MicroStrategy's Next Bitcoin Purchase Is Likely to Take Its Holdings Above Grayscale's GBTC

-

MicroStrategy mights soon hold more bitcoin than Grayscale.

-

The company has used capital markets to continually raise money for additional bitcoin buys, while Grayscale has seen a large exit of tokens since the U.S. spot ETFs were introduced in January.

MicroStrategy (MSTR) could soon have bigger bitcoin {{BTC}} pockets than Grayscale.

The company held a total of 252,220 bitcoins, or 1.2% of the total supply which is capped at 21 million, per its latest regulatory filing on Sept. 20. Grayscale, which held upwards of 620,000 in its Bitcoin Trust (GBTC) prior to the launch of the U.S. spot ETFs in January, currently holds just over 254,000 tokens split between GBTC and its newer lower-fee Bitcoin Mini Trust (BTC).

Recent capital raises, though, have left MicroStrategy with more than $1 billion which the company has yet to put to work (or at least has not yet announced). Presumably, these funds will be used for more bitcoin, which would add thousands of more coins to its balance sheet and bring its holdings far above that of Grayscale.

This would also make MicroStrategy the fifth largest holder of the cryptocurrency, trailing only BlackRock, Binance, Satoshi Nakamoto and Coinbase. An important distinction, of course, is that BlackRock, Binance and Coinbase hold bitcoins for clients, not for their own account.

Under the leadership of then CEO and now Executive Chairman Michael Saylor, MicroStrategy started purchasing bitcoin with cash from its balance sheet in August 2020. Since, it has aggressively used the capital markets to raise billions with which to continually add to holdings. The company’s average purchase price is just over $39,000 versus bitcoin’s current price of around $64,000. The stack today is worth about $16 billion.

As for Grayscale, which pioneered public access to bitcoin via funds, it chose to keep the fee for its GBTC at a relatively high 1.50% – more than 100 basis points above all competitors – following the conversion to a spot ETF. The result has been a fast bleed in its assets. The Bitcoin Mini Trust, which carries a far more competitive 0.15% fee, has managed to add assets, but holdings stood at just 33,753 tokens as of the end of last week.

Amsterdam-Style Cannabis Cafes Coming To California With Celebrity Backing: Here's Who Pushed For The Bill

On Monday, Gov. Gavin Newsom (D) signed a bill allowing licensed cannabis lounges to sell food and host ticketed events, essentially giving birth to Amsterdam-style cannabis cafes

These venues will allow patrons to enjoy marijuana while eating food in the same establishment—a major shift for California’s cannabis scene, SFGate reported.

See Also: Gov. Newsom’s Hemp Ban Goes Into Effect: Consequences For Industry, Investors, Patients

The state’s existing laws permit individuals to consume cannabis inside licensed lounges, but these businesses have been prohibited from offering food.

With the new legislation, customers will no longer need to step out of the lounge in search of a meal or snack, creating a more integrated and enjoyable experience.

Celebrities Weigh In

Several high-profile names have supported this effort, including actors Whoopi Goldberg, Woody Harrelson, and comedian Bill Maher.

“It makes no sense that we don’t let cannabis lounges sell food. Right now, California makes it harder to get high at a lounge and eat a sandwich than to drive a car, but guess which one is more dangerous?” Maher said In a public statement before the bill was signed.

Both Goldberg and Harrelson, who have their own cannabis ventures in California, stand to benefit from the law, which will no doubt boost the cannabis hospitality industry.

Local Control Still A Hurdle

While this new law represents a step forward, it comes with a catch: local governments will have the final say on whether or not cannabis cafes can open in their jurisdictions.

In many parts of the state, cannabis lounges remain banned, limiting where these new social consumption spaces can operate.

At the moment, cities like San Francisco, West Hollywood and Palm Springs are home to more than a dozen lounges, but it remains unclear how quickly other cities will embrace the change.

Ellen Komp, deputy director of California’s National Organization for the Reform of Marijuana Laws (NORML) stated that while the law takes effect on January 1, local governments may require additional regulations before lounges can begin serving food.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

One Stock That Could Soar After Its Oct. 1 Split

Stock splits are usually good indicators of strength, since companies normally only split their stock after the price of an individual share has gotten expensive. Super Micro Computer‘s (NASDAQ: SMCI) split is coming soon — the company expects its 10-for-1 split to take effect on Oct. 1 — but it hit a rough patch shortly after announcing it.

Since then, the stock is down around 32%. There are a few reasons for this, but I don’t think any of them justify avoiding the stock as a long-term investment — although investors must be aware of the risk they are taking on.

Supermicro’s products are in high demand

Super Micro Computer manufactures components for data centers and builds full servers. This was a good business in recent years, and it has been a phenomenal business lately. Thanks to unprecedented artificial intelligence (AI) demand, companies are rushing to expand their computing capacity. This has caused businesses like Supermicro’s to boom because it is a key supplier in this space.

While it has many competitors, none offer a solution that is as customized as Supermicro’s for a full server. And its liquid-cooled technology offers clients the most energy-efficient server available, which saves on long-term operating costs.

These factors have combined to make Supermicro the top choice for data center components and full-server builds, which is why the stock has done so well this year.

But there is more to Supermicro’s investment thesis than its best-in-class products.

Two factors are causing the stock to struggle in the short term

Since the stock peaked in March this year, it has steadily declined. Part of this decline is warranted since the expectations priced into the stock at that time were unrealistic. However, the levels it has fallen to are too cheap, creating an exciting investment opportunity.

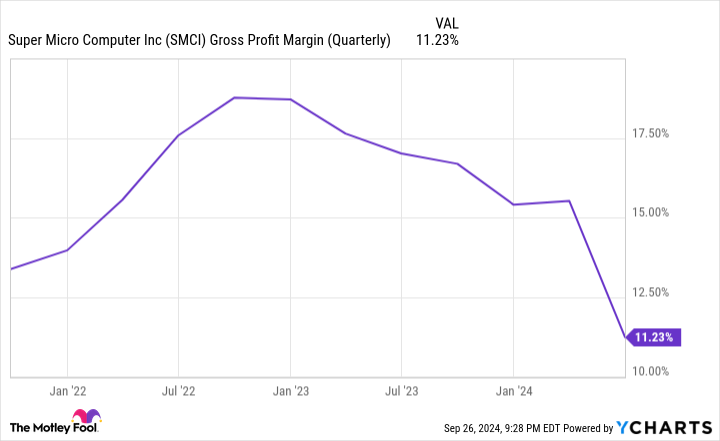

The causes of the most recent stock drop following its earnings report for its fourth quarter (ending June 30) are twofold. First, Supermicro’s gross margins have declined for many quarters.

This isn’t a great sign — declining gross margins can indicate that Supermicro’s products are becoming commoditized and that it’s losing pricing power. However, management blames the launch of its new liquid cooling technology and other new products for the decline. It believes these gross margins will recover throughout fiscal 2025 and return to historical norms over the long term.

Regardless, this will hurt profits in the short term, which investors don’t want to see. This caused the initial stock decline following earnings.

The second reason for the decline involves Hindenburg Research, a famed short-selling firm that benefits when stock prices drop. Hindenburg released a short-seller report alleging accounting malpractice by Supermicro, something that the company has already been fined for by the Securities and Exchange Commission (SEC).

To make matters worse, Supermicro has delayed filing its end-of-year form 10-K with the SEC because, management said, it is assessing the “design and operating effectiveness of its internal controls over financial reporting.” If you can’t trust the financials a company is reporting, the stock becomes unworthy of an investment, which is why many dumped the stock following the report.

But the company doesn’t expect any changes to its financial results. So this could be a wake-up call for management to get its business in order, and will likely not be a factor in the long term, assuming its financials don’t change and the Hindenburg report turns out inaccurate.

That isn’t the end of the Hindenburg saga, however. Shortly after the Hindenburg report, the U.S. Department of Justice opened at probe into Supermicro. This probe might come up with nothing. Still, there is a possibility that it could lead to further action, so the risk of investing in Supermicro has increased. Investors have a long time to wait until the results of this investigation are known.

Meanwhile, these two short-term factors driving the stock down have opened up a long-term investment opportunity if it turns out that the company isn’t found to have engaged in accounting malpractice. This can be seen in its forward price-to-earnings ratio (P/E), as the stock trades for a dirt-cheap 12 times forward earnings.

That’s cheap for any stock, let alone one set to grow its revenue between 74% and 101% in fiscal 2025. Couple that with steadily improving margins, and you have a recipe for a stock that could have a strong year once other questions are sorted out.

I think Supermicro’s stock could soar after its split. Multiple short-term factors are dragging it down, but should those be resolved favorably, Supermicro is primed to post excellent returns thanks to the massive demand for its products.

For now, there is an increased risk of investing in Supermicro due to an ongoing government probe. This shouldn’t cause you to ignore the stock completely, assuming you’re willing to take the risk, but it should guide your position sizing if you choose to invest in the stock sometime soon.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Keithen Drury has positions in Super Micro Computer. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

One Stock That Could Soar After Its Oct. 1 Split was originally published by The Motley Fool

25 Best Stocks for Your October Portfolio

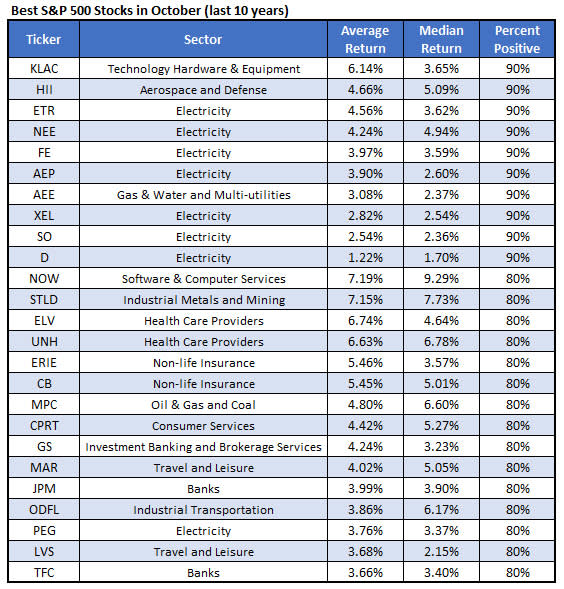

After an unseasonably strong September, traders are eager to protect their profits, or perhaps even extend them into the new month. Bearing this in mind, we compiled a list of the 25 best stocks to own during October, and Marriott International Inc (NASDAQ:MAR) is among them.

Per Schaeffer’s Senior Quantitative Analyst Rocky White, MAR finished the month of October higher eight times in the past 10 years, averaging a gain of 4%. The equity is also the best of two travel and leisure names on this list, outpacing Las Vegas Sands (LVS).

Marriot International stock was last seen down 1.4% to trade at $50.41. While familiar pressure at the $255 level is coming into play, the security is not too far off from its April 11, record high of $260.57, and sports a 26.4% year-over-year lead. Plus, the 20-day moving average looks ready to contain any additional pullbacks.

Options traders are leaning bearish, and an unwinding of this pessimism could provide tailwinds. Over at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), MAR’s 50-day put/call volume ratio of 1.49 sits in the elevated 82nd percentile of its annual range, showing a fierce appetite for puts lately.

The security could also benefit from a shift in analyst sentiment, as 17 of 23 analysts in questions still sport a tepid “hold.” Plus, options are affordably priced at the moment, per the stock’s Schaeffer’s Volatility Index (SVI) rating of 20%, which ranks in the low 8th annual percentile.

Pesticide-Free Food Tastes Better—Wait Until You Try Clean Cannabis This Autumn

As consumers embrace pesticide-free food for its health and taste benefits, Autumn Brands is bringing similar clean practices to cannabis. The women-owned, family-operated company based in Santa Barbara California is setting new standards in sustainable, pesticide-free cultivation.

Co-founded by Autumn Shelton, chief financial officer and partner, alongside the Brand family -Hans, Johnny and Hannah Brand – Autumn Brands is making a name for itself with its dedication to health, wellness and environmental responsibility.

In an exclusive interview with Benzinga Cannabis, Shelton shared the journey from traditional agriculture to cannabis and the challenges of running a pesticide-free operation.

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

From Daisies To Dank: The Bloom Of Autumn Brands

Autumn Brands started as a cut flower business growing Gerber daisies, but as competition from South America increased, the team realized they needed to pivot. “My partner Hans had owned this property for over 30 years, and the cut flower industry was struggling,” said Shelton. “We saw the legalization of cannabis as an opportunity to transition. So we flipped the operation from cut flowers to cannabis.”

But it wasn’t just a matter of switching crops.

Shelton and her team took it a step further by deciding to grow cannabis without the use of any pesticides – organic or otherwise. “Hans came to me in 2017 and said, ‘I want to stop spraying pesticides,’ and I said, ‘I love this idea, but how are we going to do it?'” she told Benzinga.

After some research and a hefty investment in beneficial insects, the team made the transition. “We threw away tens of thousands of plants until the ladybugs colonized the greenhouses,” she said, “and we’ve been 100% pesticide-free ever since.”

Read Also: Federal Health Agencies Must Take Stronger Role In U.S. Cannabis Policy Shift, New Report Says

Pesticide-Free Cannabis: A Market Niche Ready To Grow

Shelton said the market for pesticide-free cannabis is only going to grow as consumers become more educated about what’s in their products.

“People didn’t realize they were smoking cannabis with pesticides before legalization, but now they’re starting to understand the importance of clean cannabis,” she said. “Recent recalls over pesticide contamination have raised awareness, and we’re seeing a movement toward more pesticide-free products.”

But scaling a pesticide-free operation remains a challenge. “It’s more artisanal,” Shelton said. “We’ve had to create this perfect ecosystem in our greenhouses where beneficial insects can thrive, but it’s not easy to replicate at scale. That’s why we’re still searching for partners who can match our standards.”

Scaling Sustainability

“One of the hardest things was learning how to combat pests like mites without using chemicals,” Shelton said. “We had to figure out new ways to manage it without compromising the quality of our product.”

Despite these challenges, Shelton emphasized the long-term benefits of going pesticide-free. “We’ve saved money by not having to worry about recalls or heavy metal contamination. It also creates a perfect ecosystem in the greenhouse where beneficial insects thrive, reducing the need for constant pest management.”

Read Also: Want Organic Cannabis? Operators Are Turning To This Tech To Save Millions And Get Certified

Expanding Beyond California: What’s Next?

Autumn Brands operates on five and a half acres of greenhouse space, producing flowers, pre-rolls and wellness products such as pain-relieving elixirs. The company also offers self-care products focused on intimate wellness, tapping into a growing market segment.

Though deeply rooted in California, Shelton said Autumn Brands is looking to expand beyond the state through licensing deals for their products. “The flower side is a little more challenging because it is not easy to find operators who can grow 100% pesticide-free at scale,” she said. Nevertheless, the company sees significant opportunities for its products in other states.

“We’re also building out a hemp line focused on minor cannabinoids like CBG and CBN, which are challenging to incorporate into cannabis products due to the small quantities present,” Shelton explained.

New Markets

As a member of the California Cannabis Industry Association, Shelton has had a front-row seat to the regulatory struggles faced by the industry. “There’s been a huge disconnect between government and the industry, and I think that’s one of the biggest lessons other states can learn from California,” she said. “We’ve gone through over-regulation, high taxes, and oversupply, which have all contributed to the challenges we face today.”

Looking to expand into new markets, Shelton said her focus is on states that have learned from California’s missteps. “We’re looking at new state markets. Relationships are key for us—finding partners who share our ethos is the most important factor when deciding where to expand.”

Shelton remains optimistic about the future of the company and the cannabis industry. “We’re constantly innovating and looking for ways to expand while staying true to our values,” she said. “Whether it’s through our pesticide-free flower, wellness products, or hemp line, we’re committed to offering high-quality, clean cannabis to our customers.”

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Texas Stock Exchange moves closer to launch with leadership team, board

By Laura Matthews, Suzanne McGee

NEW YORK (Reuters) -The Texas Stock Exchange announced a board of directors on Monday in its latest step toward building a national exchange to rival long-established platforms in New York and said it was gearing up to launch trading next year.

TXSE announced in June that it plans to register with the U.S. Securities and Exchange Commission with backing from BlackRock and Citadel Securities. It said on Monday it had secured $135 million.

The exchange also said on Monday that Rick Perry, a former governor of Texas and former U.S. energy secretary, will be a board member. Other directors include Rick Roberts, a former SEC commissioner, and Alex Bussandri, global head of strategy at Citadel Securities.

The exchange has also drawn staff members from Nasdaq and the New York Stock Exchange, a division of the Intercontinental Exchange, as well as other trading platforms, it said on Monday.

“Texas Stock Exchange is pulling big names in preparation for the potential launch in 2025,” said Owen Lau, a senior analyst at Oppenheimer & Co, noting that the space is competitive.

Nasdaq announced last week it put in place a regional management structure for its global listings franchise and appointed Texas-native Rachel Racz, as head of listings for Texas, Southern U.S. and Latin America. It didn’t immediately respond to a request for comment.

James Lee, founder and chief executive of TXSE Group Inc, said the exchange plans to submit a SEC registration in the coming months.

After approval, he added that TXSE will execute its first trades by the end of 2025 and launch its listing early in 2026, making Dallas “a new hub for capital markets in the United States”.

Texas Governor Greg Abbott said on Monday that the exchange will ensure that businesses have access to capital and that market participants have more choice.

The exchange also named Cam Smith as its global head of trading and co-president. Smith began his career working for electronic trading platforms and served as president of Quantlab, an automated proprietary trading firm.

Jeff Brown, a former acting general counsel at Charles Schwab, is serving as general counsel of TXSE Group Inc and chief regulatory officer of the exchange.

Nicole Chambers, who handled the Texas market for Nasdaq, will run corporate listings. Jeff Karcher and Marc Cunningham, who covered the southeast U.S. and Texas while working at the NYSE, will serve as global managing director.

(Reporting by Laura Matthews; editing by Megan Davies and Bill Berkrot)

Solana-Based Bonk, Dogwifhat Outshine Dogecoin And Shiba Inu Amid Broader Market Retrace — What You Should Know

Memecoins created on the Solana SOL/USD blockchain withstood the overall market drop on Monday to post encouraging gains.

What happened: Dog-themed Bonk emerged as the best-performing billion-dollar capitalization meme coin in the last 24 hours and the third-best cryptocurrency overall, surging over 8%.

The token’s trading volume soared 92% to $486 million, indicating heightened demand.

Dogwifhat, the largest memecoin on Solana by market capitalization, jumped 4.6% to extend its weekly gains past 40%. In fact, both BONK and WIF were up more than 40% over the week.

| Cryptocurrency | Gains +/- | Price (Recorded at 11:15 p.m. EDT) |

| Bonk BONK/USD | +8.06% | $0.00002485 |

| dogwifhat (WIF) | +4.66% | $2.51 |

| Popcat (POPCAT) | +1.08% | $1.01 |

Popcat, the cryptocurrency market’s biggest gainer this year, also traded in the green. The feline-themed coin was up a massive 12317% year-to-date.

Meanwhile, blue-chip meme currencies like Dogecoin DOGE/USD and Shiba Inu SHIB/USD retraced 3.90% and 1.68%, respectively. The total meme coin market valuation shrank nearly 5% in the last 24 hours.

See Also: Pay Taxes With Bitcoin? Ohio Senator Proposes Bill For Crypto Tax Payments, But There’s A Catch

Why It Matters: The strong performance of Solana-based meme coins coincided with the broader market decline owing to an escalation in geopolitical tensions in the Middle East.

Bitcoin BTC/USD, the market bellwether, was down 1.36% in the last 24 hours, while Ethereum ETH/USD traded flat as of this writing. SOL, Solana’s native coin, lost 1.35% from yesterday.

Image via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 cheap areas of the stock market to buy as the Fed unveils a 'rare double whammy' of stimulus, BofA says

-

Investors should snap up value stocks in three specific sectors, Bank of America said.

-

The firm says they’re poised to outperform as the Fed cuts rates while corporate profits are still accelerating.

-

US stock-strategy chief Savita Subramanian refers to the situation as a “rare double whammy of stimulus.”

The Federal Reserve doesn’t usually cut rates while corporate profits are still growing. But that’s the situation we’re seeing now, which Bank of America sees creating a unique opportunity for investors.

Savita Subramanian, BofA’s head of US equity and strategy, described the situation as a “rare double whammy of stimulus.” And in an appearance on CNBC, she suggested a few portfolio tweaks, recommending that investors key in on certain types of value stocks.

Value stocks — or those trading below where fundamentals say they should be — outperform when profits rise and rates fall, as investors become less worried about hedging and embrace higher-upside names that have fallen out of favor. This is happening now, BofA said, meaning that money flows will favor value.

In this context, real estate, financials, and energy are three sectors worth pursuing, she said. These value industries offer quality and income.

The large-cap real estate sector benefits from Wall Street’s massive investment in data centers, a necessary infrastructure component of the artificial intelligence buildout. Meanwhile, real estate’s exposure to the troubled office space is not worth fretting about, Subramanian noted.

Meanwhile, financials have become a higher quality sector than they were in 2008, and currently are “starved” of capital. The same can be said for energy, she said.

“These companies have basically righted themselves since, you know, the last decade, and are now throwing off free cash flow, focused on cash return. I think these are some of the areas of the market that you really want to press,” Subramanian told CNBC.

In similar fashion, Citi’s US equity strategist Scott Chronert also highlighted financials and energy in a Bloomberg interview, calling the latter a “contrarian opportunity.”

In Subramanian’s view, part of the appeal of value sectors is the high dividends they offer.

As the Fed’s cutting cycle pulls down short-term yields, money market investors will search for new sources of income. Dividend-yielding stocks will benefit from this transition, Subramanian said.

“I think about where these assets sitting in retiree accounts and money market funds are going; I think they’re going into safe, stable income. That’s more value than growth,” she said.

She previously noted that dividend yields are especially alluring in real estate. Since 2008, real estate dividends has doubled the proportion of high-quality market cap.

According to BofA’s latest note, neither retail nor institutional investors appear adjusted to the value trend so far, with portfolios skewed more toward long-term growth stocks and defensive exposure.

Hedge funds also seem skeptical about the recent blowout rally in China, which was jumpstarted last week after Beijing pushed out new stimulus.

Subramanian expects this to be the start of a longer-term story, and suggested that investors monitor the materials sector.

Read the original article on Business Insider

Michael Dell Sells $1.2B Worth Of Dell Stock, Reducing Stake Amid Company's Recent S&P 500 Inclusion And AI Expansion

Michael Dell, the CEO of Dell Technologies Inc. DELL, has offloaded a significant portion of his shares in the company.

What Happened: According to a filing with the U.S. Securities and Exchange Commission on Thursday, Dell sold 10 million shares of Class C Common Stock at an average price of $122.4 per share.

This transaction amounts to a total value of over $1.2 billion. The sale was executed directly by Dell, reducing his holdings in the company to 16,912,241 shares.

Why It Matters: This significant sale comes on the heels of several notable events involving Michael Dell and Dell Technologies. Last week, Dell was included in the S&P 500 Index

In June, Dell expressed interest in Bitcoin BTC/USD, retweeting a message from Bitcoin advocate Michael Saylor, which sparked discussions about digital scarcity.

Additionally, Dell has been vocal about the rapid advancement of generative artificial intelligence, comparing its swift rise to the early days of the internet. He highlighted that AI’s adoption is happening at a pace much faster than previous technological waves.

In August, Jim Cramer called the bottom on Dell Technologies’ stock, emphasizing the company’s strong relationship with NVIDIA Corp NVDA and suggesting that the stock should be bought at that time.

Most recently, in September, a new analyst coverage began on a bullish note, reflecting positive sentiment around Dell Technologies.

Price Action: Dell Technologies Inc. stock closed at $118.54 on Monday, down 1.40% for the day. In after-hours trading, the stock dipped further by 0.33%. Year to date, Dell’s stock has surged by 58.50%, according to data from Benzinga Pro.

Read Next:

Image via Flickr

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NEUBERGER BERMAN REAL ESTATE SECURITIES INCOME FUND ANNOUNCES MONTHLY DISTRIBUTION

NEW YORK, Sept. 30, 2024 /PRNewswire/ — Neuberger Berman Real Estate Securities Income Fund Inc. NRO (the “Fund”) has announced a distribution declaration of $0.0312 per share of common stock. The distribution announced today is payable on October 31, 2024, has a record date of October 15, 2024, and has an ex-date of October 15, 2024.

Under its level distribution policy, the Fund anticipates that it will make regular monthly distributions, subject to market conditions, of $0.0312 per share of common stock, unless further action is taken to determine another amount. There is no assurance that the Fund will always be able to pay a distribution of any particular amount, or that a distribution will consist of only net investment income. The Fund’s ability to maintain its current distribution rate will depend on a number of factors, including the amount and stability of income received from its investments, availability of capital gains, the amount of leverage employed by the Fund, the cost of leverage and the level of other Fund fees and expenses.

The distribution announced today, as well as future distributions, may consist of net investment income, net realized capital gains and return of capital. In compliance with Section 19 of the Investment Company Act of 1940, as amended, a notice would be provided for any distribution that does not consist solely of net investment income. The notice would be for informational purposes and not for tax reporting purposes, and would disclose, among other things, estimated portions of the distribution, if any, consisting of net investment income, capital gains and return of capital. The final determination of the source and tax characteristics of all distributions paid in 2024 will be made after the end of the year.

About Neuberger Berman

Neuberger Berman is an employee-owned, private, independent investment manager founded in 1939 with over 2,800 employees in 26 countries. The firm manages $481 billion of equities, fixed income, private equity, real estate and hedge fund portfolios for global institutions, advisors and individuals. Neuberger Berman’s investment philosophy is founded on active management, fundamental research and engaged ownership. The PRI identified the firm as part of the Leader’s Group, a designation awarded to fewer than 1% of investment firms for excellence in environmental, social and governance practices. Neuberger Berman has been named by Pensions & Investments as the #1 or #2 Best Place to Work in Money Management for each of the last ten years (firms with more than 1,000 employees). Visit www.nb.com for more information. Data as of June 30, 2024.

Statements made in this release that look forward in time involve risks and uncertainties. Such risks and uncertainties include, without limitation, the adverse effect from a decline in the securities markets or a decline in the Fund’s performance, a general downturn in the economy, competition from other closed end investment companies, changes in government policy or regulation, inability of the Fund’s investment adviser to attract or retain key employees, inability of the Fund to implement its investment strategy, inability of the Fund to manage rapid expansion and unforeseen costs and other effects related to legal proceedings or investigations of governmental and self-regulatory organizations.

Contact:

Neuberger Berman Investment Advisers LLC

Investor Information

(877) 461-1899

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/neuberger-berman-real-estate-securities-income-fund-announces-monthly-distribution-302263084.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/neuberger-berman-real-estate-securities-income-fund-announces-monthly-distribution-302263084.html

SOURCE Neuberger Berman

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.