Daily Spotlight: Fourth Quarter Typically Positive for Stocks

Summary

In theory, investors can breathe easier heading into the fourth quarter, when markets typically post the strongest returns of the year. To draw this conclusion, we analyzed data collected on S&P 500 performance from 1980-2022. By our calculations, the quarter has generated average gains of 4.8%, compared to gains of 2.3%, 2.9%, and 0.4% for 1Q, 2Q, and 3Q, respectively. The fourth quarter is consistent as well, with a “win percentage” of 82%. This means that stock returns are positive in the quarter four years out of five, and compares to winning percentages of 67% in 1Q and 2Q and 62% in 3Q. But to be fair, the 4Q has posted its share of clunkers. In 1987, which included Black Friday, stocks fell 23% during the period; while in 2008 they sold off 18%, after the collapse of Lehman Brothers and as the U.S. economy plunged into a deep recession. As recently as 2018, stocks slid 14% in the final quarter when trade wars intensified and the Federal Reserve raised rates. But last year, when stocks were still in the early stages of the current bull mar

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

Market Whales and Their Recent Bets on GOOGL Options

Deep-pocketed investors have adopted a bearish approach towards Alphabet GOOGL, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in GOOGL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 58 extraordinary options activities for Alphabet. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 36% leaning bullish and 41% bearish. Among these notable options, 5 are puts, totaling $1,291,133, and 53 are calls, amounting to $4,404,282.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $120.0 to $235.0 for Alphabet over the last 3 months.

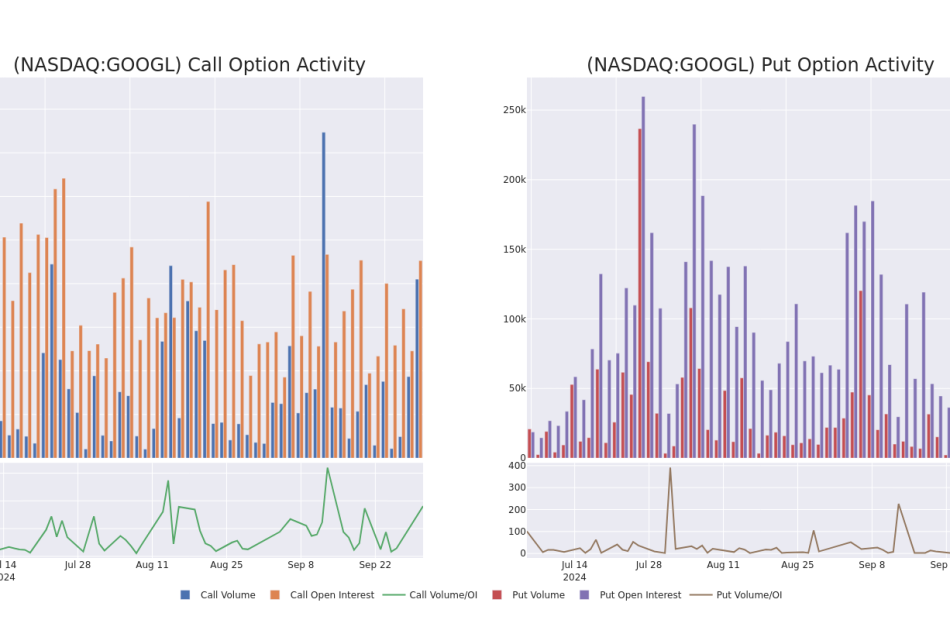

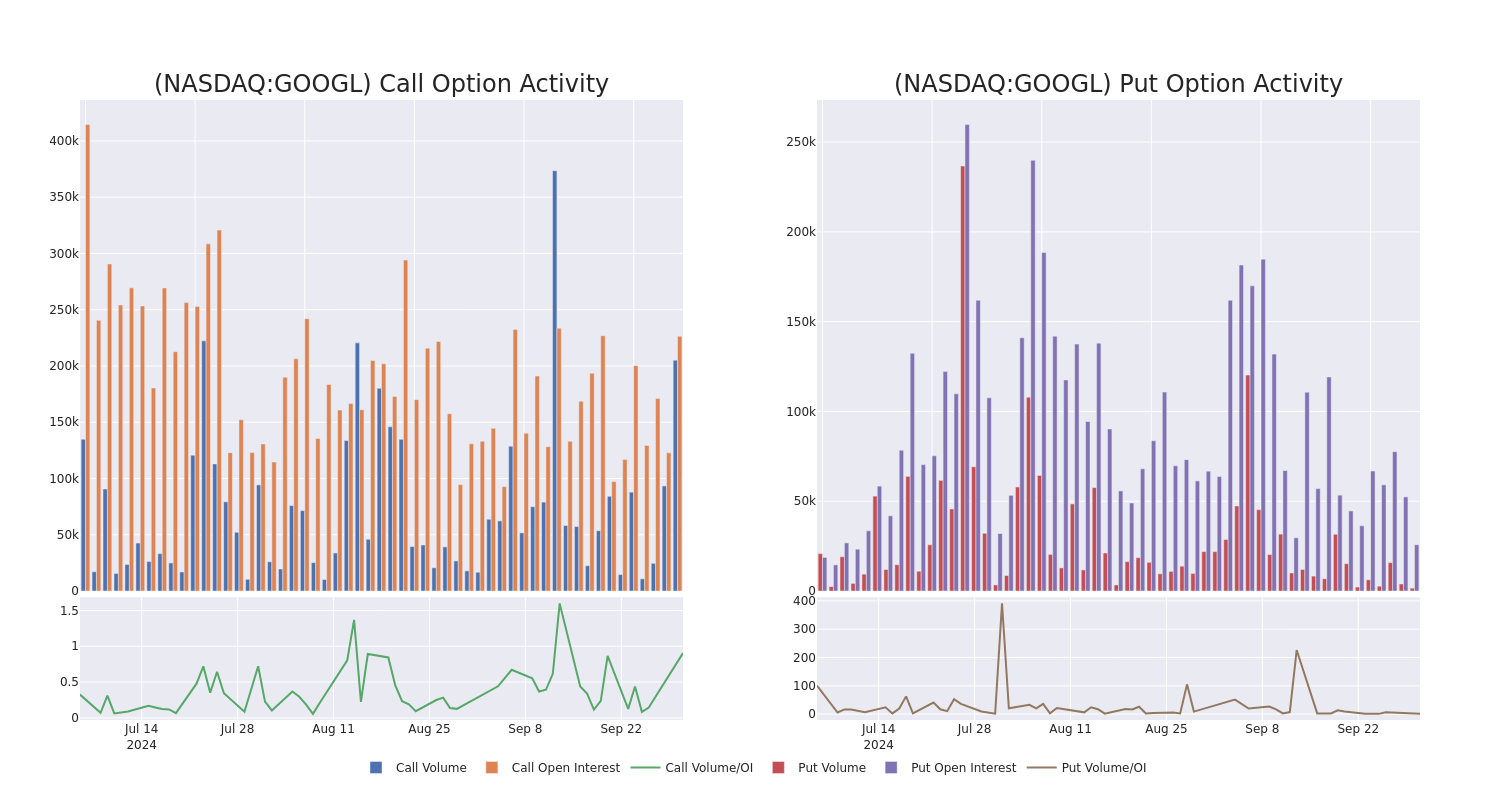

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Alphabet’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Alphabet’s significant trades, within a strike price range of $120.0 to $235.0, over the past month.

Alphabet Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GOOGL | PUT | TRADE | BULLISH | 01/16/26 | $21.15 | $20.9 | $20.9 | $170.00 | $1.1M | 656 | 550 |

| GOOGL | CALL | SWEEP | BEARISH | 12/18/26 | $62.05 | $61.7 | $61.7 | $120.00 | $617.0K | 246 | 100 |

| GOOGL | CALL | SWEEP | BULLISH | 03/21/25 | $12.5 | $12.35 | $12.5 | $170.00 | $500.0K | 5.3K | 472 |

| GOOGL | CALL | SWEEP | NEUTRAL | 11/01/24 | $9.95 | $9.85 | $9.95 | $160.00 | $199.0K | 1.1K | 116 |

| GOOGL | CALL | TRADE | BULLISH | 01/17/25 | $21.05 | $20.95 | $21.05 | $150.00 | $157.8K | 19.1K | 32 |

About Alphabet

Alphabet is a holding company that wholly owns internet giant Google. The California-based company derives slightly less than 90% of its revenue from Google services, the vast majority of which is advertising sales. Alongside online ads, Google services houses sales stemming from Google’s subscription services (YouTube TV, YouTube Music among others), platforms (sales and in-app purchases on Play Store), and devices (Chromebooks, Pixel smartphones, and smart home products such as Chromecast). Google’s cloud computing platform, or GCP, accounts for roughly 10% of Alphabet’s revenue with the firm’s investments in up-and-coming technologies such as self-driving cars (Waymo), health (Verily), and internet access (Google Fiber) making up the rest.

In light of the recent options history for Alphabet, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Alphabet Standing Right Now?

- With a volume of 13,976,837, the price of GOOGL is up 0.36% at $166.45.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 21 days.

Expert Opinions on Alphabet

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $192.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Piper Sandler downgraded its action to Overweight with a price target of $200.

* Reflecting concerns, an analyst from DA Davidson lowers its rating to Neutral with a new price target of $170.

* In a cautious move, an analyst from JMP Securities downgraded its rating to Market Outperform, setting a price target of $200.

* An analyst from Morgan Stanley persists with their Overweight rating on Alphabet, maintaining a target price of $190.

* An analyst from JMP Securities has revised its rating downward to Market Outperform, adjusting the price target to $200.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Alphabet, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jamie Dimon says the 'Buffett Rule' approach to taxing the wealthy could solve America's debt problem

-

On PBS, Jamie Dimon described the Buffett Rule as a good idea for clamping down on US debt.

-

It says richer households shouldn’t pay taxes on a smaller share of income than middle-class ones.

-

He argued that if the US followed this, it could continue spending while still reducing debt.

JPMorgan CEO Jamie Dimon has put forth a solution to unrestrained US debt: Tax the rich at the same rate as middle-class people, or at a higher rate.

The bank executive told “PBS News Hour” in August that the country could clamp down on runaway borrowing without eliminating spending. Dimon said he expects that reducing the debt while still investing in the right initiatives is “doable.”

“I would spend the money that helps make it a better country, so some of this is infrastructure, earned-income tax credits, military,” he said. “I would have a competitive national tax system, and then I would maximize growth.”

Dimon added, “And then you’ll have a little bit of a deficit, and you would maybe just raise taxes a little bit — like the Warren Buffett type of rule, I would do that.”

This rule posits that no household making above $1 million a year should pay taxes on a lower share of their income than middle-class earners. It earned its name from the billionaire investor Warren Buffett, who famously criticized the fact that his secretary paid a higher tax rate than he did.

Calls for wealthier Americans to pay higher taxes have grown louder in the past year as economists have searched for answers to the federal government’s skyrocketing debt.

Anxiety has grown as the government’s debt pile has ballooned to a record $35 trillion. The Congressional Budget Office has projected that it could make up 6% of US GDP by the end of this year, which would far outpace the 50-year average of 3.7%.

If debt remains unchecked amid high interest rates, the government will face higher borrowing costs. Some say that this might compound debt levels and that the US could eventually spiral into a default.

Otherwise, higher borrowing costs mean Washington will have less to spend on social initiatives. A recent report from the Peter G. Peterson Foundation pointed out that the Congressional Budget Office has estimated that by 2054, interest payments on the debt will triple Washington’s historical spending on research and development, infrastructure, and education.

Dimon has been among Wall Street’s most consistent voices to raise the alarm, frequently saying runaway borrowing will amplify inflation and interest-rate pressures through the coming decade.

Not everyone shares Dimon’s optimism that tax hikes alone can solve this problem. Though some commentators have pushed for tax-hike proposals that embrace all income levels, others have urged both Democrats and Republicans to consider spending cuts as well.

However, speaking with PBS, Dimon argued that the US should continue to spend money that helps maintain its economic strength and creates a more equitable income environment.

This article was originally published in August 2024.

Read the original article on Business Insider

Lakeside Holding Reports Impressive 42% Revenue Growth for Fiscal Year 2024

Cross-Border Airfreight Solutions Surge by 117%, Driving Exceptional Financial Performance

ITASCA, Ill., Oct. 1, 2024 /PRNewswire/ — Lakeside Holding Limited (“Lakeside” or the “Company”) LSH, a U.S.-based integrated cross-border supply chain solution provider with a strategic focus on the Asian market operating under the brand American Bear Logistics (“ABL”), today reported financial results for the fiscal year ended June 30, 2024.

Fiscal Year 2024 Highlights:

- Total revenues increased by 42.3% to $18.3 million, driven by a 117.6% rise in airfreight revenues to $10.4 million, partially offset by a 2.5% decrease in ocean freight revenues to $7.9 million.

- Cost of revenues increased by 41.6% to $14.6 million, primarily due to higher transportation costs, up 27.6% to $7.5 million; warehouse service charges, up 107.5% to $2.9 million; and custom declaration fees, up 50.2% to $2.4 million, as well as overhead costs also rose by 29.6%.

- Gross profit increased by 44.9% to $3.7 million, with the profit margin rising slightly from 19.9% to 20.3%. This was driven by higher sales and offering a wider range of services, such as warehousing, distribution, and customs clearance, with higher mark-ups.

- General and administrative expenses rose by 77.5% to $4.1 million, driven by increased staffing costs and higher professional fees for audit and legal services.

- Net loss for the year ended June 30, 2024 was $0.2 million, compared with a net income of $1.0 million for the year ended June 30, 2023.

Operational Achievements:

- In July, the Company successfully closed an upsized IPO, raising $6.75 million in gross proceeds, underscoring strong investor confidence in its growth potential.

- The Company entered into a one-year renewable agreement in July with a leading Asia-based e-commerce platform to provide advanced cross-border fulfillment services, enhancing supply chain visibility for sellers through API integration.

- In August, a strategic partnership was announced with a major social media and e-commerce platform to enhance customs brokerage services, offering real-time logistics data and streamlining customs clearance processes.

- In September, a Pick & Pack Fulfillment service was launched for a major Chinese logistics company, optimizing inventory management and order processing across U.S. hubs to enhance fulfillment efficiency.

- The Company expanded its Dallas-Fort Worth operations in September, more than doubling facility space to 46,657 sq. ft. and increasing staffing to support growing demand, while incorporating advanced logistics technology.

Management Commentary

Henry Liu, Chairman and Chief Executive Officer of Lakeside, commented, “We are pleased to report strong financial performance for fiscal year 2024, highlighted by a 42.3% increase in revenue to $18.3 million. This growth was driven primarily by the 117.6% surge in our cross-border airfreight solutions, as we capitalized on rising demand from the e-commerce sector. Expanding this segment has proven to be a key strategic move, with the volume of air freight processed doubling to over 26,000 tons this year, compared to fiscal year 2023.”

“We remain committed to providing flexible and competitive services that address the evolving needs of our customers. Our continued investment in workforce expansion and service capacity has allowed us to manage growing demand while maintaining exceptional service levels. With a 44.9% increase in gross profit and improvements in our gross margin, we are excited about the growth opportunities ahead. Our recent service launches, operational expansions, and partnerships with leading e-commerce platforms solidify our position as a trusted provider of seamless, technology-driven logistics solutions, setting the stage for continued success in fiscal year 2025 and beyond,” concluded Mr. Liu.

Fiscal Year 2024 Conference Call Details

The Company has scheduled a conference call and live webcast to discuss its financial results at 8:00 A.M. Eastern Time (8:00 P.M. Beijing Time) on Friday, October 4, 2024. Management will deliver prepared remarks.

The dial-in details for the conference call are as follows:

The live audio webcast of the call can also be accessed by visiting Lakeside’s Investor Relations page on the Company’s website at https://lakeside-holding.com. An archive of the webcast will be available on the Company’s website following the live call.

About Lakeside Holding Limited

Lakeside Holding Limited, based in Itasca, IL, is a U.S.-based integrated cross-border supply chain solution provider with a strategic focus on the Asian market, including China and South Korea. Operating under the brand American Bear Logistics, we primarily provide customized cross-border ocean freight solutions and airfreight solutions in the U.S. that specifically cater to our customers’ requirements and needs in transporting goods into the U.S. We are an Asian American-owned business rooted in the U.S. with in-depth understanding of both the U.S. and Asian international trading and logistics service markets. Our customers are typically Asia– and U.S.-based logistics service companies serving large e-commerce platforms, social commerce platforms, and manufacturers to sell and transport consumer and industrial goods made in Asia into the U.S. For more information, please visit https://lakeside-holding.com.

Safe Harbor Statement

This press release contains forward-looking statements that reflect our current expectations and views of future events. Known and unknown risks, uncertainties and other factors may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements involve various risks and uncertainties. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. We qualify all of our forward-looking statements by these cautionary statements.

Investor Relations Contact:

Matthew Abenante, IRC

President

Strategic Investor Relations, LLC

Tel: 347-947-2093

Email: matthew@strategic-ir.com

*** tables follow ***

|

LAKESIDE HOLDING LIMITED |

|||||||

|

CONSOLIDATED BALANCE SHEETS |

|||||||

|

As of |

As of |

||||||

|

June 30, |

June 30, |

||||||

|

2024 |

2023 |

||||||

|

ASSETS |

|||||||

|

CURRENT ASSETS |

|||||||

|

Cash |

$ |

123,550 |

$ |

174,018 |

|||

|

Accounts receivable – third parties, net |

2,082,152 |

1,373,676 |

|||||

|

Accounts receivable – related party, net |

763,285 |

44,627 |

|||||

|

Prepayment and other receivable |

– |

52,623 |

|||||

|

Contract assets |

129,506 |

44,740 |

|||||

|

Due from related parties |

441,279 |

746,130 |

|||||

|

Total current assets |

3,539,772 |

2,435,814 |

|||||

|

NON-CURRENT ASSETS |

|||||||

|

Investment in other entity |

15,741 |

— |

|||||

|

Property and equipment at cost, net of accumulated depreciation |

344,883 |

489,520 |

|||||

|

Right of use operating lease assets |

3,471,172 |

2,271,070 |

|||||

|

Right of use financing lease assets |

37,476 |

48,206 |

|||||

|

Deferred tax asset |

89,581 |

— |

|||||

|

Deferred offering costs |

1,492,798 |

90,000 |

|||||

|

Prepayment, deposit and other receivable |

202,336 |

137,336 |

|||||

|

Total non-current assets |

5,653,987 |

3,036,132 |

|||||

|

TOTAL ASSETS |

$ |

9,193,759 |

$ |

5,471,946 |

|||

|

LIABILITIES AND EQUITY |

|||||||

|

CURRENT LIABILITIES |

|||||||

|

Accounts payables – third parties |

$ |

1,161,858 |

$ |

462,214 |

|||

|

Accounts payables – related parties |

227,722 |

365,413 |

|||||

|

Accrued liabilities and other payables |

1,335,804 |

325,701 |

|||||

|

Current portion of obligations under operating leases |

1,186,809 |

769,782 |

|||||

|

Current portion of obligations under financing leases |

37,619 |

42,889 |

|||||

|

Loans payable, current |

746,962 |

586,688 |

|||||

|

Dividend payable |

98,850 |

98,850 |

|||||

|

Tax payable |

79,825 |

32,829 |

|||||

|

Due to shareholders |

1,018,281 |

90,000 |

|||||

|

Total current liabilities |

5,893,730 |

2,774,366 |

|||||

|

NON-CURRENT LIABILITIES |

|||||||

|

Loans payable, non-current |

136,375 |

231,599 |

|||||

|

Deferred tax liability |

– |

24,752 |

|||||

|

Obligations under operating leases, non-current |

2,506,402 |

1,564,633 |

|||||

|

Obligations under financing leases, non-current |

17,460 |

21,836 |

|||||

|

Total non-current liabilities |

2,660,237 |

1,842,820 |

|||||

|

TOTAL LIABILITIES |

$ |

8,553,967 |

$ |

4,617,186 |

|||

|

Commitments and Contingencies |

|||||||

|

EQUITY |

|||||||

|

Common stocks, $0.0001 par value, 200,000,000 shares authorized, |

600 |

600 |

|||||

|

Subscription receivable |

(600) |

(600) |

|||||

|

Additional paid-in capital |

642,639 |

– |

|||||

|

Accumulated other comprehensive income (loss) |

2,972 |

(244) |

|||||

|

(Deficits) Retained earnings |

(5,819) |

862,072 |

|||||

|

Total stockholders’ equity |

639,792 |

861,828 |

|||||

|

Non-controlling interests in subsidiary |

– |

(7,068) |

|||||

|

Total equity |

639,792 |

854,760 |

|||||

|

TOTAL LIABILITIES AND EQUITY |

$ |

9,193,759 |

$ |

5,471,946 |

|||

|

LAKESIDE HOLDING LIMITED |

|||||||

|

CONSOLIDATED STATEMENT OF INCOME (LOSS) AND COMPREHENSIVE |

|||||||

|

For the Years Ended |

|||||||

|

June 30, |

|||||||

|

2024 |

2023 |

||||||

|

Revenue from third party |

$ |

16,450,908 |

$ |

12,763,577 |

|||

|

Revenue from related parties |

1,864,247 |

109,314 |

|||||

|

Total revenue |

18,315,155 |

12,872,891 |

|||||

|

Cost of revenue from third party |

12,316,374 |

8,385,222 |

|||||

|

Cost of revenue from related parties |

2,282,824 |

1,923,380 |

|||||

|

Total cost of revenue |

14,599,198 |

10,308,602 |

|||||

|

Gross profit |

3,715,957 |

2,564,289 |

|||||

|

Operating expenses: |

|||||||

|

Selling expense |

2,500 |

79,822 |

|||||

|

General and administrative expenses |

4,138,190 |

2,331,312 |

|||||

|

Loss from deconsolidation of a subsidiary |

73,151 |

– |

|||||

|

Provision (reversal) of allowance for expected credit loss |

28,157 |

(93,742) |

|||||

|

Total operating expenses |

4,241,998 |

2,317,392 |

|||||

|

(Loss) Income from operations |

(526,041) |

246,897 |

|||||

|

Other income (expense): |

|||||||

|

Other income, net |

338,435 |

885,501 |

|||||

|

Interest expense |

(108,008) |

(123,600) |

|||||

|

Total other income, net |

230,427 |

761,901 |

|||||

|

(Loss) Income before income taxes |

(295,614) |

1,008,798 |

|||||

|

Credit (Provision) for income taxes |

67,337 |

(65,068) |

|||||

|

Net (loss) income and comprehensive (loss) income |

(228,277) |

943,730 |

|||||

|

Net loss attributable to non-controlling interest |

(3,025) |

(39,872) |

|||||

|

Net (loss) income attributable to common stockholders |

(225,252) |

983,602 |

|||||

|

Other comprehensive (loss) income |

|||||||

|

Foreign currency translation gain (loss) |

3,122 |

(255) |

|||||

|

Comprehensive (loss) income |

(225,155) |

943,475 |

|||||

|

Less: comprehensive loss attributable to non-controlling interest |

(3,119) |

(39,883) |

|||||

|

Comprehensive (loss) income attributable to the Company |

$ |

(222,036) |

$ |

983,358 |

|||

|

(Loss) earnings per share – basic and diluted |

$ |

(0.04) |

$ |

0.16 |

|||

|

Weighted average shares outstanding – basic and diluted* |

6,000,000 |

6,000,000 |

|||||

|

For the Years Ended |

|||||||

|

June 30, |

|||||||

|

2024 |

2023 |

||||||

|

Pro Forma information Statement for Income Tax Provision as a |

|||||||

|

C Corporation upon Reorganization |

|||||||

|

(Loss) Income before income taxes |

$ |

(295,614) |

$ |

1,008,798 |

|||

|

Credit (Provision) for income taxes |

239,466 |

(307,683) |

|||||

|

Net (loss) income and comprehensive (loss) income |

$ |

(56,148) |

$ |

701,115 |

|||

|

Net loss attributable to non-controlling interests |

(3,025) |

(39,872) |

|||||

|

Net (loss) income attributable to common stockholders |

(53,123) |

740,987 |

|||||

|

Other Comprehensive income (loss) |

|||||||

|

Foreign currency translation (loss) gain |

3,122 |

(255) |

|||||

|

Comprehensive (loss) income |

(53,026) |

700,860 |

|||||

|

Less: net loss attributable to non-controlling interest |

(3,119) |

(39,883) |

|||||

|

Comprehensive (loss) income attributable to the Company |

$ |

(49,907) |

$ |

740,743 |

|||

|

(Loss) Earnings per share – Basic and diluted* |

$ |

(0.01) |

$ |

0.12 |

|||

|

Weighted Average Shares Outstanding – Basic and diluted* |

6,000,000 |

6,000,000 |

|||||

|

LAKESIDE HOLDING LIMITED |

|||||||

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|||||||

|

For the Years Ended |

|||||||

|

June 30, |

|||||||

|

2024 |

2023 |

||||||

|

(Revised) |

|||||||

|

Cash flows from operating activities: |

|||||||

|

Net (loss) income |

$ |

(228,277) |

$ |

943,730 |

|||

|

Adjustments to reconcile net (loss) income to net cash provided by |

|||||||

|

Depreciation – G&A |

71,980 |

130,755 |

|||||

|

Depreciation – overhead cost |

72,657 |

– |

|||||

|

Non-cash operating lease expense |

1,005,686 |

826,284 |

|||||

|

Depreciation of right-of-use finance assets |

30,712 |

31,780 |

|||||

|

Provision (Reversal) of allowance for expected credit loss |

28,157 |

(93,742) |

|||||

|

Deferred tax (benefit) expense |

(114,333) |

32,239 |

|||||

|

Loss from derecognition of shares in subsidiary |

73,151 |

— |

|||||

|

Changes in operating assets and liabilities: |

|||||||

|

Accounts receivable – third parties |

(722,522) |

(506,152) |

|||||

|

Accounts receivable – related parties |

(732,769) |

(28,887) |

|||||

|

Contract assets |

(84,766) |

54,441 |

|||||

|

Due from related party |

328,820 |

(579,496) |

|||||

|

Prepayment, other deposit |

(12,377) |

18,672 |

|||||

|

Accounts payables – third parties |

699,644 |

54,410 |

|||||

|

Accounts payables – related parties |

(137,691) |

(101,896) |

|||||

|

Accrued expense and other payables |

468,284 |

57,701 |

|||||

|

Tax payable |

46,996 |

32,829 |

|||||

|

Lease liabilities – Operating lease |

(846,992) |

(833,365) |

|||||

|

Net cash (used in) provided by operating activities |

(53,640) |

39,303 |

|||||

|

Cash flows from investing activities: |

|||||||

|

Payment made for investment in other entity |

(29,906) |

— |

|||||

|

Net cash outflow from deconsolidation of a subsidiary |

(48,893) |

— |

|||||

|

Acquisition of property and equipment |

— |

(18,288) |

|||||

|

Net cash used in investing activities |

(78,799) |

(18,288) |

|||||

|

Cash flows from financing activities: |

|||||||

|

Proceeds from loans |

400,000 |

— |

|||||

|

Repayment of loans |

(214,986) |

(100,864) |

|||||

|

Repayment of equipment and vehicle loans |

(119,964) |

(104,598) |

|||||

|

Principal payment of finance lease liabilities |

(29,628) |

(20,640) |

|||||

|

Payment for deferred offering cost |

(170,000) |

(90,000) |

|||||

|

Advance to related parties |

(23,969) |

— |

|||||

|

Proceeds from shareholders |

237,302 |

110,550 |

|||||

|

Repayment to shareholders |

— |

(47,536) |

|||||

|

Net cash provided by (used in) financing activities |

78,755 |

(253,088) |

|||||

|

Effect of exchange rate changes on cash and cash equivalents |

3,216 |

32,560 |

|||||

|

Net decrease in cash |

(50,468) |

(199,513) |

|||||

|

Cash, beginning of the year |

174,018 |

373,531 |

|||||

|

Cash, end of the year |

$ |

123,550 |

$ |

174,018 |

|||

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW |

|||||||

|

Cash paid for income tax |

$ |

— |

$ |

— |

|||

|

Cash paid for interest |

$ |

31,161 |

$ |

26,474 |

|||

|

SUPPLEMENTAL SCHEDULE OF NON-CASH IN |

|||||||

|

Deferred offering costs within due to shareholders |

$ |

860,979 |

$ |

90,000 |

|||

|

Deferred offering costs within accrued expense and other |

$ |

541,819 |

$ |

— |

|||

|

NON-CASH ACTIVITIES |

|||||||

|

Dividends declared |

$ |

— |

$ |

200,000 |

|||

|

Dividends declared and offset against due from shareholders |

$ |

— |

$ |

101,150 |

|||

|

Property and equipment additions included in loan payable |

$ |

— |

$ |

98,245 |

|||

|

Right of use assets obtained in exchange for operating lease |

$ |

2,094,498 |

$ |

124,600 |

|||

|

Right of use assets obtained in exchange for finance lease |

$ |

19,982 |

$ |

32,107 |

|||

|

APPENDIX A – Net cash outflow from deconsolidation of a |

|||||||

|

Working capital, net |

$ |

29,812 |

$ |

— |

|||

|

Investment in other entity recognized |

(15,741) |

— |

|||||

|

Elimination of NCl at deconsolidation of a subsidiary |

10,187 |

— |

|||||

|

Loss from deconsolidation of a subsidiary |

(73,151) |

— |

|||||

|

Cash |

$ |

(48,893) |

$ |

— |

|||

![]() View original content:https://www.prnewswire.com/news-releases/lakeside-holding-reports-impressive-42-revenue-growth-for-fiscal-year-2024-302264006.html

View original content:https://www.prnewswire.com/news-releases/lakeside-holding-reports-impressive-42-revenue-growth-for-fiscal-year-2024-302264006.html

SOURCE Lakeside Holding Limited

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leaked EA Project Rene Images Reveal Controversial Changes: Why The Sims Fans Are Furious

Nearly two years after Electronic Arts Inc. EA teased Project Rene, a new entry in The Sims series that many hoped would become The Sims 5, the excitement has turned into frustration.

Following EA’s recent announcement that it has no plans for The Sims 5, new leaked screenshots from Project Rene have surfaced, revealing significant changes, IGN reported.

The Sims: New Features

Over the past week, various images from a recent playtest of Project Rene have circulated online, showcasing features like a to-do list, a chat box, and a small neighborhood to explore.

See Also: No Sims 5? EA Focuses On Sims 4 Expansion, AI Projects, Margot Robbie Movie

A notable addition is the ability to work at a cafe, which has drawn comparisons to The Sims Mobile, EA’s 2018 title that included a similar mechanic and stopped receiving updates earlier this year.

Players quickly compared these recent images to earlier visuals of Project Rene, leading many to believe the game has been altered significantly. Critics argue that the new art style appears downgraded and that the game’s scope seems limited, suggesting a shift towards a more mobile-friendly design.

Concerns Over Microtransactions

One of the most concerning revelations from the leaks is the introduction of a mobile-style coin tab, which appears to reward players for completing quests.

These coins seem intended for purchasing outfits, raising concerns about potential microtransactions in the game.

Speculation On Development Changes

The contrast between the initial reveal of Project Rene and the latest leaks has led some players to speculate that the game may have been internally downsized or even scrapped in its previous vision.

Initially introduced in 2022 as a free-to-play title featuring multiplayer elements inspired by games like Animal Crossing and Among Us, Project Rene was expected to refresh the series. However, the latest images suggest a very different direction, leaving fans disheartened.

EA currently has not provided a formal announcement regarding the game’s release date or official reveal. However, small, invite-only playtests have been ongoing since its announcement.

Read Next:

Image credits: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How Indian Creek Village Became A Fortress For The Ultra-Wealthy – Home To $50 Million Mansions And 24/7 Surveillance

Indian Creek Village, known as the “Billionaire Bunker,” isn’t just another gated community. It’s the ultimate fortress for the ultrarich. Nestled in South Florida’s Biscayne Bay, this private island is where some of the world’s wealthiest people, including Jeff Bezos and Tom Brady, have decided to stake their claim. But living here isn’t just about luxury. It’s about security and lots of it.

Don’t Miss:

You can’t just stroll onto Indian Creek. Not a chance. The island is locked down with a high-tech security system that’s straight out of a spy movie. “The wealthier you become, the more you want perfect security,” Setha Low, director of the Public Space Research Group at CUNY, told Business Insider recently. And Indian Creek delivers. An Israeli-designed radar system rings the island. It’s a system that can detect anyone approaching half a mile away. Cameras are everywhere: hidden in hedges, mounted on poles and linked to a command center that monitors every move.

Trending: Amid the ongoing EV revolution, previously overlooked low-income communities now harbor a huge investment opportunity at just $500.

The police force here? They’re more like personal bodyguards for the residents. With 19 officers for just 89 residents, Indian Creek has a cop-to-citizen ratio that makes New York City look understaffed. And these aren’t your average officers. They’re trained in tactical operations and armed with fully automatic weapons. They also spend most of their time patrolling the island’s perimeter, ensuring no one gets too close.

Indian Creek wasn’t always a billionaire’s playground. The island was dredged from Biscayne Bay in 1928 and officially became a village in 1939. It was originally designed to mimic the English countryside, with sprawling lawns and a golf course covering over 80% of the island. It was a refuge for wealthy white gentiles, with early residents like vacuum king William Henry Hoover and department store magnate Frank Woolworth. The place had its ways of keeping people out – especially Jewish buyers, who were excluded by running the island’s utilities through a segregated country club. While those old barriers are gone, Indian Creek has kept its exclusive vibe, evolving into a fortress for the world’s richest, where the wealthy can live in seclusion, away from the rest of us.

Trending: Commercial real estate has historically outperformed the stock market, and this platform allows individuals to invest in commercial real estate with as little as $5,000 offering a 12% target yield with a bonus 1% return boost today!

These days, Indian Creek isn’t just about keeping people out. It’s about keeping the wealth in. The island’s properties are worth nearly $1 billion collectively and prices keep climbing, especially since Jeff Bezos moved in. His arrival alone added a whopping $199 billion to the island’s net worth, sending property values through the roof. “People’s price expectations just jumped drastically,” said real estate agent Marko Gojanovic.

But the island’s obsession with security has a cost. Sure, it’s about the millions spent on technology and personnel. But it’s also about the growing divide between the haves and the have-nots. “Security has become a really big concern for billionaires now, because there’s never been more talk about the divide between the haves and the have-nots,” Brian Daniel, who runs the Celebrity Personal Assistant Network, told Business Insider. The wealth gap has never been wider. The rich are doing everything they can to keep themselves insulated from the rest of the world.

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

Indian Creek might be the most extreme example, but it’s part of a larger trend. More and more Americans are retreating into “secured communities,” building higher walls to keep the outside world at bay. But as Low pointed out, “The more you enclose yourself, the more you’re reminding yourself of a sense of risk.”

For the residents of Indian Creek, the price of paradise is constant vigilance. Every boat that gets too close, every construction worker that steps onto the island, is a potential threat. And with wealth comes the fear that someone might want to take it away. It’s a gilded cage, but still a cage.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BioAge Labs Announces Closing of Initial Public Offering, Full Exercise of Underwriters' Option to Purchase Additional Shares and Closing of the Concurrent Private Placement

RICHMOND, Calif., Oct. 01, 2024 (GLOBE NEWSWIRE) — BioAge Labs, Inc. (“BioAge”) BIOA, a clinical-stage biopharmaceutical company developing therapeutic product candidates for metabolic diseases, such as obesity, by targeting the biology of aging, today announced the closing of its upsized initial public offering of 12,650,000 shares of its common stock, which includes the exercise in full by the underwriters of their option to purchase 1,650,000 additional shares, at the initial public offering price of $18.00 per share. All of the shares were offered by BioAge.

In addition to the shares sold in the initial public offering, BioAge today announced the closing on September 27, 2024 of its sale of 588,888 shares of its common stock at the initial public offering price per share in a concurrent private placement to an existing stockholder. The sale of the shares of common stock in the concurrent private placement was not registered under the Securities Act of 1933, as amended.

Goldman Sachs & Co. LLC, Morgan Stanley, Jefferies, and Citigroup acted as joint book-running managers for the offering and as placement agents for the concurrent private placement.

The gross proceeds to BioAge from the initial public offering, including full exercise of the underwriters’ option to purchase additional shares, and the concurrent private placement, before deducting underwriting discounts and commissions, placement agent fees and offering and private placement expenses, were approximately $238.3 million.

Registration statements relating to the securities issued and sold in the initial public offering have been filed with the U.S. Securities and Exchange Commission (SEC) and became effective on September 25, 2024. A prospectus relating to and describing the terms of the initial public offering has been filed with the SEC and is available on the SEC’s website at www.sec.gov. The initial public offering was made only by means of a prospectus. Copies of the final prospectus may be obtained from Goldman Sachs & Co. LLC, Attention: Prospectus Department, 200 West Street, New York, NY 10282, by telephone at (866) 471-2526, or by email at Prospectus-ny@ny.email.gs.com; Morgan Stanley & Co. LLC, Attention: Prospectus Department, 180 Varick Street, 2nd Floor, New York, NY 10014, or by email at prospectus@morganstanley.com; Jefferies LLC, Attention: Equity Syndicate Prospectus Department, 520 Madison Avenue, New York, NY 10022, by telephone at (877) 821-7388, or by email at Prospectus_Department@Jefferies.com; Citigroup, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, by telephone at 800-831-9146.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About BioAge Labs

BioAge is a clinical-stage biopharmaceutical company developing therapeutic product candidates for metabolic diseases, such as obesity, by targeting the biology of human aging. BioAge’s lead product candidate, azelaprag, is an orally available small molecule agonist of APJ that has been well-tolerated in 265 individuals across eight Phase 1 clinical trials, including a Phase 1b clinical trial where decreased muscle atrophy, preservation of muscle quality and improved metabolism were observed in subjects treated with azelaprag over a 10-day period. In mid-2024, BioAge initiated a Phase 2 trial of azelaprag in combination with tirzepatide for the treatment of obesity in older adults. Azelaprag has potential as an oral regimen to improve weight loss and restore both body composition and muscle function in patients on obesity therapy with incretin drugs. BioAge is also developing orally available small molecule brain penetrant NLRP3 inhibitors for the treatment of diseases driven by neuroinflammation. BioAge’s preclinical programs, based on novel insights from the BioAge’s discovery platform built on human longevity data, also have the potential to address key pathways in metabolic aging.

Contacts

PR: Chris Patil, media@bioagelabs.com

IR: Elena Liapounova, ir@bioagelabs.com

Partnering: partnering@bioagelabs.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Morguard North American Residential REIT 2024 Third Quarter Results Conference Call

MISSISSAUGA, ON, Oct. 1, 2024 /CNW/ – Morguard North American Residential Real Estate Investment Trust (the “REIT”) MRG, expects to announce its financial results for the quarters ended September 30, 2024 and 2023 on Tuesday, October 29, 2024.

The REIT invites you to participate in a conference call on Thursday, October 31, 2024 at 3:00 p.m. (ET). An overview of the REIT’s financial results will be provided by Chris Newman, CFO. A question and answer session will then follow.

To participate in the conference call, please dial 1-437-900-0527 or 1-888-510-2154. Please quote conference ID 62752. To join the conference call without operator assistance, you may register and enter your phone number at https://emportal.ink/3MRgVCE to receive an instant automated call back.

For those unable to participate, a taped replay will be available after the completion of the call from 6:00 p.m. (ET) until midnight on November 30, 2024. To access the replay, dial 1-289-819-1450 or 1-888-660-6345 and enter the encore replay entry code 62752 #.

About Morguard North American Residential REIT

The REIT is an unincorporated, open-ended real estate investment trust which owns, through a limited partnership, interests in Canadian residential apartment communities, located in Alberta and Ontario, and U.S. residential apartment communities located in Colorado, Texas, Louisiana, Illinois, Georgia, Florida, North Carolina, Virginia and Maryland.

For more information, please visit Morguard.com.

SOURCE Morguard North American Residential Real Estate Investment Trust

![]() View original content: http://www.newswire.ca/en/releases/archive/October2024/01/c9255.html

View original content: http://www.newswire.ca/en/releases/archive/October2024/01/c9255.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: 3 Market-Leading Stocks That May Plunge if Donald Trump Wins in November

Exactly five weeks from today, on Nov. 5, voters from across the country will weigh in and decide which presidential nominee — former President Donald Trump or current Vice President Kamala Harris — will lead our nation forward over the next four years.

What happens on Capitol Hill doesn’t always have relevance to Wall Street. But elections ultimately determine which president and political parties will shape fiscal policy over the next, at minimum, two years. Understanding the economic policy proposals of the two presidential candidates does have bearing for the investing community and corporate America.

For former President Donald Trump, his message has remained similar to what he echoed during his 2020 campaign. He’s proposed a handful of new personal tax breaks, wants to further reduce the corporate tax rate to spur economic growth, is a big promoter of domestic energy production, and plans to get tougher with China.

While there are some pretty clear winners of this potential scenario, there are also time-tested and/or high-flying stocks that can end up as losers.

What follows are three market-leading stocks that can plunge if Donald Trump wins in November.

Nvidia

The first widely held stock that may be contending with some difficult headwinds if Trump wins in five weeks is Wall Street’s leading artificial intelligence (AI) company Nvidia (NASDAQ: NVDA).

As most investors are probably aware, Nvidia’s stock has enjoyed a historic ascent, with the company benefiting from a textbook expansion of its operations. In short order, Nvidia’s AI-graphics processing units (GPUs) became the undisputed preferred choice for businesses running generative AI solutions and building/training large language models.

Though the prospect of lowering the corporate tax rate could, at least temporarily, juice Nvidia’s gross margin and allow it to hang onto more of its income, another key aspect of Trump’s economic plan has the potential to limit Nvidia’s upside.

Specifically, Trump plans to take a hardline stance with China, the world’s No. 2 economy by gross domestic product. He’s proposed a 60% tariff on goods imported into the U.S. from China. Although Nvidia isn’t importing products from China, the global No. 2 economy has consistently been a key generator of sales for Nvidia. The potential for Trump to spark a trade war may eliminate China’s desire altogether to purchase chips from California-based Nvidia.

To add to the above, regulators under the Biden administration have, on two occasions, limited Nvidia’s ability to export its high-powered AI-GPUs to China over the last two years. I’d deem it unlikely that Trump or his administration would ease or lift these restrictions, which are capping Nvidia’s revenue potential in a key market.

I’d be remiss if I didn’t also mention that every next-big-thing technology, trend, and innovation for 30 years has navigated its way through an early stage bubble. Investors consistently overestimate the adoption and utility of game-changing innovations, and AI seems unlikely to be the exception to this unwritten rule. If the AI bubble were to burst under a Trump presidency, arguably no company would feel the sting more than Nvidia.

Tesla

A second market leader that may be set to plummet if Donald Trump wins a second term is electric-vehicle (EV) manufacturer Tesla (NASDAQ: TSLA).

Tesla has used its first-mover advantages to build itself from the ground up to producing in the neighborhood of 2 million EVs annually on a run-rate basis. It became the first EV company to generate a recurring profit and is attempting to diversify its operations by expanding into energy storage.

Although former President Trump has hinted at giving Tesla CEO Elon Musk a position in his administration if reelected in November, he’s also been critical of EV tax credits and tax incentives. While Trump hasn’t concretely said he’d do away with the $7,500 EV tax credit for new purchases, his statements suggest this is a real possibility.

Tax credits play an important role in providing a potential price advantage for EVs, when compared to internal combustion-engine vehicles. If this credit is removed, arguably the most-enticing competitive edge for EVs goes away — especially with EV charging infrastructure still somewhat limited.

To add to the above, Tesla’s reliance on unsustainable sources of income — specifically, interest income earned on its cash and automotive regulatory tax credits — have rapidly increased as a percentage of pre-tax income. In the June-ended quarter, approximately 66% of Tesla’s pre-tax income came from these two sources, with $890 million of its $1.89 billion pre-tax profit from regulatory credits.

It’s also unclear how Trump’s tariff policy will affect domestic and international sales of EVs for American-based companies. Tesla has been aggressively reducing the sales price of its EVs (Model’s 3, S, X, and Y) since the start of 2023 to counter growing competition and rising inventory levels. Unfortunately, these price cuts haven’t stopped inventory levels from rising on a year-over-year basis, and they’ve clobbered the company’s operating margin.

Even if Musk were to land a role in the Trump administration, Tesla is a stock that would likely struggle with the former president back in the Oval Office.

Apple

The third magnificent stock that may be poised to plunge if Donald Trump wins in November is Wall Street’s largest company by market cap, Apple (NASDAQ: AAPL).

Although Apple’s stock has soared in 2024 on the heels of its AI ambitions and excitement surrounding the eventual incorporation of AI tools into its top-selling iPhone, it’s the company’s Services segment that’s been the real highlight for years. CEO Tim Cook is overseeing a transformation that will see Apple become a platforms company. A subscription-driven model should lift its operating margin, smooth out the sales fluctuations that occur during iPhone upgrade cycles, and further enhance the company’s impressive customer loyalty.

Similar to Nvidia, it might also benefit from a further reduction of the corporate tax rate. Apple has repurchased a market-leading $700.6 billion worth of its common stock since the start of 2013 and reduced its outstanding share count by 42.2% in the process. A lower corporate tax rate may encourage even more buybacks.

On the other hand, Apple imports some of its products from China, is reliant on a meaningful portion of its iPhone sales from China, and the overwhelming majority of its iPhones (along with Macs and iPads) are assembled in China. Between tariffs and the potential anti-American sentiment caused by a trade war with China, Apple could see its already stalling growth engine come to a complete halt.

Though buybacks have played a key role in lifting Apple’s earnings per share over the last 11 years, what ails Apple’s growth engine can’t be fixed with the market’s leading share repurchase program. Even a reduction in corporate tax rates won’t be enough offset the persistent sales weakness Apple has been contending with across all of its physical product lines.

While tech stocks and all three major stock indexes thrived under Trump’s first term in office, it’s my prediction that Apple will flounder if Trump wins in November.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

Prediction: 3 Market-Leading Stocks That May Plunge if Donald Trump Wins in November was originally published by The Motley Fool