Market Whales and Their Recent Bets on QCOM Options

Deep-pocketed investors have adopted a bullish approach towards Qualcomm QCOM, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in QCOM usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 15 extraordinary options activities for Qualcomm. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 66% leaning bullish and 26% bearish. Among these notable options, 8 are puts, totaling $935,328, and 7 are calls, amounting to $249,290.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $160.0 to $220.0 for Qualcomm over the last 3 months.

Volume & Open Interest Development

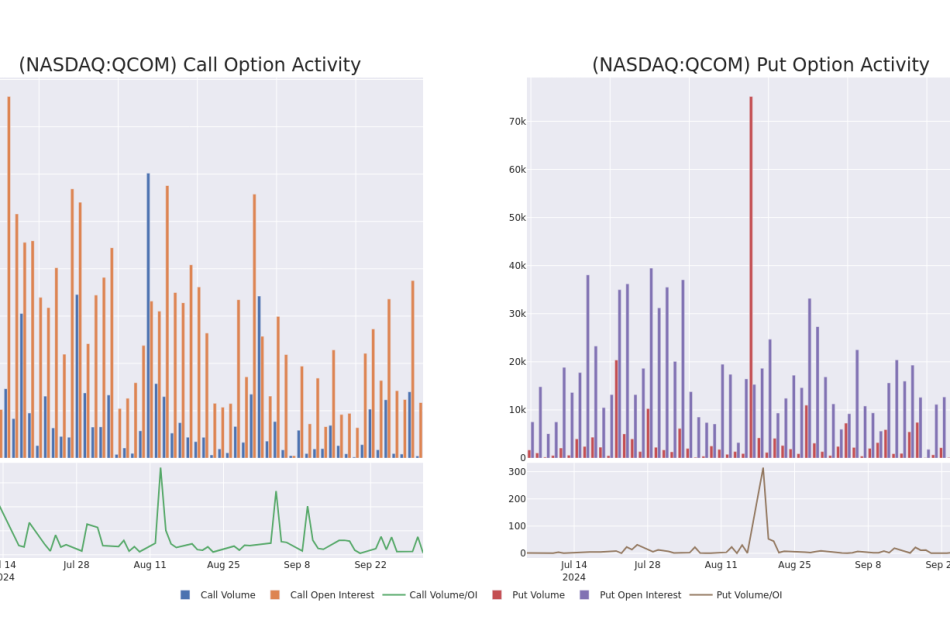

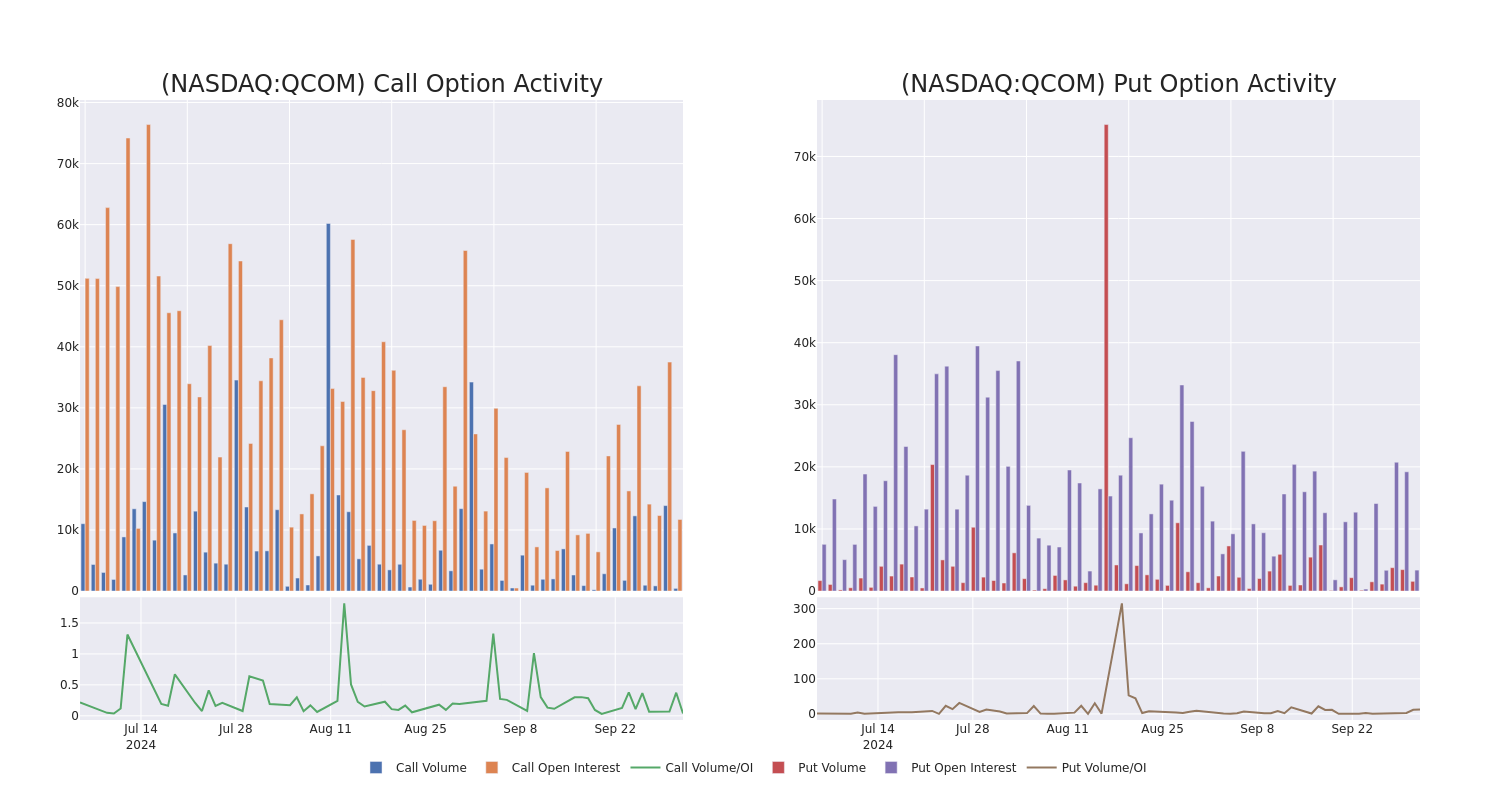

In today’s trading context, the average open interest for options of Qualcomm stands at 1372.0, with a total volume reaching 2,001.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Qualcomm, situated within the strike price corridor from $160.0 to $220.0, throughout the last 30 days.

Qualcomm 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QCOM | PUT | SWEEP | BULLISH | 09/19/25 | $27.1 | $26.55 | $26.55 | $175.00 | $286.5K | 45 | 108 |

| QCOM | PUT | SWEEP | BULLISH | 09/19/25 | $26.8 | $26.5 | $26.49 | $175.00 | $225.2K | 45 | 193 |

| QCOM | PUT | SWEEP | BEARISH | 10/04/24 | $2.42 | $2.2 | $2.41 | $167.50 | $120.9K | 1.9K | 400 |

| QCOM | PUT | SWEEP | BEARISH | 02/21/25 | $17.6 | $17.55 | $17.6 | $170.00 | $100.2K | 841 | 376 |

| QCOM | PUT | TRADE | BEARISH | 10/18/24 | $9.2 | $8.95 | $9.15 | $172.50 | $82.3K | 566 | 11 |

About Qualcomm

Qualcomm develops and licenses wireless technology and designs chips for smartphones. The company’s key patents revolve around CDMA and OFDMA technologies, which are standards in wireless communications that are the backbone of all 3G, 4G, and 5G networks. Qualcomm’s IP is licensed by virtually all wireless device makers. The firm is also the world’s largest wireless chip vendor, supplying nearly every premier handset maker with leading-edge processors. Qualcomm also sells RF-front end modules into smartphones, as well as chips into automotive and Internet of Things markets.

Qualcomm’s Current Market Status

- Currently trading with a volume of 1,901,049, the QCOM’s price is up by 2.2%, now at $169.43.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 28 days.

What The Experts Say On Qualcomm

1 market experts have recently issued ratings for this stock, with a consensus target price of $210.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Qualcomm, targeting a price of $210.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Qualcomm, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What Happened With Accenture Stock Today?

Accenture Plc ACN shares moved higher Wednesday after the company announced it expanded its partnership with NVIDIA Corp. NVDA to launch the Accenture NVIDIA Business Group.

The Details: Accenture said the new Accenture Nvidia Business Group launched with 30,000 professionals receiving training globally to help clients scale enterprise AI adoption with AI agents using Accenture’s AI Refinery developed on the NVIDIA AI stack.

The Accenture AI Refinery will be available on all public and private cloud platforms and will integrate with other Accenture Business Groups to accelerate AI across the SaaS and Cloud AI ecosystem.

Read Next: What Happened With Rivian Stock Today?

Wedbush tech analyst Dan Ives cheered the new venture, describing it as “the tip of the iceberg on the broader AI Revolution and demand adoption into 2025 and beyond.”

Ives also mentioned both companies in a post on the social media platform X in which he described the partnership as the “AI Revolution taking hold.”

Accenture shares are moving higher in Wednesday’s extended trading after its CEO Julie Sweet and Nvidia CEO Jensen Huang appeared together on CNBC’s Closing Bell Overtime program.

ACN Price Action: According to Benzinga Pro, Accenture shares are up 2.15% after-hours at $363.96 after climbing 1.20% in Wednesday’s regular trading session.

Read Also:

Photo: Courtesy of Accenture Plc

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Pan Pacific Orchard Named Best Tall Building Worldwide by Council on Tall Buildings and Urban Habitat

Chicago, Oct. 02, 2024 (GLOBE NEWSWIRE) — The Council on Tall Buildings and Urban Habitat (CTBUH) named Singapore’s Pan Pacific Orchard “2024 Best Tall Building Worldwide” at its recent annual international conference, in London and Paris. The award recognizes the project’s groundbreaking approach to high-density urbanism, combining nature, community and sustainability within the city’s bustling Orchard district. (See below for a complete list of CTBUH 2024 Award of Excellence category winners.)

Amidst Orchard’s renowned shopping malls, tree-lined boulevards and mixed-use towers, Pan Pacific Orchard stands out as a beacon of Singapore’s environmental vision. The project’s “hotel in nature” concept transforms the traditional high-rise into a vertical green space, with multiple terraced gardens and water features integrated into the building, achieving a green plot ratio of more than 300 percent. By holistically incorporating greenery into its design, Pan Pacific Orchard honors Singapore’s heritage while pushing the envelope of sustainable urban development in a dense, urban setting.

“Pan Pacific Orchard represents the best in responsible vertical urbanism today,” explained CTBUH CEO Javier Quintana de Uña. “It does so by considering the question at the very core of this year’s conference—New or Renew?—from a more encompassing and nuanced perspective: this isn’t a building refurbishment; it’s about reimagining entire communities in novel, forward-thinking ways. The significance of Pan Pacific Orchard cannot be overstated—it emphasizes the revitalization of urban spaces rather than relying solely on new developments.”

Both structurally and conceptually, Pan Pacific Orchard breaks from tradition: instead of a tower-on-podium design, it delineates a series of four terraced sky gardens with individualized motifs—forest, beach, garden and cloud—which provide guests distinctive amenities and biomimetic landscapes at each level. The “forest” terrace at ground level features lush foliage and a cascading water plaza, while the “beach” terrace includes a tranquil lagoon surrounded by palms. The “garden” terrace offers serene walking paths, and the “cloud” terrace, capped with a photovoltaic canopy, hosts events with views of the surrounding city. These spaces create a unique connection between guests and nature while mitigating Singapore’s tropical heat through passive design strategies that reduce energy consumption and improve ventilation.

Mun Summ Wong, Founding Director of WOHA, the architectural firm behind Pan Pacific Orchard, stated, “We are deeply honored by this recognition. At WOHA, we believe in creating living buildings that are integrated with nature, as well as the urban fabric of the cities they inhabit, and Pan Pacific Orchard represents our commitment to building for both people and the planet. This project demonstrates that sustainability and hospitality can go hand-in-hand, and that skyscrapers can serve as green lungs within dense urban environments.”

The project departs from conventional tower designs by carving out large open-air atria that not only reduce the building’s environmental footprint but also foster interaction between nature, the city and its many diverse communities. Its semi-outdoor tropical climate reduces reliance on mechanical cooling systems, while its 45 percent external to 55 percent internal surface area ratio optimizes energy efficiency. These features align with Singapore’s broader sustainability goals and reflect a global push to lower the environmental impact of dense urban environments.

Lay Bee Yap, Group Director (Architecture and Urban Design) at Singapore’s Urban Redevelopment Authority, who spoke at the conference’s opening plenary, added, “Greening our urban environment has always been a priority in planning for a quality living environment for residents and driving Singapore’s City in Nature vision. One innovative national strategy we adopt is partnering developers and architects to design buildings that incorporate vertical greenery in the forms of sky terraces, rooftop gardens and green walls. This is exemplified in Pan Pacific Orchard, which has transformed itself into an extension of the natural environment while enhancing Orchard Road’s skyline. Its multiple levels of greenery and open spaces also provide respite and contribute to the well-being of both its guests and the wider community.”

The project’s focus on sustainability extends to its Green Mark Platinum rating, which recognizes its commitment to minimizing energy consumption, water usage and waste. Solar panels power the common areas, rainwater is harvested for irrigation and food waste is processed via an on-site biodigester. These measures contribute to Pan Pacific Orchard’s nature-positive ethos, where the building not only connects with the environment but actively enhances the local ecosystem and biodiversity. The design’s innovative approach to energy efficiency also helps reduce the urban heat island effect, contributing to a more livable cityscape.

Pan Pacific Orchard also received CTBUH’s Space Within category award, which recognizes tall building projects that have integrated extraordinary interior spaces and demonstrate exceptional functional success in terms of the user experience, elevating the solutions and possibilities for interior space design to the next level. In addition to evaluating the interior design of the space, the judging process also considers the design and integration of movement between spaces (vertically and horizontally), the performance of building systems, vertical transportation and smart technologies, among others.

As the CTBUH 2024 Best Tall Building Worldwide, Pan Pacific Orchard joins an illustrious group of past winners, including Quay Quarter Tower, in Sydney (2023), The David Rubenstein Forum, in Chicago (2022), and One Vanderbilt Avenue, in New York City (2021). These projects represent the pinnacle of innovation in sustainable tall building design and serve as benchmarks for future urban developments.

CTBUH 2024 Award of Excellence Category Winners:

- Best Tall Building (BTB) Worldwide: Pan Pacific Orchard, Singapore

- BTB Under 100 meters: T3 Collingwood, Melbourne, Australia

- BTB 100–199 meters: Pan Pacific Orchard, Singapore

- BTB 200–299 meters: 8 Bishopsgate, London, United Kingdom

- BTB 300 meters and above: Brooklyn Tower, New York City, United States

- BTB Americas: Boston University Center for Computing & Data Sciences, Boston, United States

- BTB Asia: Greenland Hangzhou Century Center, Hangzhou, China

- BTB Europe: Kaktus Towers, Copenhagen, Denmark

- BTB Middle East & Africa: One Za’abeel, Dubai, United Arab Emirates

- BTB Oceania: T3 Collingwood, Melbourne, Australia

- Urban Habitat Award: Al Wasl Plaza, Dubai, United Arab Emirates

- Future Project Award: Centre Block Rehabilitation, Ottawa, Canada

- 10-Year Award: One World Trade Center, New York City, United States

- Construction Award: Battersea Power Station Phase Two, London, United Kingdom

- Repositioning Award: Book Tower, Detroit, United States

- Innovation Award: Voided Post-Tensioned Slabs

- Structure Award: 21 Moorfields, London, United Kingdom

- Façade Award: Paddington Square, London, United Kingdom

- Systems Award: HD Hyundai Global R&D Center, Seongnam, South Korea

- Space Within Award: Pan Pacific Orchard, Singapore

- Equity, Diversity & Inclusion Award: Williams & Russell Project (Adre)

- Global Icon Award: Petronas Towers, Kuala Lumpur, Malaysia

- Lynn S. Beedle Lifetime Achievement Award: Santiago Calatrava

- Fazlur R. Khan Lifetime Achievement Award: John Zils

CTBUH Award of Excellence Program

The annual CTBUH Award of Excellence competition celebrates projects from around the world that employ the most advanced concepts and technologies in sustainable vertical urbanism. It celebrates and amplifies game-changing approaches to some of the most pressing challenges confronting the urban environment today, including mitigating the impact of climate change, reducing carbon emissions, achieving sustainability through an environmental—as well as cultural—lens and equity and affordability in housing, among many others.

Submissions for the Award of Excellence competition were solicited widely earlier this year. Representatives for each project presented to multidisciplinary juries assembled at the London component of the organization’s annual international conference, September 23–26. Juries consisted of CTBUH members from across the globe with expertise in architecture, engineering, construction and other diverse disciplines. Overall category winners were then selected and conferred at an award ceremony and dinner. For more information on the CTBUH Award of Excellence competition, including the full slate of competitors and jury members by category, please visit https://awards.ctbuh.org/.

Council on Tall Buildings and Urban Habitat

The Council on Tall Buildings and Urban Habitat (CTBUH) is a global nonprofit organization dedicated to smarter, more sustainable cities and a more viable future for global populations. Specifically, CTBUH focuses on the critical role of density in addressing climate change. CTBUH is headquartered in Chicago and has offices in Shanghai, China, and Venice, Italy. CTBUH’s worldwide membership network includes companies from fields such as real estate development, architecture, engineering, cost consulting, building management and construction, among others. In addition to hosting leading industry events, CTBUH produces research and reporting on issues of significant consequence to its membership. Its most utilized asset is its building database, SkyscraperCenter.com, a compendium of detailed data, images and technical information on more than 40,000 tall buildings throughout the world. CTBUH is best known to the public for developing the international standards for measuring tall building height and is recognized as the arbiter of the “World’s Tallest Building” designation. For more information, please visit ctbuh.org.

Charles Mutscheller The Council on Tall Buildings and Urban Habitat cmutscheller@ctbuh.org

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Smart Money Is Betting Big In GE Aero Options

Investors with a lot of money to spend have taken a bearish stance on GE Aero GE.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with GE, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 19 uncommon options trades for GE Aero.

This isn’t normal.

The overall sentiment of these big-money traders is split between 26% bullish and 47%, bearish.

Out of all of the special options we uncovered, 13 are puts, for a total amount of $806,587, and 6 are calls, for a total amount of $930,140.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $130.0 to $260.0 for GE Aero over the recent three months.

Volume & Open Interest Development

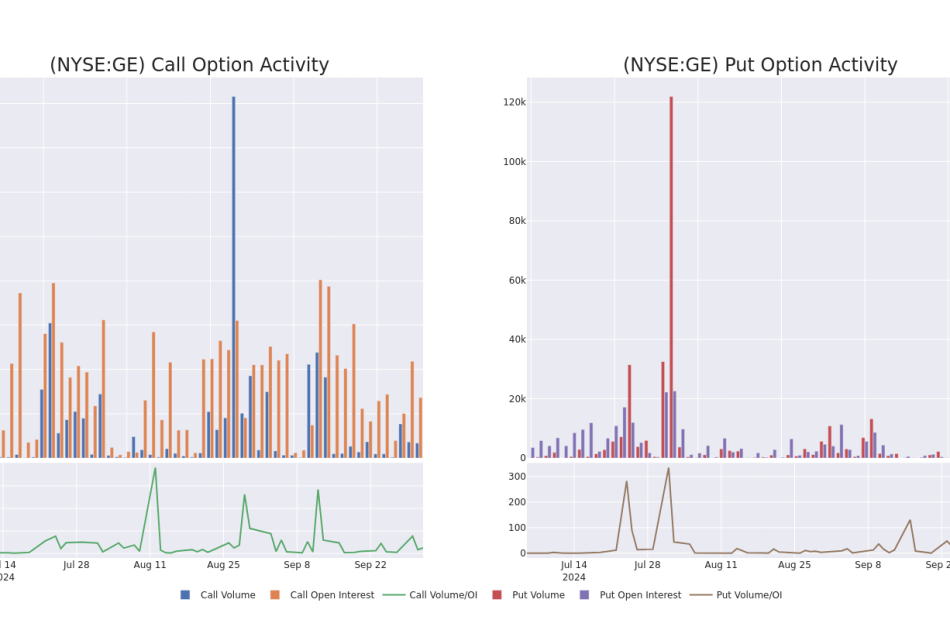

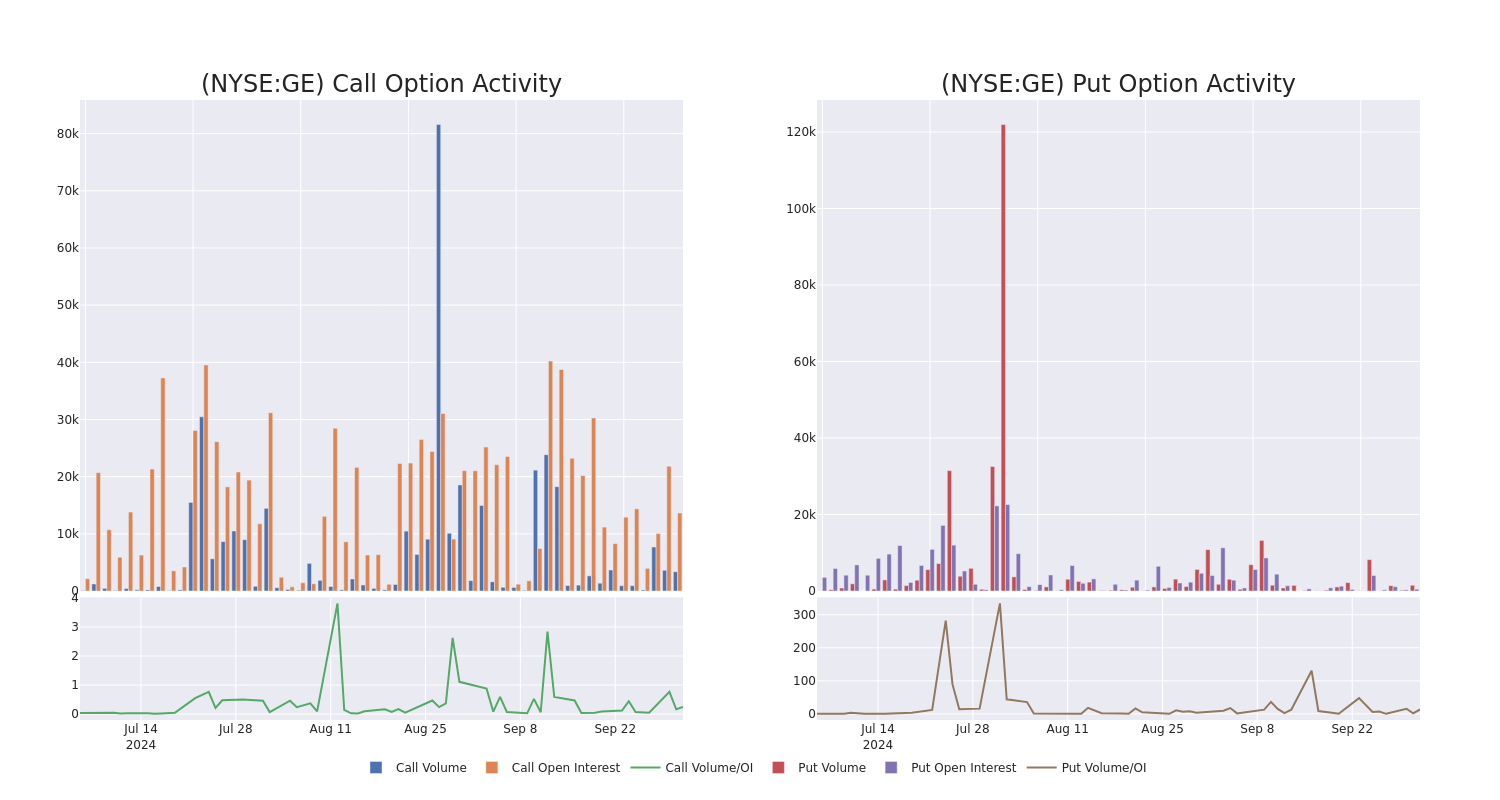

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for GE Aero’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of GE Aero’s whale trades within a strike price range from $130.0 to $260.0 in the last 30 days.

GE Aero Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GE | CALL | SWEEP | BULLISH | 10/25/24 | $5.8 | $5.65 | $5.8 | $190.00 | $288.2K | 10.3K | 1.8K |

| GE | CALL | SWEEP | BEARISH | 10/18/24 | $5.5 | $5.35 | $5.35 | $185.00 | $264.8K | 2.9K | 505 |

| GE | CALL | SWEEP | BULLISH | 11/01/24 | $6.8 | $6.25 | $6.45 | $190.00 | $170.2K | 264 | 321 |

| GE | CALL | SWEEP | BEARISH | 10/25/24 | $5.05 | $4.75 | $4.75 | $190.00 | $118.7K | 10.3K | 252 |

| GE | PUT | SWEEP | NEUTRAL | 01/16/26 | $75.4 | $73.1 | $74.43 | $260.00 | $96.7K | 35 | 25 |

About GE Aero

GE Aerospace is the global leader in designing, manufacturing, and servicing large aircraft engines, along with partner Safran in their CFM joint venture. With its massive global installed base of nearly 70,000 commercial and military engines, GE Aerospace earns most of its profits on recurring service revenue of that equipment, which operates for decades. GE Aerospace is the remaining core business of the company formed in 1892 with historical ties to American inventor Thomas Edison; that company became a storied conglomerate with peak revenue of $130 billion in 2000. GE spun off its appliance, finance, healthcare, and wind and power businesses between 2016 and 2024.

Where Is GE Aero Standing Right Now?

- With a trading volume of 1,291,609, the price of GE is up by 0.55%, reaching $187.33.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 20 days from now.

What The Experts Say On GE Aero

2 market experts have recently issued ratings for this stock, with a consensus target price of $206.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Reflecting concerns, an analyst from Bernstein lowers its rating to Outperform with a new price target of $201.

* An analyst from Deutsche Bank persists with their Buy rating on GE Aero, maintaining a target price of $212.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for GE Aero, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

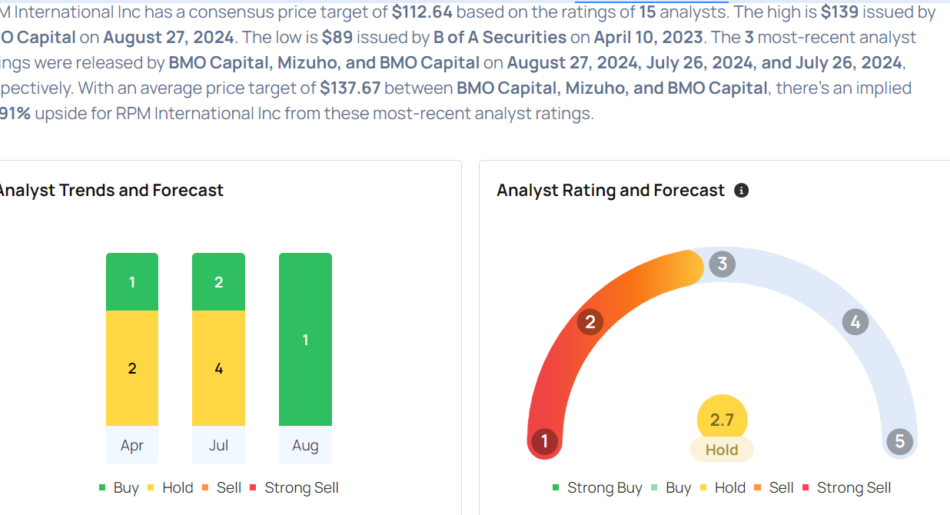

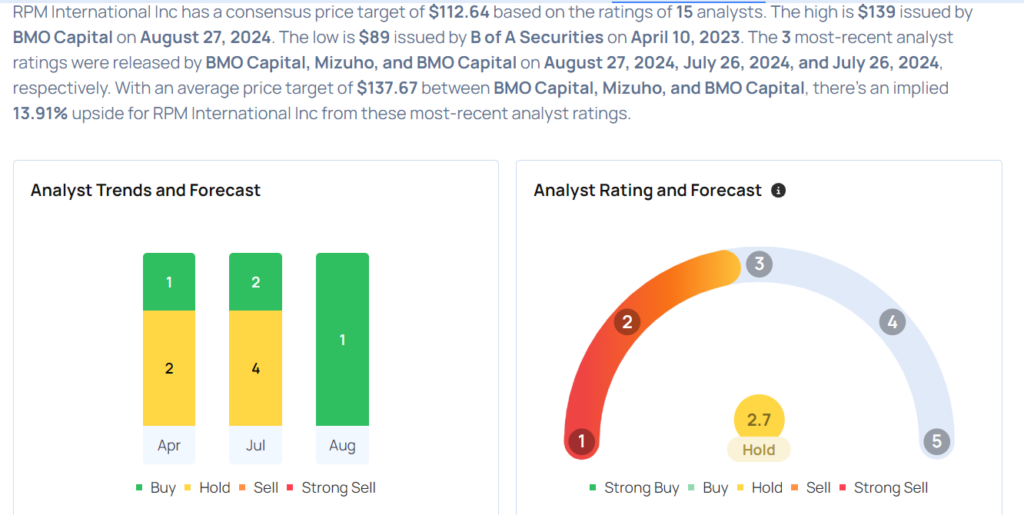

RPM International Gears Up For Q1 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

RPM International Inc. RPM will release earnings results for its first quarter, before the opening bell on Wednesday, Oct. 2.

Analysts expect the Medina, Ohio-based company to report quarterly earnings at $1.75 per share, up from $1.64 per share in the year-ago period. RPM projects to report revenue of $2.02 billion for the quarter, according to data from Benzinga Pro.

On July 25, RPM International reported better-than-expected fourth-quarter earnings.

RPM shares fell 0.8% to close at $120.09 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- BMO Capital analyst John McNulty maintained an Outperform rating and cut the price target from $140 to $139 on Aug. 27. This analyst has an accuracy rate of 66%.

- Mizuho analyst John Roberts maintained an Outperform rating and cut the price target from $136 to $134 on July 26. This analyst has an accuracy rate of 71%.

- Wells Fargo analyst Michael Sison maintained an Equal-Weight rating and boosted the price target from $110 to $125 on July 26. This analyst has an accuracy rate of 72%.

- JP Morgan analyst Jeffrey Zekauskas downgraded the stock from Overweight to Neutral with a price target of $120 on July 26. This analyst has an accuracy rate of 69%.

- UBS analyst Joshua Spector maintained a Neutral rating and lowered the price target from $122 to $117 on July 9. This analyst has an accuracy rate of 64%.

Considering buying RPM stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Investor David Tepper Just Said to Buy "Everything" in China. Here Are His 3 Largest Positions.

In late 2010, billionaire investor David Tepper made a big splash on CNBC. He predicted that the Federal Reserve’s zero interest rate environment and quantitative easing policies at the time would bolster almost every investment in the U.S. Following this appearance, the broader benchmark S&P 500 index would rip 45% higher over the next 2-1/2 years in a run now referred to as the “Tepper Rally.”

Yesterday, Tepper made a similar call on CNBC although this time he was talking about Chinese stocks after the Chinese government recently issued sweeping stimulus measures and began cutting interest rates. “Everything,” Tepper said when asked what Chinese stocks to buy. “Everything… ETFs, I would do futures, everything.”

It’s a big call, but Tepper and his fund’s track record of 28% annualized returns speaks for itself. And Tepper has made a lot of his money with a simple strategy: “Don’t fight the Fed.” In this case, it would be the Chinese government and central bank. Here are Tepper’s three largest Chinese equity positions.

Alibaba: 12% of portfolio

E-commerce giant Alibaba (NYSE: BABA) is the largest position in Tepper’s Appaloosa Holdings. The position is worth roughly 12% of the nearly $6.2 billion portfolio and was valued at $756 million at the end of the second quarter of 2024.

Alibaba is considered the Amazon of China, which makes sense considering Amazon is Appaloosa’s second-largest position. Alibaba runs several massive businesses including the world’s largest retail e-commerce business based on gross merchandise value. It also operates the world’s fourth-largest cloud business and Asia Pacific’s largest infrastructure-as-a-service provider. Additionally, like most big tech stocks, Alibaba has recently made a big push into artificial intelligence (AI).

In early 2023, Alibaba announced plans to split the company into six separate businesses, all with their own CEO and board of directors and the ability to raise capital, potentially leading to several initial public offerings (IPOs). Analysts at the time seemed to like the idea because it would allow the company to realize more of its potential on a sum-of-the-parts valuation and reduce regulatory risk.

But earlier this year, the company paused plans for two public offerings, citing difficult market conditions for IPOs. Still, you’ve got a company with a clear moat and strong growth prospects trading at 12 times forward earnings. In comparison, Amazon trades at 40 times forward earnings. If Chinese stimulus can awaken consumer demand, Alibaba is a clear beneficiary.

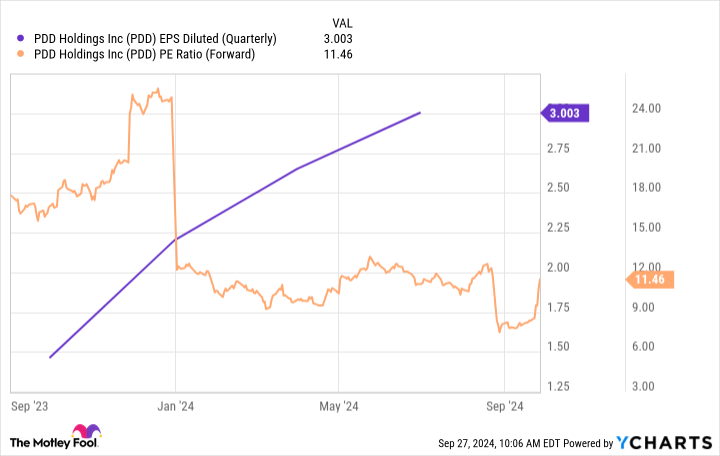

PDD Holdings: 4% of portfolio

Tepper seems to have a thing for e-commerce, because Appaloosa’s next largest Chinese position is another multinational commerce company called PDD Holdings (NASDAQ: PDD). PDD has several businesses including the online platform Pinduoduo, which is known for its wide range of product offerings at low prices. The platform has a “team purchase” concept in which consumers can invite others to group deals for discounted prices.

Other businesses owned by PDD include the next-day grocery delivery service Duo Duo and the growing U.S. brand Temu, another online retailer known for its low prices. PDD only trades at 11.5 times forward earnings and has seen earnings double over the last year. This is part of Tepper’s thesis in which you can buy Chinese stocks trading at cheap earnings multiples today that can generate double-digit growth.

Baidu: 2.3% of portfolio

Given Tepper and Appaloosa’s concentration in tech and chip stocks, Baidu (NASDAQ: BIDU) is a logical company to be in the mix. If there is a U.S. comp to Baidu it would probably be Alphabet. Baidu is the dominant search engine in China. The company is also a big player in the artificial intelligence space.

In 2023, Baidu released its ChatGPT-like assistant known as Ernie. Baidu’s developer network, PaddlePaddle, has 10.7 million users who have created 860,000 different models. The company can also create and manufacture its own chips.

Baidu’s roughly 37.5 billion market capitalization pales in comparison to Alphabet’s $2-plus trillion. Now, the Chinese economy is in a very different place from the U.S. and has been hit hard by deflationary pressure, a housing downturn, and weak consumer demand.

Chinese AI companies may also run into obstacles with the government’s AI rules and laws. But given the size of China’s economy, there is tremendous potential. Baidu has seen good earnings growth over the last two years, while its price-to-earnings multiple has fallen to below 14.

Should you invest $1,000 in Alibaba Group right now?

Before you buy stock in Alibaba Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alibaba Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $744,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, and Baidu. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.

Billionaire Investor David Tepper Just Said to Buy “Everything” in China. Here Are His 3 Largest Positions. was originally published by The Motley Fool

Humana Plunges as Medicare Star Rating Cut Threatens Revenue

(Bloomberg) — Humana Inc. has lost about half of its market value this year as the health insurer faced one disaster after another. In the wake of another major setback Wednesday, investors are growing impatient.

Most Read from Bloomberg

The latest stumble focuses on crucial quality ratings that drive billions of dollars in revenue. After the Centers for Medicare and Medicaid Services slashed Humana’s scores, only about 25% of its members will be in highly rated plans that generate extra revenue, down from 94% previously.

Humana shares tumbled as much as 24%, their biggest drop in 15 years, before paring the decline.

Stephens analyst Scott Fidel called the news “a worst-case scenario” for Humana and estimated that $3 billion in revenue could be at risk. Leerink analysts led by Whit Mayo estimated that lower ratings may cost the company $1 billion in 2026 and will delay Humana’s plans to return to its target margins of at least 3% in its Medicare Advantage business by 2027.

Humana is the only large US health insurer that’s focused almost exclusively on Medicare. That links it more tightly to the fate of the program than other diversified rivals — an advantage for years that has recently become a headwind. Surprise jumps in medical costs and lower payments from the government have helped erode almost $30 billion from the company’s market value in 2024.

In the near term, the company is appealing to the CMS, which sets the ratings. It’s unclear how long that may take, but the payment cuts from the ratings hit won’t take effect until 2026. Other insurers have successfully challenged such judgments before, restoring favorable ratings before they damage revenue.

Either way, new Chief Executive Officer Jim Rechtin faces a yearslong path to recover the insurer’s earnings and win back the confidence of investors. Rechtin took over in July from Bruce Broussard, who over more than a decade at the helm had tripled Humana’s Medicare Advantage business and presided over a 400% gain in the company’s stock price.

Humana planned to hold private calls with investors Wednesday afternoon, a spokesperson said.

Humana’s diminished market value could also revive takeover interest from Cigna Group, particularly if a second Trump administration brings lighter antitrust regulation. Cigna is divesting its own much smaller Medicare business.

Mizuho’s Jared Holz said Wednesday that investors have been speculating whether Cigna would make another approach “but doubt a move will take place until the dust settles a bit more” for Humana.

The ratings, also known as stars, assess the quality of care and customer service for private Medicare health plans that now cover more than half of all people in the US program. It’s a high-stakes calculation that will drive an estimated $11.8 billion in bonus payments to insurers this year, including $2.5 billion to Humana, according to health policy research group KFF.

Humana said it was “disappointed with its performance and has initiatives underway focused on improving its operating discipline and returning to an industry leading Stars position as quickly as possible.” The ratings aren’t expected to impact the company’s financial outlook for 2024 or 2025, the company said.

Medicare reviews plans each year ahead of the enrollment window that begins Oct. 15. So far there are few signs that any of Humana’s rivals suffered such a big hit to their ratings.

While the official ratings files haven’t been released, some are visible on Medicare’s plan finder tool that helps consumers shop for coverage. Two large plans from CVS Health Corp. appeared to retain 4-star ratings on the website, Evercore ISI analysts said Wednesday in a note. CVS shares rose as much as 3.9% in New York.

–With assistance from Angel Adegbesan.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Glucolate Unveils Breakthrough Diabetic Study

Irvine, CA October 02, 2024 –(PR.com)– Glucolate Unveils Breakthrough Study from University of California, Irvine: New Powder Form Reduces Glucose Absorption in Type 2 Diabetics

Glucolate, an innovative leader in diabetes management, is proud to announce groundbreaking findings from a recent study conducted at the University of California, Irvine. The study highlights the effectiveness of Glucolate’s unique powder formulation, which creates a temporary coating in the digestive system to reduce glucose absorption during meals, offering a promising non-invasive alternative for managing Type 2 diabetes (T2D).

The study, led by renowned researchers from UC Irvine and published in Trends in Diabetes and Metabolism, demonstrated that Glucolate’s powder, when ingested prior to meals, coats the proximal intestine, temporarily inhibiting glucose absorption. The innovative formula mimics the effects of bariatric surgery without invasive procedures or long-term side effects.

Key Findings:

• Glucolate reduced non-fasting blood glucose levels by 9% in participants after just four weeks of use.

• The product showed improvements in HbA1c levels and weight loss, making it a holistic approach to managing T2D.

• Controlled and uncontrolled diabetic patients alike experienced significant metabolic benefits, including improved gastrointestinal health and blood pressure stabilization.

Dr. Jonathan Lakey, Professor Emeritus at UC Irvine and co-author of the study, said, “We are excited about the potential of Glucolate. Its ability to mimic some effects of bariatric surgery without requiring surgical intervention could revolutionize how we manage glucose metabolism in diabetic patients.”

A Natural, Non-Invasive Solution Unlike many existing treatments, Glucolate is designed for ease of use. Taken in a simple powder form before meals, the product temporarily coats the intestine, preventing excessive glucose from entering the bloodstream. This innovative approach could provide relief for the millions of individuals struggling with managing blood sugar spikes post-meal.

As the global diabetes epidemic continues to rise, Glucolate’s new formula offers an accessible and potentially life-changing solution. The results of this pilot study underscore the importance of further research into non-invasive methods for diabetes control.

For more information about Glucolate and the UC Irvine study, visit Glucolate.com (https://glucolate.com/).

Contact Information: Glucolate Media Relations

Phone: 1-720-803-4900

Email: admin@glucolate.com

Website:

www.glucolate.com (https://glucolate.com/)

Contact Information:

Glucolate Processing, LLC

Jimmy Sierra

720-803-4900

Contact via Email

glucolate.com

Read the full story here: https://www.pr.com/press-release/921859

Press Release Distributed by PR.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Toll Brothers Announces New Luxury Home Community, Barton Ridge, Coming Soon to Ann Arbor, Michigan

ANN ARBOR, Mich., Oct. 02, 2024 (GLOBE NEWSWIRE) — Toll Brothers, Inc. TOL, the nation’s leading builder of luxury homes, today announced its newest community, Barton Ridge, is coming soon to Ann Arbor, Michigan. This exclusive Toll Brothers neighborhood will offer an array of luxurious single-family home designs and top-tier personalization options. Site work and construction is underway and the Barton Ridge community, located at Whitemore Lake Road and Warren Road in Ann Arbor, is expected to open for sale in late fall 2024.

Featuring expansive two-story single-family home designs with three-car side-entry garages and modern architectural finishes, this beautiful collection of new construction luxury homes in Ann Arbor will offer residents access to top-tier personalization options at the Toll Brothers Design Studio. Located near award-winning schools, a bustling downtown area, and boundless green space, Barton Ridge seamlessly blends everything that Ann Arbor has to offer with the luxury living of Toll Brothers.

“Barton Ridge offers home buyers the opportunity to step into the lifestyle they’ve always dreamed of,” said Isaac Boyd, Division President of Toll Brothers in Michigan. “Barton Ridge offers an unparalleled combination of luxurious living and a premier location within the highly sought-after Ann Arbor School District. This community provides the perfect setting for buyers and families of all stages looking to enjoy modern home designs and a lifestyle of luxury just minutes from downtown Ann Arbor.”

Key features of Barton Ridge include first-floor guest bedroom suites, three-car side-entry garages, multi-generational living suites, and walkout and lookout basements available with the option to finish. Homeowners will also enjoy expansive home sites nestled in a peaceful, wooded setting.

The community is just 10 minutes from Wines Elementary School, Forsythe Middle School, and Skyline High School, offering convenience for families with children. Premier shopping, dining, and recreational opportunities abound in the Ann Arbor area, providing endless entertainment options for residents. Barton Ridge is ideally situated close to outdoor recreation areas, ensuring that homeowners can enjoy the natural beauty of the region.

Home buyers will experience one-stop shopping at the Toll Brothers Design Studio. The state-of-the-art Design Studio allows home buyers to choose from a wide array of selections to personalize their dream home with the assistance of Toll Brothers professional Design Consultants.

Additional Toll Brothers new home communities in the area include Reserve at West Bloomfield, Edgewood by Toll Brothers, Parc Vista by Toll Brothers, North Oaks of Ann Arbor, and Toll Brothers at Fosdick Glen.

For more information and to join the Toll Brothers interest list for Barton Ridge, call (866) 267-0537 or visit TollBrothers.com/MI.

About Toll Brothers

Toll Brothers, Inc., a Fortune 500 Company, is the nation’s leading builder of luxury homes. The Company was founded 57 years ago in 1967 and became a public company in 1986. Its common stock is listed on the New York Stock Exchange under the symbol “TOL.” The Company serves first-time, move-up, empty-nester, active-adult, and second-home buyers, as well as urban and suburban renters. Toll Brothers builds in over 60 markets in 24 states: Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Indiana, Maryland, Massachusetts, Michigan, Nevada, New Jersey, New York, North Carolina, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia, and Washington, as well as in the District of Columbia. The Company operates its own architectural, engineering, mortgage, title, land development, smart home technology, and landscape subsidiaries. The Company also develops master-planned and golf course communities as well as operates its own lumber distribution, house component assembly, and manufacturing operations.

In 2024, Toll Brothers marked 10 years in a row being named to the Fortune World’s Most Admired Companies™ list and the Company’s Chairman and CEO Douglas C. Yearley, Jr. was named one of 25 Top CEOs by Barron’s magazine. Toll Brothers has also been named Builder of the Year by Builder magazine and is the first two-time recipient of Builder of the Year from Professional Builder magazine. For more information visit TollBrothers.com.

From Fortune, ©2024 Fortune Media IP Limited. All rights reserved. Used under license.

Contact: Andrea Meck | Toll Brothers, Director, Public Relations & Social Media | 215-938-8169 | ameck@tollbrothers.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f5350bc3-5239-474c-9a2d-f4d88b1051b3

Sent by Toll Brothers via Regional Globe Newswire (TOLL-REG)

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

LPL Financial Acquires Altria Wealth Solutions, Appoints New CEO

LPL Financial Holdings LPLA, along with its subsidiaries LPL Financial LLC, has completed the acquisition of Altria Wealth Solutions, Inc. (“Altria”). Further, the company announced a change in its leadership with the termination of its existing president and chief executive officer and the appointment of a new CEO.

Details of Acquisition Pursued by LPLA

Atria Wealth Solutions, Inc., based in New York, boasts a network of almost 2,400 advisors and serves around 150 banks and credit unions, managing an impressive $100 billion in brokerage and advisory assets. Notably, brokerage accounts comprise nearly 80% of the firm’s assets, with the rest in advisory holdings.

Per the acquisition announcement dated Feb. 13, 2024, LPLA expected onboarding and integration costs to be between $300 million and $350 million. Despite these expenses, the long-term financial projections are promising, with LPLA anticipating additional earnings of $140 million annually from the deal.

LPL Financial expects to meet or exceed its retention target of 80%. Altria will function as a wholly owned portfolio company through the onboarding of Altria advisors, which is anticipated to be completed in mid-2025.

The acquisition aligns with LPL Financial’s goal to empower independent financial advisors and institutions nationwide by providing them with comprehensive support and resources. The acquisition of Atria Wealth Solutions builds upon LPL Financial’s previous successful ventures, including the acquisition of National Planning Holdings and Waddell & Reed in 2017 and 2021, respectively.

Further, LPLA considers acquisitions a core part of its business expansion strategy. In May, the company acquired Crown Capital, while in September, it agreed to acquire The Investment Center, Inc., reinforcing its strategy of expanding its advisor network and enhancing offerings.

LPL Financial Leadership Change

LPLA’s board of directors terminated the company’s president and chief executive officer, Dan H. Arnold for violation of the company’s commitment to a respectful workplace. He has submitted his resignation from the board as well.

The dismissal is based on the cause recommended by a special committee of directors following an investigation by an external law firm, which concluded that Arnold had made statements to employees that breached LPLA’s code of conduct.

The board has appointed Rich Steinmeier (presently the company’s managing director and chief growth officer) as interim CEO, effective immediately.

James Putnam, chair of the board of directors at LPL Financial, stated, “LPL’s Code of Conduct requires every employee, no matter their title, to foster a supportive and professional workplace and show respect to each other, our stakeholders and the broader community, Mr. Arnold failed to meet these obligations.”

LPL Financial’s Zacks Rank & Price Performance

Year to date, shares of LPL Financial have risen 1% compared with the industry’s growth of 17.7%.

Image Source: Zacks Investment Research

Currently, LPLA carries a Zacks Rank #3 (Hold).

Merger & Acquisition Deal Pursued by Other Finance Firms

This week, Byline Bancorp, Inc. BY entered into a cash and stock merger deal worth $41 million with First Security Bancorp, Inc. in an effort to strengthen its position in Chicago.

The merger is expected to solidify Byline’s position as Chicago’s largest community bank, with assets under $10 billion, loans of $7.3 billion and deposits worth $7.8 billion, along with 45 branches across the greater Chicago metropolitan area.

Last week, TowneBank TOWN agreed to acquire Village Bank and Trust Financial Corp. VBFC. The all-cash transaction is valued at $120 million.

The deal is anticipated to be roughly 6% accretive to TOWN’s 2025 earnings per share, assuming the execution of cost savings on a GAAP basis. Further, TOWN projects a roughly 1% improvement in common equity tier 1 capital and an 80-basis points improvement in efficiency ratio next year.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.