2 Dividend Stocks Down Over 40% to Buy Before a Rebound

No matter what is happening to the stock market, it is always comforting to hold stocks of companies that pay growing dividends to shareholders. Let’s look at two industry leaders that are trading well off their highs and offering their highest yields in a long time.

1. Nike

Nike (NYSE: NKE) recently announced that longtime company veteran Elliott Hill will take over as President and CEO starting Oct. 14. The change in leadership comes amid weak revenue performance this year, which has sent the stock down 51% from its previous all-time high. Hill’s hiring is seen as a positive catalyst for the brand’s turnaround, as the stock is up 7% since the announcement.

Hill previously served as Nike’s President of Consumer and Marketplace, where he played a pivotal role in helping Nike expand its business globally. While investors won’t know the specific strategy Hill will implement until he is on the job, Nike’s decision to hire a former company executive could be exactly what it needs to turn things around.

Nike’s revenue declined 2% year over year in the most recent quarter, but there were silver linings that reveal how Nike can pull out of its slump. Management noted that core categories like basketball and fitness showed growth in the quarter, but that was offset by weakness in lifestyle products and the Jordan brand. This shows that Nike can perform much better if management puts more investment into its performance products, where there are ample opportunities to grow in a $300 billion athletic wear market.

Nike has paid a growing dividend for 22 straight years, and it paid out 38% of its earnings over the last year. This brings the stock’s forward dividend yield to 1.70% — higher than the 1.26% S&P 500 average. Investors should expect the new CEO to implement an effective strategy to improve performance. By this time next year, the stock should be trading higher.

2. UPS

UPS (NYSE: UPS) has paid a dividend to shareholders for 25 years, which reflects many years of solid financial performance. But the business is struggling to grow revenues as customers trade down to lower-priced shipping options. With the stock down 45% from its previous peak, investors can get the stock at a historically high dividend yield.

Wall Street has low expectations for UPS. Revenue fell slightly in the second quarter, and lower margins contributed to a 30% year-over-year decline in operating profit. But these results are already priced into the stock. If you’re buying the stock for the dividend, the most important thing is the outlook. Management expects to generate $5.8 billion in free cash flow for the full year, which is expected to fund a planned dividend payout of $5.4 billion.

The current quarterly dividend is $1.63 per share, bringing the stock’s forward dividend yield to 5.05%. That’s very attractive for a leading global shipper. While there’s always a chance the dividend could be reduced if business conditions worsen, that seems unlikely based on management’s free cash flow guidance and the company’s recent recovery in volume growth.

UPS reported an increase in U.S. volume last quarter — the first quarter of volume growth in over two years. Management credited this improvement to new e-commerce customers coming into the UPS network, which highlights a long-term opportunity for the company. It also continues to invest in the future with the planned acquisition of Estafeta, a leading small package company in Mexico. This is a strategic move by UPS to position for growth as more customers move distribution closer to the U.S.

Buying shares of industry-leading businesses when they are experiencing temporary growing pains can lead to excellent returns. Nike and UPS are well-entrenched companies that will be around for many years, paying dividends to investors.

Should you invest $1,000 in Nike right now?

Before you buy stock in Nike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

John Ballard has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nike. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.

2 Dividend Stocks Down Over 40% to Buy Before a Rebound was originally published by The Motley Fool

Water Mission Responding to Hurricane Helene

N. CHARLESTON, S.C., Sept. 28, 2024 (GLOBE NEWSWIRE) — Water Mission, a Christian engineering nonprofit, is responding to the ongoing destruction from Hurricane Helene after it unleashed destruction across Florida, Georgia, Tennessee, and the Carolinas. The storm claimed dozens of lives and caused up to $35 billion in estimated damage, leaving communities reeling from the devastation.

Nearly three million people are without power, and many are experiencing drinking water shortages. North Carolina was particularly hard hit, setting a record for the worst flooding in the state’s recorded history. In response, the Water Mission Disaster Assistance Response Team is bringing aid to the hardest-hit areas in Western North Carolina, starting in Boone. The team is actively working to provide much-needed assistance, bringing nearly 30 generators, supplies, and water treatment systems as they actively seek opportunities to provide safe water. Power is often necessary to supply safe water, especially in emergency situations.

“Water Mission has responded to more than 60 disasters around the world, including select instances within the U.S.,” said Water Mission CEO and President George C. Greene IV, PE. “Our Disaster Assistance Response Team is well versed in quickly mobilizing and collaborating with partners on the ground to provide emergency assistance as quickly as possible where it is needed most. The historic flooding caused by Hurricane Helene has resulted in immeasurable suffering and loss for so many Americans. This is one of those unique times where we can show the love of Christ by serving our fellow citizens in Western North Carolina.”

Water Mission has more than 20 years of experience responding to natural disasters and humanitarian crises with immediate and long-term safe water solutions. Over the last two years, Water Mission has responded to flooding in East Africa, earthquakes in Turkey, flooding in Pakistan, cholera outbreaks in Malawi, the ongoing conflict in Ukraine, and Hurricane Beryl in the Caribbean. Water Mission has served more than 8 million people globally since 2001.

Click here to learn more about Water Mission’s Hurricane Helene disaster response effort as the organization rushes staff and equipment to support those in desperate circumstances.

About Water Mission

Water Mission is a Christian engineering nonprofit that builds sustainable safe water solutions for people in developing countries, refugee camps, and disaster areas. Since 2001, Water Mission has served more than 8 million people in more than 60 countries, sharing safe water and the message of God’s love. Water Mission’s global headquarters is in North Charleston, SC, and the organization serves people in Africa; Asia; and North, South, and Central America. Charity Navigator has awarded Water Mission its top four-star rating 18 years in a row, a distinction shared by less than 1% of the charities rated by the organization. To learn more, visit watermission.org, Facebook, LinkedIn, Instagram, YouTube, or Twitter.

Water Mission Contact: Gregg Dinino

Director, Public Relations

Water Mission

M. +1.843.805.2097

gdinino@watermission.org

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Ultimate Electric Vehicle (EV) Stock to Buy With $1,000 Right Now

Everyone wants to find the next Tesla (NASDAQ: TSLA). But investing in the electric vehicle (EV) space can be difficult. Many EV companies have gone bankrupt over the years, and separating the good from the bad can be difficult.

Thankfully, Tesla established a clear template for success. And right now, there’s one EV stock that looks extremely attractive. But there’s only one investment strategy likely to succeed.

This is how Tesla became a massive success

In 2006, Tesla CEO Elon Musk revealed “The Secret Tesla Motors Master Plan” to the public. “As you know, the initial product of Tesla Motors is a high-performance electric sports car called the Tesla Roadster,” his essay began. “However, some readers may not be aware of the fact that our long term plan is to build a wide range of models, including affordably priced family cars.”

Musk summarized the master plan for Tesla:

Today, Tesla is a huge symbol of success when it comes to executing on long-term visions. The Tesla Roadster was a success, but given its $100,000-plus price point, its market was always small.

Tesla needed to prove its manufacturing chops, and show the public that EVs could be cool and exciting. It used this success to design, build, and deliver two new models: The Model S and Model X. These models were still expensive, but introduced Tesla to hundreds of thousands of new owners.

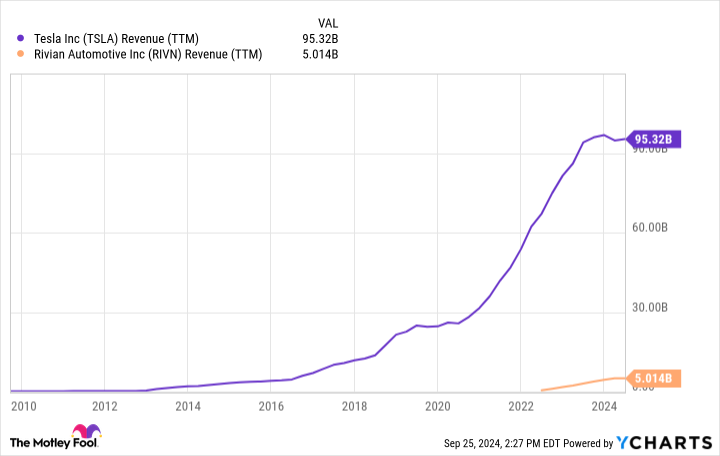

Tesla then used its reputation and access to capital to debut two new mass market models, the Model 3 and Model Y. These two models, with much more affordable price points, allowed Tesla to grow its revenue by more than 1,000% over the last decade.

Tesla’s master plan worked wonders for its valuation. The company is currently worth around $800 billion. Another company, meanwhile, is valued at just $11 billion — yet it’s executing Tesla’s proven master plan flawlessly.

Rivian could be the next big EV stock

When it comes to following Tesla’s template for success, few EV companies look as attractive as Rivian (NASDAQ: RIVN).

In 2018, Rivian announced the debut of its R1T and R1S models. Like Tesla’s earlier models, the R1T and R1S were ultra-luxury, high-quality, no-compromise vehicles with price points that could easily surpass $100,000 with certain options. Consumer feedback was fantastic. Consumer Reports found that Rivian has the highest customer satisifcation and loyalty levels of any auto manufacturer — electric or otherwise. Around 86% of Rivian owners said they would buy another Rivian. No other brand was above the 80% mark.

What will Rivian do with its newfound reputation and sales base? Exactly what Tesla did: Build more affordable cars. Earlier this year, the company revealed three new models: The R2, R3, and R3X. All are expected to debut with starting prices under $50,000. It was meeting this price point that helped put Tesla on the map for millions of people. If Rivian can execute, it should prove very successful.

If Rivian can replicate Tesla’s success, why is its market cap hovering just above $10 billion? First, its new models aren’t expected to hit the road until 2026 at the earliest. Second, the required manufacturing facilities aren’t even complete yet. Third, the company is still losing money at a rapid clip since vehicle manufacturing is capital intensive. However, management expects to reach positive gross profits by the end of 2024. Finally, Rivian is trying to compete in a market segment — electric vehicles — that has seen many bankruptcies over the years.

It’s clear that the market is skeptical of Rivian’s plans, even though it is executing on a proven model for growth, and has demonstrated its ability to manufacture vehicles that customers love. The next few years, however, will be pivotal. Rivian will become a household name like Tesla if it can execute, a result that will likely see a rapid expansion in its valuation.

There’s no guarantee that the company will retain its ability to tap capital markets affordably or get its manufacturing capabilities up and running quickly. It will have to market its vehicles in a hypercompetitive industry. Yet it is this uncertainty that provides patient investors with a lucrative entry point for Rivian stock right now. If you can remain patient, Rivian’s rise could eventually mirror Tesla’s.

Should you invest $1,000 in Rivian Automotive right now?

Before you buy stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The Ultimate Electric Vehicle (EV) Stock to Buy With $1,000 Right Now was originally published by The Motley Fool