Smart Money Is Betting Big In RH Options

Investors with a lot of money to spend have taken a bullish stance on RH RH.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with RH, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 14 uncommon options trades for RH.

This isn’t normal.

The overall sentiment of these big-money traders is split between 71% bullish and 21%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $259,072, and 8 are calls, for a total amount of $315,990.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $220.0 and $370.0 for RH, spanning the last three months.

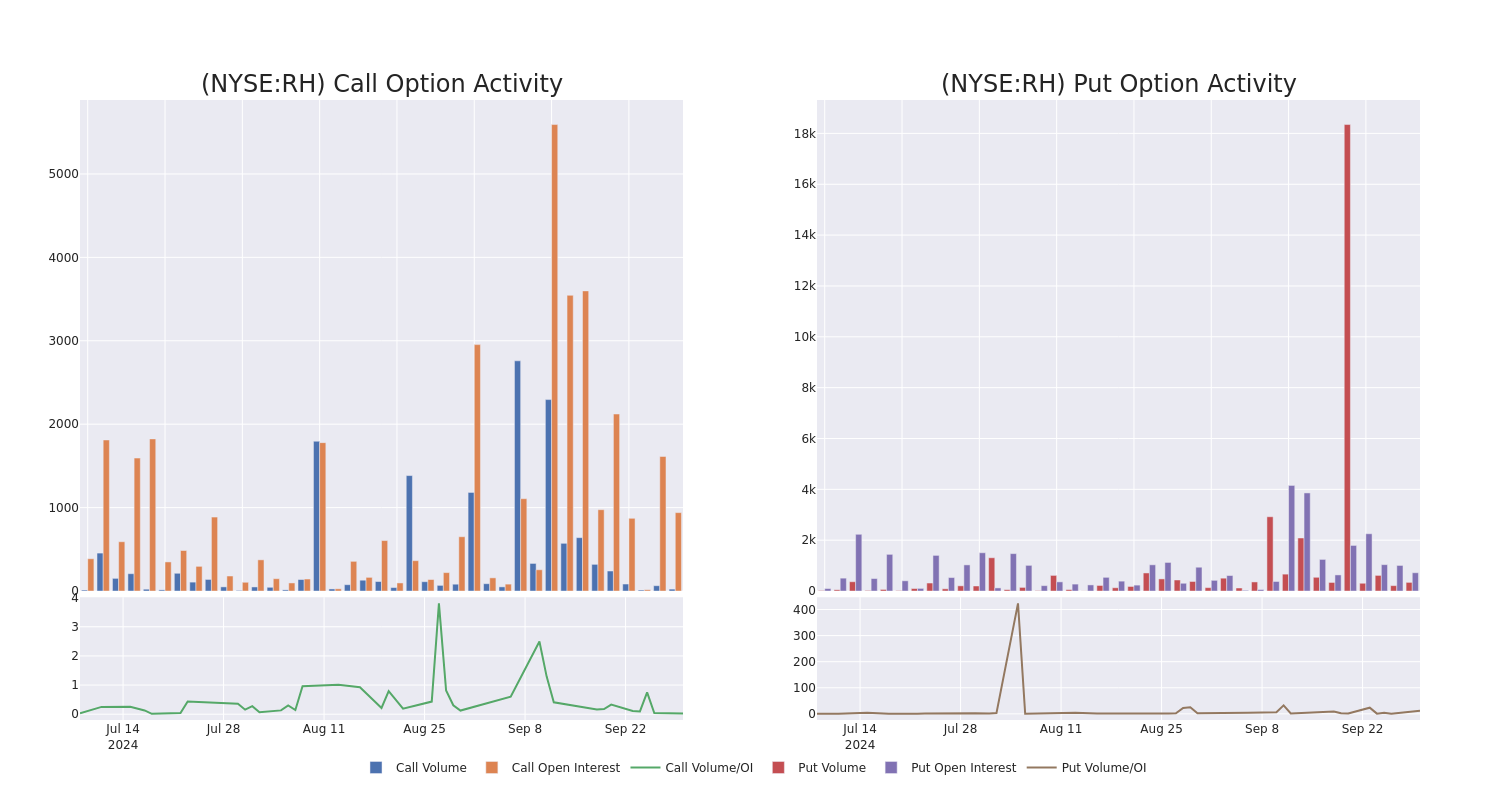

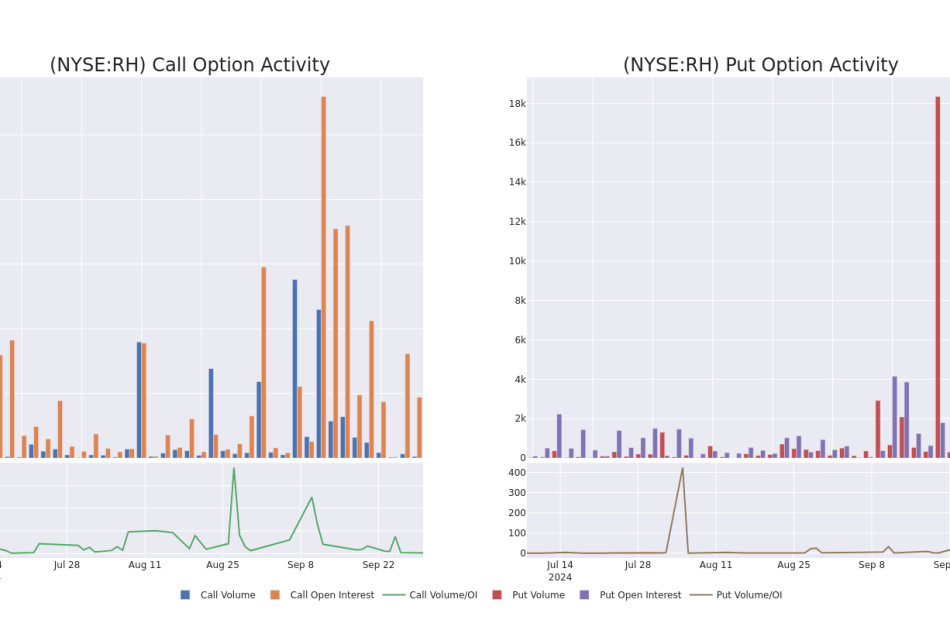

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in RH’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to RH’s substantial trades, within a strike price spectrum from $220.0 to $370.0 over the preceding 30 days.

RH Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RH | PUT | TRADE | BEARISH | 11/15/24 | $8.5 | $8.2 | $8.5 | $300.00 | $86.7K | 275 | 103 |

| RH | CALL | TRADE | BULLISH | 01/17/25 | $97.2 | $96.3 | $97.2 | $250.00 | $48.6K | 112 | 5 |

| RH | CALL | TRADE | NEUTRAL | 01/17/25 | $97.9 | $96.3 | $97.1 | $250.00 | $48.5K | 112 | 10 |

| RH | CALL | SWEEP | BULLISH | 02/21/25 | $119.7 | $116.0 | $116.0 | $230.00 | $46.5K | 3 | 4 |

| RH | CALL | TRADE | BULLISH | 01/17/25 | $81.5 | $80.4 | $81.5 | $270.00 | $40.7K | 132 | 5 |

About RH

RH is a luxury furniture and lifestyle retailer operating in the $134 billion domestic furniture and home furnishing industry. The firm offers merchandise across many categories including furniture, lighting, textiles, bath, decor, and children and is growing the presence of its hospitality business with 18 restaurant locations. RH innovates, curates, and integrates products, categories, services, and businesses across channels and brand extensions (RH Modern and Waterworks, for example). RH is fully integrated across channels and is positioned to broaden its addressable market over the next decade by expanding abroad, with its World of RH digital platform (highlighting offerings outside of home furnishings), and with offerings in color, bespoke furniture, architecture, media, and more.

In light of the recent options history for RH, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of RH

- With a trading volume of 204,291, the price of RH is down by -1.05%, reaching $335.92.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 66 days from now.

Expert Opinions on RH

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $322.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Telsey Advisory Group has decided to maintain their Market Perform rating on RH, which currently sits at a price target of $290.

* An analyst from Telsey Advisory Group persists with their Market Perform rating on RH, maintaining a target price of $290.

* An analyst from Loop Capital persists with their Hold rating on RH, maintaining a target price of $320.

* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on RH with a target price of $355.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for RH, targeting a price of $359.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest RH options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply