1 Incredible Growth Stock to Buy Before It Climbs 58% Over the Next 12 Months, According to Wall Street Analysts

Finding a stock that can increase in value more than 50% in a single year doesn’t come easy. What’s more, just because a stock has the potential to grow quickly doesn’t mean it will. Any number of factors could influence the future stock price for a company: not just the company’s financial results, but ongoing market sentiment, not to mention the outlook for the economy as a whole.

But one candidate has already proven it can consistently produce market-beating results, and it looks well positioned to do so again. Celsius Holdings (NASDAQ: CELH) has seen its stock beaten down over the last few months, as its financial outlook has scared off investors in the growth stock. But the current dip could be a great opportunity for investors willing to take on the risk.

The average analyst on Wall Street currently has a price target of $49.40 per share. That’s nearly 60% above the current stock price. Here’s why analysts are so energized around Celsius.

What’s causing the big stock slump?

Celsius has seen incredible growth over the last few years, establishing itself as the third-biggest energy drink company by market share after Monster Beverage and Red Bull. It climbed from 3.6% market share in the United States at the start of 2022 to 11.5% last quarter.

But there are some signs that the growth is at least taking a pause this year. Management noted a drop in market share in the early part of the third quarter. Earlier this year, they noted a drag on revenue growth due to its distribution partner, PepsiCo, adjusting its inventory levels.

CEO John Fieldly said Pepsi ordered $100 million to $120 million less this quarter than it did in the third quarter last year. That’s a huge bite out of Celsius’ $400 million in quarterly sales, which means the company could be in line for its first year-over-year sales decline since 2018.

Slowing sales are a concern for any company, but when it’s such a sudden shift, it can throw a stock’s momentum into reverse very quickly. That’s exactly what happened to Celsius. As concerns over the Pepsi inventory channel started to appear, investors started selling off shares. That resulted in shares falling from a high of around $98 in May to just $31 today.

But the sell-off may be overblown, as Celsius is still showing considerable strength in the end market and has a lot of potential growth ahead of it.

Why analysts remain bullish

It’s important to remember Celsius’ distribution deal with Pepsi is still fresh. It started in 2022, with 2023 being the first full year. That added a big buyer for Celsius, and it helped the company expand distribution much more quickly than it could on its own. Pepsi gives Celsius access to the valuable foodservice channel, which contributed about 12% of sales in North America.

Celsius has also been able to introduce new flavors and get them on store shelves quickly. It expanded from 12.5 products per store in 2022 to 20 per store today. The rapid expansion of its product line likely led to a strong growth in inventory for Pepsi. But with lower growth in Celsius’ shelf space, Pepsi is better able to right-size inventory needs.

Investors should expect the drop in sales to Pepsi to be a one-time event this year. If you look at other sales channels, Celsius is doing well. Sales on Amazon, for example, grew 41% year over year last quarter.

Management also plans to step up marketing and promotions in the back half of the year to reinvigorate sales. It saw its gross margin expand to 51.6% in the first half of the year, up five percentage points from last year. That’s due to supply chain efficiency as it scales. Management intends to reinvest those gross profits to scale further, which should boost the top line (although investors will see weaker gross margin).

Lastly, there’s a big international opportunity. Just 5% of Celsius’ sales come from outside the United States. By comparison, 39% of Monster’s sales come from international markets. Celsius’ international expansion is just getting started with a handful of countries this year, but it could eventually become a significant part of its business, especially with the help of Pepsi’s distribution.

Despite the drop in share price over the last few months, Celsius’ stock still isn’t cheap by any valuation standard. It currently trades for a forward earnings multiple of about 31. But the current challenges facing the business appear to be temporary, and it should resume its strong growth of the last few years as Pepsi adjusts its inventory.

The return to form could send the share price rocketing higher. And while it might not return to the levels it was trading at just a few months ago, it could produce well above average returns. For risk-tolerant growth stock investors, it may be worth adding shares at the current price.

Should you invest $1,000 in Celsius right now?

Before you buy stock in Celsius, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Celsius wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Levy has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Celsius, and Monster Beverage. The Motley Fool has a disclosure policy.

1 Incredible Growth Stock to Buy Before It Climbs 58% Over the Next 12 Months, According to Wall Street Analysts was originally published by The Motley Fool

Chinese Stocks Soar Most Since 2015, Heading for Bull Market

(Bloomberg) — Chinese stocks extended one of their most remarkable turnarounds in history, soaring for a ninth straight day as government stimulus entices investors back to one of the most beaten-down markets worldwide.

Most Read from Bloomberg

The CSI 300 Index jumped as much as 6.5% on Monday, the most since 2015, as traders rushed to buy shares in the last session before a week-long holiday. The index, which lost more than 45% of its value from a 2021 high through mid-September, has since soared more than 20% — heading for a technical bull market. Its rally last week was the biggest since 2008.

The extended gains came after three of China’s largest cities relaxed rules for homebuyers, while the central bank also moved to lower mortgage rates. The latest measures were among the key elements of a sweeping stimulus package released Tuesday that also included interest rate cuts, freeing-up of cash for banks, as well as liquidity support for stocks.

Having faced several false dawns in recent years, investors may be betting that the current momentum may be sustainable. In a sign of continued frenzy, combined turnover on both the Shanghai and Shenzhen bourses exceeded 1.6 trillion yuan ($228 billion) in the morning session, exceeding the total value of shares that changed hands Friday.

“The pace of the turnaround is clearly reflective of how oversold the market was,” said Charu Chanana, global markets strategist at Saxo Markets. “There is a clear belief that this time is different when it comes to authorities’ support for the markets.”

Demand for Chinese stocks was so strong on Monday that several local brokerages experienced delays in processing orders on their trading applications, local media reported, with some securities firms also seeing a surge in requests to open new trading accounts.

The latest hiccups came after a burst of trading led to glitches that overwhelmed the Shanghai stock exchange on Friday.

“Everyone has been such a bear and now they are all scrambling,” said Andy Maynard, head of equities at China Renaissance Securities HK Ltd. “Last week was the busiest times for China and Hong Kong I’ve seen in a long while.”

Brokerages were among the top gainers, with Citic Securities Co. hitting the 10% daily upside limit. Almost all of CSI 300’s component stocks were in the green. A Bloomberg Intelligence gauge of Chinese property developers jumped as much as 14%.

Renewed optimism about the world’s second-largest stock market is also spreading globally, with hedge funds selling US technology stocks and piling into mining and materials firms. Meanwhile, iron ore spiked almost 11% as investors bet that China’s efforts to ease property woes will improve demand from the world’s top consumer of the steel-making ingredient.

As investors pivoted toward risk assets, the country’s ten-year sovereign bonds fell Monday, extending their biggest weekly drop in a decade.

The Fear and Greed Indicator of the Shanghai Composite Index, which measures the buying and selling momentum for the stock benchmark popular among China’s retail investors, rose to the highest since 2020 on Monday.

“I think the euphoric surge that we saw last week in China markets could turn into something more concrete and sustainable because there appears to be a complete policy shift that could finally address the cyclical headwinds of the past 3 years,” said David Chao, a strategist at Invesco Asset Management. “While there may still be debate over how these policy shifts are implemented and whether enough has been done, I think a new direction has been charted.”

–With assistance from Winnie Hsu and John Cheng.

(Updates with chart, price moves and fresh quotes)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Fed's rate cut could catapult mid-cap stocks over the S&P 500 as the top trade, strategists say

Goldilocks might be onto something.

Over the past week, investors were busy figuring out the best way to play the Federal Reserve’s decision to lower interest rates for the first time since 2020.

I asked a number of strategists which stocks stand to benefit the most going forward. Surprisingly, it’s not large or small caps — the two trades that have dominated market headlines in recent months. Rather, mid-cap stocks, an often forgotten trade, may be best positioned for a breakout.

“Historically, midcaps really start to outperform once the Fed actually starts cutting rates,” Carson Group’s Ryan Detrick told me.

Detrick sees small and mid caps surging up to 20% in the next 12 months, far outperforming large-cap peers. The Russell 2000 (^RUT) — the small-cap index— has soared 10% since the end of June, compared to the S&P 500’s (^GSPC) 4.7% rise.

Recent analysis by Goldman Sachs found that mid caps typically outperform large and small cap stocks in the 12 months following the first rate cut. As confidence for a soft landing grows, investors are becoming more comfortable reaching for options outside of the biggest companies.

“The start of the Fed rate cutting cycle is a potential source of incremental equity demand and boost to investor risk sentiment,” Goldman Sachs’s Jenny Ma wrote in a note to clients earlier this month. “In the short term, mid-cap performance relative to other segments will hinge on the strength of economic growth data and the pace of the Fed’s easing cycle.”

The team sees low valuations and resilient economic growth as catalysts for future gains and expects a 13% return for the S&P 400 (^SP400) index over the next 12 months.

“This is a sentiment-driven market rotation based on soft landing hopes, benefiting the riskiest areas of the market, as the earnings backdrop is on another planet,” John Hancock investment management co-chief investment strategist Emily Roland told me.

Mid caps are the “best hedge” for the near-term, per Bank of America’s Jill Carey Hall.

“Mid caps have seen better recent guidance and revision trends, have outperformed small caps on average in Downturn regimes… and serve as a hedge against fewer-than-expected Fed cuts, given small caps’ rate sensitivity/ refinancing risk,” Hall wrote in a note to clients

Investors have priced in roughly 75 basis points of cuts before the end of the year, and see the policy rate falling to the 3.00% to 3.25% range by mid 2025, exceeding the Fed’s own projections.

Remember though, this isn’t new for Wall Street, which started the year pricing in roughly six interest rate cuts for 2024.

Risk of a slower Fed rate-cutting cycle and lingering recession fears are key factors behind the recent shift from favoring small-cap stocks to mid caps, as small caps tend to have weaker balance sheets and are less profitable.

Annex Wealth Management chief economist Brian Jacobsen told me the small-cap trade may “get challenging before it gets more compelling,” and a “fear about slower growth will likely outweigh the benefits of lower borrowing costs.”

Citi’s Stuart Kaiser is also cautious on the trade, telling me investors should approach the group “very carefully.”

“Even if you get a soft landing, our view is you’re still going to get batches of data that look worse than that, and when the data comes in looking worse than that, the market’s going to trade a hard landing like it did in early August,” Kaiser warned. “Small caps are going to be the eye of the storm on that.”

While the Street remains skeptical on small caps, I wouldn’t rush to dismiss the group entirely. Goldman’s David Kostin wrote in a note to clients this week that a positive jobs report could further increase investor appetite for risk.

“A positive jobs print could prompt some investors to rotate out of expensive ‘quality’ stocks into less -loved lower quality firms as the market would likely price lower odds of substantial labor market weakening,” Kostin wrote.

Seana Smith is an anchor at Yahoo Finance. Follow Smith on Twitter @SeanaNSmith. Tips on deals, mergers, activist situations, or anything else? Email seanasmith@yahooinc.com.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

Nayib Bukele's El Salvador Is Mainstreaming Bitcoin By Putting The Price Where Everyone Can See It: 'Over The Next Year They'll All Watch…'

Bitcoin BTC/USD advocate Jamie Robinson recently drew attention to digital displays exhibiting the price of the leading cryptocurrency in El Salvador, a sight visible to thousands of commuters daily.

What Happened: On Saturday, Robinson took to X to highlight Bitcoin’s rising mainstream acceptance in the Central American nation.

“Digital displays with the Bitcoin price now in El Salvador. Tens of thousands drive past this major intersection every day! ” Robinson said. “Over the next year they’ll all watch the price change.”

According to Robinson, the digital displays were placed at the intersection between Av. De La Revolucion and the Alameda Doctor Manuel Enrique Araujo in the capital, Sal Salvador.

Robinson serves as the chief strategy officer of The Bitcoin Hardware Store, which houses hardware wallets, textbooks, and merchandise related to the apex cryptocurrency,

Why It Matters: El Salvador has been making significant strides in integrating Bitcoin into the mainstream ever since adopting it as legal tender in 2021. The country’s ambitious ‘Bitcoin City’ project attracted a $1.6 billion investment from a Turkey-based company, marking the largest private investment in the nation’s history.

In fact, El Salvador’s Ministry of Education has partnered with a non-profit organization to incorporate Bitcoin education into the public school curriculum by 2024.

However, despite these efforts, the adoption of Bitcoin as a legal tender in the country hasn’t seen the expected widespread uptake. President Nayib Bukele admitted recently that the results could have been better, but emphasized that the choice to use Bitcoin was left to the public.

Price Action: At the time of writing, Bitcoin was trading just below $59,176.16, up 1.59% in the last 24 hours, according to data from Benzinga Pro.

Photo Courtesy: Shutterstock.com

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meet Warren Buffett's Top Artificial Intelligence (AI) Stock, Which Has 32% Upside According to Dan Ives

Helping build Berkshire Hathaway into a near-trillion-dollar enterprise and co-founding the Giving Pledge charity are just a couple of things Warren Buffett is known for.

Despite his prolific career, one thing that Buffett is not really known to be is a technology investor. In fact, many of his most famous and lucrative investments came from simple businesses across financial services and consumer goods.

However, Buffett has been a staunch supporter of Apple (NASDAQ: AAPL) for almost a decade. Today, Apple represents Berkshire’s largest position — comprising roughly 30% of its portfolio.

Although Apple stock has posted significant gains since Berkshire’s initial purchase in 2016, some on Wall Street are calling for even further share price appreciation. In particular, Dan Ives of Wedbush Securities has a $300 price target on Apple stock — implying 32% upside as of the market close on Sept. 24.

Let’s explore some catalysts that could fuel Apple stock and assess if there is a good opportunity to buy the stock now.

Positive macro indicators

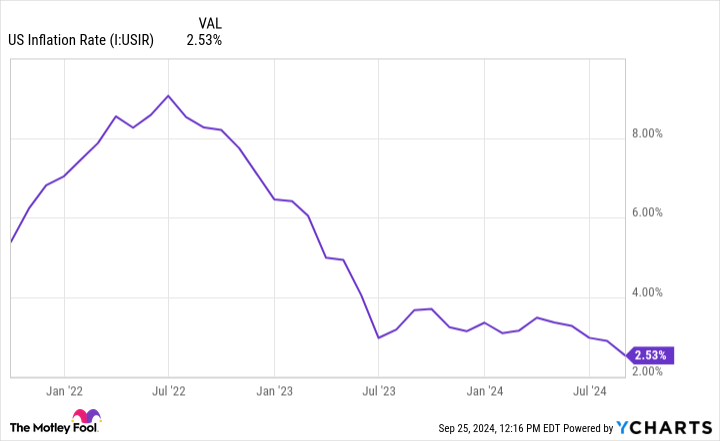

For the last couple of years, high inflation and rising interest rates have daunted the macroeconomy in the U.S. Moreover, as a global enterprise, Apple has also not been immune to some of the factors slowing down other major geographic regions such as China.

In turn, consumers and businesses have tightened budgets and spending habits have changed. People have been more cost-conscious over the last couple of years, opting to forgo expensive new iPhones or MacBooks.

However, as inflation levels show signs of decelerating and interest rate tapering from the Federal Reserve begins, consumer purchasing power should start to strengthen.

Did someone say artificial intelligence?

For the last few years, several megacap technology companies have made big splashes in the artificial intelligence (AI) arena. Apple has not been one of these companies.

However, during a recent segment on CNBC, Dan Ives proclaimed that Apple is about to enter a “renaissance.” I agree.

For starters, Apple’s new iPhone 16 hit the shelves last week. As I alluded to above, a lot of users in the Apple ecosystem have not been upgrading their devices over the last couple of years. But with signs of economic improvement on the horizon, I think Apple is set to recognize some deferred demand in its new hardware.

Furthermore, I think Apple’s recent collaboration with OpenAI will bring two additional catalysts to the company.

First, integrating OpenAI’s capabilities into its products has helped spur the creation of Apple Intelligence. As the company begins to roll out new AI-powered services, I think consumers will be inspired to upgrade and purchase Apple’s new line of products.

Moreover, Ives is predicting that the relationship with OpenAI will be just the first in a series of AI-inspired partnerships for Apple. In particular, Ives is calling for a deal between Apple and Baidu. Baidu can be thought of as the Google-equivalent in China. Such a deal could help reignite demand for Apple products overseas, particularly in China.

Whether or not a specific deal with Baidu comes to fruition is less important to me. At a higher level, I am aligned with Ives’ thinking that OpenAI will be just one in a series of partnerships that Apple strikes as it finally begins penetrating the AI market.

All of these factors could create a tailwind for Apple, which Ives calls a “supercycle.” In my eyes, Apple’s entrance into the AI realm could represent a pivotal growth arc for the company.

Should you buy Apple stock right now?

One drawback with Apple stock is that it is pricey at the moment. Right now, Apple’s forward price-to-earnings (P/E) ratio of 33.7 sits at a significant premium to the S&P 500‘s forward P/E of 22.9.

Furthermore, forward P/E trends for the S&P 500 have been normalizing for some time. By contrast, Apple has been experiencing notable valuation expansion.

I bring all of this up because investors should understand that Apple stock has become more expensive, despite its delayed entrance into the technology industry’s newest frontier: AI. There is a fair argument to be made that some of the AI-driven growth is already baked into Apple’s share price.

Despite this narrative, I think the company’s growth from the new iPhone and from Apple Intelligence more broadly is too tough to call one way or the other right now. For these reasons, I would not underestimate Apple’s ability to command reignited growth thanks to a resilient and restored consumer.

In the long run, I still see Apple as a compelling opportunity and think shares are worth a close look right now.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 773% — a market-crushing outperformance compared to 168% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Apple made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of September 23, 2024

Adam Spatacco has positions in Apple. The Motley Fool has positions in and recommends Apple, Baidu, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Meet Warren Buffett’s Top Artificial Intelligence (AI) Stock, Which Has 32% Upside According to Dan Ives was originally published by The Motley Fool

Here's the Best-Performing S&P 500 Stock of 2024 (Hint: It's Not Nvidia)

Power utilities aren’t always seen as the most exciting way to invest, but investors might need to rethink that opinion, because the top-performing S&P 500 index stock of the year is retail electricity and power generation utility Vistra (NYSE: VST), up a whopping 210% this year. That beats Nvidia‘s (NASDAQ: NVDA) 155% increase. The two events are not unconnected. Here’s why and how Vistra stock has performed so well this year.

Data centers, electricity demand, and clean energy

It’s no secret that the burgeoning demand for artificial intelligence (AI) applications is the reason for the step change in expectations for data center demand. That’s what’s fueling increased demand for graphics processing units (GPUs) and high-performance computing chips. That’s great news for technology companies like Nvidia and Taiwan Semiconductor Manufacturing.

While the latter are apparent beneficiaries, there are also data center equipment companies like Vertiv Holdings. If you are looking for a value play on the theme, then the heating, ventilation, air conditioning, and refrigeration sector, particularly Johnson Controls, is worth looking at.

However, I digress. This article’s focal point is the need to power data centers and increased electricity demand. In particular, it is in an environment where policymakers remain committed to the clean energy transition. That’s where companies and utilities like Vistra and Constellation Energy (NASDAQ: CEG) come into play.

Vistra

Vistra is a retail electricity and power generation company. At the end of 2023, it counted 4 million retail customers, and the acquisition of Energy Harbor in March added another 1 million. The Harbor Energy deal also added 4,000 megawatts (MW) of nuclear generation to go along with the 36,702 MW with which Vistra ended 2023, with 2,400 MW from nuclear.

As such, the deal made Vistra “the largest competitive power generator in the country” and made it the second-largest competitive nuclear generator in the U.S. Investors are falling in love with nuclear energy as a clean, sustainable, and zero-carbon baseload option. That’s particularly relevant as coal-powered plants are being closed down in accordance with the clean energy transition.

The clean energy transition

While nobody doubts that the transition will take place, it’s also indisputable that sentiment over the pace of the transition has changed, too. The long-term policy outlook remains favorable to renewable energy; natural gas will likely be a significant part of energy generation for decades.

That’s also good news for Vistra, because about 24,000 MW of its current 41,000 MW capacity comes from natural gas. As such, the rise in the stock price this year also reflects a more favorable view of natural gas and a vote of confidence in Vistra’s 6,400 MW nuclear capability.

Enter Amazon and Microsoft

The three biggest cloud service providers are Amazon Web Services, Microsoft‘s Azure, and Alphabet‘s Google Cloud, and they need to ensure long-term power to support their data centers. As such, Microsoft and Amazon completed long-term power purchase agreements (PPA) with Vistra this year.

Still, it’s the 20-year PPA that Microsoft recently signed with Constellation Energy that has excited the market. Microsoft is purchasing power for its data centers, and Constellation will restart the Three Mile Island nuclear plant to deliver on the agreement. That’s a positive for the market, and so is the price that Microsoft is willing to pay for the power.

According to Reuters, Microsoft is paying up to $115 per megawatt-hour (MWh) in the agreement. That compares favorably with Vistra’s total realized price of $51.20 MWh in the second quarter of 2024.

A stock to buy

The bull case for Vistra rests on the idea that there’s significant upside potential for future market pricing for nuclear-powered energy, given the Microsoft/Constellation deal and burgeoning demand stimulated by AI. Vistra’s acquisition of Energy Harbor strengthened that case. In addition, Vistra recently announced it was buying the remaining 15% of its Vistra Vision subsidiary (which houses its zero-carbon nuclear, energy storage, and solar generation businesses) for $3.085 billion.

Vistra’s natural gas, nuclear, and renewable capabilities are positive assets for the clean energy transition. Considering these factors, it’s no surprise that the sector is hot. Adding falling interest rates (utilities are often seen as interest rate sensitive due to their debt loads) is a recipe for sharp price appreciation.

Should you invest $1,000 in Vistra right now?

Before you buy stock in Vistra, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vistra wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Constellation Energy, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Johnson Controls International and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Here’s the Best-Performing S&P 500 Stock of 2024 (Hint: It’s Not Nvidia) was originally published by The Motley Fool

FTX Token Stuns Market With 60% Gains — What's Going On With Crypto Of The Bankrupt Exchange Founded By Sam Bankman-Fried?

The cryptocurrency belonging to the defunct cryptocurrency exchange FTX FTT/USD dramatically jumped on Sunday, dwarfing the gains made by the rest of the market.

What happened: FTT exploded more than 60% over the last 24 hours, turning out to be the market’s biggest gainer by a mile. The coin’s trading volume lifted an eye-popping 3734%, with the buying pressure catapulting it to values not seen since mid-March.

The rally defied the broader market that saw the total market capitalization contract by 1.89% in the last 24 hours.

FTT’s massive spike was unusual, given that the coin doesn’t have any use as of this writing. It lost more than 90% of its market value after FTX’s fraudulent activities were unearthed, leading to the exchange’s bankruptcy in the fall of 2022.

FTX’s disgraced founder Sam Bankman-Fried was sentenced to 25 years in prison earlier in March for his role in the sensational fraud case.

See Also: Maxine Waters Says ‘Crypto Is Inevitable,’ Other Countries Are ‘Way Ahead’ Of The United States

Why It Matters: FTT’s odd jump coincided with rumors that FTX would begin repaying fraud victims on Sept. 30.

However, these were categorically debunked by FTX creditor activist Sunil Kavuri, who said that the next court hearing for the restructuring plan was on Oct. 7.

Should the plan get a green signal, creditors with claims below $50,000 may see distributions by the end of 2024. Those with larger claims may have to wait until the first or second quarter of 2025, Kavuri said.

Price Action: At the time of writing, FTT was exchanging hands at $2.31, up 61% in the last 24 hours, according to data from Benzinga Pro.

Photo by Sergei Elagin on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Interest Rates (and Leaves) Are Falling, but Here Are 3 Dividends That Should Continue Rising No Matter What

After months of speculation, the Federal Reserve has finally started cutting interest rates. Furthermore, the Fed has indicated that it will continue to reduce rates.

Falling rates have vast implications. You might have already noticed that your bank lowered the interest rate on your savings account or that the rates on CDs and U.S. Treasuries aren’t quite as attractive as they once were.

However, while rates on some investments are falling like the autumn leaves, many dividend stocks expect to continue increasing their payouts. Enbridge (NYSE: ENB), Kinder Morgan (NYSE: KMI), and NextEra Energy (NYSE: NEE) stand out to a few Fool.com contributors for their ability to increase their dividends despite changing market conditions. That makes them ideal for those who want to receive more income in the future.

Enbridge isn’t sitting still

Reuben Gregg Brewer (Enbridge): The big draw for most investors with midstream giant Enbridge will probably be the company’s sizable 6.6% dividend yield. That’s reasonable, noting that the dividend has been increased annually (in Canadian dollars) for 29 consecutive years. But Enbridge offers so much more than just a dividend.

A key part of the company’s approach is to adjust its portfolio along with the changes taking shape in global energy demand. That’s why the company’s portfolio includes oil pipelines, natural gas pipelines, natural gas utilities, and renewable power investments. Natural gas is expected to be a key transition fuel as the world shifts toward cleaner alternatives, and renewable power is the direction in which the world is heading. But oil is still important, which is allowing Enbridge to use its oil tied profits to increase its natural gas exposure and build things such as wind and solar farms.

The most recent transaction, buying three natural gas utilities from Dominion Energy, is a great example of the goal. Before the deal Enbridge generated 57% of earnings before interest, taxes, depreciation, and amortization (EBITDA) from oil. After the deal that will be down to 50%. As an added bonus, the regulated natural gas utilities have highly reliable, though slow, growth opportunities ahead of them. These businesses, which expanded natural gas utilities from 12% of EBITDA to 22%, help to solidify Enbridge’s ability to reach its long-term target of 5% distributable cash flow growth.

Enbridge looks boring, but a high yield backed by a slow and steady business becomes very exciting over time. Particularly when the company is purposefully adjusting to the changing dynamics in the market it serves.

The fuel to continue rising

Matt DiLallo (Kinder Morgan): Interest rates have acted as a headwind for Kinder Morgan in recent years. For example, the company noted in late 2022 that its distributable cash flow would see a $0.15-per-share hit in 2023 because of the impact of higher interest rates. That’s because a quarter of its debt has a floating rate, meaning the interest expenses on this debt rise and fall with rates.

Despite that headwind, Kinder Morgan has continued to increase its high-yielding dividend, which currently sits at more than 5%. It delivered its seventh consecutive annual dividend increase earlier this year.

With interest rates falling, they’ll shift from a headwind to a tailwind for Kinder Morgan. The interest expenses on the company’s floating rate debt should fall over the next year, which will save it money. Meanwhile, lower rates will make it cheaper to refinance maturing debt and to issue new debt to fund acquisitions as attractive opportunities arise.

Rates aren’t the company’s only tailwind. It’s capitalizing on growing demand for natural gas to supply liquified natural gas export facilities and utilities, with the latter positioning for a surge in electricity demand from AI data centers. Kinder Morgan has already lined up $5.2 billion of expansion projects to support this growing demand. That includes a $1.7 billion pipeline project to supply more gas for utilities in the Southeast that should enter service in late 2028.

Kinder Morgan’s backlog gives it a lot of visibility into its ability to grow its robust and stable cash flows. That rising cash flow should give the company plenty of fuel to continue increasing its dividend in the coming years, even if interest rates start rising again.

Plenty of power to continue growing its payout

Neha Chamaria (NextEra Energy): NextEra Energy owns the largest utility in the U.S., Florida Power & Light, and is also the world’s largest producer of wind and solar energy. The company relies heavily on debt to fund growth in its utility and renewable energy businesses, so falling interest rates should be good news for NextEra Energy shareholders in more ways than one, including dividends.

NextEra Energy has a strong dividend track record. Between 2003 and 2023, it grew its dividend by a compound annual growth rate (CAGR) of 10%, backed by around 9% CAGR in its adjusted earnings per share (EPS). That dividend growth has generated significant returns for shareholders who reinvested the dividends over the decades, and it should continue doing so given NextEra Energy’s goals.

NextEra Energy is targeting 6% to 8% growth in adjusted EPS and 10% average growth in dividend per share through 2026, driven by cash-flow growth for its growth investments in both businesses. For example, the company expects to invest $65 billion to $70 billion in renewables alone over the next four years. Lower interest rates should make growth funding cheaper for NextEra Energy and these investments should drive its cash flows higher and support bigger dividends. In short, this 2.5%-yielding dividend stock should continue to raise its dividend payout year after year.

Should you invest $1,000 in Enbridge right now?

Before you buy stock in Enbridge, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enbridge wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Matt DiLallo has positions in Enbridge, Kinder Morgan, and NextEra Energy. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has positions in Dominion Energy and Enbridge. The Motley Fool has positions in and recommends Enbridge, Kinder Morgan, and NextEra Energy. The Motley Fool recommends Dominion Energy. The Motley Fool has a disclosure policy.

Interest Rates (and Leaves) Are Falling, but Here Are 3 Dividends That Should Continue Rising No Matter What was originally published by The Motley Fool

ROSEN, GLOBAL INVESTOR COUNSEL, Encourages lululemon athletica inc. Investors to Secure Counsel Before Important October 7 Deadline in Securities Class Action – LULU

NEW YORK, Sept. 29, 2024 (GLOBE NEWSWIRE) — WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of lululemon athletica inc. LULU between December 7, 2023 and July 24, 2024, both dates inclusive (the “Class Period”), of the important October 7, 2024 lead plaintiff deadline.

SO WHAT: If you purchased lululemon securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the lululemon class action, go to https://rosenlegal.com/submit-form/?case_id=27808 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than October 7, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, throughout the Class Period, defendants made false and misleading statements and/or failed to disclose that: (1) lululemon was struggling with inventory allocation issues and color palette execution issues; (2) as a result, lululemon’s Breezethrough product launch underperformed; (3) as a result of the foregoing, lululemon was experiencing stagnating sales in the Americas region; and (4) as a result of the foregoing, defendants’ positive statements about lululemon’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the lululemon class action, go to https://rosenlegal.com/submit-form/?case_id=27808 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.