Tesla Q3 deliveries could drive 'further strength' in the stock

Tesla (TSLA) is poised to deliver third quarter deliveries as early as Wednesday, a result that could push the stock beyond the strong recent gains it has already seen.

Wall Street expects Tesla to deliver around 461,000 electric vehicles globally in the third quarter, with annual delivery estimates coming in at 1.79 million, per Bloomberg. This figure would be a sequential improvement from the second quarter when Tesla delivered approximately 444,000 vehicles; however, it would be below the 466,000 EVs delivered a year ago.

Tesla stock is up over 20% in the past month, fueled by optimism about its upcoming robotaxi event on Oct. 10 and good news coming out of China indicating rising sales there.

A strong third quarter delivery report would also assuage fears of a “notably lower” annual vehicle growth rate, which Tesla warned about after Q1.

Wall Street analysts agree with the narrative of improving sales and, in some cases, have boosted expectations.

Piper Sandler analyst Alexander Potter raised his delivery estimates, and now sees deliveries of 459,000 EVs globally, with a full-year forecast of 1.75 million units. While Potter’s estimate is still slightly below consensus, Potter believes Tesla may report its best quarter ever in China.

Barclays analyst Dan Levy sees deliveries topping 470,000 units in Q3, easily beating estimates. Levy and Barclays cite July data for global EV sales and China sales based on August registrations and production data.

“Our delivery estimate implies volume up ~6% sequentially and up ~8% [year over year] — which would be Tesla’s first quarterly result in 2024 with positive [year-over-year] growth,” Levy wrote in a note to clients. “We believe that a beat could drive further strength of the stock into Robotaxi Day, serving as a reminder that at least for now concerns on fundamentals have dissipated.”

Tesla bull Dan Ives at Wedbush predicts that not only will sales improve in Q3 but also that profitability may finally improve after a steep slide over the past year.

“Importantly we believe price cuts are now mostly in the rear view mirror and should remove a margin overhang from the Tesla story which has plagued the name over the past year,” Ives wrote in a note last week. “We believe gross margins should finally start to rebound from these levels with 3Q a big step forward.”

Interestingly, analysts are also starting to model sales for the Cybertruck, which has seen production and sales data start climbing.

S&P Global Mobility data showed that Tesla sold over 5,000 Cybertrucks in July, the most recent month for which the firm has data collected, with year-to-date sales hitting 17,722.

Deutsche Bank predicts the Cybertruck, which is only on sale in the US, will see sales hit 13,500 in the third quarter.

While that figure would only represent 3% of overall sales, it is climbing and, at the margin, could represent the difference between a sales beat or miss for Tesla’s overall deliveries.

Pras Subramanian is a reporter for Yahoo Finance. You can follow him on Twitter and on Instagram.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Highland Global Allocation Fund Declares Monthly Distributions of $0.081 Per Share

DALLAS, Oct. 1, 2024 /PRNewswire/ — Highland Global Allocation Fund HGLB (“the “Fund”) today announced the declaration of monthly distributions of $0.081 per share, payable on the dates noted below. Under the Fund’s level distribution policy, the annual distribution rate has been reset to an amount equal to 8.5% of the average of the Fund’s net asset value (“NAV”) per share, as reported for the final five trading days of the 2023 calendar year. The Fund is declaring distributions of $0.081 per month for October through December 2024.

The following dates apply to the distributions declared:

|

Ex-Date |

Record Date |

Payable Date |

|

October 24, 2024 |

October 24, 2024 |

October 31, 2024 |

|

November 22, 2024 |

November 22, 2024 |

November 29, 2024 |

|

December 24, 2024 |

December 24, 2024 |

December 31, 2024 |

About the Level Distribution Policy

In March 2019, the Fund’s Board of Trustees (the “Board”) approved a level distribution policy (the “Level Distribution Policy”) under which the Fund makes monthly distributions to stockholders at a constant and fixed (but not guaranteed) rate that will reset annually to a rate calculated based on the average of the Fund’s NAV per share (the “Distribution Amount”), as reported for the final five trading days of the month preceding the announcement of distributions. The Distribution Amount applicable to Q4 2024 was reset based upon the results of the distribution rate calculation. The Distribution Amount applicable for future periods may be reset based upon the results of the distribution rate calculation.

There can be no guarantee that the Level Distribution Policy will be successful in its goals. The Fund’s ability to maintain a stable level of distributions to shareholders will depend on a number of factors, including changes in the financial market, market interest rates, and performance of overall equity and fixed-income markets. As portfolio and market conditions change, the ability of the Fund to continue to make distributions in accordance with the Level Distribution Policy may be affected.

Shareholders have the option of reinvesting distributions in additional common shares through the Fund’s Dividend Reinvestment Plan, or electing to receive cash by contacting AST, their financial adviser or their brokerage firm. Shareholders who wish to receive their distribution in cash must opt out of the Fund’s Dividend Reinvestment Plan. For further information, shareholders should carefully read the description of the Dividend Reinvestment Plan in the prospectus.

The Board may amend the Level Distribution Policy, the Distribution Amount or distribution intervals, or the Fund may cease distributions entirely, at any time, without prior notice to shareholders. The announcement of, amendment to, or later termination of this Level Distribution Policy may have an adverse effect on the market price of the Fund’s shares of common stock.

The Fund may at times, in its discretion, pay out less than the entire amount of net investment income earned in any particular period and may at times pay out such accumulated undistributed income in addition to net investment income earned in other periods in order to permit the Fund to maintain a stable level of distributions. As a result, the dividend paid by the Fund to shareholders for any particular period may be more or less than the amount of net investment income earned by the Fund during such period. The Fund intends to distribute all realized net long-term capital gains, if any, no more than once every twelve months.

To the extent that sufficient investment income is not available on a monthly basis, the Fund’s distributions may consist of return of capital in order to maintain the distribution amount. A return of capital occurs when some or all of the money that shareholders invested in the Fund is paid back to them. A return of capital does not necessarily reflect the Fund’s investment performance and should not be confused with ‘yield’ or ‘income.’ Any such returns of capital will decrease the Fund’s total assets and, therefore, could have the effect of increasing the Fund’s expense ratio. In addition, the Level Distribution Policy may require the Fund to sell its portfolio securities at a less than opportune time to meet the distribution amount.

Shareholders should not make any conclusions about the Fund’s investment performance from the amount of the Fund’s distributions or the Fund’s Level Distribution Policy. With each distribution that does not consist solely of net investment income, the Fund will issue a notice to shareholders that will provide detailed information regarding the amount and composition of the distribution and other related information. The amounts and sources of distributions reported in the notice to shareholders are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the distributions for tax reporting purposes will depend upon the Fund’s investment experience during its full fiscal year and may be subject to changes based on tax regulations. The Fund will send individual shareholders a Form 1099-DIV for each calendar year that will tell them how to report these distributions for federal income tax purposes. Please consult your tax advisor about any tax implications applicable to you in light of your particular circumstances.

About the Highland Global Allocation Fund

The Highland Global Allocation Fund (“HGLB”) HGLB is a closed-end fund managed by NexPoint Asset Management, L.P. For more information visit www.nexpointassetmgmt.com/global-allocation-fund.

About NexPoint Asset Management, L.P.

NexPoint Asset Management, L.P. is an SEC-registered investment adviser. It is the adviser to a suite of registered funds, including open-end mutual funds, closed-end funds, and an exchange-traded fund. For more information visit nexpointassetmgmt.com.

The distribution may include a return of capital. Please refer to the 19(a)-1 Source of Distribution Notice on the NexPoint Funds website for Section 19 notices that provide estimated amounts and sources of the fund’s distributions, which should not be relied upon for tax reporting purposes.

No assurance can be given that the Fund will achieve its investment objectives.

Shares of closed-end investment companies frequently trade at a discount to net asset value. The price of the Fund’s shares is determined by a number of factors, several of which are beyond the control of the Fund. Therefore, the Fund cannot predict whether its shares will trade at, below or above net asset value. Past performance does not guarantee future results.

Investors should consider the investment objectives, risks, charges and expenses of the Highland Global Allocation Fund carefully before investing. This and other information can be found in the Fund’s prospectus, which may be obtained by calling 1-866-745-0264 or visiting www.nexpointassetmgmt.com. Please read the prospectus carefully before you invest.

CONTACTS

Investor Relations

Kristen Thomas

IR@nexpoint.com

Media Relations

Prosek Partners for NexPoint

Pro-nexpoint@prosek.com

![]() View original content:https://www.prnewswire.com/news-releases/highland-global-allocation-fund-declares-monthly-distributions-of-0-081-per-share-302264817.html

View original content:https://www.prnewswire.com/news-releases/highland-global-allocation-fund-declares-monthly-distributions-of-0-081-per-share-302264817.html

SOURCE Highland Global Allocation Fund

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Amazon CEO Andy Jassy Faces Employee Revolt Over Full-Time Return To Office Mandate, 73% Consider Quitting: Survey

Amazon.com Inc. (NASDAQ:AMZN) employees are contemplating leaving their jobs following CEO Andy Jassy’s new policy requiring a full-time return to the office.

What Happened: A recent survey on Blind stated, “Just days after the company’s announcement, some Amazon professionals said they plan to take more drastic steps, including looking for another job. Nearly three out of four Amazon professionals (73%) said they are considering looking for another job because of the in-office work policy.”

Don’t Miss:

The survey, which included 2,585 Amazon workers, showed that 80% know colleagues also thinking about leaving. The policy, announced by Jassy, has reportedly affected morale, especially among parents.

Amazon employees are hoping leadership will reconsider the policy, which is set to begin in 2025. An internal survey shared on Slack channels, including a “remote advocacy” group, aims to provide feedback to Jassy and other leaders, reported Fortune.

Trending: Amid the ongoing EV revolution, previously overlooked low-income communities now harbor a huge investment opportunity at just $500.

The new return-to-office mandate is part of a broader strategy by Amazon to streamline operations and reduce managerial layers.

In a memo sent on Sep. 16, Jassy announced that Amazon would cut management layers and require employees to return to the office five days a week starting January 2025. This move aims to address inefficiencies caused by excessive meetings and approvals.

Why It Matters: The return-to-office policy has reportedly not been applied across Amazon’s subsidiaries. For instance, workers at Amazon’s One Medical subsidiary are only required to come to the office three times a week, starting in October. This discrepancy has fueled further dissatisfaction among Amazon’s broader workforce. However, the Amazon spokesperson has denied the report.

Trending: Teens may never need wisdom teeth removed thanks to this MedTech Company – Be an early investor for just $300 for 100 shares!

The return-to-office policy has also faced external criticism. Ahead of the holiday season, Amazon’s mandate clashed with the UK government’s push for flexible working rights. The UK government argues that flexible working improves performance and employee loyalty, contrary to Amazon’s stance that in-office work fosters better collaboration and innovation.

The dissatisfaction with Amazon’s rigid return-to-office policy has already led to a significant increase in resignations, particularly within its cloud division, In December, Amazon Web Services (AWS) employees reportedly resigned in large numbers, citing the inflexible policy as a primary reason.

Read Next:

Image Via Shutterstock

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Amazon CEO Andy Jassy Faces Employee Revolt Over Full-Time Return To Office Mandate, 73% Consider Quitting: Survey originally appeared on Benzinga.com

ITS Logistics October Port Rail Ramp Index: ILA Strike at East and Gulf Coast Ports Results in Severe Supply Chain Standstill from New England to Texas

RENO, Nev., Oct. 01, 2024 (GLOBE NEWSWIRE) — ITS Logistics today released the October forecast for the ITS Logistics US Port/Rail Ramp Freight Index. This month, the index reveals both the East and Gulf Coast regions have been moved to a severe status, as all operations and equipment will be adversely affected by the current International Longshoremen’s Association (ILA) strike. The index calls out that, similar to the COVID crisis, a significant impact will not be felt during the strike. However, once operations recommence, much of the supply chain will experience the strike’s negative effect.

“Congestion, lack of equipment, lack of yard space, capacity constrictions, and vessel congestion will stress every supply chain,” said Paul Brashier, Vice President of Global Supply Chain for ITS Logistics. “As was seen during the days leading up to the strike, driver productivity dropped significantly. Drivers that could pull six containers or more per day prior were only able to get one to two containers per day out of the port. Ultimately, shippers should be prepared to add a minimum of three to five times the number of drivers to their current network. It should also be noted that for every 36 hours the ports are closed, port operations will be negatively impacted for one full week.”

On Monday, October 1, the ILA rejected an offer from the United States Maritime Alliance (USMX), which included a wage increase over six years near 50%. After failing to reach an agreement with a new contract, approximately 50,000 ILA union longshoremen walked off the job at East and Gulf Coast ports from New England to Texas. This is the union’s first strike since 1977, and billions of dollars in trade monthly move through these two U.S. ports, equating to between 43% and 49% of all U.S. imports.

ILA represents about 45,000 workers, and the prospect of the strike creating significant economic damage places the Biden administration in a dilemma five weeks before the elections, as the President confirmed a federal labor law to force an end to the port shutdown would not be used. This tactic was last used in 2002 by President George W. Bush. Despite the President’s current sentiment to not interfere, a strike could have a damaging effect on the economy. The strike will stop the shipment of heavy machinery through the Port of Baltimore and derail the shipment of cars. Operations for both were already impeded upon most of this spring due to the Francis Scott Key Bridge collapse.

“West Coast rail operations are being tested due to inland point intermodal (IPI) volumes that have increased as volumes from the East and Gulf Coast are diverted to avoid ILA strike activity,” continued Brashier. “Export availability on the East and Gulf Coast have been closed due to strike activity, adding to congestion before and after the strike. The industry must also keep in mind that, as this strike takes place on the West Coast, significant volume increases are being experienced due to the Red Sea diversions, along with the diverted volumes to avoid the U.S. East and Gulf Coasts. This has stressed chassis, driver, and yard availability and will continue until West Coast volumes subside.”

ITS Logistics offers a full suite of network transportation solutions across North America and distribution and fulfillment services to 95% of the U.S. population within two days. These services include drayage and intermodal in 22 coastal ports and 30 rail ramps, a full suite of asset and asset-lite transportation solutions, omnichannel distribution and fulfillment, LTL, and outbound small parcel.

The ITS Logistics US Port/Rail Ramp Freight Index forecasts port container and dray operations for the Pacific, Atlantic, and Gulf regions. Ocean and domestic container rail ramp operations are also highlighted in the index for both the West Inland and East Inland regions. Visit here for a full comprehensive copy of the index with expected forecasts for the US port and rail ramps.

About ITS Logistics

ITS Logistics is one of North America’s fastest-growing, asset-based modern 3PLs, providing solutions for the industry’s most complicated supply chain challenges. With a people-first culture committed to excellence, the company relentlessly strives to deliver unmatched value through best-in-class service, expertise, and innovation. The ITS Logistics portfolio features North America’s #19 asset-lite freight brokerage, the #12 drayage and intermodal solution, a top 50 dedicated fleet, an innovative cloud-based technology ecosystem, and a nationwide distribution and fulfillment network.

Media Contact

Amber Good

LeadCoverage

amber@leadcoverage.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ed59ab20-aa78-4345-a93e-05beeb3279df

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CVS is weighing a breakup. What does it mean for the big healthcare business?

With CVS (CVS) reportedly weighing a breakup of its vertical businesses, the healthcare industry could be marching toward the end of an era in integrated businesses.

The reports make CVS the second such vertically integrated retail healthcare company in the US to consider a shift in strategy this year. It could mean a spin-off of health insurer Aetna, pharmacy benefit manager Caremark, or some combination of the two and other verticals.

Walgreens (WBA), its main retail rival, is already pulling out of its retail clinic locations in partnership with VillageMD. This, along with Walmart (WMT) shutting down its retail health locations, has signaled the end of a more consumer-focused approach to healthcare.

CVS’s stock rose to $64 per share on the news of the breakup late Monday after trading down 12% in the past year. It was trading at $61 per share on Tuesday.

The possible move by CVS is one investors are watching with interest. Some are skeptical.

“CVS’ reported decision to pursue a strategic review would not be particularly surprising given the company’s recent execution issues. We have mixed views about a potential breakup of the CVS Health assets,” said Bank of America Securities research analyst Allen Lutz in a note to clients Tuesday.

CVS has long been viewed as the poster child of successful vertical integration. The prospect of a breakup may not bode well for other players.

A key focus of the breakup effort appears to be the underperformance of health insurer Aetna, which CVS acquired in November 2018 for $70 billion, as well as increased government scrutiny on pharmacy benefit managers (PBMs).

For Aetna, the company has seen higher utilization costs hamper Aetna’s margins this year. Insurers typically prefer, and are required by the Affordable Care Act, to keep about 20% of healthcare premiums and spend 80%. If they spend any more, they are viewed as not being able to properly manage costs.

In its second quarter earnings, CVS reported spending 90% of premium dollars in the first six months of the year. That is a jump from 85% for the same period in 2023. The shift is in part due to changes in how the government pays insurers who provide private Medicare plans, known as Medicare Advantage.

“Aetna’s underperformance year-to-date is the main driver of CVS’ weak share price, and it is unclear how much investors would reward that business as a standalone entity, especially on current year or next year’s earnings. Put another way, we think CVS Health could generate substantial shareholder value by improving margins within Aetna over the next few years,” Lutz wrote.

Since acquiring Aetna, CVS has also invested $18.6 billion in primary healthcare services with the Oak Street and Signify acquisitions. The idea was to have all parts work together as part of a greater healthcare business and help control costs, Lutz wrote.

A low point

Investors and other insider experts, who were not authorized to speak on the record, told Yahoo Finance that the fact that Glenview Capital Management founder and CEO Larry Robbins is in the meeting signals the breakup effort is serious.

Robbins was previously involved in the turnaround of large hospital system Tenet Healthcare (THC). The company’s stock has surged 661% in the past five years, trading at $163 per share Tuesday. He has a reputation for coming in with a list of demands, rather than having a more open discussion, according to the insiders.

Jared Holz, Mizuho’s healthcare expert, wrote in a note to clients that with shares up in the morning on the “premise/promise” of a value-unlocking strategy, there is still skepticism around what will happen with CVS’s PBM, Caremark, which enjoys a large market share in the industry. Where would it be housed in the event of a breakup?

Recently, the Federal Trade Commission sued CVS and two other large PBMs, alleging they artificially raised the price of insulin. That pressure on PBMs, paired with employers looking at creative ways to lower costs by using multiple PBMs, has increased pressure on the large players.

“Timing is interesting given some investors are arguing the reports are coming at what seems like a low-point for both the Insurance segment and retail, given inflated procedure volume hitting the former and difficulties across the entire pharma channel at the latter,” Holz said.

One question some insiders have is what this means for vertical integration in healthcare. The only major player left standing now is UnitedHealth Group (UNH), which is facing its own scrutiny from the FTC.

“Will see what Larry [Robbins] and crew can pull off in the meantime,” Holz said.

Anjalee Khemlani is the senior health reporter at Yahoo Finance, covering all things pharma, insurance, care services, digital health, PBMs, and health policy and politics. That includes GLP-1s, of course. Follow Anjalee on most social media platforms @AnjKhem.

Is Valero Energy a Buy as Wall Street Analysts Look Optimistic?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock’s price, but are they really important?

Before we discuss the reliability of brokerage recommendations and how to use them to your advantage, let’s see what these Wall Street heavyweights think about Valero Energy.

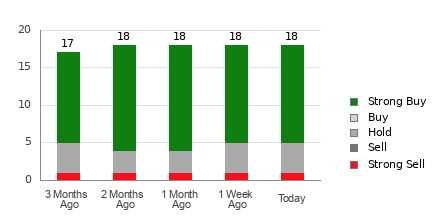

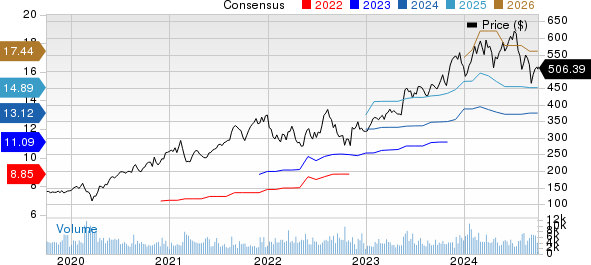

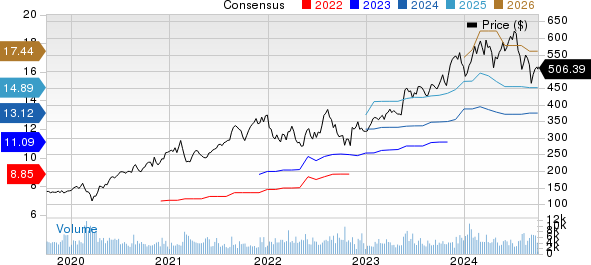

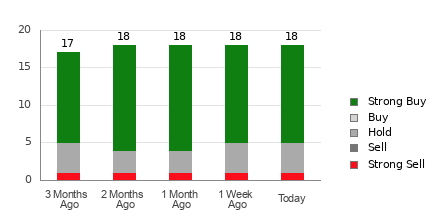

Valero Energy currently has an average brokerage recommendation of 1.67, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by 18 brokerage firms. An ABR of 1.67 approximates between Strong Buy and Buy.

Of the 18 recommendations that derive the current ABR, 13 are Strong Buy, representing 72.2% of all recommendations.

Brokerage Recommendation Trends for VLO

While the ABR calls for buying Valero Energy, it may not be wise to make an investment decision solely based on this information. Several studies have shown limited to no success of brokerage recommendations in guiding investors to pick stocks with the best price increase potential.

Do you wonder why? As a result of the vested interest of brokerage firms in a stock they cover, their analysts tend to rate it with a strong positive bias. According to our research, brokerage firms assign five “Strong Buy” recommendations for every “Strong Sell” recommendation.

In other words, their interests aren’t always aligned with retail investors, rarely indicating where the price of a stock could actually be heading. Therefore, the best use of this information could be validating your own research or an indicator that has proven to be highly successful in predicting a stock’s price movement.

Zacks Rank, our proprietary stock rating tool with an impressive externally audited track record, categorizes stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), and is an effective indicator of a stock’s price performance in the near future. Therefore, using the ABR to validate the Zacks Rank could be an efficient way of making a profitable investment decision.

ABR Should Not Be Confused With Zacks Rank

Although both Zacks Rank and ABR are displayed in a range of 1-5, they are different measures altogether.

The ABR is calculated solely based on brokerage recommendations and is typically displayed with decimals (example: 1.28). In contrast, the Zacks Rank is a quantitative model allowing investors to harness the power of earnings estimate revisions. It is displayed in whole numbers — 1 to 5.

It has been and continues to be the case that analysts employed by brokerage firms are overly optimistic with their recommendations. Because of their employers’ vested interests, these analysts issue more favorable ratings than their research would support, misguiding investors far more often than helping them.

In contrast, the Zacks Rank is driven by earnings estimate revisions. And near-term stock price movements are strongly correlated with trends in earnings estimate revisions, according to empirical research.

In addition, the different Zacks Rank grades are applied proportionately to all stocks for which brokerage analysts provide current-year earnings estimates. In other words, this tool always maintains a balance among its five ranks.

There is also a key difference between the ABR and Zacks Rank when it comes to freshness. When you look at the ABR, it may not be up-to-date. Nonetheless, since brokerage analysts constantly revise their earnings estimates to reflect changing business trends, and their actions get reflected in the Zacks Rank quickly enough, it is always timely in predicting future stock prices.

Is VLO a Good Investment?

In terms of earnings estimate revisions for Valero Energy, the Zacks Consensus Estimate for the current year has declined 16.5% over the past month to $10.26.

Analysts’ growing pessimism over the company’s earnings prospects, as indicated by strong agreement among them in revising EPS estimates lower, could be a legitimate reason for the stock to plunge in the near term.

The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #5 (Strong Sell) for Valero Energy.

Therefore, it could be wise to take the Buy-equivalent ABR for Valero Energy with a grain of salt.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

After Bitcoin, Ethereum An XRP ETF? Bitwise Registers Filing In Delaware Amid Rippe Vs SEC Legal Tussle (UPDATED)

Editor’s Note: This story has been updated to include a response from a Bitwise spokesperson.

In a groundbreaking move, cryptocurrency index fund manager Bitwise Asset Management filed for an XRP XRP/USD exchange-traded fund (ETF), a first for the U.S. market.

What Happened: Bitwise submitted the ETF filing on Monday to Delaware’s Department of State’s Division of Corporations. The filing was made under the entity name Bitwise XRP ETF, with CSC Delaware Trust Company listed as the registered agent.

This is typically the first step toward filing and listing an ETF, with similar notice seen previously for BlackRock’s iShares Bitcoin Trust ETF IBIT and iShares Ethereum Trust ETF ETHA.

A Bitwise spokesperson confirmed to Benzinga that the filing was legitimate but declined to provide additional information.

Earlier this year, the SEC approved several spot Bitcoin ETFs from firms like BlackRock, Grayscale, and Fidelity, as well as eight Ethereum ETFs. Grayscale has also launched an XRP “closed-end” fund for accredited investors.

Why It Matters: The development comes even as Ripple Labs, the blockchain company that uses XRP for its operations, is locked in a legal battle with the SEC over the token’s sale.

Ripple secured a notable victory in its protracted legal battle with the SEC last year, with a U.S. District Judge ruling that the sale of XRP on public exchanges does not constitute unregistered securities offerings. The deadline for the SEC to appeal the ruling is set for Oct. 7

Price Action: At the time of writing, XRP was trading at $0.603, down 2.67% in the last 24 hours, according to data from Benzinga Pro.

Photo Courtesy: Michaela Jilkova On Shutterstock.com

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SNPS Drops 20% From 52-Week High: Is the Stock Worth Buying on Dip?

Synopsys SNPS shares have experienced a pullback in recent times, with shares now trading 19.7% below its 52-week high of $629.38 achieved on Sept. 30.

Over the past three months, Synopsys shares have plunged 16.9%, underperforming the broader Zacks Computer & Technology Sector’s decline of 1.1% and the Zacks Computer – Software industry’s fall of 2.7%.

Synopsys is currently facing several challenges, including a rise in cost of revenues and operating expenses. In the third quarter of fiscal 2024, these costs increased to $1.17 billion compared to $1.01 billion in the same period last year. This sharp rise has raised concerns about the company’s ability to manage its rising costs effectively.

SNPS faces intense competition in the semiconductor and electronic design automation (EDA) space, which has been a headwind. Delays in realizing synergies from recent acquisitions have been a concern.

Synopsys Prospects Ride on Strong Portfolio

Synopsys’ innovative product lineup is expected to boost its prospects. The shift toward hybrid working is driving demand for higher bandwidth, which bodes well for the company’s solutions. The rising demand for AI, 5G and IoT benefits SNPS’ prospects.

Synopsys reported strong revenues in the third quarter of fiscal 2024, with revenues increasing 13% year over year to $1.53 billion, in line with the Zacks Consensus Estimate.

SNPS anticipates achieving approximately 15% revenue growth for fiscal 2024. For fiscal 2024, it expects revenues between $6.105 billion and $6.135 billion.

The Zacks Consensus Estimate for revenues is pegged at $6.13 billion, indicating year-over-year growth of 4.93%.

For fiscal 2024, non-GAAP earnings are expected in the range of $13.07-$13.12 per share. The consensus mark for earnings is pegged at $13.12 per share, unchanged over the past 30 days.

For the fourth quarter of 2024, Synopsys expects revenues between $1.614 billion and $1.644 billion. The Zacks Consensus Estimate for fourth-quarter fiscal 2024 is currently pegged at 3.28 per share, up by a penny over the past 30 days.

Non-GAAP earnings are expected to be between $3.27 per share and $3.32 per share. The consensus mark for fourth-quarter fiscal 2024 revenues is pegged at $1.62 billion, indicating year-over-year growth of 1.01%.

Will Acquisitions Help SNPS Stock Rebound?

Synopsys has made several acquisitions to expand its product portfolio and drive growth. Over the past five years, it acquired more than 15 companies, including Intrinsic ID and Valtrix in 2024.

Synopsys is in the process of acquiring ANSYS ANSS, a move designed to strengthen its Silicon to Systems strategy, particularly in sectors such as automotive, aerospace and industrial. This acquisition is expected to expand Synopsys’ customer base and enhance its product offerings.

Slowing Top-Line Growth, Stiff Competition Concerns for SNPS

Synopsys’ Design Automation segment saw slower growth in the third quarter of fiscal 2024. Revenues from this segment increased a modest 6% year over year, reaching $1.06 billion. In comparison, the same segment saw 23% growth in the third quarter of fiscal 2023, reaching $1.0 billion.

This downturn was due to tough competition in the EDA market, where Synopsys competes with major players like Cadence Design Systems CDNS and Mentor Graphics.

Unfavorable forex and a challenging macroeconomic environment are major deterrents for investors.

Zacks Rank & Valuation

Synopsys currently carries a Zacks Rank #3 (Hold), suggesting that it may be wise to wait for a more favorable entry point in the stock.

Its Value Score of D indicates a stretched valuation at this moment.

In terms of forward Price/Earnings, SNPS is currently trading at 34.82X, higher than the broader sector’s 32.33X.

A Top-Ranked Stock to Consider

Progress Software PRGS is a better-ranked stock in the broader sector, sporting a Zacks Rank #1 (Strong Buy).

Long term earnings growth rate is currently pegged at 2%. Progress Software shares have appreciated 23.2% year to date.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hurricane Helene Exposes Vulnerability Of Florida's Home Insurance Market

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Hurricane Helene has caused extensive damage across the Southeast, from Florida to the Carolinas. The estimated property damage ranges between $15 billion to $26 billion, with an additional $5 billion to $8 billion in lost economic output.

What Happened: Hurricane Helene has left a swath of destruction in its path, further underscoring the precarious nature of Florida’s property insurance market. Insurance premiums have seen a staggering 45% increase from 2017 to 2022, according to a recent report from the Florida Policy Project.

Check It Out:

Florida Gov. Ron DeSantis (R) has declared a state of emergency in 41 counties and ordered evacuations in some coastal communities. He has also urged residents to prepare for the hurricane, resulting in many boarding up windows, placing sandbags in their homes, and fueling their cars.

The average annual premium for a Florida homeowner now stands at $5,500, a figure that is approximately 140% higher than the average U.S. homeowner’s insurance premium of $2,285, as per Bankrate. This surge in costs has led some residents to forgo insurance altogether, with some reporting rates as high as $20,000 per year.

Even before Hurricane Helene, Florida’s insurance market was in turmoil, with companies questioning their ability to endure the state’s frequent superstorms. Moody’s has raised concerns about rising premiums and an increasing number of property owners either abandoning coverage or leaving the state.

Standard homeowners and renters insurance policies do not cover flooding, leaving those without flood insurance to bear high rebuilding costs. The government-run National Flood Insurance Program, the primary source of flood insurance in the U.S., is also under growing financial stress as disasters intensify.

According to a report by CBS News, traditional insurers have scaled back their home policies offerings in Florida, especially in disaster-prone regions, leaving the Citizens Property Insurance Corp. and newer insurers to fill the void. These insurers, however, are grappling with higher rates from reinsurance companies, which provide insurance for insurers.

Jeff Brandes, founder and president of the Florida Policy Project, told the outlet, “Florida, much more than any other state in the country, is exposed to the global reinsurance market.”

Trending: Your biggest returns may not come from the stock market. Invest the way colleges, pension funds, and the 1% do. Get started investing in commercial real estate today.

Recent reforms to Florida’s insurance market may offer some relief to homeowners. Governor Ron DeSantis signed a property insurance bill in 2022 aimed at deterring frivolous lawsuits and limiting insurer costs.

The home insurance crisis in Florida has escalated over the past year, with insurance premiums reaching the highest in the nation.

The crisis has hit South Florida particularly hard, where homeowners paid more than $10,000 in an average annual premium in 2023.

The arrival of Hurricane Helene threatens to exacerbate this crisis, potentially leading to higher insurance premiums and financial instability for smaller insurance companies.

Why It Matters: The escalating insurance costs in Florida underscore the broader issue of climate change and its impact on insurance markets. As extreme weather events become more frequent, homeowners in high-risk areas are likely to face increasing insurance premiums.

The situation in Florida serves as a stark reminder of the potential financial implications of climate change, with the state’s property insurance market being particularly vulnerable due to its exposure to the global reinsurance market.

The recent reforms may provide some relief, but the long-term outlook remains uncertain.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

-

“It has made me millions,” investor says this property type was the key to his success — learn the secret.

-

Private markets have historically outperformed stocks in every downturn of the past 15 years — build your diversified portfolio.

This article Hurricane Helene Exposes Vulnerability Of Florida’s Home Insurance Market originally appeared on Benzinga.com

Breaking Update: Craig Pommells Engages In Options Exercise At Cracker Barrel Old

Craig Pommells, SVP & CFO at Cracker Barrel Old CBRL, reported a large exercise of company stock options on September 30, according to a new SEC filing.

What Happened: Pommells, SVP & CFO at Cracker Barrel Old, exercised stock options for 0 shares of CBRL stock. This information was disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The exercise price of the options was $0.0 per share.

The latest update on Tuesday morning shows Cracker Barrel Old shares down by 0.68%, trading at $45.04. At this price, Pommells’s 0 shares are worth $0.

Unveiling the Story Behind Cracker Barrel Old

Cracker Barrel Old Country Store Inc operates hundreds of full-service restaurants throughout the United States. Its restaurants are open for breakfast, lunch, and dinner, with menus that offer home-style country food. Cracker Barrel’s biggest input costs are beef, dairy, fruits and vegetables, pork, and poultry. The company purchases its food products from a few different vendors on a cost-plus basis. All restaurants are located in freestanding buildings and include gift shops, which contribute roughly one fourth of total company revenue. Apparel and accessories are the company’s biggest revenue generators in the retail segment of the business.

A Deep Dive into Cracker Barrel Old’s Financials

Revenue Growth: Cracker Barrel Old’s revenue growth over a period of 3 months has been noteworthy. As of 31 July, 2024, the company achieved a revenue growth rate of approximately 6.89%. This indicates a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Profitability Metrics: Unlocking Value

-

Gross Margin: The company maintains a high gross margin of 32.1%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 0.82, Cracker Barrel Old showcases strong earnings per share.

Debt Management: Cracker Barrel Old’s debt-to-equity ratio is below the industry average. With a ratio of 2.73, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 24.78 is lower than the industry average, implying a discounted valuation for Cracker Barrel Old’s stock.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 0.29 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a lower-than-industry-average EV/EBITDA ratio of 12.96, Cracker Barrel Old presents a potential value opportunity, as investors are paying less for each unit of EBITDA.

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Understanding Crucial Transaction Codes

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of Cracker Barrel Old’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.