ASML Holding Options Trading: A Deep Dive into Market Sentiment

Financial giants have made a conspicuous bearish move on ASML Holding. Our analysis of options history for ASML Holding ASML revealed 42 unusual trades.

Delving into the details, we found 28% of traders were bullish, while 52% showed bearish tendencies. Out of all the trades we spotted, 27 were puts, with a value of $1,716,500, and 15 were calls, valued at $899,289.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $360.0 and $1080.0 for ASML Holding, spanning the last three months.

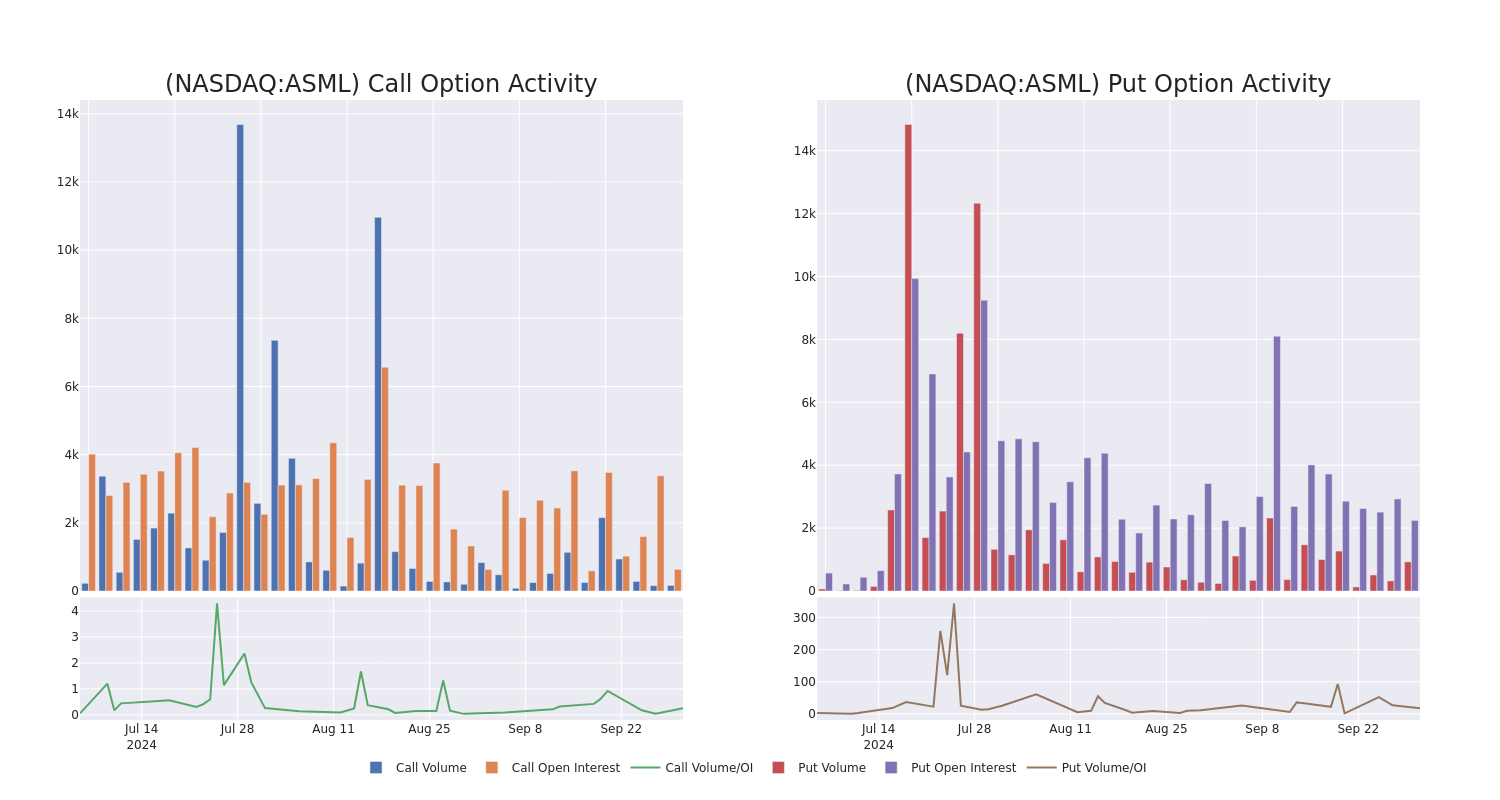

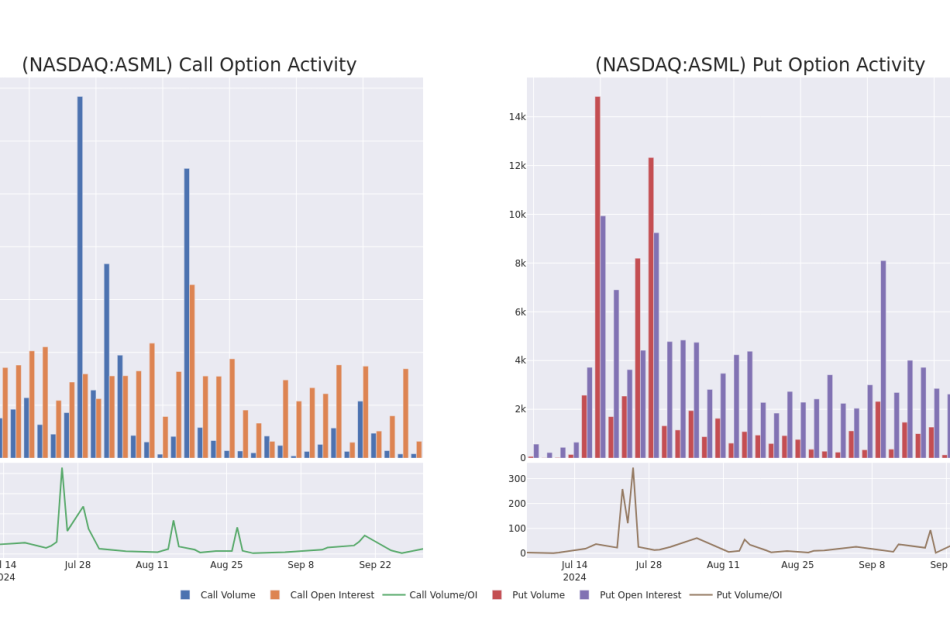

Volume & Open Interest Development

In today’s trading context, the average open interest for options of ASML Holding stands at 82.21, with a total volume reaching 1,029.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in ASML Holding, situated within the strike price corridor from $360.0 to $1080.0, throughout the last 30 days.

ASML Holding Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ASML | PUT | TRADE | NEUTRAL | 01/17/25 | $252.5 | $246.0 | $249.0 | $1060.00 | $249.0K | 43 | 0 |

| ASML | PUT | TRADE | BEARISH | 11/01/24 | $19.6 | $16.3 | $18.6 | $760.00 | $186.0K | 31 | 1 |

| ASML | PUT | SWEEP | BEARISH | 09/19/25 | $57.3 | $53.9 | $57.3 | $680.00 | $171.9K | 51 | 0 |

| ASML | CALL | SWEEP | BULLISH | 11/08/24 | $49.1 | $46.5 | $49.1 | $840.00 | $147.2K | 0 | 30 |

| ASML | CALL | TRADE | BEARISH | 01/17/25 | $186.3 | $184.0 | $184.0 | $660.00 | $147.2K | 192 | 8 |

About ASML Holding

ASML is the leader in photolithography systems used in the manufacturing of semiconductors. Photolithography is the process in which a light source is used to expose circuit patterns from a photo mask onto a semiconductor wafer. The latest technological advances in this segment allow chipmakers to continually increase the number of transistors on the same area of silicon, with lithography historically representing a high portion of the cost of making cutting-edge chips. ASML outsources the manufacturing of most of its parts, acting like an assembler. ASML’s main clients are TSMC, Samsung, and Intel.

In light of the recent options history for ASML Holding, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of ASML Holding

- Trading volume stands at 515,913, with ASML’s price down by -1.58%, positioned at $820.06.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 15 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ASML Holding with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply