Global Synthetic Rubber Market is projected to grow at a 4.21% CAGR from 2024 to 2032 | Exactitude Consultancy

Luton, Bedfordshire, United Kingdom, Sept. 30, 2024 (GLOBE NEWSWIRE) — Market of synthetic rubber is in the middle of transition due to the changes in some of the industrial sectors and demand. Thus, synthetic rubber which is produced through polymerization of the monomers is used owing to the fact that it has desirable characteristics such as high measure of hardness, moderate versatility and the degree of flexibility which can be designed to have the performance requirements of the intended application or use. It is easy to shape and form, and Its versatility makes it a favourite in manufacturing companies including automobile industries, construction industries, consumer products, and the health care sector.

Automotive industry is an interesting market for synthetic rubber since it is considered to be one of the key consumers of the product. Hence the need for synthetic rubber for various uses within this sector for instance in tires, seals, gaskets and hoses. The progress in the automobile manufacturing and the technological development in this sector has therefore resulted to the use of the synthetic rubber. Synthetic rubber: High performance tires which require various weather conditions and road stresses are much dependent on synthetic rubber comparing to natural rubber.

Inquiry for Sample Report: https://exactitudeconsultancy.com/reports/27806/synthetic-rubber-market/#request-a-sample

Moreover, the manufacturer’s innovations being used in the automobile industry further continues to push the use of synthetic rubber material in the market such as electric vehicles or smart tires.

The construction sector also sources mostly for synthetic rubber consume in the market. It is employed in various construction products, including roofing membranes and floorings, sealants and other related uses that afford advantages since is gotten from synthetic rubber. This makes the demand for construction materials, which are strong and can last for a long-time due to continuous infrastructure development as a result of expanding urbanization and the growing economy.

Other significant uses of synthetic rubber include consumer products and medical device products. In consumer goods, synthetic rubber found its application in products like footwear and household consumer products as they provide an added advantage of durability and comfort to its user. Today synthetic rubber has many applications in the medical field such as in gloves, seals and tubes, tubes due to its flexibility and chemical resistance characteristics.

However, potential barriers still threaten the further evolution of synthetic rubber market. Environmental is one of them including the great impacts in the production phase and during the disposal and utilization of synthetic rubber. Some concerns of sustainability include the use of petrochemical based raw material and the non-biodegradable characteristics of synthetic rubber. Consequently, recycling and pollution, along with labelling and sourcing policies are more and more concerned in the industry. Many companies are now focusing on research to develop better synthetic rubbers while there is increasing concern in the environmental problems that accompany production processes.

Externally, changes in the global prices of raw materials that are used in the production of synthetic rubber; especially regarding crude oil impacts its cost and volatileness. Logistic and political changes can also worsen these effects making the cost of manufacturing higher and making the markets unpredictable. To counter these risks, organizations are looking at viable substitutes for the raw materials and aiming at the diversification of supply chain sources.

Browse a Full Report: –

https://exactitudeconsultancy.com/reports/27806/synthetic-rubber-market/

In the long-run, the synthetic rubber market is also projected to have its upswing, with constant efforts towards research and development and mounting application demand from the end-use segments. The Asia-Pacific countries and Latin American countries are still at a significantly early stage of industrialization and therefore the growth potential is visible owing to the increasing number of consumers that these regions represent. Hence, the aspects such as eco-friendly synthetic rubber and greater recycling industry of the synthetic rubbers and the sustainability will bear the industry’s key defining factors in the future.

The synthetic rubber market has a fairly large number of key players such as Indian Synthetic Rubber Private Limited, Apcotex Industries Limited, Reliance Industries Limited, Trinseo, Others. These are companies that are always enhancing on the synthetic rubber and are keen on producing the synthetic rubber products with enhanced performance. These firms have also adopted other strategies such as strategic cooperation, mergers and acquisitions in a bid to strengthening their positions in the market and expand their product offerings.

Key Players

- Indian Synthetic Rubber Private Limited

- Apcotex Industries Limited

- Reliance Industries Limited

- Trinseo

- Goodyear Tire and Rubber Company

- Sinopec

- LANXESS

- TSRC Corporation

- JSR Corporation

- Kumho Petrochemical

New sources of data on the Synthetic Rubber Process Market

- 31 January 2023: Reliance Consumer Products Limited (RCPL) the FMCG arm and wholly owned subsidiary of Reliance Retail Ventures Limited (RRVL) proposed to enter into a strategic partnership with Sri Lanka based Maliban Biscuit Manufactories (Private) Limited or Maliban.

- June 2023 – Apcotex Industries Limited invested USD 24.13 million in the expansion of its two rubber projects. The purpose of the investment was to maximize the company’s revenue from its rubber segment.

- April 2023- Sinopec announced that it had increased the production capacity of styrene butadiene (SBC) by 170,000 tons per year. This increase was done in manufacturing sites located in Hainan, China. The purpose of the capacity expansion was to establish a presence in China.

- 29 December 2022: Reliance consumer products limited, a wholly-owned Subsidiary of reliance retail ventures limited, to acquire 51% controlling stake in lotus chocolate company Limited and make an open offered to acquire up to 26%.

Expanding the Advanced Process Control Industry by Region

The global market of synthetic rubber is divided by regions where the growth rates and demand stimuli differ significantly. The region that has the major influence in the market is North America such as United States of America, Canada, and Mexico the automotive industry as well as the industrial sector. The U. S. has one of the largest automotive industries and the demand from this market for tires made of synthetic rubber is rather high. In addition to this, there has been rising popularity of EVs which has also escalated the utilization of high-performance tires. Also, for conveyor belts, seals and gaskets the region’s industrial machinery sector utilizes synthetic rubber. However, such factors as high raw material costs and strict environmental standards might act as major hurdles to the market.

Currently Europe remains a prominent market for synthetic rubber with Germany, France, Italy and United Kingdom considered to be leading markets for the product. Synthetic rubber finds most of its consumption in automobile manufacturing industries especially in Germany which is a prominent manufacturer of automobiles. The area is called environmentally conscious for it has established some tighter restrictions regarding the conservation of the environment causing the producers of synthetic rubber to produce environmentally sustainable products. On the same note, Europe is focused on improving its standards of cutting carbon emissions through development of bio-based rubbers and recycling them. The market is rather already saturated, though constant development and programs meant to protect the environment make it rather progressive.

Currently, the Asia Pacific region is the biggest and rapidly growing market for synthetic rubber where leading demanders are China, India, Japan and South Korea. Synthetic rubber is widely used in tires and owing to the fact that China is the largest producer of automobiles in the world, tires produced in China comprise a large share of the global synthetic rubber market. Automotive and construction industries of India and several SE Asian nations are also growing at a fast pace making Synthetic rubber required in tires, sealant, and roofing products. Currently the region is experiencing increased urbanization and growing income per capita and this increases the demand due to more vehicle usage. The accessibility of the raw materials and the cheap labour reinforce the growth of the region in the near future.

Market Segments:

Form:

- Liquid Synthetic Rubber

- Solid Synthetic Rubber

Type of Synthetic Rubber:

- Styrene-Butadiene Rubber (SBR)

- Butadiene Rubber (BR)

- Ethylene Propylene Diene Monomer (EPDM)

- Nitrile Rubber (NBR)

- Neoprene (CR)

- Other Types

Application:

- Automotive

- Industrial

- Construction

- Consumer Goods

- Medical

End-Use Industry:

- Automotive

- Building and Construction

- Manufacturing

- Healthcare

- Others

Product Form:

- Tires

- Footwear

- Hoses and Belts

- Sheets and Rolls

Geography:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

Quantitative Analysis –

– Market size, estimates, and forecasts from 2024 – 2032

– Market size and revenue estimates for products up to 2032

– Market revenue estimates for application up to 2032

– Market revenue estimates for type up to 2032

– Regional market size and forecast up to 2032

Find more Research-

Flooring Market-

https://exactitudeconsultancy.com/reports/7196/flooring-market/

The global flooring market is expected to grow at a 3.68% CAGR from 2020 to 2029. It is expected to reach above USD 448.7 billion by 2029 from USD 324.2 billion in 2020.

Flexible substrates Market –

https://exactitudeconsultancy.com/reports/7181/flexible-substrates-market/

The global flexible substrates market is expected to grow at a 10.57% CAGR from 2020 to 2029. It is expected to reach above USD 778.6 million by 2029 from USD 315.2 million in 2020.

Rainscreen Cladding Market-

https://exactitudeconsultancy.com/reports/7177/rainscreen-cladding-market/

The global Rainscreen Cladding Market will witness a CAGR of 6.8% for the forecast period of 2022-2029. It is expected to reach above USD 20.43 Billion by 2029 from USD 11.30 Billion in 2020.

Flexible Epoxy Resin Market-

https://exactitudeconsultancy.com/reports/7111/flexible-epoxy-resin-market/

The global flexible epoxy resin market is expected to grow at a 3.74% CAGR from 2020 to 2029. It is expected to reach above USD 864.1 million by 2029 from USD 621.2 million in 2020.

High-Performance Fluoropolymers Market-

https://exactitudeconsultancy.com/reports/7100/high-performance-fluoropolymers-market/

The global High-Performance Fluoropolymers Market size is expected to grow from USD 3.46 billion in 2020 to USD 6.25 billion by 2029, at a CAGR of 6.8% during the forecast period.

Food Enzymes Market –

https://exactitudeconsultancy.com/reports/7077/food-enzymes-market/

The global Food Enzymes Market is expected to grow at a 3.65% CAGR from 2020 to 2029. It is expected to reach above USD 4.28 billion by 2029 from USD 3.1 billion in 2020.

Industrial PU Elastomer Market –

https://exactitudeconsultancy.com/reports/7067/industrial-pu-elastomer-market/

The global industrial PU elastomer market is expected to grow at 6.3 % CAGR from 2020 to 2029. It is expected to reach above USD 12.55 billion by 2029 from USD 7.24 billion in 2020.

Food Coating Market-

https://exactitudeconsultancy.com/reports/7054/food-coating-market/

The global Food Coating Market is expected to grow at a 5.75% CAGR from 2020 to 2029. It is expected to reach above USD 3.72 billion by 2029 from USD 2.25 billion in 2020.

PTFE Fabric Market –

https://exactitudeconsultancy.com/reports/6885/ptfe-fabric-market/

The global PTFE fabric market size was USD 830.00 Million in 2020 and is projected to reach USD 1,332.43 Million by 2029, exhibiting a CAGR of 5.4% during the forecast period.

Synthetic Gypsum Market –

https://exactitudeconsultancy.com/reports/6887/synthetic-gypsum-market/

The global synthetic gypsum market is expected to grow at 4.2 % CAGR from 2020 to 2029. It is expected to reach above USD 2.14 billion by 2029 from USD 1.48 billion in 2020.

Sustainable Plastic Packaging Market-

https://exactitudeconsultancy.com/reports/6869/sustainable-plastic-packaging-market/

The global sustainable plastic packaging market is expected to grow at 5.6 % CAGR from 2020 to 2029. It is expected to reach above USD 137.17 billion by 2029 from USD 84 billion in 2020.

Polyurethane Sealants Market-

https://exactitudeconsultancy.com/reports/6876/polyurethane-sealants-market/

The global Polyurethane Sealants Market size was USD 2.50 Billion in 2020 and is projected to reach USD 3.95 Billion by 2029, exhibiting a CAGR of 5.2% during the forecast period.

Synthetic Latex Polymer Market –

https://exactitudeconsultancy.com/reports/6853/synthetic-latex-polymer-market/

The global synthetic latex polymer market is expected to grow at a 6.5 % CAGR from 2020 to 2029. It is expected to reach above USD 48.82 billion by 2029 from USD 27.70 billion in 2020.

Polyurethane Composites Market-

https://exactitudeconsultancy.com/reports/6844/polyurethane-composites-market/

The global Polyurethane Composites Market will witness a CAGR of 5.7% for the forecast period of 2022-2029. It is expected to reach above USD 872.87 Million by 2029 from USD 530 Million in 2020.

Prefilled Syringes Market –

https://exactitudeconsultancy.com/reports/6828/prefilled-syringes-market/

The global prefilled syringes market will witness a CAGR of 9.7% for the forecast period of 2022-2029. It is expected to reach above USD 12.88 Billion by 2029 from USD 5.60 Billion in 2020.

Polyurethane Adhesives Market –

https://exactitudeconsultancy.com/reports/6818/polyurethane-adhesives-market/

The global Polyurethane Adhesives Market will witness a CAGR of 6.2% for the forecast period of 2022-2029. It is expected to reach above USD 11.95 Billion by 2029 from USD 7.50 Billion in 2020.

Precast Concrete Market –

https://exactitudeconsultancy.com/reports/6798/precast-concrete-market/

Precast Concrete Market will witness a CAGR of 5.3% for the forecast period of 2022-2029

Biodegradable Plastics Market –

https://exactitudeconsultancy.com/reports/6714/biodegradable-plastics-market/

Biodegradable plastics market size was valued at USD 5.9 billion in 2020 and is projected to reach USD 43.95 billion by 2029, growing at a CAGR of 25% from 2022 to 2029.

Biodegradable Paper & Plastic Packaging Market –

https://exactitudeconsultancy.com/reports/6687/biodegradable-paper-and-plastic-packaging-market/

Biodegradable paper and plastic packaging market size was valued at USD 10.77 billion in 2020 and is projected to reach USD 38.51 billion by 2029, growing at a CAGR of 15.2% from 2022 to 2029.

Biodegradable Mulch Films Market –

https://exactitudeconsultancy.com/reports/6668/biodegradable-mulch-film-market/

Biodegradable mulch films market size was valued at USD 34.59 million in 2020 and is projected to reach USD 76.38 million by 2029, growing at a CAGR of 9.2% from 2022 to 2029.

More sites:

https://bulletin.exactitudeconsultancy.com/

https://www.analytica.global/

https://www.marketintelligencedata.com/

https://www.marketinsightsreports.com/

Irfan Tamboli (Head of Sales) – Exactitude consultancy Phone: + 1704 266 3234 sales@exactitudeconsultancy.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

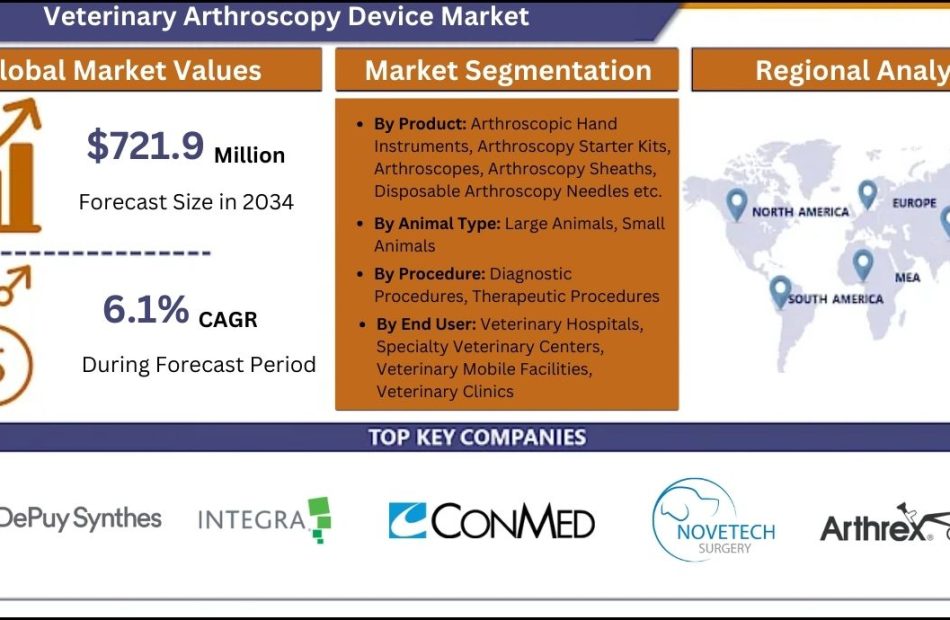

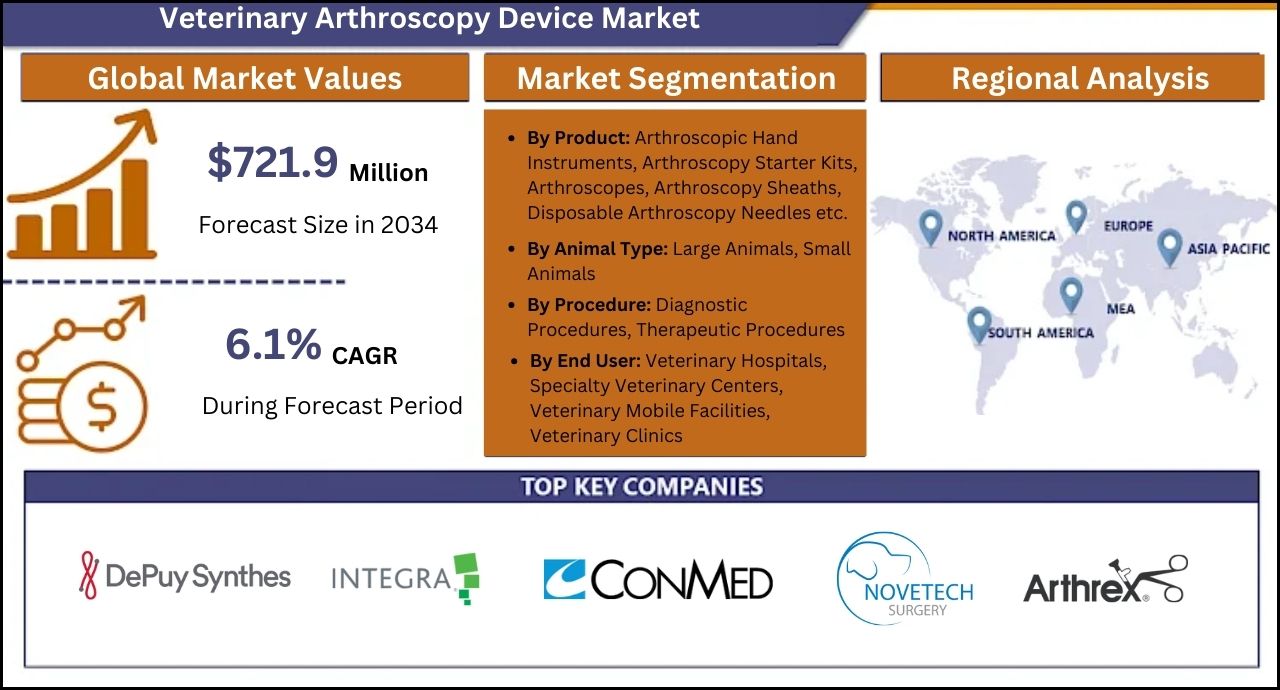

Veterinary Arthroscopy Device Market is Predicted to Reach US$ 721.9 Billion by 2034 | Fact.MR Report

Rockville, MD, Sept. 30, 2024 (GLOBE NEWSWIRE) — According to a new research report by Fact.MR, the global veterinary arthroscopy device market is expected to reach US$ 401 million in 2024 and is further projected to expand at 6.1% CAGR from 2024 to 2034.

The market is being driven by a growing number of pet owners seeking advanced medical care for their animals. With increasing awareness of pet health issues, there is a rising demand for sophisticated diagnostic and therapeutic procedures like arthroscopy. Market growth is further fueled by advancements in imaging technologies, surgical techniques, and the development of smaller, more precise instruments.

These innovations are gaining popularity among veterinarians due to their ability to improve patient outcomes and diagnostic accuracy. The proliferation of specialized veterinary clinics equipped with cutting-edge surgical capabilities is also contributing to market expansion. Clinics are increasingly investing in arthroscopy equipment to provide comprehensive orthopedic care, thereby driving further market growth.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=10231

Key Takeaways from Market Study

- The global market for veterinary arthroscopy devices is projected to expand at a CAGR of 1% from 2024 to 2034.

- The market is forecasted to climb to a size of US$ 721.9 million by the end of 2034.

- The market in the United States is set to reach a value of US$ 144 million in 2024.

- China is set to occupy 7% share of the East Asia market in 2024.

- Revenue from the sales of veterinary arthroscopy devices in Japan is estimated to reach US$ 24 million in 2024.

- The North American market is forecasted to expand at a CAGR of 4% between 2024 and 2034.

- The arthroscopic hand instruments segment is expected to reach a valuation of US$ 87.7 million in 2024.

“Rising number of specialized veterinary clinics equipped with advanced surgical capabilities is leading to higher investments in arthroscopy devices. Collaborations among veterinary arthroscopy device manufacturers, research institutions, and clinics are supporting innovation and market expansion,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Veterinary Arthroscopy Device Market

Key players in the veterinary arthroscopy device industry are GerVetUSA, Dr. Fritz Endoscopes, Depuy Synthes, Integra LifeSciences Corporation, IMEX Veterinary, Inc., ConMed Linvatec, Novetech Surgery, Arthrex, Inc., Karl Storz SE & Co. KG, Biovision Veterinary Endoscopy, LLC., Eickemeyer, vetOvation, KYON Veterinary Surgical Products, Trice Medical.

Surging Popularity of Arthroscopic Hand Instruments

Arthroscopic hand instruments allow surgeons to perform procedures with small incisions (portals) instead of having to contend with large open wounds. Since less damage is done to the surrounding tissues, there is less pain after surgery, shorter recovery period, and lower risk of complications such as infections. These devices work in conjunction with arthroscopic cameras and light sources to provide a high-definition view of the joint’s interior. Due to improved visibility, surgeons are able to diagnose and treat joint conditions more accurately, including cartilage damage, ligament tears, and other pathologies.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=10231

Veterinary Arthroscopy Device Industry News

- In May 2021, Stryker Corporation successfully acquired OrthoSensor, Inc.

- Trice Medical purchased Tenex Health in April 2021. With this acquisition, the company was able to offer a state-of-the-art, cost-effective, portable diagnostic instrument with outstanding picture quality to general and specialist veterinarians operating in small animal and horse practices.

- In December 2021, OrthoSpin, an Israeli firm that designs and manufactures automated strut systems, was acquired by Johnson & Johnson Services, Inc., a division of DePuy Synthes, an American medical device manufacturer.

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the veterinary arthroscopy device market for 2018 to 2023 and forecast statistics for 2024 to 2034.

The study divulges the veterinary arthroscopy device market based on product (arthroscopic hand instruments, arthroscopy starter kits, arthroscopes, arthroscopy sheaths, disposable arthroscopy needles, arthroscopy suture anchor implants, cleaning & sterilization trays, arthroscopy shaver systems, arthroscopy radiofrequency devices & wands, arthroscopy fluid management systems, arthroscopy visualization systems), animal type (large animals, small animals), procedure (diagnostic procedures, therapeutic procedures), and end user (veterinary hospitals, specialty veterinary centers, veterinary mobile facilities, veterinary clinics), across seven major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and MEA).

Check out More Related Studies Published by Fact.MR:

Veterinary Endoscopy Market: Size is currently valued at US$ 184 million. Global sales of veterinary endoscopy machines are expected to rise at a CAGR of 5.5% from 2022 to 2027 and will reach US$ 240.4 million by 2027.

Veterinary Artificial Insemination Market: Size is forecast to garner a market value of US$ 3.16 Bn in 2022, anticipated to register a positive CAGR of 5.2% in the forecast period 2022-2032 and reach a value of US$ 5.24 Bn.

Veterinary Imaging Systems Market: Size is anticipated to increase at a CAGR of 6.3% from 2023 to 2033. As such, the veterinary imaging systems market is expected to increase from a valuation of US$ 1.9 billion in 2023 to US$ 3.5 billion by 2033-end.

Veterinary Molecular Diagnostics Market: Size is estimated to reach US$ 211 million in 2024. The market has been analyzed to climb to a value of US$ 463.3 million by the end of 2034, expanding at a CAGR of 7.5% between 2024 and 2034.

Veterinary Anti-Infective Market: Size is estimated to reach US$ 5.03 billion in 2024. The market is analyzed to climb to a value of US$ 7.47 billion by the end of 2034, expanding at a CAGR of 4%.

Veterinary Hematology Analyzers Market: Size is valued at US$ 971.6 million in 2023 and is expected to increase at a CAGR of 5% to reach US$ 1.58 billion by the end of 2033.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Follow Us: LinkedIn | Twitter | Blog

Contact: 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583 Sales Team: sales@factmr.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Stocks Set For Flattish Start As Traders Eye Job Data, Jerome Powell Speech And Looming Dock Workers' Strike: Top Analyst Says 'Stage Is Set' For Tech Stocks To Move Higher

U.S. stocks appear on track to start the new week on the back foot, with index futures modestly lower early Monday. As the S&P 500 trades slightly shy of its record high, traders may show reluctance to add to their positions, especially ahead of the week’s labor market data. Regional manufacturing activity data and speeches by Federal Reserve officials, including one from Chair Jerome Powell, could also have a bearing on the trading direction.

Sentiment may be marred by the looming strike by the International Longshoremen’s Association that is expected to stall activity in ports from New England to Texas, potentially crippling supply chains. In a note to clients, fund manager Louis Navellier said, “Even a two-week Longshoreman strike would disrupt holiday sales and supply chains for drugs and other essential products.”

| Futures | Performance (+/-) |

| Nasdaq 100 | -0.10% |

| S&P 500 | -0.05% |

| Dow | -0.08% |

| R2K | -0.53% |

In premarket trading on Monday, the SPDR S&P 500 ETF Trust SPY eased 0.03% to $571.29 and the Invesco QQQ ETF QQQ fell 0.04% to $486.55, according to Benzinga Pro data.

Cues From Last Week:

U.S. stocks rose for a third straight week as traders bet on the continuation of the rally into the fourth quarter as the Fed delivers on its promise. The Chinese efforts to stimulate the economy set in motion buying in China-exposed stocks, while positive reaction to Micron Technology, Inc.’s MU earnings boosted the tech space.

The Dow Industrials finished the week at fresh intraday and closing highs, while the S&P 500 settled just shy of its all-time highs.

| Index | Weekly Performance (+/) |

Value |

| Nasdaq Composite | +0.95% | 18,119.59 |

| S&P 500 Index | +0.63% | 5,738.17 |

| Dow Industrials | +0.59% | 42,313.00 |

| Russell 2000 | -0.14% | 2,224.70 |

Insights From Analysts:

The solid September gains bring both good and bad news for the market, according to Carson Group Chief Investment Strategist Ryan Detrick. The S&P 500 Index is close to clocking gains of 20% year-to-date heading into October for the first time since 1997, the strategist said. When this had happened in the past, the index was down seven of the nine times. Despite the October weakness, the fourth quarter returned 4.1% on average in these years, he added.

See Also: How To Trade Futures

Upcoming Economic Data:

A quartet of employment reports, including the non-farm payrolls data for September, ADP private payrolls data, the August Job Openings and Labor Turnover survey data and the weekly jobless claims, are among the key data releases for the week. Traders may also focus on a few private sector activity reports scheduled for the week.

- On Monday Federal Reserve Governor Michelle Bowman is scheduled to speak at 8:50 a.m. EDT.

- ISM-Chicago is due to release the results of its regional manufacturing survey at 9:45 a.m. EDT. The Chicago business barometer is expected to show a reading of 45.3 for September, down from 46.1 in August, suggesting a faster rate of contraction.

- The Treasury will auction three- and six-month bills at 11:30 a.m. EDT.

- Powell will address the National Association for Business Economics, in Nashville, Tennessee, at 1:55 p.m. EDT.

Stocks In Focus:

- Carnival Corporation & plc CCL is scheduled to announce its quarterly results ahead of the market opening.

- Crypto-linked stocks pulled amid the softness seen in digital currencies. MicroStrategy, Inc. MSTR and Coinbase Global, Inc. COIN fell over 5.70% and 4.40%, respectively, in premarket trading.

- Chinese EV startup Nio, Inc. NIO climbed over 13% after the company announced additional financing from strategic investors. The shares also reacted to the optimism regarding China’s stimulus measures. Peers XPeng, Inc. XPEV and Li Auto, Inc. LI rose over 8.40% and 7.50%, respectively.

- Other U.S.-listed Chinese stocks such as Alibaba Group Holding Limited BABA, JD.com, Inc. JD and Baidu, Inc. BIDU also rallied.

Commodities, Bonds And Global Equity Markets:

Crude oil futures fell modestly and traded under $68, while gold futures, though trading off the record highs, are modestly higher. Bitcoin BTC/USD slipped over 3% over the past 24 hours and traded around $63.6K. The yield on the 10-year Treasury edged up slightly to 3.779%.

The major Asian markets closed on a mixed note, with the Japanese market plunging 4.80% as 67-year-old Shigeru Ishiba is all set to take over as prime minister after he was elected to lead the Liberal Democratic Party. Uncertainty over his fiscal and monetary policies led to the unraveling of bets, reports said. The Indian, South Korean, Taiwanese, Indonesian and New Zealand markets also advanced.

On the other hand, China’s key market gauge rallied over 8% after domestic private sector activity data came in weaker than expected, raising hopes of additional stimulus measures. The Hong Kong market also rallied strongly, while the Australian and Singaporean markets rose, although by a much more modest magnitude.

Sentiment across the Atlantic is negative, with most major markets in Europe trading firmly in the red in early trading.

Read Next:

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ROSEN, GLOBAL INVESTOR COUNSEL, Encourages Orthofix Medical Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action – OFIX

NEW YORK, Sept. 29, 2024 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of common stock of Orthofix Medical Inc. OFIX between October 11, 2022 and September 12, 2023, both dates inclusive (the “Class Period”), of the important October 21, 2024 lead plaintiff deadline.

SO WHAT: If you purchased Orthofix common stock during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the Orthofix class action, go to https://rosenlegal.com/submit-form/?case_id=19330 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than October 21, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, throughout the Class Period, defendants made misleading statements and omissions regarding Orthofix’s business, financial condition, and prospects. Specifically, defendants failed to disclose that certain of Orthofix’s management team had engaged in repeated inappropriate and offensive conduct. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the Orthofix class action, go to https://rosenlegal.com/submit-form/?case_id=19330 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Company That Buys Houses Launches Simple 3-Step Approach for Homeowners Seeking to Sell Their Property in Texas

Fort Worth, TX, Sept. 30, 2024 (GLOBE NEWSWIRE) — Company That Buys Houses, a leading authority in real estate transactions and investment in Texas, is proud to announce the launch of its simple 3-step approach that enables homeowners to swiftly sell their houses in ‘as-is’ conditions in Texas without the complications and fees commonly associated with the traditional real-estate route.

The new 3-step approach by Company That Buys Houses cuts out conventional intermediaries like realtors, lenders, appraisers, and inspectors to offer homeowners a streamlined process that ensures a hassle-free home selling experience that is free from the need to complete repairs, staging, or a lengthy closing waiting time.

“Company That Buys Houses has revolutionized the procedure for expeditiously selling your home and providing you with immediate cash,” said a spokesperson for the company. “Our method simplifies the process into Three Simple Steps and eliminates any uncertainties about how to sell your property in the future.”

The 3-step home selling approach provided at Company That Buys Houses includes:

Step 1: The first step in the process for homeowners who are considering selling their property fast for cash in Texas is to fill out the form via the company’s website or to give its friendly team a call. When Company That Buys Houses has all the required details, it will create a personalized offer.

Step 2: Next, Company That Buys Houses will arrange a convenient time to visit the property to perform a thorough walkthrough and assess any necessary repairs before providing a fair ‘as-is’ cash offer. This offer will be based on an in-depth market analysis that also considers factors such as the acquisition, resale, and essential renovations aimed at enhancing the property’s value.

Step 3: If homeowners choose to accept the offer, Company That Buys Houses will oversee the closing process in partnership with a reputable attorney to facilitate the sale of the property. Additionally, the cash home buyers will endeavor to accommodate a family’s preferred timeline and handle all the necessary components on their behalf, leaving them to attend the closing, sign the documentation, and, within a few hours, receive their cash.

Throughout the entire process, Company That Buys Houses will offer comprehensive and detailed explanations to ensure that homeowners are fully confident with their decision and the cash offer they have received for their home.

“Unlike other companies in Texas, we prioritize conducting in-person property assessments before presenting an offer. Our unwavering commitment to transparency entails furnishing you with all pertinent details, empowering you to make your decision to sell to us with confidence,” continued the spokesperson for Company That Buys Houses.

Whether it’s a house, apartment, condo, or land, Company That Buys Houses offers individuals the opportunity to sell it for cash, without the burden of commissions, fees, or closing costs, to ensure the most seamless and stress-free experience.

Company That Buys Houses encourages homeowners to stop searching for how to “Sell Your House Fast Texas” and instead reach out to its team of real estate solution experts today by calling (817) 623-5054 to receive a fair, no-obligation, no-hassle offer

About Company That Buys Houses

Company That Buys Houses is a leading authority in real estate transactions and investment, providing unparalleled service to homeowners in Texas. By choosing Company That Buys Houses, homeowners can discover the ease of selling their home for cash at an accelerated pace, with the confidence of being guided at every step.

More Information

To learn more about Company That Buys Houses and the launch of its simple 3-step approach, please visit the website at https://www.acompanythatbuyshouses.com/sell-my-house-fast-texas/.

Company That Buys Houses 111 NE 14th St. Fort Worth TX 76164 United States (817) 623-5054 https://www.acompanythatbuyshouses.com/sell-my-house-fast-texas/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fed Chair Jerome Powell Set To Speak As Economists Raise Concerns Over Risks Arising From Potential Policy Missteps And 2024 Election

Federal Reserve Chair Jerome Powell is scheduled to speak on Monday amid growing concerns among economists about potential policy mistakes and 2024 election risks.

What Happened: The National Association for Business Economics (NABE) released a survey on Sunday revealing that 39% of 32 professional forecasters consider a “monetary policy mistake” as the greatest threat to the U.S. economy over the next year.

This concern surpasses the 23% who view the upcoming U.S. presidential election and the same percentage who worry about escalating conflicts in Ukraine and the Middle East as significant risks.

Powell is expected to elaborate on the Federal Reserve’s recent decision to cut its benchmark interest rate by 50 basis points during the Sep. 17-18 meeting. He will also discuss the framework for anticipated reductions in borrowing costs through the remainder of this year and into 2025.

NABE President Ellen Zentner said, “More than half of the NABE Outlook Survey panelists believe the risks to their forecasts over the next 12 months are weighted to the downside.” The survey also indicated that panelists have revised their economic growth forecasts higher for 2024 but lowered them for 2025.

Powell’s address is scheduled for 12:55 p.m. CDT in Nashville, Tennessee.

See Also: Nasdaq, S&P 500 Futures Slip Ahead Of Inflation Data

Why It Matters: The Federal Reserve’s recent interest rate cuts have been a focal point for both economists and investors. On Sept. 21, the Fed’s half-point rate cut triggered a market rally. This move was seen as a positive signal for U.S. stocks and commodities, reducing bond market volatility.

The subsequent Benzinga poll on Sep. 25 indicated that the rate cuts could benefit small-cap stocks, making loans cheaper for companies needing capital for growth.

Additionally, the Personal Consumption Expenditures Price Index report on Friday showed lower-than-expected inflation, strengthening confidence in the Fed’s decision to cut rates. This report is crucial as the PCE is the Fed’s preferred inflation gauge and could influence future rate cuts.

Read Next:

Fed Chair Jerome Powell’s illustration was created using artificial intelligence via Midjourney.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's Why China is Urging Its Companies to Forgo Nvidia's Chips

In a move to strengthen its semiconductor industry and counter U.S. sanctions, Beijing is reportedly encouraging Chinese firms to prioritize locally produced artificial intelligence (AI) chips over those from Nvidia Corp. NVDA.

What Happened: Chinese regulators are discouraging companies from purchasing Nvidia’s H20 chips, which are utilized for developing and operating AI models.

This policy, more of a guidance than a strict prohibition, is designed to avoid stifling local AI startups and exacerbating US-China tensions.

The initiative is aimed at bolstering domestic Chinese AI chipmakers, such as Cambricon Technologies Corp. and Huawei Technologies Co., by helping them capture a larger market share and equipping local tech firms for potential additional US restrictions. Earlier this year, Beijing also promoted local electric-vehicle manufacturers to source more supplies from domestic chipmakers, reports Bloomberg.

Following this development, Nvidia shares dipped by up to 3.9% to $119.26 on Friday. In 2022, the US government had prohibited Nvidia from selling its most advanced AI processors to Chinese customers, in an attempt to curb Beijing’s technological progress.

Also Read: Here’s How China’s Missile Stockpile Expands, Threatening US Military Supremacy

Chinese regulators, including the Ministry of Industry and Information Technology, issued directives to minimize the use of Nvidia, urging companies to depend on domestic vendors like Huawei and Cambricon. Nevertheless, Beijing will continue to allow the procurement of foreign semiconductors over domestic alternatives if necessary for local firms to build the best possible AI systems.

Nvidia chose not to comment on the issue. The company’s CEO, Jensen Huang, stated that they are striving to serve customers in China while adhering to US government restrictions.

Why It Matters: This move by Beijing is a clear indication of its intent to bolster its domestic semiconductor industry and reduce reliance on foreign technology.

By encouraging local firms to opt for domestic AI chips, China is not only supporting its local chipmakers but also preparing for any potential escalation in US restrictions.

This development is a crucial part of the ongoing tech war between the U.S. and China, with both nations striving to gain technological supremacy.

Read Next

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wire-Rope Market to Reach $14.4 Billion, Globally, by 2032 at 5.3% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 30, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Wire-Rope Market by Material (Stainless Steel, Galvanized Steel and Coated Wire Rope), and Application (Industrial & Crane, Oil & Gas, Mining, Fishing & Marine, Construction, Telecommunications and Others): Global Opportunity Analysis and Industry Forecast, 2024-2032”. According to the report, the wire-rope market was valued at $9.1 billion in 2023, and is estimated to reach $14.4 billion by 2032, growing at a CAGR of 5.3% from 2024 to 2032.

Prime Determination of Growth

In addition, the expansion of telecommunication networks worldwide necessitates robust infrastructure, further driving the market growth. Moreover, the surge in construction projects across the globe, fueled by urbanization and infrastructure development initiatives, contributes significantly to the escalating demand for wire ropes in various applications within the construction sector.

Download Sample Copy @ https://www.alliedmarketresearch.com/request-sample/A47411

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2032 |

| Base Year | 2023 |

| Market Size in 2023 | $9.1billion |

| Market Size in 2032 | $14.4 billion |

| CAGR | 5.3% |

| No. of Pages in Report | 250 |

| Segments covered | Material, Application, and Region |

| Drivers | Growing industrial activities, Expansion of telecommunications networks worldwide Increasing construction projects worldwide. |

| Opportunities | Implementing smart technologies for predictive maintenance and performance optimization |

| Restraints | Fluctuating Raw Material Prices |

The galvanized steel segment to maintain its leadership status throughout the forecast period.

Based on material, the construction segment held the highest market share in 2023, accounting for nearly one-third of the global Wire-Rope market revenue and is estimated to maintain its leadership status throughout the forecast period, due to the incessant demand for infrastructure development worldwide. Wire-Rope plays a crucial role in various construction activities, including building construction, road and bridge development, and utility installations. As urbanization accelerates and governments invest in large-scale infrastructure projects, the construction sector continues to drive significant demand for Wire-Rope solutions, bolstering its market dominance.

Buy This Research Report ( 250 Pages PDF with Insights, Charts, Tables, Figures):

https://bit.ly/3ztUDnJ

The construction sector to maintain its leadership status throughout the forecast period.

Based on the application, the construction sector held the highest market share in 2023, accounting for more than two-fifths of the Wire-Rope market revenue due to the extensive use of wire ropes in lifting, hoisting, and supporting structures like cranes. These essential applications drive consistent demand, making construction the primary driver of wire rope sales.

Asia-Pacific to maintain its dominance by 2032.

Based on region, Asia-Pacific held the highest market share in terms of revenue in 2023, accounting for more than two-fifth of the global Wire-Rope market revenue owing to rapid industrialization, urbanization, and infrastructure development initiatives. The Asia-Pacific wire rope market is growing rapidly which is driven by rapid industrialization, infrastructure development, and increasing investments in construction and mining sectors. Countries like China, India, Japan, and South Korea are key contributors to market expansion. The region’s burgeoning construction industry, fueled by urbanization and government-led infrastructure projects, drives significant demand for wire ropes in lifting, hoisting, and suspension applications.

Inquire Before Buying @ https://www.alliedmarketresearch.com/purchase-enquiry/A47411

Leading Market Players: -

- WireCo WorldGroup Inc.

- Bridon-Bekaert The Ropes Group

- Tokyo Rope International

- Wire Rope Corporation of America Inc.

- Teufelberger Holding AG

- Pfeifer Drako Drahtseilwerk GmbH

The report provides a detailed analysis of these key players of the global Wire-Rope market. These players have adopted different strategies such as product launch, acquisition, agreement and partnership and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Trending Reports in Wire industry:

Wire Pulling And Tensioning Market : Global Opportunity Analysis and Industry Forecast, 2024-2032

Copper Magnetic Wire Market : Global Opportunity Analysis and Industry Forecast, 2022-2031

Cable Drum Market : Global Opportunity Analysis and Industry Forecast, 2019-2026

Underground Cable Accessories Market : Global Opportunity Analysis and Industry Forecast, 2024-2032

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” Allied Market Research has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Rise of Enterprise Networking Market: A $175.2 billion Industry Dominated by Cisco Systems (US) and Hewlett Packard Enterprise (US) | MarketsandMarkets™

Delray Beach, FL, Sept. 30, 2024 (GLOBE NEWSWIRE) — The Enterprise Networking Market size is projected to grow from USD 115.8 billion in 2024 to USD 175.2 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 8.6%, according to a new report by MarketsandMarkets™. An enterprise network offers end-to-end services to users, things, and applications and each constituent network is designed, provisioned, and optimized for a specific purpose and business objectives. The various network types include campus networks, data center networks, and wide-area networks. These networks serve as a foundation for modern digital enterprises and are expected to improve security, enhance user experience, and support many devices performing essential business tasks. An enterprise network can improve the user experience through proactive network optimization, faster issue resolution, proper prioritization of essential traffic, and security and privacy assurance. Wi-Fi 6, 5G, and newly opened frequency bands for ultra-fast, short-range transmissions enable access to high-speed wireless connectivity. At the same time, 400 Gbps is the new standard for high-speed data center networks. These innovations are spurring productivity enhancements and continued innovation across organizations.

Browse in-depth TOC on “Enterprise Networking Market”

450 – Tables

55 – Figures

350 – Pages

Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=168098457

Enterprise Networking Market Dynamics:

Drivers:

- Zero-Trust Network Models: Implementing a zero-trust architecture ensures that only authorized devices and users can access the network, minimizing the risk of unauthorized access and data breaches.

- Firewall Protection: Firewalls act as the first line of defense, controlling incoming and outgoing network traffic based on predefined rules to prevent unauthorized access.

- Security Tools: Anti-malware software and intrusion detection systems are essential for continuously monitoring the network for suspicious activity and responding to threats.

Restraints:

- High Cost for Wide Area Connections: Traditional WAN links like MPLS and leased lines can be expensive, especially for geographically dispersed locations and high bandwidth requirements.

- Dedicated Circuits for Critical Applications: Running critical applications often requires dedicated circuits, which can be particularly costly in rural or remote areas with less developed infrastructure.

Opportunities:

- Enhanced Security: Zero-trust verifies the identity and integrity of users, devices, and applications, preventing unauthorized access and data breaches.

- Improved Efficiency: Strong authentication, network segmentation, and granular policy simplification streamline security management and reduce the risk of lateral movement.

List of Enterprise Networking Market Companies:

- Cisco Systems (US)

- Broadcom (US)

- Hewlett Packard Enterprise (US)

- Juniper Networks (US)

- Extreme Networks, Inc. (US)

- Huawei (China)

- Fortinet (US)

- Cloudflare, Inc. (US)

- Alcatel-Lucent Enterprise (France)

- Arista Networks (US)

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=168098457

By offering, the networking devices segment is expected to have the largest market size during the forecast period.

Network devices offer support for communication between the users of the network and external networks. These devices manage the flow of traffic and connect a number of secure network segments. Network devices include routers, switches, gateways, firewalls, and other such devices. All of the network devices are important in terms of the role they play toward the function and security of the network infrastructure, so they all play a vital role in order to have a healthy IT environment. It facilitates sharing resources such as files, printers, and the internet to users and devices connected over the network and ensures that data transmitted over it gets routed accurately. Network devices scale businesses by making the networks scalable to the dynamic requirements of a business in terms of running operations to their optimum and protecting them against cyber threats.

By connection type, wireless segment is expected to hold a higher growth rate during the forecast period.

Wireless networking focuses on devices connected to a network without the need for physical cable deployments. Among the most critical issues in advanced enterprise environments is enterprise wireless networking. This is due to the rising adoption of mobile and Internet of Things devices and the shifting corporate demand for flexible and mobile-first work environments. The indoor wireless network solution, on the other hand, applies to any office space, campus, or industrial environment. The surge in the adoption of Wi-Fi solutions is being propelled by the increased adoption of Wi-Fi 6/6E and the latest Wi-Fi 7 for enhanced performance and capacity to meet the requirements of enterprises. Further, the need for robust wireless networking solutions is helping to scale up remote, hybrid work environments, and smart-building environments.

Inquire Before Buying: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=168098457

Based on region, North America is expected to hold the largest market share during the forecast period.

The trends of enterprise networking in North America, especially in the United States, are marked by fast-changing technology and shifting workplace dynamics, all while delivering on security, speed, and flexibility. Enterprises invest heavily in secure remote access solutions that provide seamless connectivity and security for remote workers. Enterprises are increasingly migrating to cloud services, whereby flexibility, scalability, and cost efficiency are expected through the cloud infrastructure. Cloud-based networking solutions are being adopted by enterprises. SD-WAN, cloud-managed networking, and multi-cloud strategies are becoming core technologies in enterprise networking architecture.

Get access to the latest updates on Enterprise Networking Companies and Enterprise Networking Industry

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Crypto Billionaire Zhao Vows More Tech Investment After Leaving US Custody

(Bloomberg) — Billionaire Changpeng Zhao pledged to keep investing in the blockchain sector as well as artificial intelligence and biotechnology, in the crypto mogul’s first public comments since his release from US custody.

Most Read from Bloomberg

In a post on social-media platform X over the weekend, the co-founder of the Binance Holdings Ltd. digital-asset exchange described himself as a long-term investor who cares about “impact, not returns.”

Binance was hit with a $4.3 billion penalty in November under a plea deal to settle US charges over failures that let criminals and terror groups use the exchange. Zhao agreed to pay a $50 million personal fine and was later sentenced to four months in custody. He was released from a correctional facility in California on Sept. 27.

Zhao said his new endeavor called Giggle Academy, a nonprofit online education platform, “will be a big part of my life.” He said he will also dedicate more time and funding to charity.

Binance is the world’s largest crypto exchange, making it a linchpin of trading in digital assets and related derivatives. Under the plea deal, Zhao stepped down as chief executive officer, handing the reins to Richard Teng. The platform also faces years of compliance monitoring by the Justice Department and the US Treasury’s Financial Crimes Enforcement Network.

Zhao has a net worth of more than $30 billion, according to the Bloomberg Billionaires Index — likely making him the richest ever US inmate.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.