1 Growth Stock Down 85% to Buy Right Now

Investors are likely still trying to make sense of Roku (NASDAQ: ROKU) stock. The pandemic darling crashed during the 2022 bear market and never recovered, leaving it trading about 85% below the all-time high it set in July 2021.

However, despite the stock’s struggles, the user base and hours spent on the platform have never stopped growing. That and other factors could serve as the catalyst that finally brings about a recovery in the entertainment stock.

The state of Roku

Indeed, some of the user numbers may leave investors wondering why the stock has never recovered. In the second quarter of 2024, almost 84 million streaming households were actively using a Roku device, a 14% yearly increase. Moreover, the 30 billion streaming hours meant usage was up 20%, indicating that users spent more time on Roku’s platform.

Additionally, Roku remains the most popular TV operating system in the U.S., Canada, and Mexico. Roku unit sales are also higher than those of the company’s next two peers combined. Such signs should be bullish for the stock.

The frustration among Roku shareholders probably lies in the average revenue per user (ARPU) numbers. Despite higher usage by more people, ARPU over the trailing 12 months stood at $40.68, marking virtually no change from year-ago levels.

Roku has explained this by elaborating on its moves into international markets. In many of these places, monetization is in its early stages, meaning the added subscribers are not yet generating significant revenue for Roku.

Roku is trying to counteract this through advertising. The company said ad revenue growth outpaced the overall ad market when excluding media and entertainment. Also, Roku touted its partnership with The Trade Desk, which allows advertisers to better interpret and optimize ad campaigns based on Roku’s data.

Nonetheless, such improvements do not seem to have worked fast enough for Roku’s investors. With the stock up only 10% over the last year, investors may rightly wonder when this anticipated recovery will finally happen.

Roku’s financial results

Still, Roku’s overall financials have improved despite its struggles. Revenue in the first half of 2024 was $1.85 billion, a 16% increase compared to the same period in 2023. The fastest growth came from device revenue at 29%, but platform revenue, which is most of the company’s revenue, still rose by 15%.

Moreover, Roku managed to cut its operating expenses by 9%. This significantly reduced losses, which fell to $85 million for the first two quarters of 2024, a massive improvement from the $301 million loss in the same period last year.

Also, free cash flow was nearly $69 million, showing that the obstacle to profitability was its $183 million in stock-based compensation expenses.

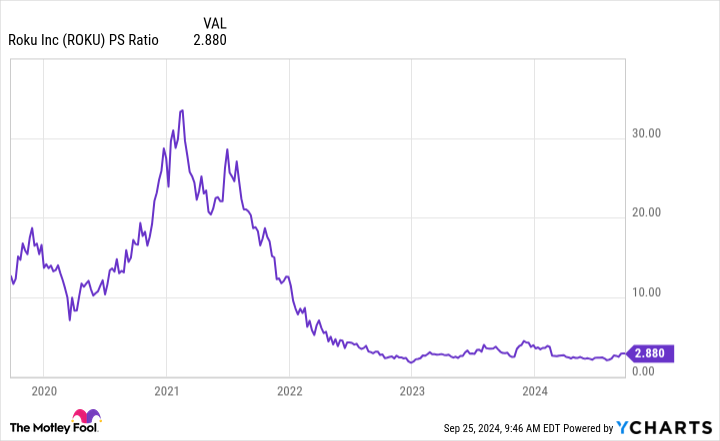

Such challenges have made Roku an inexpensive stock. Although its losses mean shares have no P/E ratio, the price-to-sales (P/S) ratio remains under 3. This is far below the sales multiple at the peak of the 2021 bull market when Roku briefly sold above 30 times sales.

Although shareholders should not expect a return to that valuation, it shows how much Roku could rise if it wins back the confidence of investors.

Consider Roku stock

Ultimately, despite the massive drop in Roku stock and the years of stagnation, a sustained stock recovery could finally come soon.

Roku continues to attract more users who spend more time on its platform. It also continues to build the relationships that should grow revenue as Roku better monetizes its ad platform both in the U.S. and internationally. Admittedly, the lack of growth in ARPU and the ongoing losses remain a frustration. However, as the company builds monetization efforts in international markets, its ARPU should rise over time.

Additionally, Roku’s rising popularity has increased revenue. With continued improvements, the company could become profitable soon, giving investors all the more reason to start believing in Roku stock again.

Should you invest $1,000 in Roku right now?

Before you buy stock in Roku, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Roku wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Will Healy has positions in Roku and The Trade Desk. The Motley Fool has positions in and recommends Roku and The Trade Desk. The Motley Fool has a disclosure policy.

1 Growth Stock Down 85% to Buy Right Now was originally published by The Motley Fool

Leave a Reply