVDA is CEO Jensen Huang‘s relentless focus. He is committed to transforming NVDA into a fully AI-driven data center powerhouse that covers all aspects of hardware and software under the NVDA brand.

This strategy is a key reason why NVDA can maintain premium pricing for its products, contributing to steady growth in its profit margins. However, critics argue that NVDA’s exceptional revenue and margin growth may not be sustainable. Some members of the investment community are worried about a slowdown in revenue growth over the coming years.

For context, NVDA reported an extraordinary 217% increase in its data center revenues for fiscal 2024. While that growth is expected to moderate to around 130% in 2025, this remains an impressive triple-digit figure, especially considering the strong FY2024 baseline for comparison. Although lower than today’s pace, these are still remarkable growth projections for the future. I view bullish analyst estimates as a reason to remain confident in this AI leader, particularly as the disruptive potential of generative AI is only beginning to unfold.

Demand for NVDA’s chips is robust and will boost future revenues in the coming quarters. Therefore, despite some investor concerns, I expect NVDA will continue to maintain its clear AI dominance with an unbeatable competitive moat and best-in-class AI products and services.

A Discussion of Nvidia’s Impressive Quarterly Earnings

Nvidia posted yet another stellar Q2 result on August 28, 2024, driven by accelerated computing and the continued momentum of generative AI. Adjusted earnings of $0.68 per share handily beat the consensus analyst estimate of $0.65 per share. The figure came in much higher (+152%) than the Fiscal Q2-2023 figure of $0.27 per share.

The company posted a 122% year-over-year revenue growth, delivering $30.04 billion for the three months ending July 31 and surpassing analysts’ projections. Importantly, Data Center revenues, the company’s crown-jewel division, grew 154% year-over-year to $26.3 billion. Additionally NVDA’s adjusted gross margin expanded 5 percentage points to 75.1% from 70.1% a year ago. Many investors were apparently hoping for even bigger numbers, and therefore the stock dropped slightly following the Q2 report. Shares then continued a downtrend until they bottomed out on September 6, just above the $100 level.

Nvidia’s guidance for the 3rd quarter appeared less promising to investors, with revenues expected to reach about $32.5 billion. Guidance came in below expectations. Adjusted gross margins are forecast to level off at about 75%, versus 75.15% delivered in Q2.

NVDA’s Insider Selling Concerns are Over

Insider selling at Nvidia added downward pressure on NVDA shares in recent months. CEO Jensen Huang sold NVDA shares across multiple transactions from June to September, but it’s important to know that those sales were part of a predetermined trading plan adopted in March. This plan allowed Huang to sell up to six million NVDA shares by the end of Q1 2025.

Notably, Huang has completed sales of more than $700 million worth of NVDA stock. Despite the significance of these sales, he remains the largest individual shareholder of the company. At last report, Huang held 786 million shares through various trusts and partnerships, and 75.3 million shares directly, according to company filings. Combined, Huang controls a ~3.5% stake in the company, with an approximate total of 859 million shares.

NVDA Valuation Isn’t Expensive, Given Its Earnings Growth Prowess

Investors may have been hesitant to buy NVDA stock at current levels, pointing to the stock’s extraordinary run as well as due to concerns about the company’s and slowing growth.

On the contrary, however, my contention is that NVDA stock is not as expensive as it may seem. Currently, it’s trading at a forward P/E ratio of about 43x (based on FY2025 earnings expectations). This is actually cheaper than some valuation multiples of its peers. For instance, NVDA’s closest competitor and U.S.-based semiconductor company, Advanced Micro Devices, carries a 46.8x forward P/E. Interestingly, NVDA’s current valuation still reflects a 10% discount to its five-year average forward P/E of 47.3x.

Given NVDA’s consistent outperformance and strong growth potential, the current valuation appears reasonable and justified. Any future dip in the stock price could represent a solid buying opportunity, in my opinion, especially considering Nvidia’s immense potential in the rapidly expanding AI market.

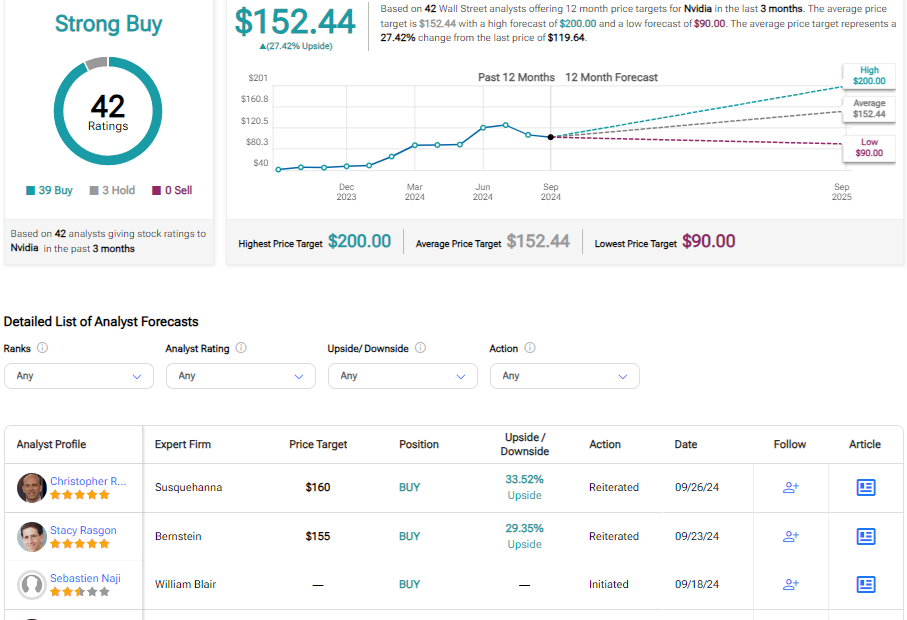

Is NVDA Stock a Buy or Sell, According to Analysts?

With 39 Buys and three Hold ratings from analysts in the last three months, the consensus TipRanks rating is a Strong Buy. The average Nvidia stock target price of $152.44 implies potential upside of about 26% for the next year.

Conclusion: Consider NVDA Stock for Its Long-Term AI Potential

Despite recent weakness, NVDA shares have nearly tripled over the past year compared to a rise of about 37% for the Nasdaq 100. The post-earnings sell-off for NVDA stock, in my view, was largely driven by profit-taking. After bottoming near $100, the stock appears to be in recovery mode now.

In the near term, I believe ongoing economic and political uncertainties may keep the stock range-bound. However, I view any dips as buying opportunities. I see NVDA as a strong long-term investment given the significant continued potential of AI.

Read full Disclosure

1 Incredibly Cheap Tech Stock That Could Soar 50% Thanks to Apple's Generative AI Move

Apple (NASDAQ: AAPL) recently jumped into the fast-growing market for smartphones capable of running generative artificial intelligence (AI) applications. Even though the latest iPhone models won’t get the company’s Apple Intelligence suite of features until October, the demand for its latest devices seems to be good.

JPMorgan analysts point out that the delivery time delays of Apple’s new iPhones are expanding, which is a sign of healthy demand for these smartphones. Meanwhile, Dan Ives of Wedbush Securities said he believes that Apple could sell 90 million units of its new smartphones in 2024. That’s up 8 million to 10 million units when compared to last year’s release.

T-Mobile CEO Mike Sievert goes a step further, saying that the demand for iPhone 16 models is better than it was last year. All of this indicates that Apple could strike gold with its latest smartphones, and that won’t be surprising as the market for generative AI smartphones is forecast to clock a compound annual growth rate (CAGR) of 78% through 2028, according to IDC.

Additionally, there is a huge installed base of 300 million iPhones that have not been upgraded in at least four years, according to Wedbush, and that could trigger a huge upgrade cycle as customers move to generative AI smartphones.

One way investors can take advantage of the robust sales of the iPhone 16 is by buying Apple stock. However, another company could ride Apple’s coattails and deliver handsome gains thanks to the iPhone 16. Let’s take a closer look at it.

This Apple supplier could get a nice boost to its bottom line

Qorvo (NASDAQ: QRVO) is a well-known supplier of radio frequency (RF) chips used in Apple’s devices such as iPhones and iPads. The chipmaker is trying to diversify its customer base and supply chips to leading Android smartphone OEMs (original equipment manufacturers), but it still got 46% of its total revenue from Apple in the previous fiscal year.

As Qorvo’s fortunes appear to be intertwined with Apple’s, the sunny sales prospects of the latest iPhones bode well. Even better, Qorvo could be supplying more chip content for the new iPhones and thus making more money on each unit that Apple builds.

On its fiscal 2025 first-quarter earnings conference call a couple of months ago, Qorvo management remarked that the company is investing in several long-term programs with its largest customer to increase its content and grow its business further. What’s more, a report by the Chinese newspaper Economic Daily News in April this year pointed out that Apple has changed the design of the antenna module for its latest iPhone generation, thereby incorporating more chips from Qorvo.

Not surprisingly, Qorvo’s fiscal first-quarter results (for the three months ended June 29) impressed many. The company’s Q1 revenue increased 36% year over year to $887 million. Non-GAAP earnings came in at $0.87 per share as compared to $0.34 per share last year. Qorvo completed the acquisition of Anokiwave in the fourth quarter of fiscal 2024, and that seems to have given the chipmaker’s financial performance a nice boost. Investors should note that Apple is reportedly using Anokiwave’s offerings in its latest iPhones to improve signal reception.

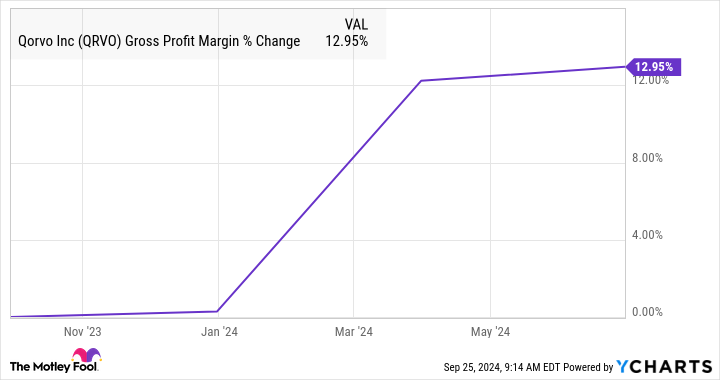

Qorvo, therefore, could benefit from a combination of stronger volume shipments and more revenue per unit from the new iPhone models. As a result, the margin improvement that Qorvo is seeing of late is likely to continue.

This improvement in the company’s margin profile is expected to lead to healthy growth in the company’s earnings over the next couple of years.

Investors can expect Qorvo stock to deliver solid gains

The chart above indicates that Qorvo’s bottom line could increase at an annual rate of 28% in the next two fiscal years. Assuming Qorvo’s earnings indeed jump to $10.25 per share after three years and it trades at 15 times forward earnings at that time (in line with its five-year average forward earnings multiple), its stock price could increase to $154. That would be a jump of nearly 50% from current levels.

Interestingly, Qorvo currently trades at 15 times forward earnings, a discount to the U.S. technology sector’s average earnings multiple of 45. That’s why investors should consider buying this undervalued semiconductor stock hand over fist, as the strong sales of Apple’s iPhones are set to improve Qorvo’s earnings power and could send its shares soaring over the long run.

Should you invest $1,000 in Qorvo right now?

Before you buy stock in Qorvo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Qorvo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and JPMorgan Chase. The Motley Fool recommends Qorvo and T-Mobile US. The Motley Fool has a disclosure policy.

1 Incredibly Cheap Tech Stock That Could Soar 50% Thanks to Apple’s Generative AI Move was originally published by The Motley Fool