Price Over Earnings Overview: SM Energy

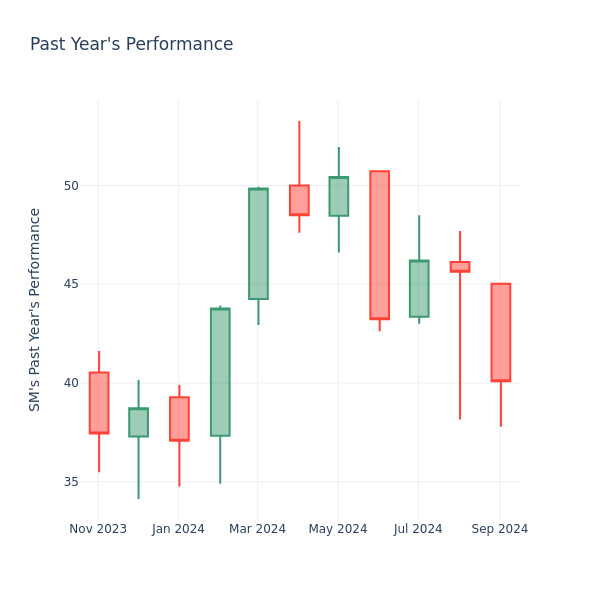

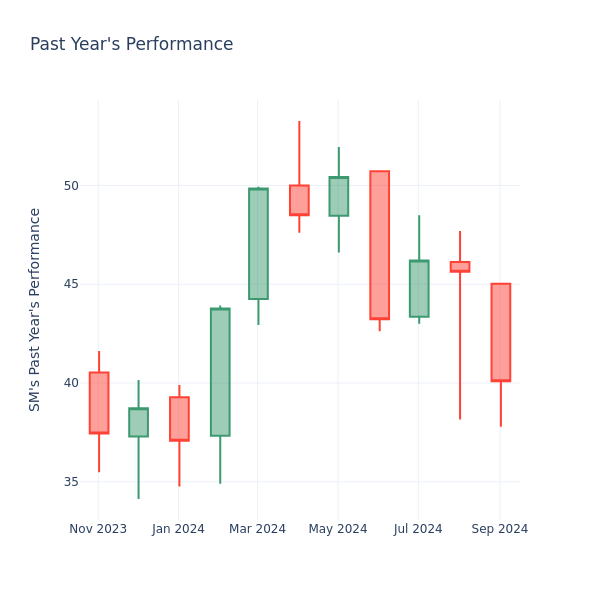

Looking into the current session, SM Energy Inc. SM shares are trading at $39.32, after a 1.23% drop. Over the past month, the stock decreased by 6.55%, but over the past year, it actually went up by 5.22%. With questionable short-term performance like this, and great long-term performance, long-term shareholders might want to start looking into the company’s price-to-earnings ratio.

Comparing SM Energy P/E Against Its Peers

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

SM Energy has a lower P/E than the aggregate P/E of 23.46 of the Oil, Gas & Consumable Fuels industry. Ideally, one might believe that the stock might perform worse than its peers, but it’s also probable that the stock is undervalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company’s market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company’s stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

KE Holdings's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bullish stance on KE Holdings.

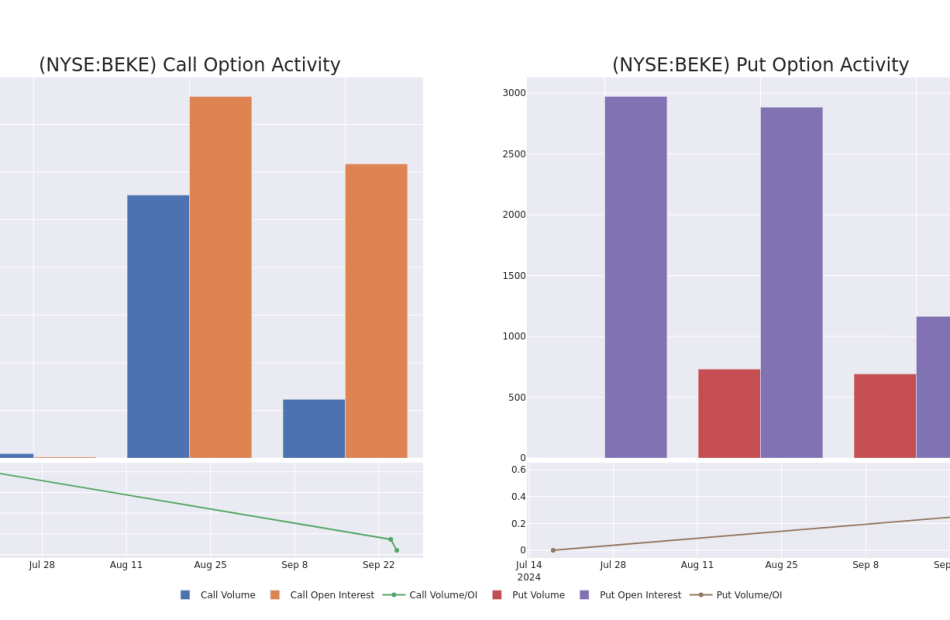

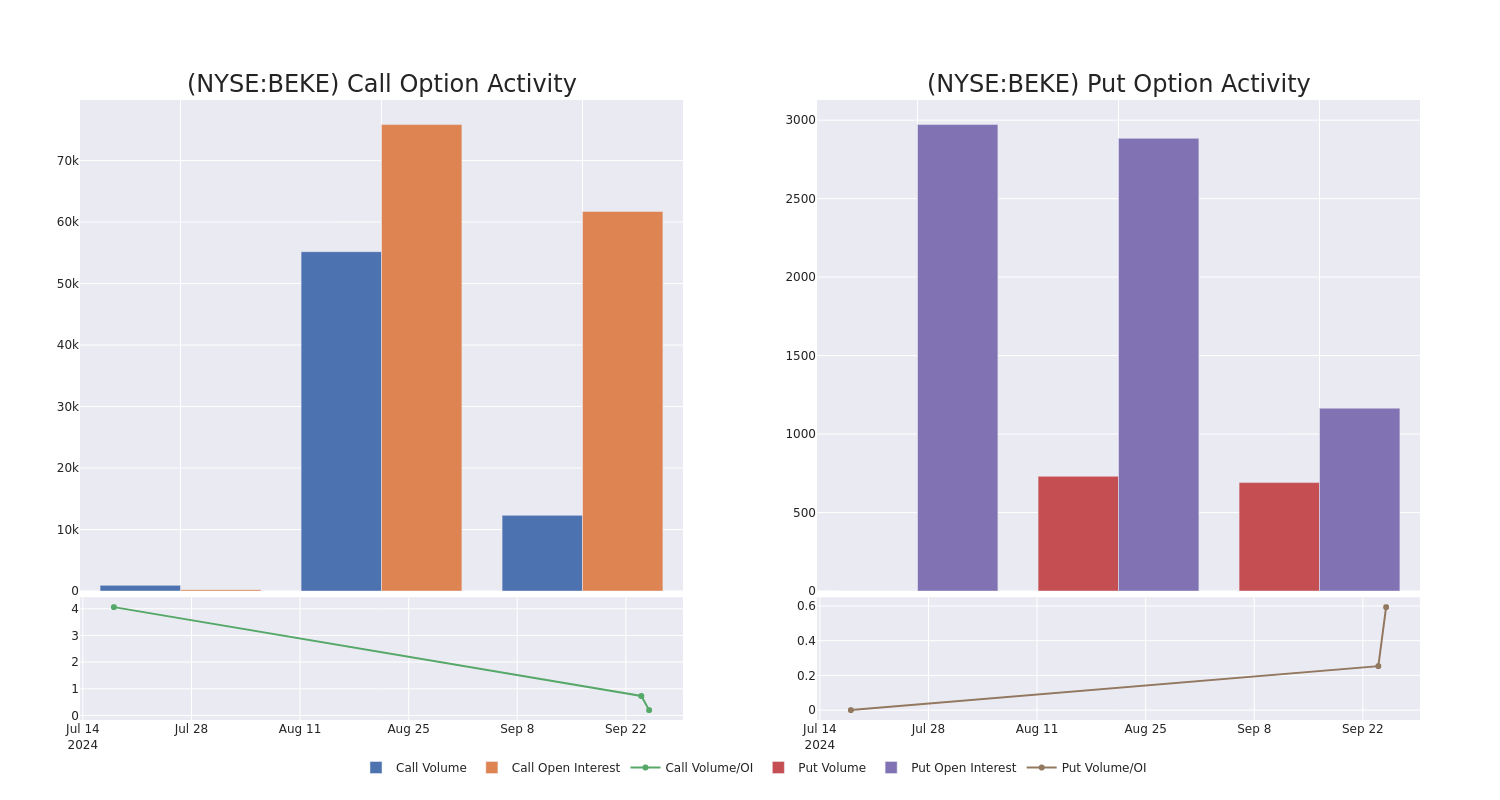

Looking at options history for KE Holdings BEKE we detected 25 trades.

If we consider the specifics of each trade, it is accurate to state that 52% of the investors opened trades with bullish expectations and 44% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $382,960 and 21, calls, for a total amount of $2,926,444.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $15.0 to $31.0 for KE Holdings during the past quarter.

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for KE Holdings’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across KE Holdings’s significant trades, within a strike price range of $15.0 to $31.0, over the past month.

KE Holdings Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BEKE | CALL | TRADE | BEARISH | 01/17/25 | $1.05 | $0.87 | $0.88 | $31.00 | $880.0K | 0 | 10.0K |

| BEKE | CALL | SWEEP | BEARISH | 11/15/24 | $7.8 | $7.6 | $7.6 | $15.00 | $456.0K | 6.5K | 611 |

| BEKE | CALL | TRADE | BULLISH | 10/18/24 | $6.5 | $6.45 | $6.5 | $16.00 | $390.0K | 3.2K | 881 |

| BEKE | PUT | SWEEP | BEARISH | 01/17/25 | $5.1 | $4.9 | $5.1 | $26.00 | $255.0K | 0 | 500 |

| BEKE | CALL | SWEEP | BEARISH | 11/15/24 | $7.75 | $7.6 | $7.61 | $15.00 | $219.7K | 6.5K | 1.6K |

About KE Holdings

KE Holdings, or Beike, is a large residential real estate sales and rental brokerage company in China. Founded in 2001, the company operates through self-owned Lianjia stores in Beijing and Shanghai and connected third-party agencies including franchise brand Deyou in other cities, with commissions charged on existing-home and new-home transactions. Leveraging an online-offline hybrid model, Beike also attract clients through its namesake online marketplace. The company tapped into home renovation services by acquiring Shengdu Home Decoration in 2022. As of the end of 2023, Beike’s cofounders collectively control the company, while Tencent and its affiliates share 8% of voting power.

Where Is KE Holdings Standing Right Now?

- With a volume of 23,266,582, the price of BEKE is up 9.12% at $21.82.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 37 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for KE Holdings with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Amazon Stock Gets Price-Target Hike As 'Favorite Mega Cap'

Amazon.com (AMZN) stock got a price-target hike from an analyst Monday, who cited data reflecting strong consumer spending along with positive signs for the company’s cloud business. Amazon shares were slightly lower early Monday as they work toward a potential flat base buy point.

Truist analyst Youssef Squali upped the firm’s price target on Amazon stock to 265 from 230 and reiterated a buy rating in a note to clients Monday.

“We believe North American revenue is tracking virtually to consensus estimates quarter-to-date (through Sept. 24), reflecting a resilient consumer, sustained growth in ad revenue, faster growth at AWS and higher operating margins year-over-year,” Squali wrote to clients. “This even as the company invests aggressively in AI, AWS, logistics and Project Kuiper.”

↑

X

How To Buy Stocks: IBD’s Four Pillars Of Investing

On the stock market today, Amazon stock is down a half-percent at 187.23 in recent premarket action. The stock has formed a consolidation pattern with a 201.20 buy point, according to MarketSurge.

Closing Out Q3

Monday marks the final day of Amazon’s third quarter. The company is expected to report Q3 earnings late in October. Analysts project, on average, that Amazon’s revenue will rise 9.9% to $157.2 billion, according to FactSet.

Squali said that Truist Card data indicates Amazon’s U.S. revenue is tracking in line with current consensus of $95.4 billion for the third quarter. That gives the analyst confidence that Amazon is on track to meet overall consensus revenue estimates, the note added.

The 265 price target for Amazon stock reflects Truist’s estimates for Amazon’s fiscal year 2025 value, compared to its fiscal year 2024 target of 230.

“Amazon is our favorite mega cap currently as it continues to gain share of global e-commerce and improve its value proposition to both merchants and consumers,” Squali wrote. “It is also one of the best ways to play cloud, AI, digital ads and global logistics.”

Amazon stock fell following its second quarter earnings report in early August, which showed lower-than-expected revenue. The results prompted concern from some investors that a trend of consumers trading down on price will cut into improvements for Amazon’s retail margins.

Truist analysts expect Amazon’s capital expenditures will “remain elevated” as its builds up its AI-related infrastructure. The company’s Project Kuiper satellite internet business could also weigh on Amazon’s North American margins, the Truist report added, as the company scales up satellite launched. But Squali said the effort could pay “dividends over the medium/long term.”

Amazon Stock: Consolidation Buy Point

With its recent action, Amazon stock is working up the right side of a 12-week consolidation pattern. That’s despite a recent three-day downtrend.

MarketSurge has identified a 201.20 buy point on Amazon’s daily chart. That would represent a return to highs the e-commerce giant reached in early July, before the stock slumped.

In a healthy sign, Amazon rebounded above its 200-day and 50-day moving averages in early September. Shares have held above those levels since.

Amazon stock is up more than 20% this year after an 81% rally in 2023.

YOU MAY ALSO LIKE:

Learn How To Time The Market With IBD’s ETF Market Strategy

Amazon Setting Up, Robinhood Makes Bullish Move: Five Stocks Near Buy Points

IBD Live: A New Tool For Daily Stock Market Analysis

Want To Get Quick Profits And Avoid Big Losses? Try SwingTrader

Why Nio Stock Surged Again Monday and Could Keep Rising

Nio (NYSE: NIO) shares are down almost 30% so far this year. But anyone who bought stock in the Chinese electric vehicle (EV) maker more recently has done quite well. Nio shares have soared by more than 65% over the past month.

The stock continued to surge again today as the trading week started. Nio’s U.S.-listed American depositary shares had gained 12.7% as of 10:15 a.m. ET. Some of the recent spike came from China’s latest plan to stimulate its struggling economy. But news that Nio has secured a new capital injection from strategic investors in China has the shares moving today.

Strong orders for Nio’s new mass-market brand

The company announced that three strategic investor partners will invest the equivalent of almost $500 million in Nio China, the company’s main operating unit. Nio will also contribute cash for newly issued shares of Nio China that will bring the total cash injection to nearly $2 billion.

Nio will subsequently hold a more than 88% interest in Nio China while the other existing investors will have nearly 12% ownership. While Nio finished the second quarter with about $5.7 billion in cash on its balance sheet, it is expected to burn about $1 billion per year on average over the next two years as it works to increase production volume and sales.

One big step the company recently took was to launch a new, family oriented, mass-market brand. The Onvo brand’s first model began deliveries last week. The company said its mid-size family L60 SUV has received “an order intake far stronger than anticipated.”

Nio may provide more information on the Onvo brand when it reports its September vehicle delivery results tomorrow morning. Nio has delivered more than 20,000 EVs for four straight months, and investors likely expect that streak to be extended.

Should you invest $1,000 in Nio right now?

Before you buy stock in Nio, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nio wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Howard Smith has positions in Nio. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why Nio Stock Surged Again Monday and Could Keep Rising was originally published by The Motley Fool

Stock market today: S&P, Nasdaq edge higher to start jobs report week as Powell set to speak

US stocks wavered on Monday but were still set for strong monthly and quarterly gains as investors reacted to Federal Reserve Chair Jerome Powell vowing to do what it takes to keep the economy humming, while signaling he won’t rush future rate cuts.

“Overall, the economy is in solid shape; we intend to use our tools to keep it there,” Powell said in a speech before the National Association for Business Economics in Nashville, Tenn. His remarks come days ahead of the the crucial monthly jobs report.

During afternoon trading the S&P 500 (^GSPC) fell 0.5%, while the Nasdaq Composite (^IXIC) lost 0.6%. Meanwhile, the Dow Jones Industrial Average (^DJI) shed 0.8%.

Wall Street indexes were still eyeing a monthly gain heading into the last trading day of September, typically the cruelest month for stocks. The Federal Reserve’s jumbo interest rate cut and signs of resilience in the US economy have lifted confidence, helping stocks post three weekly wins in a row. The final trading day of the month and the quarter also came with profit taking and rebalancing.

Investors are now bracing for the September jobs report, due out on Friday, which is seen as posing an important test for the recent rally. The pressing question is just how quickly the labor market is slowing as the market weighs whether the Fed has acted aggressively to protect a healthy economy or to help a flailing one.

Powell’s comments on not rushing the next round of rate decisions also lowered expectations of another jumbo cut.

Read more: What the Fed rate cut means for bank accounts, CDs, loans, and credit cards

A growing pile of profit warnings from automakers clouded the mood early Monday. Stellantis (STLA, STLAM.MI) shares tumbled 13% after the Chrysler parent slashed its margin outlook, citing supply chain disruption and weakness in China. General Motors (GM) and Ford (F) were both down around 4% in tandem. Aston Martin (AML.L, ARGGY) shares plunged over 20% after the luxury automaker warned on earnings too.

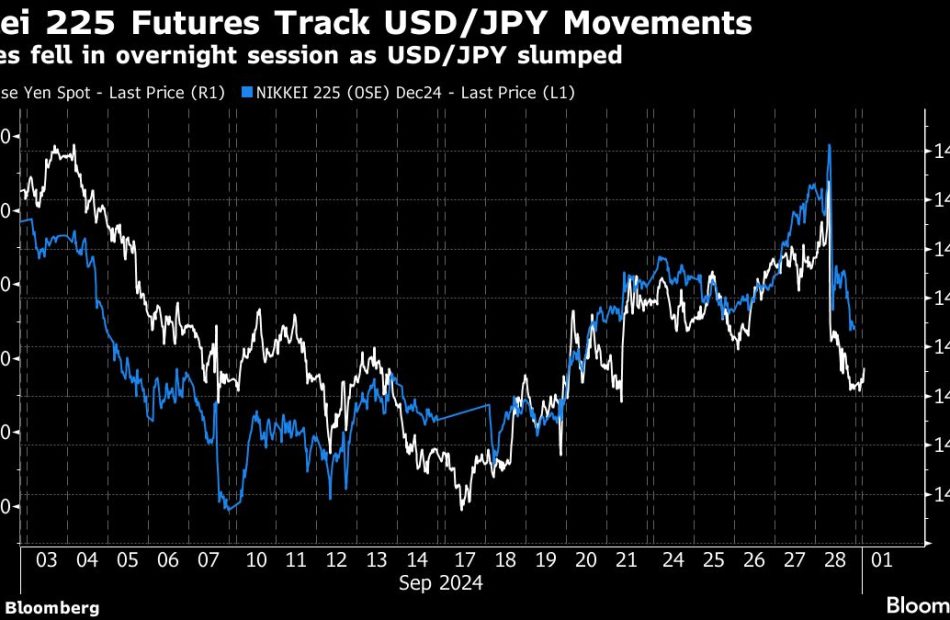

Overseas, China’s benchmark stock index (000300.SS) posted its biggest gain since 2008, entering a bull market, as buyers rushed in ahead of a weeklong holiday. But in Japan, the Nikkei 225 (^N225) tumbled as a surprise vote wrong-footed investors betting on an easing-friendly prime minister.

Live9 updates

Automotive Software Market worth $32.3 billion by 2030, Globally, at a CAGR of 7.8%, says MarketsandMarkets™

Delray Beach, FL, Sept. 29, 2024 (GLOBE NEWSWIRE) — Automotive Software Market size is projected to grow from USD 19.0 billion in 2023 to USD 32.3 billion by 2030, at a CAGR of 7.8%, as per the recent study by MarketsandMarkets™. The rise in focus towards software-defined vehicles paired with increasing penetration of ADAS features in vehicles are expected to increase the demand for automotive software solutions. Also, the strong government support for vehicle safety paired with rising adoption of software-over-the-air (SOTA) updates are anticipated to promote the revenue growth of automotive software market.

Browse in-depth TOC on “Automotive Software Market”

206 – Tables

80 – Figures

274 – Pages

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=200707066

List of Key Players in Automotive Software Market:

- Robert Bosch GmbH (Germany)

- NXP Semiconductors (Netherlands)

- NVIDIA Corporation (US)

- BlackBerry Limited (Canada)

- Continental AG (Germany)

Drivers, Opportunities and Challenges in Automotive Software Market:

- Driver: Advancements in infotainment systems

- Restraint: Lack of standard protocols for automotive software systems

- Opportunity: Developments in automated driving and software-defined vehicles

- Challenge: Risk of Cyberattacks

Key Findings of the Study:

- ADAS & safety systems segment is expected to witness a significant growth rate in the global automotive software market during the forecast period

- The application software segment is expected to lead the automotive software market growth

- Body control & comfort systems are expected to have significant growth opportunities in EVs during the forecast period

- The automotive software market in Asia Pacific is projected to hold the largest market share by 2030

Get Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=200707066

Operating system segment is expected to have significant share in the global automotive software market

The operating system is expected to be a noticeable segment in the automotive software market, as it controls the core capabilities of the vehicle while keeping passengers and the driving environment safe, which makes it the most important part of the software. Additionally, the automotive operating system market is expected to grow significantly with the growing adoption of connected car technologies. As such, operating system (OS) plays a critical role in connected vehicles. The OS provides the platform for the telematics system to run on and provides the features and functionality that allow the vehicle to communicate with other devices and services.

Passenger car segment is expected to have significant growth opportunities in global automotive software market

The passenger car segment is expected to have significant growth opportunities in the automotive software market during the forecast period. This is due to the increasing adoption of ADAS features in passenger cars and the rising inclination towards autonomous driving. Additionally, rising demand for passenger cars in emerging and developed countries has also contributed to the growth of the automotive software market. For example, in 2022, car production in China was around 23.8 million units, while in Japan, it was around 6.5 million. South Korea accounted for around 3.4 million units; in India, it was around 4.4 million units in the same year. The demand for automotive software in the Asia Pacific region is expected to increase due to the advent of autonomous driving, rising vehicle production, and prominent growth in demand for high-end services such as connected car services and telematics. All these aforementioned factors are anticipated to bolster the revenue growth of the passenger car segment during the forecast period.

“Germany to lead the automotive software market in Europe”

Germany is expected to have a sizeable market for automotive software among all the European countries. The most significant factors supporting the growth of the automotive software market in Germany are the penetration of premium passenger car brands with high-end software applications and government mandates regarding safety. The high sales of premium vehicles, such as the Mercedes-Benz S-Class, BMW 7 Series, Mercedes-Benz G-Class Audi A8, and Audi S8, are expected to drive the automotive software market in Germany during the forecast period.

Inquiry Before Buying: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=200707066

Recent Developments:

- In September 2023, Bosch showcased its Vehicle Dynamics Control 2.0 at IAA Mobility 2023. The software will provide easier handling and safety of automobiles with control over braking, electric powertrain, and electric steering systems. This will lead to less counter-steering with a shorter braking distance.

- In September 2023, NXP Semiconductors worked with Elektrobit to develop software for next-generation automotive BMS. This will reduce the entry-level cost of BMS development and the use of NXP’s high-voltage BMS design.

- In May 2023, BlackBerry Limited showcased its QNX Software Development Platform (SDP) 8.0. It will enable automakers to deliver more powerful software products at lower costs while maintaining the safety, security, and reliability of QNX software.

- In February 2022, Jaguar Land Rover partnered with NVIDIA Corporation to deliver next-generation ADAS and AI-powered services. In 2025, new Jaguar and Land Rover vehicles will be built on the NVIDIA DRIVE SDV platform and provide active safety, automated driving, and driver assistance systems.

Related Reports:

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Stocks Rally Loses Steam Ahead of Powell Speech: Markets Wrap

(Bloomberg) — The world’s biggest bond market sagged while US stocks slipped on Monday after Federal Reserve Chair Jerome Powell signaled he was in no hurry to cut interest-rates.

Most Read from Bloomberg

Treasury yields remained higher, led by the policy-sensitive two-year note which climbed to a 3.65% after Powell said the US didn’t have the data yet to make a call on the November meeting.

Powell said the central bank will lower interest rates “over time,” while re-emphasizing that the overall economy remains on solid footing.

“Powell a tiny bit hawkish at the margin, but the Fed still has a lot of cutting to do,” according to Vital Knowledge’s Adam Crisafulli. The Fed Chair’s remarks seem to suggest, he added, markets should think about a half-point cut instead of three-quarters of a point for the rest of the year.

Swaps traders further reined in their rate cut bets which had traded closer to a three-quarter point move before the US open.

S&P 500 slumped with declines in Amazon.com Inc. and Nvidia Corp. weighing on the benchmark index. Despite the day’s weakness, the equities gauge is on track for its fourth consecutive quarter of gains — the longest such winning stretch since 2021. The tech-heavy Nasdaq 100 fell 0.8% before paring losses.

“Powell won’t end the 25 bp versus 50 bp debate this afternoon. Or at least it is very unlikely,” BMO’s Ian Lyngen wrote in a note before the meeting. Friday’s employment report is the main event this week, he said, adding Tuesday’s JOLTS figures from August “should reinforce the idea that a cooling labor market has become the new norm.”

While gauging the outlook for Fed rate cuts, investors must contend with a cocktail of risks, including rising tensions in the Middle East and a looming dockworkers’ strike in critical US ports.

Chicago Fed President Austan Goolsbee voiced his concerns about a supply shock if a strike drags on. “That’s going to raise the cost of doing business and lead to shortages,” he told Fox Business.

Meanwhile, Raphael Bostic of the Atlanta Fed told Reuters he was open to another half-point of policy easing at the central bank’s November meeting if the upcoming data showed slower-than-expected job growth.

To Goldman Sachs Group Inc. strategists led by David Kostin, a strong print Friday may help fuel risk-on bets and embolden investors to move “out of expensive ‘quality’ stocks into less-loved lower quality firms.”

The relentless rally in stocks will also be tested by third-quarter corporate results set to kick off in mid-October.

“The bull market has survived the year’s historically weakest quarter, the third quarter, and it is likely to remain intact through at least the end of the year, as earnings remain strong, interest rates are moving lower and consumers are still spending,” said Emily Bowersock Hill at Bowersock Capital Partners.

“We expect the fourth quarter to be quite similar to the third quarter – elevated volatility, but with a strong finish,” she added.

European stocks dropped some 1% after Jeep maker Stellantis NV cut its profit margin forecast. On Friday, Volkswagen AG had issued its second profit warning in three months. Ford Motor Co. and General Motors Co. slumped in US trading.

That was in contrast to the mood in China, where the CSI 300 Index jumped as much as 9.1%, the most since 2008, fueled by the stimulus package.

Corporate Highlights

-

Verizon Communications Inc., the biggest wireless carrier in the US, has agreed to sell thousands of mobile phone towers to digital infrastructure firm Vertical Bridge.

-

DirecTV and Dish have agreed to combine in a deal that will create the biggest pay-TV provider in the US.

-

REA Group Ltd. walked away from its pursuit of Rightmove Plc after being repeatedly rejected by the UK property portal.

Key events this week:

-

Fed Chair Jerome Powell delivers speech at National Association for Business Economics conference in Nashville on Monday

-

Bank of England policymaker Megan Greene joins panel at NABE to discuss global monetary policy on Monday

-

Atlanta Fed President Raphael Bostic, Fed Governor Lisa Cook, Richmond Fed President Thomas Barkin and Boston Fed President Susan Collins attend conference on Tuesday

-

ECB policy makers speaking at various locations include Olli Rehn, Luis de Guindos, Isabel Schnabel and Joachim Nagel on Tuesday

-

BOE chief economist Huw Pill speaks at Confederation of British Industry economic growth board on Tuesday

-

Bank of Japan issues summary of opinions for September on Tuesday

-

South Korea CPI, S&P Global Manufacturing PMI on Wednesday

-

Fed speakers include Richmond’s Thomas Barkin, Cleveland’s Beth Hammack, St. Louis’s Alberto Musalem and Fed Governor Michelle Bowman on Wednesday

-

US nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 0.1% as of 2:46 p.m. New York time

-

The Nasdaq 100 fell 0.3%

-

The Dow Jones Industrial Average fell 0.4%

-

The MSCI World Index fell 0.6%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.3%

-

The euro fell 0.3% to $1.1133

-

The British pound was little changed at $1.3376

-

The Japanese yen fell 1% to 143.70 per dollar

Cryptocurrencies

-

Bitcoin fell 3.6% to $63,432.77

-

Ether fell 2.7% to $2,589.23

Bonds

-

The yield on 10-year Treasuries advanced four basis points to 3.79%

-

Germany’s 10-year yield declined one basis point to 2.12%

-

Britain’s 10-year yield advanced three basis points to 4.00%

Commodities

-

West Texas Intermediate crude was little changed

-

Spot gold fell 1% to $2,630.39 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Michael Mackenzie, Sagarika Jaisinghani, Kit Rees, Margaryta Kirakosian and Catherine Bosley.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

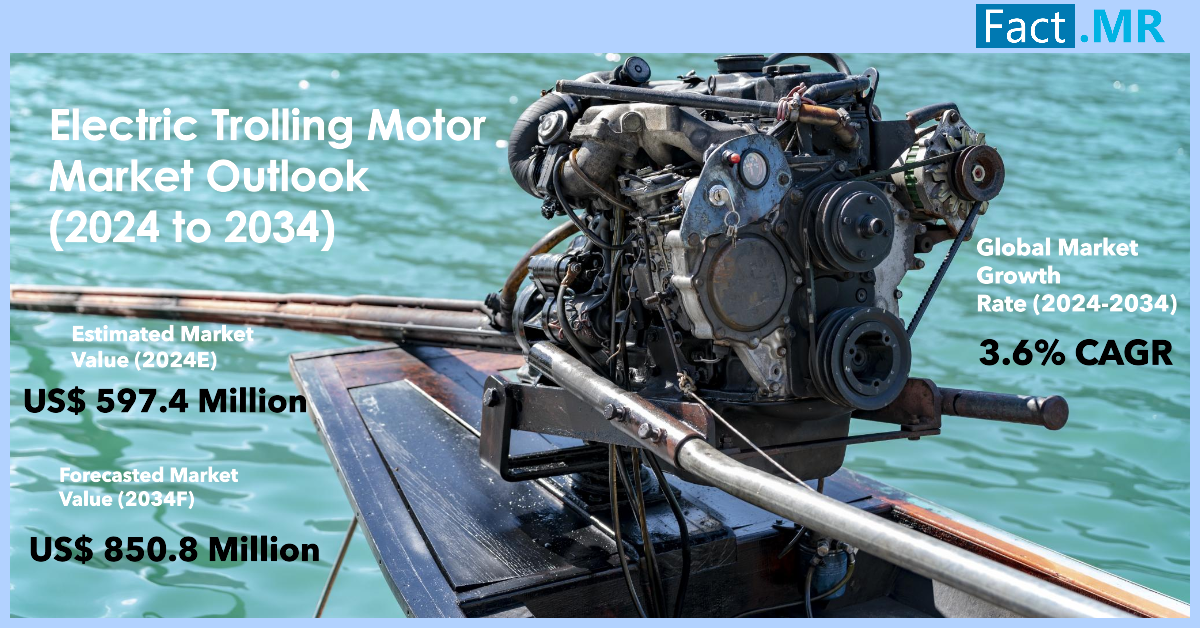

Electric Trolling Motor Market is Projected to Expand at 3.6% CAGR and Hit US$ 850.8 Million by 2034 | Fact.MR Report

Rockville, MD , Sept. 30, 2024 (GLOBE NEWSWIRE) — The global Electric Trolling Motor Market is set to reach a valuation of US$ 597.4 Mn in 2024 and further expand at a CAGR of 3.6% to end up at US$ 850.8 Mn by the year 2034.

Various market players have started investing in innovation in the electric trolling motor. For instance, anglers have started aligning with the current market trends and are benefiting from the advancement in electric trolling motors. These motors are loaded with multiple features such as GPS-enabled motors, foot pedal steering, and remote control steering among others. For example, GPS-enabled motors can record routes and anglers can fish at the same spot the next day as well

Due to the several advantages in the form of easy driving, greater control, and safety, the fishermen are getting great value from electric power. It also enables them to fish more effectively. With this, the demand for trolling motors is expected to increase along with numerous opportunities opening up for firms in the electric trolling motors market.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=4860

Key Takeaways from the Market Study:

- The global electric trolling motor market is projected to expand at an impressive CAGR of 6% and be valued at US$ 850.8 million by 2034.

- The market witnessed 4 % CAGR for the period of 2019-2023.

- Under motor, bow mount motors will dominate the market and are valued at US$ 359.6 million in 2024.

- North America and Western Europe dominated the market with 9% and 22.4% market share in 2024.

- Under application, salt water is likely to represent 7% market share in 2024.

- Based on the Motor Type, the bow-mounted motor can reach a valuation of US$ 359.6 million in 2024.

“Fishing and Freshwater Sports Funding Drives Success in Electric Trolling Motor Market,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Electric Trolling Motor Market:

Minn Kota (Johnson Outdoor Marine); Motorguide (Brunswick Corporation); Garmin Ltd; Lowrance (Navico); Torqeedo GmbH; propulsion; Rhodan Marine; Newport Vessels; Watersnake (Jarvis Walker Pty, Inc.); Aquamot; Other Competitors.

Market Growth Stratagems:

The companies present in the market are seen to build partnerships and create new products together. They do it in order to make their products better for higher demand and eventually good sales. Also, they have strong demand in, Western Europe and North America, in silent motors and effective fishing-related solutions.

- In July 2024, Garmin added a new 48-inch shaft option to the Force Kraken trolling motor series, targeting the smaller craft pontoon or microskiff.

- In September 2024, Minn Kota introduced the new Riptide Instinct and updated Riptide Terrova trolling motors. The new models boast better technologies for a better and more durable performance. They are specifically made for saltwater fishermen and grow the electric trolling motor market.

Electric Trolling Motor Industry News:

- In September 2024, ePropulsion started ePropulsion Commercial, a new business unit that aims to provide electric propulsion solutions for commercial marine applications. This initiative focuses on providing sustainable and efficient electric motors for the rising demand in the commercial sector to enhance operational efficiency while reducing environmental impacts.

- In November 2023, BSI A/S- one of the leading companies making electric trolling motors-inaugurated its upscale Motor-Riptide Ulterra which also offers customers precise control as well as higher efficiency hence contributing towards the growing market for this device in Europe and North America respectively.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=4860

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the electric trolling motors market, presenting historical market data (2019-2023) and forecast statistics for the period of 2024 to 2034.

The study reveals essential insights based on by Motor Type (Bow-Mount Motors, Transom-Mount Motors, Engine Mount Motor), By Application (Fresh Water, Salt Water), By Boat Type (Solvent-based Mirror Coatings, Water-based Mirror Coatings, Nano Mirror Coatings) across major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and Pacific, Middle East & Africa).

Segmentation of Electric Trolling Motor Industry Research:

By Motor Type :

- Bow-Mount Motors

- Transom-Mount Motors

- Engine Mount Motor

By Application :

By Boat Type :

- Bass Boat

- Jon Boat

- Deep-V Boat

- Pontoon

- Skiffs

- Flat Boats

- Deck Boat

- Fish and Ski Boats

Checkout More Related Studies Published by Fact.MR Research:

The global micro motor was valued at US$ 39,220.8 million in 2023 and has been forecasted to expand at a noteworthy CAGR of 5.0% to end up at US$ 66,845.3 million by 2034.

The global electric trolling motors market is expected to surpass a value of US$ 850.8 Mn by 2034-end, and expand at a CAGR of 3.6% during the forecast period (2024-2034).

The global light tower market was valued at US$ 1,710.6 Million in 2024 and has been forecasted to expand at a noteworthy CAGR of 5.0% to end up at US$ 2,786.3 Million by 2034.

The global magnetic induction heating devices are projected to reach a valuation of US$ 562.8 million in 2024 and thereafter forecasted to expand at a 4.3% CAGR to reach US$ 857.4 million by 2034.

The global piston air motors market was valued at US$ 661.9 million in 2023 and has been forecast to expand at a noteworthy CAGR of 3.7% to end up at US$ 987.0 million by 2034.

The global electric grill market is estimated to reach a value of US$ 2.44 billion in 2024 and further expand at a CAGR of 7.3% to end up at US$ 4.94 billion by 2034-end.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dow Tumbles Over 200 Points; Carnival Posts Upbeat Earnings

U.S. stocks traded mixed this morning, with the Dow Jones index falling more than 200 points during on Monday.

Following the market opening Monday, the Dow traded down 0.55% to 42,079.06 while the NASDAQ rose 0.14% to 18,144.66. The S&P 500 also fell, dropping, 0.14% to 5,730.18.

Check This Out: How To Earn $500 A Month From McCormick Stock Ahead Of Q3 Earnings

Leading and Lagging Sectors

Consumer staples shares jumped by 0.3% on Monday.

In trading on Monday, materials shares fell by 0.6%.

Top Headline

Carnival Corporation CCL posted better-than-expected quarterly earnings.

Carnival posted adjusted earnings of $1.27 per share, beating analysts’ estimates of $1.16 per share. The company posted quarterly sales of $7.90 billion versus expectations of $7.83 billion.

Equities Trading UP

- Kaixin Holdings KXIN shares shot up 166% to $0.2397.

- Shares of XChange TEC.INC XHG got a boost, surging 142% to $2.36.

- EMCORE Corporation EMKR shares were also up, gaining 73% to $2.08 after Mobix Labs submitted an all-cash offer to acquire the company for $3.80 per share.

Equities Trading DOWN

- Nano Labs Ltd NA shares dropped 30% to $0.71.

- Shares of YXT.COM Group Holding Limited YXT were down 25% to $2.80.

- Plus Therapeutics, Inc. PSTV was down, falling 25% to $1.39.

Commodities

In commodity news, oil traded down 0.2% to $68.05 while gold traded down 0.3% at $2,659.10.

Silver traded down 1.2% to $31.445 on Monday, while copper fell 0.8% to $4.5645.

Euro zone

European shares were lower today. The eurozone’s STOXX 600 fell 0.9%, Germany’s DAX fell 0.6% and France’s CAC 40 dipped 1.6%. Spain’s IBEX 35 Index fell 0.6%, while London’s FTSE 100 fell 0.5%.

The British economy grew by 0.5% on quarter during the second quarter, down from 0.7% in the first quarter, while the UK’s current account deficit widened to £28.4 billion in the second quarter, versus a revised £13.8 billion in the prior quarter. Net consumer credit in the U.K. rose by £1.3 billion in August, from £1.2 billion in the previous month. German import prices increased by 0.2% year-over-year in August compared to a 0.9% rise in July.

Asia Pacific Markets

Asian markets closed mixed on Monday, with Japan’s Nikkei 225 dipping 4.80%, Hong Kong’s Hang Seng Index jumping 2.43%, China’s Shanghai Composite Index gaining 8.06% and India’s BSE Sensex falling 1.49%.

Japan’s housing starts fell by 5.1% year-over-year in August compared to a 0.2% decline in the prior month, while industrial production fell by 3.3% month-over-month in August. Retail sales in Japan climbed by 2.8% year-over-year in August.

The official NBS Non-Manufacturing PMI in China fell to 50.0 in September from 50.3 in the prior month, while official NBS Manufacturing PMI climbed to 49.8 in September from 49.1 in August.

Economics

The Chicago PMI rose to 46.6 in September from 46.1 in August versus market estimates of 46.2.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.