Missed Nvidia? 10 Other S&P 500 Stocks Will Make You Much Richer

It’s hard not to love Nvidia (NVDA) — given its huge run this year. But analysts think you can do much better with other S&P 500 stocks.

↑

X

Beating The Market: How To Find Outperforming Stocks

Analysts think 10 S&P 500 stocks, including Super Micro Computer (SMCI), Moderna (MRNA) and Schlumberger (SLB), will jump more than 40% in the next 12 months, says an Investor’s Business Daily analysis of data from S&P Global Market Intelligence and MarketSurge.

Not only is a 40% jump the highest in the S&P 500. It’s considerably higher than the 28.1% gain analysts predict for Nvidia in the next 12 months.

Nvidia: Make Room For Next S&P 500 Champs

Nvidia has found itself to be perfectly positioned for the AI chip boom. But it’s hardly an undiscovered gem.

The stock is up 136% this year. That makes it the No. 2 best stock of the year and gives it a 97 RS Rating. Additionally, analysts think Nvidia’s profit will rise 120% in 2025.

But even with all that going for it, analysts think the stock will trade for 149.86 in 12 months. Analysts have much higher hopes for other stocks in the S&P 500. Nvidia ranks just 25th in terms of expected upside in the stock in the index.

Big Hopes On Former S&P 500 Winners

Analysts’ bullishness on AI computing firm, Super Micro Computer, is off the charts. It’s the only stock in the S&P 500 analysts think will jump more than 100% in 12 months.

The stock is the target of a short-selling campaign questioning its accounting. Nearly 15% of its shares are controlled by short sellers.

Even so, the stock is still up nearly 43% this year. And while the RS Rating has crumbled to 16, it still has an EPS Rating of 99. And analysts are calling for 51% earnings growth in 2025.

It’s a different but similar story at vaccine maker Moderna. Analysts think the stock is due for a more than 50% rally in 12 months. But it’s more of a case of looking for a bounce. Shares are down more than 35% this year. They sport a RS Rating of just 7. But analysts expect the company’s earnings growth to return in 2025.

To be sure, analysts aren’t always right. In fact, they’re often wrong. It’s always best to use time-tested rules for buying and selling stocks.

But if analysts’ usually glowing forecasts for Nvidia are cooling, it might be worth paying attention to.

Analysts Favorite S&P 500 Stocks

Based on 12-month price targets

| Company | Ticker | Implied upside | Sector |

|---|---|---|---|

| Super Micro Computer | SMCI | 149.8% | Information Technology |

| Moderna | MRNA | 54.2% | Health Care |

| Schlumberger | SLB | 48.5% | Energy |

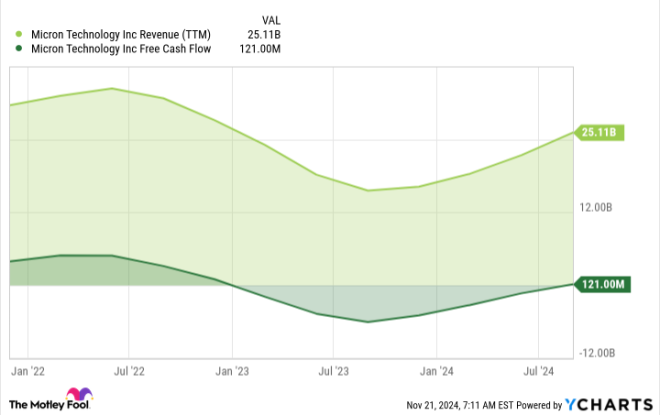

| Micron Technology | MU | 45.6% | Information Technology |

| Dexcom | DXCM | 45.6% | Health Care |

| Bath & Body Works | BBWI | 42.0% | Consumer Discretionary |

| Biogen | BIIB | 41.6% | Health Care |

| Walgreens Boots Alliance | WBA | 40.7% | Consumer Staples |

| Halliburton | HAL | 40.7% | Energy |

| Humana | HUM | 40.0% | Health Care |

Leave a Reply