Billionaire Philippe Laffont Sold 72% of Coatue's Stake in Nvidia and Is Piling Into This Historically Cheap Dual-Industry Leader

On Wall Street, important data releases are a common occurrence. Monthly inflation and jobs reports, coupled with Wall Street’s leading businesses reporting their quarterly operating results over a six-week stretch every quarter, can make it easy for a key data release to slip under the radar.

Aug. 14 marked what can arguably be described as the most important data dump of the third quarter. This was the last day to for institutional investors and wealthy asset managers to file Form 13F with the Securities and Exchange Commission. A 13F details which stocks Wall Street’s smartest and most-successful money managers purchased and sold in the latest quarter (i.e., the June-ended quarter).

It was a particularly busy quarter of additions and subtractions for billionaire Philippe Laffont at Coatue Management. Laffont’s hedge fund, which is primarily focused on higher-growth tech stocks, oversees more than $25 billion in assets spread across 74 holdings.

What’s most noteworthy about Laffont’s trading activity has been his continued selling of former top holding Nvidia (NASDAQ: NVDA), as well as his purchasing of shares of a company that’s a leader in two industries.

Laffont’s fund has shed nearly three-quarters of its Nvidia stake in 15 months

When March 2023 came to a close, Coatue Management held a split-adjusted 49,802,020 shares of Nvidia stock. I say “split-adjusted,” because the king of artificial intelligence (AI) completed a historic 10-for-1 forward stock split in June 2024.

But when the curtain closed on the second quarter, Laffont’s fund was holding “just” 13,754,447 shares of Nvidia. This equates to a 72% decline over 15 months and dropped Nvidia from Coatue’s top holding by market value to No. 4.

Profit-taking may explain some of Laffont’s persistent selling. Since the start of 2023, Nvidia’s shares have increased by nearly 750%, with the company tacking on around $2.7 trillion in market value. We’ve never witnessed the valuation of a market-leading businesses expand so quickly, which may be encouraging Laffont and his team to ring the register.

But there may be more to this selling than meets the eye.

For example, every game-changing innovation, technology, and trend since the advent of the internet has endured an early innings bubble. These bubbles consistently occur because investors overestimate how quickly a new technology or innovation will be adopted by consumers and/or businesses. Invariably, every one of these new technologies, innovations, and trends needs time to mature, which is seemingly never baked into investor expectations. More than likely, AI is the next in a long line of overhyped innovations that will need time to mature.

Additionally, Nvidia’s management team and board aren’t giving billionaires or everyday investors reasons to be excited. Not one Nvidia insider has purchased shares of their company on the open market since Chief Financial Officer Colette Kress in December 2020. Almost four years without insider buying sends a crystal-clear message to Wall Street that shares aren’t attractive.

Laffont and his advisors may also be anticipating competitive pressures picking up for Nvidia in the coming quarters. A number of chipmakers have debuted or are in the process of developing AI-graphics processing units (GPUs) that will compete directly with Nvidia’s popular H100 and coming Blackwell GPU architecture.

Furthermore, all four of Nvidia’s top customers by net sales are internally developing GPU platforms of their own. Even if these customers choose to simply complement the Nvidia hardware they’ve purchased, this looks to be a clear signal that future order opportunities will be limited.

But while Philippe Laffont has been dumping shares of Nvidia, he’s been piling into a historically cheap company that sits at the top of the pecking order in two industries.

Billionaire Philippe Laffont can’t get enough of this historically inexpensive dual-industry leader

Although Laffont and his team added to 21 existing positions and opened stakes in six others during the June-ended quarter, the purchase that really stands out is the 702,235 shares added to Coatue’s existing position in Amazon (NASDAQ: AMZN). The roughly 10.77 million shares of Amazon held by Coatue equates to more than 7% of invested assets (as of June 30), and is the fund’s second-largest holding by market value, behind only Meta Platforms.

Most investors are familiar with Amazon because it’s the undisputed e-commerce leader. In 2023, it accounted for nearly 38% of domestic online retail market share, which is more than 31 percentage points ahead of Walmart, which occupied the No. 2 spot.

While Amazon’s e-commerce presence is the face of the company and helps to draw more than 3 billion visits each month, online retail sales generate menial margins and minimal operating cash flow. The bulk of what makes Amazon special can be traced to its three ancillary operating segments, none of which is more important than Amazon Web Services (AWS).

According to data from tech analysis firm Canalys, AWS accounted for a 33% share of global spend for cloud infrastructure service platforms in the June-ended quarter. This is well ahead of the 20% market share for Microsoft‘s Azure, which is the No. 2 cloud infrastructure service provider.

Enterprise cloud-service spending is still in its relatively early stages of expansion. To boot, the AI revolution is sparking plenty of interest in generative AI solutions and large language models, which are being incorporated into AWS for clients. AWS consistently accounts for 50% to 100% of Amazon’s operating income on a quarterly basis and is responsible for a sizable percentage of the company’s rapid growth in cash flow.

The other two ancillary segments of importance include advertising services and subscription services. With over 3 billion visitors each month and an expanding content library, Amazon is having no trouble commanding strong ad-pricing power.

Meanwhile, Amazon recently landed an 11-year streaming rights deal with the NBA and WNBA, and is the exclusive streaming partner of the NFL’s Thursday Night Football. Securing popular sports packages will only increase the value of Prime subscriptions.

The final piece of the puzzle that looks to have Laffont favoring Amazon over Nvidia is its historically cheap valuation. Throughout the 2010s, investors paid a median of 30 times cash flow to own shares of Amazon. As of this writing on Sept. 26, shares are valued at less than 13 times cash flow for 2025.

With a valuation that’s more compelling than, arguably, any point in its publicly traded existence, Amazon has the tools and intangibles needed to outpace Nvidia in the return department.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Amazon and Meta Platforms. The Motley Fool has positions in and recommends Amazon, Meta Platforms, Microsoft, Nvidia, and Walmart. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Billionaire Philippe Laffont Sold 72% of Coatue’s Stake in Nvidia and Is Piling Into This Historically Cheap Dual-Industry Leader was originally published by The Motley Fool

Precision Optics Reports Fourth Quarter and Fiscal Year 2024 Financial Results

GARDNER, Mass., Sept. 30, 2024 (GLOBE NEWSWIRE) — Precision Optics Corporation, Inc. POCI, a leading designer and manufacturer of advanced optical instruments for the medical and defense/aerospace industries, announced operating results on an unaudited basis for its fourth quarter and fiscal year ended June 30, 2024.

FY 2024 Financial Highlights (Year Ended June 30, 2024):

- Revenue was $19.1 million compared to $21.0 million in the previous fiscal year. Revenue of $19.1 million, exceeded the high end of the expected range announced on August 14, 2024 of $18.9 million.

- Production revenue was $10.8 million, a decrease of 25% compared to the previous fiscal year.

- Engineering revenue was a record $8.3 million, an increase of 24% compared to the previous fiscal year.

- Gross margin was 30.3% compared to 36.8% in the previous fiscal year, which included a one-time sale of $600,000 in technology rights relating to a single-use medical device..

- Net loss was ($3.0) million which compared to net loss of ($0.1) million in the previous year.

- Adjusted EBITDA, defined as earnings before interest, taxes, depreciation, amortization, stock-based compensation and other income, was $(1.6) million, compared to $0.5 million in the previous fiscal year.

Q4 FY2024 Financial Highlights (3 Months Ended June 30, 2024):

- Revenue was $4.7 million compared to $5.0 million in the same quarter of the previous fiscal year. Revenue of $4.7 million exceeded the implied high end of the range we announced on August 14, 2024 of 4.5 million.

- Engineering revenue was $1.9 million compared to $1.4 million in the same quarter of the previous fiscal year.

- Production revenue was $2.8 million compared to $3.6 million in the same quarter of the previous fiscal year.

- Gross margins were 21.7% compared to 35.0% in the same quarter of the previous year.

- Net loss for the quarter was ($1.4) million, compared to $(0.1) million in the same quarter of the previous year.

- Adjusted EBITDA was $(1.1) million for the quarter compared to $(0.4) million in the same quarter of the previous year.

Recent Additional Highlights:

- In May 2024, the Company announced the receipt of a $9 million production order for a high volume single-use cystoscopy surgery program. The program began production shipments of product in July, 2024.

- Subsequent to the end of the fiscal year, in August 2024 the Company announced a closing of a $1.4 million registered direct offering of common stock, which included participation from directors and officers.

Precision Optics’ CEO, Joseph Forkey, commented, “Upon exiting fiscal 2023, we were facing the loss of several significant programs that would not be continuing in fiscal 2024, totaling more than $7 million in annualized revenue. Due to the strength of our engineering pipeline, we backfilled a significant portion of the shortfall with record levels of product development revenue coupled with new products entering production. Currently several programs are transitioning from the development phase to production, including the program associated with the $9 million purchase order we announced in May. We have now reached a new phase for the Company, with a sizeable and growing base of production programs and product development revenue continuing at the record levels we achieved last year.”

“As we look forward to fiscal 2025, we expect our first quarter revenue will be in the range of $4.2 to $4.4 million, relatively flat compared to the previous year’s first quarter. Revenue for the first quarter was impacted by certain challenges in the start-up and ramp of key production programs. However, these issues are mostly now resolved, and with the growth of production and ongoing strong product development sales, we expect double digit revenue growth for fiscal 2025 with significant increases in revenue beginning with the second quarter of fiscal 2025,” Dr. Forkey concluded.

The following table summarizes the fourth quarter (unaudited) and fiscal year to date results for the periods ended June 30, 2024, and 2023:

| Three Months | Year | ||||||||||||

| Ended June 30 | Ended June 30 | ||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||

| Revenues | $ | 4,716,226 | $ | 5,024,140 | $ | 19,104,350 | $ | 21,044,467 | |||||

| Gross Profit | 1,024,451 | 1,934,945 | 5,797,777 | 7,909,956 | |||||||||

| Stock Compensation Expenses | 210,393 | 139,686 | 959,784 | 884,066 | |||||||||

| Other | 2,170,410 | 2,407,733 | 7,562,326 | 7,664,437 | |||||||||

| Total Operating Expenses | 2,380,803 | 2,547,419 | 8,522,110 | 8,548,503 | |||||||||

| Operating Income (Loss) | (1,356,352 | ) | (612,475 | ) | (2,724,333 | ) | (638,548 | ) | |||||

| Net Income (Loss) | (1,411,106 | ) | (96,125 | ) | (2,951,377 | ) | (144,613 | ) | |||||

| Income (Loss) per Share | |||||||||||||

| Basic & Fully Diluted | $ | (0.23 | ) | $ | (0.02 | ) | $ | (0.49 | ) | $ | (0.03 | ) | |

| Weighted Average Common Shares Outstanding | |||||||||||||

| Basic & Fully Diluted | 6,071,846 | 5,666,034 | 6,068,329 | 5,666,034 | |||||||||

Note: The Common Shares in this table reflect shares on a post reverse split basis for all periods presented.

Conference Call Details

Date and Time: Monday, September 30, at 5:00pm ET

Call-in Information: Interested parties can access the conference call by dialing (844) 735-3662 or (412) 317-5705.

Live Webcast Information: Interested parties can access the conference call via a live webcast, which is available at https://app.webinar.net/0Aa98ozwG53.

Replay: A teleconference replay of the call will be available until October 3, 2024, at (877) 344-7529 or (412) 317-0088, replay access code 7367981. A webcast replay will be available at https://app.webinar.net/0Aa98ozwG53.

About Precision Optics Corporation

Founded in 1982, Precision Optics is a vertically integrated optics company primarily focused on leveraging its proprietary micro-optics and 3D imaging technologies to the healthcare and defense/aerospace industries by providing services ranging from new product concept through mass manufacture. Utilizing its leading-edge in-house design, prototype, regulatory and fabrication capabilities as well as its Lighthouse Imaging division’s electronic imaging expertise and its Ross Optical division’s high volume world-wide sourcing, inspecting and production resources, the Company designs and manufactures next-generation product solutions for the most challenging customer requirements. Within healthcare, Precision Optics enables next generation medical device companies around the world to meet the increasing demands of the surgical community who require more enhanced and smaller imaging systems for minimally invasive surgery, including single-use medical devices, as well as 3D endoscopy systems to support the rapid proliferation of surgical robotic systems. In addition to these next generation applications, Precision Optics has supplied top tier medical device companies with a wide variety of optical products for decades, including complex endocouplers and specialized endoscopes. The Company is also leveraging its technical proficiency in micro-optics to enable leading edge defense/aerospace applications which require the highest quality standards and the optimization of size, weight and power. For more information, please visit www.poci.com.

Non-GAAP Financial Measures

Precision Optics has provided in this press release financial information that has not been prepared in accordance with accounting principles generally accepted in the Unites States of America (“non-GAAP”). The non-GAAP financial measure is Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization). Adjusted EBITDA also excludes from Net Income (Loss) the effect of stock-based compensation, restructuring and other acquisition-related items.

This non-GAAP financial measure assists Precision Optics management in comparing its operating performance over time because certain items may obscure the underlying business trends and make comparisons of long-term performance difficult, as they are of a nature and/or size that occur with inconsistent frequency or relate to discrete acquisition or restructuring plans that are fundamentally different from the ongoing productivity of the Company. Precision Optics management also believes that presenting this measure allows investors to view its performance using the same measures that the Company uses in evaluating its financial and business performance and trends.

Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information calculated in accordance with GAAP. Investors are encouraged to review the reconciliation of non-GAAP measures to their most directly comparable GAAP financial measures. A reconciliation of the non-GAAP financial measure presented above to GAAP results has been provided in the financial tables included with this press release.

About Forward-Looking Statements

This press release contains forward-looking statements. Forward-looking statements include, but are not limited to, statements that express the Company’s intentions, beliefs, expectations, strategies, predictions or any other statements related to the Company’s future activities or future events or conditions. These statements are based on current expectations, estimates and projections about the Company’s business based, in part, on assumptions made by the Company’s management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in the forward-looking statements due to numerous risk factors, including those risks discussed in the Company’s annual report on Form 10-K and in other documents that we file from time to time with the SEC. Any forward-looking statements speak only as of the date on which they are made, and the Company does not undertake any obligation to update any forward-looking statement, except as required by law.

Company Contact:

PRECISION OPTICS CORPORATION

22 East Broadway

Gardner, Massachusetts 01440-3338

Telephone: 978-630-1800

Investor Contact:

LYTHAM PARTNERS, LLC

Robert Blum

Telephone: 602-889-9700

poci@lythampartners.com

| PRECISION OPTICS CORPORATION, INC. Consolidated Balance Sheets at June 30, 2024 and 2023 |

||||||||

| 2024 | 2023 | |||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash and cash equivalents | $ | 405,278 | $ | 2,925,852 | ||||

| Accounts receivable, net of allowance for credit losses of $118,872 at June 30, 2024 and $606,715 at June 30, 2023 | 3,545,491 | 3,907,407 | ||||||

| Inventories | 2,868,100 | 2,776,216 | ||||||

| Prepaid expenses | 299,364 | 249,681 | ||||||

| Total current assets | 7,118,233 | 9,859,156 | ||||||

| Fixed Assets: | ||||||||

| Machinery and equipment | 3,341,194 | 3,227,481 | ||||||

| Leasehold improvements | 810,914 | 825,752 | ||||||

| Furniture and fixtures | 416,425 | 242,865 | ||||||

| 4,568,533 | 4,296,098 | |||||||

| Less—Accumulated depreciation and amortization | 4,074,960 | 3,862,578 | ||||||

| Net fixed assets | 493,573 | 433,520 | ||||||

| Operating lease right-of-use asset | 189,999 | 358,437 | ||||||

| Patents, net | 286,559 | 265,111 | ||||||

| Goodwill | 8,824,210 | 8,824,210 | ||||||

| TOTAL ASSETS | $ | 16,912,574 | $ | 19,740,434 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current Liabilities: | ||||||||

| Revolving line of credit | $ | 1,000,000 | $ | – | ||||

| Current portion of capital lease obligation | 41,113 | 43,209 | ||||||

| Current maturities of long-term debt | 276,928 | 513,259 | ||||||

| Accounts payable | 1,397,313 | 2,432,264 | ||||||

| Customer advances | 1,172,350 | 1,174,690 | ||||||

| Accrued compensation and other | 840,662 | 927,521 | ||||||

| Operating lease liability | 178,450 | 168,677 | ||||||

| Total current liabilities | 4,906,816 | 5,259,620 | ||||||

| Capital lease obligation, net of current portion | 27,369 | 68,482 | ||||||

| Long-term debt, net of current maturities | 1,899,052 | 2,175,980 | ||||||

| Operating lease liability, net of current portion | 11,549 | 189,760 | ||||||

| Stockholders’ Equity: | ||||||||

| Common stock, $0.01 par value: 50,000,000 shares authorized; issued and outstanding – 6,073,939 shares at June 30, 2024 and 6,066,518 shares at June 30, 2023 | 60,739 | 60,665 | ||||||

| Additional paid-in capital | 61,197,433 | 60,224,934 | ||||||

| Accumulated deficit | (51,190,384 | ) | (48,239,007 | ) | ||||

| Total stockholders’ equity | 10,067,788 | 12,046,592 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 16,912,574 | $ | 19,740,434 | ||||

| PRECISION OPTICS CORPORATION, INC. Consolidated Statements of Operations for the Years Ended June 30, 2024 and 2023 |

||||||||

| 2024 | 2023 | |||||||

| Revenues | $ | 19,104,350 | $ | 21,044,467 | ||||

| Cost of goods sold | 13,306,573 | 13,310,331 | ||||||

| Gross profit | 5,797,777 | 7,734,136 | ||||||

| Research and development expenses, net | 981,781 | 992,375 | ||||||

| Selling, general and administrative expenses | 7,540,329 | 7,380,309 | ||||||

| Total operating expenses | 8,522,110 | 8,372,684 | ||||||

| Operating loss | (2,724,333 | ) | (638,548 | ) | ||||

| Other income (expense) | ||||||||

| Interest expense | (225,108 | ) | (218,927 | ) | ||||

| Gain on revaluation of contingent earn-out liability | – | 714,798 | ||||||

| Loss before provision for income taxes | (2,949,441 | ) | (142,677 | ) | ||||

| Provision for income taxes | 1,936 | 1,936 | ||||||

| Net loss | $ | (2,951,377 | ) | $ | (144,613 | ) | ||

| Loss per share: | ||||||||

| Basic and fully diluted | $ | (0.49 | ) | $ | (0.03 | ) | ||

| Weighted average common shares outstanding: | ||||||||

| Basic and fully diluted | 6,068,329 | 5,666,034 | ||||||

| PRECISION OPTICS CORPORATION, INC. Consolidated Statements of Cash Flows For the Years Ended June 30, 2024 and 2023 |

||||||||

| 2024 | 2023 | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net loss | $ | (2,951,377 | ) | $ | (144,613 | ) | ||

| Adjustments to reconcile net loss to net cash (used in) provided by operating activities- | ||||||||

| Gain on revaluation of contingent earn-out liability | – | (705,892 | ) | |||||

| Depreciation and amortization | 212,382 | 210,735 | ||||||

| Stock-based compensation expense | 959,784 | 919,032 | ||||||

| Non-cash interest expense | 17,504 | 4,087 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable, net | 361,916 | (1,243,535 | ) | |||||

| Inventories | (91,884 | ) | 245,931 | |||||

| Prepaid expenses | (49,683 | ) | (36,233 | ) | ||||

| Accounts payable | (1,034,951 | ) | 193,089 | |||||

| Customer advances | (2,340 | ) | 269,577 | |||||

| Accrued compensation and other | (104,363 | ) | 206,732 | |||||

| Net cash used in operating activities | (2,683,012 | ) | (81,090 | ) | ||||

| Cash Flows from Investing Activities: | ||||||||

| Additional patent costs | (21,448 | ) | (35,713 | ) | ||||

| Purchases of property and equipment | (272,435 | ) | (16,784 | ) | ||||

| Net cash used in investing activities | (293,883 | ) | (52,497 | ) | ||||

| Cash Flows from Financing Activities: | ||||||||

| Payment of capital lease obligations | (43,209 | ) | (40,705 | ) | ||||

| Payments of long-term debt | (513,259 | ) | (367,341 | ) | ||||

| Issuance of long-term debt | – | 750,000 | ||||||

| Payment of debt issuance costs | – | (22,275 | ) | |||||

| Payment of acquisition earn-out liability | – | (166,667 | ) | |||||

| Borrowings on revolving line of credit | 1,000,000 | |||||||

| Gross proceeds from private placements of common stock | – | 2,288,281 | ||||||

| Gross proceeds from exercise of stock options | 12,789 | 12,397 | ||||||

| Net cash provided by financing activities | 456,321 | 2,453,690 | ||||||

| Net increase (decrease) in cash and cash equivalents | (2,520,574 | ) | 2,320,103 | |||||

| Cash and cash equivalents, beginning of year | 2,925,852 | 605,749 | ||||||

| Cash and cash equivalents, end of year | $ | 405,278 | $ | 2,925,852 | ||||

| Supplemental disclosure of cash flow information: | ||||||||

| Cash paid during the year for income taxes | $ | 1,936 | $ | 1,936 | ||||

| PRECISION OPTICS CORPORATION, INC. AND SUBSIDIARIES | ||||||||||||||||

| RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES | ||||||||||||||||

| ADJUSTED EBITDA | ||||||||||||||||

| Three Months | Year | |||||||||||||||

| Ended June 30, | Ended June 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Net Income (loss) (GAAP) | $ | (1,411,106 | ) | $ | (96,125 | ) | $ | (2,951,377 | ) | $ | (144,613 | ) | ||||

| Stock based compensation | 210,393 | 149,242 | 959,784 | 919,032 | ||||||||||||

| Depreciation and amortization | 55,796 | 53,442 | 212,382 | 218,927 | ||||||||||||

| State Income Taxes | 1,936 | 1,936 | 1,936 | 1,936 | ||||||||||||

| Revaluation of earn-out liability | – | (571,838 | ) | – | (714,798 | ) | ||||||||||

| Interest expense | 52,818 | 53,552 | 225,108 | 210,735 | ||||||||||||

| Adjusted EBITDA (non-GAAP) | $ | (1,090,163 | ) | $ | (409,791 | ) | $ | (1,552,167 | ) | $ | 491,219 | |||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin, Ethereum, Dogecoin Pull Back As Israel Launches Ground Operations In Lebanon: Analyst Says Google Trends Slump For King Crypto A Bullish Thing — 'Believe It Or Not'

Leading cryptocurrencies retraced Monday as geopolitical tensions escalated after Israel launched a military operation in Lebanon.

| Cryptocurrency | Gains +/- | Price (Recorded at 9:30 p.m. EDT) |

| Bitcoin BTC/USD | -2.99% | $63,358.69 |

| Ethereum ETH/USD |

-1.03% | $2,611.87 |

| Dogecoin DOGE/USD | -6.84% | $0.1148 |

What Happened: Bitcoin went downhill throughout the day, at one point slipping below $63,000, wiping away gains from the previous day’s rally to $66,000.

Ethereum was comparatively less hassled, as it continued to wiggle in the $2,600 region.

The Israeli military reportedly launched a localized operation against Hezbollah targets in southern Lebanon, the latest flare-up in hostilities in the tensed Middle East region.

Cryptocurrency liquidations surpassed $225 million in the last 24 hours, the highest since Sept. 6. More than $180 million locked in long positions were erased.

Bitcoin’s Open Interest slid 1.14%, further indicating the liquidation of bullish leveraged bets.

The number of traders opening short positions for the leading cryptocurrency continued to outnumber those taking bullish positions, according to the Long/Short Ratio.

The market sentiment fell from “Greed” to “Neutral,” according to the popular Cryptocurrency Fear & Greed Index.

On a positive note, the market ended September on a high, with the biggest monthly gains ever recorded at 7.35%.

Top Gainers (24-Hours)

| Cryptocurrency | Gains +/- | Price (Recorded at 9:30 p.m. EDT) |

| Bonk (BONK) | +7.68% | $0.00002423 |

| Fantom (FTM) | +5.19% | $0.7042 |

| Bittensor (TAO) | +4.89% | $578.95 |

The global cryptocurrency stood at $2.23 trillion in the last 24 hours, shrinking 2.42% in the last 24 hours.

Stocks ended September on a high. The S&P 500 gained 24.31 points, or 0.42%, to close at 5,762.48, while the Dow Jones Industrial Average lifted marginally by 0.04% to end at 42,330.15. Both the blue-chip indexes closed at record highs. The Nasdaq Composite added 0.38% to end at 18,189.17.

The rally recouped losses following Fed Chair Jerome Powell’s comments that economic data would determine the speed of future interest rate cuts and that the regulator was not in a hurry.

The U.S. dollar initially strengthened following the hawkish remark, with the dollar index rising to 100.75. At last check, the index was down 0.04% at 100.715.

Investors’ next focus would be on the unemployment data for September, due for release on Friday. Powell stated that one of the Fed’s main goals was not to have higher unemployment, as they bring inflation down.

See More: Best Cryptocurrency Scanners

Analyst Notes: Popular on-chain research firm Santiment highlighted its earlier analysis, which predicted a market top due to Bitcoin’s strong bullish crowd sentiment.

“With Monday’s retrace, there are some expected panic sells. If the FOMO turns to FUD, the bull market should resume quickly,” Santiment predicted.

Influential cryptocurrency trader Ali Martinez also underlined lower interest in King Crypto, citing less internet searches. “Believe it or not, this is bullish!” he added.

Widely-followed cryptocurrency investor Ted deemed the latest fall as a “bullish retest,” highlighting the significance of stabilizing an overheated market.

“Now the market looks much healthier. I’m expecting a reversal soon,” the analyst projected.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[Latest] Global Interposer and Fan-Out WLP Market Size/Share Worth USD 58.6 Billion by 2033 at a 3.7% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

Austin, TX, USA, Oct. 01, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “IInterposer and Fan-Out WLP Market Size, Trends and Insights By Packaging Technology (Through-silicon Vias, Interposers), By Application (Imaging and Optoelectronics, Memory, MEMES or Sensors, LED, Power, Analog and Mixed-Signal, Photonics and Radio Frequency), By End-User Industry (Consumer Electronics, Telecommunication, Industrial Sector, Automotive, Military & Aerospace, Smart Technologies, Medical Devices) and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

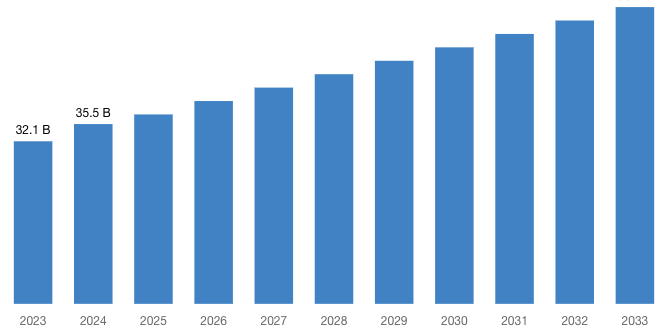

“According to the latest research study, the demand of global Interposer and Fan-Out WLP Market size & share was valued at approximately USD 32.1 Billion in 2023 and is expected to reach USD 35.5 Billion in 2024 and is expected to reach a value of around USD 58.6 Billion by 2033, at a compound annual growth rate (CAGR) of about 3.7% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Interposer and Fan-Out WLP Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=52167

Interposer and Fan-Out WLP Market: Overview

Interposer and Fan-Out Wafer Level Packaging (FOWLP) are advanced packaging technologies used in the semiconductor industry to enhance the performance, miniaturization, and functionality of integrated circuits (ICs).

Interposer technology involves placing a silicon, glass, or organic substrate between the die and the package substrate, enabling the integration of heterogeneous dies, such as memory, logic, and sensors, onto a single package.

This allows for higher bandwidth, lower power consumption, and improved thermal management in ICs, making it suitable for applications like high-performance computing, networking, and consumer electronics. Fan-Out WLP is a packaging technique where the IC is directly embedded in a polymer matrix, eliminating the need for traditional package substrates.

This approach enables the miniaturization of devices, as the package size can be closely matched to the size of the IC. FOWLP also offers increased input/output (I/O) density, improved signal integrity, and enhanced thermal performance, making it ideal for compact and high-performance applications such as smartphones, wearables, and automotive electronics.

Request a Customized Copy of the Interposer and Fan-Out WLP Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=52167

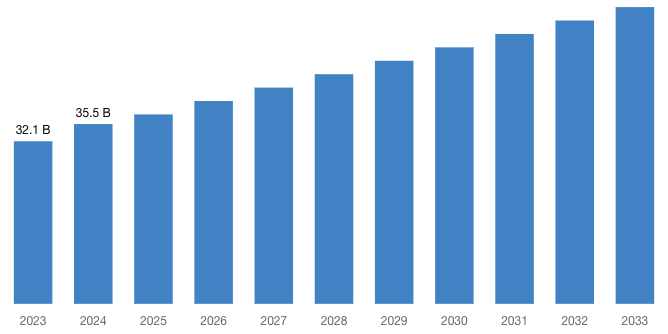

By packaging technology, the Through-silicon Vias segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. Through-Silicon Vias (TSVs) are vertical electrical connections that pass through the entire thickness of a silicon wafer.

They enable communication between different layers of semiconductor devices, facilitating high-density packaging and improved performance in integrated circuits.

By application, the Imaging and Optoelectronics segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. Imaging and Optoelectronics involve the capture, processing, and manipulation of light to create images or perform optical sensing tasks.

This field encompasses technologies like cameras, displays, sensors, lasers, and fiber optics, with applications spanning from photography to medical imaging and communication systems.

In North America, a notable trend involves the increasing adoption of renewable energy sources such as solar and wind power, driven by environmental concerns and technological advancements. This shift is reshaping energy infrastructure, policies, and investment priorities, aiming for a more sustainable and diversified energy landscape.

Taiwan Semiconductor offers a product portfolio, spanning Rectifiers, MOSFETs, Diodes, ICs, and Sensors, providing customers with power management.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 35.5 Billion |

| Projected Market Size in 2033 | USD 58.6 Billion |

| Market Size in 2023 | USD 32.1 Billion |

| CAGR Growth Rate | 3.7% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Packaging Technology, Application and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Interposer and Fan-Out WLP report is available upon request; please contact us for more information.)

Request a Customized Copy of the Interposer and Fan-Out WLP Market Report @ https://www.custommarketinsights.com/report/interposer-and-fan-out-wlp-market/

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Interposer and Fan-Out WLP report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Interposer and Fan-Out WLP Market Report @ https://www.custommarketinsights.com/report/interposer-and-fan-out-wlp-market/

CMI has comprehensively analyzed the Global Interposer and Fan-Out WLP market. The driving forces, restraints, challenges, opportunities, and key trends have been explained in depth to depict depth scenarios of the market. Segment wise market size and market share during the forecast period are duly addressed to portray the probable picture of this Global Interposer and Fan-Out WLP industry.

The competitive landscape includes key innovators, after market service providers, market giants as well as niche players are studied and analyzed extensively concerning their strengths, weaknesses as well as value addition prospects. In addition, this report covers key players profiling, market shares, mergers and acquisitions, consequent market fragmentation, new trends and dynamics in partnerships.

Key questions answered in this report:

- What is the size of the Interposer and Fan-Out WLP market and what is its expected growth rate?

- What are the primary driving factors that push the Interposer and Fan-Out WLP market forward?

- What are the Interposer and Fan-Out WLP Industry’s top companies?

- What are the different categories that the Interposer and Fan-Out WLP Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Interposer and Fan-Out WLP market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Interposer and Fan-Out WLP Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/interposer-and-fan-out-wlp-market/

Interposer and Fan-Out WLP Market: Regional Analysis

By region, Interposer and Fan-Out WLP market is segmented into North America, Europe, Asia-Pacific, Latin America, Middle East & Africa. The North America dominated the global Interposer and Fan-Out WLP market in 2023 with market share of 40.1% and is expected to keep its dominance during the forecast period 2024-2033.

North America’s dominance in the Interposer and Fan-Out Wafer Level Packaging (FOWLP) market stems from its innovative ecosystem, strong technological infrastructure, and diverse industry applications.

The region’s leading semiconductor companies and research institutions drive significant advancements in FOWLP technology, leveraging their expertise to develop cutting-edge packaging solutions.

North America’s robust demand for high-performance computing, data centers, and consumer electronics fuels the adoption of interposer and FOWLP technologies. These packaging methods offer advantages such as increased performance, miniaturization, and enhanced functionality, catering to the evolving needs of various industries.

Furthermore, North America’s leadership in emerging technologies like 5G, artificial intelligence, and Internet of Things (IoT) drives the demand for advanced semiconductor packaging solutions.

The presence of major players in the semiconductor industry, coupled with a supportive regulatory environment and substantial investments in research and development, solidifies North America’s position as a key driver of the interposer and FOWLP market.

Additionally, collaborations between semiconductor companies, equipment manufacturers, and research institutions further accelerate the innovation and adoption of these packaging technologies in the region.

Request a Customized Copy of the Interposer and Fan-Out WLP Market Report @ https://www.custommarketinsights.com/report/interposer-and-fan-out-wlp-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Interposer and Fan-Out WLP Market Size, Trends and Insights By Packaging Technology (Through-silicon Vias, Interposers), By Application (Imaging and Optoelectronics, Memory, MEMES or Sensors, LED, Power, Analog and Mixed-Signal, Photonics and Radio Frequency), By End-User Industry (Consumer Electronics, Telecommunication, Industrial Sector, Automotive, Military & Aerospace, Smart Technologies, Medical Devices) and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/interposer-and-fan-out-wlp-market/

List of the prominent players in the Interposer and Fan-Out WLP Market:

- Taiwan Semiconductor Manufacturing Company

- Jiangsu Changjiang Electronics Tech Co

- Siliconware Precision Industries Co. Ltd.

- Tongfu Microelectronics Co. Ltd.

- Amkor Technology

- ASE TECHNOLOGY HOLDING

- TOSHIBA CORPORATION

- SPTS Technologies Ltd.

- Brewer Science Inc.

- Fraunhofer IZM

- Cadence Design Systems Inc.

- Samsung Electronics

- Qualcomm Incorporated

- Texas Instruments

- United Microelectronics

- STMicroelectronics.

- Others

Click Here to Access a Free Sample Report of the Global Interposer and Fan-Out WLP Market @ https://www.custommarketinsights.com/report/interposer-and-fan-out-wlp-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Europe Commercial Refrigeration Equipment Market: Europe Commercial Refrigeration Equipment Market Size, Trends and Insights By Product Type (Refrigerators and Freezers, Refrigerated Display Cases, Beverage Refrigeration, Ice Machines, Others), By Application (Food Service, Food and Beverage Retail, Healthcare, Hotels and Hospitality, Other), By Capacity (Small Capacity, Medium Capacity, Large Capacity), By Technology (Self-contained Refrigeration Units, Remote Condensing Units, Smart Refrigeration), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Digital Multimeter Market: Digital Multimeter Market Size, Trends and Insights By Product Type (Handheld, Desktop, Mounted), By Ranging Type (Auto-ranging, Manual), By Application (Automotive, Energy & Utility, Consumer electronics, Medical, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Digital Panel Meter Market: Digital Panel Meter Market Size, Trends and Insights By Type (Temperature Meters, Voltage Meters, Current Meters, Power Meters, Multifunction Meters), By Display Type (LED Display, LCD Display, OLED Display), By Application (Industrial Automation, Energy Management, Process Control, Environmental Monitoring), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Data Center CPU Market: Data Center CPU Market Size, Trends and Insights By Chip Type (Central Processing Unit (CPU), Graphics Processing Unit (GPU), Field-Programmable Gate Array (FPGA), Application Specific Integrated Circuit (ASIC), Others), By Data Center Size (Small and medium size, Large size), By Vertical Industry (BFSI, Government, IT and telecom, Transportation, Energy & utilities, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Non-Volatile Memory Market: Non-Volatile Memory Market Size, Trends and Insights By Type (Electrically Addressed, Mechanically Addressed), By Application (Consumer Electronics, Healthcare Monitoring, Automotive Application, Enterprise Storage, Industrial), By End-User (Automotive, Healthcare, Telecom and IT, Energy and Power, Manufacturing Industries), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Cross-Connect System Market: Cross-Connect System Market Size, Trends and Insights By Type (Fiber, CAT Cables, COAX, Others), By Application (Connectivity, Protection Switching & Network Restoration), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Tantalum Capacitor Market: Tantalum Capacitor Market Size, Trends and Insights By Product Type (Solid Tantalum Capacitors, Tantalum Polymer Capacitors, Surface Mount Technology (SMT) Tantalum Capacitors, Leaded Tantalum Capacitors), By Application (Consumer Electronics, Automotive Electronics, Industrial Electronics, Telecommunications, Medical Electronics, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Vibration Monitoring Market: Vibration Monitoring Market Size, Trends and Insights By Component Type (Hardware, Accelerometers, Proximity Probes, Velocity Sensors, Others, Software, Vibration Analyzers, Data Collectors, Condition Monitoring Software, Others), By Monitoring Process (Online Monitoring, Portable Monitoring), By System Type (Embedded Systems, Vibration Analyzers, Vibration Meters, Vibration Transmitters, Others), By Application (Machinery Monitoring, Bearing Condition Monitoring, Gearbox Monitoring, Fan & Pump Monitoring, Rotor Dynamics Analysis, Others), By Industry Vertical (Oil & Gas, Energy & Power, Automotive, Aerospace & Defense, Chemicals & Petrochemicals, Mining & Metals, Food & Beverages, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Interposer and Fan-Out WLP Market is segmented as follows:

By Packaging Technology

- Through-silicon Vias

- Interposers

By Application

- Imaging and Optoelectronics

- Memory

- MEMES or Sensors

- LED

- Power

- Analog and Mixed-Signal

- Photonics and Radio Frequency

By End-User Industry

- Consumer Electronics

- Telecommunication

- Industrial Sector

- Automotive

- Military & Aerospace

- Smart Technologies

- Medical Devices

Click Here to Get a Free Sample Report of the Global Interposer and Fan-Out WLP Market @ https://www.custommarketinsights.com/report/interposer-and-fan-out-wlp-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Interposer and Fan-Out WLP Market Research/Analysis Report Contains Answers to the following Questions.

- What Developments Are Going On in That Technology? Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Interposer and Fan-Out WLP Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Interposer and Fan-Out WLP Market? What Was the Capacity, Production Value, Cost and PROFIT of the Interposer and Fan-Out WLP Market?

- What Is the Current Market Status of the Interposer and Fan-Out WLP Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Interposer and Fan-Out WLP Market by Considering Applications and Types?

- What Are Projections of the Global Interposer and Fan-Out WLP Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Interposer and Fan-Out WLP Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Interposer and Fan-Out WLP Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Interposer and Fan-Out WLP Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Interposer and Fan-Out WLP Industry?

Click Here to Access a Free Sample Report of the Global Interposer and Fan-Out WLP Market @ https://www.custommarketinsights.com/report/interposer-and-fan-out-wlp-market/

Reasons to Purchase Interposer and Fan-Out WLP Market Report

- Interposer and Fan-Out WLP Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Interposer and Fan-Out WLP Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Interposer and Fan-Out WLP Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Interposer and Fan-Out WLP Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Interposer and Fan-Out WLP market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Interposer and Fan-Out WLP Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/interposer-and-fan-out-wlp-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Interposer and Fan-Out WLP market analysis.

- The competitive environment of current and potential participants in the Interposer and Fan-Out WLP market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Interposer and Fan-Out WLP market should find this report useful. The research will be useful to all market participants in the Interposer and Fan-Out WLP industry.

- Managers in the Interposer and Fan-Out WLP sector are interested in publishing up-to-date and projected data about the worldwide Interposer and Fan-Out WLP market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Interposer and Fan-Out WLP products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Interposer and Fan-Out WLP Market Report @ https://www.custommarketinsights.com/report/interposer-and-fan-out-wlp-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Interposer and Fan-Out WLP Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/interposer-and-fan-out-wlp-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Self-contained Breathing Apparatus Market is Expected to Reach US$ 2.28 Billion at a CAGR of 6% by 2034 | Fact.MR Report

Rockville, MD , Oct. 01, 2024 (GLOBE NEWSWIRE) — According to the recently updated report by Fact.MR, a market research and competitive intelligence provider, the global Self-Contained Breathing Apparatus (SCBA) Market is evaluated to reach US$ 1.27 billion in 2024. The market is projected to escalate at a CAGR of 6% between 2024 and 2034.

Due to its several uses and vital role in a range of sectors, self-contained breathing equipment (SCBA) is seeing a sharp increase in demand globally. In industrial environments where air quality is impaired, such as mining, firefighting, and handling dangerous materials, these life-saving equipment are indispensable. This demand is further spurred by the rising emphasis on workplace safety laws and the greater knowledge of respiratory health concerns than ever before.

In the healthcare industry, SCBAs are also becoming more popular, especially in reaction to infectious disease outbreaks. Their adaptability is found in deep-sea diving operations, aerospace, and law enforcement applications. SCBAs are essential in emergency response scenarios because they ensure a consistent supply of breathing air in harsh environments.

SCBAs are estimated to see steady growth in the global market as industries grow and safety rules change. Because of the increase in demand, SCBA producers are being forced to develop and advance the technology of these essential devices, keeping them at the forefront of personal protective equipment.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=763

Key Takeaways from Market Study:

- The global self-contained breathing apparatus market is projected to reach a valuation of US$ 2.28 billion by the end of 2034.

- North America is evaluated to account for a 28.6% share of the global market by 2034.

- The East Asian market for self-contained breathing apparatus is projected to expand at a CAGR of 6.8% from 2024 to 2034.

- Sales of self-contained breathing apparatus (SCBA) in Mexico are forecasted to rise at a CAGR of 7.2% through 2034.

- Japan is evaluated to account for a market share of 26.9% in East Asia by 2034.

- Sales of open-circuit self-contained breathing apparatus are analyzed to increase at a CAGR of 6.5% from 2024 to 2034.

“Hazardous material handing is becoming very easy due to the employment of SCBA products leading to improved market growth,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Self-contained Breathing Apparatus (SCBA) Market:

Key players in the self-contained breathing apparatus market are 3M Corporation, Kimberly Clark Incorporation, Avon Protection Systems Incorporation, MSA Safety Incorporation, Alpha Pro Tech Corporation, Bullard Limited, Dragerwerk Limited, Honeywell International Inc., Scott Safety, Interspiro A/S, Gentex Corporation, C.C. Holdings Inc., Aqua Lung International LLC.

Accelerating Demand for SCBAs for Ensuring Comfort and Minimal Fatigue during Prolonged Use:

With the use of more advanced materials, SCBAs are becoming increasingly comfortable and lightweight, which lessens user fatigue during prolonged usage. Better fit across a range of body shapes is ensured through improved ergonomics and adaptability, thereby improving both comfort and safety.

Smart technology integration is completely changing the functionality of SCBAs. Real-time monitoring systems send data to command centers for better situational awareness by tracking user vital signs, air supply levels, and environmental variables. Certain types see infrared, which makes them useful for navigating through smoke-filled areas.

Battery technology advancements have extended operational times, while rapid charging systems minimize downtime. Enhanced communication systems integrated into SCBAs improve team coordination in hazardous situations. Additionally, modular designs allow for easier maintenance and component upgrades. These innovations help in improving safety and efficiency along with expanding potential applications of SCBAs, which is driving increased adoption across several industries and driving market growth globally.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=763

Self-contained Breathing Apparatus (SCBA) Industry News:

- A brand-new self-contained breathing equipment solution created especially for law enforcement and special operations was introduced by 3M Corporation in May 2022. The first SCBA approved under the NFPA 1986 standard for tactical operations respiratory protection equipment is the 3M Scott X3-21 Pro SCBA.

- The U.K.-based nonprofit organization FIRE AID and MSA Safety announced a collaboration in July 2021 to support firefighter safety in potentially high-growth nations.

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the self-contained breathing apparatus (SCBA) market for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on type (open circuit, closed circuit), sales channel (specialty stores, direct sale, online sale), and application (chemical & petrochemical, oil & gas, firefighting, mining, paints & coatings), across seven major regions of the world (North America, Western Europe, Eastern Europe, East Asia, Latin America, South Asia & Pacific, and MEA).

Check out More Related Studies Published by Fact.MR:

Desiccant Air Breathers Market: Stands at a value of US$ 748.7 million and is predicted to reach US$ 1.34 billion by 2033, expanding at a healthy CAGR of 6% from 2023 to 2033.

Construction Equipment Rental Market: Size is estimated to reach US$ 131.2 billion in 2024. The market has been projected to climb to a value of US$ 201.81 billion by the end of 2034, expanding at a CAGR of 4.4% between 2024 and 2034.

Machine Tool Market: Share is expected to reach US$ 71.6 billion in 2024. The global machine tool market has been forecast to expand at a 5.1% CAGR and ascend to a valuation of US$ 117.74 billion by the end of 2034.

Elevator Component Market: Size is currently valued at US$ 54.6 billion, according to a recent report by Fact.MR, and is forecasted to expand at a CAGR of 9.4% to reach US$ 134.1 billion by the end of 2034.

Air Conditioning System Market: Size is estimated at US$ 135.4 billion in 2024 and is forecasted to rise at a CAGR of 4.8% to reach US$ 216.4 billion by the end of 2034.

Stationary Fuel Cell System Market: Size has been forecasted to expand at a remarkable CAGR of 20.3% to reach US$ 30.97 billion by the end of 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nobel Laureate Paul Krugman Slams Trump, Says Campaign 'Rests Entirely On Denouncing' Imaginary Things: Praises Biden-Harris Administration's Handling Of Inflation

Nobel laureate Paul Krugman has taken a potshot at former President Donald Trump‘s campaign for focusing on what he describes as “imaginary” problems.

What Happened: In a post on X, formerly Twitter, Krugman accused the Trump campaign of denouncing a non-existent bad economy, runaway crime, and alleged failures by President Joe Biden and Vice President Kamala Harris‘ administration.

According to Krugman, “We’ve all become desensitized, but it’s amazing how at this point the Trump campaign rests entirely on denouncing things that aren’t happening — a imaginary bad economy, imaginary runaway crime and now an imaginary failure of Biden and Harris to respond to natural disaster.”

He elaborated on his views in an opinion piece for The New York Times published the same day.

In his opinion piece titled “Why Trumponomics Could Lead to Trumpflation,” Krugman warned that Trump’s economic policies could lead to significant inflation. He argued that Trump’s proposed high tariffs, mass deportations, and undermining of the Federal Reserve’s independence would disrupt the economy.

Krugman also highlighted that the Federal Reserve’s preferred measure of consumer prices rose only 2.2% over the past year, close to its 2% target, without causing a recession.

He credited the Biden administration for not pressuring the Fed to keep rates low, which helped manage inflation expectations.

Krugman concluded that Trump’s policies could lead to long-term stagflation, contrasting the current administration’s handling of economic issues.

See Also: Economist Ben Golub Sounds Alarm On Upcoming US Shipping Strike Affecting 36 Ports

Why It Matters: Krugman’s comments come amid heightened scrutiny of Trump’s economic policies. Earlier this month, Krugman criticized Elon Musk and Trump’s federal efficiency plans, warning about risks to Medicare and Social Security.

He stated, “The federal government is an insurance company with an army. You can’t make major spending cuts without slashing Social Security, Medicare and Medicaid and/or weakening national defense.”

In mid-September, Trump voiced his disapproval of the Federal Reserve’s decision to cut its benchmark interest rate by half a percentage point, suggesting it indicated a faltering U.S. economy or a politically motivated action. He said, “I guess it shows the economy is very bad to cut it by that much, assuming that they are not just playing politics.”

Additionally, Trump has claimed that inflation has cost American households $28,000, a figure that has sparked debate among economists and analysts. During a rally in Las Vegas, Trump asserted that “the worst inflation in American history” has caused severe financial strain for American families.

Adding to the controversy, Trump recently launched a $100,000 luxury watch collection, while his wife, Melania Trump, voiced concerns over rising inflation and its impact on American families.

Read Next:

Image Via Flickr

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fannie Mae Reminds Homeowners, Renters, and Mortgage Servicers of Disaster Relief Options for Those Affected by Hurricane Helene

WASHINGTON, Sept. 30, 2024 /PRNewswire/ — Fannie Mae FNMA is reminding homeowners and renters impacted by natural disasters, including those affected by Hurricane Helene, of available mortgage assistance and disaster relief options. Mortgage servicers also are reminded of options to assist homeowners under Fannie Mae’s guidelines during these circumstances.

“Our top priority is the safety and well-being of those affected by Hurricane Helene. Homeowners facing hardship due to the hurricane should contact their mortgage servicer to discuss relief options as soon as they’re able to do so,” said Cyndi Danko, Senior Vice President and Chief Credit Officer, Single-Family, Fannie Mae.

Homeowners and renters should call 855-HERE2HELP (855-437-3243) to access Fannie Mae’s disaster recovery counseling* or visit the Fannie Mae website for more information.

Under Fannie Mae’s guidelines for single-family mortgages impacted by a disaster:

- Homeowners may request mortgage assistance by contacting their mortgage servicer (the company listed on their mortgage statement) following a disaster.

- Homeowners affected by a disaster are often eligible to reduce or suspend their mortgage payments for up to 12 months by entering a forbearance plan with their mortgage servicer. During this temporary reduction or pause in payments, homeowners will not incur late fees and foreclosure and other legal proceedings are suspended.

- In instances where contact with the homeowner has not been established, mortgage servicers are authorized to offer a forbearance plan for up to 90 days if the servicer believes the home was affected by a disaster.

- Following a forbearance plan, there are a number of options available to potentially help homeowners resolve the delinquency without paying a lump sum, including Disaster Payment Deferral and Fannie Mae Flex Modification.

- In addition, homeowners on a COVID-19-related forbearance plan who are subsequently impacted by a disaster may still be eligible for assistance and should contact their mortgage servicer to discuss options.

Homeowners and renters looking for disaster recovery resources may visit the Fannie Mae website to learn more about addressing immediate needs. Fannie Mae also offers help navigating the broader financial effects of a disaster to homeowners and renters through disaster recovery counseling at 855-HERE2HELP (855-437-3243).* Assistance is provided free of charge by U.S. Department of Housing and Urban Development-approved housing counselors who are trained disaster-recovery experts that provide:

- A needs assessment and personalized recovery plan.

- Help requesting financial relief from the Federal Emergency Management Agency, insurance, and other sources.

- Web resources and ongoing guidance for up to 18 months.

- Services available in multiple languages.

*Operated by Money Management International/MMI

About Fannie Mae

Fannie Mae advances equitable and sustainable access to homeownership and quality, affordable rental housing for millions of people across America. We enable the 30-year fixed-rate mortgage and drive responsible innovation to make homebuying and renting easier, fairer, and more accessible. To learn more, visit:

fanniemae.com | X (formerly Twitter) | Facebook | LinkedIn | Instagram | YouTube | Blog

Fannie Mae Newsroom

https://www.fanniemae.com/news

Photo of Fannie Mae

https://www.fanniemae.com/resources/img/about-fm/fm-building.tif

Fannie Mae Resource Center

1-800-2FANNIE (800-232-6643)

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/fannie-mae-reminds-homeowners-renters-and-mortgage-servicers-of-disaster-relief-options-for-those-affected-by-hurricane-helene-302263197.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/fannie-mae-reminds-homeowners-renters-and-mortgage-servicers-of-disaster-relief-options-for-those-affected-by-hurricane-helene-302263197.html

SOURCE Fannie Mae

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AI chip firm Cerebras reveals threefold revenue jump in US IPO filing

(Reuters) -Cerebras Systems recorded an over threefold jump in annual revenue in 2023, the artificial intelligence chip firm said on Monday in its paperwork for a US initial public offering.

Businesses racing to adopt AI applications like ChatGPT have benefited the companies behind the semiconductors needed to power the technology. AI chip leader Nvidia’s (NVDA) stock has more than doubled in market value this year and briefly dethroned Microsoft (MSFT) as the world’s most valuable company.

Still, concerns of excessive euphoria around AI-linked stocks prompted some investors to exit the technology sector earlier in the year, and the Cerebras IPO will likely serve as a litmus test for the market’s AI appetite.

The Sunnyvale, California-based company did not disclose the terms or size of its offering.

Receding recession fears and a strong equities rally have also rejuvenated the U.S. IPO market in 2024 after two lackluster years.

Cerebras designs processors for AI training and inference, and builds AI systems to power the processors and feed them data.

On Monday, the company revealed total revenue of $78.74 million for the 12 months ended Dec. 31, 2023, up from $24.62 million in 2022.

It recorded a net loss of $127.16 million for the same period, compared with a loss of $177.72 million in 2022.

Cerebras has been backed by a number of high-profile investors, including the Abu Dhabi Growth Fund and Coatue Management.

Citigroup, Barclays, UBS Investment, Wells Fargo Securities and Mizuho are among the underwriters for the offering.

Cerebras will list on the Nasdaq Global Market under the symbol “CBRS”.

(Reporting by Pritam Biswas in Bengaluru; Editing by Devika Syamnath)

BGC Group Updates its Outlook for the Third Quarter of 2024

NEW YORK, Sept. 30, 2024 /PRNewswire/ — BGC Group, Inc. BGC, today announced that it has updated its outlook for the quarter ending September 30, 2024.

Updated Outlook

BGC expects to be around the high-end of its previously stated outlook ranges for revenue and pre-tax Adjusted Earnings for the third quarter of 2024. The Company’s outlook was contained in BGC’s financial results press release issued on July 30, 2024, which can be found at http://ir.bgcg.com.

Non-GAAP Financial Measures

The non-GAAP definitions below include references to certain equity-based compensation instruments, such as restricted stock awards and/or restricted stock units (“RSUs”), that the Company has issued and outstanding following its corporate conversion on July 1, 2023. Although BGC is retaining certain defined terms and references, including references to partnerships or partnership units, for purposes of comparability before and after the corporate conversion, such references may not be applicable following the period ended June 30, 2023.

This document contains non-GAAP financial measures that differ from the most directly comparable measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States (“GAAP”). Non-GAAP financial measures used by the Company include “Adjusted Earnings before noncontrolling interests and taxes”, which is used interchangeably with “pre-tax Adjusted Earnings”; “Post-tax Adjusted Earnings to fully diluted shareholders”, which is used interchangeably with “post-tax Adjusted Earnings”; “Adjusted EBITDA”; “Liquidity”; and “Constant Currency”. The definitions of these terms are below.

Adjusted Earnings Defined

BGC uses non-GAAP financial measures, including “Adjusted Earnings before noncontrolling interests and taxes” and “Post-tax Adjusted Earnings to fully diluted shareholders”, which are supplemental measures of operating results used by management to evaluate the financial performance of the Company and its consolidated subsidiaries. BGC believes that Adjusted Earnings best reflect the operating earnings generated by the Company on a consolidated basis and are the earnings which management considers when managing its business.

As compared with “Income (loss) from operations before income taxes” and “Net income (loss) for fully diluted shares”, both prepared in accordance with GAAP, Adjusted Earnings calculations primarily exclude certain non-cash items and other expenses that generally do not involve the receipt or outlay of cash by the Company and/or which do not dilute existing stockholders. In addition, Adjusted Earnings calculations exclude certain gains and charges that management believes do not best reflect the underlying operating performance of BGC. Adjusted Earnings is calculated by taking the most comparable GAAP measures and adjusting for certain items with respect to compensation expenses, non-compensation expenses, and other income, as discussed below.

Calculations of Compensation Adjustments for Adjusted Earnings and Adjusted EBITDA

Treatment of Equity-Based Compensation Line Item for Adjusted Earnings and Adjusted EBITDA

The Company’s Adjusted Earnings and Adjusted EBITDA measures exclude all GAAP charges included in the line item “Equity-based compensation and allocations of net income to limited partnership units and FPUs” (or “equity-based compensation” for purposes of defining the Company’s non-GAAP results) as recorded on the Company’s GAAP Consolidated Statements of Operations and GAAP Consolidated Statements of Cash Flows. These GAAP equity-based compensation charges reflect the following items:

- Charges related to amortization of RSUs, restricted stock awards, other equity-based awards, and limited partnership units;

- Charges with respect to grants of exchangeability, which reflect the right of holders of limited partnership units with no capital accounts, such as LPUs and PSUs, to exchange these units into shares of common stock, or into partnership units with capital accounts, such as HDUs, as well as cash paid with respect to taxes withheld or expected to be owed by the unit holder upon such exchange. The withholding taxes related to the exchange of certain non-exchangeable units without a capital account into either common shares or units with a capital account may be funded by the redemption of preferred units such as PPSUs;

- Charges with respect to preferred units and RSU tax accounts. Any preferred units and RSU tax accounts would not be included in the Company’s fully diluted share count because they cannot be made exchangeable into shares of common stock and are entitled only to a fixed distribution or dividend. Preferred units are granted in connection with the grant of certain limited partnership units that may be granted exchangeability or redeemed in connection with the grant of shares of common stock, and RSU tax accounts are granted in connection with the grant of RSUs. The preferred units and RSU tax accounts are granted at ratios designed to cover any withholding taxes expected to be paid. This is an alternative to the common practice among public companies of issuing the gross amount of shares to employees, subject to cashless withholding of shares, to pay applicable withholding taxes;

- GAAP equity-based compensation charges with respect to the grant of an offsetting amount of common stock or partnership units with capital accounts in connection with the redemption of non-exchangeable units, including PSUs and LPUs;

- Charges related to grants of equity awards, including common stock, RSUs, restricted stock awards or partnership units with capital accounts;

- Allocations of net income to limited partnership units and FPUs. Such allocations represent the pro-rata portion of post-tax GAAP earnings available to such unit holders; and

- Charges related to dividend equivalents earned on RSUs and any preferred returns on RSU tax accounts.