Smart Money Is Betting Big In INTC Options

Investors with a lot of money to spend have taken a bullish stance on Intel INTC.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with INTC, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 15 uncommon options trades for Intel.

This isn’t normal.

The overall sentiment of these big-money traders is split between 53% bullish and 33%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $251,075, and 12 are calls, for a total amount of $665,770.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $18.0 and $35.0 for Intel, spanning the last three months.

Analyzing Volume & Open Interest

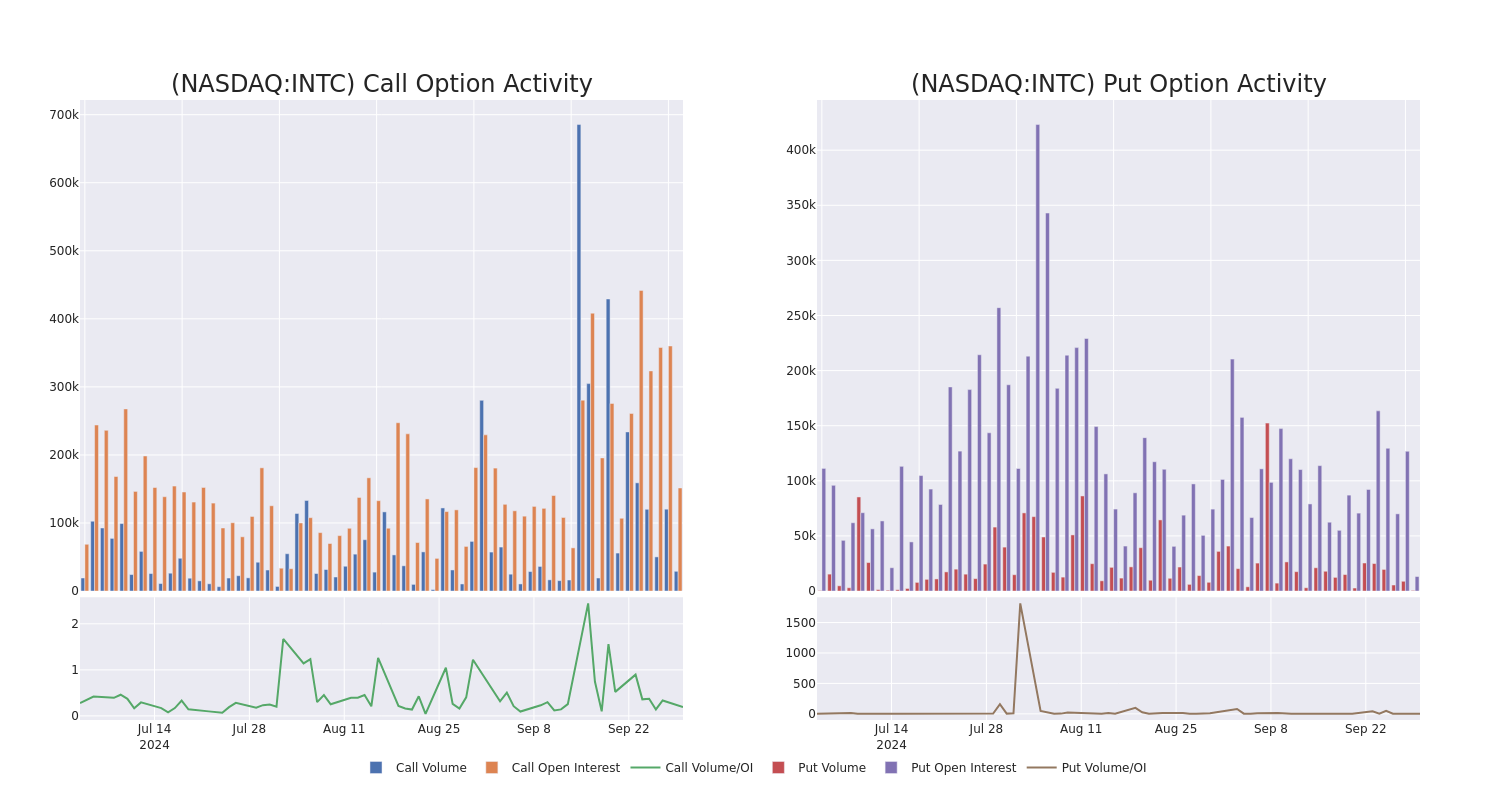

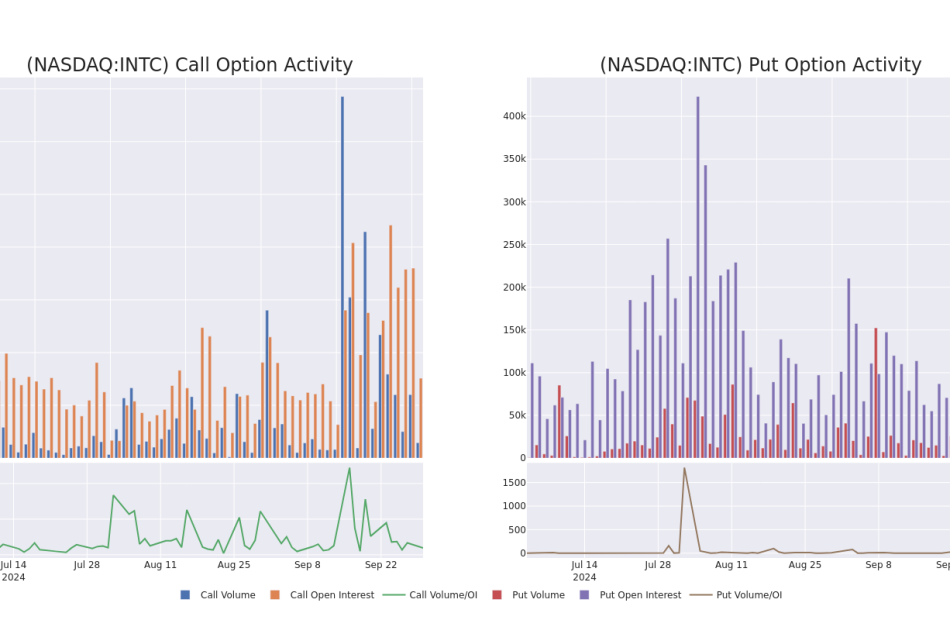

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Intel’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Intel’s substantial trades, within a strike price spectrum from $18.0 to $35.0 over the preceding 30 days.

Intel Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTC | PUT | TRADE | NEUTRAL | 01/15/27 | $13.3 | $12.9 | $13.1 | $35.00 | $131.0K | 59 | 150 |

| INTC | CALL | SWEEP | BEARISH | 12/20/24 | $0.8 | $0.79 | $0.79 | $29.00 | $118.5K | 33.3K | 3.1K |

| INTC | CALL | SWEEP | BEARISH | 12/20/24 | $0.81 | $0.79 | $0.79 | $29.00 | $118.5K | 33.3K | 1.6K |

| INTC | CALL | TRADE | BULLISH | 12/19/25 | $8.8 | $6.0 | $8.7 | $18.00 | $86.9K | 1.5K | 100 |

| INTC | PUT | SWEEP | NEUTRAL | 01/17/25 | $10.7 | $10.6 | $10.65 | $34.00 | $79.8K | 211 | 107 |

About Intel

Intel is a leading digital chipmaker, focused on the design and manufacturing of microprocessors for the global personal computer and data center markets. Intel pioneered the x86 architecture for microprocessors and was the prime proponent of Moore’s law for advances in semiconductor manufacturing. Intel remains the market share leader in central processing units in both the PC and server end markets. Intel has also been expanding into new adjacencies, such as communications infrastructure, automotive, and the Internet of Things. Further, Intel expects to leverage its chip manufacturing capabilities into an outsourced foundry model where it constructs chips for others.

After a thorough review of the options trading surrounding Intel, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Intel

- With a volume of 20,349,013, the price of INTC is down -1.76% at $23.49.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 24 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Intel options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply