McCormick Q3 Earnings Top Estimates, MKC Volumes Improve Y/Y

McCormick & Company, Incorporated MKC reported solid third-quarter fiscal 2024 results, wherein the top and bottom lines beat the Zacks Consensus Estimate, and earnings increased year over year.

The company achieved a significant milestone by delivering overall global positive volume growth in the quarter, indicating improving trends across both business segments. The momentum is expected to carry into the fourth quarter. In the Consumer segment, MKC recorded solid volume growth despite facing a challenging macroeconomic environment in China. Meanwhile, in the Flavor Solutions segment, sequential volume improvements were realized, driven by strong growth in Branded Foodservice.

Management continues to bolster its position across major markets and core categories by focusing on growth levers such as brand marketing, product and packaging innovation, category management and proprietary technology. The company expects its cost-saving initiatives to help fund future investments and drive operating margin expansion. The year-to-date results, combined with strategic growth plans, reinforce confidence in achieving the mid-to-high range of projected sales growth for 2024.

MKC’s Quarterly Performance: Key Metrics and Insights

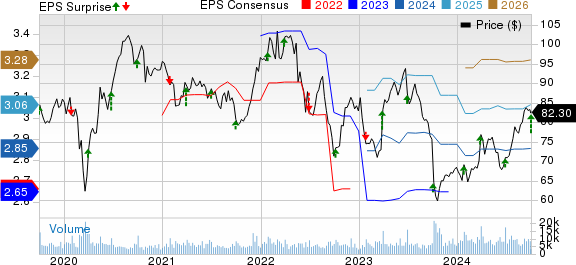

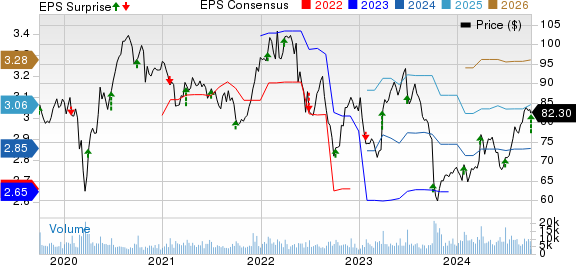

Adjusted earnings of 83 cents per share increased from 65 cents reported in the year-ago quarter. The metric came above the Zacks Consensus Estimate of 68 cents per share, representing a surprise of 22.1%. The year-over-year upside can be attributed to greater operating profit, the timing of a specific tax benefit and increased income from unconsolidated operations, fueled by robust performance from McCormick de Mexico, the company’s largest joint venture.

This global leader in flavor generated sales of $1,679.8 million, flat year over year, including minimum impacts from currency movements. Impacts from the company’s strategic decision to divest its canning business were offset by a 1% increase in volume backed by the Consumer segment, somewhat negated by pricing. The top line exceeded the Zacks Consensus Estimate of $1,664 million.

McCormick’s gross profit margin expanded 170 basis points. The upside can be attributed to improved mix and cost savings from the Comprehensive Continuous Improvement program.

The adjusted operating income came in at $288 million, up 15% year over year, reflecting gross margin expansion and reduced SG&A expenses.

Decoding MKC’s Segmental Performance

Consumer: Sales remained flat year over year at $937.4 million, with a negligible impact on currency movements. Sales were hurt by a 1% decline from pricing actions, offset by 1% volume growth. Volume growth in the Americas and the Europe, Middle East, and Africa (“EMEA”) regions was partly negated by declines in the Asia-Pacific region (APAC). Sales remained flat year over year in the Americas while moving up 3% in the EMEA region. Segment sales dipped 1% in the APAC.

Flavor Solutions: Sales in the segment inched down 1% to $742.4 million. On a constant-currency basis, sales were flat year over year as a 1% rise in pricing was countered by the company’s strategic move to sell off its canning business. Flavor Solutions’ sales in the Americas grew 2%. Flavor Solutions’ sales in the EMEA fell by 8%. Sales in the APAC market fell 1% year over year.

MKC’s Financial Health Snapshot

McCormick exited the quarter with cash and cash equivalents of $200.8 million, long-term debt of $3,343.1 million and total shareholders’ equity of $5,451 million. In the nine months ended Aug. 31, 2024, net cash provided by operating activities was $463.2 million.

What to Expect From MKC in 2024?

For fiscal 2024, McCormick is focused on strengthening its volume trends and prioritizing investments to fuel profits. The company’s CCI and Global Operating Effectiveness programs are driving growth investments and operating margin expansion. Management anticipates currency movements to have a minimal impact on 2024 results.

For 2024, management expects sales to range between a 1% decline and 1% growth, including minimal currency impacts. The company anticipates witnessing a favorable impact of pricing actions undertaken in the prior year. Volume trends are likely to improve due to solid brands and targeted investments. However, its decision to discontinue the low-margin business and sell the canning business is likely to put some pressure on volume during 2024.

Management expects adjusted operating income to grow 4-6%, including minimal currency impacts. This is likely to be driven by gross margin expansion, somewhat offset by a major rise in brand marketing investments.

Management envisions 2024 adjusted EPS in the band of $2.85-$2.90, which suggests a 5-7% increase from the year-ago period, including minimal currency impacts. On a GAAP basis, McCormick projects 2024 earnings in the range of $2.81- $2.86 per share compared with the year-ago period figure of $2.52.

This Zacks Rank #2 (Buy) stock has rallied 17.2% in the past three months compared with the industry’s growth of 8.8%.

Other Top Staple Stocks

Here, we have highlighted three other top-ranked consumer staple stocks — The Chef’s Warehouse CHEF, Flowers Foods FLO and Kimberly-Clark Corporation KMB.

The Chef’s Warehouse, which engages in the distribution of specialty food products, currently sports a Zacks Rank #1 (Strong Buy).

CHEF has a trailing four-quarter earnings surprise of 33.7%, on average. The Zacks Consensus Estimate for The Chef’s Warehouse’s current fiscal year sales and earnings indicates growth of 9.7% and 12.6%, respectively, from the year-ago reported numbers.

Flowers Foods, one of the largest producers of packaged bakery foods in the United States, currently carries a Zacks Rank #2. FLO has a trailing four-quarter earnings surprise of 1.9%, on average.

The Zacks Consensus Estimate for Flowers Foods’ current financial-year sales and earnings implies growth of around 1% and 5%, respectively, from the year-ago reported numbers.

Kimberly-Clark is a personal care and consumer tissue product company that currently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for Kimberly-Clark’s current fiscal-year earnings indicates an advancement of 10.4% from the year-ago reported figure. KMB has a trailing four-quarter earnings surprise of 12.6%, on average.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply