3 High-Yield Dividend Stocks to Buy Hand Over Fist in October

When is the best time to buy high-yield dividend stocks? The best answer for income investors is probably as quickly as possible. The sooner you invest, the sooner the dividends begin flowing in.

Some stocks are better than others at different times, though. As we enter the final quarter of 2024, I think a few stocks especially stand out. Here are three high-yield dividend stocks to buy hand over fist in October.

1. Enterprise Products Partners LP

Enterprise Products Partners LP (NYSE: EPD) is one of the top providers of midstream energy services in North America. The limited partnership (LP) operates over 50,000 miles of pipeline, liquids storage facilities, natural gas processing facilities, and more.

Income investors have a lot to like with Enterprise Products Partners. Its forward-distribution yield is a sky-high 7.2%. Even better, Enterprise has increased its distribution for 26 consecutive years.

The midstream company is in a great position to keep the distributions flowing and growing. Enterprise Products Partners boasts a solid balance sheet with respectable A- and A3 credit ratings reflecting a low risk of default. Its cash flow has also been resilient through the years even during the financial crisis of 2007 and 2008, the oil price collapse of 2015 through 2017, and the COVID-19 pandemic in 2020 and 2021.

Enterprise Products Partners isn’t likely to be a high-growth stock, but it still has pretty good growth prospects. The company currently has roughly $6.7 billion of major growth-capital projects under construction. U.S. crude oil, natural gas, and natural gas liquids production are projected to increase through the end of the decade with a significant portion exported to other countries. The demand for Enterprise’s pipelines and other midstream assets should remain strong.

2. Realty Income

Realty Income (NYSE: O) ranks as the world’s seventh-largest real estate investment trust (REIT). It owns 15,450 commercial real estate properties that are leased to a diversified group of clients spanning 90 industries.

The REIT pays a monthly dividend with a forward yield of 5%. Realty Income has increased its dividend for 29 consecutive years with a compound annual growth rate (CAGR) of 4.3%.

One key for Realty Income to continue this impressive streak is maintaining a high-occupancy rate. The company has done a great job on both fronts in the past. Realty Income’s median historical occupancy is an industry-leading 98.2% with its lowest year-end occupancy at 96.6%.

Growth shouldn’t be a problem for Realty Income. In the U.S., the REIT has significant growth potential in consumer-centric medical facilities, data centers, gaming, and industrial facilities. Realty Income believes its opportunities in Europe are even bigger with a total addressable market (TAM) of $8.5 trillion.

3. United Parcel Service

United Parcel Service (NYSE: UPS) is the largest package-delivery company in the world. It delivers packages for roughly 1.6 million customers to 10.2 million recipients in over 200 countries and territories every business day.

UPS’ forward-dividend yield stands at 4.8%. The company has increased its dividend for 15 consecutive years. While UPS’ dividend payout grew nearly 70% over the last five years, most of that increase came from a big dividend hike in 2022.

Funding the dividend program is one of UPS’ top capital-allocation priorities. Excess cash after paying dividends and investing in the business is used for stock buybacks. The company recently announced plans to repurchase $500 million of its shares this year.

UPS returned to volume growth in the U.S. in the second quarter of 2024 for the first time in nine quarters. Its acquisition of Estafeta, which is expected to close by year end, will increase its capabilities in Mexico. The company’s focus on healthcare logistics and small- to medium-sized businesses should also boost growth.

Should you invest $1,000 in Enterprise Products Partners right now?

Before you buy stock in Enterprise Products Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enterprise Products Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Keith Speights has positions in Enterprise Products Partners, Realty Income, and United Parcel Service. The Motley Fool has positions in and recommends Realty Income. The Motley Fool recommends Enterprise Products Partners and United Parcel Service. The Motley Fool has a disclosure policy.

3 High-Yield Dividend Stocks to Buy Hand Over Fist in October was originally published by The Motley Fool

Protective Coating Market is Projected to Reach US$ 66.37 Billion by 2034, Growing at a CAGR of 6.3% | Fact.MR Report

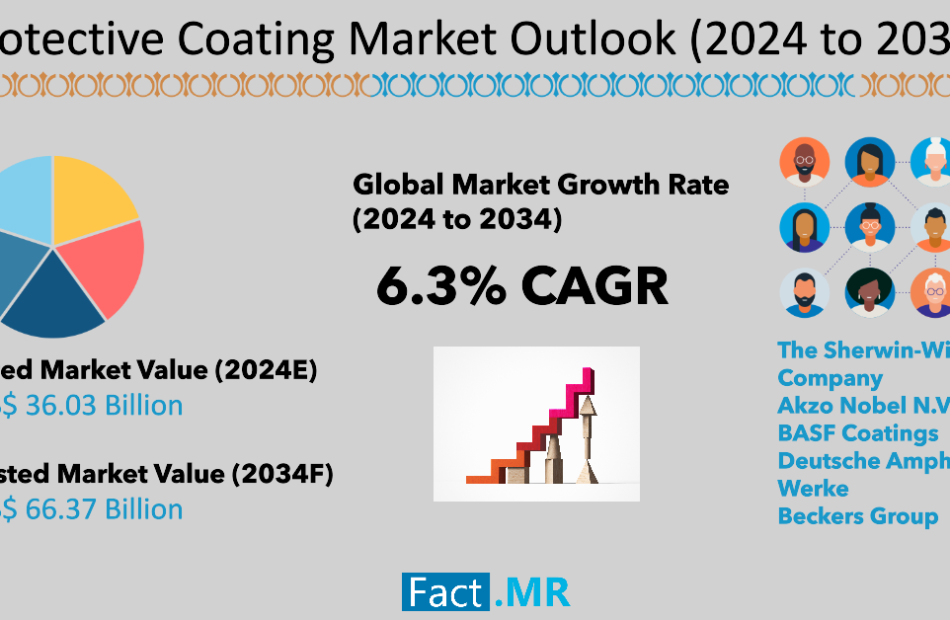

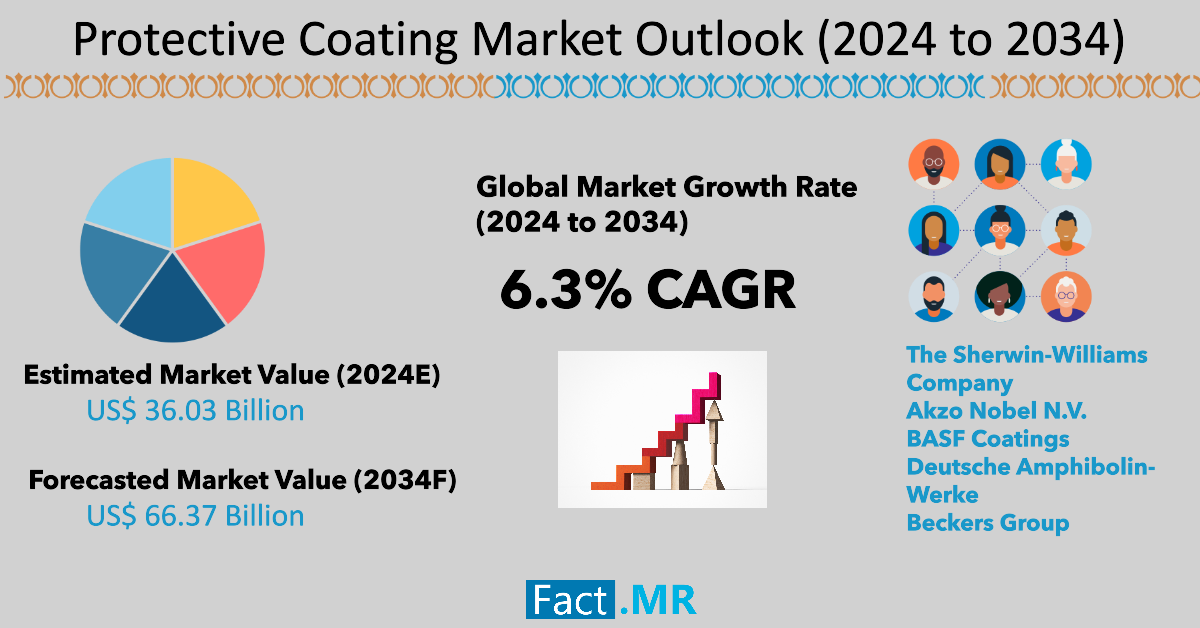

Rockville, MD, Oct. 01, 2024 (GLOBE NEWSWIRE) — The global Protective Coating Market is projected to touch a value of US$ 36.03 billion in 2024 and has been thoroughly analyzed to increase to a size of US$ 66.37 billion by 2034 end. Worldwide demand for protective coatings is evaluated to increase at a CAGR of 6.3% throughout the projection period (from 2024 to 2034).The growth of the automobile industry is driving up the need for protective coatings, especially as electric vehicles are gaining popularity all over the world.

Protective coatings are used by auto manufacturers to insulate vehicles against external factors such as corrosion, ultraviolet radiation, bad weather, and others. These coatings contribute to the durability and aesthetic appeal of automobiles. Apart from this, the use of protective coatings in renewable energy such as solar and wind power is increasing. Protective coatings are crucial for shielding solar panels, wind turbines, and other renewable energy equipment from environmental degradation.

The market in East Asia is growing at a notable rate due to the rising building and infrastructure development in South Korea, Japan, and China. The development in residential, commercial, and industrial construction projects is driving up demand for coatings that provide defense against corrosion, abrasion, and harsh weather conditions.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=8951

Key Takeaways from Market Study:

- The global market for protective coating is projected to increase at 6.3% CAGR between 2024 and 2034.

- East Asia is estimated to account for 36.5% of the global market share in 2024.

- By technology, the demand for water-borne coatings is projected to rise at 7.1% CAGR through 2034.

- The North American market is analyzed to generate revenue worth US$ 19.31 billion by 2034.

- The market in South Korea is poised to touch a value of US$ 5.03 billion by the end of 2034.

- In the East Asia market, China is evaluated to lead with a 56.1% market share in 2024.

“Low-VOC and water-based protective coatings are becoming more popular due to increasing environmental regulations and safety standards in several countries, which is creating lucrative opportunities for market players,” says a Fact.MR analyst

Leading Players Driving Innovation in Powder Protective Coating Market:

The Sherwin-Williams Company; Akzo Nobel N.V.; BASF Coatings; Deutsche Amphibolin-Werke; Beckers Group; Tikkurila; Brillux; Cromology; Teknos; Meffert AG Farbwerke; Mankiewicz; IVM Chemicals; Kansai Paints Co. Ltd.; The Valspar Corporation; PPG Industries Inc.; Evonik Industries; Arkema Group; Sika AG; Dow Chemical; Wacker Chemie AG; Hempel A/S; Jot.

Powder Protective Coating Gaining Traction:

Compared to solvent-borne, water-borne, and other protective coatings, powder formulation technology is high in demand due to its non-solvent content and lack of volatile organic compounds (VOCs). These coatings satisfy several stringent environmental requirements and are safe for the environment.

Powder coatings are thought to be ideal for several industrial applications because of their remarkable durability, which includes resistance to chipping, scratches, and corrosion. Aside from this, the application efficiency of powder coatings which results in less waste and thicker coatings in a single layer makes them more cost-effective.

Powder Protective Coating Industry News:

- In July 2024, to offer effective protection against electronic components in application in renewable energy, power tools, home appliances, and e-Motors, Dow introduced the SIL CC-8000 Series of conformal coatings for UV and Dual Moisture Cure, a line of solventless silicone coatings that applies quickly.

- In July 2024, to leverage green technology to cut down on building waste, the Nano and Advanced Materials Institute (NAMI) and Hong Kong developer Chinachem Group collaborated to introduce a sustainable protective window coating.

- In April 2024, a new epoxy cure hardener for spray applications with several components, Ancamine 2844, was added by Evonik to its range of curing agents. For demanding low temperature and high humidity situations, such as those in maritime and protective coating applications, this novel high-functional aliphatic amine hardener delivers extremely quick cure times and steady property development.

Get Customization on this Report for Specific Research Solutions-https://www.factmr.com/connectus/sample?flag=S&rep_id=8951

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the protective coating market, presenting historical demand data (2019 to 2023) and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on technology (solvent-borne, water-borne, powder), resin (epoxy, polyurethane, acrylic, alkyd, polyester), and application (infrastructure, commercial real estate, industrial plants & facilities, oil & gas, power, mining), across seven major regions of the world (North America, Western Europe, Eastern Europe, East Asia, Latin America, South Asia & Pacific, and MEA).

Segmentation of Protective Coating Market Research:

- By Technology :

- Solvent-Borne

- Water-Borne

- Powder

- By Resin :

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Polyester

- By Application :

- Infrastructure

- Commercial Real Estate

- Industrial Plants & Facilities

- Oil & Gas

- Power

- Mining

Checkout More Related Studies Published by Fact.MR Research:

The global coating additives market is valued to be US$ 9.3 billion in 2023 and it is anticipated to grow at a CAGR of 5.0% to reach US$ 15.1 billion by the end of 2033.

Global coating binders market is estimated to be valued at USD 35,133 million in 2022 and is forecast to reach USD 50,563 million by 2032, growing with a CAGR of 3.1% from 2022-2032.

The global coating pigments market is estimated at USD 24.5 billion in 2022 and is forecast to reach USD 41.9 billion by 2032, growing at a CAGR of 5.5% during 2022-2032.

Coating Removal System Market By Type (Chemical Based, Blast Media Based, Laser Based, Microwaves), By Application (Steel, Plastics, Concrete, Composites), By End-use (Building Renovation, Vehicle maintenance, Industrial Repair, Furniture Refinishing, Shipbuilding) – Global Review 2020 to 2030

global coating solvent market has been valued at US$ 10.02 billion in 2024, as analyzed and revealed in the recently published research report by Fact.MR. Worldwide revenue from the sales of coating solvents is forecasted to rise at a CAGR of 4.4% and reach US$ 15.41 billion by the end of 2034.

The global packaging coating market is anticipated to be valued at US$ 3.5 billion in 2023 and it is anticipated to grow at a CAGR of 6.8% to reach US$ 6.8 billion by the end of 2033.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

McCORMICK REPORTS THIRD QUARTER PERFORMANCE AND REAFFIRMS 2024 OUTLOOK

HUNT VALLEY, Md., Oct. 1, 2024 /PRNewswire/ — McCormick & Company, Incorporated MKC, a global leader in flavor, today reported financial results for the third quarter ended August 31, 2024 and reaffirmed fiscal 2024 outlook for sales and operating profit.

- Sales in the third quarter were comparable to the year-ago period, reflecting volume growth of 1%, partially offset by price.

- Operating income was $287 million in the third quarter compared to $245 million in the year-ago period. Adjusted operating income was $288 million compared to $251 million in the year-ago period.

- Earnings per share was $0.83 in the third quarter as compared to $0.63 in the year-ago period. Adjusted earnings per share was $0.83 compared to $0.65 in the year-ago period.

- For fiscal year 2024, McCormick reaffirmed its sales and operating profit growth outlook, reflecting minimal impact from currency. In addition, the Company increased its earnings per share outlook.

- The Company plans to host its Investor Day on October 22, 2024 in Hunt Valley, Maryland.

President and CEO’s Remarks

Brendan M. Foley, President and CEO, stated, “We are pleased with our year to date performance, which was in line with our expectations and reflects the success of our prioritized investments in the areas within our portfolio that we believe will drive the greatest value. This quarter we reached a meaningful milestone by delivering total global positive volume growth, reflecting improved trends across both segments, and we expect this momentum to continue into the fourth quarter. In our Consumer segment, we delivered solid volume growth, despite a more challenging macro environment in China. In Flavor Solutions, we drove sequential volume improvement, as we delivered strong growth in Branded Foodservice.

“We continue to strengthen our business across major markets and core categories by executing with speed and agility on the initiatives within our growth levers, including brand marketing, new products and packaging, category management, and proprietary technology. Additionally, we believe we are well positioned with our cost savings initiatives to fuel investments and generate operating margin expansion. Our year to date results coupled with our growth plans reinforce our confidence in achieving the mid to high-end of our projected sales growth for 2024. Our business fundamentals are strong, and we expect to continue to deliver profitable growth and drive shareholder value.

“Overall, we remain confident in the sustained trajectory of our business, and in our ability to deliver on our 2024 outlook and long-term financial objectives. Our commitment is underpinned by our proven track record, our broad and advantaged global portfolio, our alignment with consumer trends, as well as our differentiated heat platform. We look forward to sharing the strategic roadmap and building blocks that support our long-term objectives at our upcoming Investor Day.

“Lastly, I want to express my appreciation to McCormick employees worldwide. They are the foundation of our success. Their dedication, continuous contributions, and execution in a dynamic environment continue to inspire me. As a leadership team, we are committed to continuing to enhance our people-centric culture and developing the next generation of leaders and capabilities that will drive our success well into the future.”

Third Quarter 2024 Results

McCormick reported sales in the third quarter that were comparable to the year-ago period, with minimal impact from currency. Sales include the impact of the Company’s strategic decision to divest a small canning business and reflect 1% volume growth driven by the Consumer segment, partially offset by pricing.

Gross profit margin expanded 170 basis points versus the third quarter of last year. This expansion was driven by favorable mix as well as cost savings led by the Company’s Comprehensive Continuous Improvement (CCI) program.

Operating income increased to $287 million in the third quarter of 2024 compared to $245 million in the third quarter of 2023. Excluding special charges, adjusted operating income was $288 million in the third quarter of 2024 compared to $251 million in the year-ago period. Adjusted operating income increased 15% from the year-ago period, driven primarily by gross margin expansion in addition to lower selling, general, and administrative expenses.

Income tax expense for the quarter included $16.3 million of net discrete tax benefits primarily associated with the resolution of a tax matter and deferred taxes related to state sales mix.

Earnings per share was $0.83 in the third quarter of 2024 compared to $0.63 in the year-ago period. Special charges lowered earnings per share $0.02 in the prior year period. Excluding these special charges, adjusted earnings per share was $0.83 in the third quarter of 2024 compared to $0.65 in the year-ago period. This increase was primarily attributable to the increase in operating profit, the impact of discrete tax benefits, and higher income from unconsolidated operations, driven by strong performance by the Company’s largest joint venture, McCormick de Mexico.

Net cash provided by operating activities through the third quarter of 2024 was $463 million compared to $660 million through the third quarter of 2023. The benefit from the increase in earnings year over year was more than offset by the impacts of cash used for working capital, higher incentive compensation payments, and the timing of income tax payments.

Fiscal Year 2024 Financial Outlook

McCormick’s 2024 outlook reflects the Company’s commitment to strengthen volume trends and prioritize investments to drive profitable results and return to differentiated volume-led growth as the year progresses. The Company’s CCI and GOE programs are fueling growth investments while also driving operating margin expansion. The Company expects the impact of foreign currency rates in 2024 to be minimal.

In 2024, McCormick expects sales to range between (1)% to 1% compared to 2023, with minimal impact from currency. The Company expects a favorable impact from the prior year’s pricing actions. Through the power of its brands and its targeted investments, the Company expects to improve volume trends as the year progresses. The Company’s strategic decisions in 2023 to discontinue low margin business and divest a small canning business will impact volume growth in 2024.

Operating income in 2024 is expected to grow by 9% to 11% from $963 million in 2023. The Company anticipates approximately $15 million of special charges in 2024 that relate to previous organizational and streamlining actions. Excluding the impact of special charges in 2024 and 2023, adjusted operating income is expected to increase 4% to 6%, with minimal impact from currency, driven by gross margin expansion partially offset by a significant increase in brand marketing investments.

McCormick projects 2024 earnings per share to be in the range of $2.81 to $2.86, compared to $2.52 of earnings per share in 2023. The Company expects special charges to lower earnings per share by $0.04 in 2024. Excluding these impacts in 2024 and 2023, the Company projects 2024 adjusted earnings per share to be in the range of $2.85 to $2.90, compared to $2.70 of adjusted earnings per share in 2023, which represents an expected increase of 5% to 7%, with minimal impact from currency. For fiscal 2024, the Company expects strong cash flow driven by profit and working capital initiatives and anticipates returning a significant portion of cash flow to shareholders through dividends.

Business Segment Results

Consumer Segment

|

(in millions) |

Three months ended |

Nine months ended |

||||||

|

8/31/2024 |

8/31/2023 |

8/31/2024 |

8/31/2023 |

|||||

|

Net sales |

$ 937.4 |

$ 937.1 |

$ 2,763.4 |

$ 2,758.7 |

||||

|

Operating income, excluding special charges |

186.8 |

173.3 |

512.4 |

500.3 |

||||

Consumer segment sales were comparable to the third quarter of 2023, with minimal currency impact, reflecting a 1% increase in volume growth fully offset by a 1% decrease from pricing. Volume growth in the Americas and the Europe, Middle East, and Africa (EMEA) regions was partially offset by volume declines in the Asia-Pacific region (APAC) principally attributable to the macro environment in China.

- Consumer sales in the Americas were comparable to the third quarter of 2023, reflecting a 1% increase from volume and product mix fully offset by a 1% decrease from pricing, with minimal impact from currency. Volume growth benefited from growth in the Company’s core categories.

- Consumer sales in EMEA increased 3% compared to the third quarter of 2023 with minimal impact from currency. A 4% increase from higher volume and product mix was partially offset by a 1% decline from price. In major markets, volume growth was broad based across product categories.

- Consumer sales in APAC decreased 1% in the third quarter of 2024 compared to the year-ago period. In constant currency, sales were comparable with a 1% volume decline fully offset by a 1% increase from pricing actions. The volume decline was driven by slower demand in China, related to the macro environment. Outside of China, sales growth was strong and primarily driven by volume and product mix.

Consumer segment operating income, excluding special charges, increased 8% in the third quarter of 2024 compared to the year-ago period with minimal impact from currency. The growth was due to lower selling, general, and administrative expenses.

Flavor Solutions Segment

|

(in millions) |

Three months ended |

Nine months ended |

||||||

|

8/31/2024 |

8/31/2023 |

8/31/2024 |

8/31/2023 |

|||||

|

Net sales |

$ 742.4 |

$ 747.6 |

$ 2,162.3 |

$ 2,150.7 |

||||

|

Operating income, excluding special charges |

101.6 |

77.8 |

249.6 |

212.6 |

||||

Flavor Solutions segment sales declined 1% from the third quarter of 2023. In constant currency, sales were comparable to the prior year period with a 1% increase from pricing fully offset by the impact of the Company’s strategic decision to divest its canning business.

- In the Americas, Flavor Solutions sales increased 2% as compared to the third quarter of 2023. In constant currency, sales increased 3%, reflecting a 1% increase from pricing and a 2% increase in volume and product mix driven by strong growth in branded foodservice and the timing of customer activities.

- The EMEA region’s Flavor Solutions sales declined 8% compared to the third quarter of 2023. In constant currency, sales decreased 9% including a 3% decline from the canning divestiture. The remainder of the decrease was primarily driven by a volume decline of 5% attributable to softness in quick service restaurant volumes.

- The APAC region’s Flavor Solutions sales declined 1% compared to the third quarter of 2023. In constant currency, sales were comparable with minimal impact from both pricing and volume and product mix.

Flavor Solutions segment operating income, excluding special charges, grew 31% in the third quarter of 2024 compared to the year-ago period, or 32% in constant currency driven by product mix, pricing and cost savings generated by our CCI program.

Non-GAAP Financial Measures

The following tables include financial measures of adjusted operating income, adjusted operating income margin, adjusted income tax expense, adjusted income tax rate, adjusted net income and adjusted diluted earnings per share. These represent non-GAAP financial measures, which are prepared as a complement to our financial results prepared in accordance with United States generally accepted accounting principles. These financial measures exclude the impact of special charges and the associated income tax effects, as applicable.

Special charges consist of expenses and income, as applicable, associated with certain actions undertaken by the Company to reduce fixed costs, simplify or improve processes, and improve our competitiveness, and are of such significance in terms of both up-front costs and organizational/structural impact to require advance approval by our Management Committee. Expenses associated with the approved actions are classified as special charges upon recognition and monitored on an on-going basis through completion.

We believe that these non-GAAP financial measures are important. The exclusion of the items noted above provides additional information that enables enhanced comparisons to prior periods and, accordingly, facilitates the development of future projections and earnings growth prospects. This information is also used by management to measure the profitability of our ongoing operations and analyze our business performance and trends.

These non-GAAP financial measures may be considered in addition to results prepared in accordance with GAAP, but they should not be considered a substitute for, or superior to, GAAP results. In addition, these non-GAAP financial measures may not be comparable to similarly titled measures of other companies because other companies may not calculate them in the same manner that we do. We intend to continue to provide these non-GAAP financial measures as part of our future earnings discussions and, therefore, the inclusion of these non-GAAP financial measures will provide consistency in our financial reporting. A reconciliation of these non-GAAP financial measures to the related GAAP financial measures is provided below:

|

(in millions except per share data) |

Three Months Ended |

Nine Months Ended |

|||||

|

8/31/2024 |

8/31/2023 |

8/31/2024 |

8/31/2023 |

||||

|

Operating income |

$ 286.5 |

$ 245.0 |

$ 754.1 |

$ 665.8 |

|||

|

Impact of special charges |

1.9 |

6.1 |

7.9 |

47.1 |

|||

|

Adjusted operating income |

$ 288.4 |

$ 251.1 |

$ 762.0 |

$ 712.9 |

|||

|

% increase versus year-ago period |

14.9 % |

6.9 % |

|||||

|

Operating income margin (1) |

17.1 % |

14.5 % |

15.3 % |

13.6 % |

|||

|

Impact of special charges |

0.1 % |

0.4 % |

0.2 % |

0.9 % |

|||

|

Adjusted operating income margin (1) |

17.2 % |

14.9 % |

15.5 % |

14.5 % |

|||

|

Income tax expense |

$ 41.0 |

$ 42.7 |

$ 116.8 |

$ 117.4 |

|||

|

Impact of special charges |

0.6 |

1.3 |

2.1 |

11.0 |

|||

|

Adjusted income tax expense |

$ 41.6 |

$ 44.0 |

$ 118.9 |

$ 128.4 |

|||

|

Income tax rate (2) |

16.7 % |

21.4 % |

18.4 % |

21.7 % |

|||

|

Impact of special charges |

0.1 % |

— % |

0.1 % |

0.1 % |

|||

|

Adjusted income tax rate (2) |

16.8 % |

21.4 % |

18.5 % |

21.8 % |

|||

|

Net income |

$ 223.1 |

$ 170.1 |

$ 573.3 |

$ 461.3 |

|||

|

Impact of special charges |

1.3 |

4.8 |

5.8 |

36.1 |

|||

|

Adjusted net income |

$ 224.4 |

$ 174.9 |

$ 579.1 |

$ 497.4 |

|||

|

% increase versus year-ago period |

28.3 % |

16.4 % |

|||||

|

Earnings per share – diluted |

$ 0.83 |

$ 0.63 |

$ 2.13 |

$ 1.71 |

|||

|

Impact of special charges |

— |

0.02 |

0.02 |

0.13 |

|||

|

Adjusted earnings per share – diluted |

$ 0.83 |

$ 0.65 |

$ 2.15 |

$ 1.84 |

|||

|

% increase versus year-ago period |

27.7 % |

16.8 % |

|||||

|

(1) |

Operating income margin, impact of special charges, and adjusted operating income margin are calculated as operating income, impact of special charges, and adjusted operating income as a percentage of net sales for each period presented. |

|

(2) |

Income tax rate is calculated as income tax expense as a percentage of income from consolidated operations before income taxes. Adjusted income tax rate is calculated as adjusted income tax expense as a percentage of income from consolidated operations before income taxes excluding special charges of $248.1 million and $205.5 million for the three months ended August 31, 2024, and 2023 respectively, and $642.0 million and $588.1 million for the nine months ended August 31, 2024 and 2023, respectively. |

Because we are a multi-national company, we are subject to variability of our reported U.S. dollar results due to changes in foreign currency exchange rates. Those changes have been volatile over the past several years. The exclusion of the effects of foreign currency exchange, or what we refer to as amounts expressed “on a constant currency basis”, is a non-GAAP measure. We believe that this non-GAAP measure provides additional information that enables enhanced comparison to prior periods excluding the translation effects of changes in rates of foreign currency exchange and provides additional insight into the underlying performance of our operations located outside of the U.S. It should be noted that our presentation herein of amounts and percentage changes on a constant currency basis does not exclude the impact of foreign currency transaction gains and losses (that is, the impact of transactions denominated in other than the local currency of any of our subsidiaries in their local currency reported results).

Percentage changes in sales and adjusted operating income expressed on a constant currency basis are presented excluding the impact of foreign currency exchange. To present this information for historical periods, current period results for entities reporting in currencies other than the U.S. dollar are translated into U.S. dollars at the average exchange rates in effect during the corresponding period of the comparative year, rather than at the actual average exchange rates in effect during the current fiscal year. As a result, the foreign currency impact is equal to the current year results in local currencies multiplied by the change in the average foreign currency exchange rate between the current fiscal period and the corresponding period of the comparative year. Rates of constant currency growth (decline) follow:

|

Three Months Ended August 31, 2024 |

|||||||

|

Percentage Change |

Impact of Foreign |

Percentage Change on |

|||||

|

Net sales |

|||||||

|

Consumer Segment |

|||||||

|

Americas |

(0.4) % |

(0.2) % |

(0.2) % |

||||

|

EMEA |

2.9 % |

0.3 % |

2.6 % |

||||

|

APAC |

(0.9) % |

(0.9) % |

— % |

||||

|

Total Consumer segment |

— % |

(0.2) % |

0.2 % |

||||

|

Flavor Solutions Segment |

|||||||

|

Americas |

1.8 % |

(0.8) % |

2.6 % |

||||

|

EMEA |

(8.4) % |

0.6 % |

(9.0) % |

||||

|

APAC |

(1.3) % |

(1.2) % |

(0.1) % |

||||

|

Total Flavor Solutions segment |

(0.7) % |

(0.5) % |

(0.2) % |

||||

|

Total net sales |

(0.3) % |

(0.4) % |

0.1 % |

||||

|

Adjusted operating income |

|||||||

|

Consumer segment |

7.8 % |

(0.3) % |

8.1 % |

||||

|

Flavor Solutions segment |

30.6 % |

(1.4) % |

32.0 % |

||||

|

Total adjusted operating income |

14.9 % |

(0.7) % |

15.6 % |

||||

|

Nine Months Ended August 31, 2024 |

|||||||

|

Percentage Change |

Impact of Foreign |

Percentage Change on |

|||||

|

Net sales |

|||||||

|

Consumer Segment |

|||||||

|

Americas |

(0.7) % |

(0.1) % |

(0.6) % |

||||

|

EMEA |

7.1 % |

2.2 % |

4.9 % |

||||

|

APAC |

(4.6) % |

(2.3) % |

(2.3) % |

||||

|

Total Consumer segment |

0.2 % |

— % |

0.2 % |

||||

|

Flavor Solutions Segment |

|||||||

|

Americas |

2.0 % |

0.4 % |

1.6 % |

||||

|

EMEA |

(5.0) % |

1.4 % |

(6.4) % |

||||

|

APAC |

1.9 % |

(2.8) % |

4.7 % |

||||

|

Total Flavor Solutions segment |

0.5 % |

0.3 % |

0.2 % |

||||

|

Total net sales |

0.3 % |

0.2 % |

0.1 % |

||||

|

Adjusted operating income |

|||||||

|

Consumer segment |

2.4 % |

(0.1) % |

2.5 % |

||||

|

Flavor Solutions segment |

17.4 % |

— % |

17.4 % |

||||

|

Total adjusted operating income |

6.9 % |

(0.1) % |

7.0 % |

||||

To present “constant currency” information for the fiscal year 2024 projection, projected sales and adjusted operating income for entities reporting in currencies other than the U.S. dollar are translated into U.S. dollars at the Company’s budgeted exchange rates for 2024 and are compared to the 2023 results, translated into U.S. dollars using the same 2024 budgeted exchange rates, rather than at the average actual exchange rates in effect during fiscal year 2023.

The following provides a reconciliation of our estimated earnings per share to adjusted earnings per share for 2024 and actual results for 2023:

|

Year Ended |

|||

|

2024 Projection |

11/30/23 |

||

|

Earnings per share – diluted |

$2.81 to $2.86 |

$ 2.52 |

|

|

Impact of special charges |

0.04 |

0.18 |

|

|

Adjusted earnings per share – diluted |

$2.85 to $2.90 |

$ 2.70 |

|

Live Webcast

As previously announced, McCormick will hold a conference call with analysts today at 8:00 a.m. ET. The conference call will be webcast live via the McCormick website. Go to ir.mccormick.com and follow directions to listen to the call and access the accompanying presentation materials. At this same location, a replay of the call will be available following the live call. Past press releases and additional information can be found at this address.

Forward-Looking Information

Certain statements contained in this release, including statements concerning expected performance such as those relating to net sales, gross margin, earnings, cost savings, special charges, acquisitions, brand marketing support, volume and product mix, income tax expense, and the impact of foreign currency rates are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These statements may be identified by the use of words such as “may,” “will,” “expect,” “should,” “anticipate,” “intend,” “believe” and “plan” and similar expressions. These statements may relate to: general economic and industry conditions, including consumer spending rates, interest rates, and availability of capital; expectations regarding sales growth potential in various geographies and markets, including the impact from brand marketing support, product innovation, and customer, channel, category, heat platform and e-commerce expansion; expected trends in net sales and earnings performance and other financial measures; the expected impact of pricing actions on the Company’s results of operations, including our sales volume and mix as well as gross margins; the expected impact of the inflationary cost environment on our business; the expected impact of factors affecting our supply chain, including the availability and prices of commodities and other supply chain resources including raw materials, packaging, labor, energy, and transportation; the expected impact of productivity improvements, and cost savings, including those associated with our CCI and GOE programs and Global Business Services operating model initiative; the ability to identify, attract, hire, retain and develop qualified personnel and develop the next generation of leaders; the impact of the ongoing conflicts between Russia and Ukraine, Israel and Hamas, and in the Red Sea, including the potential for broader economic disruption; expected working capital improvements; the expected timing and costs of implementing our business transformation initiative, which includes the implementation of a global enterprise resource planning (ERP) system; the expected impact of accounting pronouncements; the expectations of pension and postretirement plan contributions and anticipated charges associated with those plans; the holding period and market risks associated with financial instruments; the impact of foreign exchange fluctuations; the adequacy of internally generated funds and existing sources of liquidity, such as the availability of bank financing; the anticipated sufficiency of future cash flows to enable the payments of interest and repayment of short- and long-term debt, working capital needs, planned capital expenditures, quarterly dividends and our ability to obtain additional short- and long-term financing or issue additional debt securities; and expectations regarding purchasing shares of McCormick’s common stock under the existing repurchase authorization.

These and other forward-looking statements are based on management’s current views and assumptions and involve risks and uncertainties that could significantly affect expected results. Results may be materially affected by factors such as: the Company’s ability to drive revenue growth; the Company’s ability to increase pricing to offset, or partially offset, inflationary pressures on the cost of our products; damage to the Company’s reputation or brand name; loss of brand relevance; increased private label use; the Company’s ability to drive productivity improvements, including those related to our CCI program and streamlining actions, including our GOE program; product quality, labeling, or safety concerns; negative publicity about our products; actions by, and the financial condition of, competitors and customers; the longevity of mutually beneficial relationships with our large customers; the ability to identify, interpret and react to changes in consumer preference and demand; business interruptions due to natural disasters, unexpected events or public health crises; issues affecting the Company’s supply chain and procurement of raw materials, including fluctuations in the cost and availability of raw and packaging materials; labor shortage, turnover and labor cost increases; the impact of the ongoing conflicts between Russia and Ukraine, Israel and Hamas, and in the Red Sea, including the potential for broader economic disruption; government regulation, and changes in legal and regulatory requirements and enforcement practices; the lack of successful acquisition and integration of new businesses; global economic and financial conditions generally, availability of financing, interest and inflation rates, and the imposition of tariffs, quotas, trade barriers and other similar restrictions; foreign currency fluctuations; the effects of our amount of outstanding indebtedness and related level of debt service as well as the effects that such debt service may have on the Company’s ability to borrow or the cost of any such additional borrowing, our credit rating, and our ability to react to certain economic and industry conditions; impairments of indefinite-lived intangible assets; assumptions we have made regarding the investment return on retirement plan assets, and the costs associated with pension obligations; the stability of credit and capital markets; risks associated with the Company’s information technology systems, including the threat of data breaches and cyber-attacks; the Company’s inability to successfully implement our business transformation initiative; fundamental changes in tax laws; including interpretations and assumptions we have made, and guidance that may be issued, and volatility in our effective tax rate; climate change; Environmental, Social and Governance (ESG) matters; infringement of intellectual property rights, and those of customers; litigation, legal and administrative proceedings; the Company’s inability to achieve expected and/or needed cost savings or margin improvements; negative employee relations; and other risks described in the Company’s filings with the Securities and Exchange Commission.

Actual results could differ materially from those projected in the forward-looking statements. The Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

About McCormick

McCormick & Company, Incorporated is a global leader in flavor. With over $6.5 billion in annual sales across 150 countries and territories, we manufacture, market, and distribute herbs, spices, seasonings, condiments and flavors to the entire food and beverage industry including retailers, food manufacturers and foodservice businesses. Our most popular brands with trademark registrations include McCormick, French’s, Frank’s RedHot, Stubb’s, OLD BAY, Lawry’s, Zatarain’s, Ducros, Vahiné, Cholula, Schwartz, Kamis, DaQiao, Club House, Aeroplane, Gourmet Garden, FONA and Giotti. The breadth and reach of our portfolio uniquely position us to capitalize on the consumer demand for flavor in every sip and bite, through our products and our customers’ products. We operate in two segments, Consumer and Flavor Solutions, which complement each other and reinforce our differentiation. The scale, insights, and technology that we leverage from both segments are meaningful in driving sustainable growth.

Founded in 1889 and headquartered in Hunt Valley, Maryland USA, McCormick is guided by our principles and committed to our Purpose – To Stand Together for the Future of Flavor. McCormick envisions A World United by Flavor where healthy, sustainable, and delicious go hand in hand.

To learn more, visit www.mccormickcorporation.com or follow McCormick & Company on Instagram and LinkedIn.

For information contact:

Investor Relations:

Faten Freiha – faten_freiha@mccormick.com

Global Communications:

Lori Robinson – lori_robinson@mccormick.com

(Financial tables follow)

|

Third Quarter Report |

McCormick & Company, Incorporated |

|||||||

|

Consolidated Income Statement (Unaudited) |

||||||||

|

(In millions except per-share data) |

||||||||

|

Three months ended |

Nine months ended |

|||||||

|

August 31, |

August 31, |

August 31, |

August 31, |

|||||

|

Net sales |

$ 1,679.8 |

$ 1,684.7 |

$ 4,925.7 |

$ 4,909.4 |

||||

|

Cost of goods sold |

1,029.9 |

1,061.9 |

3,056.9 |

3,108.2 |

||||

|

Gross profit |

649.9 |

622.8 |

1,868.8 |

1,801.2 |

||||

|

Gross profit margin |

38.7 % |

37.0 % |

37.9 % |

36.7 % |

||||

|

Selling, general and administrative expense |

361.5 |

371.7 |

1,106.8 |

1,088.3 |

||||

|

Special charges |

1.9 |

6.1 |

7.9 |

47.1 |

||||

|

Operating income |

286.5 |

245.0 |

754.1 |

665.8 |

||||

|

Interest expense |

53.5 |

52.7 |

156.7 |

155.5 |

||||

|

Other income, net |

13.2 |

7.1 |

36.7 |

30.7 |

||||

|

Income from consolidated operations before income taxes |

246.2 |

199.4 |

634.1 |

541.0 |

||||

|

Income tax expense |

41.0 |

42.7 |

116.8 |

117.4 |

||||

|

Net income from consolidated operations |

205.2 |

156.7 |

517.3 |

423.6 |

||||

|

Income from unconsolidated operations |

17.9 |

13.4 |

56.0 |

37.7 |

||||

|

Net income |

$ 223.1 |

$ 170.1 |

$ 573.3 |

$ 461.3 |

||||

|

Earnings per share – basic |

$ 0.83 |

$ 0.63 |

$ 2.13 |

$ 1.72 |

||||

|

Earnings per share – diluted |

$ 0.83 |

$ 0.63 |

$ 2.13 |

$ 1.71 |

||||

|

Average shares outstanding – basic |

268.6 |

268.4 |

268.5 |

$ 268.4 |

||||

|

Average shares outstanding – diluted |

269.7 |

270.1 |

269.6 |

269.8 |

||||

|

Third Quarter Report |

McCormick & Company, Incorporated |

|||

|

Consolidated Balance Sheet (Unaudited) |

||||

|

(In millions) |

||||

|

August 31, 2024 |

November 30, 2023 |

|||

|

Assets |

||||

|

Cash and cash equivalents |

$ 200.8 |

$ 166.6 |

||

|

Trade accounts receivable, net |

660.9 |

587.5 |

||

|

Inventories |

1,242.6 |

1,126.5 |

||

|

Prepaid expenses and other current assets |

140.0 |

121.0 |

||

|

Total current assets |

2,244.3 |

2,001.6 |

||

|

Property, plant and equipment, net |

1,399.5 |

1,324.7 |

||

|

Goodwill |

5,277.7 |

5,260.1 |

||

|

Intangible assets, net |

3,332.7 |

3,356.7 |

||

|

Other long-term assets |

950.7 |

919.2 |

||

|

Total assets |

$ 13,204.9 |

$ 12,862.3 |

||

|

Liabilities |

||||

|

Short-term borrowings and current portion of long-term debt |

$ 1,244.9 |

$ 1,071.5 |

||

|

Trade accounts payable |

1,227.8 |

1,119.3 |

||

|

Other accrued liabilities |

671.6 |

908.1 |

||

|

Total current liabilities |

3,144.3 |

3,098.9 |

||

|

Long-term debt |

3,343.1 |

3,339.9 |

||

|

Deferred taxes |

836.2 |

861.2 |

||

|

Other long-term liabilities |

430.3 |

478.8 |

||

|

Total liabilities |

7,753.9 |

7,778.8 |

||

|

Shareholders’ equity |

||||

|

Common stock |

2,234.7 |

2,199.6 |

||

|

Retained earnings |

3,577.2 |

3,249.7 |

||

|

Accumulated other comprehensive loss |

(390.4) |

(388.6) |

||

|

Total McCormick shareholders’ equity |

5,421.5 |

5,060.7 |

||

|

Non-controlling interests |

29.5 |

22.8 |

||

|

Total shareholders’ equity |

5,451.0 |

5,083.5 |

||

|

Total liabilities and shareholders’ equity |

$ 13,204.9 |

$ 12,862.3 |

||

|

Third Quarter Report |

McCormick & Company, Incorporated |

|||

|

Consolidated Cash Flow Statement (Unaudited) |

||||

|

(In millions) |

||||

|

Nine Months Ended |

||||

|

August 31, 2024 |

August 31, 2023 |

|||

|

Operating activities |

||||

|

Net income |

$ 573.3 |

$ 461.3 |

||

|

Adjustments to reconcile net income to net cash provided by operating activities: |

||||

|

Depreciation and amortization |

157.5 |

150.4 |

||

|

Stock-based compensation |

39.9 |

51.1 |

||

|

Deferred income tax expense (benefit) |

(37.2) |

1.7 |

||

|

Income from unconsolidated operations |

(56.0) |

(37.7) |

||

|

Changes in operating assets and liabilities |

||||

|

Trade accounts receivable |

(72.2) |

(22.9) |

||

|

Inventories |

(108.9) |

139.7 |

||

|

Trade accounts payable |

112.3 |

(90.4) |

||

|

Other assets and liabilities |

(202.1) |

(43.6) |

||

|

Dividends from unconsolidated affiliates |

56.6 |

50.5 |

||

|

Net cash flow provided by operating activities |

463.2 |

660.1 |

||

|

Investing activities |

||||

|

Capital expenditures (including software) |

(189.3) |

(187.2) |

||

|

Other investing activities |

0.2 |

2.4 |

||

|

Net cash flow used in investing activities |

(189.1) |

(184.8) |

||

|

Financing activities |

||||

|

Short-term borrowings, net |

908.6 |

(850.0) |

||

|

Long-term debt borrowings |

— |

496.4 |

||

|

Payment of debt issuance costs |

— |

(1.1) |

||

|

Long-term debt repayments |

(752.8) |

(12.7) |

||

|

Proceeds from exercised stock options |

12.8 |

15.9 |

||

|

Taxes withheld and paid on employee stock awards |

(8.9) |

(10.8) |

||

|

Common stock acquired by purchase |

(29.0) |

(26.7) |

||

|

Dividends paid |

(338.3) |

(313.8) |

||

|

Other financing activities |

1.7 |

1.6 |

||

|

Net cash flow used in financing activities |

(205.9) |

(701.2) |

||

|

Effect of exchange rate changes on cash and cash equivalents |

(34.0) |

46.6 |

||

|

Decrease in cash and cash equivalents |

34.2 |

(179.3) |

||

|

Cash and cash equivalents at beginning of period |

166.6 |

334.0 |

||

|

Cash and cash equivalents at end of period |

$ 200.8 |

$ 154.7 |

||

![]() View original content:https://www.prnewswire.com/news-releases/mccormick-reports-third-quarter-performance-and-reaffirms-2024-outlook-302263799.html

View original content:https://www.prnewswire.com/news-releases/mccormick-reports-third-quarter-performance-and-reaffirms-2024-outlook-302263799.html

SOURCE McCormick & Company, Incorporated

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Up 90% and Still Running: On Holding Stock's Remarkable Climb

While footwear manufacturers like Nike Inc. NKE, Crocs Inc. CROX, and Skechers U.S.A. Inc. SKX stocks took hits with contracting sales due to weaker consumer spending, ON Holdings AG ONON has been quietly making new highs trading up nearly 90% year-to-date (YTD). This consumer discretionary sector company’s sneakers have an elastic demand appeal with runners.

On Holding’s CloudTec Technology

From Deckers Outdoor Co. DECK Hoka’s “Active Foot Frame” and “MetaRocker” technology to Nike’s “Tensil Air” and “ReactX” technology with carbon fiber plates and ZoomX foam, it seems every sneaker manufacturer has some proprietary technology that makes their shoes special.

On Holding’s CloudTec technology is meant to make runners feel like they’re walking on clouds. It’s a Swiss-engineered cushioning technology comprised of cylindrical cloud parts located on the shoe’s outsole that compress vertically and horizontally to absorb impact, providing a soft landing with each step.

It also has a rebounding effect that builds a propulsive force to propel the runner forward. It converts the kinetic energy generated by each landing into a powerful takeoff.

Unveiling LightSpray Technology

On Holding unveiled its LightSpray technology during the 2024 Paris Olympics. It’s a revolutionary manufacturing process that takes three minutes to make each shoe. They are spray-on shoes. It uses a robotic arm that applies liquid polymer material onto an upper shoe mold, instantly solidifying on contact and creating a completely customized upper weight of only 30 grams with 75% less carbon emission. The technology eliminates seams, laces, tongue, and heel caps to improve comfort, reduce irritation, and create a shoe that weighs virtually nothing. Hellen Obiri wore LightSpray On shoes to win her second Boston Marathon in 2024.

Not Inventory Glut, But Inventory Shortage

Apparently, runners can’t get enough, as On Holding has had to deal with inventory shortages, not inventory surpluses and glutes experienced by competitors. This also keeps On Holding’s merchandise selling at full price, from $140 to $190 per pair of shoes, with very few promotions, which contributes to its margins.

Double-Digit Sales Growth in All Channels

On Holding reported its second quarter 2024 EPS of 16 cents, missing analyst estimates by 1 penny. Gross profit margin rose 40 bps to a hefty 59.95%, driven by full-price sales and lower freight costs. Revenue climbed an impressive 27.8% YoY to 635.2 million, beating analyst estimates of $628.52 million. Sales rose double-digits across all channels. Direct-to-consumer (DTC) sales rose 28.1% YoY. Wholesale revenue rose 27.6% YoY. Sales for the Americas rose 26.7% YoY. Asia Pacific sales rose 24.8% YoY.

Reiterating Double-Digit Guidance

On Holding reiterates its full-year expectations of at least 30% YoY net sales growth, 60% gross operating profit margin, and an adjusted EBITDA margin of 16% to 16.5% in constant currency. The focus will be on On’s U.S. warehouse automation to scale its distribution capabilities in the United States to meet the outsized demand.

On Holding CEO and Co-Founder David Allemann commented, “As mentioned, the strong brand momentum converts into strong demand for On across all our channels and partners. The ability to convert this momentum to sales, especially in the Americas region, would have been even higher. Still, the ongoing transition of our Atlanta warehouse led to some product availability constraints, including key franchises like the Cloud and delayed or missing deliveries both toward our D2C and wholesale customers.”

ONON Stock Sets Up an Ascending Triangle

An ascending triangle is a bullish pattern comprised of a flat-top upper trendline resistance converging with an ascending lower trendline support at the apex point. The breakout occurs when the stock surges through the upper trendline resistance.

ONON formed a flat-top upper trendline resistance at $52.06. The rising lower trendline support formed from higher lows on pullbacks. The ascending triangle breakout triggers above $52.06. The daily anchored VWAP support is at $47.09. The daily relative strength index (RSI) is flat around the 66-band. Fibonacci (Fib) pullback support levels are at $47.90, $43.47, $40.58, and $37.50.

On Holding’s average consensus price target is $47.95, and its highest analyst price target is $60.00. Analysts have given it 18 Buy ratings and five Hold ratings.

Actionable Options Strategies: Bullish investors can buy on pullbacks using cash-secured puts at the fib pullback support levels to buy the dip and write covered calls to execute a wheel strategy for income.

Bullish options investors can take a bullish call debit spread for less capital than owning the stock while minimizing the downside with capped upside gains.

The article “Up 90% and Still Running: On Holding Stock’s Remarkable Climb” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

15 Best Dividend Stocks for Lifelong Passive Income

Dividend stocks offer a path to steady passive income, but not all are created equal. The key to long-term success lies in dividend sustainability, not just high current yields.

The payout ratio serves as a critical tool for assessing sustainability. This metric, representing the percentage of earnings distributed as dividends, reveals a company’s ability to maintain and grow its dividend. A conservative ratio below 50% typically signals strength and room for growth, while ratios above 75% can indicate that a dividend is at risk.

Context matters when evaluating payout ratios. Pharmaceutical companies often exhibit exceptionally high ratios because of their cyclical nature. Real Estate Investment Trusts (REITs) must distribute 90% of taxable income as dividends, naturally elevating their ratios.

Armed with this primer, the following 15 dividend stocks emerge as some of the best plays for passive income. Their yields, payout ratios, and other key factors signal the potential for sustainable returns over the long haul. Here’s a nuts-and-bolts overview of these top-tier dividend payers.

Dividend powerhouses

Johnson & Johnson (NYSE: JNJ) and Coca-Cola (NYSE: KO) stand out thanks to their decades of consistent increases in their dividend programs. J&J offers a 3.07% yield and a 72.70% payout ratio. The company’s diverse healthcare portfolio also provides stability and above-average growth potential.

Coca-Cola stock pays a 2.7% yield with a 76.80% payout ratio. Its iconic brand and global distribution network create a wide economic moat, an important buffer against potential dividend cuts.

Retail giants

Target (NYSE: TGT) and Lowe’s (NYSE: LOW) represent strong retail dividend options. Target pays a decent 2.89% yield with a conservative 45.50% payout ratio. The company’s omnichannel strategy and exclusive brands drive customer loyalty.

Lowe’s, for its part, offers a 1.72% yield and a highly conservative 36.7% payout ratio. Its entrenched position in the home improvement market provides consistent cash flow and ample growth opportunities.

Consumer staples leaders

PepsiCo (NASDAQ: PEP) and Costco (NASDAQ: COST) offer stability in the consumer staples sector. PepsiCo stock yields 3.19% with a 74.50% payout ratio. Its diverse snack and beverage portfolio provides resilience during economic downturns and shocks.

Costco’s 0.52% yield and 26.30% payout ratio may seem low, but the company’s consistent dividend growth and special dividends enhance shareholder returns. To wit, Costco’s stock has trounced the benchmark S&P 500 over the prior 10-year period (more on this below).

Pharmaceutical giants

AbbVie (NYSE: ABBV) and Pfizer (NYSE: PFE) illustrate the pharmaceutical industry’s distinctive dividend landscape. AbbVie’s 3.18% yield and 202% payout ratio reflect its post-Humira transition, with newer immunology drugs gaining traction to support its substantial dividend.

Pfizer, offering a 5.78% yield and a 443% payout ratio, exemplifies the industry’s cyclical nature. Despite current challenges, Pfizer’s history of dividend growth and shareholder commitment suggests its high yield will persist through this trough period.

Financial services innovators

Visa (NYSE: V) and S&P Global (NYSE: SPGI) represent financial services stocks with significant room for dividend growth. Visa’s 0.76% yield and 21.50% payout ratio reflect its focus on reinvestment for expansion in an age defined by an ongoing shift to digital payments.

S&P Global offers a 0.71% yield and 34.3% payout ratio. The company is a leader in credit ratings, benchmarks, and analytics. Thanks to its wide moat in most of these areas, S&P Global has been able to boost its payouts for 51 consecutive years.

Dividend yield leaders

Altria (NYSE: MO) and AT&T (NYSE: T) stand out with their impressive yields. Altria boasts a 7.99% yield and a 67.50% payout ratio. Despite declining smoking rates, the tobacco giant has historically offset volume drops with price hikes, suggesting dividend stability for now.

AT&T offers a 5.07% yield with a 63.70% payout ratio. Following a strategic restructuring, the telecom company has strengthened its core business. While AT&T’s stock has rallied this year, it remains attractively valued at 9.6 times forward earnings, potentially cushioning against economic headwinds.

Industrial and real estate options

Grainger (NYSE: GWW) and Realty Income (NYSE: O) stand out in the industrial and real estate arenas. Grainger’s 0.79% yield and 20.9% payout ratio reflect its focus on impressive growth in the areas of maintenance, repair, and operations. Realty Income offers a 5.04% yield with a 285.9% payout ratio. Its triple-net lease model provides a stable income for shareholders.

International exposure

Philip Morris International (NYSE: PM) brings international exposure to this dividend portfolio, offering a 4.48% yield and 92% payout ratio. Its worldwide tobacco and reduced-risk product lineup provides steady growth prospects and stability for income-focused investors.

Despite the elevated payout ratio, Philip Morris has consistently increased its dividend annually since its 2008 spinoff, with an impressive 7% compound annual growth rate. This track record suggests the tobacco giant’s substantial dividend remains dependable for the foreseeable future.

Performance comparison

Over the past decade, many of these dividend stalwarts have outperformed the S&P 500. Visa, S&P Global, and Costco have delivered particularly strong total returns:

However, some high-yield options like AT&T have lagged the broader market, highlighting the importance of focusing on dividend growth potential rather than current yield alone.

Key takeaways

This diverse group of 15 dividend stocks offers investors a range of options for building a portfolio focused on lifelong passive income. By prioritizing sustainable payouts, consistent growth, and strong competitive positions, these companies provide a solid foundation for long-term wealth accumulation through dividends.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 773% — a market-crushing outperformance compared to 168% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now…

*Stock Advisor returns as of September 23, 2024

George Budwell has positions in AT&T, AbbVie, Costco Wholesale, PepsiCo, Pfizer, Philip Morris International, Realty Income, Target, and Visa. The Motley Fool has positions in and recommends AbbVie, Costco Wholesale, Pfizer, Realty Income, S&P Global, Target, and Visa. The Motley Fool recommends Johnson & Johnson, Lowe’s Companies, and Philip Morris International. The Motley Fool has a disclosure policy.

15 Best Dividend Stocks for Lifelong Passive Income was originally published by The Motley Fool

Acuity Brands Reports Fiscal 2024 Fourth-Quarter and Full-Year Results

- Increased Fiscal Q4 2024 Net Sales 2% to $1.03B Compared to the Prior Year

- Reported Fiscal Q4 2024 Diluted EPS of $3.77, up 43% Over the Prior Year; Adjusted Diluted EPS of $4.30, up 8% Over the Prior Year

- Delivered Fiscal 2024 Net Sales of $3.8B, a 3% Decline Compared to the Prior Year

- Reported Fiscal 2024 Diluted EPS of $13.44, up 25% Over the Prior Year; Adjusted Diluted EPS of $15.56, up 11% Over the Prior Year

- Generated $619M in Cash Flow from Operations in Fiscal 2024, up 7% Over the Prior Year

ATLANTA, Oct. 01, 2024 (GLOBE NEWSWIRE) — Acuity Brands, Inc. AYI (the “Company”), a market-leading industrial technology company, announced net sales of $1.03 billion in the fourth quarter of fiscal 2024 ended August 31, 2024, an increase of $21.9 million, or 2.2 percent, compared to the prior year.

“Our fiscal 2024 fourth quarter performance was strong. We grew net sales in both Lighting and Spaces, delivered margin expansion and increased earnings per share,” stated Neil Ashe, Chairman, President and Chief Executive Officer of Acuity Brands, Inc. “Fiscal 2024 was a successful year of improved operating performance that delivered increased end-user satisfaction and financial results.”

Operating profit was $157.0 million in the fourth quarter of fiscal 2024, an increase of $47.3 million, compared to the prior year. Operating profit as a percent of net sales was 15.2 percent in the fourth quarter of fiscal 2024, an increase of approximately 430 basis points compared to the prior year. Adjusted operating profit was $178.5 million in the fourth quarter of fiscal 2024, an increase of $16.2 million compared to the prior year. Adjusted operating profit as a percent of net sales was 17.3 percent in the fourth quarter of fiscal 2024, an increase of approximately 120 basis points compared to the prior year.

Diluted earnings per share was $3.77 in the fourth quarter of fiscal 2024, an increase of $1.14, or 43.3 percent, compared to the prior year. Adjusted diluted earnings per share was $4.30 in the fourth quarter of fiscal 2024, an increase of $0.33, or 8.3 percent from $3.97 in the prior year.

Full-Year 2024 Summary

Net sales of $3.84 billion for the full year of fiscal 2024 decreased $111.2 million, or 2.8 percent, from $3.95 billion in the full year of fiscal 2023.

Operating profit was $553.3 million for the full year of fiscal 2024, an increase of $79.9 million compared to the prior year. Operating profit as a percent of net sales was 14.4 percent for the full year of fiscal 2024, an increase of approximately 240 basis points compared to the prior year. Adjusted operating profit was $639.6 million for the full year of fiscal 2024, an increase of $42.2 million compared to the prior year. Adjusted operating profit as a percent of net sales was 16.7 percent for the full year of fiscal 2024, an increase of approximately 160 basis points compared to the prior year.

Diluted earnings per share was $13.44 for the full year of fiscal 2024, an increase of $2.68 or 24.9 percent, compared to the prior year. Adjusted diluted earnings per share was $15.56, an increase of $1.51, or 10.7 percent, from $14.05 in the prior year.

Segment Performance

Acuity Brands Lighting and Lighting Controls (“ABL”)

Fourth-Quarter Results

ABL generated net sales of $955.0 million in the fourth quarter of fiscal 2024, an increase of $10.8 million, or 1.1 percent, compared to the prior year.

ABL operating profit was $161.5 million in the fourth quarter of fiscal 2024, an increase of $43.7 million compared to the prior year. ABL operating profit as a percent of ABL net sales was 16.9 percent in the fourth quarter of fiscal 2024, an increase of approximately 440 basis points compared to the prior year. ABL adjusted operating profit was $171.9 million in the fourth quarter of fiscal 2024, an increase of $13.2 million compared to the prior year. ABL adjusted operating profit as a percent of ABL net sales was 18.0 percent in the fourth quarter of fiscal 2024, an increase of approximately 120 basis points compared to the prior year.

Full-Year Results

ABL generated net sales of $3.6 billion for the full year of fiscal 2024, a decrease of $149.4 million, or 4.0 percent, as compared to the prior year.

ABL operating profit was $582.8 million for the full year of fiscal 2024, an increase of $73.3 million, or 14.4 percent, compared to the prior year. ABL operating profit as a percent of ABL net sales was 16.3 percent for the full year of fiscal 2024, an increase of approximately 260 basis points compared to the prior year. ABL adjusted operating profit was $624.2 million for the full year of fiscal 2024, an increase of $33.7 million, or 5.7 percent, from the same period of fiscal 2024. ABL adjusted operating profit as a percent of ABL net sales was 17.5 percent for the full year of fiscal 2024, an increase of approximately 160 basis points compared to the prior year.

Intelligent Spaces Group (“ISG”)

Fourth-Quarter Results

ISG generated net sales of $83.9 million in the fourth quarter of fiscal 2024, an increase of $12.0 million, or 16.7 percent, compared to the prior year.

ISG operating profit was $16.7 million in the fourth quarter of fiscal 2024, an increase of $7.3 million compared to the prior year. ISG operating profit as a percent of ISG net sales was 19.9 percent in the fourth quarter of fiscal 2024. ISG adjusted operating profit was $21.5 million in the fourth quarter of fiscal 2024, an increase of $7.3 million compared to the prior year. ISG adjusted operating profit as a percent of ISG net sales was 25.6 percent in the fourth quarter of fiscal 2024.

Full-Year Results

ISG generated net sales of $291.9 million for the full year of fiscal 2024, an increase of $39.2 million, or 15.5 percent, as compared to the prior year.

ISG operating profit was $43.6 million for the full year of fiscal 2024, an increase of $11.5 million compared to the prior year. ISG operating profit as a percent of ISG net sales was 14.9 percent for the full year of fiscal 2024. ISG adjusted operating profit was $63.4 million for the full year of fiscal 2024, an increase of $13.3 million as compared to the prior year. ISG adjusted operating profit as a percent of ISG net sales was 21.7 percent for the full year of fiscal 2024.

Cash Flow and Capital Allocation

Net cash from operating activities was $619.2 million for the full year of fiscal 2024, an increase of $41.1 million compared to the prior year.

During fiscal 2024, the Company repurchased approximately 454,000 shares of common stock for a total of approximately $89 million.

Form 10-K Filing

The independent registered public accounting firm’s audit report with respect to the Company’s fiscal year-end financial statements will not be issued until the Company files its annual report on Form 10-K, including its evaluation of the effectiveness of internal controls over financial reporting. Accordingly, the financial results reported in this earnings release are preliminary pending completion of the audit.

Today’s Call Details

The Company will host a conference call at 8:00 a.m. (ET) today, Tuesday, October 1, 2024. Neil Ashe, Chairman, President and Chief Executive Officer of Acuity Brands, Inc. will lead the call. The conference call and earnings release can be accessed via the Investor Relations section of the Company’s website at www.investors.acuitybrands.com. A replay of the call will also be posted to the Investor Relations website within two hours of the completion of the conference call and will be available on the website for a limited time.

About Acuity Brands

Acuity Brands, Inc. AYI is a market-leading industrial technology company. We use technology to solve problems in spaces, light, and more things to come. Through our two business segments, Acuity Brands Lighting and Lighting Controls (ABL) and the Intelligent Spaces Group (ISG), we design, manufacture, and bring to market products and services that make a valuable difference in people’s lives.

We achieve growth through the development of innovative new products and services, including lighting, lighting controls, building management solutions, and location-aware applications. We achieve customer-focused efficiencies that allow us to increase market share and deliver superior returns. We look to aggressively deploy capital to grow the business and to enter attractive new verticals.

Acuity Brands, Inc. is based in Atlanta, Georgia, with operations across North America, Europe, and Asia. The Company is powered by more than 12,000 dedicated and talented associates. Visit us at www.acuitybrands.com.

Non-GAAP Financial Measures

This news release includes the following non-generally accepted accounting principles (“GAAP”) financial measures: “adjusted gross profit”, and “adjusted gross profit margin” for total company; “adjusted operating profit” and “adjusted operating profit margin” for total company and by segment; “adjusted net income;” “adjusted diluted EPS;” “earnings before interest, taxes, depreciation, and amortization (“EBITDA”);” “EBITDA margin;” “adjusted EBITDA;” and “adjusted EBITDA margin”. These non-GAAP financial measures are provided to enhance the reader’s overall understanding of the Company’s current financial performance and prospects for the future. Specifically, management believes that these non-GAAP measures provide useful information to investors by excluding or adjusting items for amortization of acquired intangible assets, share-based payment expense, supplier recovery charge, loss on sale of business, and special charges associated with continued efforts to streamline the organization and integrate recent acquisitions.

We also provide “free cash flow” (“FCF”) to enhance the reader’s understanding of the Company’s ability to generate additional cash from its business.

Management typically adjusts for these items for internal reviews of performance and uses the above non-GAAP measures for baseline comparative operational analysis, decision making, and other activities. Management believes these non-GAAP measures provide greater comparability and enhanced visibility into the Company’s results of operations as well as comparability with many of its peers, especially those companies focused more on technology and software. Non-GAAP financial measures included in this news release should be considered in addition to, and not as a substitute for or superior to, results prepared in accordance with GAAP.

The most directly comparable GAAP measures for adjusted gross profit and adjusted gross profit margin for total company are “gross profit” and “gross profit margin,” respectively, which include the impact of supplier recovery charge. Adjusted gross profit margin is adjusted gross profit divided by net sales for total company. The most directly comparable GAAP measures for adjusted operating profit and adjusted operating profit margin for total company and by segment are “operating profit” and “operating profit margin,” respectively, which include the impact of amortization of acquired intangible assets, share-based payment expense, supplier recovery charge, impairment of investments, and special charges. Adjusted operating profit margin is adjusted operating profit divided by net sales for total company and by segment. The most directly comparable GAAP measures for adjusted net income and adjusted diluted EPS are “net income” and “diluted EPS,” respectively, which include the impact of amortization of acquired intangible assets, loss on sale of business, share-based payment expense, impairments of investment, supplier recovery charge and special charges. Adjusted diluted EPS is adjusted net income divided by diluted weighted average shares outstanding. The most directly comparable GAAP measure for EBITDA is “net income”, which includes the impact of net interest expense, income taxes, depreciation, and amortization of acquired intangible assets. The most directly comparable GAAP measure for adjusted EBITDA is “net income”, which includes the impact of net interest expense, income taxes, depreciation, amortization of acquired intangible assets, share-based payment expense, special charges, supplier recovery charge and miscellaneous (income) expense, net. The most directly comparable GAAP measure for FCF is net cash provided by operating activities. A calculation of this measure is available in this news release. A reconciliation of each measure to the most directly comparable GAAP measure is available in this news release.

The Company defines FCF as net cash provided by operating activities less purchases of property, plant and equipment. A calculation of this measure is available in this news release.

The Company’s non-GAAP financial measures may not be comparable to similarly titled non-GAAP financial measures used by other companies, have limitations as an analytical tool, and should not be considered in isolation or as a substitute for GAAP financial measures. Our presentation of such measures, which may include adjustments to exclude unusual or non-recurring items, should not be construed as an inference that our future results will be unaffected by other unusual or non-recurring items.

Forward-Looking Information