AppLovin Unusual Options Activity For October 02

Deep-pocketed investors have adopted a bullish approach towards AppLovin APP, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in APP usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 17 extraordinary options activities for AppLovin. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 52% leaning bullish and 17% bearish. Among these notable options, 2 are puts, totaling $112,680, and 15 are calls, amounting to $579,453.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $50.0 and $132.0 for AppLovin, spanning the last three months.

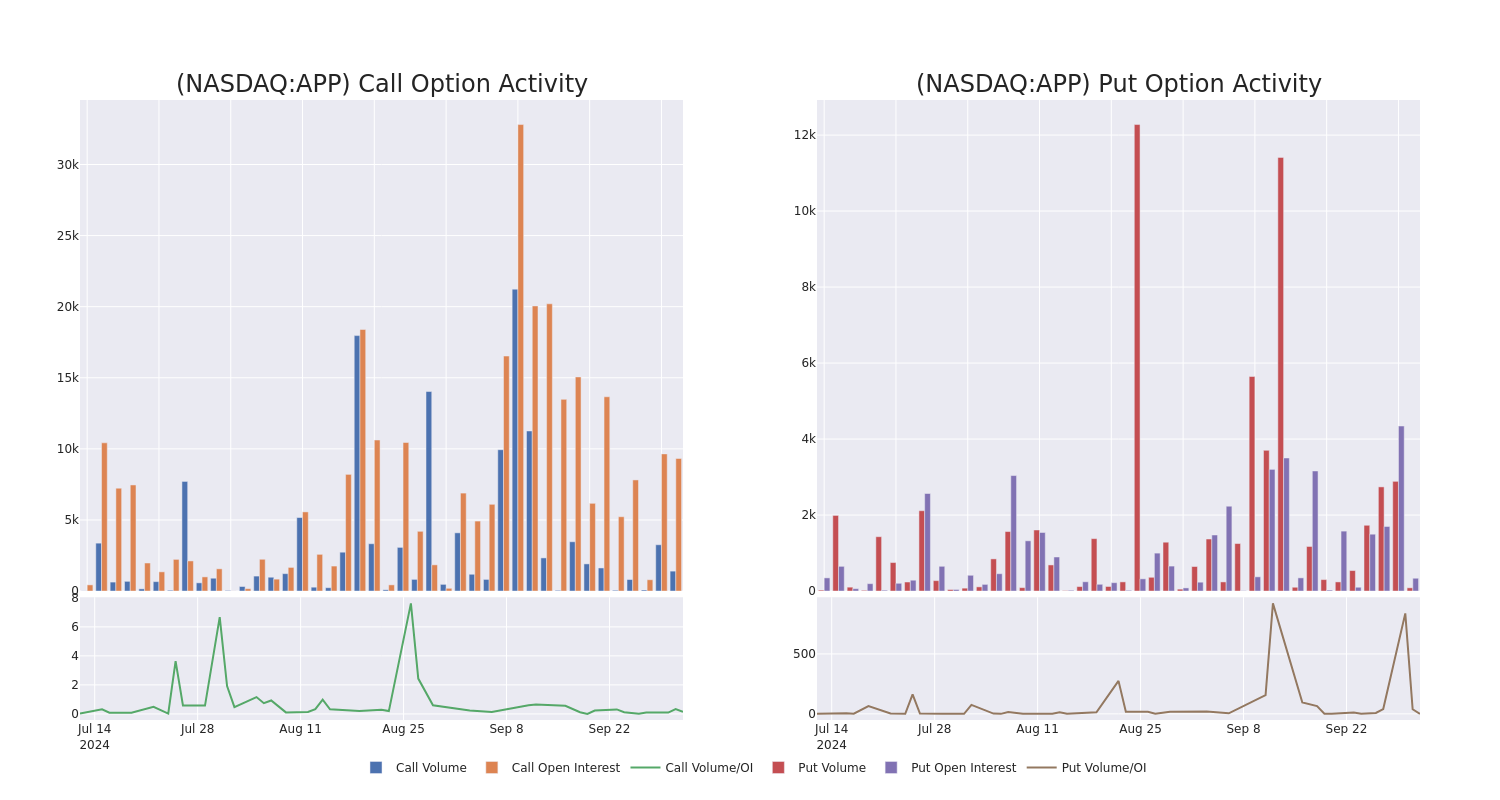

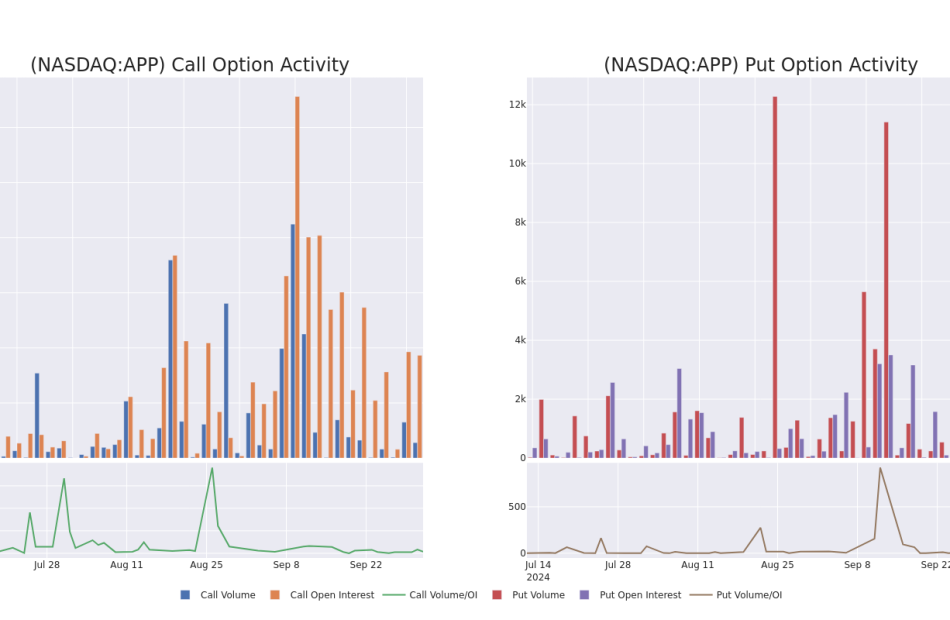

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in AppLovin’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to AppLovin’s substantial trades, within a strike price spectrum from $50.0 to $132.0 over the preceding 30 days.

AppLovin 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| APP | PUT | SWEEP | BULLISH | 03/21/25 | $15.2 | $15.0 | $15.0 | $125.00 | $87.0K | 70 | 0 |

| APP | CALL | SWEEP | BULLISH | 10/11/24 | $3.3 | $3.1 | $3.3 | $132.00 | $56.0K | 30 | 460 |

| APP | CALL | TRADE | BULLISH | 07/18/25 | $42.5 | $42.0 | $42.5 | $100.00 | $42.5K | 912 | 0 |

| APP | CALL | TRADE | BULLISH | 11/15/24 | $82.1 | $82.1 | $82.1 | $50.00 | $41.0K | 200 | 20 |

| APP | CALL | TRADE | BEARISH | 11/15/24 | $82.9 | $82.1 | $82.1 | $50.00 | $41.0K | 200 | 15 |

About AppLovin

AppLovin Corp is a mobile app technology company. It focuses on growing the mobile app ecosystem by enabling the success of mobile app developers. The company’s software solutions provide tools for mobile app developers to grow their businesses by automating and optimizing the marketing and monetization of their applications.

After a thorough review of the options trading surrounding AppLovin, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of AppLovin

- Currently trading with a volume of 925,725, the APP’s price is up by 0.74%, now at $131.62.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 35 days.

Professional Analyst Ratings for AppLovin

In the last month, 5 experts released ratings on this stock with an average target price of $135.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from UBS has elevated its stance to Buy, setting a new price target at $145.

* An analyst from B of A Securities persists with their Buy rating on AppLovin, maintaining a target price of $120.

* In a cautious move, an analyst from Macquarie downgraded its rating to Outperform, setting a price target of $150.

* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on AppLovin with a target price of $155.

* An analyst from Jefferies has decided to maintain their Buy rating on AppLovin, which currently sits at a price target of $108.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest AppLovin options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply