Preview: Levi Strauss's Earnings

Levi Strauss LEVI is gearing up to announce its quarterly earnings on Wednesday, 2024-10-02. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Levi Strauss will report an earnings per share (EPS) of $0.31.

Anticipation surrounds Levi Strauss’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

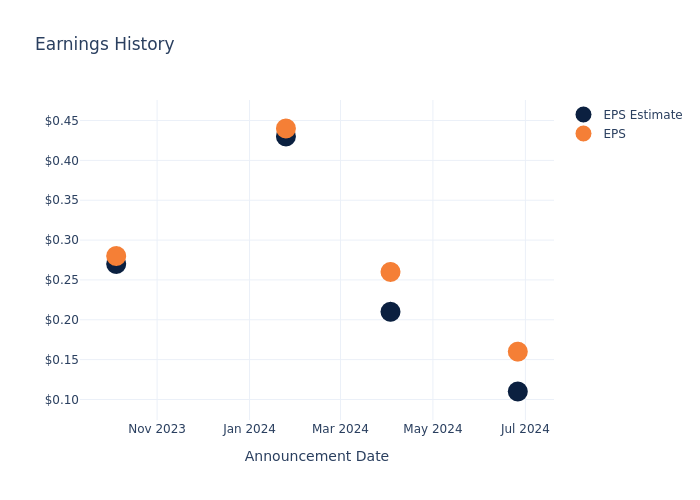

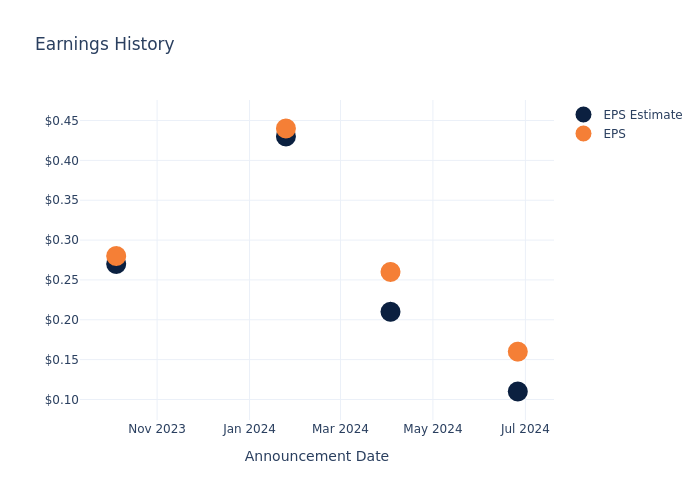

Earnings History Snapshot

The company’s EPS beat by $0.05 in the last quarter, leading to a 15.4% drop in the share price on the following day.

Stock Performance

Shares of Levi Strauss were trading at $21.8 as of September 30. Over the last 52-week period, shares are up 60.54%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Perspectives on Levi Strauss

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Levi Strauss.

The consensus rating for Levi Strauss is Buy, based on 2 analyst ratings. With an average one-year price target of $25.5, there’s a potential 16.97% upside.

Peer Ratings Comparison

In this comparison, we explore the analyst ratings and average 1-year price targets of Amer Sports, VF and Tapestry, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Amer Sports is maintaining an Buy status according to analysts, with an average 1-year price target of $19.0, indicating a potential 12.84% downside.

- VF is maintaining an Neutral status according to analysts, with an average 1-year price target of $16.32, indicating a potential 25.14% downside.

- Tapestry is maintaining an Outperform status according to analysts, with an average 1-year price target of $49.62, indicating a potential 127.61% upside.

Overview of Peer Analysis

The peer analysis summary provides a snapshot of key metrics for Amer Sports, VF and Tapestry, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Levi Strauss | Buy | 7.81% | $871.70M | 0.92% |

| Amer Sports | Buy | 15.99% | $551.30M | -0.09% |

| VF | Neutral | -8.58% | $991.66M | -17.00% |

| Tapestry | Outperform | -1.75% | $1.19B | 5.62% |

Key Takeaway:

Levi Strauss ranks first in revenue growth among its peers. It has the highest gross profit margin. However, it has the lowest return on equity.

Delving into Levi Strauss’s Background

Levi Strauss & Co is involved in designing, marketing, and selling products that include jeans, casual and dresses pants, tops, shorts, skirts, jackets, footwear, and related accessories directly or through third parties and licensees for men, women, and children under Levi’s, Dockers, Signature by Levi Strauss & Co. and Denizen brands. The company manages its business according to three regional segments: the Americas, which is the key revenue driver; Europe; and Asia.

Levi Strauss’s Economic Impact: An Analysis

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Positive Revenue Trend: Examining Levi Strauss’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 7.81% as of 31 May, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: The company’s net margin is a standout performer, exceeding industry averages. With an impressive net margin of 1.25%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company’s ROE is a standout performer, exceeding industry averages. With an impressive ROE of 0.92%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Levi Strauss’s ROA surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 0.3% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Levi Strauss’s debt-to-equity ratio is below the industry average. With a ratio of 1.12, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Levi Strauss visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply