Shopify Inc. Is Attracting Investor Attention: Here Is What You Should Know

Shopify SHOP is one of the stocks most watched by Zacks.com visitors lately. So, it might be a good idea to review some of the factors that might affect the near-term performance of the stock.

Over the past month, shares of this cloud-based commerce company have returned +6.9%, compared to the Zacks S&P 500 composite’s +2.1% change. During this period, the Zacks Internet – Services industry, which Shopify falls in, has gained 0.2%. The key question now is: What could be the stock’s future direction?

While media releases or rumors about a substantial change in a company’s business prospects usually make its stock ‘trending’ and lead to an immediate price change, there are always some fundamental facts that eventually dominate the buy-and-hold decision-making.

Revisions To Earnings Estimates

Rather than focusing on anything else, we at Zacks prioritize evaluating the change in a company’s earnings projection. This is because we believe the fair value for its stock is determined by the present value of its future stream of earnings.

We essentially look at how sell-side analysts covering the stock are revising their earnings estimates to reflect the impact of the latest business trends. And if earnings estimates go up for a company, the fair value for its stock goes up. A higher fair value than the current market price drives investors’ interest in buying the stock, leading to its price moving higher. This is why empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements.

Shopify is expected to post earnings of $0.27 per share for the current quarter, representing a year-over-year change of +12.5%. Over the last 30 days, the Zacks Consensus Estimate remained unchanged.

The consensus earnings estimate of $1.12 for the current fiscal year indicates a year-over-year change of +51.4%. This estimate has remained unchanged over the last 30 days.

For the next fiscal year, the consensus earnings estimate of $1.32 indicates a change of +18.5% from what Shopify is expected to report a year ago. Over the past month, the estimate has remained unchanged.

With an impressive externally audited track record, our proprietary stock rating tool — the Zacks Rank — is a more conclusive indicator of a stock’s near-term price performance, as it effectively harnesses the power of earnings estimate revisions. The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #3 (Hold) for Shopify.

Projected Revenue Growth

While earnings growth is arguably the most superior indicator of a company’s financial health, nothing happens as such if a business isn’t able to grow its revenues. After all, it’s nearly impossible for a company to increase its earnings for an extended period without increasing its revenues. So, it’s important to know a company’s potential revenue growth.

For Shopify, the consensus sales estimate for the current quarter of $2.11 billion indicates a year-over-year change of +22.9%. For the current and next fiscal years, $8.62 billion and $10.31 billion estimates indicate +22.2% and +19.6% changes, respectively.

Last Reported Results And Surprise History

Shopify reported revenues of $2.05 billion in the last reported quarter, representing a year-over-year change of +20.7%. EPS of $0.26 for the same period compares with $0.14 a year ago.

Compared to the Zacks Consensus Estimate of $2 billion, the reported revenues represent a surprise of +2.03%. The EPS surprise was +30%.

The company beat consensus EPS estimates in each of the trailing four quarters. The company topped consensus revenue estimates each time over this period.

Valuation

No investment decision can be efficient without considering a stock’s valuation. Whether a stock’s current price rightly reflects the intrinsic value of the underlying business and the company’s growth prospects is an essential determinant of its future price performance.

While comparing the current values of a company’s valuation multiples, such as price-to-earnings (P/E), price-to-sales (P/S) and price-to-cash flow (P/CF), with its own historical values helps determine whether its stock is fairly valued, overvalued, or undervalued, comparing the company relative to its peers on these parameters gives a good sense of the reasonability of the stock’s price.

As part of the Zacks Style Scores system, the Zacks Value Style Score (which evaluates both traditional and unconventional valuation metrics) organizes stocks into five groups ranging from A to F (A is better than B; B is better than C; and so on), making it helpful in identifying whether a stock is overvalued, rightly valued, or temporarily undervalued.

Shopify is graded D on this front, indicating that it is trading at a premium to its peers. Click here to see the values of some of the valuation metrics that have driven this grade.

Conclusion

The facts discussed here and much other information on Zacks.com might help determine whether or not it’s worthwhile paying attention to the market buzz about Shopify. However, its Zacks Rank #3 does suggest that it may perform in line with the broader market in the near term.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's Why I Never Redeem My Credit Card Rewards for Cash Back

I’m a big fan of getting rewarded, so I use rewards credit cards to pay for everyday purchases. Many people redeem their credit card rewards for cash back or as a statement credit to their credit card account. But for many credit cards, this isn’t the only redemption choice.

Travelers may be able to get more value from their rewards by avoiding cash back redemptions. Find out why I prefer to redeem my credit card rewards for travel instead of cash.

I prioritize travel in my budget

Like many people, I budget some of my earnings for so-called “fun money.” While some like spending this cash on things like shopping, entertainment, or dining out, I prefer to spend it on travel. Travel is a passion of mine, and it makes me happy.

But travel costs can add up quickly, so I look for ways to save money when booking flights and hotel stays. One way I keep my spending in check is by redeeming my credit card rewards for travel. This allows me to afford to travel more often because I have more fun money left over for other travel expenses like tours and excursions.

Cash back redemptions may not provide the most value

I’ve been using rewards credit cards for nearly a decade. As a newbie, I redeemed my credit card rewards for a statement credit. It was easy and straightforward. But I’ve since learned that I can get much more value from my rewards by redeeming my points and miles differently.

Instead of cashing out my earnings, I transfer my rewards to eligible travel partners. Some travel credit cards partner with select airline and hotel loyalty programs, letting travelers transfer their credit card rewards to these programs to book flights and hotel stays.

As I’ve continued learning more about credit cards, maximizing the value of my credit card rewards is vital to me. I don’t plan to redeem them for cash again.

How I received 3x more value from my rewards

To further illustrate my point, here’s one recent redemption I made with one of the best Chase credit cards. I found myself with a stash of points that I needed to use and a vacation to plan. When searching available award flights through one of Chase’s airline partners, I found one-way business-class flights requiring only 50,000 points.

I booked two one-way business-class tickets for 100,000 points. In addition, I paid $168.20 in taxes and fees. You’re responsible for paying these additional fees when booking award tickets, so review these fees before booking an award ticket to avoid a costly surprise.

How much would I have paid without points? The total cash price for these tickets was $3,448.20. Spending less than $200 to book premium tickets was a significant win.

My credit card issuer also allows me to redeem my points for cash, but this option yields less value. If I had redeemed 100,000 points this way, I’d have received $1,000. While that’s a lot of money, it made more sense for me to redeem my points for round-trip airfare that was worth three times as much.

Explore all redemption choices before cashing out your rewards

If you prefer to pay yourself back by redeeming your credit card rewards for cash, that’s OK! But don’t assume it’s the only choice available. You may be ignoring high-value redemptions without realizing it. It’s a good idea to review all the reward redemptions your credit card issuer provides to make a more informed decision when using your rewards.

Alert: highest cash back card we’ve seen now has 0% intro APR until nearly 2026

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a 0% intro APR for 15 months, a cash back rate of up to 5%, and all somehow for no annual fee!

Click here to read our full review for free and apply in just 2 minutes.

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Natasha Gabrielle has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool has a disclosure policy.

Here’s Why I Never Redeem My Credit Card Rewards for Cash Back was originally published by The Motley Fool

Crude Oil Moves Higher; Prime Medicine Shares Spike Higher

U.S. stocks traded mixed midway through trading, with the Dow Jones index falling more than 200 points during on Monday.

The Dow traded down 0.55% to 42,079.06 while the NASDAQ rose 0.14% to 18,144.66. The S&P 500 also fell, dropping, 0.14% to 5,730.18.

Check This Out: How To Earn $500 A Month From McCormick Stock Ahead Of Q3 Earnings

Leading and Lagging Sectors

Consumer staples shares jumped by 0.3% on Monday.

In trading on Monday, materials shares fell by 0.6%.

Top Headline

The Chicago PMI rose to 46.6 in September from 46.1 in August versus market estimates of 46.2

Equities Trading UP

- NIO Inc. NIO shares shot up 11% to $7.24 after investors agreed to invest an aggregate of 3.3 billion yuan in its Nio China subsidiary while the company agreed to invest 10 billion yuan.

- Shares of Prime Medicine, Inc. PRME got a boost, surging 23% to $4.26 after the company announced a strategic research collaboration and license agreement with Bristol Myers Squibb to develop reagents for the next generation of ex vivo T-cell therapies. Also, it announced that it is focusing its pipeline on a set of high value programs.

- EMCORE Corporation EMKR shares were also up, gaining 71% to $2.06 after Mobix Labs submitted an all-cash offer to acquire the company for $3.80 per share.

Equities Trading DOWN

- Prothena Corporation plc PRTA shares dropped 19% to $16.31. Prothena announced leadership team updates. Cantor Fitzgerald analyst Charles Duncan reiterated Prothena with an Overweight rating.

- Shares of Heritage Insurance Holdings, Inc. HRTG were down 17% to $12.94.

- Stellantis N.V. STLA was down, falling 14% to $13.79 after the company lowered its FY24 guidance.

Commodities

In commodity news, oil traded up 0.9% to $68.81 while gold traded down 0.5% at $2,655.10.

Silver traded down 1.2% to $31.44 on Monday, while copper fell 1.4% to $4.5340.

Euro zone

European shares were lower today. The eurozone’s STOXX 600 fell 0.84%, Germany’s DAX fell 0.66% and France’s CAC 40 dipped 1.71%. Spain’s IBEX 35 Index fell 0.52%, while London’s FTSE 100 fell 0.81%.

The British economy grew by 0.5% on quarter during the second quarter, down from 0.7% in the first quarter, while the UK’s current account deficit widened to £28.4 billion in the second quarter, versus a revised £13.8 billion in the prior quarter. Net consumer credit in the U.K. rose by £1.3 billion in August, from £1.2 billion in the previous month. German import prices increased by 0.2% year-over-year in August compared to a 0.9% rise in July.

Asia Pacific Markets

Asian markets closed mixed on Monday, with Japan’s Nikkei 225 dipping 4.80%, Hong Kong’s Hang Seng Index jumping 2.43%, China’s Shanghai Composite Index gaining 8.06% and India’s BSE Sensex falling 1.49%.

Japan’s housing starts fell by 5.1% year-over-year in August compared to a 0.2% decline in the prior month, while industrial production fell by 3.3% month-over-month in August. Retail sales in Japan climbed by 2.8% year-over-year in August.

The official NBS Non-Manufacturing PMI in China fell to 50.0 in September from 50.3 in the prior month, while official NBS Manufacturing PMI climbed to 49.8 in September from 49.1 in August.

Economics

The Chicago PMI rose to 46.6 in September from 46.1 in August versus market estimates of 46.2.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analysts Think There's Still Time To Get In On Edgewise

Edgewise Therapeutics EWTX is a small-cap pharmaceutical stock that has been all the rage recently. Shares are up 55% in the last three months and up 332% over the past 52 weeks. Yet, with still only a market cap of $2.4 billion, is there still time to get in? I’ll examine recent news around the company, its drug pipeline, and what Wall Street is saying to get a better handle on this question.

Edgewise’s Muscular Dystrophy Treatments Have Large Market Than Others

Edgewise currently has two drugs that are driving the company. They are Sevasemten and EDG-7500. The company is researching Sevasemten to treat muscular dystrophy (MD). One interesting thing about this medicine is that it is being researched to treat multiple types of MD.

Specifically, it is currently in Phase 3 trials to treat Becker MD and in Phase 2 trials for Duchenne MD. Many medicines are being researched only on one form of MD. So, the possibility that they could apply to both is a strong differentiator for the company.

However, this is likely because the treatment manages symptoms. It does not target the genetic cause of Duchenne MD. The root cause of Duchenne and Becker is different, but the symptoms are similar.

Still, this treatment could be valuable and could theoretically be used in conjunction with genetic treatments. The focus on treatment management opens the product up to the entire MD market rather than a sliver of it; another potential benefit.

In its latest results for Becker, the drug showed it actually slightly improved muscle function after 24 months. Those given a placebo showed significantly worse function. Becker MD currently has no approved treatments. The company estimates there are currently around 47,000 people with one of the diseases in the US, EU, and Japan combined.

EDG-7500 Results Show It Keeps Up With The Competition

The company’s other main drug, EDG-7500, is a cardiovascular medicine. Specifically, it works to treat hypertrophic cardiomyopathy (HCM). Recent good news around this drug was why shares of Edgewise jumped 50% in one day. HCM primarily affects the left ventricle of the heart, causing its walls to thicken. The left ventricle is the main pumping station of the heart. pumped. The thickening makes it hard for the left ventricle to pump blood and can result in heart failure.

On average, the study revealed that a biomarker linked to heart stress decreased by 64%. Another measurement of how well the heart is pumping blood is the left ventricular ejection fraction (LVEF).

The results showed that all the patients maintained a normal level of LVEF. Thus, the treatment reduced stress on the heart without interfering with its ability to pump. The market for this treatment is much larger, affecting up to 630,000 people in the United States alone.

However, HCM does have an approved treatment: Bristol Myers Squibb’s BMY Camzyos. The drug showed a 67% reduction in the same biomarker as EDG-7500. However, a very small number of patients did see their LVEF levels fall below normal. At this point, the drugs appear to have similar levels of safety and efficacy. Two and a half years ago, Camzyos received approval. It generated $139 million last quarter, up by 184% from the previous year.

Cytokinetics’ CYTK aficamten, another competitor, is further along but has yet to receive approval. According to Fierce Biotech, analysts at Mizuho Securities say the results of the two drugs look similar.

When it comes to Wall Street, several analysts still see significant upside in Edgewise. At least four firms have increased their price targets on Edgewise since it released Phase 2 results for EDG-7500.

Based on the average of those four targets, the implied upside of Edgewise is 55%, based on the Sept. 24 closing price of nearly $26. The most bullish analyst, Wedbush, thinks Edgewise could rise 70%.

Final Thoughts On Edgewise

At the end of the day, the party is certainly not over for Edgewise until it is. More good news about the drug treatments would continue to boost the stock price. But, it will take a long time for sales to justify its high valuation. The probability of treatments getting approved is low, at around 12% on average.

The results of EDG-7500 do show promise not only in their comparability to the already approved treatment but also in the revenue that Bristol-Myers has demonstrated. However, with Sevasemten in Phase 3 trials for Becker MD, the company could be the first to get an approved treatment in that market.

The article “Analysts Think There’s Still Time to Get in on Edgewise, Up 332%” first appeared on MarketBeat.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stellantis sees things going from bad to worse

The automaker behind brands including Jeep (STLA), Chrysler, and Dodge slashed its full-year financial expectations on Monday, as CEO Carlos Tavares looks to fix the company’s so-called “disaster” in North America.

Stellantis cited performance issues in the market as well as “deterioration” in the global automotive industry, pointing to the rising threat of Chinese automakers and a growing supply of vehicles. Rivals such as BMW, Mercedes-Benz, and Volkswagen, as well as luxury carmaker Aston Martin, have all lowered their guidance in recent weeks, citing similar reasons.

The Netherlands-based automaker has pushed up its timeline to lower U.S. dealer inventory to about 330,000 units to the end of 2024, from the first quarter of 2025. To do so, it will cut shipments to North American over the second half of 2024 by more than 200,000 units compared to a year earlier, doubling its prior guidance.

Plus, Stellantis will offer more generous incentives on vehicles made for the 2024 model year and older, as well as launch “productivity improvement initiatives that encompass both cost and capacity adjustments.”

Stellantis’ performance in North America has been rough in recent months, plagued by big recalls, stagnating sales, plummeting profits, and quality issues. That’s in addition to the departure of several executives and bold offers to buy back at least one of the automaker’s brands. Dealerships earlier this month wrote to Tavares about the “rapid degradation” of Stellantis brands caused by “short-term decision making” that hit market share.

“A disaster not just for us, but for everyone involved — and now that disaster has arrived,” the U.S. Stellantis National Dealer Council wrote in the Sept. 10 letter.

Stellantis is also facing potential walkouts from members of the United Auto Workers (UAW) union, which filed a series of federal labor charges against the automaker earlier this month. The union accused it of failing to keep to the promises made in its labor contract and planning to transfer production of the Dodge Durango to Ontario from Detroit. Stellantis has denied both of the UAW’s allegations.

Stellantis lowered its adjusted operating income margin to between 5.5% and 7% for fiscal 2024, from its prior “double-digit” target. Expected industrial free cash flow was lowered to between negative 5 billion euros and negative 10 billion euros, from Stellantis’ prior “positive” prediction.”

“The Company will continue to leverage and expand its competitive differentiators and believes that the recovery actions being put in place will ensure stronger operational and financial performance in 2025 and beyond,” Stellantis said in a statement.

Adobe Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Adobe.

Looking at options history for Adobe ADBE we detected 22 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 31% with bearish.

From the overall spotted trades, 14 are puts, for a total amount of $1,097,651 and 8, calls, for a total amount of $534,813.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $410.0 to $595.0 for Adobe over the recent three months.

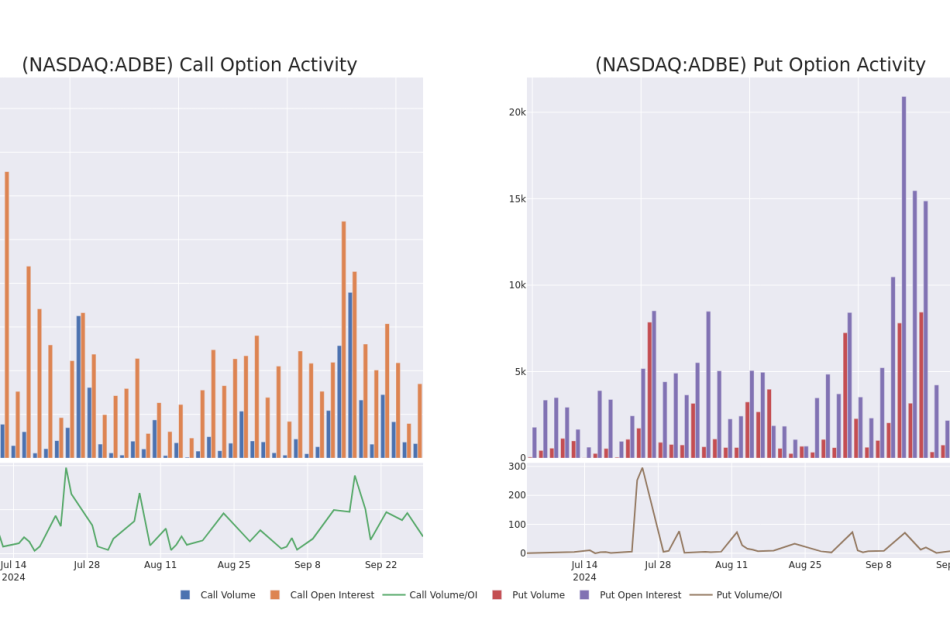

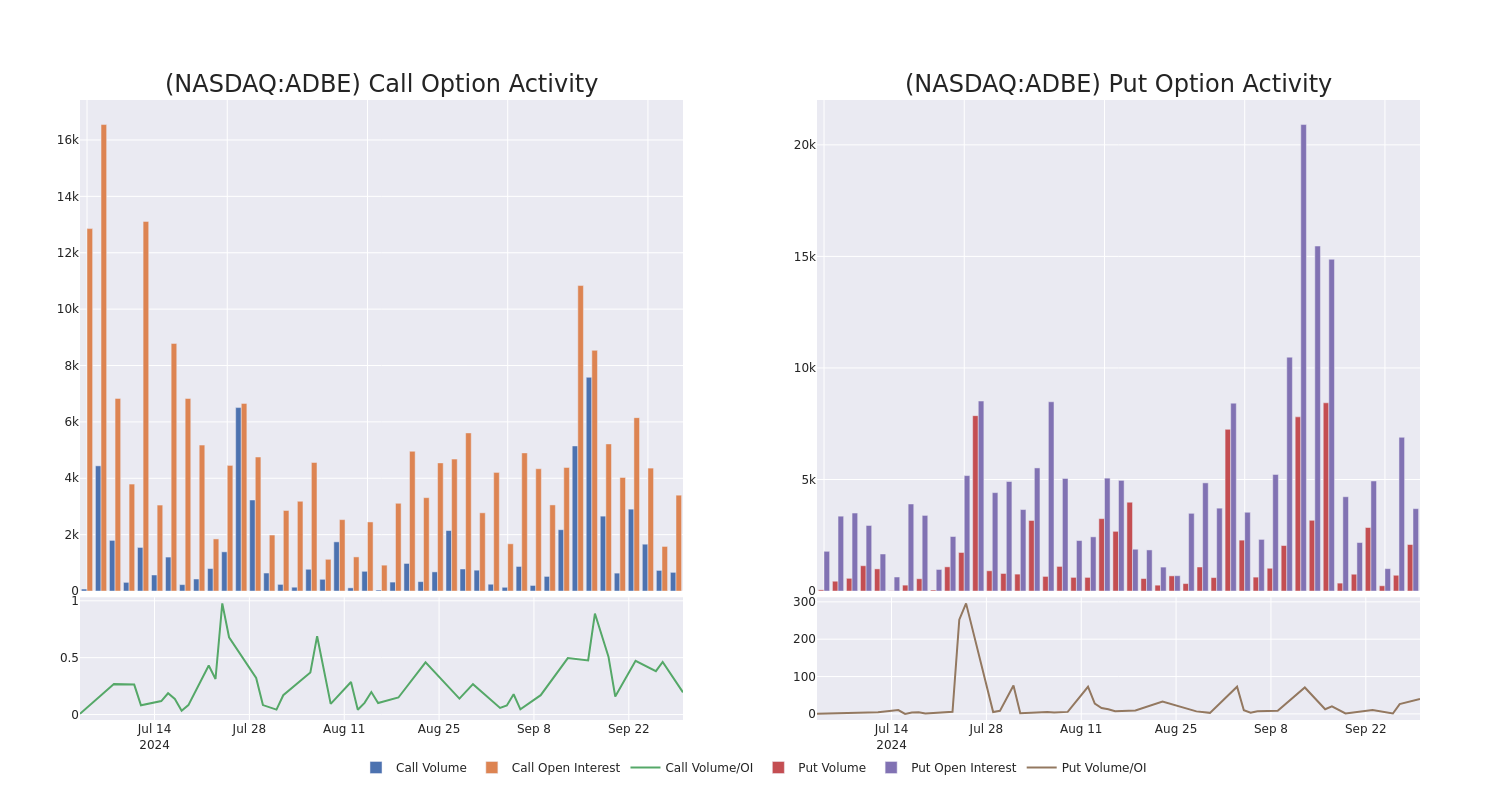

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Adobe’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Adobe’s whale activity within a strike price range from $410.0 to $595.0 in the last 30 days.

Adobe 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADBE | PUT | SWEEP | BULLISH | 12/20/24 | $21.3 | $21.0 | $21.0 | $500.00 | $350.7K | 1.4K | 167 |

| ADBE | CALL | TRADE | BULLISH | 11/15/24 | $10.4 | $10.05 | $10.4 | $540.00 | $312.0K | 836 | 325 |

| ADBE | PUT | SWEEP | BULLISH | 12/20/24 | $21.05 | $21.0 | $21.0 | $500.00 | $102.9K | 1.4K | 370 |

| ADBE | PUT | SWEEP | BEARISH | 09/19/25 | $29.3 | $26.85 | $28.45 | $450.00 | $91.0K | 5 | 64 |

| ADBE | PUT | SWEEP | BEARISH | 09/19/25 | $29.3 | $26.85 | $28.45 | $450.00 | $91.0K | 5 | 40 |

About Adobe

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers for creating, managing, delivering, measuring, optimizing, and engaging with compelling content multiple operating systems, devices, and media. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products (less than 5% of revenue).

Where Is Adobe Standing Right Now?

- Currently trading with a volume of 863,777, the ADBE’s price is down by -0.04%, now at $515.29.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 72 days.

What The Experts Say On Adobe

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $619.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Piper Sandler keeps a Overweight rating on Adobe with a target price of $635.

* An analyst from Barclays has decided to maintain their Overweight rating on Adobe, which currently sits at a price target of $675.

* An analyst from RBC Capital downgraded its action to Outperform with a price target of $610.

* An analyst from Oppenheimer has decided to maintain their Outperform rating on Adobe, which currently sits at a price target of $625.

* An analyst from UBS has decided to maintain their Neutral rating on Adobe, which currently sits at a price target of $550.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Adobe with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bariatric Surgery Devices Market to Reach $3.2 Billion, Globally, by 2033 at 6.5% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 30, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Bariatric Surgery Devices Market by Device Type (Assisting Devices, Implantable Devices and Others), Procedure (Sleeve Gastrectomy, Gastric Bypass and Others), and End User (Hospitals and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the bariatric surgery devices market was valued at $1.7 billion in 2023, and is estimated to reach $3.2 billion by 2033, growing at a CAGR of 6.5% from 2024 to 2033.

Request Sample of the Report on Bariatric Surgery Devices Market 2033 – https://www.alliedmarketresearch.com/request-sample/A43688

Prime determinants of growth

Gowing number of obese population and rise in complications related to obesity are the major factors that drive the growth of the market. However, high cost hinder the market growth. Moreover, technological advancements in bariatric surgery devices offer remunerative opportunities for the expansion of the global bariatric surgery devices market.

Report coverage & details

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $1.7 billion |

| Market Size in 2033 | $3.2 billion |

| CAGR | 6.6% |

| No. of Pages in Report | 216 |

| Segments Covered | Device Type, Procedure, End User and Region |

| Drivers |

|

| Opportunities |

|

| Restraints |

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/connect-to-analyst/A43688

Segment Highlights

Assisting devices in bariatric surgery

Assisting devices in bariatric surgery, such as laparoscopic instruments, staplers, and sutures, are more commonly used compared to implantable devices like gastric bands. These assisting devices facilitate minimally invasive procedures, offering precision and efficiency. Their versatility across various surgical techniques and the trend towards less invasive interventions drive their higher usage over implantable options.

Predominant use of bariatric surgery devices in sleeve gastrectomy

Bariatric surgery devices are predominantly used in sleeve gastrectomy procedures due to the procedure’s rising popularity. Sleeve gastrectomy, a minimally invasive technique, involves resecting a large portion of the stomach. Devices like staplers and laparoscopic instruments are crucial for ensuring precision, safety, and effectiveness, driving their extensive use in this surgery.

Hospitals are the prime users of bariatric surgery devices

Hospitals are the primary end users of bariatric surgery devices due to their comprehensive medical facilities and expertise. They provide the necessary infrastructure, skilled surgeons, and post-operative care required for bariatric procedures. The high patient volume and capability to handle complex cases make hospitals the leading centers for utilizing these advanced surgical devices.

Regional Outlook

The bariatric surgery devices market shows robust growth globally, with North America leading due to high obesity rates and advanced healthcare infrastructure. Europe follows with increasing adoption of minimally invasive surgeries. In Asia Pacific, rising healthcare expenditure and awareness are driving market expansion. Latin America and the Middle East & Africa regions are also witnessing gradual market growth.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A43688

Key Players

- Teleflex Incorporated

- Asensus Surgical Us, Inc.

The report provides a detailed analysis of these key players in the global bariatric surgery devices market. These players have adopted different strategies such as, product launch, expansion and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Recent Developments in Bariatric Surgery Devices Market Worldwide

- In February 2023, Teleflex Incorporated, announced it was awarded a group purchasing organization (GPO) agreement with Premier, Inc. for the Titan SGS powered stapling device, expanding access to this innovative technology for surgeons affiliated with Premier.

- In September 2022, Olympus Corporation announced the launch of VISERA ELITE III, its newest surgical visualization platform that addresses the needs of healthcare professionals (HCPs) for endoscopic procedures across multiple medical disciplines.

Trending Reports in Healthcare Industry:

Minimally Invasive Surgical Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Shoulder Arthroplasty Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Cataract Surgery Devices Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Electrocardiograph (ECG) Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get an access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Investor Home Buyers Publishes the Key Advantages of Choosing a Cash Home-Buying Company in Texas

Dallas, TX, Sept. 30, 2024 (GLOBE NEWSWIRE) — Investor Home Buyers, a dedicated real estate solutions and investment firm focusing on assisting homeowners in swiftly relieving themselves of troublesome properties in Texas, is happy to announce that it has recently published the key advantages that homeowners can experience when choosing a cash home-buying company in Texas.

The recently published article on the key advantages of choosing a cash-home buying company in Texas by Investor Home Buyers has been created to offer homeowners considering selling their homes an honest and in-depth guide that comprehensively outlines the key advantages of bypassing the traditional real estate route to sell their homes. The top fast cash-for-houses company hopes that its new article will empower families with difficult properties to discover a new way to sell their homes.

“We Buy Houses In Texas For Cash. So, what are the benefits you get when choosing this alternative route? You won’t have to renovate or worry about expensive repair issues as we buy houses as-is,” said a spokesperson for Investor Home Buyers. “You also don’t have to deal with questionable agents and the long process of putting your house on the market. Best of all, you won’t get slammed by hidden fees and commissions because we buy houses without any agent fees involved.”

From helping homeowners avoid costly fees and long closing delays to purchasing houses in ‘as-is’ conditions that do not require any cleaning or repairs, Investor Home Buyers comprises a team of professional house buyers who will provide individuals with troublesome properties in Texas with a fair and honest cash offering.

The key advantages highlighted in the cash home buyers new article include:

No Repairs: Upgrades, fixes, and renovations can cost a fortune. Homeowners who choose to sell their homes through an agent need to get their houses market-ready, which, in addition to high expenses, can take a significant period of time. By selling a house for cash in Texas, families can sell their house in the exact condition it is currently in.

No Agents: With appraisals, financing, advertising, and inspections to deal with, agents can extend and complicate the home selling process while additionally charging 5% for their services and usually tending to decide when to close a deal. Investor Home Buyers remove agents from the process and all the unnecessary hurdles to provide a seamless and quick process.

No Fees: Without agents, homeowners don’t have to worry about commission costs and escrow or brokerage fees. Instead, they will be offered a transparent, honest, and fair cash offer based on the current condition of their home.

“It’s a simple process when you sell your house to a professional cash-for-houses company like ours. You can leave your old furniture, your leaky roof, and your old toilets. When we say we’ll buy it as-is and give you an offer, we’re true to our word. We come with years of experience and can handle all of the heavy lifting, such as major renovations and plumbing work, so you can sell your house hassle-free,” furthered the spokesperson for Investor Home Buyers.

Investor Home Buyers invites homeowners in Dallas and surrounding areas seeking a swift and reliable way to sell their homes to fill out the convenient form via its website today.

About Investor Home Buyers

Investor Home Buyers is a dedicated real estate solutions and investment firm that assists homeowners in swiftly relieving themselves of troublesome properties in Texas. As experienced investors and adept problem solvers, the company is equipped to make a prompt, equitable, all-cash offer for homes in ‘as-is’ conditions.

More Information

To learn more about Investor Home Buyers and the advantages of choosing a cash home-buying company in Texas, please visit the website at https://www.investorhomebuyers.com/sell-my-house-fast-texas-tx/.

Investor Home Buyers 673 W Seventh St Dallas TX 75208 United States (214) 253-4544 https://www.investorhomebuyers.com/sell-my-house-fast-texas-tx/

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.