Where Will Berkshire Hathaway Stock Be in 5 Years?

The legendary head of Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), Warren Buffett, is nearly unmatched in his investing acumen. You don’t get a nickname like “Oracle of Omaha” by being a slouch. Although it sometimes seems like it, his success isn’t from divining the future; it’s from sticking to a clear, disciplined strategy and philosophy that guide his every move.

Buffett has his eyes on the horizon at all times. He believes in finding businesses with fundamental competitive advantages — “moats” — and backing them for the long term. As he put it in a letter to shareholders in 2023, “When you find a truly wonderful business, stick with it. Patience pays.”

Berkshire Hathaway is surely a wonderful business, and patience has definitely paid. Just a $1,000 investment in Berkshire in 1980 would be worth $2.3 million today. Is that true moving forward though? What do the next five years hold for the company? Let’s take a look.

Berkshire’s own businesses are humming, especially insurance

Berkshire is a conglomerate that owns a portfolio of subsidiaries as well as a portfolio of investments in outside companies, like its stake in Apple. Although the latter often gets more media attention, the businesses that Berkshire controls are a huge part of its bottom line.

Berkshire’s subsidiaries span a diverse set of industries, from energy to manufacturing. Most of these businesses look strong and critically, they provide quite a bit of cash, which enables Buffett to be successful on the investment side of the business.

Insurance has long been the backbone of Berkshire and as of late, Berkshire’s insurance segment has been growing rapidly. Its first-quarter 2024 net-underwriting earnings nearly tripled year over year and nearly doubled year over year in Q2 2024. Geico, likely the most well-known of these, is a major part of this growth.

Geico has been outpaced lately by Progressive, which has grown even faster. Berkshire’s Vice Chairman of Insurance Operations, Ajit Jain, pointed to Geico falling behind in its use of technology as the main culprit. Progressive has better utilized new tech to manage risk.

The good news here is leadership is aware of this and pushing to catch up. Geico has delivered stellar growth despite this handicap; if it can improve its use of new technology, the business will be that much stronger. Considering Geico has some of the lowest costs of any major insurer, I think this is a recipe for success over the coming years.

It’s been a big year for Berkshire’s investments

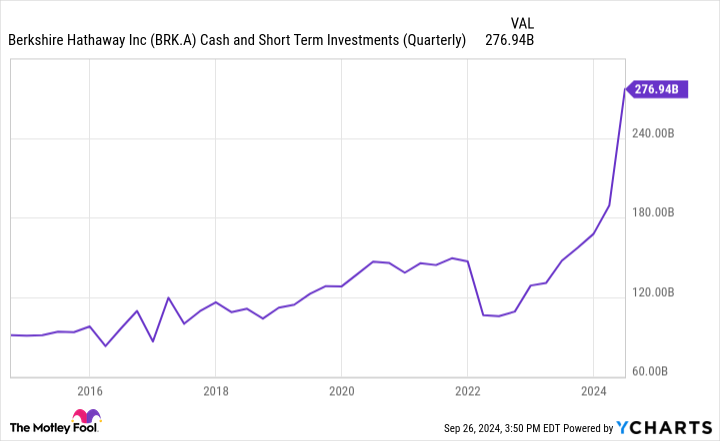

Some major shakeups came this year to Berkshire’s core portfolio. The biggest were the sales of nearly half of its stake in Apple followed closely by the sale of a significant portion of its Bank of America position. There have been some purchases as well, but they’ve been completely overshadowed by Berkshire’s shedding of major chunks of core holdings. The company is sitting on a mountain of cash at the moment (and much of it held in relatively liquid assets like short-term U.S. Treasuries). Take a look at the wild upswing in this reserve over the last year.

What does Buffett have up his sleeve? While it’s impossible to know for sure, I think there’s a good chance Buffett is concerned that the market is a bit too hot at the moment, but he won’t sit on this much cash for too long. I think it’s safe to say he and his company have something in mind and are gearing up to make a major investment or two. I think that he believes that he can find other businesses that will outperform Apple and Bank of America in the years to come.

Buffett’s age is the elephant in the room

Warren Buffett is 94 years old. I think it’s safe to say that he won’t be in the driver’s seat for too much longer. It’s possible his departure could come in the five-year time frame being considered. This will inevitably impact the company as he is one of a kind. However, what he does isn’t magic. His vision and philosophy are so ingrained in the company that his departure will be more seamless than some investors fear.

He has never been the sole guiding hand, especially in recent years. He built the company in tandem with the late Charlie Munger, and the two of them groomed a team of managers for years, many of whom have had independent control of parts of the Berkshire portfolio for some time.

I believe that the continued strength of Berkshire’s subsidiaries, with the likely major investments that will come from its current pile of cash, means that the next five years will continue to be successful for the company. Even if Buffett departs Berkshire in the near future, the company’s stock will outperform the market.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, and Progressive. The Motley Fool has a disclosure policy.

Where Will Berkshire Hathaway Stock Be in 5 Years? was originally published by The Motley Fool

Leave a Reply