Market Whales and Their Recent Bets on CMG Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Chipotle Mexican Grill.

Looking at options history for Chipotle Mexican Grill CMG we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 42% of the investors opened trades with bullish expectations and 42% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $307,320 and 11, calls, for a total amount of $495,855.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $36.0 to $58.7 for Chipotle Mexican Grill over the recent three months.

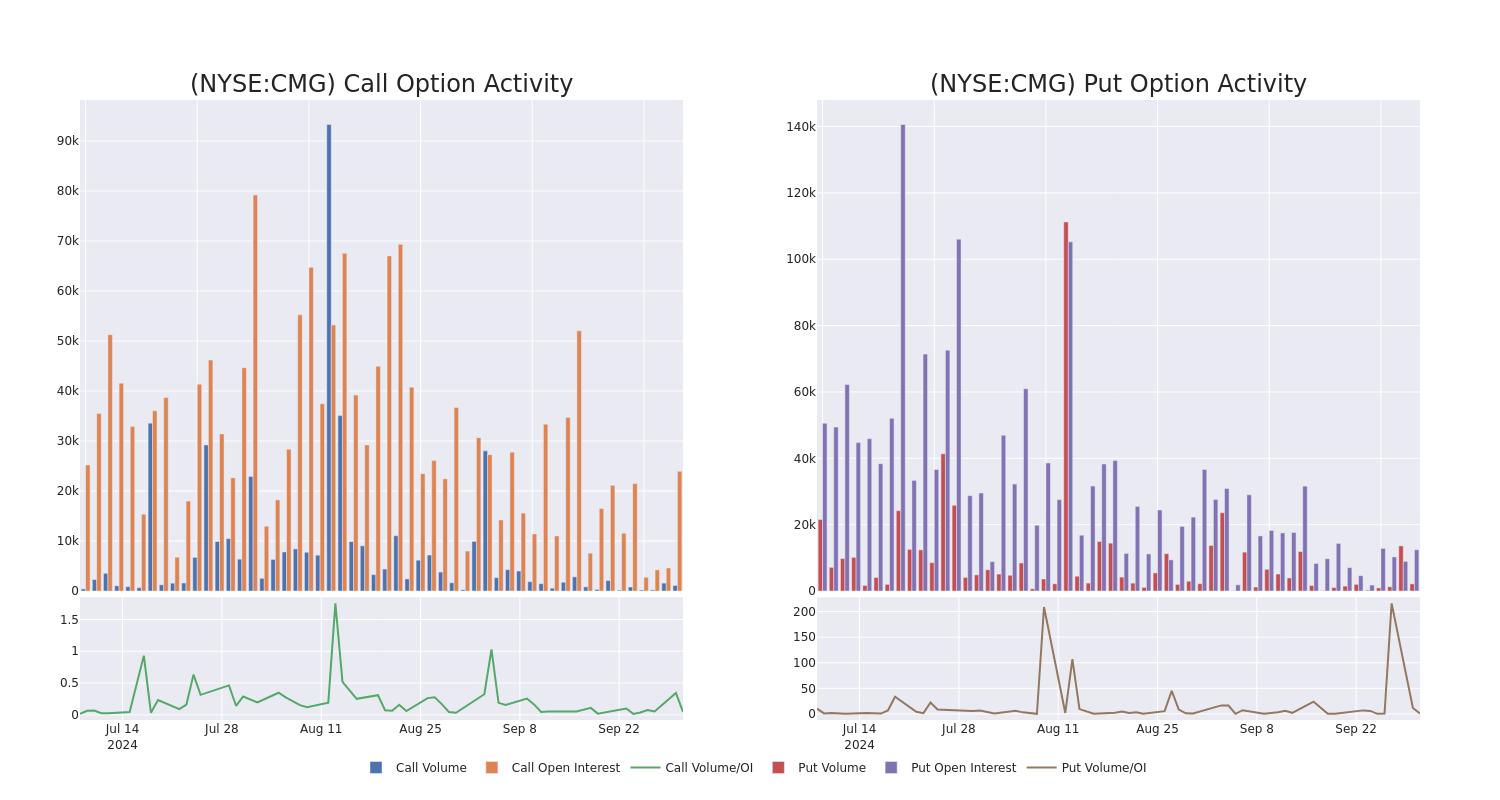

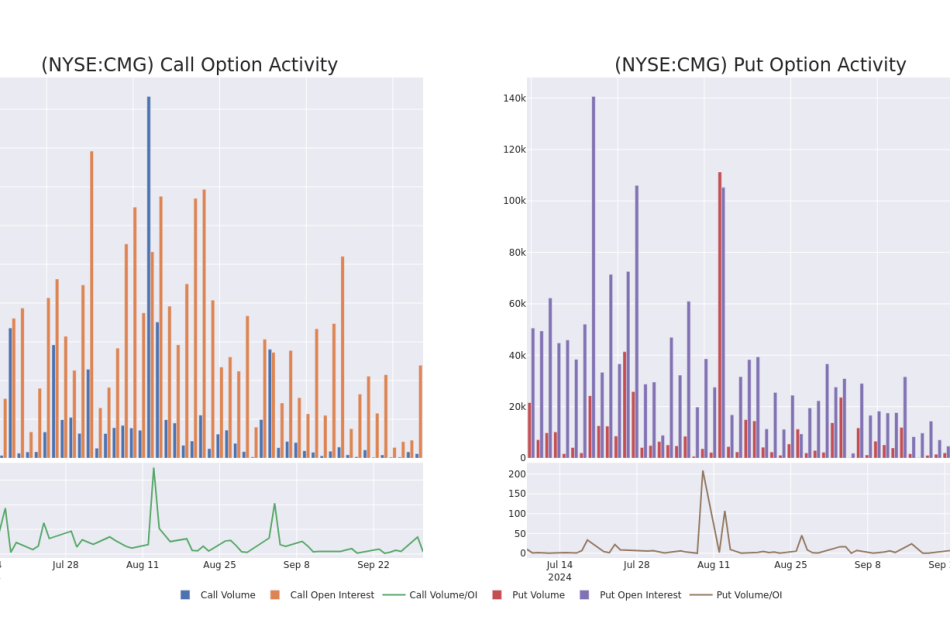

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Chipotle Mexican Grill’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Chipotle Mexican Grill’s whale activity within a strike price range from $36.0 to $58.7 in the last 30 days.

Chipotle Mexican Grill Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CMG | PUT | SWEEP | BEARISH | 01/16/26 | $5.2 | $5.0 | $5.2 | $52.00 | $130.0K | 843 | 1 |

| CMG | PUT | SWEEP | BULLISH | 10/18/24 | $0.8 | $0.75 | $0.75 | $55.00 | $128.1K | 10.7K | 1.7K |

| CMG | CALL | SWEEP | BULLISH | 06/20/25 | $22.8 | $22.6 | $22.8 | $36.00 | $114.0K | 565 | 50 |

| CMG | CALL | SWEEP | BEARISH | 10/18/24 | $1.1 | $1.05 | $1.1 | $58.00 | $63.0K | 2.6K | 800 |

| CMG | CALL | SWEEP | BEARISH | 01/16/26 | $20.5 | $20.2 | $20.2 | $41.00 | $60.6K | 205 | 50 |

About Chipotle Mexican Grill

Chipotle Mexican Grill is the largest fast-casual chain restaurant in the United States, with systemwide sales of $9.9 billion in 2023. The Mexican concept is predominately company-owned, although it recently inked a development agreement with Alshaya Group in the Middle East. It had a footprint of nearly 3,440 stores at the end of 2023, heavily indexed to the United States, although it maintains a small presence in Canada, the UK, France, and Germany. Chipotle sells burritos, burrito bowls, tacos, quesadillas, and beverages, with a selling proposition built around competitive prices, high-quality food sourcing, speed of service, and convenience. The company generates its revenue entirely from restaurant sales and delivery fees.

Chipotle Mexican Grill’s Current Market Status

- With a trading volume of 3,426,707, the price of CMG is down by -1.29%, reaching $56.88.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 28 days from now.

Professional Analyst Ratings for Chipotle Mexican Grill

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $65.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Oppenheimer has revised its rating downward to Outperform, adjusting the price target to $65.

* An analyst from TD Cowen has revised its rating downward to Buy, adjusting the price target to $65.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Chipotle Mexican Grill, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply