These 2 Semiconductor Stocks Are Down Over 22%, but Could Soar in 2025

It’s a great time to invest in top semiconductor chip stocks. Powerful trends like artificial intelligence (AI), cloud computing, AI-powered smartphones, and electric vehicles (EVs) are driving more demand for chips than ever before. The PHLX Semiconductor Sector index is up 50% over the last 12 months, beating the S&P 500 return of 34%.

Here are two leading semiconductor companies with shares trading down at least 25% from their recent highs. Investors that add these two stocks to their portfolio today could see excellent returns as each stock rebounds.

1. Micron Technology

Exploding demand for Micron Technology‘s (NASDAQ: MU) memory and storage components makes it a great stock to buy on the dip. The company just reported better-than-expected financial results for fiscal Q4 (which ended Aug. 29), with strong data center demand sending revenue up 93% year over year.

Increasing demand for Micron’s memory chips should continue in calendar 2025, driven by AI, automotive, and data centers. Growth in the AI server market is expected to drive demand for Micron’s high-capacity dynamic random access memory (DRAM) modules. Statista projects the AI server market to increase tenfold to $430 billion by 2033, which could fuel strong growth for Micron’s data center business.

Other markets are expected to pick up next year. Micron’s automotive revenue hit a record in fiscal 2024. The increase in infotainment and driver assistance systems is increasing the number of chips per vehicle. This is a long-term growth opportunity that is expected to drive more demand in the second half of fiscal 2025.

PC and mobile are two more opportunities for growth next year, where Micron is a leading supplier of memory and solid-state storage drives. PC unit volumes are anticipated to accelerate in the second half of the year, driven by upgrades to new AI-powered PCs and Microsoft‘s discontinued support for older versions of its Windows OS. The release of more AI-enabled smartphones will drive similar demand trends for Micron’s mobile business.

Analysts expect Micron’s earnings to increase 42% to $12.74 in fiscal 2025. Assuming the stock trades at its historical average price-to-earnings (P/E) ratio of 16, the shares could reach $203 within the next year. Micron investors could potentially almost double their money from the current share price.

2. Advanced Micro Devices

Major data center operators, including Microsoft, Meta Platforms, and Oracle are using Advanced Micro Devices‘ (NASDAQ: AMD) MI300 chip to help handle their AI workloads. Since launching this chip in December, AMD’s data center revenue has skyrocketed, with revenue more than doubling year over year in Q2.

AMD’s data center business should continue to post strong growth to support enterprise investment in AI. Data centers require powerful graphics processing units (GPUs) to run AI models. While Nvidia is the leading GPU provider, AMD expects to generate $4.5 billion from data center GPUs this year.

AMD is filling out a GPU market that has been supply-constrained, but it’s also positioned to meet demand from customers who may look for alternatives to the high prices that Nvidia’s chips command. AMD estimates the total addressable market for AI accelerators, or GPUs, to reach $400 billion by 2027.

Looking ahead, new AI models will require exponentially higher processing power. In June, AMD unveiled a multiyear roadmap for its AMD Instinct accelerators. It’s planning to launch the MI325X accelerator in Q4, with the MI350 launching in 2025. The MI350 will bring a 35x increase in AI inference performance compared to the MI300 series. The company also said it will release new products annually to meet growing demand, which points to a long runway of growth ahead.

The consensus Wall Street estimate forecasts AMD’s revenue to increase 28% next year, with earnings per share reaching $5.44. If AMD stock is trading at the same forward P/E of 48 a year from now, it could trade at $261, implying an upside of 59%.

Should you invest $1,000 in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Ballard has positions in Advanced Micro Devices, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

These 2 Semiconductor Stocks Are Down Over 22%, but Could Soar in 2025 was originally published by The Motley Fool

Preview: Levi Strauss's Earnings

Levi Strauss LEVI is gearing up to announce its quarterly earnings on Wednesday, 2024-10-02. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Levi Strauss will report an earnings per share (EPS) of $0.31.

Anticipation surrounds Levi Strauss’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

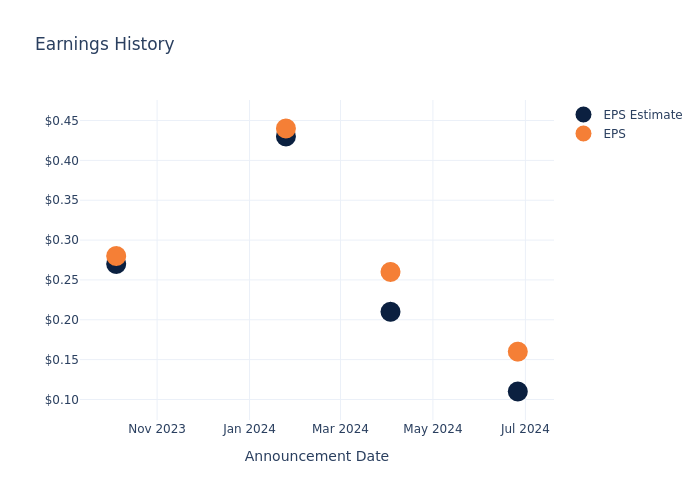

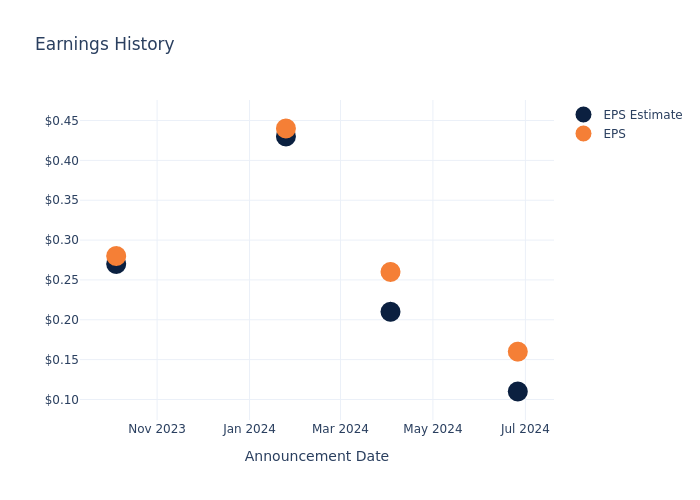

Earnings History Snapshot

The company’s EPS beat by $0.05 in the last quarter, leading to a 15.4% drop in the share price on the following day.

Stock Performance

Shares of Levi Strauss were trading at $21.8 as of September 30. Over the last 52-week period, shares are up 60.54%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Perspectives on Levi Strauss

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Levi Strauss.

The consensus rating for Levi Strauss is Buy, based on 2 analyst ratings. With an average one-year price target of $25.5, there’s a potential 16.97% upside.

Peer Ratings Comparison

In this comparison, we explore the analyst ratings and average 1-year price targets of Amer Sports, VF and Tapestry, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Amer Sports is maintaining an Buy status according to analysts, with an average 1-year price target of $19.0, indicating a potential 12.84% downside.

- VF is maintaining an Neutral status according to analysts, with an average 1-year price target of $16.32, indicating a potential 25.14% downside.

- Tapestry is maintaining an Outperform status according to analysts, with an average 1-year price target of $49.62, indicating a potential 127.61% upside.

Overview of Peer Analysis

The peer analysis summary provides a snapshot of key metrics for Amer Sports, VF and Tapestry, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Levi Strauss | Buy | 7.81% | $871.70M | 0.92% |

| Amer Sports | Buy | 15.99% | $551.30M | -0.09% |

| VF | Neutral | -8.58% | $991.66M | -17.00% |

| Tapestry | Outperform | -1.75% | $1.19B | 5.62% |

Key Takeaway:

Levi Strauss ranks first in revenue growth among its peers. It has the highest gross profit margin. However, it has the lowest return on equity.

Delving into Levi Strauss’s Background

Levi Strauss & Co is involved in designing, marketing, and selling products that include jeans, casual and dresses pants, tops, shorts, skirts, jackets, footwear, and related accessories directly or through third parties and licensees for men, women, and children under Levi’s, Dockers, Signature by Levi Strauss & Co. and Denizen brands. The company manages its business according to three regional segments: the Americas, which is the key revenue driver; Europe; and Asia.

Levi Strauss’s Economic Impact: An Analysis

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Positive Revenue Trend: Examining Levi Strauss’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 7.81% as of 31 May, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: The company’s net margin is a standout performer, exceeding industry averages. With an impressive net margin of 1.25%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company’s ROE is a standout performer, exceeding industry averages. With an impressive ROE of 0.92%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Levi Strauss’s ROA surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 0.3% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Levi Strauss’s debt-to-equity ratio is below the industry average. With a ratio of 1.12, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Levi Strauss visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BP's Options Frenzy: What You Need to Know

Investors with a lot of money to spend have taken a bullish stance on BP BP.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with BP, it often means somebody knows something is about to happen.

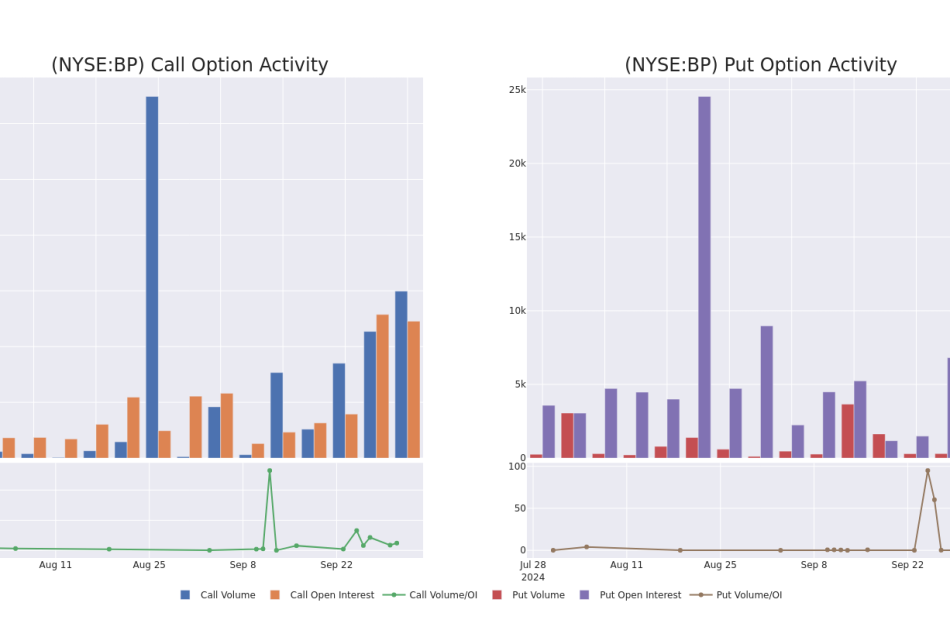

Today, Benzinga’s options scanner spotted 11 options trades for BP.

This isn’t normal.

The overall sentiment of these big-money traders is split between 54% bullish and 36%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $34,933, and 10, calls, for a total amount of $546,939.

Expected Price Movements

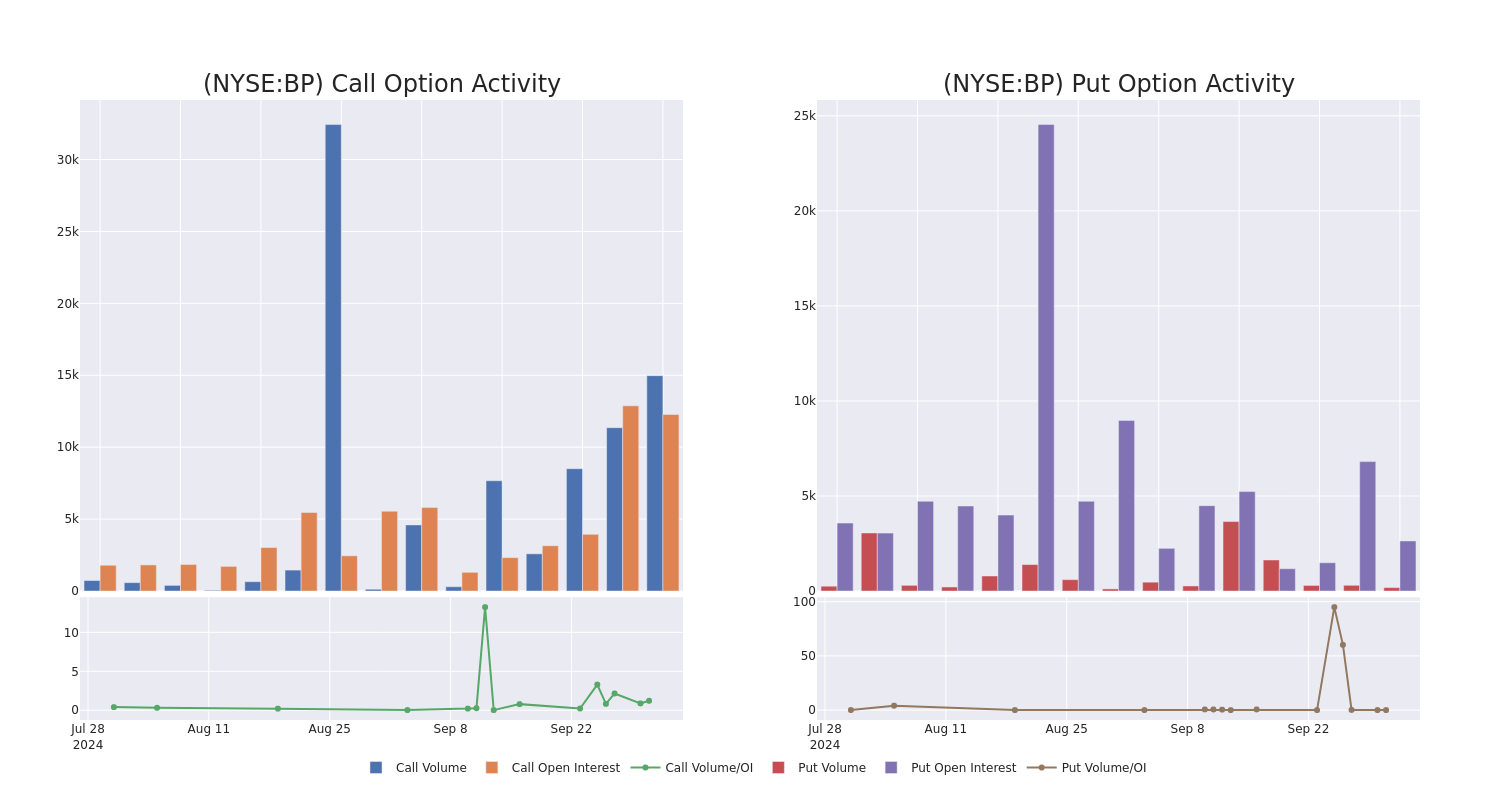

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $23.0 to $33.0 for BP during the past quarter.

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in BP’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to BP’s substantial trades, within a strike price spectrum from $23.0 to $33.0 over the preceding 30 days.

BP Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BP | CALL | SWEEP | NEUTRAL | 12/18/26 | $9.5 | $9.35 | $9.5 | $23.00 | $94.0K | 385 | 178 |

| BP | CALL | SWEEP | BULLISH | 01/17/25 | $4.6 | $4.5 | $4.6 | $28.00 | $86.9K | 365 | 189 |

| BP | CALL | SWEEP | BEARISH | 10/04/24 | $0.42 | $0.38 | $0.39 | $32.00 | $86.9K | 8.4K | 4.7K |

| BP | CALL | SWEEP | BEARISH | 10/04/24 | $0.38 | $0.31 | $0.31 | $32.00 | $69.3K | 8.4K | 7.3K |

| BP | CALL | SWEEP | BULLISH | 01/15/27 | $9.5 | $9.45 | $9.5 | $23.00 | $43.7K | 60 | 46 |

About BP

BP is an integrated oil and gas company that explores for, produces, and refines oil around the world. In 2023, it produced 1.1 million barrels of liquids and 6.9 billion cubic feet of natural gas per day. At the end of 2023, reserves stood at 6.8 billion barrels of oil equivalent, 55% of which are liquids. The company operates refineries with a capacity of 1.6 million barrels of oil per day.

Following our analysis of the options activities associated with BP, we pivot to a closer look at the company’s own performance.

BP’s Current Market Status

- Currently trading with a volume of 7,681,813, the BP’s price is down by -0.13%, now at $31.35.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 28 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest BP options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Clinical Decision Support Platform Market to Reach $2.4 Billion, Globally, by 2033 at 7.3% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 30, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Clinical Decision Support Platform Market by Component (Software and Services), Delivery Mode (On-Premises and Cloud Based), Application (Drug Allergy Alerts, Clinical Guidelines, Drug-Drug Interactions, Clinical Reminders and Others), and End User (Hospitals, Clinics, Ambulatory Care Centers and Academic and Research Institutes): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the clinical decision support platform market was valued at $1.2 billion in 2023, and is estimated to reach $2.4 billion by 2033, growing at a CAGR of 7.3% from 2024 to 2033.

Request Sample of the Report on Clinical Decision Support Platform Market 2033 – https://www.alliedmarketresearch.com/request-sample/A323980

Prime determinants of growth

Increasing prevalence of chronic diseases and focus on personalized medicine are the major factors that drive the growth of the clinical decision support platform market. However, high cost of implication hinders market growth. Moreover, rise in adoption of telemedicine offers remunerative opportunities for the expansion of the global clinical decision support platform market.

Report coverage & details

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $1.2 billion |

| Market Size in 2033 | $2.4 billion |

| CAGR | 7.3% |

| No. of Pages in Report | 216 |

| Segments Covered | Component, Delivery mode, Application, End user and Region. |

| Drivers |

|

| Opportunities |

|

| Restraints |

|

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/connect-to-analyst/A323980

Segment Highlights

Software component is widely used in clinical decision support

The software component of the clinical decision support platform is widely used to enhance decision-making processes in healthcare. It integrates patient data, evidence-based guidelines, and clinical knowledge to provide real-time support to clinicians, improving diagnostic accuracy, treatment planning, and patient outcomes. Its use spans across various medical settings, including hospitals, clinics, and research institutions.

Application of on premise clinical decision support platform

On-premise clinical decision support platforms are preferred for their enhanced data security and control. Healthcare organizations value the ability to manage sensitive patient information within their own infrastructure, ensuring compliance with strict regulatory standards and reducing the risk of data breaches associated with cloud-based solutions.

Drug-drug interaction application of clinical decision support platform’s

The clinical decision support platform’s drug-drug interaction application helps healthcare providers identify and manage potential adverse interactions between prescribed medications. By analyzing patient medication profiles and referencing comprehensive drug databases, it alerts clinicians to possible contraindications, thus enhancing patient safety, reducing medication errors, and optimizing therapeutic outcomes. This tool is crucial in complex treatment regimens involving multiple medications.

Hospitals are the important end users of clinical decision support platform’s

Hospitals are the major end users of clinical decision support platforms, leveraging these systems to improve patient care and operational efficiency. These platforms assist healthcare professionals in making informed clinical decisions, reducing errors, and enhancing treatment outcomes. With extensive patient data and complex care requirements, hospitals benefit significantly from real-time insights and evidence-based recommendations provided by these platforms.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A323980

Regional Outlook

The clinical decision support platform market is experiencing significant growth across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates due to advanced healthcare infrastructure and high adoption rates, while Asia Pacific shows rapid growth driven by increasing healthcare investments and technological advancements.

Key Players

- Cerner Corporation

- Epic Systems Corporation

- IBM

- Change Healthcare

- Medical Information Technology Inc

- Koninklijke Philips NV

- Siemens Healthcare

- Allscripts Healthcare Solutions Inc.

- Wolters Kluwer NV

- Mckesson Corporation

The report provides a detailed analysis of these key players in the global clinical decision support platform market. These players have adopted different strategies such as, product launch, expansion, partnership, collaboration and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Get Customized Reports with your Requirements – https://www.alliedmarketresearch.com/request-for-customization/A323980

Recent Developments in Clinical Decision Support Platform Market Worldwide

- In February 2024, Elsevier Health, a global leader in medical information and data analytics, launched ClinicalKey AI, the first and most advanced clinical decision support tool to be introduced in the US that combines the latest and most trusted medical content with generative artificial intelligence (AI) to help clinicians at the point of care.

- In February 2023, The province of Nova Scotia, in collaboration with Nova Scotia Health Authority (NSHA) and IWK Health (IWK), announced, a new 10-year agreement has been signed with Oracle Cerner to implement an integrated electronic care record across the province for the more than one million Nova Scotians.

Trending Reports in Healthcare Industry:

Medical Device Outsourcing Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Sleep Aids Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Structural Heart Devices Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Pulse Oximeters Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get an access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ask an Advisor: Should My Wife Wait to File for Spousal Benefits or Claim Her Benefit Now?

I’m 63 and still working. My wife, who is 64 ½ and retired, spent most of her working life raising our children at home. She qualifies for Social Security at a current rate of $675 and $845 if she waits until FRA. I plan on working for another two or three years. My Social Security at 65 is $2,785 and $3,295 at FRA. Should she start drawing on her Social Security now and invest it, switching to spousal benefits when I retire? Or should she wait until I retire and draw the full 50% spousal benefit?

– Two Air Force Vets

I suggest waiting in most cases, but that doesn’t mean it’s always the best approach. Depending on your situation, risk tolerance and goals, your wife may want to file for Social Security now. However, there may also be a blended third option depending on when you file that I think you should consider. I’ll explain the tradeoffs and reasons why you might choose one option or the other so you and your wife can decide which route is best for you.

If you have retirement planning questions or need help with another area of your finances, consider connecting with a financial advisor.

Early Filing Reduction

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

As you’ve pointed out, your wife will receive a reduced benefit if she files for Social Security before reaching her full retirement age (FRA). That is true of both her own benefit and her spousal benefit. However, those reductions are different so let’s start by clarifying how early filing impacts both types of benefits:

-

Primary benefits are reduced by 5/9 of 1% per month for up to 36 months and then by 5/12 of 1% for each additional month

-

Spousal benefits are reduced by 25/36 of 1% per month for up to 36 and then by 5/12 of 1% for each additional month

Based on your wife’s current age, I’m assuming she was born in 1960. As a result, she’ll reach FRA at age 67. So, if she is exactly 30 months shy of her FRA:

Keep in mind that she can’t claim her spousal benefit until you file for Social Security. But since her spousal benefit will be higher than her own primary benefit, she would end up switching later, at which point this reduction would apply. (And if you need additional help deciding when to claim Social Security or how to plan for spousal benefits, speak with a financial advisor.)

Filing Now and Investing

If your wife files for benefits now and invests the money, here’s approximately what she might have when she turns 67 based on the following rates of return:

-

2% = $20,781

-

4% = $21,331

-

6% = $21,898

-

8% = $22,484

-

10% = $23,089

However, if she waits until age 67 to file for Social Security, she’ll receive $845 per month – $170 more than what she would collect if she starts now. Then again, if she starts collecting Social Security now and invests those payments, she could have upwards of $23,000 in savings by age 67.

So how do you compare the two options? You can start by thinking about it in terms of a withdrawal rate. How much would you need in savings to generate an additional $170 per month?

If we use the 4% rule as a guide, your wife would need $51,000 to support a monthly withdrawal of $170. Clearly, none of the investment return assumptions above get close to that.

(Calculating potential investment returns can be complicated, but financial advisors often have the tools and expertise to run complex calculations to help you make important decisions.)

Filing Early vs. Waiting

However, there are still a number of scenarios in which your wife may still decide to file for her benefits early, including:

-

She has a short life expectancy due to a medical condition or family history

-

You absolutely need the money now

-

You already have sufficient guaranteed income such as military retired pay, pensions or annuities, and want more immediate cash flow

-

You are very aggressive investors and prefer the chance of a higher return even if it means taking on more risk

Then again, waiting until FRA may be more appropriate if:

-

You and your wife are risk averse or financially conservative and prefer security

-

She expects to live to at least an average age

-

You do not have adequate guaranteed income

-

You don’t need the money right now

Which Benefit to Choose?

As of right now the only benefit your wife can receive is her own. She won’t be able to claim her spousal benefit until you file, which you clearly understand.

However, filing now results in a steep reduction in benefits. Unless other considerations weigh heavily for you, this may not the best choice. So, she could wait until you file and claim the full spousal benefit, which would be worth $1,647.50 (50% of your full retirement benefit).

But here’s where a blended third option comes in. Let’s lay out the relevant details:

-

Her spousal benefit is based on 50% of your FRA benefit regardless of when you file

-

She receives that full 50% as long as she files at her own FRA

-

If she files early, her spousal benefit is reduced as explained above. The spousal benefit does not earn delayed filing credits, so there’s no benefit for her to wait past her FRA

-

She is a few years older than you

The third option is for your wife to file for her own benefit once she reaches her FRA and then switch to her spousal benefit after you file. If she does this, she will not be subject to any reductions.

However, when you file is another point of discussion. You imply that you intend to file when you retire in a few years. You may want to evaluate the benefit of waiting until age 70 to take advantage of delayed retirement credits. Likely, this will maximize Social Security benefits for the two of you, making it an option I’d strongly consider.

(And if you have additional questions related to Social Security and retirement income planning, reach out to a financial advisor and see how they can help.)

Bottom Line

Filing early to invest the money is not likely to provide the same level of income as waiting to maximize your Social Security benefits, and it’s riskier. If financial security in retirement is your goal, I’d give serious thought to having your wife claim at her FRA and delaying your own benefit.

Social Security Planning Tips

-

Up to 85% of your Social Security benefits may be taxable depending on your total income. Advanced tax planning strategies, such as adjusting withdrawals from retirement accounts or Roth conversions, can help manage your taxable income in retirement and reduce the tax burden on Social Security benefits.

-

A financial advisor with retirement planning expertise can help you plan for Social Security benefits and integrate them with your other income sources. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Brandon Renfro, CFP®, is a SmartAsset financial planning columnist and answers reader questions on personal finance and tax topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Please note that Brandon is not an employee of SmartAsset and is not a participant in SmartAsset AMP. He has been compensated for this article. Some reader-submitted questions are edited for clarity or brevity.

Photo credit: ©iStock.com/LaylaBird, ©iStock.com/JLco – Julia Amaral

The post Ask an Advisor: Should My Wife Wait to File for Spousal Benefits or Claim Her Benefit Now? appeared first on SmartReads by SmartAsset.

S&P Records First Positive September Since 2019 Amid Improving Investor Sentiment: Fear Index Moves To 'Extreme Greed' Zone

The CNN Money Fear and Greed index showed an improvement in the overall market sentiment, with the index moving to the “Extreme Greed” zone on Monday.

U.S. stocks settled higher on Monday, with the S&P 500 recording its first positive September month since 2019. In the month, the Dow Jones gained 1.9%, while the Nasdaq rose 2.7%. The S&P 500 jumped 2%, recording its first positive September month since 2019.

Carnival Corporation CCL posted better-than-expected quarterly earnings. EMCORE Corporation EMKR shares jumped around 83% on Monday after Mobix Labs submitted an all-cash offer to acquire the company for $3.80 per share.

On the economic data front, the Chicago PMI rose to 46.6 in September from 46.1 in August versus market estimates of 46.2.

Most sectors on the S&P 500 closed on a positive note, with energy, real estate, and communication services stocks recording the biggest gains on Monday. However, consumer discretionary and materials stocks bucked the overall market trend, closing the session lower.

The Dow Jones closed higher by around 17 points to 42,330.15 on Monday. The S&P 500 rose 0.42% to 5,762.48, while the Nasdaq Composite climbed 0.38% at 18,189.17 during Monday’s session.

Investors are awaiting earnings results from Acuity Brands, Inc. AYI, McCormick & Company, Incorporated MKC, and NIKE, Inc. NKE today.

What is CNN Business Fear & Greed Index?

At a current reading of 75.5, the index moved to the “Extreme Greed” zone on Monday, versus a prior reading of 72.8.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tesla Remixes The Tune: LiveOne Shares Dip After Partnership Changes And Slashed Revenue Guidance

LiveOne, Inc. LVO shares are trading lower on Tuesday following its amended partnership with Tesla, Inc. TSLA.

LiveOne renewed its partnership with the EV behemoth through May 2026. Effective today, Tesla replaced its streaming button with LiveOne’s in perpetuity.

The company also announced the launch of its LiveOne 2.0, for subscribers access to music on all devices. About 1.9 million subscribers can convert to Premium/Plus services.

As of Dec 1, 2024, Tesla will no longer subsidize LiveOne products to some of its customers. However, LiveOne will offer all Tesla customers discounted LiveOne music packages, the company said.

“The conversion opportunity has enormous upside by offering Tesla owners an opportunity to upgrade and have access on all devices at discounted priority pricing,” said Robert Ellin, CEO of LiveOne.

Tesla will continue to pay LiveOne monthly for grandfathered users in perpetuity.

Also Read: East Coast Dockworkers Strike: How Labor Dispute Impacts Economy, Logistics Companies

“We’ll drive growth, unlock new revenue streams, own our data, and increase ARPU. To be conservative, due to the timing of our conversion rate, we are adjusting FY2025 revenue guidance to $120M – $135M and $8-15M adjusted EBITDA,” the CEO added.

Outlook: For fiscal year 2025, LiveOne revised its consolidated revenue from $140 million – $155 million to $120 million – $135 million (estimate: $144.99 million), with consolidated adjusted EBITDA projected at $8 million – $15 million (prior view $16 million – $20 million).

The company has reaffirmed its $12 million share buyback program and officially retired 4.2 million shares, bringing the total outstanding shares to approximately 94 million.

Price Action: LVO shares are trading lower by 21.4% to $0.7460 at last check Tuesday.

Image via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia Falls Amid SMCI Stock Split; Is Nvidia A Buy Now?

When a stock pulls back, it is best not to panic. Check its recent action and chart patterns to see if it is anything to worry about.

↑

X

How Nvidia Is Injecting AI Into The Health Care Industry

Nvidia (NVDA) fell 2% on Friday and was unchanged on Monday after reports from Barron’s that China was trying to boost local AI chip makers and urging local companies to avoid Nvidia chipes. China accounted for 11% of Nvidia sales in the first half the fiscal year ending in January.

Nvidia stock cleared multiple trendline entries last week. The stock is 5% above its 50-day moving average. Shares are 14% below their split-adjusted all-time high of 140.76 after rising more than 4.6% last week. But should you be buying Nvidia stock now?

Timing your stock purchases can surely improve gains. Yet even with an obvious market leader like Nvidia, it’s not easy to tell whether you should buy or sell the stock now. Chart signals and checking technical measures can help investors assess whether Nvidia stock is a buy now.

On Tuesday, AI server provider Super Micro Computer (SMCI) started trading on a split-adjusted basis. The company announced the 10-for-1 stock split in its fourth-quarter earnings report in August. Stock splits increase the number of shares outstanding but do not change the market capitalization of the stock.

AI’s Total Addressable Market

On Wednesday, shares rose after consulting firm Bain said the total addressable market for artificial intelligence hardware and software will grow 40% to 55% for at least next three years. Demand for Nvidia’s next generation graphic processing units GB200 is expected to reach 3 million in 2026 vs. 1.5 million for its H100 units in 2023.

According to Barron’s, Nvidia last week lost its place as the best performing S&P 500 stock so far this year. Vistra (VST) had gained 190% year to date as of Monday’s closing price last week, whereas Nvidia was up 135%.

But Nvidia stock rose last Monday after news that China e-commerce behemoth Alibaba (BABA) will collaborate with Nvidia to improve autonomous driving technology for Chinese EV manufacturers, several of which are rivals to Tesla (TSLA). Alibaba’s portfolio of large-language models are now integrated with Nvidia’s drive platform for autonomous vehicles.

On Monday last week, analysts at Melius Research gave the stock a price target of 165 with a buy rating as the company ramps up its Blackwell chip production in the fourth quarter.

White House Meeting

In September, shares climbed above the 50-day moving average amid news that Nvidia and OpenAI chief executive officers, Jensen Huang and Sam Altman, met officials at the White House to discuss AI infrastructure spending. According to reports, Alphabet (GOOGL), Amazon.com (AMZN) and Microsoft (MSFT) executives were also present. The White House announced an interagency task force to accelerate permissions for setting up data centers.

However, news that companies may be diversifying and looking for other chips besides Nvidia’s likely weighed on Nvidia stock. According to Barron’s, Saudi oil behemoth Aramco is planning on using chips made by a startup Groq to offer “AI computing power to local companies.”

The news followed Huang remarks that the return on investment for artificial intelligence infrastructure plays like Nvidia remained strong since “infrastructure players like ourselves and all the cloud service providers put the infrastructure in the cloud, so that developers could use these machines to train the models, fine-tune the models, guardrail the models, and so forth.”

Analysts at Bernstein said that after its phenomenal growth, sustainability is the main question Nvidia faces, but the “time to worry is clearly not now.”

On Sept. 3, Nvidia fell sharply below the 50-day moving average and saw its largest one-day market cap loss for any U.S. company, according to Dow Jones Markets Data.

Earnings From AI Giants

Results from other AI leading companies have influenced the stock. Last week, memory chip maker Micron (MU) cited robust AI demand, which gave Nvidia stock a lift.

Oracle (ORCL) results showed strong demand for AI chips. According to the Chairman and Chief Technology Officer Larry Ellison, Oracle is building a data center with “acres of Nvidia GPU clusters for training large language scale AI models.”

Earlier, results from Broadcom (AVGO) weighed on Nvidia stock. Broadcom’s sales and earnings beat estimates but its sales outlook disappointed. Broadcom’s outlook has implications for demand for AI chips.

Shares also came under pressure amid news that the Department of Justice was investigating antitrust regulations concerning the artificial intelligence chip company. According to reports, the DOJ originally sent questionnaires to the company. But it has now sent subpoenas.

Shares fell 6.4% after earnings on Aug. 28 even though Nvidia beat analyst estimates.

Nvidia’s Second-Quarter Results

In August, Nvidia reported earnings that beat Wall Street views. Sales of $30.04 billion were higher than $28.7 billion analysts expected and came in 122% ahead of the year-earlier quarter. Earnings also came in above views of 65 cents at 68 cents per share and were 152% higher than the prior year. The artificial intelligence chip leader also guided higher for the current quarter with sales of $32.5 billion vs. views of $31.7 billion.

Earnings have moved Nvidia stock in 2023 and 2024 and that is shining proof of why fundamental performance is one of the pillars of the Investor’s Business Daily methodology. In 2023, Nvidia had a huge 239% run.

After losing 5.3% in July, the stock gained 2% in August. It gained 1.7% in September and is up over 140% so far this year.

Fundamentals make up just one of four IBD pillars of investing — the others are a stock’s technical strength, which indicates the stock’s performance vs. other stocks, the market direction and risk management.

In early August, the stock dived amid a report that Nvidia will delay its next-generation AI chip by at least three months due to a design flaw. Nvidia’s chart also shows that the stock underperformed the S&P 500 during the sell-off.

Reuters cited Bernstein analyst Stacy Rasgon’s opinion that the three-month delay would not cause a significant dent on the chip leader’s market share.

Nvidia Stock: Microsoft Partnership

The AI leader has also teamed up with Microsoft (MSFT) to make the latest AI software available on Nvidia’s graphic processing units.

Nvidia stock holds an Accumulation/Distribution Rating of E on an A+ to E scale. That reflects the heavy institutional selling in recent weeks.

Huang sold $580 million of Nvidia stock from June 14 through Aug. 9, based on a trading plan.

AI Products Drive Growth

Nvidia’s graphic processing units help accelerate computing in data centers and AI applications. The company was an early pioneer in the graphics processors that many say drastically improved computer gaming. Along with gaming, Nvidia chips now are used in such industries as health care, automobiles and robotics.

In March 2023, generative AI took a leap forward with OpenAI’s ChatGPT. According to Huang, Nvidia’s AI-capable supercomputer paved the way for the “iPhone moment of AI.”

That helped Nvidia turn the tide on its results. It reported three quarters of declining year-over-year sales and four quarters of tapering earnings in late 2022 and early 2023.

But then the company achieved record top- and bottom-line growth in the five most recent quarters.

Top Ratings For Nvidia Stock

Nvidia stock still boasts a strong Relative Strength Rating of 97 from Investor’s Business Daily. Its three-month RS Rating is 59.

Its EPS Rating is an ideal 99, while the stock holds a Composite Rating of 99. The stock is also on IBD Leaderboard, IBD SwingTrader and the growth IBD 50.

Nvidia is one of the Magnificent Seven stocks that led the market in 2023 and much of this year.

Is Nvidia Stock A Buy?

Nvidia is above its 50-day moving average and has cleared multiple trendline entries as market conditions improve. But investors may still want to wait till volume picks up. It’s been running below average for a few weeks. Nvidia also offers a proper buy point of 140.76, which is its all-time high.

YOU MAY ALSO LIKE:

See Stocks On The List Of Leaders Near A Buy Point

Find Winning Stocks With MarketSurge Pattern Recognition & Custom Screens

IBD Live: Learn And Analyze Growth Stocks With The Pros

Looking For The Next Big Stock Market Winners? Start With These 3 Steps

Magnificent Seven Stocks: Latest News & Market Cap Weighting