Stocks Mixed as Apple Down, Amazon Up on Earnings: Markets Wrap

(Bloomberg) — Wall Street traders hoping for a clear direction on stocks after Thursday’s selloff didn’t get that in late hours amid a mixed bag of earnings from a pair of tech heavyweights.

Most Read from Bloomberg

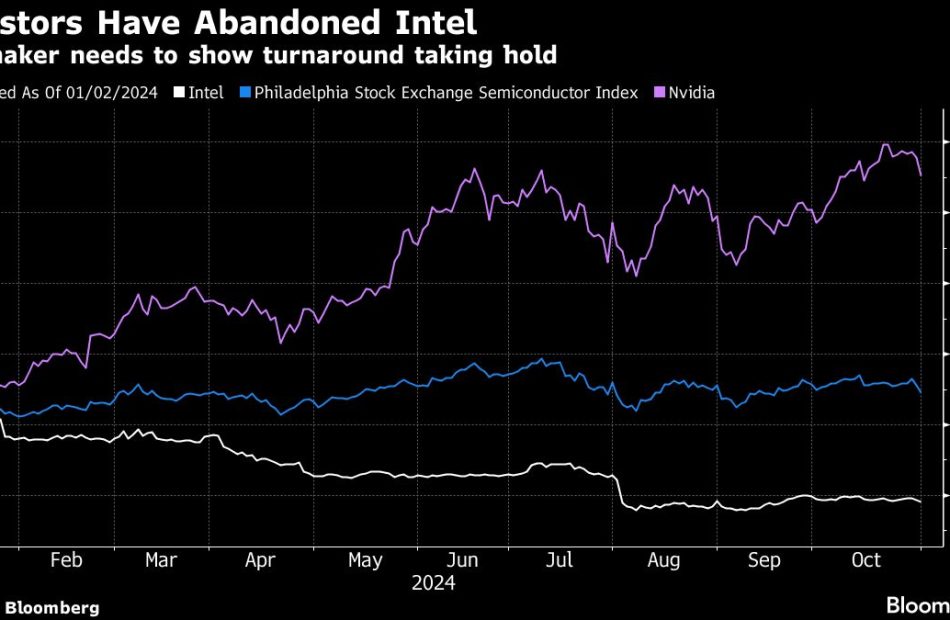

A roughly $300 billion exchange-traded fund tracking the Nasdaq 100 (QQQ) struggled for direction after the close of regular trading. Apple Inc., the world’s most valuable company, fell 2% after reporting weaker-than-anticipated sales in China. Amazon.com Inc. climbed 4% on a bullish forecast. Intel Corp. jumped 9% as its outlook sparked optimism over a turnaround effort.

In regular hours, a 1.9% slide in the S&P 500 wiped out the gauge’s advance for October, halting a streak of monthly gains that would have been the longest since 2021. The Nasdaq 100 dropped 2.4%. Disappointing outlooks from Microsoft Corp. and Meta Platforms Inc. fueled concern that a nearly 45% surge in the megacaps that have powered the bull market might have gone too far.

“Halloween is bringing tricks, not treats to many investors,” said Steve Sosnick at Interactive Brokers. “The market’s mindset seems to be switching from one where anything AI-related was a reason for enthusiasm towards one where investors are looking for some returns on their massive spending.”

Those worries hit a market showing signs of exhaustion near record highs ahead of next week’s US election and the Federal Reserve decision. Moreover, there’s a nearly palpable narrative taking hold that the election – rather than offering a sense of certainty – will cause volatility to spike, noted Quincy Krosby at LPL Financial. That’s not to mention the jobs report on Friday.

Treasuries saw their biggest monthly loss in two years on bets the Fed won’t be too aggressive with rate cuts amid a strong economy. The dollar notched its best month since 2022.

The yen jumped as much as 1%, extending gains seen after Bank of Japan Governor Kazuo Ueda said that currency markets have had a major impact on the economy, pointing to another potential rate hike in coming months. Chancellor of the Exchequer Rachel Reeves sought to reassure the financial markets after her budget on Wednesday triggered a selloff in UK bonds.

Oil surged on a report Iran is planning a fresh attack on Israel. Gold retreated as some investors booked profit after the metal’s rally to a fresh record.

Why Altria Stock Was Surging Today

On Thursday, good news from one of the market’s favorite “sin stocks” drove its share price up by almost 8%. This lucky company was Altria (NYSE: MO); the cigarette maker’s latest quarterly earnings report was received most favorably by market players. The stock’s pop on the day was in market contrast to the 1.9% slump of the benchmark S&P 500 index.

That morning, Altria released its third-quarter figures, which were slightly higher than the consensus analyst estimates. The tobacco giant also reaffirmed its existing full-year guidance.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The quarter saw the company book $5.34 billion in net revenue, which was up by 1% from the same period of 2023. Meanwhile, non-GAAP (adjusted) net income improved over that time span, rising by nearly 4% to a shade under $2.36 billion ($1.38 per share).

Both headline numbers topped pundit projections, although not spectacularly. The consensus analyst expectation for revenue was $5.32 billion, and that for adjusted profitability was $1.35 per share.

For years, Altria has been contending with precipitous declines in the traditional cigarette market due to a general consumer move to more healthy lifestyle choices (in addition to concentrated anti-smoking efforts by authorities). However, vaping products and other consumption alternatives have found quite a niche in the market.

The company did well with next-generation products during the quarter. Its shipment volume for NJOY electric cigarette and vaping products more than doubled on a year-over-year basis, and that for its on! nicotine pouches saw a 46% increase.

Altria also maintained its adjusted net income guidance for the entirety of 2024; since this means growth over the 2023 numbers if fulfilled, the market found this encouraging. Management is expecting $5.07 to $5.15 per share for the line item, which would shake out to annual growth of at least 2.5%.

The company continues to do a decent job coping with the end of the Cigarette Era, although it remains to be seen whether next-generation products can ultimately offset the severe shrinking of the traditional segment.

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

Light & Wonder (LNW) Faces Scrutiny Over Gaming Revenue Claims- Hagens Berman

SAN FRANCISCO , Oct. 31, 2024 (GLOBE NEWSWIRE) — Shares in Light & Wonder, a leading gaming technology company, are under pressure following a recent court ruling that questioned the legality of its popular Dragon Train® slot machines. The ruling has raised questions about the propriety of Light & Wonder’s disclosures regarding the success of Dragon Train® and its prospects for continued revenue growth.

Hagens Berman encourages Light & Wonder, Inc. LNW investors who suffered substantial losses to submit your losses now. The firm also encourages persons with knowledge who may assist the investigation to contact its attorneys.

Visit: www.hbsslaw.com/investor-fraud/lnw

Contact the Firm Now: LNW@hbsslaw.com

844-916-0895

Investigation Into Light & Wonder, Inc. (LNW):

Aristocrat Technologies, a competitor, recently secured a preliminary injunction against Light & Wonder, alleging that the latter had misappropriated trade secrets in the development of Dragon Train®. The court found that Aristocrat was likely to succeed in demonstrating Light & Wonder’s wrongdoing and that the company had gained an unfair advantage.

The financial press has reported that Aristocrat’s allegations also involve two former Aristocrat designers who worked on a similar product, Dragon Link. The designers’ involvement in both products has raised questions about the originality of Dragon Train®.

Following the court ruling, Light & Wonder’s share price plummeted by 19% on September 24, 2024, wiping out approximately $1.9 billion in shareholder value.

Law firm Hagens Berman has announced an investigation into whether Light & Wonder may have misled investors about the legality and propriety of its reported gaming revenue growth. The firm is examining the company’s disclosures and the circumstances surrounding the development of Dragon Train®.

If you invested in Light & Wonder and have substantial losses, or have knowledge that may assist the firm’s investigation, submit your losses now »

If you’d like more information and answers to frequently asked questions about the Light & Wonder investigation, read more »

Whistleblowers: Persons with non-public information regarding Light & Wonder should consider their options to help in the investigation or take advantage of the SEC Whistleblower program. Under the new program, whistleblowers who provide original information may receive rewards totaling up to 30 percent of any successful recovery made by the SEC. For more information, call Reed Kathrein at 844-916-0895 or email LNW@hbsslaw.com.

About Hagens Berman

Hagens Berman is a global plaintiffs’ rights complex litigation firm focusing on corporate accountability. The firm is home to a robust practice and represents investors as well as whistleblowers, workers, consumers and others in cases achieving real results for those harmed by corporate negligence and other wrongdoings. Hagens Berman’s team has secured more than $2.9 billion in this area of law. More about the firm and its successes can be found at hbsslaw.com. Follow the firm for updates and news at @ClassActionLaw.

Contact:

Reed Kathrein, 844-916-0895

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hostaway Announces Strategic Integration with Lake.com to Enhance Vacation Rental Management

TORONTO, Oct. 31, 2024 /PRNewswire/ – Hostaway, the premier all-in-one vacation rental software and Airbnb management system, is pleased to announce its strategic integration with Lake.com, a leading online vacation rental platform. This collaboration is set to elevate the vacation rental management experience by merging Hostaway’s robust tools with Lake.com’s innovative solutions.

Highlights:

- Seamless Connectivity: Integrate Hostaway’s comprehensive management system with Lake.com’s platform for enhanced synchronization and efficiency.

- Enhanced Automation: Increase efficiency of daily work processes and introduce such features as auto-messaging and auto-invoicing.

- Broadened Market Reach: Increase demand and acquire more reservations with the help of Lake.com’s extensive network.

- Unified Management: Manage reservations, availability, and communications from a single, unified dashboard.

David Ciccarelli, CEO of Lake Inc., shared, “We’re excited to partner with Hostaway, a leader in vacation rental management. This collaboration will help us provide property owners with cutting-edge tools to manage their listings effortlessly, while also enhancing the experience for our guests. It’s a big step in our mission to make lakeside getaways seamless and memorable for everyone.”

Marcus Rader, CEO and Co-Founder of Hostaway, added,”Lake is a great tribute to how segmentation within the travel industry works. You have to find your niche, and stick to it. Lakes are some of the best ways of extending the seasonality too – shallow lakes get warm quickly in spring, while bigger lakes bring in warm air the entire fall. Having lived by the Great Lakes for a decade, I’m proud to see Lake.com as a Hostaway partner!”

Hostaway’s flexible and customizable platform will now be integrated with Lake.com, allowing property managers to automate and simplify their marketing, sales, communication, and operations processes. By leveraging Hostaway’s robust software, Lake.com aims to enhance the efficiency of property management, making it easier for property owners to manage their listings and bookings while delivering an exceptional experience to travelers.

To learn more, visit:

https://www.lake.com/integrations/hostaway/

About Lake.com

Lake.com specializes in vacation rentals within a 15-minute drive of lakes, bays, rivers and canals. Focusing on family, friendship, and caring for the natural world, Lake.com blends tradition with technology, offering a return to the simple pleasures of life for families vacationing in the great outdoors. For more information, visit https://www.lake.com.

About Hostaway

Hostaway provides a single package for end-to-end vacation rental software and Airbnb management from listing to bookings and everything in between. It begins with channel management and communication up to analytics and reporting, Hostaway helps property managers to grow their business. For more information, visit https://www.hostaway.com/.

![]() View original content:https://www.prnewswire.com/news-releases/hostaway-announces-strategic-integration-with-lakecom-to-enhance-vacation-rental-management-302292963.html

View original content:https://www.prnewswire.com/news-releases/hostaway-announces-strategic-integration-with-lakecom-to-enhance-vacation-rental-management-302292963.html

SOURCE Lake.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

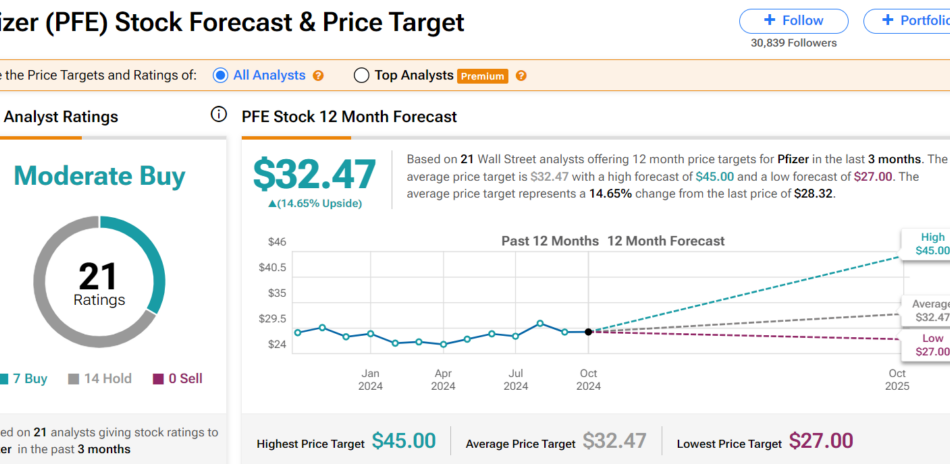

Is Pfizer (NYSE:PFE) a High-Yielding Dividend Stock Worth Buying?

In life, there’s a common expression that also carries over into the dividend investing world: If it seems too good to be true, it usually is too good to be true. Oftentimes, dividend stocks with 6% or higher yields are yield traps. This means that the dividend income they provide to shareholders seems great, but it isn’t sustainable. Now and then, though, I stumble across high-yielding dividend stocks that aren’t yield traps. I believe that one such example is Pfizer (PFE).

Interestingly, Pfizer’s 5.9% dividend yield is more than quadruple the 1.3% yield of the S&P 500 index (SPX). Despite the high yield, here is why I think the well-known healthcare stock is an income stock that warrants a Buy rating after its third-quarter earnings results.

On October 29th, Pfizer released its third-quarter financial results. The firm’s total revenue jumped 31.2% over the year-ago period to $17.7 billion, which topped the analyst consensus by $2.8 billion. Rising COVID-19 infections in the summer and early fall led to an uptick in demand for antiviral COVID-19 treatment, Paxlovid, according to CEO Albert Bourla. That mainly was what drove the 43.6% year-over-year spike in Primary Care segment revenue to nearly $9.1 billion in the third quarter.

In addition, Pfizer’s Oncology segment posted $4 billion in revenue, which was up 29.8% over the year-ago period. This was due to ongoing momentum from advanced prostate cancer treatment Xtandi and the recent launches of advanced bladder cancer therapy Padcev and lymphoma therapy Adcetris. The company’s Specialty Care segment reported $4.3 billion in revenue during the quarter, which was equivalent to a 14% year-over-year growth rate. That was made possible by the expansion of the healthcare provider base for the Vyndaqel rare heart disease medication family.

Pfizer also posted $1.06 in adjusted diluted EPS for the third quarter, which was comfortably ahead of the analyst consensus of $0.61. These results were fueled by topline performance as well as by improvements in operating structure and favorable tax rates. On the first point, ongoing cost reductions have improved the company’s profitability. That’s how adjusted diluted EPS growth significantly outpaced revenue growth in the quarter.

After coming down from its COVID-19 pandemic high, Pfizer looks like it is firmly on the road to recovery, which adds to my bullish outlook. The company expects to realize $4 billion of its $5.5 billion-plus in annual targeted savings in 2024. That’s thanks to its cost realignment program launched last October. The other $1.5 billion-plus in anticipated annual savings are expected to materialize by the end of 2027 from the first phase of the manufacturing optimization program.

Stock market today: Indexes drop as tech shares slide before Apple, Amazon earnings

-

Indexes fell for a second day on Thursday as a huge week for tech earnings shows mixed results.

-

Meta and Microsoft slid after slight earnings beats, and Amazon and Apple are set to report after market close.

-

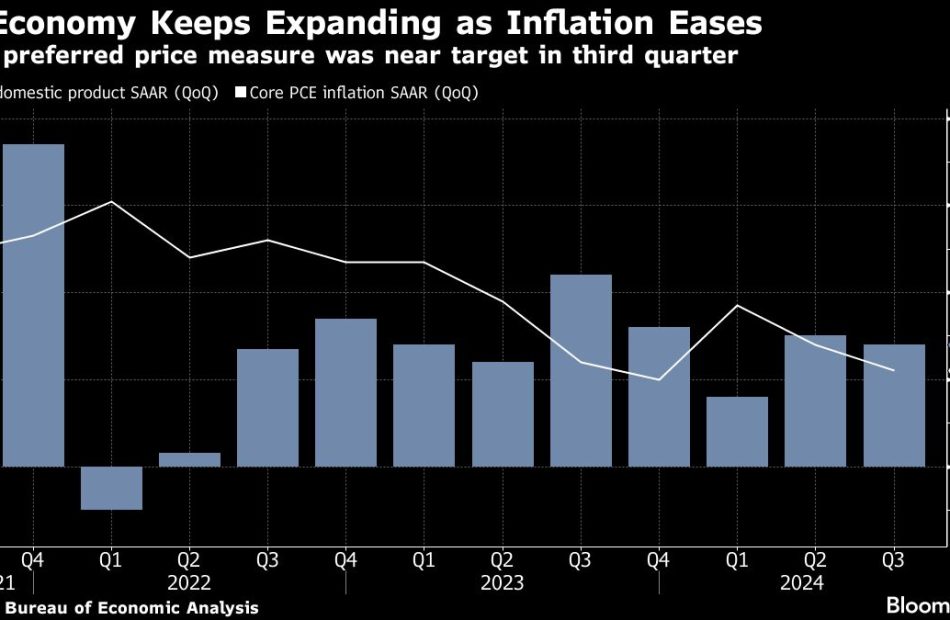

PCE inflation, the Fed’s preferred inflation gauge, dropped to 2.1% while jobless claims fell more than expected.

Indexes slid on Thursday, heading for a second day of declines as big tech earnings fail to impress investors so far.

The S&P 500 and Nasdaq both slid, and the Dow Jones Industrial Average lost over 200 points shortly after the opening bell.

The drop comes amid a packed week for earnings, with several of the biggest tech stocks reporting third-quarter results.

Microsoft and Meta reported earnings that beat estimates after the closing bell on Wednesday, but the shares of both tech giants slid on forward guidance. Microsoft declined more than 4% after it shared expectations for slower growth in its cloud business, while Meta shares lost over 2% after forecasting “significant” capital expenditures growth next year.

Earlier in the week, Alphabet’s earnings beat generated more enthusiasm among investors as CEO Sundar Pichai said the company’s AI investments are “paying off.”

Investors are bracing for earnings from Apple and Amazon after market close today. They will be paying particularly close attention for signs that AI is driving iPhone demand for Apple, especially after the company rolled out its iOS 18.1 update earlier this week, and they expect a strong beat from Amazon.

Meanwhile, the personal-consumption expenditures index, the Fed’s preferred inflation gauge, cooled to 2.1% year over year in September from 2.2% in August. That marks progress toward the Fed’s 2% inflation target, but the core index—which excludes food and energy prices—came in hotter than expected at 2.7%.

Jobless claims from last week fell by more than expected to 216,000, a 12,000 drop from the week prior. Economists had expected claims to come in at 230,000.

Here’s where US indexes stood shortly after the 9:30 a.m. opening bell on Thursday:

Here’s what else is going on:

MasTec Announces Third Quarter 2024 Financial Results and Increases Guidance for the Year

- Third Quarter 2024 Revenue of $3.3 Billion with Significant Margin Expansion Over Last Year

- Third Quarter 2024 Diluted Earnings Per Share of $1.21 and Adjusted Diluted Earnings Per Share of $1.63, Above Expectations by $0.43 and $0.39, Respectively

- Third Quarter 2024 GAAP Net Income of $105.4 Million and Adjusted EBITDA of $305.9 Million, Above Expectations by $33.4 Million and $10.9 Million, Respectively

- Record 18-month Backlog as of September 30, 2024 of $13.9 Billion Increased $1.4 Billion from the Third Quarter of 2023

- Year-to-Date Cash Flow Generated by Operating Activities of $650 Million and DSO at 68 Days

CORAL GABLES, Fla., Oct. 31, 2024 /PRNewswire/ — MasTec, Inc. MTZ today announced third quarter 2024 financial results and increased its full year bottom line 2024 guidance expectations.

Third quarter 2024 revenue was $3.3 billion, compared to $3.3 billion for the third quarter of 2023. Third quarter 2024 GAAP net income was $105.4 million, or $1.21 per diluted share, compared to net income of $15.3 million, or $0.18 per diluted share, in the third quarter of 2023.

Third quarter 2024 adjusted net income and adjusted diluted earnings per share, both non-GAAP measures, were $138.7 million and $1.63, respectively, up 83% and 71%, respectively, as compared to adjusted net income and adjusted diluted earnings per share of $75.9 million and $0.95, respectively, in the third quarter of 2023. Third quarter 2024 adjusted EBITDA, also a non-GAAP measure, was up 13% to $305.9 million, compared to $271.1 million in the third quarter of 2023.

18-month backlog as of September 30, 2024, was $13.9 billion, up $1.4 billion from the third quarter of 2023.

Jose Mas, MasTec’s Chief Executive Officer, commented, “I am pleased with our margin expansion that exceeded our guidance and which drove excellent bottom line performance. Once again, our record backlog and bookings in multiple segments illustrate the strength of our diversified business model and provide good visibility to the work that will drive MasTec’s performance in 2025 and beyond. I also want to recognize the hard work and dedication of the men and women of MasTec who continue to deliver for our shareholders.”

Paul DiMarco, MasTec’s Executive Vice President and Chief Financial Officer, noted, “We again significantly exceeded our cash flow targets, generating $278 million of cash flow from operations in the quarter and driving net debt leverage down to 2.2x. The macrotrends in our end markets remain favorable and we will prioritize capital allocation to take advantage of opportunities for growth.”

Based on the information available today, the Company is providing fourth quarter 2024 and updating full year 2024 guidance. The Company currently expects full year 2024 revenue of approximately $12.225 billion. Full year 2024 GAAP net income is expected to approximate $187 million, representing 1.5% of revenue, with GAAP diluted earnings per share expected to be $1.98. Full year 2024 adjusted EBITDA is expected to be $990 million, representing 8.1% of revenue, with adjusted diluted earnings per share expected to be $3.75.

For the fourth quarter of 2024, the Company expects revenue of approximately $3.325 billion. Fourth quarter 2024 GAAP net income is expected to approximate $72 million, representing 2.2% of revenue, with GAAP diluted earnings per share expected to be $0.86. Fourth quarter 2024 adjusted EBITDA is expected to approximate $259 million, representing 7.8% of revenue, with adjusted diluted earnings per share expected to be $1.29.

Adjusted net income, adjusted net income attributable to MasTec, Inc., adjusted diluted earnings per share, adjusted EBITDA, adjusted EBITDA margin and net debt, which are all non-GAAP measures, exclude certain items which are detailed and reconciled to the most comparable GAAP-reported measures in the attached Supplemental Disclosures and Reconciliation of Non-GAAP Disclosures.

Management will hold a conference call to discuss these results on Friday, November 1, 2024, at 9:00 a.m. Eastern Time. The call-in number for the conference call is (856) 344-9221 or (888) 204-4368 with a pass code of 9237122. Additionally, the call will be broadcast live over the Internet and can be accessed and replayed for 60 days through the Investors section of the Company’s website at www.mastec.com.

The following tables set forth the financial results for the periods ended September 30, 2024 and 2023:

|

Consolidated Statements of Operations (unaudited – in thousands, except per share information) |

|||||||

|

For the Three Months Ended |

For the Nine Months Ended |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Revenue |

$ 3,252,427 |

$ 3,257,077 |

$ 8,900,362 |

$ 8,715,851 |

|||

|

Costs of revenue, excluding depreciation and amortization |

2,789,274 |

2,857,118 |

7,709,393 |

7,701,392 |

|||

|

Depreciation |

80,193 |

115,033 |

289,769 |

325,318 |

|||

|

Amortization of intangible assets |

34,368 |

42,266 |

101,669 |

126,252 |

|||

|

General and administrative expenses |

168,874 |

180,640 |

501,491 |

520,709 |

|||

|

Interest expense, net |

47,048 |

62,556 |

149,678 |

174,664 |

|||

|

Equity in earnings of unconsolidated affiliates, net |

(7,042) |

(6,787) |

(22,153) |

(23,434) |

|||

|

Loss on extinguishment of debt |

— |

— |

11,344 |

— |

|||

|

Other expense (income), net |

2,754 |

(16,623) |

4,639 |

(26,332) |

|||

|

Income (loss) before income taxes |

$ 136,958 |

$ 22,874 |

$ 154,532 |

$ (82,718) |

|||

|

(Provision for) benefit from income taxes |

(31,548) |

(7,569) |

(39,813) |

34,231 |

|||

|

Net income (loss) |

$ 105,410 |

$ 15,305 |

$ 114,719 |

$ (48,487) |

|||

|

Net income attributable to non-controlling interests |

10,170 |

1,009 |

26,671 |

2,215 |

|||

|

Net income (loss) attributable to MasTec, Inc. |

$ 95,240 |

$ 14,296 |

$ 88,048 |

$ (50,702) |

|||

|

Earnings (loss) per share: |

|||||||

|

Basic earnings (loss) per share |

$ 1.22 |

$ 0.18 |

$ 1.13 |

$ (0.65) |

|||

|

Basic weighted average common shares outstanding |

78,044 |

77,640 |

78,004 |

77,418 |

|||

|

Diluted earnings (loss) per share |

$ 1.21 |

$ 0.18 |

$ 1.12 |

$ (0.65) |

|||

|

Diluted weighted average common shares outstanding |

78,913 |

78,455 |

78,801 |

77,418 |

|||

|

Consolidated Balance Sheets (unaudited – in thousands) |

|||

|

September 30, |

December 31, |

||

|

Assets |

|||

|

Current assets |

$ 3,572,895 |

$ 3,974,253 |

|

|

Property and equipment, net |

1,519,378 |

1,651,462 |

|

|

Operating lease right-of-use assets |

398,564 |

418,685 |

|

|

Goodwill, net |

2,135,683 |

2,126,366 |

|

|

Other intangible assets, net |

718,230 |

784,260 |

|

|

Other long-term assets |

418,222 |

418,485 |

|

|

Total assets |

$ 8,762,972 |

$ 9,373,511 |

|

|

Liabilities and equity |

|||

|

Current liabilities |

$ 2,887,751 |

$ 2,837,219 |

|

|

Long-term debt, including finance leases |

2,138,697 |

2,888,058 |

|

|

Long-term operating lease liabilities |

264,632 |

292,873 |

|

|

Deferred income taxes |

381,219 |

390,399 |

|

|

Other long-term liabilities |

261,961 |

243,701 |

|

|

Total liabilities |

$ 5,934,260 |

$ 6,652,250 |

|

|

Total equity |

$ 2,828,712 |

$ 2,721,261 |

|

|

Total liabilities and equity |

$ 8,762,972 |

$ 9,373,511 |

|

|

Consolidated Statements of Cash Flows (unaudited – in thousands) |

|||

|

For the Nine Months Ended |

|||

|

2024 |

2023 |

||

|

Net cash provided by operating activities |

$ 649,926 |

$ 196,572 |

|

|

Net cash used in investing activities |

(80,798) |

(171,683) |

|

|

Net cash used in financing activities |

(916,513) |

(181,587) |

|

|

Effect of currency translation on cash |

(951) |

280 |

|

|

Net decrease in cash and cash equivalents |

$ (348,336) |

$ (156,418) |

|

|

Cash and cash equivalents – beginning of period |

$ 529,561 |

$ 370,592 |

|

|

Cash and cash equivalents – end of period |

$ 181,225 |

$ 214,174 |

|

|

Backlog by Reportable Segment (unaudited – in millions) |

September 30, |

June 30, |

September 30, |

||

|

Communications |

$ 5,855 |

$ 5,898 |

$ 5,299 |

||

|

Clean Energy and Infrastructure |

4,141 |

3,666 |

3,073 |

||

|

Power Delivery |

3,160 |

2,974 |

2,437 |

||

|

Oil and Gas |

702 |

800 |

1,681 |

||

|

Other |

— |

— |

— |

||

|

Estimated 18-month backlog |

$ 13,858 |

$ 13,338 |

$ 12,490 |

Backlog is a common measurement used in our industry. Our methodology for determining backlog may not, however, be comparable to the methodologies used by others. Estimated backlog represents the amount of revenue we expect to realize over the next 18 months from future work on uncompleted construction contracts, including new contracts under which work has not begun, as well as revenue from change orders and renewal options. Our estimated backlog also includes amounts under master service and other service agreements and our proportionate share of estimated revenue from proportionately consolidated non-controlled contractual joint ventures. Estimated backlog for work under master service and other service agreements is determined based on historical trends, anticipated seasonal impacts, experience from similar projects and estimates of customer demand based on communications with our customers.

|

Supplemental Disclosures and Reconciliation of Non-GAAP Disclosures (unaudited – in millions, except for percentages and per share information) |

|||||||

|

For the Three Months Ended |

For the Nine Months Ended |

||||||

|

Segment Information |

2024 |

2023 |

2024 |

2023 |

|||

|

Revenue by Reportable Segment |

|||||||

|

Communications |

$ 927.2 |

$ 824.4 |

$ 2,484.7 |

$ 2,499.6 |

|||

|

Clean Energy and Infrastructure |

1,138.4 |

1,099.9 |

2,834.2 |

2,894.5 |

|||

|

Power Delivery |

712.5 |

665.0 |

1,920.1 |

2,077.1 |

|||

|

Oil and Gas |

497.8 |

672.3 |

1,704.0 |

1,270.6 |

|||

|

Other |

— |

— |

— |

— |

|||

|

Eliminations |

(23.5) |

(4.5) |

(42.6) |

(25.9) |

|||

|

Consolidated revenue |

$ 3,252.4 |

$ 3,257.1 |

$ 8,900.4 |

$ 8,715.9 |

|||

|

For the Three Months Ended |

For the Nine Months Ended |

||||||||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||||||||

|

Adjusted EBITDA and EBITDA Margin by Segment |

|||||||||||||||

|

EBITDA |

$ 298.6 |

9.2 % |

$ 242.7 |

7.5 % |

$ 695.6 |

7.8 % |

$ 543.5 |

6.2 % |

|||||||

|

Non-cash stock-based compensation expense (a) |

7.3 |

0.2 % |

7.2 |

0.2 % |

24.0 |

0.3 % |

24.3 |

0.3 % |

|||||||

|

Loss on extinguishment of debt (a) |

— |

— % |

— |

— % |

11.3 |

0.1 % |

— |

— % |

|||||||

|

Acquisition and integration costs (b) |

— |

— % |

21.1 |

0.6 % |

— |

— % |

60.9 |

0.7 % |

|||||||

|

Losses on fair value of investment (a) |

— |

— % |

— |

— % |

— |

— % |

0.2 |

0.0 % |

|||||||

|

Adjusted EBITDA |

$ 305.9 |

9.4 % |

$ 271.1 |

8.3 % |

$ 731.0 |

8.2 % |

$ 629.0 |

7.2 % |

|||||||

|

Segment: |

|||||||||||||||

|

Communications |

$ 106.6 |

11.5 % |

$ 78.2 |

9.5 % |

$ 237.3 |

9.5 % |

$ 234.0 |

9.4 % |

|||||||

|

Clean Energy and Infrastructure |

85.0 |

7.5 % |

57.6 |

5.2 % |

152.8 |

5.4 % |

117.8 |

4.1 % |

|||||||

|

Power Delivery |

54.5 |

7.6 % |

57.0 |

8.6 % |

133.2 |

6.9 % |

163.5 |

7.9 % |

|||||||

|

Oil and Gas |

103.1 |

20.7 % |

97.3 |

14.5 % |

330.9 |

19.4 % |

188.9 |

14.9 % |

|||||||

|

Other |

7.4 |

NM |

4.4 |

NM |

17.2 |

NM |

18.2 |

NM |

|||||||

|

Segment Total |

$ 356.6 |

11.0 % |

$ 294.5 |

9.0 % |

$ 871.4 |

9.8 % |

$ 722.4 |

8.3 % |

|||||||

|

Corporate |

(50.7) |

— |

(23.4) |

— |

(140.4) |

— |

(93.4) |

— |

|||||||

|

Adjusted EBITDA |

$ 305.9 |

9.4 % |

$ 271.1 |

8.3 % |

$ 731.0 |

8.2 % |

$ 629.0 |

7.2 % |

|||||||

|

NM – Percentage is not meaningful |

|

|

(a) |

Non-cash stock-based compensation expense, loss on extinguishment of debt and losses on the fair value of an investment are included within Corporate EBITDA. |

|

(b) |

For the three month period ended September 30, 2023, Communications, Clean Energy and Infrastructure and Power Delivery EBITDA included $4.8 million, $15.3 million and $0.5 million, respectively, of acquisition and integration costs related to certain acquisitions, and Corporate EBITDA included $0.5 million of such costs, and for the nine month period ended September 30, 2023, $18.3 million, $36.9 million, $2.5 million and $3.2 million of such costs were included in EBITDA of the segments and Corporate, respectively. |

|

Supplemental Disclosures and Reconciliation of Non-GAAP Disclosures (unaudited – in millions, except for percentages and per share information) |

|||||||||||||||

|

For the Three Months Ended |

For the Nine Months Ended |

||||||||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||||||||

|

EBITDA and Adjusted EBITDA Reconciliation |

|||||||||||||||

|

Net income (loss) |

$ 105.4 |

3.2 % |

$ 15.3 |

0.5 % |

$ 114.7 |

1.3 % |

$ (48.5) |

(0.6) % |

|||||||

|

Interest expense, net |

47.0 |

1.4 % |

62.6 |

1.9 % |

149.7 |

1.7 % |

174.7 |

2.0 % |

|||||||

|

Provision for (benefit from) income taxes |

31.5 |

1.0 % |

7.6 |

0.2 % |

39.8 |

0.4 % |

(34.2) |

(0.4) % |

|||||||

|

Depreciation |

80.2 |

2.5 % |

115.0 |

3.5 % |

289.8 |

3.3 % |

325.3 |

3.7 % |

|||||||

|

Amortization of intangible assets |

34.4 |

1.1 % |

42.3 |

1.3 % |

101.7 |

1.1 % |

126.3 |

1.4 % |

|||||||

|

EBITDA |

$ 298.6 |

9.2 % |

$ 242.7 |

7.5 % |

$ 695.6 |

7.8 % |

$ 543.5 |

6.2 % |

|||||||

|

Non-cash stock-based compensation expense |

7.3 |

0.2 % |

7.2 |

0.2 % |

24.0 |

0.3 % |

24.3 |

0.3 % |

|||||||

|

Loss on extinguishment of debt |

— |

— % |

— |

— % |

11.3 |

0.1 % |

— |

— % |

|||||||

|

Acquisition and integration costs |

— |

— % |

21.1 |

0.6 % |

— |

— % |

60.9 |

0.7 % |

|||||||

|

Losses on fair value of investment |

— |

— % |

— |

— % |

— |

— % |

0.2 |

0.0 % |

|||||||

|

Adjusted EBITDA |

$ 305.9 |

9.4 % |

$ 271.1 |

8.3 % |

$ 731.0 |

8.2 % |

$ 629.0 |

7.2 % |

|||||||

|

For the Three Months Ended |

For the Nine Months Ended |

||||||

|

Adjusted Net Income Reconciliation |

2024 |

2023 |

2024 |

2023 |

|||

|

Net income (loss) |

$ 105.4 |

$ 15.3 |

$ 114.7 |

$ (48.5) |

|||

|

Adjustments: |

|||||||

|

Non-cash stock-based compensation expense |

7.3 |

7.2 |

24.0 |

24.3 |

|||

|

Amortization of intangible assets |

34.4 |

42.3 |

101.7 |

126.3 |

|||

|

Loss on extinguishment of debt |

— |

— |

11.3 |

— |

|||

|

Acquisition and integration costs |

— |

21.1 |

— |

60.9 |

|||

|

Losses on fair value of investment |

— |

— |

— |

0.2 |

|||

|

Total adjustments, pre-tax |

$ 41.7 |

$ 70.6 |

$ 137.1 |

$ 211.7 |

|||

|

Income tax effect of adjustments (a) |

(8.4) |

(10.0) |

(30.7) |

(58.6) |

|||

|

Adjusted net income |

$ 138.7 |

$ 75.9 |

$ 221.0 |

$ 104.7 |

|||

|

Net income attributable to non-controlling interests |

10.2 |

1.0 |

26.7 |

2.2 |

|||

|

Adjusted net income attributable to MasTec, Inc. |

$ 128.5 |

$ 74.9 |

$ 194.3 |

$ 102.5 |

|||

|

For the Three Months Ended |

For the Nine Months Ended |

||||||

|

Adjusted Diluted Earnings per Share Reconciliation |

2024 |

2023 |

2024 |

2023 |

|||

|

Diluted earnings (loss) per share |

$ 1.21 |

$ 0.18 |

$ 1.12 |

$ (0.65) |

|||

|

Adjustments: |

|||||||

|

Non-cash stock-based compensation expense |

0.09 |

0.09 |

0.31 |

0.31 |

|||

|

Amortization of intangible assets |

0.44 |

0.54 |

1.29 |

1.61 |

|||

|

Loss on extinguishment of debt |

— |

— |

0.14 |

— |

|||

|

Acquisition and integration costs |

— |

0.27 |

— |

0.78 |

|||

|

Losses on fair value of investment |

— |

— |

— |

0.00 |

|||

|

Total adjustments, pre-tax |

$ 0.53 |

$ 0.90 |

$ 1.74 |

$ 2.70 |

|||

|

Income tax effect of adjustments (a) |

(0.11) |

(0.13) |

(0.39) |

(0.75) |

|||

|

Adjusted diluted earnings per share |

$ 1.63 |

$ 0.95 |

$ 2.47 |

$ 1.31 |

|||

|

(a) |

Represents the tax effects of the adjusted items that are subject to tax, including the tax effects of non-cash stock-based compensation expense, including from share-based payment awards. Tax effects are determined based on the tax treatment of the related item, the incremental statutory tax rate of the jurisdictions pertaining to the adjustment, and their effects on pre-tax income. |

|

Supplemental Disclosures and Reconciliation of Non-GAAP Disclosures (unaudited – in millions, except for percentages and per share information)

|

|||

|

Calculation of Net Debt |

September 30, |

December 31, |

|

|

Current portion of long-term debt, including finance leases |

$ 185.1 |

$ 177.2 |

|

|

Long-term debt, including finance leases |

2,138.7 |

2,888.1 |

|

|

Total Debt |

$ 2,323.8 |

$ 3,065.3 |

|

|

Less: cash and cash equivalents |

(181.2) |

(529.6) |

|

|

Net Debt |

$ 2,142.6 |

$ 2,535.7 |

|

|

Guidance for the |

For the Year |

For the Year |

|||||||||

|

EBITDA and Adjusted EBITDA Reconciliation |

|||||||||||

|

Net income (loss) |

$ 187 |

1.5 % |

$ (47.3) |

(0.4) % |

$ 33.9 |

0.3 % |

|||||

|

Interest expense, net |

196 |

1.6 % |

234.4 |

2.0 % |

112.3 |

1.1 % |

|||||

|

Provision for (benefit from) income taxes |

57 |

0.5 % |

(35.4) |

(0.3) % |

9.2 |

0.1 % |

|||||

|

Depreciation |

371 |

3.0 % |

433.9 |

3.6 % |

371.2 |

3.8 % |

|||||

|

Amortization of intangible assets |

137 |

1.1 % |

169.2 |

1.4 % |

135.9 |

1.4 % |

|||||

|

EBITDA |

$ 947 |

7.7 % |

$ 754.9 |

6.3 % |

$ 662.5 |

6.8 % |

|||||

|

Non-cash stock-based compensation expense |

32 |

0.3 % |

33.3 |

0.3 % |

27.4 |

0.3 % |

|||||

|

Loss on extinguishment of debt |

11 |

0.1 % |

— |

— % |

— |

— % |

|||||

|

Acquisition and integration costs |

— |

— % |

71.9 |

0.6 % |

86.0 |

0.9 % |

|||||

|

Losses on fair value of investment |

— |

— % |

0.2 |

0.0 % |

7.7 |

0.1 % |

|||||

|

Project results from non-controlled joint venture |

— |

— % |

— |

— % |

(2.8) |

(0.0) % |

|||||

|

Bargain purchase gain |

— |

— % |

— |

— % |

(0.2) |

(0.0) % |

|||||

|

Adjusted EBITDA |

$ 990 |

8.1 % |

$ 860.3 |

7.2 % |

$ 780.6 |

8.0 % |

|||||

|

Supplemental Disclosures and Reconciliation of Non-GAAP Disclosures (unaudited – in millions, except for percentages and per share information) |

|||||

|

Guidance for the |

For the Year |

For the Year |

|||

|

Adjusted Net Income Reconciliation |

|||||

|

Net income (loss) |

$ 187 |

$ (47.3) |

$ 33.9 |

||

|

Adjustments: |

|||||

|

Non-cash stock-based compensation expense |

32 |

33.3 |

27.4 |

||

|

Amortization of intangible assets |

137 |

169.2 |

135.9 |

||

|

Loss on extinguishment of debt |

11 |

— |

— |

||

|

Acquisition and integration costs |

— |

71.9 |

86.0 |

||

|

Losses on fair value of investment |

— |

0.2 |

7.7 |

||

|

Project results from non-controlled joint venture |

— |

— |

(2.8) |

||

|

Bargain purchase gain |

— |

— |

(0.2) |

||

|

Total adjustments, pre-tax |

$ 180 |

$ 274.7 |

$ 254.1 |

||

|

Income tax effect of adjustments (a) |

(40) |

(75.3) |

(58.6) |

||

|

Statutory and other tax rate effects (b) |

— |

4.6 |

5.5 |

||

|

Adjusted net income |

$ 327 |

$ 156.7 |

$ 234.8 |

||

|

Net income attributable to non-controlling interests |

31 |

2.7 |

0.5 |

||

|

Adjusted net income attributable to MasTec, Inc. |

$ 296 |

$ 154.0 |

$ 234.3 |

||

|

Guidance for the |

For the Year |

For the Year |

|||

|

Adjusted Diluted Earnings per Share Reconciliation |

|||||

|

Diluted earnings (loss) per share |

$ 1.98 |

$ (0.64) |

$ 0.42 |

||

|

Adjustments: |

|||||

|

Non-cash stock-based compensation expense |

0.41 |

0.43 |

0.36 |

||

|

Amortization of intangible assets |

1.73 |

2.16 |

1.78 |

||

|

Loss on extinguishment of debt |

0.14 |

— |

— |

||

|

Acquisition and integration costs |

— |

0.92 |

1.13 |

||

|

Losses on fair value of investment |

— |

0.00 |

0.10 |

||

|

Project results from non-controlled joint venture |

— |

— |

(0.04) |

||

|

Bargain purchase gain |

— |

— |

(0.00) |

||

|

Total adjustments, pre-tax |

$ 2.28 |

$ 3.51 |

$ 3.34 |

||

|

Income tax effect of adjustments (a) |

(0.51) |

(0.96) |

(0.77) |

||

|

Statutory and other tax rate effects (b) |

— |

0.06 |

0.07 |

||

|

Adjusted diluted earnings per share |

$ 3.75 |

$ 1.97 |

$ 3.05 |

|

(a) |

Represents the tax effects of the adjusted items that are subject to tax, including the tax effects of non-cash stock-based compensation expense, including from share-based payment awards. Tax effects are determined based on the tax treatment of the related item, the incremental statutory tax rate of the jurisdictions pertaining to the adjustment, and their effects on pre-tax income. |

|

(b) |

For the years ended December 31, 2023 and 2022, represents the effects of statutory and other tax rate changes. |

|

Supplemental Disclosures and Reconciliation of Non-GAAP Disclosures (unaudited – in millions, except for percentages and per share information) |

|||||||

|

Guidance for the Three |

For the Three Months |

||||||

|

EBITDA and Adjusted EBITDA Reconciliation |

|||||||

|

Net income |

$ 72 |

2.2 % |

$ 1.2 |

0.0 % |

|||

|

Interest expense, net |

46 |

1.4 % |

59.7 |

1.8 % |

|||

|

Provision for (benefit from) income taxes |

17 |

0.5 % |

(1.2) |

(0.0) % |

|||

|

Depreciation |

81 |

2.4 % |

108.6 |

3.3 % |

|||

|

Amortization of intangible assets |

35 |

1.0 % |

43.0 |

1.3 % |

|||

|

EBITDA |

$ 251 |

7.5 % |

$ 211.3 |

6.4 % |

|||

|

Non-cash stock-based compensation expense |

8 |

0.2 % |

9.0 |

0.3 % |

|||

|

Acquisition and integration costs |

— |

— % |

11.0 |

0.3 % |

|||

|

Adjusted EBITDA |

$ 259 |

7.8 % |

$ 231.4 |

7.1 % |

|||

|

Guidance for the |

For the Three |

||

|

Adjusted Net Income Reconciliation |

|||

|

Net income |

$ 72 |

$ 1.2 |

|

|

Adjustments: |

|||

|

Non-cash stock-based compensation expense |

8 |

9.0 |

|

|

Amortization of intangible assets |

35 |

43.0 |

|

|

Acquisition and integration costs |

— |

11.0 |

|

|

Total adjustments, pre-tax |

$ 43 |

$ 63.0 |

|

|

Income tax effect of adjustments (a) |

(10) |

(16.8) |

|

|

Statutory tax rate effects (b) |

— |

4.6 |

|

|

Adjusted net income |

$ 106 |

$ 52.0 |

|

|

Net income attributable to non-controlling interests |

4 |

0.4 |

|

|

Adjusted net income attributable to MasTec, Inc. |

$ 102 |

$ 51.6 |

|

Guidance for the |

For the Three |

||

|

Adjusted Diluted Earnings per Share Reconciliation |

|||

|

Diluted earnings per share |

$ 0.86 |

$ 0.01 |

|

|

Adjustments: |

|||

|

Non-cash stock-based compensation expense |

0.10 |

0.11 |

|

|

Amortization of intangible assets |

0.44 |

0.55 |

|

|

Acquisition and integration costs |

— |

0.14 |

|

|

Total adjustments, pre-tax |

$ 0.54 |

$ 0.80 |

|

|

Income tax effect of adjustments (a) |

(0.12) |

(0.21) |

|

|

Statutory tax rate effects (b) |

— |

0.06 |

|

|

Adjusted diluted earnings per share |

$ 1.29 |

$ 0.66 |

|

(a) |

Represents the tax effects of the adjusted items that are subject to tax, including the tax effects of non-cash stock-based compensation expense, including from share-based payment awards. Tax effects are determined based on the tax treatment of the related item, the incremental statutory tax rate of the jurisdictions pertaining to the adjustment, and their effects on pre-tax income. |

|

(b) |

For the three month period ended December 31, 2023, represents the effects of statutory and other tax rate changes. |

The tables may contain slight summation differences due to rounding.

MasTec uses EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin, as well as Adjusted Net Income, Adjusted Net Income Attributable to MasTec, Inc., Adjusted Diluted Earnings Per Share and Net Debt, to evaluate our performance, both internally and as compared with its peers, because these measures exclude certain items that may not be indicative of its core operating results, as well as items that can vary widely across different industries or among companies within the same industry. MasTec believes that these adjusted measures provide a baseline for analyzing trends in its underlying business. MasTec believes that these non-U.S. GAAP financial measures provide meaningful information and help investors understand its financial results and assess its prospects for future performance. Because non-U.S. GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies’ non-U.S. GAAP financial measures having the same or similar names. These financial measures should not be considered in isolation from, as substitutes for, or alternative measures of, reported net income or diluted earnings per share or total debt, and should be viewed in conjunction with the most comparable U.S. GAAP financial measures and the provided reconciliations thereto. MasTec believes these non-U.S. GAAP financial measures, when viewed together with its U.S. GAAP results and related reconciliations, provide a more complete understanding of its business. Investors are strongly encouraged to review MasTec’s consolidated financial statements and publicly filed reports in their entirety and not rely on any single financial measure.

MasTec, Inc. is a leading infrastructure construction company operating mainly throughout North America across a range of industries. The Company’s primary activities include the engineering, building, installation, maintenance and upgrade of communications, energy, utility and other infrastructure, such as: wireless, wireline/fiber and customer fulfillment activities; power delivery infrastructure, including transmission, distribution, environmental planning and compliance; power generation infrastructure, primarily from clean energy and renewable sources; pipeline infrastructure, including for natural gas, water and carbon capture sequestration pipelines and pipeline integrity services; heavy civil and industrial infrastructure, including roads, bridges and rail; and environmental remediation services. MasTec’s customers are primarily in these industries. The Company’s corporate website is located at www.mastec.com. The Company’s website should be considered as a recognized channel of distribution, and the Company may periodically post important, or supplemental, information regarding contracts, awards or other related news and webcasts on the Events & Presentations page in the Investors section therein.

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements include, but are not limited to, statements relating to expectations regarding the future financial and operational performance of MasTec; expectations regarding MasTec’s business or financial outlook; expectations regarding MasTec’s plans, strategies and opportunities; expectations regarding opportunities, technological developments, competitive positioning, future economic conditions and other trends in particular markets or industries; the impact of inflation on MasTec’s costs and the ability to recover increased costs, as well as other statements reflecting expectations, intentions, assumptions or beliefs about future events and other statements that do not relate strictly to historical or current facts. These statements are based on currently available operating, financial, economic and other information, and are subject to a number of significant risks and uncertainties. A variety of factors in addition to those mentioned above, many of which are beyond our control, could cause actual future results to differ materially from those projected in the forward-looking statements. Other factors that might cause such a difference include, but are not limited to: market conditions, including from rising or elevated levels of inflation or interest rates, regulatory or policy changes, including permitting processes and tax incentives that affect us or our customers’ industries, supply chain issues and technological developments; the effect of federal, local, state, foreign or tax legislation and other regulations affecting the industries we serve and related projects and expenditures; project delays due to permitting processes, compliance with environmental and other regulatory requirements and challenges to the granting of project permits, which could cause increased costs and delayed or reduced revenue; the effect on demand for our services of changes in the amount of capital expenditures by our customers due to, among other things, economic conditions, including potential economic downturns, inflationary issues, the availability and cost of financing, supply chain disruptions, climate-related matters, customer consolidation in the industries we serve and/or the effects of public health matters; activity in the industries we serve and the impact on the expenditure levels of our customers of, among other items, fluctuations in commodity prices, including for fuel and energy sources, fluctuations in the cost of materials, labor, supplies or equipment, and/or supply-related issues that affect availability or cause delays for such items; the outcome of our plans for future operations, growth and services, including business development efforts, backlog, acquisitions and dispositions; risks related to completed or potential acquisitions, including our ability to integrate acquired businesses within expected timeframes, including their business operations, internal controls and/or systems, which may be found to have material weaknesses, and our ability to achieve the revenue, cost savings and earnings levels from such acquisitions at or above the levels projected, as well as the risk of potential asset impairment charges and write-downs of goodwill; our ability to manage projects effectively and in accordance with our estimates, as well as our ability to accurately estimate the costs associated with our fixed price and other contracts, including any material changes in estimates for completion of projects and estimates of the recoverability of change orders; our ability to attract and retain qualified personnel, key management and skilled employees, including from acquired businesses, our ability to enforce any noncompetition agreements, and our ability to maintain a workforce based upon current and anticipated workloads; any material changes in estimates for legal costs or case settlements or adverse determinations on any claim, lawsuit or proceeding; the adequacy of our insurance, legal and other reserves; the timing and extent of fluctuations in operational, geographic and weather factors, including from climate-related events, that affect our customers, projects and the industries in which we operate; the highly competitive nature of our industry and the ability of our customers, including our largest customers, to terminate or reduce the amount of work, or in some cases, the prices paid for services, on short or no notice under our contracts, and/or customer disputes related to our performance of services and the resolution of unapproved change orders; the effect of state and federal regulatory initiatives, including risks related to the costs of compliance with existing and potential future environmental, social and governance requirements, including with respect to climate-related matters; requirements of and restrictions imposed by our credit facility, term loans, senior notes and any future loans or securities; systems and information technology interruptions and/or data security breaches that could adversely affect our ability to operate, our operating results, our data security or our reputation, or other cybersecurity-related matters; our dependence on a limited number of customers and our ability to replace non-recurring projects with new projects; risks associated with potential environmental issues and other hazards from our operations; disputes with, or failures of, our subcontractors to deliver agreed-upon supplies or services in a timely fashion, and the risk of being required to pay our subcontractors even if our customers do not pay us; risks related to our strategic arrangements, including our equity investments; risks associated with volatility of our stock price or any dilution or stock price volatility that shareholders may experience, including as a result of shares we may issue as purchase consideration in connection with acquisitions, or as a result of other stock issuances; our ability to obtain performance and surety bonds; risks associated with operating in or expanding into additional international markets, including risks from fluctuations in foreign currencies, foreign labor and general business conditions and risks from failure to comply with laws applicable to our foreign activities and/or governmental policy uncertainty; risks related to our operations that employ a unionized workforce, including labor availability, productivity and relations, risks related to a small number of our existing shareholders having the ability to influence major corporate decisions, as well as risks associated with multiemployer union pension plans, including underfunding and withdrawal liabilities; risks associated with our internal controls over financial reporting, as well as other risks detailed in our filings with the Securities and Exchange Commission. We believe these forward-looking statements are reasonable; however, you should not place undue reliance on any forward-looking statements, which are based on current expectations. Furthermore, forward-looking statements speak only as of the date they are made. If any of these risks or uncertainties materialize, or if any of our underlying assumptions are incorrect, our actual results may differ significantly from the results that we express in, or imply by, any of our forward-looking statements. These and other risks are detailed in our filings with the Securities and Exchange Commission. We do not undertake any obligation to publicly update or revise these forward-looking statements after the date of this press release to reflect future events or circumstances, except as required by applicable law. We qualify any and all of our forward-looking statements by these cautionary factors.

![]() View original content:https://www.prnewswire.com/news-releases/mastec-announces-third-quarter-2024-financial-results-and-increases-guidance-for-the-year-302293355.html

View original content:https://www.prnewswire.com/news-releases/mastec-announces-third-quarter-2024-financial-results-and-increases-guidance-for-the-year-302293355.html

SOURCE MasTec, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

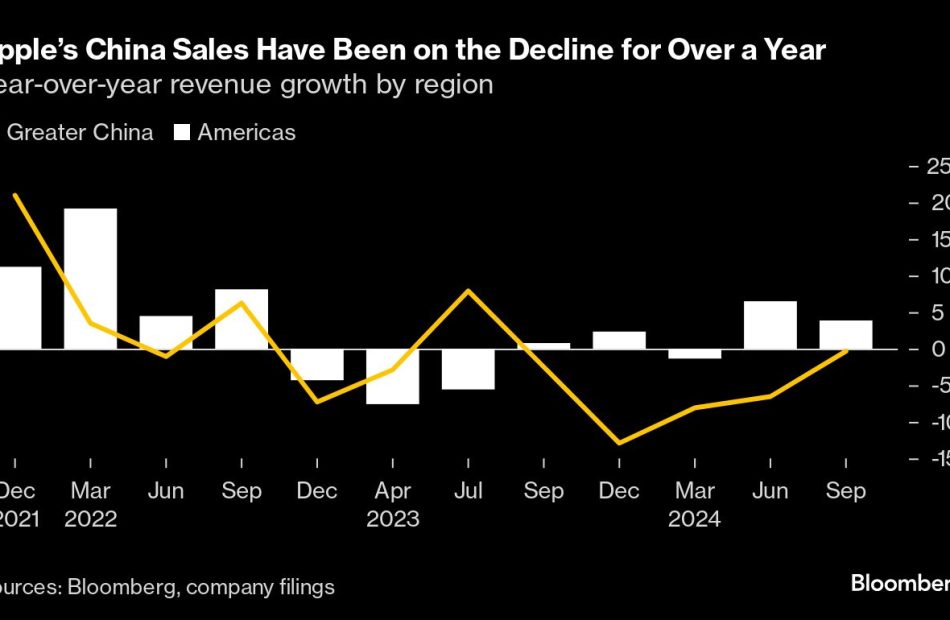

Apple Disappoints Investors With Tepid Forecast, China Weakness

(Bloomberg) — Apple Inc., heading into its most critical sales period of the year, sparked fresh concerns about revenue growth and lingering weakness in an intensely competitive China market.

Most Read from Bloomberg

Following the company’s quarterly earnings report, Apple said that total sales in the December period will rise by a percentage in the low-to-middle single digits. Analysts had been projecting a 7% increase. The company also posted a decline in China revenue last quarter, falling short of estimates.

The broader picture shows a company still trying to rebound from one of the longest sales slumps in its history. Revenue had declined four straight quarters in fiscal 2023 and only returned solidly in the past two quarters. Apple remains the most valuable company on Earth, but it’s had to contend with a sluggish smartphone market, more competition in China and regulatory scrutiny around the world.

The concerns weighed on shares in late trading, sending them down about 2%. The stock had been up 17% this year through Thursday’s close, fueled by optimism about Apple’s artificial intelligence prospects.

Overall revenue edged past Wall Street projections last quarter — helped by global iPhone demand — but the results show that the company is still struggling in a key market. Apple is competing with local brands in China, which serves as its main manufacturing hub.

Revenue in the region fell slightly from a year earlier to $15 billion in the fourth fiscal quarter, which ended Sept. 28. Analysts had estimated $15.8 billion.

The iPhone grew in every geographic market, Chief Executive Officer Tim Cook said, signaling that the rest of the company’s product lineup may have been the issue in China, its biggest source of revenue after the Americas and Europe.

Total sales rose 6.1% to $94.9 billion, compared with an average estimate of $94.4 billion. Earnings were 97 cents a share, though they would have been $1.64 without a one-time charge related to a European General Court decision, Apple said.

The Cupertino, California-based company introduced the iPhone 16 in September, helping spur upgrades. It also updated Apple Watches and released new AirPods. Those consumer devices account for the majority of the company’s revenue.

Investors have been betting that Apple Intelligence — the company’s new suite of AI features — will help fuel device sales. But the software debuted weeks after the iPhone went on sale, and many of its biggest features are still months away.

Oak Ridge Financial Services, Inc. Announces Third Quarter 2024 Results and Quarterly Cash Dividend of $0.12 Per Share

OAK RIDGE, N.C., Oct. 31, 2024 (GLOBE NEWSWIRE) — Oak Ridge Financial Services, Inc. (“Oak Ridge”; or the “Company”) BKOR, the parent company of Bank of Oak Ridge (the “Bank”), announced unaudited financial results for the third quarter of 2024.

Third Quarter 2024 Highlights

- Earnings per share of $0.54, compared to $0.46 for the prior quarter and $0.55 for the third quarter of 2023.

- Return on equity of 9.56%, compared to 8.57% for the prior quarter and 10.63% for the third quarter of 2023.

- Dividends declared per common share of $0.12, unchanged from the prior quarter and up 20% from the third quarter of 2023.

- Tangible book value per common share of $22.78 as of quarter end, compared to $21.95 at the end of the prior quarter, and $20.26 at the end of the comparable period in 2023.

- Net interest margin of 3.81%, unchanged from the prior quarter and 3.83% for the third quarter of 2023.

- Efficiency ratio of 67.9%, compared to 70.0% for the prior quarter and 68.7% for the comparable period in 2023.

- Loans receivable of $505.5 million at quarter end, up 11.1% (annualized) from $466.8 million as of the prior year end, and up 11.2% from $454.5 million at the comparable quarter end in 2023.

- Nonperforming assets to total assets of 0.45% at quarter end, compared to 0.08% as of the prior quarter end and 0.08% at the comparable quarter end in 2023.

- Nonperforming assets were $2.9 million at quarter end, compared to $542,000 as of the prior quarter end and $412,000 at the comparable quarter end in 2023. $2.2 million of the total $2.4 million increase in nonperforming assets from the prior quarter end to the current quarter end were due to the guaranteed and nonguaranteed balances of four Small Business Administration (“SBA”) 7(a) loans moving to nonaccrual status during the third quarter of 2024. The balance of nonperforming loans guaranteed by the SBA was $1.8 million at quarter end, with no balances as of the prior quarter end and the comparable quarter end in 2023.

- Securities available-for-sale and held-to maturity of $102.4 million at quarter end, down 9.8% (annualized) from $110.6 million as of the prior year end, and down 5.9% from $108.9 million at the comparable quarter end in 2023.

- Total deposits of $510.5 million at quarter end, up 4.7% (annualized) from $493.1 million as of the prior year end, and up 6.5% from $477.9 million at the comparable quarter end in 2023.

- Total short and long-term borrowings, junior subordinated notes, and subordinated debentures of $70.2 million at quarter end, up 27.6% (annualized) from $58.2 million as of the prior year end, and up 3.0% from $68.2 million at the comparable quarter end in 2023.

- Total stockholders’ equity of $62.9 million at quarter end, up 7.3% (annualized) from $58.3 million as of the prior quarter end, and up 6.9% from $55.3 million at the comparable quarter end in 2023. At September 30, 2024, the Bank’s Community Bank Leverage Ratio (CBLR) was 11.1%, down slightly from 11.2% at December 31, 2023. A bank or savings institution electing to use the CBLR will generally be considered well-capitalized and to have met the risk-based and leverage capital requirements of the capital regulations if it has a leverage ratio greater than 9.0%.

Tom Wayne, Chief Executive Officer, announced, “While our earnings per share in the third quarter of 2024 decreased compared to the comparable 2023 period, they increased from the previous quarter. We had double-digit annualized loan growth from the 2023-year end and the comparable quarter end in 2023, funded by a mix of deposits and borrowings. Despite a rise in nonperforming assets of $2.4 million from the previous quarter, $2.3 million and $1.8 million of this increase pertains to the total and guaranteed balances, respectively, of four SBA loans which are also secured by real estate and personal guarantees. Our net interest margin remained stable and strong in the current quarter, with our capital and liquidity positions remaining solid at quarter end. Oak Ridge is dedicated to fostering and expanding comprehensive client relationships, offering long-term core deposit and lending solutions, alongside various products and services tailored to our clients’ financial goals. We are immensely proud of our team and grateful for their dedication to serving our clients and ensuring the Bank’s safe and sound management.”

The Company adopted and implemented a share repurchase program in the third quarter of 2024. There were no shares repurchased during the third quarter of 2024. Between September 30, 2024, and October 30, 2024, the Company repurchased a total of 16,700 shares for $321,000.

A quarterly cash dividend of $0.12 per share of common stock is payable on December 3, 2024, to stockholders of record as of the close of business on November 15, 2024, which represents the 24th consecutive quarterly dividend paid by the Company. “We are pleased to pay another quarterly cash dividend to our stockholders,” said Mr. Wayne. “Paying stockholders a portion of our earnings reflects our continuing commitment to enhance stockholder value.”

For the three months ended September 30, 2024, and 2023, net interest income was $6.0 million and $5.6 million, respectively. For the three months ended September 30, 2024, the annualized net interest margin was 3.81% compared to 3.83% for the third quarter of 2023, a decrease of two basis points. For the nine months ended September 30, 2024, and 2023, net interest income was $17.5 million and $16.4 million, respectively. For the nine months ended September 30, 2024, the annualized net interest margin was 3.80% compared to 3.88% in the same period in 2023, a decrease of eight basis points.

For the three months ended September 30, 2024, the Company recorded a provision for credit losses of $261,000, compared to a provision for credit losses of $137,000 in the third quarter of 2023. For the nine months ended September 30, 2024, the Company recorded a provision for credit losses of $848,000, compared to a provision for credit losses of $295,000 for the same period in 2023. The allowance for credit losses as a percentage of total loans was 1.06% at September 30, 2024, compared to 1.05% at December 31, 2023. Nonperforming assets represented 0.45% of total assets on September 30, 2024, compared to 0.07% on December 31, 2023. The recorded balances of nonperforming loans were $2.9 million on September 30, 2024, compared to $418,000 on December 31, 2023. The increase in nonperforming loans from December 31, 2023, was primarily attributable to four SBA 7(a) loans totaling $2.3 million moving to nonaccrual status during the third quarter of 2024, of which $1.8 million is guaranteed by the SBA.

Noninterest income totaled $924,000 for the three months ended September 30, 2024, compared to $1.1 million for the third quarter of 2023. There were increases and decreases in components of noninterest income from the third quarter of 2023 to the comparable quarter of 2024, with the following category significantly contributing to the overall net decrease: there were no gains on sale(s) of SBA loans during the third quarter of 2024, compared to gains of $147,000 in the third quarter of 2023. The Company retained all its third quarter 2024 originations of SBA loans for balance sheet management purposes, while selling the guaranteed portion for most SBA loans originated in the third quarter of 2023.

Noninterest income totaled $2.5 million for the nine months ended September 30, 2024, compared to $3.0 million for the comparable period in 2023. There were increases and decreases in components of noninterest income from the first nine months of 2023 to the comparable period 2024, with the following category significantly contributing to the overall net decrease: There were no gains on sale(s) of SBA loans during the first nine months of 2024, compared to gains of $475,000 in the comparable period in 2023. The Company retained all its 2024 originations of SBA loans for balance sheet management purposes, while selling the guaranteed portion for most SBA loans originated in the first nine months of 2023.

Noninterest expense totaled $4.7 million for the three months ended September 30, 2024, compared to $4.6 million for the comparable period in 2023. There were increases and decreases in components of noninterest expense from 2023 to 2024, with the following category significantly contributing to the overall net increase: Salaries were $2.3 million for the three months ended September 30, 2024, compared to $2.2 million for the comparable period in 2023. The increase in salaries is mostly due to annual merit increases to employees effective April 1, 2024. Occupancy expenses were $658,000 for the three months ended September 30, 2024, compared to $250,000 in the comparable period in 2023. The increase in occupancy expense is mostly due to higher property maintenance expenses in 2024 compared to 2023. Equipment expense was $143,000 for the three months ended September 30, 2024, compared to $208,000 in the comparable period in 2023. The decrease in equipment expense is mostly due to lower equipment depreciation expense in 2024 compared to 2023. Professional and advertising expenses were $332,000 for the three months ended September 30, 2024, compared to $379,000 in the comparable period in 2023. The decrease in professional and advertising expenses is mostly due to decreases in information technology contracted services in 2024 compared to 2023. Telecommunications expense was $71,000 for the three months ended September 30, 2024, compared to $135,000 in the comparable period in 2023. The decrease in telecommunications expense is mostly due to the reduction in unnecessary or redundant telecommunications expenses.

Noninterest expense totaled $13.7 million and $13.6 million for the nine months ended September 30, 2024, and 2023, respectively. There were increases and decreases in components of noninterest expense from 2023 to 2024, with the following categories significantly contributing to the overall net increase of $31,000: Equipment expense was $461,000 for the nine months ended September 30, 2024, compared to $658,000 in the comparable period in 2023. The decrease in equipment expense is mostly due to lower equipment depreciation expense in 2024 compared to 2023. Occupancy expenses were $1.0 million for the nine months ended September 30, 2024, compared to $819,000 in the comparable period in 2023. The increase in occupancy expense is mostly due to higher property maintenance expenses in 2024 compared to 2023. Data and items processing expense was $1.7 million for the nine months ended September 30, 2024, compared to $1.5 million in the comparable period in 2023. The increase in data and items processing expense is mostly due to higher software licensing fees from our core processing vendor. Professional and advertising expenses were $951,000 for the nine months ended September 30, 2024, compared to $1.1 million in the comparable period in 2023. The decrease in professional and advertising expenses is mostly due to decreases in information technology contracted services in 2024 compared to 2023. Telecommunications expense was $213,000 for the nine months ended September 30, 2024, compared to $390,000 in the comparable period in 2023. The decrease in telecommunications expense is mostly due to the reduction in unnecessary or redundant telecommunications expenses.

Many communities in western North Carolina suffered significant damage from Hurricane Helene. Currently, it appears that our customers, who are predominantly located in the Piedmont Triad area of North Carolina, have been largely unaffected. The Bank made monetary donations to two organizations and our employees have donated critical supplies to support hurricane Helene relief efforts in western North Carolina.

About Oak Ridge Financial Services, Inc., and Bank of Oak Ridge

At Bank of Oak Ridge, we pride ourselves on knowing your name when you walk through our door. Whether in-person or through our digital offerings, managing your financial well-being is easy, safe, and convenient. We are the longest-running employee-owned community bank in the Triad and have served community members, local businesses, and non-profit organizations since 2000. Learn more about what makes Bank of Oak Ridge the Triad’s community bank by visiting one of our convenient locations in Greensboro, High Point, Summerfield, and Oak Ridge.

Oak Ridge Financial Services, Inc. BKOR is the holding company for Bank of Oak Ridge. Bank of Oak Ridge is a member of the FDIC and an Equal Housing Lender.

Awards & Recognitions | Best Bank in the Triad | Triad’s Top Workplace Finalist | 2016 Better Business Bureau Torch Award for Business Ethics | Triad’s Healthiest Employer Winner

Banking for Business & Personal | Mobile & Online Banking | Worldwide ATM | Debit, Credit + Rewards | Checking, Savings & Money Market | Loans + SBA | Mortgage | Insurance | Wealth Management

Let’s Talk | 336.644.9944 | www.BankofOakRidge.com | Extended Interactive Teller Machine Hours at all Triad Locations

Forward-looking Information This earnings release contains certain forward-looking statements with respect to the financial condition, results of operations and business of the Company. These forward-looking statements involve risks and uncertainties and are based on the beliefs and assumptions of the management of the Company and on the information available to management at the time that these disclosures were prepared. These statements can be identified by the use of the words “expect,” “anticipate,” “estimate” and “believe,” variations of these words and other similar expressions. Readers should not place undue reliance on forward-looking statements as a number of important factors could cause actual results to differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, (1) competition in the Company’s markets, (2) changes in the interest rate environment, (3) general national, regional or local economic conditions may be less favorable than expected, resulting in, among other things, a deterioration in credit quality and the possible impairment of collectability of loans, (4) legislative or regulatory changes, including changes in accounting standards, (5) significant changes in the federal and state legal and regulatory environment and tax laws, and (6) the impact of changes in monetary and fiscal policies, laws, rules and regulations. The Company undertakes no obligation to update any forward-looking statements.

| OAK RIDGE FINANCIAL SERVICES, INC. | ||||||||||||||||

| CONSOLIDATED BALANCE SHEETS | ||||||||||||||||

| (Dollars in thousands, except share data) | ||||||||||||||||

| September 30, | December 31, | September 30, |

||||||||||||||

| 2024 | 2023 | 2023 | ||||||||||||||

| ASSETS | (unaudited) | (audited) | (unaudited) | |||||||||||||

| Cash and due from banks | $ | 10,522 | $ | 7,792 | $ | 9,182 | ||||||||||

| Interest-bearing deposits with banks | 11,308 | 12,633 | 15,294 | |||||||||||||

| Total cash and cash equivalents | 21,830 | 20,425 | 24,476 | |||||||||||||

| Securities available-for-sale | 83,769 | 91,849 | 90,148 | |||||||||||||

| Securities held-to-maturity, net of allowance for credit losses | 18,668 | 18,706 | 18,720 | |||||||||||||

| Restricted stock, at cost | 4,006 | 2,404 | 2,828 | |||||||||||||

| Loans receivable | 505,521 | 466,796 | 454,521 | |||||||||||||

| Allowance for credit losses | (5,354 | ) | (4,920 | ) | (4,808 | ) | ||||||||||

| Net loans receivable | 500,167 | 461,876 | 449,713 | |||||||||||||

| Property and equipment, net | 8,827 | 8,366 | 8,523 | |||||||||||||

| Accrued interest receivable | 3,098 | 2,580 | 2,427 | |||||||||||||

| Bank owned life insurance | 6,244 | 6,178 | 6,155 | |||||||||||||

| Right-of-use assets – operating leases | 2,242 | 2,466 | 2,537 | |||||||||||||

| Other assets | 4,614 | 4,544 | 5,735 | |||||||||||||

| Total assets | $ | 653,465 | $ | 619,394 | $ | 611,262 | ||||||||||

| LIABILITIES | ||||||||||||||||

| Noninterest-bearing deposits | $ | 114,152 | $ | 99,702 | $ | 106,981 | ||||||||||

| Interest-bearing deposits | 396,346 | 393,442 | 370,881 | |||||||||||||

| Total deposits | 510,498 | 493,144 | 477,862 | |||||||||||||

| Short-term borrowings | 52,000 | 40,000 | 50,000 | |||||||||||||