Levi & Korsinsky Notifies Shareholders of New Fortress Energy Inc.(NFE) of a Class Action Lawsuit and an Upcoming Deadline

NEW YORK, Sept. 30, 2024 (GLOBE NEWSWIRE) — Levi & Korsinsky, LLP notifies investors in New Fortress Energy Inc. (“New Fortress” or the “Company”) NFE of a class action securities lawsuit.

CLASS DEFINITION: The lawsuit seeks to recover losses on behalf of New Fortress investors who were adversely affected by alleged securities fraud between February 29, 2024 and August 8, 2024. Follow the link below to get more information and be contacted by a member of our team:

https://zlk.com/pslra-1/new-fortress-energy-inc-lawsuit-submission-form?prid=105630&wire=3

NFE investors may also contact Joseph E. Levi, Esq. via email at jlevi@levikorsinsky.com or by telephone at (212) 363-7500.

CASE DETAILS: The filed complaint alleged that defendants created the false impression that they possessed reliable information pertaining to the Company’s projected revenue outlook and anticipated growth while simultaneously minimizing the risk involved in New Fortress’ plan to have its Fast Liquefied Natural Gas (“LNG”) projects fully operational and to increase business growth globally. In reality, New Fortress’ Fast LNG projects failed to fulfill the Company’s public statements that its FLNG 1 project would be in service by March 2024. Even following the announcement that these delays were costing the Company upwards of $150 million per quarter, defendants continued to tout the speed at which New Fortress was building facilities. Defendants misled investors by providing the public with materially flawed statements of confidence and growth projections that did not account for these variables.

WHAT’S NEXT? If you suffered a loss in New Fortress during the relevant time frame, you have until November 18, 2024 to request that the Court appoint you as lead plaintiff. Your ability to share in any recovery doesn’t require that you serve as a lead plaintiff.

NO COST TO YOU: If you are a class member, you may be entitled to compensation without payment of any out-of-pocket costs or fees. There is no cost or obligation to participate.

WHY LEVI & KORSINSKY: Over the past 20 years, the team at Levi & Korsinsky has secured hundreds of millions of dollars for aggrieved shareholders and built a track record of winning high-stakes cases. Our firm has extensive expertise representing investors in complex securities litigation and a team of over 70 employees to serve our clients. For seven years in a row, Levi & Korsinsky has ranked in ISS Securities Class Action Services’ Top 50 Report as one of the top securities litigation firms in the United States.

CONTACT:

Levi & Korsinsky, LLP

Joseph E. Levi, Esq.

Ed Korsinsky, Esq.

33 Whitehall Street, 17th Floor

New York, NY 10004

jlevi@levikorsinsky.com

Tel: (212) 363-7500

Fax: (212) 363-7171

www.zlk.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Els Reports Minimal Impact From Hurricane Helene

CHICAGO, Sept. 30, 2024 /PRNewswire/ — Equity LifeStyle Properties, Inc. ELS (referred to herein as the “Company,” “we,” “us,” and “our”) reported today its preliminary assessment of the impact of Hurricane Helene on its Florida, North Carolina and South Carolina properties.

No injuries to our residents, guests or employees have been reported. Certain properties were affected by flooding, wind, wind-blown debris, and falling trees and branches. We are in the process of estimating costs associated with cleanup and restoration efforts. We believe that we have adequate insurance, subject to deductibles, including business interruption coverage. At this time, we do not believe that Hurricane Helene will significantly impact our results of operations or our financial condition on a consolidated basis

This press release includes certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. When used, words such as “anticipate,” “expect,” “believe,” “project,” “estimate,” “guidance,” “intend,” “may be” and “will be” and similar words or phrases, or the negative thereof, unless the context requires otherwise, are intended to identify forward-looking statements and may include, without limitation, information regarding our expectations, goals or intentions regarding the future, and the expected effect of our acquisitions. Forward-looking statements, by their nature, involve estimates, projections, goals, forecasts and assumptions and are subject to risks and uncertainties that could cause actual results or outcomes to differ materially from those expressed in a forward-looking statement due to a number of factors, which include, but are not limited to the following: (i) the mix of site usage within the portfolio; (ii) yield management on our short-term resort and marina sites; (iii) scheduled or implemented rate increases on community, resort and marina sites; (iv) scheduled or implemented rate increases in annual payments under membership subscriptions; (v) occupancy changes; (vi) our ability to attract and retain membership customers; (vii) change in customer demand regarding travel and outdoor vacation destinations; (viii) our ability to manage expenses in an inflationary environment; (ix) changes in debt service and interest rates; (x) our ability to integrate and operate recent acquisitions in accordance with our estimates; (xi) our ability to execute expansion/development opportunities in the face of changes impacting the supply chain or labor markets; (xii) completion of pending transactions in their entirety and on assumed schedule; (xiii) our ability to attract and retain property employees, particularly seasonal employees; (xiv) ongoing legal matters and related fees; (xv) costs to restore property operations and potential revenue losses following storms or other unplanned events; and (xvi) the potential impact of, and our ability to remediate material weaknesses in our internal control over financial reporting.

For further information on these and other factors that could impact us and the statements contained herein, refer to our filings with the Securities and Exchange Commission, including the “Risk Factors” and “Forward-Looking Statements” sections in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q.

These forward-looking statements are based on management’s present expectations and beliefs about future events. As with any projection or forecast, these statements are inherently susceptible to uncertainty and changes in circumstances. We are under no obligation to, and expressly disclaim any obligation to, update or alter our forward-looking statements whether as a result of such changes, new information, subsequent events or otherwise.

We are a fully integrated owner of lifestyle-oriented properties and own or have an interest in 452 properties located predominantly in the United States consisting of 172,866 sites as of July 22, 2024. We are a self-administered, self-managed, real estate investment trust with headquarters in Chicago.

![]() View original content:https://www.prnewswire.com/news-releases/els-reports-minimal-impact-from-hurricane-helene-302263305.html

View original content:https://www.prnewswire.com/news-releases/els-reports-minimal-impact-from-hurricane-helene-302263305.html

SOURCE Equity Lifestyle Properties, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CYMAT REPORTS RECORD RESULTS FOR Q1 FISCAL 2025

Symbols: TSXV: CYM

OTCQB: CYMHF

MISSISSAUGA, ON, Sept. 30, 2024 /PRNewswire/ – Cymat Technologies Ltd. CYM CYMHF (the “Company” or “Cymat“) is pleased to announce its results for the first quarter of the fiscal 2025 year – the three months ended July 31, 2024.

Cymat commenced its new fiscal year with a record-setting quarterly revenue of $2M and achieving positive cashflow from operations. Sales were led by Cymat’s architectural business as the Company delivered $1.8M of AlusionTM panels. Sales included its first major order for the NEOM development in the Kingdom of Saudi Arabia, cladding for an Italian energy company’s new head office, and a major restocking order for its China-based AlusionTM distributor.

While more modestly represented in the quarterly revenue figure, SmartMetalTM – Cymat’s custom engineered stabilized aluminum foam (SAF) – commenced with initial deliveries under long-term contracts in key industry verticals.

One such vertical for SmartMetalTM is the defense and security sector. SmartMetalTM attributes particularly relevant to the needs of this market sector include its ability to dissipate blast and impact energy, its comparative lightweight, and its compatibility with composite systems designed for multi-threat protection applications. Within this defense vertical, Cymat is pleased to announce that it has shipped the first 24 SmartMetalTM underbelly protection kits to our Asian military vehicle manufacturer customer. This shipment is the leading edge of an expected initial 350 kit order. These SmartMetalTM equipped transport vehicles have been ordered by the customer’s national military who is expanding its fleet by approximately 700 vehicles. While this order is still on a quoted-price basis, Cymat is in the final stages of approval for the definitive 3-year supply contract. The full value of the initial contract is anticipated to be in the $4M – $5M range. The OEM’s marketing efforts for this vehicle are expected to extend to the broader global military customer base, where earlier vehicle variants are in service.

Another key market for SmartMetalTM is the energy infrastructure sector. In a recently issued press release, Cymat announced the receipt of a major order for SmartMetalTM panels from NUVIA, a global specialist in nuclear technology based in France. Cymat has begun the shipment of these panels which NUVIA will integrate into its NuFoamTM system to provide protection of sensitive nuclear power generation equipment from external threats. These panels represent the first $1M phase of a total $2.7M order. France’s ongoing life extension programs for its nuclear power generating facilities is expected to result in a future stream of similar orders. By attaining this order, Cymat has demonstrated its ability to meet the exacting manufacturing standards of the nuclear energy industry. Based on the efficacy of SmartMetalTM within the NuFoamTM platform, Cymat has initiated conversations with several other entities interested in providing enhanced resilience for new energy infrastructure projects.

Additionally, Cymat continues to place a high priority on business development efforts targeting the automotive industry, with a focus on electrified vehicle platforms. Recent media reports have highlighted the challenges that automotive OEMs are facing with regards to the expense of manufacturing BEVs and softening consumer demand. Cost reduction is clearly a key element necessary for OEMs to succeed in their journey to vehicle electrification. As proven by independently performed dynamic testing, a SmartMetalTM based prototype successfully demonstrated its ability to protect the underside of battery enclosure from object impact while offering a reduced component weight, increased energy absorption and reduced post-crash deflection. Moreover, this SmartMetalTM component can deliver cost savings and contribute to battery system simplification goals. Communication of enhanced SmartMetalTM marketing material featuring the independent testing report from this prototype continues to drive discussions with several automotive OEMs and Tier One suppliers. For fiscal 2025, Cymat expects to build upon its investment in manufacturing, testing and information systems to further demonstrate its capability in meeting the requirements of the automotive manufacturing environment.

Cymat CEO and Chairman Michael Liik stated “We are extremely pleased with this significant turn around in our business after a challenging fiscal 2024. While Alusion continues to generate a significant portion of our revenues, the beginnings of long-term contractual revenue from our SmartMetal division should provide a much higher degree of predictability to our financial performance going forward.” He went on to say that “It is particularly satisfying to see our long term business and product development efforts in the nuclear and defence industries begin to yield results. We anticipate that these two business verticals will lay a strong and growing foundation to our business going forward.”

Michael Liik will lead an Investor Update call and presentation on Tuesday October 1st at 11:00 AM Eastern Time (ET), hosted by Investor Cubed. Full details of the event are outlined below.

PRESENTATION DETAILS:

- Date: Tuesday , October 1st, 2024

- Time: 11:00 AM Eastern Time (ET)

Please see below the link to the webinar.

https://us06web.zoom.us/webinar/register/WN_9BKqPPs5TYWj4Pd7t-JGTw

The following table presents selected financial information for the three-month periods ended July 31, 2024, and July 31, 2023 (in $CAD 000’s).

|

Three Months Ended July 31 |

||

|

2024 |

2023 |

|

|

($) |

($) |

|

|

Interim Consolidated Statements of Operations |

||

|

Revenue |

1,992 |

1,037 |

|

Plant operating expenses |

1,440 |

1,067 |

|

Research and material testing expense |

141 |

53 |

|

Selling, general and administrative expenses |

670 |

979 |

|

Loss from operations |

(259) |

(1,062) |

|

Net loss |

(542) |

(1,154) |

|

Interim Statements of Cash Flows |

||

|

Cash provided by (used in) operating activities |

272 |

(622) |

About Cymat Technologies Ltd.

Cymat Technologies Ltd. has the global rights, through patents and established know-how, to manufacture and sell Stabilized Aluminum Foam (“SAF”), a unique, ultra-light, cellular metallic material. The proprietary production process entails the injection of gases through a molten bath of alloyed aluminum infused with ceramic particles. The result is an advanced, lightweight, recyclable material that exhibits unique characteristics including customizable density and dimensions; mechanical energy absorption; thermal and acoustic insulation; and time, temperature and strain-rate insensitivity. A key benefit of this continuous foam production process is its scalability and resultant low cost of production. SAF is used in such industries as architectural design, military and automotive. Cymat markets its architectural SAF under the

AlusionTM brand and its automotive and military SAF under the SmartMetalTM brand. For further information, please visit our website at www.cymat.com.

Certain information set forth in this news release may contain forward-looking statements that involve substantial known and unknown risks and uncertainties. All statements other than statements of historical fact are forward-looking statements, including, without limitation, statements regarding future financial position, business strategy, use of proceeds, corporate vision, proposed acquisitions, partnerships, joint-ventures and strategic alliances and co-operations, budgets, cost and plans and objectives of or involving the Company. Such forward-looking information reflects management’s current beliefs and is based on information currently available to management. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “predicts”, “intends”, “targets”, “aims”, “anticipates” or “believes” or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions “may”, “could”, “should”, “would”, “might” or “will” be taken, occur or be achieved. A number of known and unknown risks, uncertainties and other factors may cause the actual results or performance to materially differ from any future results or performance expressed or implied by the forward-looking information. These forward-looking statements are subject to numerous risks and uncertainties, certain of which are beyond the control of the Company including, but not limited to, the impact of general economic conditions, industry conditions and dependence upon regulatory approvals. Certain material assumptions regarding such forward-looking statements may be discussed in this news release and the Company’s annual and quarterly management’s discussion and analysis filed at www.sedar.com. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. The Company does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by securities laws.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/cymat-reports-record-results-for-q1-fiscal-2025-302262542.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/cymat-reports-record-results-for-q1-fiscal-2025-302262542.html

SOURCE Cymat Technologies Ltd.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

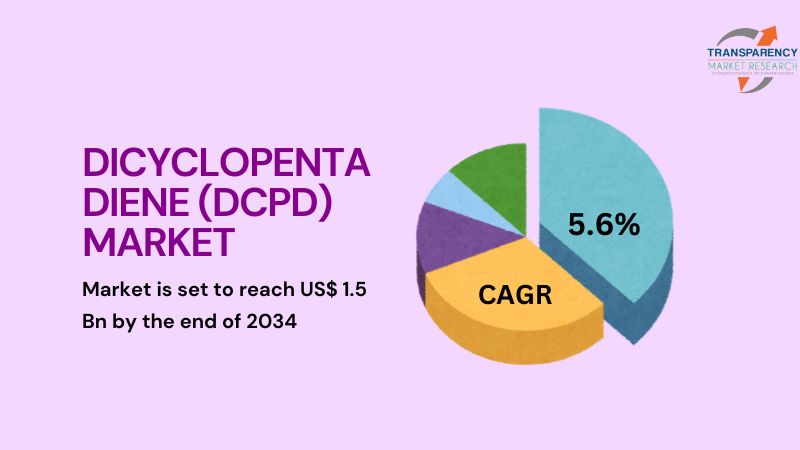

Dicyclopentadiene (DCPD) Market Anticipates Reaching USD 1.5 billion by 2034 with a 5.6% CAGR | States Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Sept. 30, 2024 (GLOBE NEWSWIRE) — The global dicyclopentadiene (DCPD) market (디사이클로펜타디엔(DCPD) 시장) was projected to attain US$ 810.7 million in 2023. It is anticipated to garner a 5.6% CAGR from 2024 to 2034, and by 2034, the market is likely to attain US$ 1.5 billion.

The output of main plastic resins in the United States reached 8.5 billion pounds in December 2023, up 24.6% from December 2022 and 5% from November 2023, according to the American Chemistry Council (ACC). This year’s production has totaled 96.7 billion pounds, a 5% rise over the same period in 2022.

In the building and construction industry, specialty resins are utilized as coatings, adhesives and sealants, and composite materials. Unsaturated polyester resins (UPRs) treated with dicyclopentadiene (DCPD) are mostly used for toilet facilities, decks, and hulls because they have quick drying in thin layers, cheaper cost, and less styrene emission.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/dicyclopentadiene-market.html

Key Findings of Market Report

- Among thermoplastic elastomers, ethylene propylene (EPDM) is the most often used.

- Given its inexpensive cost, low specific gravity or density, simplicity of processing, paintability, and weatherability, it is used in the automobile industry.

- EPDM shows good compatibility with ketones and fireproof hydraulic fluids.

- Currently, dienes such as vinyl norbornene (VNB), ethylidene norbornene (ENB), and DCPD are utilized to make EPDM rubbers.

- Swim fins, handle grips, wire and cable jacketing, and weatherstripping are all made using EPDMs.

- The dicyclopentadiene (DCPD) market revenue is being enhanced by the rise in demand for EPDM elastomers.

- A relatively new polymer called polydicyclopentadiene (PDCPD) is created when DCPD undergoes ring-opening metathesis polymerization, or ROP.

- In general, people prefer it over ordinary since it offers more resilience at lower temperatures.

Market Trends For Dicyclopentadiene (DCPD)

- Glass fiber-reinforced plastics are primarily used for unsaturated polyester resins (FRP). Their exceptional tensile strength, bending strength, impact strength, heat resistance, corrosion resistance, and electric characteristics make them popular for use in construction, transportation, and housing equipment.

- In the dicyclopentadiene (DCPD) business, EPDM elastomers are highly sought after because to their unparalleled resistance to heat, steam, water, and ozone. Due to their long-lasting withstanding qualities, EPDM elastomers are a good option for tubing and window and architectural sealing, among other uses.

Global Market for Dicyclopentadiene (DCPD): Regional Outlook

Various reasons propel the dicyclopentadiene (DCPD) market growth throughout the different regions. These are:

- In 2023, Asia Pacific accounted for the dominant market share. Japan is the country that uses DCPD the most. The dicyclopentadiene (DCPD) market is also expanding significantly in China, India, South Korea, and Indonesia.

- The demand for dicyclopentadiene (DCPD) in the Asia Pacific market is driven by the plastics industry’s expansion and the rise in the use of polyester resin in electrical and electronic components.

- According to the India Brand Equity Foundation (IBEF), there is a considerable geographical difference in the country’s plastic consumption: 47% is consumed in Western India, 23% in Northern India, and 21% in Southern India.

- The demand for plastics is being driven by the expansion of the end-use industries of automotive, packaging (including bulk packaging), plastics applications, and electronic appliances. This is leading to an increase in the market share of dicyclopentadiene (DCPD) in Asia Pacific.

Global Dicyclopentadiene (DCPD) Market: Key Players

Compared with other general-purpose polyesters, resins based on DCPD contain less styrene. As governments throughout North America and Europe impose stricter rules on the emission of styrene, vendors in the global dicyclopentadiene (DCPD) market are adopting innovative manufacturing technologies.

The following companies are well-known participants in the global dicyclopentadiene (DCPD) market:

- Braskem

- Chevron Phillips Chemical Company LLC

- Cymetech Corporation

- ExxonMobil Corporation

- MESNAC

- Kolon Industries, Inc.

- LyondellBasell

- Maruzen Petrochemical Co., Ltd.

- Shell Chemicals

- Texmark Chemicals, Inc.

- Zibo Luhua Hongjin New Material Co., Ltd.

Few of key developments by the players in this market are:

- In October 2023, Braskem announced the establishment of a Representative Office in Tokyo, Japan, one of the primary markets for I’m greenT bio-based Polyethylene (PE). The company’s ongoing development of biopolymer solutions based on renewable feedstock is reflected in this growth.

- OQ Chemicals stated in September 2023 that Oxbalance TCD Alcohol DM (tricyclodecane dimethanol) with ISCC PLUS certification is now available for purchase. The bio-circular precursor DCPD from Shell Chemicals Europe, a major participant in the dicyclopentadiene resin market, is used in the production of this product.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/dicyclopentadiene-market.html

Global Dicyclopentadiene (DCPD) Market Segmentation

- Application

- Unsaturated Polyester Resin

- Hydrocarbon Resin

- EPDM Elastomer

- COP & COC

- Poly-DCPD

- Others

- Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

More Trending Reports by Transparency Market Research –

PVC Emulsion Market (PVCエマルジョン市場) – The global PVC emulsion market is projected to expand at a CAGR of 4.3% between 2022 and 2031

Sulfuric Acid Market (سوق حمض الكبريتيك) – The global sulfuric acid market is estimated to surge at a CAGR of 2.7% from 2022 to 2031. Transparency Market Research projects that the overall sales revenue for sulfuric acid is estimated to reach US$ 18.2 billion by the end of 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

LOBO EV Technologies Ltd. Announces H1 2024 Earnings with 49% Revenue Growth and 45% Increase in Units Sold

WUXI, China, Sept. 30, 2024 (GLOBE NEWSWIRE) — LOBO EV Technologies Ltd. LOBO, (“LOBO” or the “Company”), an innovative e-bicycle, e-moped, e-tricycle, and electric off-highway four-wheeled shuttle designer, developer, manufacturer and seller, today announced its financial results for the six months ended June 30, 2024.

H1 2024 Financial Highlights:

- Total Revenue: $12.13 million, up 49% compared to $8.14 million in H1 2023.

- Gross Profit: $1.36 million, reflecting a gross margin of 11.2%.

- Net Loss: $(0.31) million compared to net income of $0.67 million in H1 2023.

- Units Sold: 56,000 units, up 45% from 38,600 units sold in H1 2023.

- Adjusted EBITDA: Loss of $(0.09) million, compared to positive EBITDA of $0.44 million in the same period last year.

Operational Performance:

Sales from electric vehicles and accessories grew 61%, contributing $12.08 million in total revenue. The Company delivered 56,000 units in the first half of 2024, a 45% year-over-year increase, driven by strong demand for LOBO’s e-bicycles, e-mopeds, and electric four-wheelers, with additional contributions from distribution channel expansion and entry into new markets.

LOBO made significant strides in expanding its distribution network domestically and internationally during H1 2024. The Company successfully entered new international markets, broadening its global footprint and making its products available to a larger audience. These efforts were instrumental in increasing unit sales and positioning LOBO for sustained future growth.

LOBO’s CEO, Huajian Xu, commented: “Our H1 results demonstrate the growing demand for sustainable transportation solutions. The 45% increase in units sold underscores our ability to scale production and meet rising global demand. Our expansion into new international markets has opened exciting growth opportunities, and we remain committed to delivering high-quality electric vehicles to an expanding customer base.”

Financial Overview:

- Revenue Growth: The 49% year-over-year increase was driven by significant growth in unit sales and LOBO’s ongoing expansion into new markets. The company sold 56,000 vehicles in H1 2024, compared to 38,600 in H1 2023.

- Gross Profit: Gross profit improved to $1.36 million, up from $1.18 million in H1 2023, reflecting improved operational efficiency despite rising production costs.

- Net Loss: The net loss of $(0.31) million was primarily due to increased operating expenses, including research and development investments and expanded administrative costs to support growth, particularly as LOBO entered new international markets.

Strategic Investments and Margin Outlook:

In H1 2024, LOBO increased its research and development spending by 86%, focusing on enhancing product features and developing advanced software solutions to meet customer needs in newly entered markets. The Company also expanded its inventory by 55% to support growing demand and facilitate the roll-out of new vehicle models in the second half of the year.

LOBO anticipates margin improvements in H2 2024 as the Company continues to scale operations and optimize its supply chain. The introduction of new vehicle models and increased sales in higher-margin international markets are expected to contribute to improved profitability. LOBO’s management remains focused on cost control measures and operational efficiencies to drive sustainable margin expansion in the second half of the year.

Outlook for the Full Year 2024:

With the successful execution of its growth strategy, including international expansion and product innovation, LOBO remains optimistic about continued momentum in the second half of 2024. The Company plans to launch several new vehicle models and further strengthen its presence in international markets, driving both unit sales and revenue growth.

Xu added: “Our strong revenue growth and expanded global reach underscores our long-term vision. As we continue to enter new markets and deliver innovative products, we are confident in our ability to sustain growth and deliver value to our shareholders.”

About LOBO EV Technologies Ltd.

LOBO is an innovative designer, developer, manufacturer and seller of e-bicycles, e-mopeds, e-tricycles, and electric off-highway four-wheeled shuttles such as golf carts and mobility scooters for the elderly and disabled persons. LOBO also provides automobile information and entertainment software development and design services to customers. Leveraging its cutting-edge technologies in connectivity, multimedia interactive systems and artificial intelligence, LOBO re-defines and develops its products in order to provide users with convenient, affordable and pleasant driving experiences. For more information, visit: https://loboev.io/. Any information displayed on, or that can be accessed through, our website or any other website or any social media is not a part of this press release.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) as well as Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, as amended, that are intended to be covered by the safe harbor created by those sections. Forward-looking statements, which are based on certain assumptions and describe the Company’s future plans, strategies and expectations, can generally be identified by the use of forward-looking terms such as “believe,” “expect,” “may,” “will,” “should,” “would,” “could,” “seek,” “intend,” “plan,” “goal,” “project,” “estimate,” “anticipate,” “strategy,” “future,” “likely” or other comparable terms, although not all forward-looking statements contain these identifying words. All statements other than statements of historical facts included in this press release regarding the expected closing date of the public offering and the Company’s strategies, prospects, financial condition, operations, costs, plans and objectives are forward-looking statements. Important factors that could cause the Company’s actual results and financial condition to differ materially from those indicated in the forward-looking statements. Such forward-looking statements are subject to risk and uncertainties, including, but not limited to, those described in “Risk Factors,” “Operating and Financial Review and Prospects,” “Cautionary Note Regarding Forward-Looking Statements” in the Annual Report on Form 20-F filed with the SEC (File No. 333-270499) on April 30, 2024. LOBO undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events except as required by law. You should read this press release with the understanding that our actual future results may be materially different from what we expect.

Contact:

For more information, contact:

Zane Xu

IR Manager

ir@loboai.com

Dave Gentry

RedChip Companies Inc.

1 (407) 644-4256

LOBO@redchip.com

| LOBO EV TECHNOLOGIES LTD UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS (In U.S. dollars except for number of shares) |

|||||||

| As of | |||||||

| June 30, | December 31, | ||||||

| 2024 | 2023 | ||||||

| Assets | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 1,115,181 | $ | 470,335 | |||

| Accounts receivable, net | 2,339,830 | 2,532,551 | |||||

| Inventories, net | 8,886,337 | 5,737,781 | |||||

| Short-term investments | 184,231 | 56,768 | |||||

| Prepaid expenses and other current assets | 7,828,258 | 7,307,478 | |||||

| Total current assets | 20,353,837 | 16,104,913 | |||||

| Property and equipment, net | 986,122 | 1,080,747 | |||||

| Intangible assets, net | 1,996,823 | 1,916,362 | |||||

| Operating lease right-of-use assets, net | 1,122,664 | 569,462 | |||||

| Total Assets | 24,459,446 | 19,671,484 | |||||

| Liabilities and Shareholders’ Equity | |||||||

| Current liabilities: | |||||||

| Accounts payable | $ | 1,281,014 | $ | 929,816 | |||

| Advances from customers | 2,613,072 | 1,555,424 | |||||

| Other current payables | 393,297 | 370,913 | |||||

| VAT payable | 6,450,933 | 6,078,846 | |||||

| Taxes payable | 2,669,546 | 2,372,646 | |||||

| Amounts due to related parties | 1,486,145 | 1,671,371 | |||||

| Operating lease liabilities, current | 701,446 | 362,720 | |||||

| Total current liabilities | 15,595,453 | 13,341,736 | |||||

| Long-term Loan | 137,605 | 140,847 | |||||

| Operating lease liabilities, non-current | 633,389 | 298,961 | |||||

| Other payables | – | 11,320 | |||||

| Total liabilities | 16,366,447 | 13,792,864 | |||||

| Commitments and contingencies | – | – | |||||

| Equity: | |||||||

| Common stock (par value of $0.001 per share, 50,000,000 shares authorized, 7,780,000 and 6,400,000 issued and outstanding, as of June 30, 2024 and December 31, 2023, respectively) | 7,780 | 6,400 | |||||

| Additional paid-in capital | 5,708,280 | 3,013,333 | |||||

| Retained earnings | 2,102,211 | 2,490,044 | |||||

| Accumulated other comprehensive income | (529,893 | ) | (377,790 | ) | |||

| Statutory reserve | 606,881 | 521,566 | |||||

| Total LOBO EV Technologies LTD’s shareholders’ equity | 7,895,259 | 5,653,553 | |||||

| Non-controlling interest | 197,740 | 225,067 | |||||

| Total Equity | 8,092,999 | 5,878,620 | |||||

| Total Liabilities and Equity | $ | 24,459,446 | $ | 19,671,484 | |||

| LOBO EV TECHNOLOGIES LTD UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (In U.S. dollars except for number of shares) |

|||||||

| Six Months Ended | |||||||

| June 30, | |||||||

| 2024 | 2023 | ||||||

| Revenues | $ | 12,132,668 | $ | 8,137,820 | |||

| Cost of revenues | 10,768,717 | 6,954,364 | |||||

| Gross Profit | 1,363,951 | 1,183,456 | |||||

| Operating expenses | |||||||

| Selling and marketing expenses | 329,471 | 325,800 | |||||

| General and administrative expenses | 878,547 | 284,134 | |||||

| Research and development expenses | 245,642 | 132,174 | |||||

| Total operating expenses | 1,453,660 | 742,108 | |||||

| Operating (loss)/income | (89,709 | ) | 441,348 | ||||

| Other expenses (income) | |||||||

| Interest expense (income) | (19,964 | ) | 4,656 | ||||

| Other (income) | (45,537 | ) | (484,545 | ) | |||

| Total other income, net | (65,501 | ) | (479,889 | ) | |||

| (loss)/Income before income tax expense | (24,208 | ) | 921,237 | ||||

| Income tax expense | 289,039 | 249,200 | |||||

| Net (loss)/Income | (313,247 | ) | 672,037 | ||||

| Net (loss)/Income | (313,247 | ) | 672,037 | ||||

| Less: Net (loss)/income attributable to non-controlling interest | (10,729 | ) | 14,263 | ||||

| Net (loss)/income attributable to LOBO EV Technologies LTD | (302,518 | ) | 657,774 | ||||

| Net (loss)/Income | (313,247 | ) | 672,037 | ||||

| Foreign currency translation adjustments | (168,701 | ) | (346,119 | ) | |||

| Total comprehensive (loss) income | (481,948 | ) | 325,918 | ||||

| Less: Total comprehensive (loss) income attributable to noncontrolling interests | (27,327 | ) | 5,889 | ||||

| Total comprehensive (loss) income attributable to LOBO EV Technologies LTD | $ | (454,621 | ) | $ | 320,029 | ||

| Net (loss)/income per share, basic and diluted | $ | (0.04 | ) | $ | 0.11 | ||

| Weighted average shares outstanding, basic and diluted | 7,143,077 | 6,400,000 | |||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Decision: Scott Robinson Exercises Options At Donaldson For $1.57M

On September 30, it was revealed in an SEC filing that Scott Robinson, Chief Financial Officer at Donaldson DCI executed a significant exercise of company stock options.

What Happened: Robinson, Chief Financial Officer at Donaldson, exercised stock options for 83,600 shares of DCI stock. This information was disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The exercise price of the options was $55.14 per share.

During Monday’s morning session, Donaldson shares down by 0.0%, currently priced at $73.82. Considering the current price, Robinson’s 83,600 shares have a total value of $1,567,378.

About Donaldson

Donaldson is a leading manufacturer of filtration systems and replacement parts (including air filtration systems, liquid filtration systems, and dust, fume, and mist collectors). The company serves a diverse range of end markets, including construction, mining, agriculture, truck, and industrial. Its business is organized into three segments: mobile solutions, industrial solutions, and life sciences. Donaldson generated approximately $3.6 billion in revenue and $544 million in operating income in its fiscal 2024.

Donaldson’s Financial Performance

Positive Revenue Trend: Examining Donaldson’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 0.81% as of 31 July, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Navigating Financial Profits:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 35.79%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): Donaldson’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 0.91.

Debt Management: Donaldson’s debt-to-equity ratio is below the industry average at 0.36, reflecting a lower dependency on debt financing and a more conservative financial approach.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 21.84, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: With a lower-than-average P/S ratio of 2.52, the stock presents an attractive valuation, potentially signaling a buying opportunity for investors interested in sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry benchmarks at 13.96, Donaldson presents an attractive value opportunity.

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Illuminating the Importance of Insider Transactions

Investors should view insider transactions as part of a multifaceted analysis and not rely solely on them for decision-making.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Cracking Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Donaldson’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CARNIVAL CORPORATION & PLC REPORTS RECORD-SETTING OPERATING RESULTS, OUTPERFORMS THIRD QUARTER GUIDANCE AND RAISES FULL YEAR 2024 GUIDANCE FOR THE THIRD TIME

MIAMI, Sept. 30, 2024 /PRNewswire/ — Carnival Corporation & plc ((NYSE/LSE: CCL, NYSE:CUK) announced financial results for the third quarter 2024 and provided an updated outlook for the full year and an outlook for fourth quarter 2024.

- Third quarter net income was $1.7 billion, an increase of over 60 percent compared to 2023 and adjusted net income1 outperformed June guidance by $170 million.

- Third quarter revenues hit an all-time high of $7.9 billion, up $1.0 billion compared to the prior year.

- Record operating income of $2.2 billion exceeded 2023 levels by $554 million.

- As a result of strong demand and cost saving opportunities, raised its full year 2024 adjusted EBITDA1 guidance to approximately $6.0 billion, up over 40 percent compared to 2023 and better than June guidance by nearly $200 million.

- The cumulative advanced booked position for full year 2025 is above the previous 2024 record with prices (in constant currency) ahead of prior year.

“We delivered a phenomenal third quarter, breaking operational records and outperforming across the board. Our strong improvements were led by high-margin, same-ship yield growth, driving a 26 percent improvement in unit operating income, the highest level we have reached in fifteen years,” commented Carnival Corporation & plc’s Chief Executive Officer Josh Weinstein.

“We are poised to deliver record operating performance for full year 2024, with adjusted EBITDA now expected to cross $6 billion and adjusted return on invested capital1 to be approximately 10.5 percent. Strong demand enabled us to increase our full year yield guidance for the third time this year and we improved our cost guidance driving more revenue to the bottom line,” Weinstein added.

“Looking forward, the momentum continues as our enhanced commercial execution drives demand well in excess of our capacity growth, leaving us well positioned with an even stronger base of business for 2025, a record start to 2026 and firmly on the path toward our SEA Change targets,” Weinstein noted.

Third Quarter 2024 Results

- Net income was $1.7 billion, or $1.26 diluted EPS, an increase of $662 million compared to 2023. Adjusted net income of $1.8 billion, or $1.27 adjusted EPS1, was higher than June guidance by $170 million driven by outperformance in both yield and cost.

- Record operating income of $2.2 billion exceeded 2023 levels by $554 million or 34 percent.

- Record adjusted EBITDA of $2.8 billion increased over 25 percent compared to 2023 and outperformed June guidance by $160 million.

- Third quarter revenues hit an all-time high of $7.9 billion, with record net yields1 (in constant currency) and record net per diems1 (in constant currency) both significantly exceeding 2023 levels.

- Gross margin yields increased by 19 percent compared to 2023 and net yields (in constant currency) exceeded 2023 levels by 8.7 percent.

- Gross margin per diems were up 16 percent compared to 2023. Net per diems (in constant currency) were up nearly 6 percent compared to 2023 with both ticket prices and onboard spending up mid-single digits.

- Cruise costs per available lower berth day (“ALBD”) increased 3.4 percent compared to 2023. Adjusted cruise costs excluding fuel per ALBD1 (in constant currency) decreased compared to 2023 and were significantly better than June guidance driven by cost saving opportunities, accelerated easing of inflationary pressures, benefits from one-time items and the timing of expenses between the quarters.

- Total customer deposits reached a third quarter record of $6.8 billion, surpassing the previous third quarter record of $6.3 billion as of August 31, 2023, despite lower capacity growth.

Bookings

“With nearly half of 2025 booked and less inventory remaining for sale than the prior year, we are leveraging strong demand to achieve record ticket pricing (in constant currency). Our brands continue to deliver robust bookings momentum, with all our brands ahead on price for 2025 sailings, based on the success of their demand generation efforts along with the exciting offerings and unparalleled experiences we consistently provide our guests. Likewise, 2026 is off to an unprecedented start achieving record booking volumes in the last three months,” Weinstein noted.

During the third quarter, booking volumes remained robust for 2025 sailings at higher prices (in constant currency) compared to the prior year.

The cumulative advanced booked position for full year 2025 is above the previous 2024 record with prices (in constant currency) ahead of prior year.

_____________________________

1 See “Non-GAAP Financial Measures” at the end of this release for additional information.

2024 Outlook

For the full year 2024, the company expects:

- Net yields (in constant currency) up approximately 10.4 percent compared to 2023, better than June guidance, based on continued strength in demand.

- Adjusted cruise costs excluding fuel per ALBD (in constant currency) up approximately 3.5 percent compared to 2023, approximately 1 percentage point better than June guidance driven by cost saving opportunities, accelerated easing of inflationary pressures and benefits from one-time items.

- Adjusted EBITDA of approximately $6.0 billion, up over 40 percent compared to 2023 and better than June guidance by nearly $200 million.

- Adjusted return on invested capital (“ROIC”) of approximately 10.5 percent, an improvement of approximately 5.0 percentage points compared to 2023 and half a point better than June guidance.

For the fourth quarter of 2024, the company expects:

- Net yields (in constant currency) up approximately 5.0 percent compared to particularly strong 2023 levels.

- Adjusted cruise costs excluding fuel per ALBD (in constant currency) up approximately 8.0 percent compared to the fourth quarter of 2023 due primarily to higher dry-dock days and higher investment in advertising.

- Adjusted EBITDA of approximately $1.14 billion, up 20 percent compared to the fourth quarter of 2023.

See “Guidance” and “Reconciliation of Forecasted Data” for additional information on the company’s 2024 outlook.

Financing and Capital Activity

“We have continued to improve our leverage metrics and balance sheet with strong cash generation and continued debt reduction. We are pleased these efforts were recognized by both S&P and Moody’s with their recent credit rating upgrades. For 2024, we expect better than a two turn improvement in net debt to adjusted EBITDA1 compared to 2023, approaching 4.5x, well on our way to investment grade. In fact, this year’s adjusted free cash flow1 is expected to be over $3.0 billion,” commented Carnival Corporation & plc’s Chief Financial Officer David Bernstein.

The company continued its efforts to proactively manage its debt profile. Since June 2024, the company prepaid another $625 million of debt, bringing its total prepayments to $7.3 billion since the beginning of 2023. Additionally, the company has now fully utilized the accordion feature of its revolving credit facility, increasing the borrowing capacity by nearly $500 million and bringing the total undrawn commitment to $3.0 billion. The company ended the quarter with $4.5 billion of liquidity, including cash and borrowings available under the revolving credit facility.

During the third quarter, Fitch initiated its coverage of the company with a BB credit rating with a positive outlook. The company is now rated by all three major internationally recognized rating agencies. Additionally, S&P upgraded its credit rating to BB with a stable outlook and Moody’s upgraded to B1 with a positive outlook. The company believes this is a testament to its improved leverage metrics and continuing journey to investment grade ratings.

The company continues to strategically direct new capacity towards its highest returning brand with the recent order of three additional ships to Carnival Cruise Line for delivery in 2029, 2031 and 2033. These ships will become the largest ships in the company’s fleet and will carry more passengers than any other cruise ship to date. The company is following through on its measured capacity growth strategy of one to two ships per year on average, including just three ships scheduled for delivery through 2028. This will enable the company to utilize its substantial free cash flow to strategically improve its balance sheet by significantly reducing its leverage levels over the next several years.

The company obtained a new export credit facility, bringing its total committed financings related to ship deliveries to $3.4 billion, continuing its strategy to finance its newbuild program at preferential interest rates.

_____________________________

1 See “Non-GAAP Financial Measures” at the end of this release for additional information.

Other Recent Highlights

- Named by TIME as one of the World’s Best Companies of 2024 and by Forbes as one of America’s Best Employers for Women in 2024.

- Opened a new innovative Fleet Operations Center in Hamburg, Germany to support its European brands.

- Announced the expansion of Half Moon Cay. This popular private island will be enhanced to include an expanded beach, dining and beverage experiences along with a new pier that will allow the company’s larger ships to visit.

- In anticipation of Celebration Key’s debut in July 2025, Carnival Cruise Line opened bookings for the destination’s new exclusive retreat, Pearl Cove Beach Club, which will offer a premium experience for guests with a large selection of supervillas, cabanas and shore excursions.

- Carnival Conquest, AIDAdiva and AIDAluna became the first cruise ships to connect to shore power at PortMiami, the Port of Stockholm and the Port of Oslo.

- AIDA Cruises successfully piloted a new advanced blended biofuel, which is specifically intended for the maritime industry and lowers greenhouse gas emissions compared to conventional fossil fuels.

- Seabourn Pursuit was named in a historic expedition ceremony, debuting its new itineraries visiting the Kimberley region in Australia.

Guidance

(See “Reconciliation of Forecasted Data”)

|

4Q 2024 |

Full Year 2024 |

||||||

|

Year over year change |

Current Dollars |

Constant Currency |

Current Dollars |

Constant Currency |

|||

|

Net yields |

Approx. 7.0% |

Approx. 5.0% |

Approx. 11.0% |

Approx. 10.4% |

|||

|

Adjusted cruise costs excluding fuel per ALBD |

Approx. 9.5% |

Approx. 8.0% |

Approx. 4.0% |

Approx. 3.5% |

|||

|

4Q 2024 |

Full Year 2024 |

||

|

ALBDs (in millions) (a) |

24.0 |

95.6 |

|

|

Capacity growth compared to prior year |

3.1 % |

4.7 % |

|

|

Fuel consumption in metric tons (in millions) |

0.7 |

2.9 |

|

|

Fuel cost per metric ton consumed (excluding European Union Allowance (“EUA”)) |

$ 590 |

$ 658 |

|

|

Fuel expense (including EUA expense) (in billions) |

$ 0.43 |

$ 1.98 |

|

|

Depreciation and amortization (in billions) |

$ 0.67 |

$ 2.57 |

|

|

Interest expense, net of capitalized interest and interest income (in billions) |

$ 0.41 |

$ 1.68 |

|

|

Adjusted EBITDA (in billions) |

Approx. $1.14 |

Approx. $6.0 |

|

|

Adjusted net income (loss) (in millions) |

Approx. $60 |

Approx. $1,760 |

|

|

Adjusted earnings per share – diluted (b) |

Approx. $0.05 |

Approx. $1.33 |

|

|

Weighted-average shares outstanding – basic |

1,296 |

1,273 |

|

|

Weighted-average shares outstanding – diluted |

1,301 |

1,398 |

|

(a) |

See “Notes to Statistical Information” |

|

(b) |

Diluted adjusted earnings per share includes the add-back of dilutive interest expense related to the company’s |

|

Currencies (USD to 1) |

4Q 2024 |

Full Year 2024 |

|

AUD |

$ 0.68 |

$ 0.67 |

|

CAD |

$ 0.74 |

$ 0.74 |

|

EUR |

$ 1.12 |

$ 1.09 |

|

GBP |

$ 1.33 |

$ 1.28 |

|

Sensitivities (impact to adjusted net income (loss) in millions) |

4Q 2024 |

|

1% change in net yields |

$ 42 |

|

1% change in adjusted cruise costs excluding fuel per ALBD |

$ 27 |

|

1% change in currency exchange rates |

$ 5 |

|

10% change in fuel price |

$ 42 |

|

100 basis point change in variable rate debt (including derivatives) |

$ 12 |

Capital Expenditures

For the fourth quarter of 2024, newbuild capital expenditures are $0.2 billion and non-newbuild capital expenditures are $0.6 billion. These future capital expenditures will fluctuate with foreign currency movements relative to the U.S. Dollar. In addition, these figures do not include potential stage payments for ship orders that the company may place in the future.

Conference Call

The company has scheduled a conference call with analysts at 10:00 a.m. EDT (3:00 p.m. BST) today to discuss its earnings release. This call can be listened to live, and additional information including the company’s earnings presentation and debt maturities schedule, can be obtained via Carnival Corporation & plc’s website at www.carnivalcorp.com and www.carnivalplc.com.

Carnival Corporation & plc is the largest global cruise company, and among the largest leisure travel companies, with a portfolio of world-class cruise lines – AIDA Cruises, Carnival Cruise Line, Costa Cruises, Cunard, Holland America Line, P&O Cruises (Australia), P&O Cruises (UK), Princess Cruises, and Seabourn.

Additional information can be found on www.carnivalcorp.com, www.aida.de, www.carnival.com, www.costacruise.com, www.cunard.com, www.hollandamerica.com, www.pocruises.com.au, www.pocruises.com, www.princess.com and www.seabourn.com. For more information on Carnival Corporation’s industry-leading sustainability initiatives, visit www.carnivalsustainability.com.

Cautionary Note Concerning Factors That May Affect Future Results

Some of the statements, estimates or projections contained in this document are “forward-looking statements” that involve risks, uncertainties and assumptions with respect to us, including some statements concerning future results, operations, outlooks, plans, goals, reputation, cash flows, liquidity and other events which have not yet occurred. These statements are intended to qualify for the safe harbors from liability provided by Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts are statements that could be deemed forward-looking. These statements are based on current expectations, estimates, forecasts and projections about our business and the industry in which we operate and the beliefs and assumptions of our management. We have tried, whenever possible, to identify these statements by using words like “will,” “may,” “could,” “should,” “would,” “believe,” “depends,” “expect,” “goal,” “aspiration,” “anticipate,” “forecast,” “project,” “future,” “intend,” “plan,” “estimate,” “target,” “indicate,” “outlook,” and similar expressions of future intent or the negative of such terms.

Forward-looking statements include those statements that relate to our outlook and financial position including, but not limited to, statements regarding:

|

• Pricing |

• Adjusted EBITDA |

|

• Booking levels |

• Adjusted earnings per share |

|

• Occupancy |

• Adjusted free cash flow |

|

• Interest, tax and fuel expenses |

• Net debt to adjusted EBITDA |

|

• Currency exchange rates |

• Net per diems |

|

• Goodwill, ship and trademark fair values |

• Net yields |

|

• Liquidity and credit ratings |

• Adjusted cruise costs per ALBD |

|

• Investment grade leverage metrics |

• Adjusted cruise costs excluding fuel per ALBD |

|

• Estimates of ship depreciable lives and residual values |

• Adjusted return on invested capital |

|

• Adjusted net income (loss) |

Because forward-looking statements involve risks and uncertainties, there are many factors that could cause our actual results, performance or achievements to differ materially from those expressed or implied by our forward-looking statements. This note contains important cautionary statements of the known factors that we consider could materially affect the accuracy of our forward-looking statements and adversely affect our business, results of operations and financial position. These factors include, but are not limited to, the following:

- Events and conditions around the world, including geopolitical uncertainty, war and other military actions, inflation, higher fuel prices, higher interest rates and other general concerns impacting the ability or desire of people to travel have led, and may in the future lead, to a decline in demand for cruises as well as negative impacts to our operating costs and profitability.

- Pandemics have in the past and may in the future have a significant negative impact on our financial condition and operations.

- Incidents concerning our ships, guests or the cruise industry have in the past and may, in the future, negatively impact the satisfaction of our guests and crew and lead to reputational damage.

- Changes in and non-compliance with laws and regulations under which we operate, such as those relating to health, environment, safety and security, data privacy and protection, anti-money laundering, anti-corruption, economic sanctions, trade protection, labor and employment, and tax may be costly and have in the past and may, in the future, lead to litigation, enforcement actions, fines, penalties and reputational damage.

- Factors associated with climate change, including evolving and increasing regulations, increasing global concern about climate change and the shift in climate conscious consumerism and stakeholder scrutiny, and increasing frequency and/or severity of adverse weather conditions could adversely affect our business.

- Inability to meet or achieve our targets, goals, aspirations, initiatives, and our public statements and disclosures regarding them, including those that are related to sustainability matters, may expose us to risks that may adversely impact our business.

- Breaches in data security and lapses in data privacy as well as disruptions and other damages to our principal offices, information technology operations and system networks and failure to keep pace with developments in technology may adversely impact our business operations, the satisfaction of our guests and crew and may lead to reputational damage.

- The loss of key team members, our inability to recruit or retain qualified shoreside and shipboard team members and increased labor costs could have an adverse effect on our business and results of operations.

- Increases in fuel prices, changes in the types of fuel consumed and availability of fuel supply may adversely impact our scheduled itineraries and costs.

- We rely on supply chain vendors who are integral to the operations of our businesses. These vendors and service providers may be unable to deliver on their commitments, which could negatively impact our business.

- Fluctuations in foreign currency exchange rates may adversely impact our financial results.

- Overcapacity and competition in the cruise and land-based vacation industry may negatively impact our cruise sales, pricing and destination options.

- Inability to implement our shipbuilding programs and ship repairs, maintenance and refurbishments may adversely impact our business operations and the satisfaction of our guests.

- We require a significant amount of cash to service our debt and sustain our operations. Our ability to generate cash depends on many factors, including those beyond our control, and we may not be able to generate cash required to service our debt and sustain our operations.

- Our substantial debt could adversely affect our financial health and operating flexibility.

The ordering of the risk factors set forth above is not intended to reflect our indication of priority or likelihood. Additionally, many of these risks and uncertainties are currently, and in the future may continue to be, amplified by our substantial debt balance incurred during the pause of our guest cruise operations. There may be additional risks that we consider immaterial or which are unknown.

Forward-looking statements should not be relied upon as a prediction of actual results. Subject to any continuing obligations under applicable law or any relevant stock exchange rules, we expressly disclaim any obligation to disseminate, after the date of this document, any updates or revisions to any such forward-looking statements to reflect any change in expectations or events, conditions or circumstances on which any such statements are based.

Forward-looking and other statements in this document may also address our sustainability progress, plans, and goals (including climate change and environmental-related matters). In addition, historical, current, and forward-looking sustainability- and climate-related statements may be based on standards and tools for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions and predictions that are subject to change in the future and may not be generally shared.

|

CARNIVAL CORPORATION & PLC CONSOLIDATED STATEMENTS OF INCOME (LOSS) (UNAUDITED) (in millions, except per share data) |

|||||||

|

Three Months Ended |

Nine Months Ended August 31, |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Revenues |

|||||||

|

Passenger ticket |

$ 5,239 |

$ 4,546 |

$ 12,609 |

$ 10,557 |

|||

|

Onboard and other |

2,657 |

2,308 |

6,474 |

5,640 |

|||

|

7,896 |

6,854 |

19,083 |

16,197 |

||||

|

Operating Expenses |

|||||||

|

Commissions, transportation and other |

958 |

823 |

2,510 |

2,097 |

|||

|

Onboard and other |

866 |

752 |

2,043 |

1,785 |

|||

|

Payroll and related |

575 |

585 |

1,812 |

1,768 |

|||

|

Fuel |

515 |

468 |

1,546 |

1,492 |

|||

|

Food |

393 |

364 |

1,099 |

1,000 |

|||

|

Other operating |

995 |

928 |

2,796 |

2,546 |

|||

|

Cruise and tour operating expenses |

4,303 |

3,921 |

11,805 |

10,688 |

|||

|

Selling and administrative |

763 |

713 |

2,366 |

2,162 |

|||

|

Depreciation and amortization |

651 |

596 |

1,898 |

1,774 |

|||

|

5,718 |

5,230 |

16,070 |

14,624 |

||||

|

Operating Income (Loss) |

2,178 |

1,624 |

3,013 |

1,572 |

|||

|

Nonoperating Income (Expense) |

|||||||

|

Interest income |

19 |

59 |

77 |

183 |

|||

|

Interest expense, net of capitalized interest |

(431) |

(518) |

(1,352) |

(1,600) |

|||

|

Debt extinguishment and modification costs |

(13) |

(81) |

(78) |

(112) |

|||

|

Other income (expense), net |

(10) |

(19) |

(35) |

(67) |

|||

|

(435) |

(559) |

(1,388) |

(1,595) |

||||

|

Income (Loss) Before Income Taxes |

1,743 |

1,065 |

1,626 |

(23) |

|||

|

Income Tax Benefit (Expense), Net |

(8) |

9 |

(13) |

(3) |

|||

|

Net Income (Loss) |

$ 1,735 |

$ 1,074 |

$ 1,613 |

$ (26) |

|||

|

Earnings Per Share |

|||||||

|

Basic |

$ 1.37 |

$ 0.85 |

$ 1.27 |

$ (0.02) |

|||

|

Diluted |

$ 1.26 |

$ 0.79 |

$ 1.21 |

$ (0.02) |

|||

|

Weighted-Average Shares Outstanding – Basic |

1,267 |

1,263 |

1,266 |

1,262 |

|||

|

Weighted-Average Shares Outstanding – Diluted |

1,399 |

1,396 |

1,398 |

1,262 |

|||

|

CARNIVAL CORPORATION & PLC CONSOLIDATED BALANCE SHEETS (UNAUDITED) (in millions, except par values) |

|||

|

August 31, |

November 30, |

||

|

ASSETS |

|||

|

Current Assets |

|||

|

Cash and cash equivalents |

$ 1,522 |

$ 2,415 |

|

|

Trade and other receivables, net |

632 |

556 |

|

|

Inventories |

492 |

528 |

|

|

Prepaid expenses and other |

980 |

1,767 |

|

|

Total current assets |

3,626 |

5,266 |

|

|

Property and Equipment, Net |

42,380 |

40,116 |

|

|

Operating Lease Right-of-Use Assets, Net |

1,383 |

1,265 |

|

|

Goodwill |

579 |

579 |

|

|

Other Intangibles |

1,173 |

1,169 |

|

|

Other Assets |

665 |

725 |

|

|

$ 49,805 |

$ 49,120 |

||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|||

|

Current Liabilities |

|||

|

Current portion of long-term debt |

$ 2,214 |

$ 2,089 |

|

|

Current portion of operating lease liabilities |

159 |

149 |

|

|

Accounts payable |

1,062 |

1,168 |

|

|

Accrued liabilities and other |

2,393 |

2,003 |

|

|

Customer deposits |

6,436 |

6,072 |

|

|

Total current liabilities |

12,265 |

11,481 |

|

|

Long-Term Debt |

26,642 |

28,483 |

|

|

Long-Term Operating Lease Liabilities |

1,258 |

1,170 |

|

|

Other Long-Term Liabilities |

1,042 |

1,105 |

|

|

Shareholders’ Equity |

|||

|

Carnival Corporation common stock, $0.01 par value; 1,960 shares authorized; 1,253 |

13 |

12 |

|

|

Carnival plc ordinary shares, $1.66 par value; 217 shares issued at 2024 and 2023 |

361 |

361 |

|

|

Additional paid-in capital |

16,723 |

16,712 |

|

|

Retained earnings |

1,798 |

185 |

|

|

Accumulated other comprehensive income (loss) |

(1,894) |

(1,939) |

|

|

Treasury stock, 130 shares at 2024 and 2023 of Carnival Corporation and 73 shares at |

(8,404) |

(8,449) |

|

|

Total shareholders’ equity |

8,597 |

6,882 |

|

|

$ 49,805 |

$ 49,120 |

||

|

CARNIVAL CORPORATION & PLC OTHER INFORMATION |

|||

|

OTHER BALANCE SHEET INFORMATION (in millions) |

August 31, 2024 |

November 30, 2023 |

|

|

Liquidity |

$ 4,519 |

$ 5,392 |

|

|

Debt (current and long-term) |

$ 28,856 |

$ 30,572 |

|

|

Customer deposits (current and long-term) |

$ 6,819 |

$ 6,353 |

|

|

Three Months Ended August 31, |

Nine Months Ended August 31, |

||||||

|

STATISTICAL INFORMATION |

2024 |

2023 |

2024 |

2023 |

|||

|

Passenger cruise days (“PCDs”) (in millions) (a) |

28.1 |

25.8 |

76.0 |

67.8 |

|||

|

ALBDs (in millions) (b) |

25.2 |

23.7 |

71.7 |

68.1 |

|||

|

Occupancy percentage (c) |

112 % |

109 % |

106 % |

100 % |

|||

|

Passengers carried (in millions) |

3.9 |

3.6 |

10.3 |

9.3 |

|||

|

Fuel consumption in metric tons (in millions) |

0.7 |

0.7 |

2.2 |

2.2 |

|||

|

Fuel consumption in metric tons per thousand ALBDs |

29.5 |

31.1 |

31.0 |

32.3 |

|||

|

Fuel cost per metric ton consumed (excluding EUA) |

$ 670 |

$ 636 |

$ 680 |

$ 681 |

|||

|

Currencies (USD to 1) |

|||||||

|

AUD |

$ 0.67 |

$ 0.66 |

$ 0.66 |

$ 0.67 |

|||

|

CAD |

$ 0.73 |

$ 0.75 |

$ 0.74 |

$ 0.74 |

|||

|

EUR |

$ 1.09 |

$ 1.09 |

$ 1.08 |

$ 1.08 |

|||

|

GBP |

$ 1.28 |

$ 1.27 |

$ 1.27 |

$ 1.24 |

|||

|

Notes to Statistical Information |

|

|

(a) |

PCD represents the number of cruise passengers on a voyage multiplied by the number of revenue-producing ship |

|

(b) |

ALBD is a standard measure of passenger capacity for the period that we use to approximate rate and capacity variances, |

|

(c) |

Occupancy, in accordance with cruise industry practice, is calculated using a numerator of PCDs and a denominator of |

|

CARNIVAL CORPORATION & PLC NON-GAAP FINANCIAL MEASURES |

|||||||

|

Three Months Ended |

Nine Months Ended August 31, |

||||||

|

(in millions, except per share data) |

2024 |

2023 |

2024 |

2023 |

|||

|

Net income (loss) |

$ 1,735 |

$ 1,074 |

$ 1,613 |

$ (26) |

|||

|

(Gains) losses on ship sales and impairments |

(6) |

— |

(6) |

(54) |

|||

|

Debt extinguishment and modification costs |

13 |

81 |

78 |

112 |

|||

|

Restructuring expenses |

9 |

1 |

20 |

16 |

|||

|

Other |

— |

20 |

— |

43 |

|||

|

Adjusted net income (loss) |

$ 1,751 |

$ 1,176 |

$ 1,705 |

$ 90 |

|||

|

Interest expense, net of capitalized interest |

431 |

518 |

1,352 |

1,600 |

|||

|

Interest income |

(19) |

(59) |

(77) |

(183) |

|||

|

Income tax benefit (expense), net |

8 |

(9) |

13 |

3 |

|||

|

Depreciation and amortization |

651 |

596 |

1,898 |

1,774 |

|||

|

Adjusted EBITDA |

$ 2,822 |

$ 2,221 |

$ 4,890 |

$ 3,285 |

|||

|

Earnings per share – diluted (a) |

$ 1.26 |

$ 0.79 |

$ 1.21 |

$ (0.02) |

|||

|

Adjusted earnings per share – diluted (a) |

$ 1.27 |

$ 0.86 |

$ 1.27 |

$ 0.07 |

|||

|

Weighted-average shares outstanding – diluted |

1,399 |

1,396 |

1,398 |

1,262 |

|||

|

(a) |

Diluted earnings per share includes the add-back of dilutive interest expense related to the company’s convertible notes |

|

Three Months Ended |

Nine Months Ended August 31, |

||||||

|

(in millions) |

2024 |

2023 |

2024 |

2023 |

|||

|

Cash from (used in) operations |

$ 1,205 |

$ 1,834 |

$ 5,012 |

$ 3,359 |

|||

|

Capital expenditures (Purchases of Property and Equipment) |

(578) |

(837) |

(4,034) |

(2,609) |

|||

|

Proceeds from export credits |

— |

140 |

2,314 |

1,157 |

|||

|

Adjusted free cash flow |

$ 627 |

$ 1,137 |

$ 3,292 |

$ 1,906 |

|||

|

(See Non-GAAP Financial Measures) |

|||||||

CARNIVAL CORPORATION & PLC

NON-GAAP FINANCIAL MEASURES (CONTINUED)

Gross margin per diems and net per diems were computed by dividing the gross margin and adjusted gross margin by PCDs. Gross margin yields and net yields were computed by dividing the gross margin and adjusted gross margin by ALBDs as follows:

|

Three Months Ended August 31, |

Nine Months Ended August 31, |

||||||||||

|

(in millions, except per diems and yields data) |

2024 |

2024 Constant Currency |

2023 |

2024 |

2024 Constant Currency |

2023 |

|||||

|

Total revenues |

$ 7,896 |

$ 6,854 |

$ 19,083 |

$ 16,197 |

|||||||

|

Less: Cruise and tour operating expenses |

(4,303) |

(3,921) |

(11,805) |

(10,688) |

|||||||

|

Depreciation and amortization |

(651) |

(596) |

(1,898) |

(1,774) |

|||||||

|

Gross margin |

2,941 |

2,337 |

5,380 |

3,734 |

|||||||

|

Less: Tour and other revenues |

(181) |

(172) |

(222) |

(216) |

|||||||

|

Add: Payroll and related |

575 |

585 |

1,812 |

1,768 |

|||||||

|

Fuel |

515 |

468 |

1,546 |

1,492 |

|||||||

|

Food |

393 |

364 |

1,099 |

1,000 |

|||||||

|

Ship and other impairments |

— |

— |

— |

— |

|||||||

|

Other operating |

995 |

928 |

2,796 |

2,546 |

|||||||

|

Depreciation and amortization |

651 |

596 |

1,898 |

1,774 |

|||||||

|

Adjusted gross margin |

$ 5,891 |

$ 5,894 |

$ 5,107 |

$ 14,307 |

$ 14,293 |

$ 12,099 |

|||||

|

PCDs |

28.1 |

28.1 |

25.8 |

76.0 |

76.0 |

67.8 |

|||||

|

Gross margin per diems (per PCD) |

$ 104.49 |

$ 90.45 |

$ 70.80 |

$ 55.04 |

|||||||

|

% increase (decrease) |

16 % |

29 % |

|||||||||

|

Net per diems (per PCD) |

$ 209.28 |

$ 209.39 |

$ 197.64 |

$ 188.30 |

$ 188.10 |

$ 178.36 |

|||||

|

% increase (decrease) |

5.9 % |

5.9 % |

5.6 % |

5.5 % |

|||||||

|

ALBDs |

25.2 |

25.2 |

23.7 |

71.7 |

71.7 |

68.1 |

|||||

|

Gross margin yields (per ALBD) |

$ 116.77 |

$ 98.50 |

$ 75.05 |

$ 54.85 |

|||||||

|