Amazon, Apple, Tesla Brace For Supply Chain Disruptions As Potential East Coast Dockworkers Strike Nears

With a looming dockworkers’ strike on the East and Gulf Coasts set to begin Oct. 1, major companies like Amazon.com Inc AMZN, Apple Inc AAPL, and Tesla Inc TSLA are bracing for substantial disruptions.

The strike, led by the International Longshoremen’s Association, could shut down 36 ports from Maine to Texas, potentially halting half of the goods entering and leaving the U.S.

Retail & Tech Sectors At Risk

Retail giants like Amazon and Apple are particularly vulnerable. They rely heavily on East Coast ports to bring in consumer electronics and inventory. Delays could hit these companies with the holiday shopping season around the corner.

Amazon’s ability to meet demand for everything from household goods to electronics may suffer, while Apple risks product shortages on key items like the iPhone 15, iPhone 16 and MacBooks, all critical to its revenue in the fourth quarter.

Automotive Sector May Feel The Pinch

Tesla could also face a significant blow as it sources essential components globally. The Ports of New York/New Jersey are critical for Tesla’s supply chain, and any prolonged shutdowns could delay deliveries and increase manufacturing costs. Other automakers, like Ford Motor Co F and General Motors GM, could also struggle with supply bottlenecks for parts, further squeezing a sector already battling rising costs.

Inflation Pressures Could Rise

The Toy Association has expressed concerns that 60% of toy sales occur in the fourth quarter, and major toy companies like Mattel Inc MAT and Hasbro Inc HAS could face inventory shortages, driving up prices.

Agriculture and food companies reliant on East Coast ports, such as Tyson Foods Inc. TSN, may also face delays in getting goods to market, worsening consumer inflation.

Business leaders and investors are watching closely, as a prolonged strike could have far-reaching consequences on multiple sectors, potentially pushing inflation higher and slowing economic growth.

Read Next:

Photo: Wayne Via/Shutterstock.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Super Micro Computer's big stock split is today. Here’s what to know

Super Micro Computer (SMCI) is set to undergo a stock split after the market closes on Monday, aligning itself with other prominent AI-driven companies like Nvidia and Broadcom, which also executed stock splits earlier this year. Following the split, the stock will begin trading Tuesday at its adjusted—and substantially lower—price.

Shortly after the market opened on Monday morning, Super Micro Computer’s shares were priced at $426, reflecting a 1.5% increase.

What is SMCI’s stock split?

Super Micro Computer’s 10-for-1 stock split is expected to boost demand for the company’s shares. In a stock split, the company increases the number of shares, reducing the share price, but the total dollar value of all shares outstanding remains the same and doesn’t affect the company’s valuation.

Super Micro Computer’s 10-for-1 split means that, for each SMCI share an investor owns, they will receive an extra nine after the split is completed.

A rollercoaster year for SMCI

The San Jose-based IT company, which makes hardware that supports AI applications, thrived this year due to the high demand for AI and entered the Fortune 500 at No. 498. As a key partner and reseller of Nvidia’s (NVDA) GPUs and other components, Super Micro integrates its technology into its servers to support AI workloads. Super Micro CEO Charles Liang and Nvidia CEO Jensen Huang, are both Taiwanese immigrants and have a long-standing relationship.

Super Micro Computer went through a rough phase in September when a short seller, Hindenburg Research, published a scathing report accusing the company of accounting red flags and questionable business dealings, including potential sanctions evasion from exports to Russian and Chinese firms.

Following these accusations, Super Micro’s stock price took a significant hit. The company refuted the claims, stating that the report contained misleading and inaccurate information and that it would address the allegations in due course.

Interim Results for the six months ended 30 June 2024

CAMBRIDGE, United Kingdom, Sept. 30, 2024 (GLOBE NEWSWIRE) — Bango BGO, today announces its interim results for the six months ended 30 June 2024.

Financial Overview (unaudited):

| Results for the 6 months ended 30 June 2024 | 1H24 | 1H23 | Change | ||

| Total Revenue | $24.1M | $20.3M | +18.6% | ||

| Transactional Revenue1 | $16.4M | $15.5M | +5.3% | ||

| DVM, Audiences & One-Off2 | $ 7.7M | $ 4.7M | +62.5% | ||

| Annual recurring revenue (ARR)3 | $12.9M | $5.6M | +130.4% | ||

| Net Revenue Retention4 | 159% | ||||

| Adjusted EBITDA5 | $4.0M | ($0.2M) | +$4.2M | ||

| Profit/(Loss) before taxation | ($3.4M) | ($4.9M) | +$1.5M | ||

| Net (Debt6)/Cash | ($5.1M) | $5.5M | -$10.6M | ||

Notes:

- Transactional revenue grew 9.4% on a constant currency basis.

- Other Income of $1.4M, which is not included in the revenue figure above, related to recovery of tax costs from the acquisition of DOCOMO Digital. $1.1M will be accounted for as a tax cost, resulting in $0.3M profit.

- Gross profit margin of 80.8% (1H23: 90.0%) reduced from 82.8% in 2H 2023 due to geographic mix. Improvements expected in 2H 2024 as high margin DVM revenue grows.

- Net debt6 of $5.1M at 30 June 2024 (net debt of $3.9M at 31 Dec 2023) after R&D investment of $7.6M in the period.

Operational Highlights

- Bango signed 4 new Digital Vending Machine® (DVM) customers in 1H24, including a Bank in Brazil. Post-period there has been a further 3 new customer wins.

- A leading European telco that adopted the DVM in 2020 extended their contract for a further 3 years, with a minimum contract value of $1.5M over the term.

- 13 new subscription content providers were added to the DVM in 1H24, taking the total to 106.

- The eDisti7 program now has 20 content providers, including Microsoft and Disney, allowing Bango to provide a ‘pre-stocked’ Digital Vending Machine, reducing time to revenue for both DVM customers and Bango.

- Bango signed a global agreement with Uber to accelerate the take-up of Uber One subscriptions through telco channels, proving the appeal of the Bango DVM beyond digital video, music and gaming services.

- The ‘global technology leader’ (announced in June 2022) launched its first two telcos with Bango in 1H24. Additional launches are underway.

- Chartered Accountant Tony Perkins joined the Bango Board as a Non-Executive Director and Chair of the Audit Committee. In Q3, Tony was appointed as Senior Independent Director replacing Eric Peacock who retired from the Board to focus on his recovery from an accident.

Presentation and Webcast

A presentation of the interim results will be made to investors and analysts at 10:00 BST today via the Investor Meet Company Platform. Those wishing to join the call can sign up to Investor Meet Company for free via:

https://www.investormeetcompany.com/bango-plc/register-investor

Full RNS announcement

Read the full Interims Results RNS announcement here: https://polaris.brighterir.com/public/bango_plc/news/rns/story/r7ze9jw

Paul Larbey, Chief Executive Officer of Bango, commented:

“The first six months of 2024 have gone to plan and are in-line with the Trading Update issued in July. The payments business continues to deliver growth, providing cash to fund expansion of the Digital Vending Machine® (DVM), which continues to be adopted as the defacto standard platform for subscription bundling by the world’s largest companies. The addition of Disney+ to the Bango eDisti program is further evidence of this and will help accelerate time-to-revenue from DVM deals. With 4 new DVM wins in the 1H and a further 3 in Q3, the pipeline built over the past years continued to deliver results and provides confidence in meeting market expectations for the full year.

The subscriptions market is vast and growing, and the percentage of subscriptions bundled through channels is increasing. Bango’s leadership position in this market is strengthening with the DVM now playing a key role in the customer acquisition and engagement strategies of major content brands. We are excited by the opportunity ahead and remain on track to continue our strong growth trajectory and return to a positive net cash position in FY25.”

1 Transactional Revenue is revenue derived by charging a percentage of the retail price paid by the consumer and is made up of direct carrier billing, resale and revenue share amounts.

2 DVM, Bango Audiences & one-off Revenue includes all DVM license and support fees, revenue from Bango Audiences (discontinued in Q1) and one-off fees including DVM set-up and change requests.

3 Annual Recurring Revenue is the expected annual revenues to be generated in the next 12 months based on contracted revenues recognized as at 30 June 2024.

4 Net Revenue Retention is a measure of the retention and expansion of revenue from customers over the previous 12 months and is calculated by dividing the ARR from existing customers at the end of 1H24 to the ARR from those same customers at the end of 1H23.

5 Adjusted EBITDA is earnings before interest, tax, depreciation, amortization, negative goodwill, exceptional items, share of net loss of associate and share based payment charge

6 Net debt is cash and cash equivalents plus short-term investments less the loan from NHN and borrowings. Barclays continues to provide an overdraft facility which was not used at the end of the period .

7 eDisti is a program that allows Bango to resell subscriptions from content providers removing the need for a commercial agreement between the DVM customer and the content provider.

Contact Details:

investors@bango.com

About Bango

Bango enables content providers to reach more paying customers through global partnerships. Bango revolutionized the monetization of digital content and services, by opening-up online payments to mobile phone users worldwide. Today, the Digital Vending Machine® is driving the rapid growth of the subscriptions economy, powering choice and control for subscribers.

The world’s largest content providers, including Amazon, Google and Microsoft trust Bango technology to reach subscribers everywhere.

Bango, where people subscribe. For more information, visit www.bangoinvestor.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

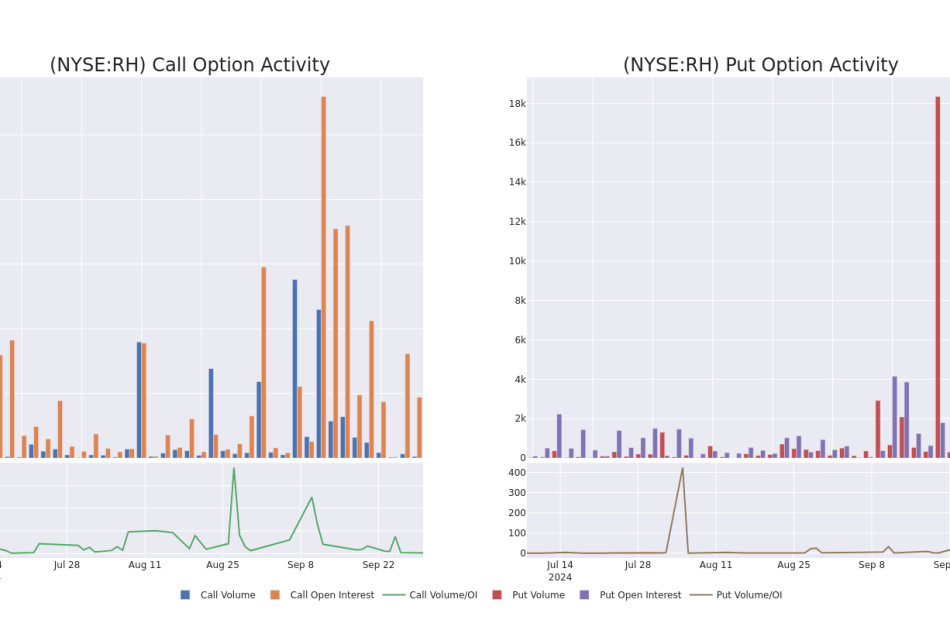

Smart Money Is Betting Big In RH Options

Investors with a lot of money to spend have taken a bullish stance on RH RH.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with RH, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 14 uncommon options trades for RH.

This isn’t normal.

The overall sentiment of these big-money traders is split between 71% bullish and 21%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $259,072, and 8 are calls, for a total amount of $315,990.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $220.0 and $370.0 for RH, spanning the last three months.

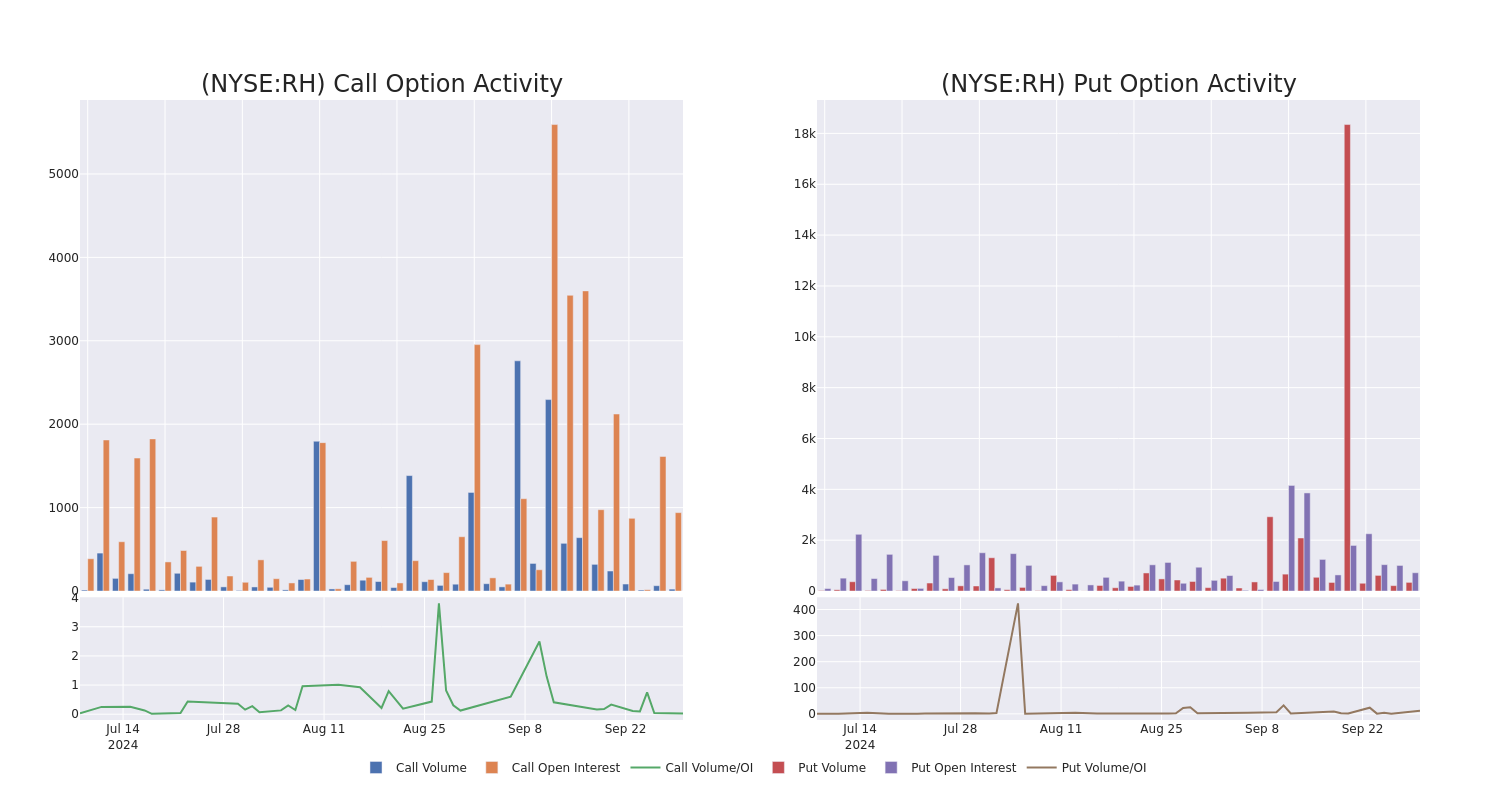

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in RH’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to RH’s substantial trades, within a strike price spectrum from $220.0 to $370.0 over the preceding 30 days.

RH Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RH | PUT | TRADE | BEARISH | 11/15/24 | $8.5 | $8.2 | $8.5 | $300.00 | $86.7K | 275 | 103 |

| RH | CALL | TRADE | BULLISH | 01/17/25 | $97.2 | $96.3 | $97.2 | $250.00 | $48.6K | 112 | 5 |

| RH | CALL | TRADE | NEUTRAL | 01/17/25 | $97.9 | $96.3 | $97.1 | $250.00 | $48.5K | 112 | 10 |

| RH | CALL | SWEEP | BULLISH | 02/21/25 | $119.7 | $116.0 | $116.0 | $230.00 | $46.5K | 3 | 4 |

| RH | CALL | TRADE | BULLISH | 01/17/25 | $81.5 | $80.4 | $81.5 | $270.00 | $40.7K | 132 | 5 |

About RH

RH is a luxury furniture and lifestyle retailer operating in the $134 billion domestic furniture and home furnishing industry. The firm offers merchandise across many categories including furniture, lighting, textiles, bath, decor, and children and is growing the presence of its hospitality business with 18 restaurant locations. RH innovates, curates, and integrates products, categories, services, and businesses across channels and brand extensions (RH Modern and Waterworks, for example). RH is fully integrated across channels and is positioned to broaden its addressable market over the next decade by expanding abroad, with its World of RH digital platform (highlighting offerings outside of home furnishings), and with offerings in color, bespoke furniture, architecture, media, and more.

In light of the recent options history for RH, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of RH

- With a trading volume of 204,291, the price of RH is down by -1.05%, reaching $335.92.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 66 days from now.

Expert Opinions on RH

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $322.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Telsey Advisory Group has decided to maintain their Market Perform rating on RH, which currently sits at a price target of $290.

* An analyst from Telsey Advisory Group persists with their Market Perform rating on RH, maintaining a target price of $290.

* An analyst from Loop Capital persists with their Hold rating on RH, maintaining a target price of $320.

* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on RH with a target price of $355.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for RH, targeting a price of $359.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest RH options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What Nvidia CEO Jensen Huang told the founder of this Google rival after investing in his startup

Listen and subscribe to Opening Bid on Apple Podcasts, Spotify, YouTube or wherever you find your favorite podcasts.

Hungry upstarts don’t always get the attention of major players, but in the case of You.com, founder Richard Socher got a front-row seat with Nvidia’s Jensen Huang.

“I was extremely impressed with Jensen,” Socher told Yahoo Finance Executive Editor Brian Sozzi on Yahoo Finance’s Opening Bid podcast (see video above; listen below).

His AI-powered search engine recently announced a $50 million Series B round, with investors including Nvidia (NVDA), Salesforce (CRM) Ventures, and DuckDuckGo. The capital raise valued the Google (GOOG) and Yahoo rival at close to $1 billion.

Socher said he met with Huang for nearly two hours around the time of the investment, discussing topics ranging from history to running a business.

“I don’t generally get nervous with most people, but it was very impressive to hear him giving advice,” Socher said.

During his conversation, Socher said Huang shared that “he focused a lot on the speed of Nvidia” during its early years.

Eventually, Nvidia opted to pivot a little to gain focus.

“At some point, they realized that the best way is to focus on gaming first and really dominate that niche,” Socher said, adding that Huang suggested staying focused on You.com’s mission of being an artificial intelligence-powered alternative to Google.

This isn’t the first time Socher and Nvidia have crossed paths.

In the early 2010s, his research group at Stanford utilized Nvidia GPUs. At that time, Nvidia mostly sold GPU products to the graphics sector. “Nvidia was like, ‘Who are you? Why are you trying to buy our GPUs?’” said Socher, noting that GPUs now assist with the company’s AI workloads.

Nvidia launched in 1993 — born from Huang’s scribbling on a napkin at a Denny’s — to develop 3D graphics for gaming and multimedia purposes. Back then, an increasing number of consumers were taking the computing plunge, leading to demand for higher-powered computers.

Six years later, Nvidia introduced graphics processing units (GPU), and in 2012, it brought AI to the forefront by introducing the AlexNet neural network.

This summer, Nvidia introduced an initiative that would bring generative AI to a wider audience using its latest GPU technology. The company’s AI chips are seen as having a wide performance lead over rivals AMD (AMD) and Intel (INTC), leading to impressive financial results over the past two years.

Nvidia’s second quarter sales and earnings rose 122% and 152%, respectively, from the prior year.

After a summer pullback following mixed third quarter guidance, Nvidia is now the third most valuable company in the world. It sports a market cap of $2.98 trillion, while Microsoft sits at $3.18 trillion and Apple stands at $3.46 trillion, according to Yahoo Finance’s comparison tool.

Year to date, shares are up 145% compared to an 18% gain for the tech-heavy Nasdaq Composite.

Three times each week, Yahoo Finance Executive Editor Brian Sozzi fields insight-filled conversations and chats with the biggest names in business and markets on Opening Bid. You can find more episodes on our video hub or watch on your preferred streaming service.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance

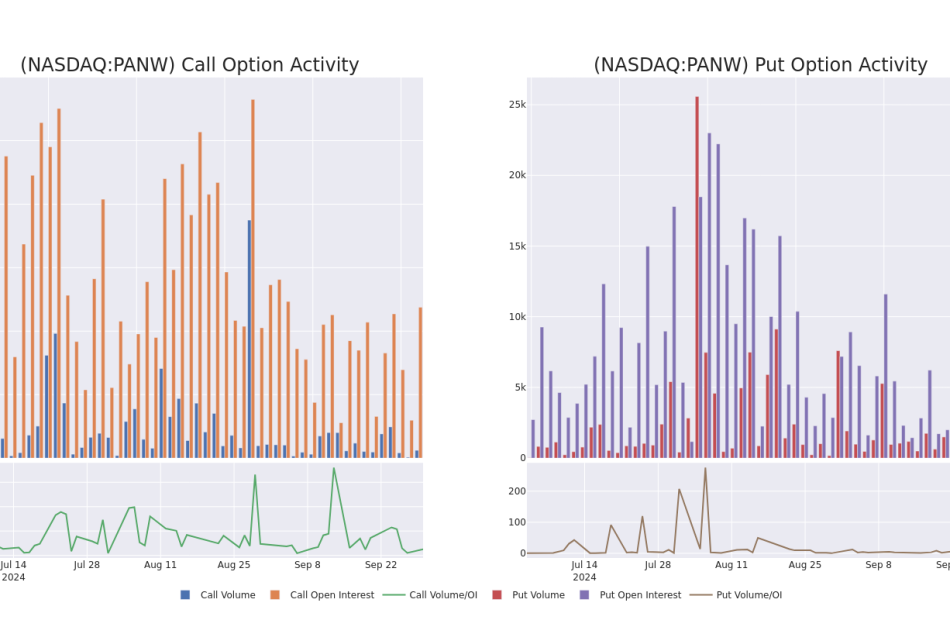

Palo Alto Networks's Options: A Look at What the Big Money is Thinking

Whales with a lot of money to spend have taken a noticeably bullish stance on Palo Alto Networks.

Looking at options history for Palo Alto Networks PANW we detected 25 trades.

If we consider the specifics of each trade, it is accurate to state that 52% of the investors opened trades with bullish expectations and 32% with bearish.

From the overall spotted trades, 10 are puts, for a total amount of $463,210 and 15, calls, for a total amount of $656,959.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $70.0 to $440.0 for Palo Alto Networks over the recent three months.

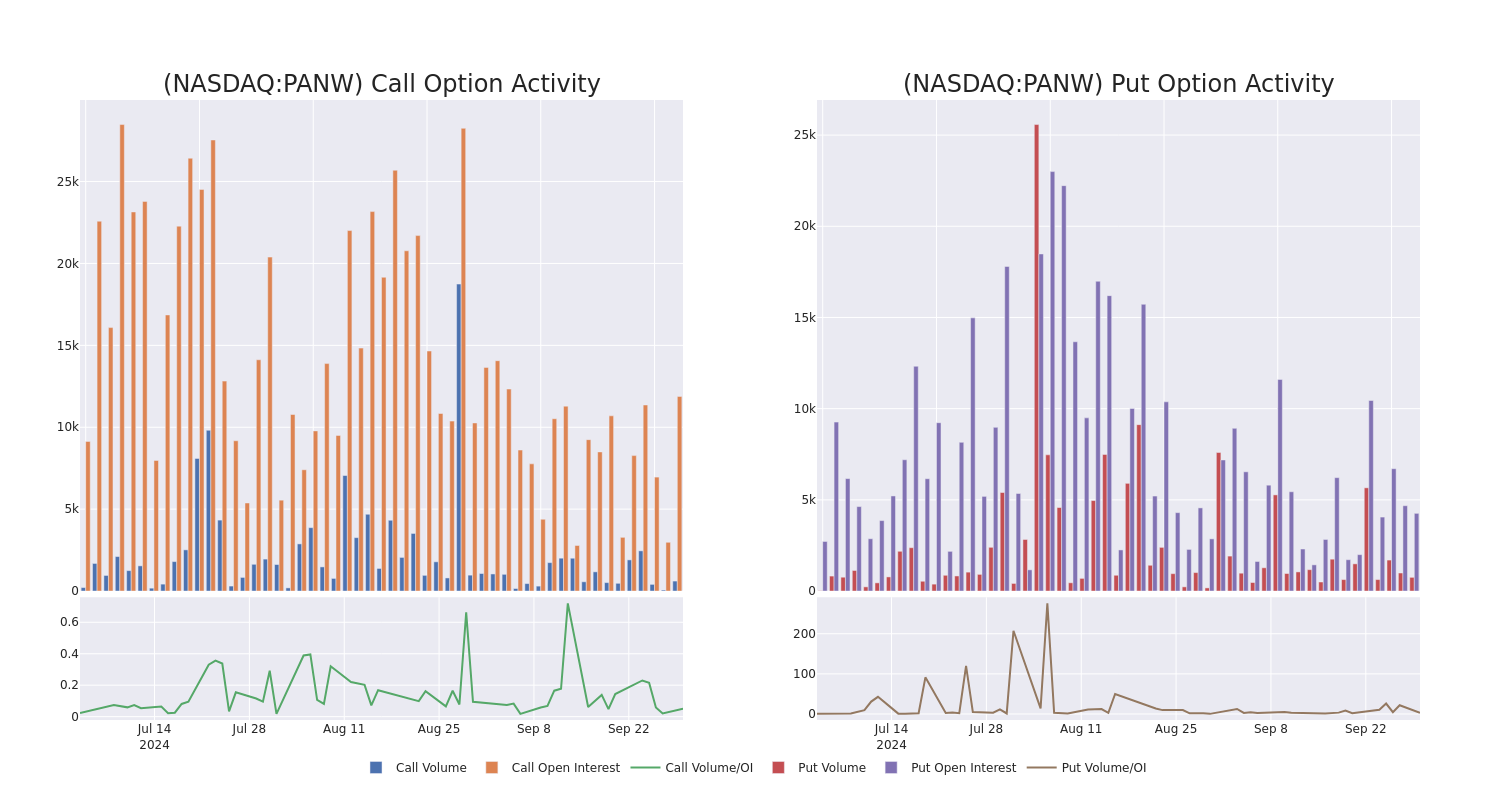

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Palo Alto Networks’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Palo Alto Networks’s substantial trades, within a strike price spectrum from $70.0 to $440.0 over the preceding 30 days.

Palo Alto Networks Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PANW | CALL | SWEEP | BEARISH | 11/01/24 | $14.3 | $13.35 | $13.56 | $340.00 | $108.8K | 20 | 5 |

| PANW | PUT | TRADE | BULLISH | 01/16/26 | $60.5 | $59.3 | $59.3 | $360.00 | $88.9K | 167 | 15 |

| PANW | CALL | SWEEP | BULLISH | 10/18/24 | $16.2 | $15.2 | $16.2 | $330.00 | $76.1K | 850 | 50 |

| PANW | CALL | TRADE | BULLISH | 11/15/24 | $7.2 | $6.95 | $7.2 | $370.00 | $72.0K | 1.1K | 117 |

| PANW | PUT | TRADE | BULLISH | 11/15/24 | $27.55 | $27.2 | $27.2 | $360.00 | $65.2K | 357 | 24 |

About Palo Alto Networks

Palo Alto Networks is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, and security operations. The California-based firm has more than 80,000 enterprise customers across the world, including more than three fourths of the Global 2000.

Palo Alto Networks’s Current Market Status

- With a trading volume of 862,492, the price of PANW is up by 1.38%, reaching $340.38.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 44 days from now.

What Analysts Are Saying About Palo Alto Networks

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $420.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Susquehanna has decided to maintain their Positive rating on Palo Alto Networks, which currently sits at a price target of $420.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Palo Alto Networks options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Big US oil companies reveal massive payments to foreign governments

(Reuters) – The three largest US energy exploration companies paid more than $42 billion to foreign governments last year, about eight times more than what they paid in the United States, according to regulatory filings.

The disclosures from Exxon Mobil (XOM), Chevron Corp, (CVX) and ConocoPhillips (COP) were required this year for the first time ever under a new Securities and Exchange Commission requirement.

Transparency advocates had been pushing for the rule for more than a decade to shine a light on Big Oil’s foreign financial transactions in its global quest for oil, and provide a sense of whether U.S. taxpayers are getting a fair share of the value of soaring U.S. production.

The United States has become the world’s largest oil and gas producer in recent years, thanks mainly to a boom in the massive Permian Basin in Texas and New Mexico.

“The truth is, here in the U.S., we get one of the worst deals for the extraction of our natural resources,” said Michelle Harrison, deputy general counsel for EarthRights International, an environmental advocacy group.

About 90% of Exxon’s nearly $25 billion in global payments went to foreign governments in 2023, even though close to a quarter of Exxon’s global exploration and production earnings come from the United States.

The Texas-based oil giant paid out $22.5 billion in taxes, royalties and other items overseas, with the United Arab Emirates ($7.4 billion), Indonesia ($4.6 billion) and Malaysia ($3.2 billion) topping the list, according to the disclosures.

By contrast, Exxon made about $2.3 billion in U.S.-based payments in 2023, including just $1.2 billion to the U.S. Internal Revenue Service, according to Exxon’s report.

Exxon’s U.S.-based upstream earnings totaled $4.2 billion, compared to $17.1 billion in non-U.S. markets, according to Exxon’s 2023 annual report.

In the preamble of Exxon’s SEC report, the company complained that comparisons between U.S. and overseas payments were not fair and said U.S. government payments totaled $6.6 billion last year when you include more than $4 billion in state and local taxes omitted by the regulations.

Exxon declined to comment further.

Chevron, meanwhile, paid $14.6 billion to foreign governments in 2023, including $4 billion to Australia alone, according to the filings. The company paid just $2 billion in the U.S., according to the filings.

A Chevron spokesperson said the company’s overhead in the U.S. can be much lower than in overseas oil fields.

Chevron’s holdings in the Permian Basin, for example, total about 2.2 million acres with about 75% of that land connected to either low or no royalty payments. Chevron executives see that as a huge advantage and one that creates shareholder value, according to presentations by the company.

Last year, most of Chevron’s upstream profits were from international markets – at $17.4 billion compared to $4.1 billion in the United States – according to Chevron’s 2023 annual report.

Chevron did not criticize the disclosure parameters in its filing, and told Reuters it would continue to work with relevant agencies toward transparency and accountability between governments and the industry.

For ConocoPhillips, just $1.3 billion of a total $6.5 billion in total global payments last year went to the U.S., according to the disclosures.

The company declined to comment.

Section 1504 of the Dodd-Frank Act opened the door for the new disclosures around overseas activities by energy exploration and production companies.

A divided SEC adopted the rules in 2020 in a 3-2 vote, as the burgeoning ESG movement, which focuses on environmental, social and governance matters, demanded more transparency on behalf of millions of U.S. investors.

The adoption of the rule, however, came after a pitched years-long battle: A federal court in 2013 vacated the SEC’s first attempt at imposing the mandate, and Congress blocked a second attempt in 2017.

Company US payments Overseas ($B) Total ($B)

($B)

Exxon $2.3 $22.5 $24.8

Chevron $2.0 $14.6 $16.6

ConocoPhillips $1.3 $5.2 $6.5

Total $5.8 $42.3 $47.9

(Reporting By Tim McLaughlin; Editing by Aurora Ellis)

Captivision Reports Half-Year Results for 2024

MIAMI and SEOUL, South Korea, Sept. 30, 2024 (GLOBE NEWSWIRE) — Captivision Inc. (“Captivision” or the “Company”) CAPT, a pioneer manufacturer of architectural media glass and innovative LED solution provider, today reported financial results for the six months ended June 30, 2024, and provided a summary of recent financing and business activities.

Half-year 2024 Financial Highlights and Recent Financing Summary

- Revenue for half-year 2024 increased by 22% to $15.3 million compared to $12.6 million in the 2023 period

- Gross margin for half-year 2024 improved to 56% compared to 50% in the 2023 period

- Subsequent to the Company’s public listing late last year, Captivision raised approximately $8.3 million through equity and debt financings and converted approximately $4.2 million of outstanding debt into equity, further strengthening its balance sheet:

- Raised $4.1 million via three equity financings, at an average effective price of approximately $3.68 per share

- Announced the conversion of approximately $4.2 million of outstanding debt into equity at a $3.00 price per share

- Raised approximately $2.2 million of debt financing

- Raised approximately $2.0 million through an equity line of credit

- Streamlined and internalized the European and Middle Eastern sales functions, which included disposing of the Company’s European sales affiliate and partly owned subsidiary, G-SMATT Europe. This was achieved by converting outstanding debt and third party equity holders to CAPT equity, and subsequently selling the subsidiary for nominal consideration

Gary Garrabrant, Chairman and CEO of Captivision, commented: “We are pleased with the strong growth of sales during the first six months of 2024, especially in combination with increasing profit margins. With the recent conversion of debt into equity, strategic debt financing and restructuring of our European operation, we have significantly improved our financial position during the first six months of 2024. We recognize our investors’ strong support as we position Captivision for multiple business catalysts and important milestones.

“Further, we’re excited about upcoming developments that we believe will be transformative for our company and our stakeholders. We are continuing to build on the momentum of our half-year financials as well as recent announcements of our partnerships with leading entertainment, hospitality and gaming companies. Notable collaborations so far this year include the Mohegan INSPIRE Entertainment Resort and Activision’s Call of Duty: Mobile at the Framework in the Desert event in Coachella Valley. With much in store for the remainder of the year, we expect the second half of 2024 to be pivotal for our company in multiple respects.”

Half-year 2024 Financial Results

Revenue increased by $2.8 million, or 22%, to $15.3 million for the six months ended June 30, 2024, compared to $12.6 million for the six months ended June 30, 2023. The increase was primarily attributable to increased sales of the Company’s products and the completion of installations on a select number of meaningful, previously announced projects, primarily the Mohegan INSPIRE Entertainment Resort, the Coex Magok convention center in Seoul and the UE Garden Hotel & Resort on Japan’s Boso Peninsula.

Cost of sales increased by $0.5 million, or 7%, to $6.8 million for the six months ended June 30, 2024, compared to $6.3 million for the six months ended June 30, 2023. The increase was primarily driven by the higher amounts of products sold and installations completed.

Gross margin increased to 56% for the six months ended June 30, 2024, from 50% for the six months ended June 30, 2023, primarily due to the completion of the forementioned projects. A higher proportion of the costs associated with these projects was previously recognized during the six months ended December 31, 2023.

Selling and administrative expenses increased by $11.1 million, or 223%, from $5.0 million for the six months ended June 30, 2023, to $16.1 million for the six months ended June 30, 2024. This change was primarily due to higher legal, accounting, and compliance costs related to the company’s transition to a publicly traded entity.

Net loss for the six months ended June 30, 2024, was $9.3 million, compared to a net profit of $0.5 million for the six months ended June 30, 2023. The increase in net loss was primarily due to the increase in selling and administrative expenses, partially offset by the increase in revenues.

Liquidity

The Company’s existing sources of liquidity as of June 30, 2024 included cash and cash equivalents of $0.7 million and net trade receivables of $9.4 million.

About Captivision

Captivision is a pioneering manufacturer of media glass, combining IT building material and architectural glass. The product has a boundless array of applications including entertainment media, information media, cultural and artistic content as well as marketing use cases. Captivision can transform any glass façade into a transparent media screen with real time live stream capability. Captivision is fast becoming a solution provider across the LED product spectrum.

Captivision’s media glass and solutions have been implemented in hundreds of locations globally across sports stadiums, entertainment venues, casinos and hotels, convention centers, office and retail properties and airports. Learn more at http://www.captivision.com/.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These forward-looking statements include, without limitation, statements relating to expectations for future financial performance, business strategies or expectations for the Company’s respective businesses. These statements are based on the beliefs and assumptions of the management of the Company. Although the Company believes that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, it cannot assure you that it will achieve or realize these plans, intentions or expectations. These statements constitute projections, forecasts and forward-looking statements, and are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this press release, words such as “believe”, “can”, “continue”, “expect”, “forecast”, “may”, “plan”, “project”, “should”, “will” or the negative of such terms, and similar expressions, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The risks and uncertainties include, but are not limited to: (1) the ability to raise financing in the future and to comply with restrictive covenants related to indebtedness; (2) the ability to realize the benefits expected from the business combination and the Company’s strategic direction; (3) the significant market adoption, demand and opportunities in the construction and digital out of home media industries for the Company’s products; (4) the ability to maintain the listing of the Company’s ordinary shares and warrants on Nasdaq; (5) the ability of the Company to remain competitive in the fourth generation architectural media glass industry in the face of future technological innovations; (6) the ability of the Company to execute its international expansion strategy; (7) the ability of the Company to protect its intellectual property rights; (8) the profitability of the Company’s larger projects, which are subject to protracted sales cycles; (9) whether the raw materials, components, finished goods and services used by the Company to manufacture its products will continue to be available and will not be subject to significant price increases; (10) the IT, vertical real estate and large format wallscape modified regulatory restrictions or building codes; (11) the ability of the Company’s manufacturing facilities to meet their projected manufacturing costs and production capacity; (12) the future financial performance of the Company; (13) the emergence of new technologies and the response of the Company’s customer base to those technologies; (14) the ability of the Company to retain or recruit, or to effect changes required in, its officers, key employees or directors; (15) the ability of the Company to comply with laws and regulations applicable to its business; and other risks and uncertainties set forth under the section of the Company’s Annual Report on Form 20-F entitled “Risk Factors.”

These forward-looking statements are based on information available as of the date of this press release and the Company’s management team’s current expectations, forecasts and assumptions, and involve a number of judgments, known and unknown risks and uncertainties and other factors, many of which are outside the control of the Company and its directors, officers and affiliates. Accordingly, forward-looking statements should not be relied upon as representing the Company management team’s views as of any subsequent date. The Company does not undertake any obligation to update, add or to otherwise correct any forward-looking statements contained herein to reflect events or circumstances after the date they were made, whether as a result of new information, future events, inaccuracies that become apparent after the date hereof or otherwise, except as may be required under applicable securities laws.

Media Contact:

Dukas Linden Public Relations

+1 212-704-7385

captivision@dlpr.com

Investor Contact:

Gateway Group

Ralf Esper

+1 949-574-3860

CAPT@gateway-grp.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nissin Foods Looks 'Down Under' To Escape China Pressure Cooker

Key Takeaways:

- Nissin Foods is purchasing Australian frozen dumpling maker ABC Pastry for $23.3 million, seeking to tap demand from the country’s growing Asian population

- Nissin is looking to diversify geographically from its base in Mainland China and Hong Kong with other recent moves into Vietnam and Taiwan

By Doug Young

If you can’t stand the heat from China’s economic slowdown, you get out of the kitchen.

Perhaps that’s just a slight exaggeration if your name is Nissin Foods Co. Ltd. NSFCF, the China subsidiary of Japan’s Nissin Food Holdings NFPDF, the former of which still gets nearly all its revenue from its two main markets in Mainland China and Hong Kong. But the Hong Kong-listed Nissin is increasingly creeping beyond those two main markets with several strategic moves, laying the groundwork for a more diversified revenue base.

In its latest move in that direction, the company announced on Friday it will purchase Australian frozen dumpling maker ABC Pastry for a cool A$33.7 million ($23.3 million). The purchase price looks quite affordable for Hong Kong-listed Nissin, which is debt-free and had HK$1.32 billion ($170 million) in net cash and another HK$820 million in banking facilities at the end of June.

In addition to the purchase price, Nissin said it also has the option to purchase the land where ABC’s factory produces its dumplings for another A$8.8 million.

Nissin called the deal a “premium opportunity” to expand its business into Australia. “The Australian frozen food market size is expected to experience robust growth as the frozen dumplings, in particular, have been benefiting from the rising Asian migration to Australia,” it said.

Nissin’s Hong Kong shares rose 2.24% in Monday morning trade after the announcement. The stock has been quite the laggard lately compared with its peers, reflecting the difficulties the company is facing during China’s economic slowdown. Nissin’s shares are down 29% so far this year, in sharp contrast to rivals Tingyi (0322.HK) and Uni-President China (0220.HK), which are up 17% and 27%, respectively.

Nissin used to be a leader among that trio in terms of valuation, reflecting its market positioning. With its Japanese roots and status as the inventor of instant noodles, the company bills itself as a premium brand within its class. But as its stock has sunk, its price-to-earnings (P/E) ratio has fallen to 14, trailing Tingyi’s 17 and Uni-President’s 16.

Nissin’s positioning as a premium brand seems to be increasingly problematic in the current environment where consumers are reining in their spending and downgrading from higher-end products to more affordable ones. As that happens, the company’s revenue began contracting last year after several years of solid growth during the pandemic when consumers slurped up its cheap and convenient stay-at-home foods.

Nissin’s revenue contraction continued in the first half of this year, falling 5.5% year-on-year to HK$1.82 billion. That decline contrasted sharply with a slight 0.1% revenue increase for Tingyi during the same period, and an even larger 6% rise for Uni-President China. Weilong Delicious (9985.HK), a maker of cheap snacks costing just pennies each, reported its revenue jumped 26% during the period, partly due to the growing consumer fondness for cheap eats.

Growing Global Footprint

Nissin’s Japanese parent is quite the global company, with its signature Cup Noodles available in most major markets throughout the world. Within Asia, the Japanese company is active in most major Southeast Asian markets, including the Philippines, Thailand, Singapore, Malaysia and Indonesia.

The Hong Kong-listed Nissin is still largely confined to the Hong Kong and Mainland China markets, with those two accounting for about 40% and 60% of its revenue, respectively, in the first half of this year. Both markets experienced revenue declines in the latest six-month period, with Hong Kong down 6% while Mainland China fell 3% in yuan terms.

Even though its revenue fell, Nissin’s profit held mostly steady at HK$169 million, down slightly from HK$172 million a year earlier, thanks to a 0.9 percentage point improvement in its gross margin due to falling raw material costs.

The newly acquired Australia operation, by comparison, looks a bit healthier, at least in terms of profitability. Nissin said ABC Pastry recorded revenue of A$15.2 million for its fiscal year through June this year, though it didn’t provide any previous-year comparisons. That figure is quite small compared to Nissin’s own revenue, equating to about 2% of the HK$3.83 billion Nissin generated last year.

ABC Pastry also looks quite profitable, with its profit after tax rising 27% to A$2.84 million in the fiscal year through June from A$2.23 million a year earlier. That equates to a net profit margin of 18.7% for ABC Pastry, or roughly double Nissin’s own net margin of 9.3% in the first six months of this year. All this shows that ABC Pastry is quite profitable and probably growing in terms of revenue, meaning it could serve as a good base for Nissin to quickly expand in the market.

Australia is just the latest regional market where the Hong Kong-listed Nissin is expanding its footprint as it tries to diversify geographically beyond Hong Kong and Mainland China.

The company took its first fledgling step outside those two core markets last July, when it purchased 67% of its parent company’s Vietnamese business. That operation consists mostly of a single instant noodle factory, and the unit lost $1.4 million in its fiscal year through March 2023. Nissin mentioned the Vietnam operation in its latest half-year report, but said only that “a good performance was achieved, and the overall business outlook was encouraging,” suggesting it still generates relatively small revenue.

More recently, Nissin established an office late last year in Taiwan, where its products are currently sold through distributors and wholesalers. In its latest report it said the operation “is expected to achieve sales growth subsequently,” but didn’t elaborate on potential plans to beef up the operation or potentially set up any local manufacturing.

Here, we should note that Taiwan is the home turf for both Uni-President and Tingyi, and thus Nissin will face extremely tough competition from these two players if it makes a serious attempt to expand in the market. Then again, Taiwanese are also famous for their love of all things Japanese, and thus local consumers might enjoy such a new instant noodle option.

At the end of the day, this diversification strategy looks prudent for the Hong Kong-listed Nissin as its two main markets head into what could become a prolonged period of uncertainty. Vietnam and Taiwan are probably both already quite competitive but could still have some potential due to Nissin’s positioning as a premium brand. Meantime, the latest move into Australia could have even greater potential due to the country’s growing Asian population and a lower level of competition in foods catering to this customer group.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Behavioral Rehabilitation Market to Reach $777.2 Billion, Globally, by 2033 at 6.3% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 30, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Behavioral Rehabilitation Market by Behavioral Disorder (Anxiety Disorder, Mood Disorder, Substance Abuse Disorder, Personality Disorder and Attention Deficit Disorder), and Healthcare setting (Outpatient Behavioral Rehabilitation, Inpatient Behavioral Rehabilitation and Residential Behavioral Rehabilitation): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the behavioral rehabilitation market was valued at $421.5 billion in 2023, and is estimated to reach $777.2 billion by 2033, growing at a CAGR of 6.3% from 2024 to 2033.

Request Sample of the Report on Behavioral Rehabilitation Market 2033 – https://www.alliedmarketresearch.com/request-sample/A38564

Prime determinants of growth

Gowing number of cases for mental health disorder, and availability of customized treatment plans are the major factors that drive the growth of the market. However, high treatment cost hinder the market growth. Moreover, technological advancements offer remunerative opportunities for the expansion of the global behavioral rehabilitation market.

Report coverage & details

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $421.5 billion |

| Market Size in 2033 | $777.2 billion |

| CAGR | 6.3% |

| No. of Pages in Report | 216 |

| Segments Covered | Behavioral Disorder, Healthcare setting, and Region |

| Drivers |

|

| Opportunities |

|

| Restraints |

|

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/connect-to-analyst/A38564

Segment Highlights

Increases in prevalence of anxiety disorders and mood disorder

The increasing prevalence of anxiety and mood disorders is significantly driving the behavioral rehabilitation market. Rising cases of these mental health conditions have led to greater demand for specialized treatment programs. This surge underscores the need for comprehensive rehabilitation services, including therapy and support, to address the growing mental health crisis effectively.

Outpatient healthcare settings for behavioral rehabilitation

Outpatient healthcare settings for behavioral rehabilitation are increasingly preferred due to their flexibility and convenience. Patients can receive necessary therapy and support while maintaining their daily routines, reducing the stigma associated with inpatient treatment. Additionally, outpatient programs often provide a cost-effective alternative, making mental health care more accessible to a broader population.

Regional Outlook

The behavioral rehabilitation market shows robust growth across North America and Europe, driven by advanced healthcare infrastructure and rising mental health awareness. In Asia-Pacific, increasing government initiatives and healthcare investments are expanding market opportunities. Latin America and Middle East & Africa are emerging with improving healthcare access and growing awareness.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A38564

Key Players

- Aurora Behavioral Health System

- Behavioral Health Group

- Haven Behavioral Healthcare Inc.

- Niznik Behavioral Health

- Promises Behavioral Health

- Universal Health Services Inc.

The report provides a detailed analysis of these key players in the global behavioral rehabilitation market. These players have adopted different strategies such as, product launch, expansion and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Get Customized Reports with your Requirements – https://www.alliedmarketresearch.com/request-for-customization/A38564

Recent Developments in Behavioral Rehabilitation Market Worldwide

- In June 2023, Mount Sinai Health System inaugurated the newly constructed Mount Sinai-Behavioral Health Center, located at 45 Rivington Street in Lower Manhattan. The facility is aimed to transform behavioral health care in New York City by serving as a comprehensive one-stop shop for mental health care, substance use treatment, and primary care.

Trending Reports in Healthcare Industry:

Intraocular Lens Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

miRNA Tools and Services Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Single-use Bioprocessing Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Forensics Technology Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get an access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.