Suze Orman Says The Personal Finance Of Americans Is 'Really, Really Bad' Even Though The Stock Market Is Doing Great

In a recent conversation with Chris Wallace on CNN Max, Suze Orman highlighted that while the stock market is performing well, it doesn’t reflect how most American households are really doing financially.

“What if I were to tell you that 75% of the people in the United States don’t have $400 to their name in case of an emergency?” Orman said, describing the financial situation of ordinary Americans as “really, really bad.”

Don’t Miss:

Although we often use the stock market to measure economic health overall, Orman emphasizes that it doesn’t reliably tell us how the everyday American is doing. “On the whole, ordinary human beings in America today are living paycheck to paycheck and they’re not doing well at all,” she explained.

As household debts rise and reliance on credit cards increases, it’s clear that individuals may be in a deeper financial crisis. Last summer, U.S. credit card debt surpassed $1 trillion for the first time, a milestone that Orman pointed to as a symptom of a much larger issue.

Trending: Can you guess how many retire with a $5,000,000 nest egg? – How does it compare to the average?

Even as some sectors of the economy show strength, Orman made it clear that inflation makes it difficult for most Americans to keep up. Wallace, taken aback by Orman’s statistics, asked her to elaborate on what she described as a “financial pandemic.”

“We’re in a pandemic in that there isn’t a financial vaccine to cure this,” Orman explained, adding that the crisis won’t be resolved by external forces. The only way forward, she argues, is for individuals to take responsibility for their financial well-being. “The government’s not gonna save them. The economy is not gonna save them. They’re gonna have to be their own financial vaccine so to speak.”

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

Orman’s stark warning reflects a growing disconnect between market performance and individual financial health. While stock market gains might boost portfolios for wealthier Americans, many face difficult choices, living paycheck to paycheck with little to no safety net.

A recent MarketWatch survey corroborates Orman, stating that nearly two-thirds of Americans feel like they are living paycheck to paycheck.

In response to this crisis, Orman has cofounded SecureSave, a business that addresses one critical component of personal finance: emergency savings. Through this business, Orman hopes to help people build a financial cushion that can protect them in times of need.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” Here’s how you can earn passive income with just $100.

“The goal of money is for you to be secure,” Orman told Wallace. She explained that SecureSave partners with employers to allow workers to automatically save a portion of their paycheck, making it easier to build an emergency fund without thinking too much about it.

With the program, employees can save small amounts, such as $25 per paycheck, and some employers offer to match a portion of those contributions. “Within a year period of time, they have about $1,000,” Orman noted, adding that the goal isn’t to amass large sums right away but rather to establish a savings habit that can lead to bigger habits like saving for retirement.

Trending: Beating the market through ethical real estate investing’ — this platform aims to give tenants equity in the homes they live in while scoring 17.17% average annual returns for investors – here’s how to join with just $100

These emergency savings accounts are FDIC-insured and employees can access the money whenever needed.

The stock market may be doing well, which is great for retirement and investment accounts, but many people don’t have the basics of emergency savings. Orman’s message is that security doesn’t come from market gains – not that it can’t help – but from building healthy financial habits like emergency savings that can provide stability in uncertain times.

If you’re facing financial uncertainty and unsure where to start building security with your own finances, consider speaking with a financial advisor. They will offer advice tailored to your unique situation and help you determine a plan that matches your financial goals.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Suze Orman Says The Personal Finance Of Americans Is ‘Really, Really Bad’ Even Though The Stock Market Is Doing Great originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On New Fortress Energy

Whales with a lot of money to spend have taken a noticeably bullish stance on New Fortress Energy.

Looking at options history for New Fortress Energy NFE we detected 29 trades.

If we consider the specifics of each trade, it is accurate to state that 51% of the investors opened trades with bullish expectations and 41% with bearish.

From the overall spotted trades, 19 are puts, for a total amount of $1,551,134 and 10, calls, for a total amount of $560,290.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $7.0 to $25.0 for New Fortress Energy over the last 3 months.

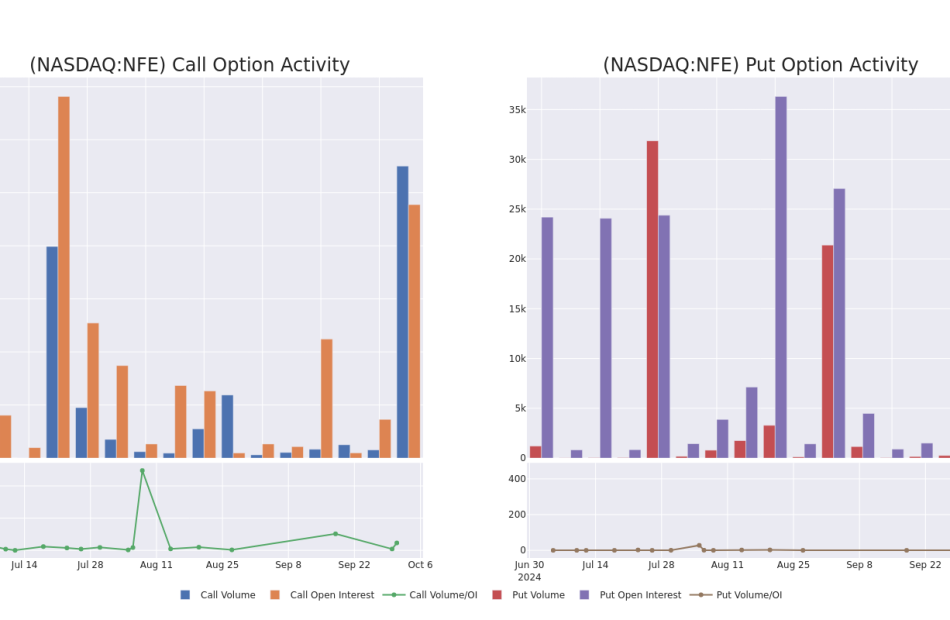

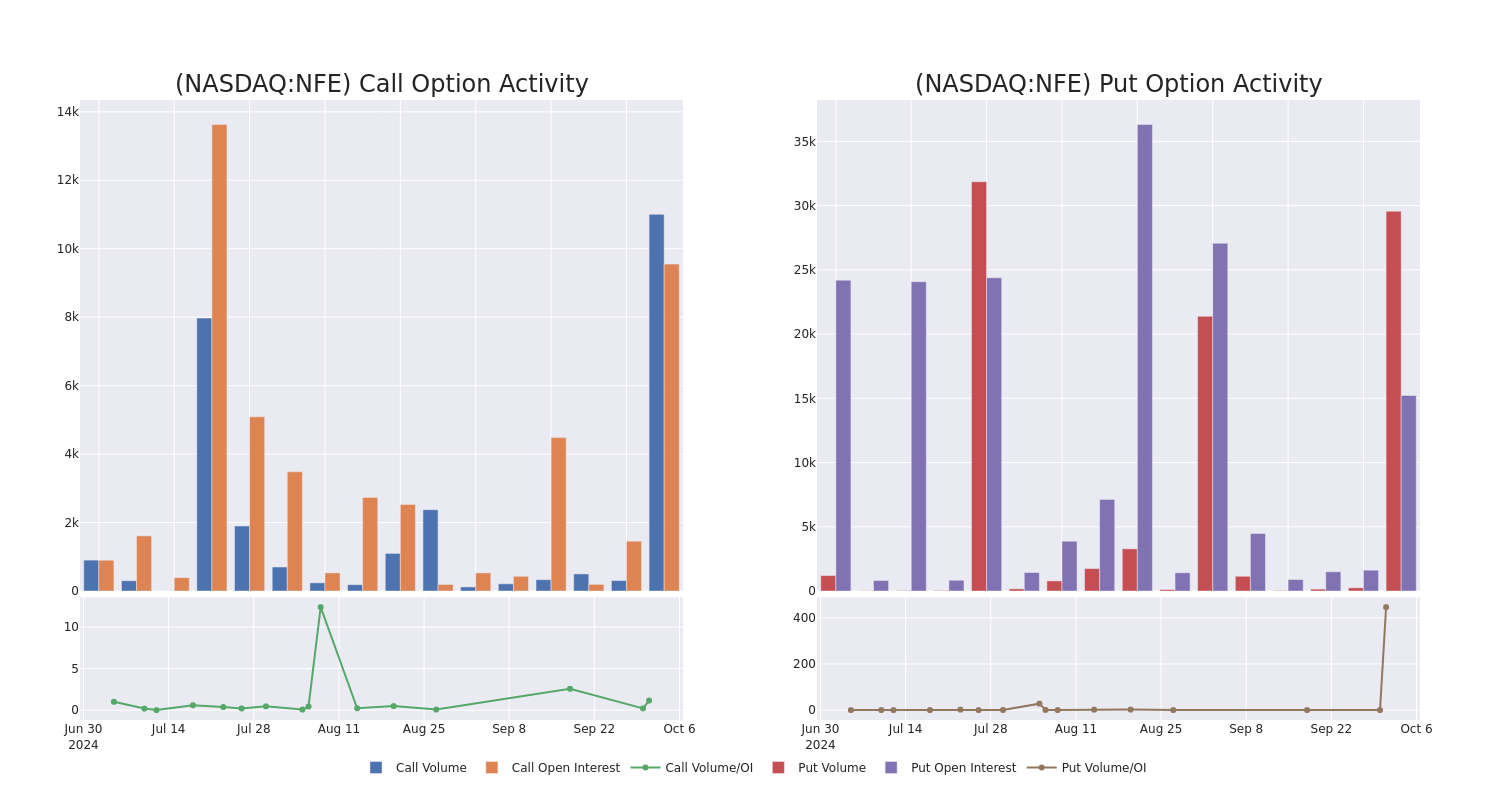

Volume & Open Interest Development

In today’s trading context, the average open interest for options of New Fortress Energy stands at 2064.67, with a total volume reaching 40,473.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in New Fortress Energy, situated within the strike price corridor from $7.0 to $25.0, throughout the last 30 days.

New Fortress Energy Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NFE | PUT | SWEEP | BULLISH | 11/15/24 | $1.5 | $1.3 | $1.34 | $9.00 | $340.0K | 5.0K | 2.4K |

| NFE | PUT | TRADE | BEARISH | 11/15/24 | $1.5 | $1.25 | $1.42 | $9.00 | $284.0K | 5.0K | 400 |

| NFE | CALL | SWEEP | BEARISH | 01/16/26 | $7.0 | $4.2 | $4.22 | $10.00 | $238.0K | 1.7K | 860 |

| NFE | PUT | SWEEP | BULLISH | 11/15/24 | $1.35 | $1.3 | $1.3 | $9.00 | $184.4K | 5.0K | 6.4K |

| NFE | PUT | TRADE | BEARISH | 12/20/24 | $10.2 | $9.9 | $10.1 | $20.00 | $101.0K | 4.8K | 401 |

About New Fortress Energy

New Fortress Energy is an integrated gas-to-power company. Its business model spans the entire production and delivery chain from natural gas procurement and liquefaction to logistics, shipping, terminals, and conversion or development of a natural gas-fired generation. It has invested in floating, liquefied natural gas vessels to both lower the cost of acquiring gas while securing a long-term supply for its terminals. Its segments include terminals and infrastructure, or T&I, and ships.

In light of the recent options history for New Fortress Energy, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of New Fortress Energy

- Currently trading with a volume of 26,151,255, the NFE’s price is up by 6.27%, now at $9.66.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 36 days.

Professional Analyst Ratings for New Fortress Energy

1 market experts have recently issued ratings for this stock, with a consensus target price of $15.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from BTIG keeps a Buy rating on New Fortress Energy with a target price of $15.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for New Fortress Energy with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Commercial Heating Equipment Market to Reach $25.6 billion, Globally, by 2032 at 5.2% CAGR: Allied Market Research

Wilmington, Delaware, Oct. 01, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Commercial Heating Equipment Market by Product Type (Heat Pumps, Furnaces, and Boilers), Fuel Type (Fossil Fuel and Electric), and End User (Offices, Restaurants & Hotels, and Others): Global Opportunity Analysis and Industry Forecast, 2023-2032″. According to the report, the “commercial heating equipment market” was valued at $15.1 billion in 2018, and is estimated to reach $25.6 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032.

Download PDF Sample Copy: https://www.alliedmarketresearch.com/request-sample/A323554

Prime determinants of growth

The commercial heating equipment market is expected to witness notable growth owing to rapid urbanization globally, increase in awareness of environmental issues, and expansion of the commercial sector. Moreover, the incorporation of IOT devices and smart technologies in heating systems and updating heating systems with modern, and energy-efficient alternatives are expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, high initial costs and implementation of stringent government regulations toward environmental pollution limit the growth of the commercial heating equipment market.

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2023–2032 |

| Base Year | 2018 |

| Market Size in 2018 | $15.1 billion |

| Market Size in 2032 | $25.6 billion |

| CAGR | 5.2% |

| No. of Pages in Report | 275 |

| Segments Covered | Product Type, Fuel Type, End User, and Region. |

| Drivers |

|

| Opportunities |

|

| Restraint |

|

The heat pumps segment is expected to grow faster throughout the forecast period.

The heat pumps segment is anticipated to experience faster growth in the commercial heating equipment market. The increase in focus on energy efficiency and sustainability prompts businesses to embrace heat pump technology, given its lower energy consumption and reduced environmental footprint compared to traditional heating systems. Moreover, advancements in heat pump technology, marked by enhanced efficiency and performance, enhance their appeal among commercial users seeking economical and dependable heating solutions. In addition, government incentives and rebates designed to promote energy-efficient heating systems present opportunities for businesses to mitigate the upfront costs associated with heat pump installations. Furthermore, the adaptability of heat pumps, which offer both heating and cooling functionalities, renders them suitable for diverse commercial settings, spanning from office complexes and hotels to retail outlets and healthcare facilities. Thus, the commercial heating equipment market is anticipated for substantial growth owing to the increase in adoption of heat pumps globally.

Buy This Research Report (275 Pages PDF with Insights, Charts, Tables, Figures) https://bit.ly/3XMmlUz

The electric segment is expected to grow faster throughout the forecast period.

The electric segment is anticipated to experience growth in the commercial heating equipment market. Electric-powered commercial heating equipment are preferred due to rise in concerns over energy efficiency and environmental sustainability. As businesses and industries aim to curtail their carbon footprint and operational expenses, electric heating systems emerge as a clean and efficient alternative to traditional fossil fuel-based options. In addition, advancements in electric heating technology, including enhancements in heat pump efficiency and the incorporation of smart controls and IoT functionalities, have reshaped the industry landscape. These innovations improve the performance, adaptability, and manageability of electric heating systems.

The restaurants and hotels segment is expected to grow faster throughout the forecast period.

The restaurants and hotels segment is anticipated to experience growth in the commercial heating equipment market. The demand for adaptable heating solutions in restaurants and hotels is growing, particularly for versatile options such as infrared heaters and portable units. These solutions effectively manage temperatures in diverse spaces such as outdoor dining areas and event venues. Their mobility and ease of installation make them ideal for temporary or seasonal use on terraces, patios, or banquet halls, enhancing guest comfort year-round. This adaptability boosts customer satisfaction and revenue by maximizing space utilization. Technological advancements, such as smart heating controls and building automation systems, offer precise temperature regulation and energy optimization, while evolving design trends call for efficient, aesthetically pleasing heating solutions.

Asia-Pacific to maintain its dominance by 2032.

Asia-Pacific accounted for the highest market share in 2018 and it is expected to grow with a highest CAGR during the forecast period. The Asia-Pacific commercial heating equipment market growth, primarily driven by the emergence of thriving economies in the region. These heating solutions are gaining traction across various sectors including automotive, metals & mining, electronics, and oil & gas in countries such as Japan and South Korea. Furthermore, the rapid industrialization rate in the region is anticipated to contribute significantly to the growth of the heating equipment market in Asia-Pacific during the forecast period. The rapid industrialization in the Asia-Pacific region presents a promising opportunity for the commercial heating equipment market. As countries across the region undergo significant industrial expansion, there is a rise in demand for heating solutions to support various industrial processes and facilities. This surge in industrial activities, coupled with the need for efficient heating systems, creates a favorable environment for market growth.

Inquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A323554

Players: –

- Daikin Industries, Ltd.,

- Lennox International Inc.

- Mitsubishi Electric Corporation

- Panasonic Corporation (Panasonic Holdings Corporation)

- Rheem Manufacturing Company

The report provides a detailed analysis of these key players in the global commercial heating equipment market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, and agreements to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Similar Reports:

About us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact us:

Wilmington, Delaware

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle, Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SEC-Approved Cannabis Lender Acquired By Investment Giant, Changes Ticker To $LIEN

Investment manager fund Chicago Atlantic recently acquired Silver Spike Investment Corp. SSIC, the only SEC-approved business development company (BDC) focused on lending to the cannabis industry.

As a result, Silver Spike has been renamed Chicago Atlantic BDC, Inc., and its ticker symbol will change to $LIEN on October 2, 2024. Chicago Atlantic originates senior secured loans to state-licensed cannabis operators and has consistently traded at a premium.=

“Chicago Atlantic seeks to capitalize on opportunities in private markets by providing debt capital to lower middle-market companies, typically non-sponsor, and unique industries facing structural reasons for an insufficient supply of capital,” said the company’s new CEO, Andreas Bodmeier.

Significant Timing For Cannabis Investors

The acquisition comes at a critical moment for the cannabis industry, as both presidential candidates are signaling support for marijuana reform, rescheduling of cannabis could boost cash flow in the sector. This shift will likely benefit the company’s cannabis-focused lending platform.

“We are excited about the prospects for further growth within our core activity of providing capital to high-quality operators within the cannabis ecosystem,” said Scott Gordon, executive chairman and co-chief Investment Officer. “As one of the largest direct lenders to the sector, we see significant potential to continue playing an important role in shaping the flow of much-needed debt financing to the industry.”

Read Also: Hedge Fund Settles At $2.25M With SEC For Exposed Short Seller Deal, 2 Cannabis Stocks Affected

Unique Market Opportunity

The merger also creates a unique opportunity for investors.

Chicago Atlantic BDC allows access to credit alpha that differs from traditional BDCs or private credit funds. Bodmeier pointed out the value of this position, noting that “the rapidly growing cannabis sector represents a compelling example of an industry where capital is in short supply.”

This acquisition and joint venture between Chicago Atlantic and Silver Spike are expected to strengthen the company’s role in providing financing solutions to cannabis operators.

Cover: AI Generated Image

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jim Cramer Hand Picks These 3 Stocks To Ride The Crest Of The Chinese Stimulus Frenzy

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

China has gone all out to stimulate the domestic economy and a slew of measures the government and the central bank proposed has kickstarted a strong rally in the domestic stock market. CNBC Mad Money host Jim Cramer weighed in on the development and recommended a few stocks that could be potential beneficiaries.

What Happened: “The Chinese are, once again, stimulating and everyone’s back,” said Cramer in a post on X, formerly Twitter. He also recommended Apple, Inc. (NASDAQ:AAPL), Starbucks Corp. (NASDAQ:SBUX) and Alibaba Group Holding Limited (NYSE:BABA) for those looking for stimulus plays.

Check It Out:

In a separate post, Cramer said he would love for China to set up a stock stabilization fund and use it to cushion any downside in stocks.

On Monday, the Chinese Shanghai Composite Index settled 8.06% higher 3,336.50 after Caixin manufacturing and services sector purchasing managers’ indices disappointed to the downside. The index has gained nearly 22% since Sept. 20 and is up about a little over 12% for the year.

The People’s Bank of China announced last week it will in the near future cut the reserve requirement ratio, which is the amount of cash banks must hold as reserves, by 50 basis points freeing up about 1 trillion yuan ($142 billion) for new lending, Reuters reported.

The central bank hinted at the possibility of reducing it by an incremental 0.25-0.50% points. The PBoC also said it would lower the seven-day repo rate by 0.2 points, the interest rate on a medium-term lending facility by about 30 basis points and loan prime rates by 20-25 basis points.

Trending: With returns as high as 300%, it’s no wonder this asset is the investment choice of many billionaires. Uncover the secret.

Why It’s Important: For Apple, China is a key market both from the perspective of supply and demand. Cupertino counts China as its major manufacturing base despite its efforts to diversify its production base. China is also a key market for the company’s consumer electronics products, specifically its iPhone, and its services business. Of late, Apple has been stymied by domestic competition that is flooding the market with cheaper smartphones. Huawei has re-emerged as a key rival for Apple in the Chinese smartphone market.

Coffee chain retailer Starbucks has a strong presence in China. The weakening of economic fundamentals in China has impacted the company’s sales in recent quarters. In the June quarter, Starbucks’ same-store sales in China fell 14% compared to a more modest 2% drop in the U.S.

Alibaba’s fortunes are closely tied to the Chinese economy as it generates the bulk of its e-commerce sales from China.

Apart from Cramer’s recommendation, a Chinese economic revival may also bode well for commodity and energy stocks and those multinational corporations have a big presence in the country such as Tesla, Inc. (NASDAQ:TSLA).

The iShares MSCI China ETF (NYSE:MCHI) rallied 3.35% to $52.70 in premarket trading on Monday, according to Benzinga Pro data.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

This article Jim Cramer Hand Picks These 3 Stocks To Ride The Crest Of The Chinese Stimulus Frenzy originally appeared on Benzinga.com

FrontView REIT, Inc. Announces Pricing of Initial Public Offering

DALLAS, Oct. 1, 2024 /PRNewswire/ — FrontView REIT, Inc. (the “Company” or “FrontView”) today announced the pricing of its underwritten initial public offering of 13,200,000 shares of its common stock at the initial public offering price of $19.00 per share. In addition, the underwriters of the offering have been granted a 30-day option to purchase from the Company up to 1,980,000 additional shares of its common stock at the initial public offering price, less underwriting discounts and commissions. The Company intends to use the net proceeds from the offering to repay borrowings outstanding under its revolving credit facility and term loan credit facility. Following such uses, the Company expects to use any remaining net proceeds for general business and working capital purposes, including potential future acquisitions.

The Company’s common stock is expected to begin trading on the New York Stock Exchange on October 2, 2024, under the ticker symbol “FVR.” The offering is expected to close on October 3, 2024, subject to customary closing conditions.

Morgan Stanley, J.P. Morgan, Wells Fargo Securities, and BofA Securities are acting as joint book-running managers for the proposed offering. Capital One Securities and CIBC Capital Markets are acting as co-managers.

The offering is being made only by means of a prospectus. Copies of the final prospectus related to this offering, when available, may be obtained from Morgan Stanley, Prospectus Department, 180 Varick Street, New York, New York 10014, or email: prospectus@morganstanley.com; J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717 or by email at prospectus-eq_fi@jpmchase.com and postsalemanualrequests@broadridge.com; Wells Fargo Securities, 90 South 7th Street, 5th Floor, Minneapolis, MN 55402, at 800-645-3751 (option #5) or email a request to WFScustomerservice@wellsfargo.com; and BofA Securities, NC1-022-02-25, 201 North Tryon Street, Charlotte, North Carolina 28255-0001, Attention: Prospectus Department, email: dg.prospectus_requests@bofa.com.

About FrontView

FrontView is an internally-managed net-lease REIT that acquires, owns and manages primarily outparcel properties that are net leased on a long-term basis to a diversified group of tenants. FrontView is differentiated by a “real estate first” investment approach focused on outparcel properties that are in prominent locations with direct frontage on high-traffic roads that are highly visible to consumers. As of June 30, 2024, FrontView owned a well-diversified portfolio of 278 outparcel properties with direct frontage across 31 U.S. states. FrontView’s tenants include service-oriented businesses, such as restaurants, cellular stores, financial institutions, automotive stores and dealers, medical and dental providers, pharmacies, convenience and gas stores, car washes, home improvement stores, grocery stores, professional services as well as general retail tenants.

Important Information

A registration statement relating to these securities has been filed with, and declared effective by, the U.S. Securities and Exchange Commission (the “SEC”) on October 1, 2024. Copies of the registration statement can be accessed through the SEC’s website at www.sec.gov.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Forward-Looking Statements

Certain statements contained in this press release, including statements relating to FrontView’s expectations regarding the completion and timing of its proposed public offering and listing, may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. FrontView intends for all such forward-looking statements to be covered by the applicable safe harbor provisions for forward-looking statements contained in those acts. Such forward-looking statements can generally be identified by FrontView’s use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” “seek,” “objective,” “goal,” “strategy,” “plan,” “focus,” “priority,” “should,” “could,” “potential,” “possible,” “look forward,” “optimistic,” or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Such statements are subject to certain risks and uncertainties, including known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of FrontView’s performance in future periods. Except as required by law, FrontView does not undertake any obligation to update or revise any forward-looking statements contained in this release.

Investor Relations Contact

Rob Shelton

ras@frontviewreit.com

![]() View original content:https://www.prnewswire.com/news-releases/frontview-reit-inc-announces-pricing-of-initial-public-offering-302264943.html

View original content:https://www.prnewswire.com/news-releases/frontview-reit-inc-announces-pricing-of-initial-public-offering-302264943.html

SOURCE FrontView REIT, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

George J Christ Executes Sell Order: Offloads $4.76M In Altair Engineering Stock

It was reported on September 30, that George J Christ, 10% Owner at Altair Engineering ALTR executed a significant insider sell, according to an SEC filing.

What Happened: A Form 4 filing with the U.S. Securities and Exchange Commission on Monday outlined that Christ executed a sale of 50,048 shares of Altair Engineering with a total value of $4,758,223.

The latest update on Tuesday morning shows Altair Engineering shares down by 3.2%, trading at $92.45.

All You Need to Know About Altair Engineering

Altair Engineering Inc is a provider of enterprise-class engineering software enabling origination of the entire product lifecycle from concept design to in-service operation. The integrated suite of software provided by the company optimizes design performance across multiple disciplines encompassing structures, motion, fluids, thermal management, system modeling, and embedded systems. It operates through two segments: Software which includes the portfolio of software products such as solvers and optimization technology products, modeling and visualization tools, industrial and concept design tools, and others; and Client Engineering Services which provides client engineering services to support customers. Majority of its revenue comes from the software segment.

Financial Milestones: Altair Engineering’s Journey

Revenue Growth: Altair Engineering displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 5.41%. This indicates a notable increase in the company’s top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Profitability Metrics: Unlocking Value

-

Gross Margin: The company sets a benchmark with a high gross margin of 79.49%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Altair Engineering exhibits below-average bottom-line performance with a current EPS of -0.06.

Debt Management: Altair Engineering’s debt-to-equity ratio is below the industry average. With a ratio of 0.33, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Exploring Valuation Metrics Landscape:

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 298.47 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 12.83 is above industry norms, reflecting an elevated valuation for Altair Engineering’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Altair Engineering’s EV/EBITDA ratio stands at 95.92, surpassing industry benchmarks. This places the company in a position with a higher-than-average market valuation.

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Understanding the Significance of Insider Transactions

Investors should view insider transactions as part of a multifaceted analysis and not rely solely on them for decision-making.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

The Insider’s Guide to Important Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Altair Engineering’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Acuity Brands Q4 Earnings: 2.2% Topline Growth, Margin Boost, Strong Cash Flow And More

Lighting and building management firm Acuity Brands, Inc. AYI reported fiscal fourth-quarter 2024 net sales growth of 2.2% year over year to $1.03 billion, beating the analyst consensus estimate of $1.02 billion.

It clocked an adjusted EPS of $4.30, beating the analyst consensus estimate of $4.28.

Sales by segments: Acuity Brands Lighting (ABL) and Lighting Controls revenue hit $955.0 million (+1.1% Y/Y), and Intelligent Spaces Group (ISG) clocked $83.9 million (+16.7% Y/Y).

The consolidated adjusted operating margin grew by 120 bps to 17.3%. ABL’s adjusted operating margin expanded by 120 bps to 18.0%. ISG’s margin increased by 590 bps to 25.6%.

The company generated $619.2 million in operating cash flow for fiscal 2024, an increase of $41.1 million compared to the prior year. It held cash and equivalents of $846 million compared to $398 million last year.

Adjusted EBITDA was $191.3 million, up from $175.1 million a year ago. The margin expanded by 120 bps to 18.5%.

“We grew net sales in both Lighting and Spaces, delivered margin expansion and increased earnings per share,” stated Neil Ashe, Chairman, President and Chief Executive Officer of Acuity Brands, Inc.

Acuity Brands stock is up 65% in the last 12 months.

Price Action: AYI stock is up 1.67% at $280.00 premarket at the last check on Tuesday.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.