European Stock Gains May Falter On Geopolitical, Economic Fears

Gains in European equities may falter on geopolitical and economic fears after receiving a boost from China’s stimulus plans and slowing inflation.

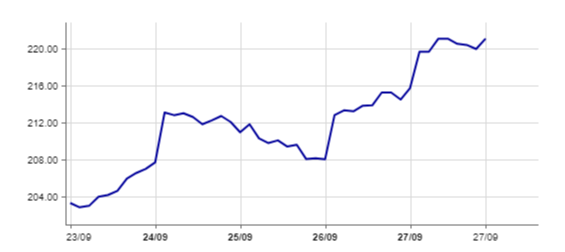

The Euro Area Stoxx 600 gained 2.69% in the week ending September 27 to a record, extending its year-to-date climb to 10.1%. Germany’s DAX40 closed the week at a record level, gaining 4% after increasing 1.22% on Friday.

Source: TradingEconomics

Slow economic growth, volatile natural gas prices, and inflation have hurt European economic sentiment. GDP is projected to end 2024 at 0.8%.

Geopolitical developments, including the war in Ukraine and the upcoming U.S. elections, have curbed European stock optimism. European policymakers have expressed concerns about issues from climate change, security and trade if Trump wins a second term.

Fears about a wider Middle East war escalated after Israel killed Hezbollah’s leader Hassan Nasrallah in airstrikes Friday in Beirut.

The EU “is extremely concerned” about the confrontation between Israel and Hezbollah,” Josep Borrell, EU’s High Representative for Foreign Affairs and Security Policy, said.

“Any further escalation would have dramatic consequences for the region and beyond.”

European Investors Welcome China’s ‘Stimulus Blitz

Despite the ongoing headwinds, investors welcomed the People’s Bank of China (PBOC) “stimulus blitz” to tackle the country’s economic headwinds.

China announced “a series of bold moves aimed at stabilizing both the economy and the stock market,” Charu Chanana, Head of FX Strategy at Saxo, wrote on September 25.

The package included a 50-basis-point cut to banks’ required reserve ratios (RRR) and a 20-basis-point cut to the seven-day reverse repurchase rate.

The PBOC announced a 500 billion yuan ($71.3 billion) liquidity support for stock buybacks.

European Fashion, Automobile Stocks See Most Gains

Although European equities rose immediately on the PBOC news, fashion and automobile stocks climbed the most.

France’s LVMH LVMHF jumped 19.2% ,and Hermes HESAY rose 16.5% for the week.

German automobile makers also clocked gains. Volkswagen VWAGY rose by 7%, Mercedes-Benz Group MBGAF by 6.55 and BMW BMWYY by 6.6%.

Germany’s automobile index rose 8.70% for the week.

Source: Boerse-Frankfurt

European companies operating in China have worried that the slowdown in the world’s second-largest economy may hurt profitability.

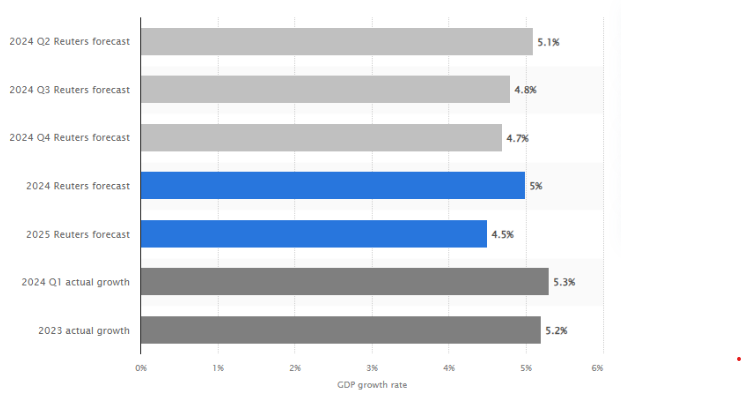

The Chinese economy grew 4.7% in the second quarter from April to June. This is the slowest pace since the first quarter of 2023 and below forecasts of 5% to 5.3%.

Source: Statista

The stimulus package “can help to repair some of the confidence levels in the economy and policymakers,” Chanana wrote.

European Equities Helped by Inflation Data

European equities received an added boost this week from inflation data.

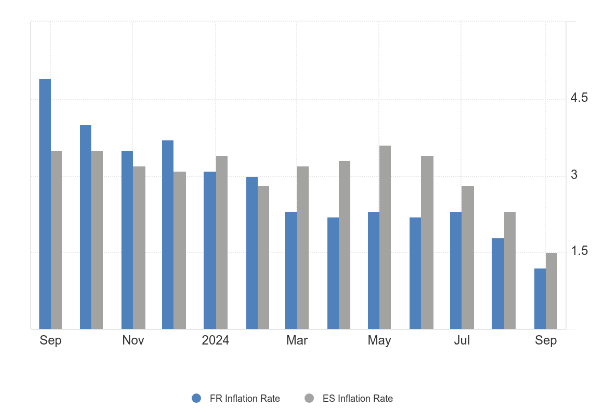

German preliminary data showed inflation slowing to1.6% in September, compared to 1.9% in August, the country’s Federal Statistical Office said on Monday. France and Spain reported on September 27 that inflation slowed below 2%, beating analysts expectations.

Investors now give the European Central Bank (ECB) a 70% chance of cutting rates next month.

Source: Tradingeconomics

Although the latest economic data has buoyed confidence, some investors have expressed caution.

Data is “looking quite shaky,” Anwiti Bahuguna, Northern Trust Asset Management’s chief investment officer of global allocation, told Bloomberg TV.

“Inflation is coming down, but not fast enough to think there would be very sharp relief on the rates front.”

European Consumer Sentiment Improves

Despite these concerns, European consumer sentiment has started to improve. It rose 0.5 points in the Euro Area in September to -12.9, which was in line with preliminary estimates.

“Consumers were markedly more optimistic about their households’ expected financial situation,” the European Commission said on September 27.

In Germany, France and Italy, Europe’s three largest economies, consumer confidence rose moderately, according to monthly surveys.

However, the Nuremberg Institute for Market Decisions (NIM) warned on September 26 that it was too early to conclude German consumer confidence had improved.

The improvement in Germany “can be interpreted more as a stabilization at a low level,” Rolf Bürkl, an expert at NIM, said.

“The slight increase cannot be interpreted as the beginning of a noticeable recovery.”

Disclaimer:

Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply