Ed Yardeni Points Out Skills Mismatch In Labor Market Amid Federal Reserve's Focus On Reducing Unemployment: 'We Have A Lot Of Work To Do…'

Ed Yardeni, the president of Yardeni Research, highlighted a significant issue in the labor market: a skills mismatch. This could have far-reaching implications for the economy, particularly in the context of the Federal Reserve’s current focus on unemployment.

What Happened: Yardeni pointed out that the Fed’s current focus on unemployment might be misguided, given the skills mismatch in the labor market, in his interview with CNBC. He noted that the Fed, under the leadership of Jerome Powell, has been liberal in its mandate, with a strong emphasis on maintaining low unemployment rates.

However, Yardeni argued that the current low unemployment rate is not necessarily indicative of a healthy labor market, pointing towards the lesser number of job openings and the absence of skilled workforce who can operate advanced technologies.

“What we really need is a lot of very skilled workers, particularly in the area of technology. Or at least with a technology background. And if that’s the case, we have a lot of work to do to augment the productivity of workers with technology,” Yardeni said.

See Also: Nasdaq Futures Surges Higher After Micron Earnings: What’s Going On

Why It Matters: The Fed’s focus on unemployment has been a central theme in recent economic discussions. The Fed’s decision to cut interest rates by 50 basis points in September was largely seen as a move to sustain the labor market. This bold decision, which defied most economists’ predictions, was accompanied by a strong emphasis on the importance of preemptive action to support robust employment.

Despite the skills mismatch highlighted by Yardeni, recent economic indicators have suggested strength in the labor market. The U.S. economy expanded by 3% in the second quarter, marking the eighth consecutive quarter of growth. Additionally, initial jobless claims for the week ending Sept. 21 came in slightly below expectations, indicating some improvement in labor market conditions.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image via Unsplash

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Where Will Berkshire Hathaway Stock Be in 5 Years?

The legendary head of Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), Warren Buffett, is nearly unmatched in his investing acumen. You don’t get a nickname like “Oracle of Omaha” by being a slouch. Although it sometimes seems like it, his success isn’t from divining the future; it’s from sticking to a clear, disciplined strategy and philosophy that guide his every move.

Buffett has his eyes on the horizon at all times. He believes in finding businesses with fundamental competitive advantages — “moats” — and backing them for the long term. As he put it in a letter to shareholders in 2023, “When you find a truly wonderful business, stick with it. Patience pays.”

Berkshire Hathaway is surely a wonderful business, and patience has definitely paid. Just a $1,000 investment in Berkshire in 1980 would be worth $2.3 million today. Is that true moving forward though? What do the next five years hold for the company? Let’s take a look.

Berkshire’s own businesses are humming, especially insurance

Berkshire is a conglomerate that owns a portfolio of subsidiaries as well as a portfolio of investments in outside companies, like its stake in Apple. Although the latter often gets more media attention, the businesses that Berkshire controls are a huge part of its bottom line.

Berkshire’s subsidiaries span a diverse set of industries, from energy to manufacturing. Most of these businesses look strong and critically, they provide quite a bit of cash, which enables Buffett to be successful on the investment side of the business.

Insurance has long been the backbone of Berkshire and as of late, Berkshire’s insurance segment has been growing rapidly. Its first-quarter 2024 net-underwriting earnings nearly tripled year over year and nearly doubled year over year in Q2 2024. Geico, likely the most well-known of these, is a major part of this growth.

Geico has been outpaced lately by Progressive, which has grown even faster. Berkshire’s Vice Chairman of Insurance Operations, Ajit Jain, pointed to Geico falling behind in its use of technology as the main culprit. Progressive has better utilized new tech to manage risk.

The good news here is leadership is aware of this and pushing to catch up. Geico has delivered stellar growth despite this handicap; if it can improve its use of new technology, the business will be that much stronger. Considering Geico has some of the lowest costs of any major insurer, I think this is a recipe for success over the coming years.

It’s been a big year for Berkshire’s investments

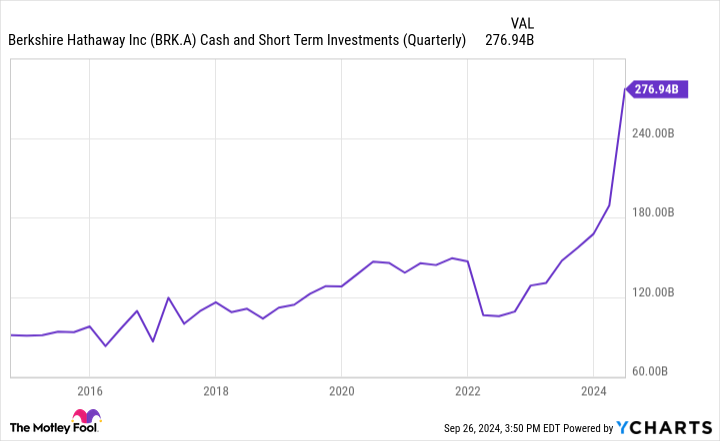

Some major shakeups came this year to Berkshire’s core portfolio. The biggest were the sales of nearly half of its stake in Apple followed closely by the sale of a significant portion of its Bank of America position. There have been some purchases as well, but they’ve been completely overshadowed by Berkshire’s shedding of major chunks of core holdings. The company is sitting on a mountain of cash at the moment (and much of it held in relatively liquid assets like short-term U.S. Treasuries). Take a look at the wild upswing in this reserve over the last year.

What does Buffett have up his sleeve? While it’s impossible to know for sure, I think there’s a good chance Buffett is concerned that the market is a bit too hot at the moment, but he won’t sit on this much cash for too long. I think it’s safe to say he and his company have something in mind and are gearing up to make a major investment or two. I think that he believes that he can find other businesses that will outperform Apple and Bank of America in the years to come.

Buffett’s age is the elephant in the room

Warren Buffett is 94 years old. I think it’s safe to say that he won’t be in the driver’s seat for too much longer. It’s possible his departure could come in the five-year time frame being considered. This will inevitably impact the company as he is one of a kind. However, what he does isn’t magic. His vision and philosophy are so ingrained in the company that his departure will be more seamless than some investors fear.

He has never been the sole guiding hand, especially in recent years. He built the company in tandem with the late Charlie Munger, and the two of them groomed a team of managers for years, many of whom have had independent control of parts of the Berkshire portfolio for some time.

I believe that the continued strength of Berkshire’s subsidiaries, with the likely major investments that will come from its current pile of cash, means that the next five years will continue to be successful for the company. Even if Buffett departs Berkshire in the near future, the company’s stock will outperform the market.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, and Progressive. The Motley Fool has a disclosure policy.

Where Will Berkshire Hathaway Stock Be in 5 Years? was originally published by The Motley Fool

A Gen Xer with a master's degree has been looking for a job for 9 years. He's slowly running out of money.

-

Chris Putro, 55, has been struggling to find a job for the last nine years.

-

He has a master’s and over a decade of experience but says this hasn’t helped him get interviews.

-

He said he’s on track to run out of savings in a few years.

In 2013, Chris Putro got fired from his financial analyst job at a tech company. More than a decade later, he’s still looking for work.

Despite having a bachelor’s and master’s degree in chemistry — and sending out countless applications — Putro said he’s had little luck in the job market.

“I’ve gotten a total of four phone interviews,” the 55-year-old, who’s based in Los Angeles, told Business Insider via email. Three of these employers ended up “ghosting” him, while the other one ended the interview call early after deciding he was overqualified for the job.

When Putro lost his job, he was in his 16th year working for the same employer. After taking stock of his finances, he estimated that he had enough savings to get by for a little over a decade if necessary.

“I made enough in those 16 years to survive for another 11,” he said.

We want to hear from you. Are you struggling to find a job and would be comfortable sharing your story with a reporter? Please fill out this form.

Based on his initial forecast, he would have run out of money sometime this year. However, Putro said his stock market investments have performed better than he expected, which he thinks could buy him a “few more years.”

Putro said it’s been helpful financially that he has no student debt or children. However, he said the only source of income over the last decade has been the $50 a week he gets for producing a standup comedy show in the Los Angeles area. He considers this to be effectively “volunteer work” that helps him stay busy, but as things stand, it’s not doing much to slow the steady decline of his savings.

“Thinking about when I might run out of money and lose all my possessions is a very difficult thought process for me,” he said.

Putro is among the Americans who are having a hard time finding work. In large part, it’s because businesses across the US have significantly pulled back on hiring. The ratio of job openings to unemployed people — an indicator of job availability — has declined considerably over the past two years.

To be sure, both the unemployment rate and layoff rate remain low compared to historical levels. However, the hiring slowdown means that many of the people who are looking for work — whether it be because they were laid off, have just graduated from college, or are returning to the workforce — are having a much harder time than the job seekers of a few years ago.

Putro shared his job search strategies — and why he’s unsure whether his age is helping or hurting him on his job hunt.

Application burnout can make it harder to find a job

In the early 1990s, Putro earned a bachelor’s in chemistry from La Salle University and a master’s in chemistry from UCLA. He worked at a pharmacy for a couple of years until 1998, when he landed a customer service job at a tech company. In 2006, he began working as a financial analyst for the same employer — a position he held until he was fired.

After losing his job, Putro didn’t immediately start applying for jobs. He said he took about two years to think about what he wanted to do with the rest of his life. Then, about nine years ago, his job hunt officially began.

Over the past decade, Putro said he’s applied “irregularly” for jobs — anywhere between zero and 40 applications in a given month.

“I get burned out and wait a bit and hope that there’s turnover in a company’s HR, he said.

Putro said he generally looks for roles through Indeed, LinkedIn, and the websites of major local employers like CBS and NBCUniversal. Given his prior work experience, job platforms tend to nudge him to apply for financial analyst roles.

“I apply for jobs I’m qualified for,” he said. “People have told me to apply for minimum-wage jobs, but I don’t know how to find them.”

Despite his efforts, Putro hasn’t had much luck. He said he’s not sure whether being 55 years old is helping or hurting him in the job market.

“I keep reading that employers will absolutely not hire anyone my age because of false assumptions, but also that they prefer people my age because millennials and younger have a poor work ethic,” he said.

Going forward, Putro plans to continue sending out applications. He said October is typically the month when he begins applying more aggressively.

“I applied to two jobs this week that I was a great match for on paper, but no reply as usual,” he said.

Read the original article on Business Insider

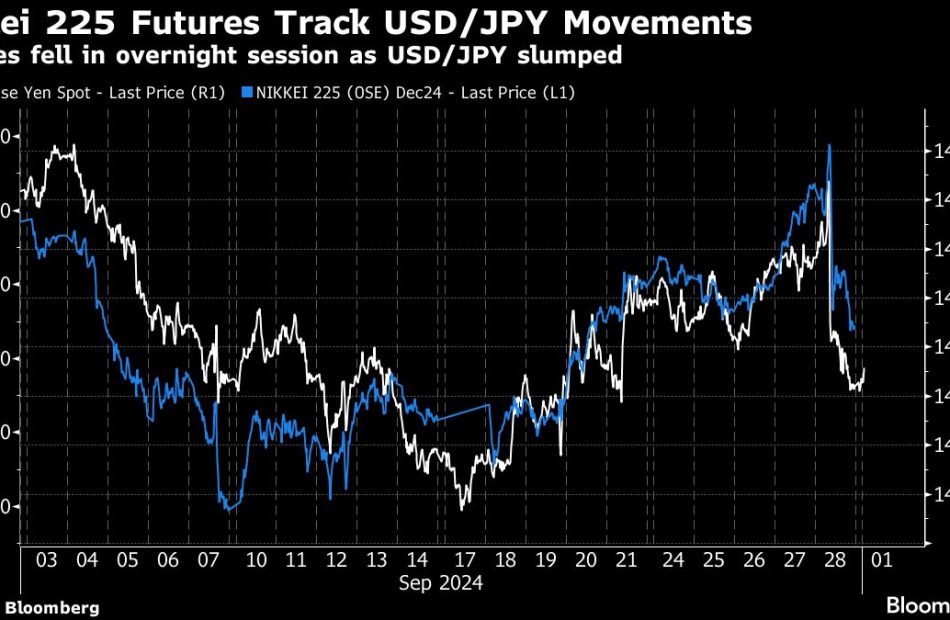

Japan Slumps, Property Aid Boosts Chinese Stocks: Markets Wrap

(Bloomberg) — US equity futures posted small moves after last week’s record highs on Wall Street, with traders already looking forward to key data on the American labor market due Friday and its impact on Federal Reserve interest-rate cuts.

Most Read from Bloomberg

S&P 500 and Nasdaq 100 contracts were steady. US-listed Chinese stocks rallied in premarket trading after the latest steps by authorities to boost the economy. Treasury yields climbed, led by the policy-sensitive two-year note. The dollar was little changed.

Europe’s Stoxx 600 index slid 0.8%, paced by declines in automakers as Jeep maker Stellantis NV cut its profit margin forecast. Volkswagen AG on Friday issued its second profit warning in three months.

That was in contrast to the mood in China, where the CSI 300 Index jumped as much as 9.1%, the most since 2008, fueled by the stimulus package. The policy steps also buoyed European mining and luxury stocks.

“Right now, we see an improvement in sentiment, which is driven by more stringent action that we see in China — that is good news for the European equity markets,” Marcus Poppe, co-head of European equities at DWS Investment, said in an interview with Bloomberg TV. “But I would caution against expecting that we will see in three-four weeks companies saying: ‘China is picking up.’”

Last week, US data bolstered bets for further interest-rate cuts by the Federal Reserve and investors will be tuning in for remarks by Fed Chair Jerome Powell on Monday when he takes the stage at a National Association for Business Economics conference.

Further out, the US jobs print on Friday could decide whether last week’s risk—on rally can extend. A strong reading might lead to a rotation toward stocks with weaker earnings, according to Goldman Sachs Group Inc. strategists.

A positive report may prompt some investors to “price lower odds of substantial labor market weakening,” leading them to “rotate out of expensive ‘quality’ stocks into less-loved lower quality firms,” the team led by David Kostin wrote.

As they prepare for the US data to gauge the outlook for Fed rate cuts, investors must also ponder a cocktail of risks, including rising tensions in the Middle East. The record-setting rally in stocks will also be tested by third-quarter corporate results set to kick off in mid-October.

Political developments in Europe provide an additional layer of complexity. Austria’s traditional political powers are pledging to block the far-right Freedom Party from forming a government following Sunday’s national elections that resulted in its historic victory.

In commodities, oil steadied as the market studied the outlook from Israel’s killing of Hezbollah leader Hassan Nasrallah in Beirut, and China’s stimulus moves.

Key events this week:

-

Fed Chair Jerome Powell delivers speech at National Association for Business Economics conference in Nashville on Monday

-

European Central Bank President Christine Lagarde speaks at EU Parliament monetary dialogue on Monday

-

Bank of England policy maker Megan Greene joins panel at NABE to discuss global monetary policy on Monday

-

Atlanta Fed President Raphael Bostic, Fed Governor Lisa Cook, Richmond Fed President Thomas Barkin and Boston Fed President Susan Collins attend conference on Tuesday

-

ECB policy makers speaking at various locations include Olli Rehn, Luis de Guindos, Isabel Schnabel and Joachim Nagel on Tuesday

-

BOE chief economist Huw Pill speaks at Confederation of British Industry economic growth board on Tuesday

-

Bank of Japan issues summary of opinions for September on Tuesday

-

South Korea CPI, S&P Global Manufacturing PMI on Wednesday

-

Fed speakers include Richmond’s Thomas Barkin, Cleveland’s Beth Hammack, St. Louis’s Alberto Musalem and Fed Governor Michelle Bowman on Wednesday

-

US nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.2% as of 7:18 a.m. New York time

-

Nasdaq 100 futures fell 0.3%

-

Futures on the Dow Jones Industrial Average fell 0.1%

-

The Stoxx Europe 600 fell 1%

-

The MSCI World Index fell 0.3%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro rose 0.3% to $1.1192

-

The British pound rose 0.3% to $1.3408

-

The Japanese yen fell 0.2% to 142.51 per dollar

Cryptocurrencies

-

Bitcoin fell 3.3% to $63,636.11

-

Ether fell 1.8% to $2,612.59

Bonds

-

The yield on 10-year Treasuries advanced two basis points to 3.77%

-

Germany’s 10-year yield was little changed at 2.14%

-

Britain’s 10-year yield advanced two basis points to 4.00%

Commodities

-

West Texas Intermediate crude fell 0.3% to $67.96 a barrel

-

Spot gold fell 0.7% to $2,638.83 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Catherine Bosley, Sagarika Jaisinghani and Kit Rees.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

A Bull Market Is Here: 2 Magnificent S&P 500 Dividend Stocks Down 50% and 61% to Buy Right Now

The stock market has posted strong performance in 2024, with the S&P 500 index climbing roughly 20% across that stretch. On the other hand, not every company included in the benchmark index has been a big winner this year.

Following recent pullbacks, some promising S&P 500 companies have been pushed down to attractive valuations. And for a few dividend-paying companies in the index, recent sell-offs have also pushed their yields higher.

If you’re on the hunt for stocks that can generate passive income and deliver capital appreciation, read on to see why these fool.com contributors think that investing in Nike (NYSE: NKE) and Bath & Body Works (NYSE: BBWI), two beaten-down S&P 500 dividend stocks, would be a magnificent move right now.

Having what it takes to be a long-term winner

Keith Noonan (Nike): It’s been a tough year for Nike. Growth bets in China haven’t been paying off, and it doesn’t look like performance on that front will improve significantly in the short term.

Making matters worse, the athletic footwear and apparel company has been facing new challenges from rising competition in the U.S. and Europe, and store closures for key retail partners, including Foot Locker, are creating more headwinds.

With its last guidance update, Nike said that it expected sales to fall roughly 10% year over year in the first quarter of its current fiscal year (ending Aug. 31). Meanwhile, management expected sales for the full fiscal year to fall by the mid-single digits.

The company’s share price has declined roughly 18% year to date due to the challenging outlook, and it trades down 50% from its lifetime high.

Big sell-offs have pushed Nike’s dividend yield up to roughly 1.7%, above the S&P 500 average. The yield might not look big compared to some companies in the benchmark index, but there’s a good chance that it will continue to increase its payout at above-average rates.

With its last dividend increase, the company raised its payout by 9%. It has increased it by 51% over the last five years and 164% over the last decade, and it will likely serve up another substantial dividend hike this fall.

Of course, near-term payout increases won’t mean much for investors if the company can’t emerge from challenges and return to growth. But there are good reasons to bet on this beaten-down industry leader.

The company still has one of the world’s strongest brands, along with infrastructure and distribution advantages that are unmatched in its industry. If you’re seeking attractively valued dividend stocks that are capable of delivering big long-term wins, Nike looks like a smart buy right now.

A sweet-smelling cash machine

Anders Bylund (Bath & Body Works): This personal-care and home-goods company might not look like an exciting investment these days, but Bath & Body Works presents a compelling investment opportunity. The company, formerly known as L Brands, spun off Victoria’s Secret (NYSE: VSCO) in 2021 to focus on the Bath & Body Works brand. Its sales have been flattish over the last three years.

But I’m not looking for a skyrocketing growth story here. If you want generous dividends backed by robust cash flows, Bath & Body Works delivers on both counts.

It pays out quarterly dividends of $0.20 per share, adding up to $0.80 in annual dividends. That works out to a 2.7% yield at current share prices. By comparison, the average yield among S&P 500 stocks is just 1.5%.

Moreover, the stock looks deeply undervalued. Bath & Body Works has some of the strongest profit margins in the specialty retail industry, ahead of market darlings like Ulta Beauty (NASDAQ: ULTA) and Five Below (NASDAQ: FIVE). The company is also an effective cash machine, converting 9% of incoming revenue into free cash flow.

Yet, its shares are changing hands at the downright gloomy valuation of 7.7 times trailing earnings, or 0.9 times sales. The stock chart shows a 39% price drop from the 52-week highs of early June and a 61% drop from its lifetime peak.

I’m not alone on the rosy side of the fence, by the way. Bath & Body Works comes with a consensus buy rating from Wall Street analysts with an average price target 48% above its current level.

Even the short-sellers are staying away from this stock. Only 4.1% of its shares are sold short at the moment, far below Ulta’s 6.9% and Five Below’s 8.3% short interest. Don’t even get me started on Victoria’s Secret, whose shares come with a risky 11.4% reading in this metric.

So you can lock in that sweet dividend yield at a low share price today, which should also set you up for robust price gains in this bull market. That’s a win-win in my book.

Should you invest $1,000 in Nike right now?

Before you buy stock in Nike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Anders Bylund has no position in any of the stocks mentioned. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nike and Ulta Beauty. The Motley Fool recommends Five Below and Foot Locker. The Motley Fool has a disclosure policy.

A Bull Market Is Here: 2 Magnificent S&P 500 Dividend Stocks Down 50% and 61% to Buy Right Now was originally published by The Motley Fool

If I Could Only Buy 3 Stocks in the Last Half of 2024, I'd Pick These

Successful investing requires digging into a company’s financials and assessing its prospects. This process may sound tedious, but it allows you to have a better sense of which growth stocks can do well over the long term. As research takes time and effort, it’s good to shortlist a bunch of stocks that you feel comfortable buying for long-term capital appreciation. These stocks should ideally have a solid growth track record, a dominant market share, and possess catalysts that can ensure their steady and continuous growth.

As you gain more knowledge about businesses, you will end up with a pool of solid stock ideas to consider. The next step is to select your best ideas to buy first as these will be your most compelling buys. When push comes to shove, here are three stocks that I will pick above the rest for their promising prospects and strong business fundamentals.

Hawkins

Hawkins (NASDAQ: HWKN) is a specialty chemicals and ingredients company that manufactures products for the industrial, water treatment, and health and nutrition sectors. The company has not only demonstrated steady growth in revenue and net income over the years, but has also paid out a dividend for 39 consecutive years.

Hawkins saw sales rise from $774.5 million in fiscal 2022 (ending March 31) to $919.2 million in fiscal 2024. Net income climbed 46% over this period from $51.5 million to $75.4 million. The most impressive was the company’s free-cash-flow generation, which leapt more than eightfold from $14.3 million in fiscal 2022 to $119.3 million in fiscal 2024.

Hawkins’ strong performance has carried on in the first quarter of fiscal 2025. Sales inched up almost 2% year over year to $255.9 million but operating income managed to jump 22.5% year over year to $39.8 million. Net income improved by 23.3% year over year to $28.9 million, and the business also churned out a positive free cash flow of $6.9 million, continuing its track record of free-cash-flow generation. In tandem with its good results, management upped the company’s quarterly cash dividend from $0.16 to $0.18.

Investors can also look forward to acquisitive growth to drive earnings to the next level. Hawkins demonstrated a solid track record of accretive acquisitions with an average of two per calendar year since 2020. In June and July of this year, the company completed two acquisitions — that of Wofford Water Service and Intercoastal Trading, both for its water treatment division.

Wofford will help Hawkins to build up a larger customer base in Mississippi while Intercoastal helps the business to expand into the East Coast region. Over in the industrial and health and nutrition segments, Hawkins will focus on new product development, with an eye to growing its specialty branded products backed by its research and development.

Garmin

Garmin (NYSE: GRMN) is a technology and engineering company that manufactures products for five key sectors: fitness, outdoor, aviation, marine, and auto OEM. The company is well known for utilizing global positioning satellite (GPS) technology and incorporating it into its various products such as multi-sports watches, smartwatch devices, and golf devices. Garmin saw its revenue increase from $5 billion to $5.2 billion from 2021 to 2023 while its net income went from $1.1 billion to $1.3 billion. The business also generated an average positive free cash flow of $810 million over this period.

Garmin’s robust results have continued in the first half of 2024. Sales increased by 17% year over year to $2.9 billion with operating income climbing 33% year over year to $640.4 million. Net income increased by 17.6% year over year to $576.6 million, and the business generated a positive free cash flow of $620.3 million. Garmin paid out a quarterly dividend of $0.75 per share, taking its annualized dividend to $3. The company has been steadily increasing its dividend since paying out $0.40 per quarter back in 2011.

Garmin has raised its full-year revenue guidance and expects revenue to increase by 13.8% year over year to $5.95 billion for 2024, which demonstrates healthy top-line growth for this accessories company. The company continues to release innovative new products for its five divisions along with Garmin Pay, which supports contactless payments. With its broad range of products that endear customers, the business looks set to continue doing well.

Symbotic

Symbotic (NASDAQ: SYM) is an automation technology company that integrates artificial intelligence (AI) into its platform to solve distribution challenges and supply chain issues. The company helps its clients by deploying solutions to improve their product delivery efficiency and accuracy to help them achieve cost savings and better workflow. Symbotic saw its revenue rise nearly fivefold from $251.9 million in fiscal 2021 (ending Sept. 30) to $1.2 billion in fiscal 2023. Gross profit also shot up sharply from just $10.4 million to $189.7 million over the same period. The business also saw its free cash flow more than double from $97.4 million in fiscal 2021 to $209.5 million in fiscal 2023.

The technology company continued to report strong results for the first nine months of fiscal 2024. Revenue surged 63.6% year over year to $1.3 billion while gross profit increased by nearly 39% year over year to $181.7 million. The business also generated a positive free cash flow of $18.3 million. Symbotic has 39 systems in deployment, which helped revenue hit a record high for the current quarter. Although gross margin was temporarily affected by implementation delays, CFO Carol Hibbard expects margins to revert to historical levels by the fourth quarter of the fiscal year.

There could be more to come for Symbotic. In August, the company forked out $8.7 million to acquire Veo Robotics, which deals with intelligent safeguarding for industrial robots. Veo developed a FreeMove 3D depth-sensing computer vision system that Symbotic plans to integrate into its robotic warehouse automation system to increase productivity in line with enhanced human-machine collaboration. Management sees a large serviceable addressable market for in-house supply chains of $432 billion, which implies significant opportunities are available for Symbotic to expand its reach and continue growing for many more years.

Should you invest $1,000 in Hawkins right now?

Before you buy stock in Hawkins, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Hawkins wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Royston Yang has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Garmin. The Motley Fool has a disclosure policy.

If I Could Only Buy 3 Stocks in the Last Half of 2024, I’d Pick These was originally published by The Motley Fool

Mark Spitznagel warns we’re in ‘black swan’ territory now, and diversified portfolios are a ‘big lie’

The stock market crashed last month on recession fears but has since soared to fresh record highs as the Federal Reserve began cutting rates and China unveiled stimulus measures.

To Mark Spitznagel, cofounder and chief investment officer of the hedge fund Universa Investments, events are unfolding as he predicted.

The hedge fund veteran previously said markets would rally as the Fed eases in a Goldilocks phase, but has also warned a recession is coming and that rate cuts are also the opening signal for big reversals down the line.

In the current environment, that means in the biggest market bubble in history will soon pop, eventually prompting the Fed to “do something heroic” but doom the economy to stagflation, he has said.

In an interview with Bloomberg TV on Thursday, Spitznagel said the market will continue to see “pure euphoria” in the short term, but will exit the Goldilocks zone toward the end of the year.

To be sure, he has frequently sounded the alarm about extreme market events. His hedge fund specializes in tail-risk hedging, a strategy that seeks to prevent losses from unforeseeable and unlikely economic catastrophes, also known as “black swans.”

With the recent uninversion of the yield curve after years of being inverted, the clock has started ticking, Spitznagel warned.

“That’s when you enter black swan territory,” he said. “Black swans always lurk, but now we’re in their territory.”

Instead of pointing to a specific catalyst, he said the risks in the market stem from an overall environment that’s feeling the lagged effects of the Fed’s aggressive rate-hiking cycle that began in 2022, when central bankers sought to rein in high inflation.

Despite the current risky landscape, Spitznagel cautioned against conventional approaches to diversifying investments that can actually worsen a portfolio.

“Diversification, ‘diworsification,’ modern portfolio theory—it’s got people distracted into mean variants, into risk-adjusted returns, and these are things that have made people poorer over the years, sort of a solution looking for a problem,” he explained. “Diversification is not the holy grail as it’s been touted by many people. That is a big lie actually.”

Investors should to think about how their portfolios would perform in good markets and bad markets—and be comfortable with both outcomes, he added.

Still, he acknowledged it’s difficult to try to hedge this market, saying gold will follow stocks lower and that crypto will go down with risk assets. But the key is to stop fixating on what the market will do.

“We need to protect ourselves not from the market but from ourselves. We need to forecast not the market but ourselves,” Spitznagel said. “We need to think about what we are going to do in these two scenarios: markets boom and bust. Markets zig in order to zag. It’s like poker, they try to squeeze us out of our positions to make us sell the low and buy the high. Let’s make sure we don’t do that.”

This story was originally featured on Fortune.com

Prediction: SoFi Stock Will Soar Over the Next 5 Years. Here's 1 Reason Why.

The stock of SoFi Technologies (NASDAQ: SOFI) has been crushed this year after doubling last year. It’s down 20% year to date despite what seems like pretty solid performance.

However, the tide might turn, and soon. Let’s see why SoFi stock could soar over the next five years.

Expanded business, lower interest rates

SoFi’s main business is lending, but it has expanded into a large array of financial services like bank accounts and investments. Offering other services provides several benefits for SoFi.

It gives it new revenue sources, it creates greater cross-platform engagement among current members, it can attract new members, and — what stands out now — is that it shields the business from the changing effects of interest rates.

Lending can be a lucrative business, but it’s highly sensitive to interest rates, and SoFi’s lending segment has been under pressure as rates remain high.

Now that interest rates look like they’re going to start coming down, the pressure should begin to ease. Meanwhile, the other segments are still in growth mode, and they continue to account for a higher percentage of the company’s overall business.

The lending segment continues to grow, but the non-lending segments are growing much faster. They accounted for 45% of the business in the 2024 second quarter, up from 38% a year ago. As the other segments outpace lending growth, SoFi will become a more stable business, with lower exposure to interest rate movement.

If the lending segment picks up with lower rates, which is how the segment works, investors’ current concerns about the business will fall away. When you combine that with the strength in the company’s expansion model, SoFi stock could explode over the next five years, and now could be a great time to buy in.

Should you invest $1,000 in SoFi Technologies right now?

Before you buy stock in SoFi Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Jennifer Saibil has positions in SoFi Technologies. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Prediction: SoFi Stock Will Soar Over the Next 5 Years. Here’s 1 Reason Why. was originally published by The Motley Fool

Economist Ben Golub Sounds Alarm On Upcoming US Shipping Strike Affecting 36 Ports: 'Chaotic Supply Chain Crisis' Of 2021-2022 Threatens To Resurface

In a stark warning reminiscent of the supply chain disruptions that plagued global commerce in 2021-2022, Northwestern University professor Ben Golub predicts potential chaos as the United States braces for its largest shipping strike in decades.

What Happened: The economist’s analysis, shared on social media platform X, highlights the fragility of modern supply networks and the far-reaching consequences of localized disruptions.

“On Tuesday, 36 US ports will be shut down by the largest shipping strike in living memory,” Golub wrote. “This could recreate the chaotic supply chain crisis of 2021-2022.”

Golub, a professor of economics and computer science, emphasizes that supply chains are far more complex than their linear name suggests. “Supply networks are complex, interconnected webs of relationships,” he explains, citing Toyota’s post-2011 earthquake discovery of 400,000 distinct items across ten supplier tiers.

The economist identifies key vulnerabilities in these networks:

- Concentrated dependence on specific suppliers or regions

- The “diversification mirage,” where apparent multisourcing fails to protect against upstream crises

- The “complexity trap,” where moderate disruptions across the network can cause systemic failure

Golub argues that market forces alone are insufficient to ensure supply network stability. “Unlike road systems, global supply networks operate without oversight,” he notes, adding that research shows market equilibria are not robust enough to prevent crises.

Golub also pointed out that the semiconductor industry, heavily reliant on Taiwan Semiconductor TSM, is particularly vulnerable. Any disruption in this sector could halt entire industries, as seen during the 2021-2022 semiconductor shortages.

Why It Matters: The looming strike is not an isolated event but part of a broader context of potential disruptions. Costco Wholesale COST has already taken proactive measures to mitigate the impact. CEO Ron Vachris detailed contingency plans, including pre-shipping holiday goods and preparing to use alternative ports.

Additionally, transatlantic container shipping volumes have surged as U.S. retailers rush to replenish inventories ahead of the potential strike. Hapag-Lloyd CEO Rolf Habben Jansen noted the temptation among customers to bring in goods early.

Lastly, China’s exports are also at risk due to the anticipated U.S. port strikes, compounded by typhoons and the upcoming Golden Week holiday, which traditionally slows logistics activities in China.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Growth Stock Down 85% to Buy Right Now

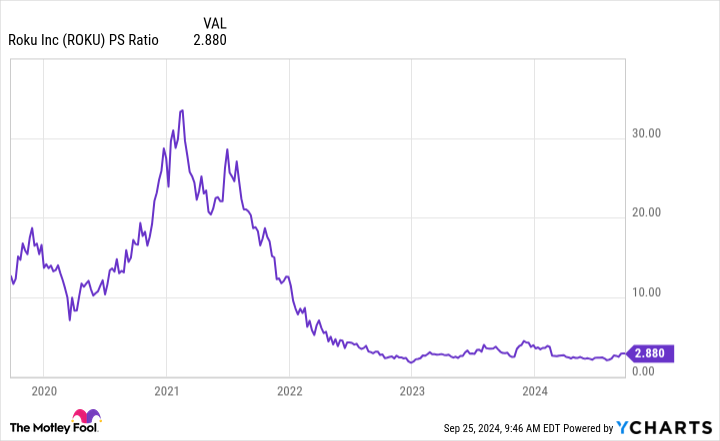

Investors are likely still trying to make sense of Roku (NASDAQ: ROKU) stock. The pandemic darling crashed during the 2022 bear market and never recovered, leaving it trading about 85% below the all-time high it set in July 2021.

However, despite the stock’s struggles, the user base and hours spent on the platform have never stopped growing. That and other factors could serve as the catalyst that finally brings about a recovery in the entertainment stock.

The state of Roku

Indeed, some of the user numbers may leave investors wondering why the stock has never recovered. In the second quarter of 2024, almost 84 million streaming households were actively using a Roku device, a 14% yearly increase. Moreover, the 30 billion streaming hours meant usage was up 20%, indicating that users spent more time on Roku’s platform.

Additionally, Roku remains the most popular TV operating system in the U.S., Canada, and Mexico. Roku unit sales are also higher than those of the company’s next two peers combined. Such signs should be bullish for the stock.

The frustration among Roku shareholders probably lies in the average revenue per user (ARPU) numbers. Despite higher usage by more people, ARPU over the trailing 12 months stood at $40.68, marking virtually no change from year-ago levels.

Roku has explained this by elaborating on its moves into international markets. In many of these places, monetization is in its early stages, meaning the added subscribers are not yet generating significant revenue for Roku.

Roku is trying to counteract this through advertising. The company said ad revenue growth outpaced the overall ad market when excluding media and entertainment. Also, Roku touted its partnership with The Trade Desk, which allows advertisers to better interpret and optimize ad campaigns based on Roku’s data.

Nonetheless, such improvements do not seem to have worked fast enough for Roku’s investors. With the stock up only 10% over the last year, investors may rightly wonder when this anticipated recovery will finally happen.

Roku’s financial results

Still, Roku’s overall financials have improved despite its struggles. Revenue in the first half of 2024 was $1.85 billion, a 16% increase compared to the same period in 2023. The fastest growth came from device revenue at 29%, but platform revenue, which is most of the company’s revenue, still rose by 15%.

Moreover, Roku managed to cut its operating expenses by 9%. This significantly reduced losses, which fell to $85 million for the first two quarters of 2024, a massive improvement from the $301 million loss in the same period last year.

Also, free cash flow was nearly $69 million, showing that the obstacle to profitability was its $183 million in stock-based compensation expenses.

Such challenges have made Roku an inexpensive stock. Although its losses mean shares have no P/E ratio, the price-to-sales (P/S) ratio remains under 3. This is far below the sales multiple at the peak of the 2021 bull market when Roku briefly sold above 30 times sales.

Although shareholders should not expect a return to that valuation, it shows how much Roku could rise if it wins back the confidence of investors.

Consider Roku stock

Ultimately, despite the massive drop in Roku stock and the years of stagnation, a sustained stock recovery could finally come soon.

Roku continues to attract more users who spend more time on its platform. It also continues to build the relationships that should grow revenue as Roku better monetizes its ad platform both in the U.S. and internationally. Admittedly, the lack of growth in ARPU and the ongoing losses remain a frustration. However, as the company builds monetization efforts in international markets, its ARPU should rise over time.

Additionally, Roku’s rising popularity has increased revenue. With continued improvements, the company could become profitable soon, giving investors all the more reason to start believing in Roku stock again.

Should you invest $1,000 in Roku right now?

Before you buy stock in Roku, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Roku wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Will Healy has positions in Roku and The Trade Desk. The Motley Fool has positions in and recommends Roku and The Trade Desk. The Motley Fool has a disclosure policy.

1 Growth Stock Down 85% to Buy Right Now was originally published by The Motley Fool