Ladybug Surpasses $6 Million in Revenue for First Half of Year

TULSA, Okla., Oct. 02, 2024 (GLOBE NEWSWIRE) — Ladybug Resource Group, Inc. LBRG, also known as Ladybug NutraTech, reported revenues of $6.0 million USD for the six months ending June 30, 2024, reflecting an impressive increase of approximately $2.8 million USD compared to total revenues generated in 2023.

Ladybug Resource Group’s strategic initiatives for 2024, operating under the brand name Ladybug NutraTech, include the acquisition of profitable websites, expansion of product lines, and growth of the customer base. These initiatives are clearly reflected in the Company’s Q1 and Q2 revenue results. The development and optimization of e-commerce platforms have driven significant revenue growth, resulting in an approximately 84% increase compared to total revenues in 2023. This consistent upward trend highlights Ladybug Resource Group’s robust market position and growth potential, setting the stage for ongoing success in the nutraceutical industry.

Tamara Maxfield, a key figure in the Company, shared her excitement about the platform’s recent advancements. She emphasized the positive trajectory of the company’s growth, stating, “Our company is heading in the right direction. We are committed to pursuing our growth objectives while maintaining a prudent approach to risk management. Our primary focus remains on ensuring the company’s long-term sustainability and delivering substantial value to our shareholders.” Tamara’s comments reflect a balanced and forward-thinking strategy, underlining the company’s dedication to steady growth, cautious decision-making, and a deep commitment to its investors’ interests.

The ongoing development of the Company’s proprietary AI platform, NutraBuddy, has yielded impressive results, with significant progress continuing during the Alpha testing phase. Ladybug’s digital strategy is centered on providing users with an intelligent and highly responsive system powered by a unique interface and a sophisticated Large Language Model (LLM). This cutting-edge platform is designed to deliver tailored health and wellness recommendations, offering everything from personalized fitness tips to specific guidance on managing individual health concerns. As NutraBuddy evolves, it promises to revolutionize how users approach their well-being, integrating advanced AI capabilities to create a truly customized experience. The platform’s ability to adapt to user needs and preferences sets it apart in the industry, positioning Ladybug at the forefront of digital health innovation. With continued development, NutraBuddy is poised to become an essential tool for anyone seeking to optimize their health and wellness journey.

About Ladybug Resource Group Inc.

Ladybug Resource Group Inc., operating under the brand name Ladybug NutraTech, leads the health and wellness e-commerce sector with innovative strategies, diverse product offerings, and a commitment to customer and shareholder satisfaction.

For further information, please contact:

Ladybug Resource Group Inc.

1408 S. Denver Avenue, Tulsa, OK 74119

info@ladybuglbrg.com

+1 (918) 727-7137

www.ladybugnutratech.com

OTC: $LBRG OTC Markets

Investor Hub

Yahoo Finance

Or connect with us on Ladybug Resource Inc’s social media sites:

X/Twitter: LadybugNutra

LinkedIn: LadybugNutraTech

Facebook: LadybugNutraTech

Instagram: LadybugNutraTech

Safe Harbor for Forward-Looking Statements:

This news release contains forward-looking statements, which are not statements of historical fact. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives, or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by terms such as “believes,” “anticipates,” “expects,” “estimates,” “may,” “could,” “would,” “will,” or “plan.” Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties, and other factors involved with forward-looking information could cause actual events, results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, changes in general economic and financial market conditions. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur within the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events, or otherwise, other than as required by law.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin's Safe Haven Narrative Comes Under Pressure Amid Iran-Israel War Fears, Investors Prefer Gold During Crisis

The thesis that Bitcoin BTC/USD would keep investors’ wealth secured during geopolitical risks was negated after the leading cryptocurrency plunged along with stocks over fears of a full-fledged war in the Middle East.

What happened: The world’s largest cryptocurrency slipped below $62,000, down about 3.52%, as news of Iran launching a missile barrage toward Israel spooked markets.

The decline mirrored a slump in the stock market, with blue-chip indexes like the Dow Jones Industrial Average and the S&P 500 closing Tuesday’s trading session in the red.

Bitcoin’s slump called into question its ‘store of value’ moniker, which has been frequently championed by proponents seeking to establish equivalency with gold.

On the contrary, spot gold rose more than 1% to $2,666 per ounce following the development, to later retreat below $2,500 as the missile barrage ended.

In fact, Tether Gold (CRYPTO: XauT), a cryptocurrency backed by physical gold, was among the market’s biggest gainers in the last 24 hours.

See Also: Pay Taxes With Bitcoin? Ohio Senator Proposes Bill For Crypto Tax Payments, But There’s A Catch

Precious metals analyst Jesse Colombo called Bitcoin a risk asset like any other “high-flying tech stocks,” arguing that it invariably falls during geopolitical fears.

However, cryptocurrency analyst Timothy Peterson rebutted, saying that both Bitcoin and gold protect against debasement, though gold has a 6,000-year head start on Bitcoin.

Why It Matters: The latest developments cast a shadow on the cryptocurrency market’s next moves.

In a note to Benzinga, Chris Kline, COO and Co-Founder of BitcoinIRA, stated that war fears would create headwinds for high-risk investments.

“This potent combination of regional conflicts, evolving monetary landscapes, and looming political shifts sets the stage for a period of significant market unpredictability in the weeks ahead,” Kline anticipated.

Price Action: At the time of writing, Bitcoin was exchanging hands at $61,680.41, down 3.56% in the last 24 hours, according to data from Benzinga Pro.

Image Via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Walmart President and CEO Trades Company's Stock

Douglas McMillon, President and CEO at Walmart WMT, disclosed an insider sell on September 30, according to a recent SEC filing.

What Happened: McMillon’s decision to sell 29,124 shares of Walmart was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The total value of the sale is $2,348,635.

The latest update on Tuesday morning shows Walmart shares up by 0.19%, trading at $80.91.

All You Need to Know About Walmart

Walmart serves as the preeminent retailer in the United States, with its strategy predicated on superior operating efficiency and offering the lowest priced goods to consumers to drive robust store traffic and product turnover. Walmart augmented its low-price business strategy by offering a convenient one-stop shopping destination with the opening of its first supercenter in 1988.Today, Walmart operates over 4,600 stores in the United States (5,200 including Sam’s Club) and over 10,000 stores globally. Walmart generated over $440 billion in domestic namesake sales in fiscal 2024, with Sam’s Club contributing another $86 billion to the company’s top line. Internationally, Walmart generated $115 billion in sales. The retailer serves around 240 million customers globally each week.

A Deep Dive into Walmart’s Financials

Revenue Growth: Walmart displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 4.77%. This indicates a notable increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Staples sector.

Profitability Metrics: Unlocking Value

-

Gross Margin: With a high gross margin of 25.11%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Walmart’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 0.56.

Debt Management: Walmart’s debt-to-equity ratio is below the industry average. With a ratio of 0.73, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: Walmart’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 42.06.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 0.98 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Walmart’s EV/EBITDA ratio stands at 19.02, surpassing industry benchmarks. This places the company in a position with a higher-than-average market valuation.

Market Capitalization Analysis: Above industry benchmarks, the company’s market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

A Closer Look at Important Transaction Codes

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Walmart’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MicroStrategy's Returns Are 3X Higher Than Bitcoin: Time to Buy?

MicroStrategy MSTR has become one way many investors have found to get into Bitcoin BTC/USD. Looking at the returns of the two over the past three years, investing in MicroStrategy has been far superior to investing in Bitcoin. The total return over that time for each has been 177% versus 51%, respectively. But why is that the case?

Based on the reports of new Bitcoin purchases, the value of the company’s Bitcoin is around $16 billion today. However, the technology company’s market capitalization is $34 billion. Somewhere in MicroStrategy, investors see an extra $18 billion in value over just its cryptocurrency. So, where does this extra value come from?

Breaking Down MicroStrategy’s Lesser-Known Business: Software

Looking at MicroStrategy, there are two big parts of its business: bitcoin purchases and its software. The software business is based on its MicroStrategy ONE data analytics software. It offers business intelligence tools, allowing users to take advantage of machine learning and create custom analytics. Looking at this part of the business, revenues are declining.

From Q1 2023 to Q2 2024, revenue went from $122 million to $111 million, a drop of 9%. The business is unprofitable as well, and that unprofitability is getting worse. In Q1 2023, the software business’s net loss was half a million dollars.

In Q2 2024, that loss has increased exponentially to nearly $19 million. These numbers are on a non-adjusted basis. On an adjusted basis, the business has been profitable over those periods. However, it still only brought in $2 million in adjusted net income last quarter.

Still, no matter how you slice it, the software business is making little to no money. The argument could be made that the business is poised to grow, so the fact that it isn’t making money now doesn’t mean it won’t in the future. The software business’s subscriptions and services revenue did grow by 21% last quarter.

However, over half of the software business revenue comes from the support it provides; so, revenue still fell by 7%. But its subscription billings, an indicator of future revenue, increased by 45%. These increases breathe some life into the argument that the software business could see higher revenue in the future.

But, with only $2 million in adjusted net income last quarter, it’s hard to say that the software business is worth $16 billion, even with future revenue in mind.

MicroStrategy’s Main Value Proposition: A Leveraged Bitcoin Investment

The other big value add that MicroStrategy emphasizes, and many have come to know it for, is its ability to issue extremely low-cost debt to buy Bitcoin. Through issuing mostly convertible bonds, the company has over $3.8 billion in debt with an average interest rate of 1.6%.

This is far lower than any individual would be able to borrow funds at, with the effective Fed Funds Rate at nearly 5%. The company recently announced it completed another offering of $1 billion convertible bonds. This will bring the company’s average interest rate down to 1.4%. By investing in MicroStrategy, investors can get leveraged investments in Bitcoin at a far lower rate than they otherwise could.

This is why many who believe in Bitcoin are putting a significant premium on MicroStrategy over Bitcoin itself. However, because convertible debt could be converted into equity, there is a potential for shareholder dilution. This would eliminate significant value from the low-cost debt strategy, especially since nearly 90% of the company’s debt is convertible.

MicroStrategy’s Bitcoin Acquisition Is Adding Value, but Is It Enough at This Price?

The company addresses this idea using its BTC Yield measurement. After accounting for possible dilution, this shows the added value of investing in MicroStrategy over Bitcoin. It achieved a positive BTC Yield of 12% in 2024 and expects it to be between 4% and 8% over the next three years. This shows that the strategy is adding value. However, is it adding enough value to justify the company’s $16 billion valuation over its Bitcoin holdings?

To me, the company’s valuation is over double the value of its Bitcoin, while it only provides a 4% to 8% yield compared to paying for Bitcoin itself.

The article “MicroStrategy’s Returns Are 3X Higher Than Bitcoin: Time to Buy?” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Johnson & Johnson's Options: A Look at What the Big Money is Thinking

Financial giants have made a conspicuous bearish move on Johnson & Johnson. Our analysis of options history for Johnson & Johnson JNJ revealed 8 unusual trades.

Delving into the details, we found 25% of traders were bullish, while 75% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $294,749, and 4 were calls, valued at $638,264.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $155.0 and $162.5 for Johnson & Johnson, spanning the last three months.

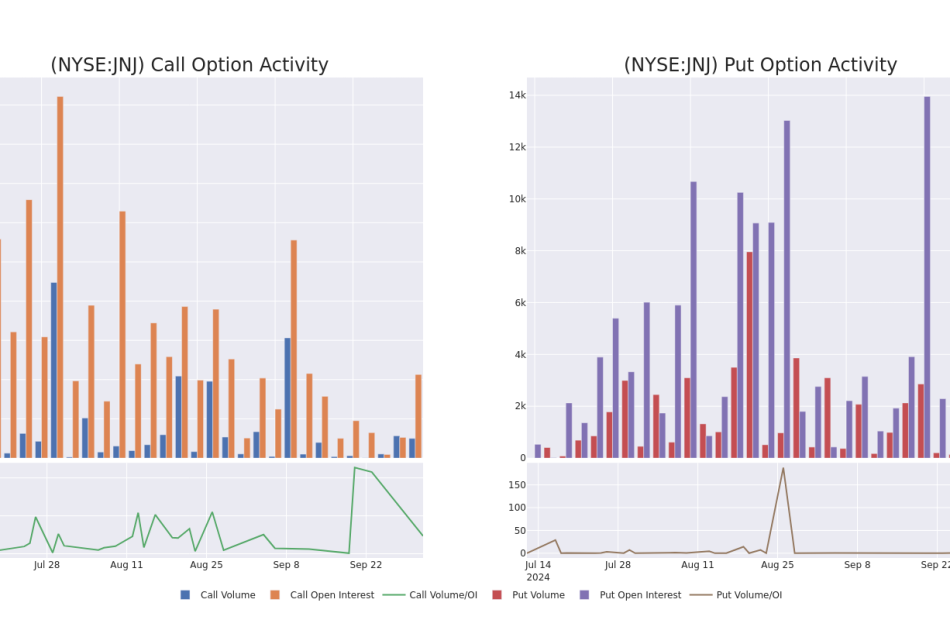

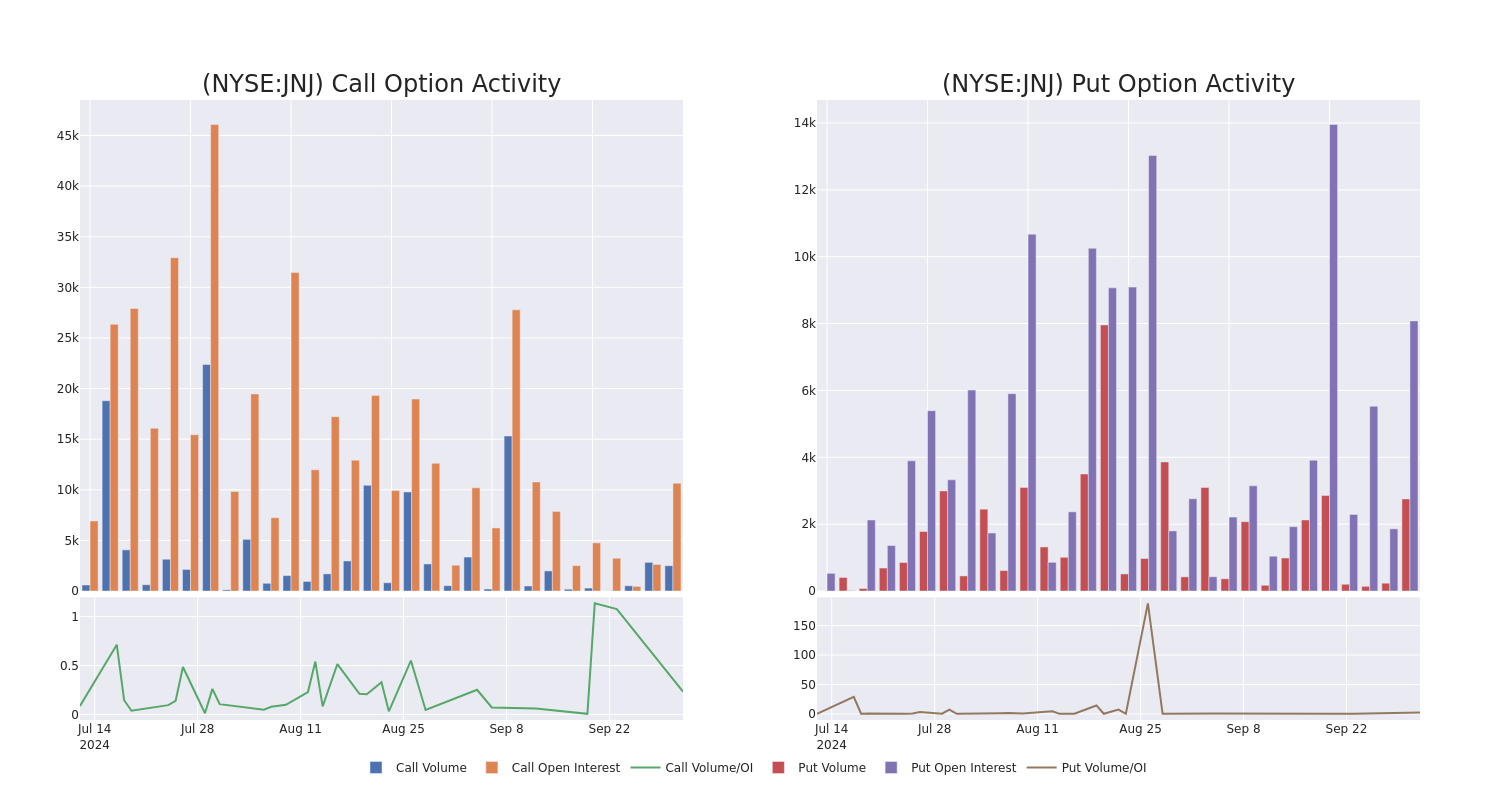

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Johnson & Johnson options trades today is 2676.43 with a total volume of 5,256.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Johnson & Johnson’s big money trades within a strike price range of $155.0 to $162.5 over the last 30 days.

Johnson & Johnson Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JNJ | CALL | TRADE | BEARISH | 10/18/24 | $2.61 | $2.5 | $2.52 | $162.50 | $504.0K | 761 | 2.0K |

| JNJ | PUT | SWEEP | BEARISH | 10/11/24 | $1.23 | $1.22 | $1.23 | $160.00 | $128.4K | 1.0K | 380 |

| JNJ | PUT | SWEEP | BEARISH | 10/11/24 | $1.29 | $1.28 | $1.28 | $160.00 | $103.8K | 1.0K | 2.2K |

| JNJ | CALL | SWEEP | BEARISH | 10/25/24 | $2.92 | $2.91 | $2.92 | $162.50 | $55.7K | 30 | 345 |

| JNJ | CALL | SWEEP | BEARISH | 01/17/25 | $11.0 | $10.85 | $10.85 | $155.00 | $45.5K | 3.2K | 95 |

About Johnson & Johnson

Johnson & Johnson is the world’s largest and most diverse healthcare firm. It has two divisions: pharmaceutical and medical devices. These now represent all of the company’s sales following the divestment of the consumer business, Kenvue, in 2023. The drug division focuses on the following therapeutic areas: immunology, oncology, neurology, pulmonary, cardiology, and metabolic diseases. Geographically, just over half of total revenue is generated in the United States.

Having examined the options trading patterns of Johnson & Johnson, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Johnson & Johnson

- Trading volume stands at 2,469,466, with JNJ’s price down by -0.48%, positioned at $161.21.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 13 days.

What The Experts Say On Johnson & Johnson

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $207.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a cautious move, an analyst from RBC Capital downgraded its rating to Outperform, setting a price target of $175.

* An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $215.

* In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $215.

* In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $215.

* Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $215.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Johnson & Johnson options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Bargain-Basement Stock-Split Stock to Buy Hand Over Fist in the 4th Quarter and 1 Highflier to Shy Away From

Since the start of 2023, no trend on Wall Street has garnered more attention from investors than the rise of artificial intelligence (AI). But over the last eight months, the excitement surrounding stock splits in top-notch companies has played a close second fiddle.

A stock split allows publicly traded companies the option of cosmetically adjusting their share price and outstanding share count by the same factor. The “cosmetic” aspect of splits has to do with the fact that they don’t alter a company’s market cap and have no impact on underlying operating performance.

In 2024, just over a dozen high-profile companies announced or completed a stock split — all but one of which is of the forward-split variety. Forward splits are designed to reduce a company’s share price to make it more nominally affordable for retail investors. More importantly, the companies conducting forward splits are almost always doing so from a position of operating strength.

As we push forward into the fourth quarter, one bargain-basement stock-split stock stands out as ripe for the picking for opportunistic value seekers. Meanwhile, growth investors might be wise to steer clear of another stock-split stock that’s been the buzz of the AI movement.

This historically cheap stock-split stock can be confidently dialed up by patient investors

The unique stock-split stock that makes for a no-brainer buy in the fourth quarter is none other than satellite-radio operator Sirius XM Holdings (NASDAQ: SIRI).

What makes Sirius XM’s split “unique” is that it’s the lone company I alluded to above that didn’t complete a forward split.

On Dec. 12, 2023, Sirius XM unveiled plans to merge with Liberty Media’s Sirius XM tracking stock, Liberty Sirius XM Group. Liberty Media is the majority stakeholder in Sirius XM and its multiple classes of Sirius XM tracking stock have always been somewhat confusing to everyday investors. To add, they never tracked Sirius XM’s stock particularly well. The merger of these share classes, which took place following the close of trading on Sept. 9, cleared up some confusion.

In addition to creating a single class of Sirius XM stock, the company completed a 1-for-10 reverse split following the merger. Though reverse splits are usually enacted to avoid delisting from a major stock exchange, Sirius XM was in no danger of being removed. Rather, its split was designed to increase its share price to make it more attractive to institutional investors and fund managers.

Aside from being Wall Street’s most-anticipated reverse stock split of 2024, Sirius XM provides investors with three compelling reasons to buy its stock.

To start with, there’s a level of cash flow predictability with Sirius XM that terrestrial and online radio companies can’t match. The difference can be seen in how Sirius XM generates its revenue, compared to traditional radio operators.

For terrestrial and online radio, most of their revenue comes from advertising. While this strategy works well during lengthy periods of economic growth, it can lead to lean times during recessions. Comparatively, Sirius XM brings in only around 20% of its net sales from ads, with the lion’s share of its revenue (more than three-quarters) coming from subscriptions. Subscribers are less likely to cancel their service during periods of economic instability than businesses are to pare back their ad spending.

The second compelling reason to buy shares of Sirius XM is its moat. As the only licensed satellite-radio operator, it possesses meaningful subscription pricing power. In instances where subscriber growth slows or shifts into reverse, the company has an opportunity to raise prices and boost its sales.

Lastly, Sirius XM’s bargain-basement valuation is highly attractive. As of the closing bell on Sept. 27, the company’s shares were valued at 7.5 times estimated earnings per share (EPS) for 2025. Even with sales growth stagnating at the moment, this marks the company’s cheapest forward-year earnings multiple since going public in September 1994.

This stock-split stock’s parabolic move higher looks unsustainable

However, not all stock-split stocks are necessarily worth buying. Even though companies conducting forward splits have historically outperformed the benchmark S&P 500 in the 12 months following their split announcement, the one I’d suggest shying away from in the fourth quarter (and beyond) is artificial intelligence kingpin Nvidia (NASDAQ: NVDA). Nvidia completed its historic 10-for-1 split in June.

To be fair, Nvidia has done a lot of things right. Its AI-graphics processing units (GPUs) are the undisputed top choice among businesses building out high-compute data centers. After accounting for an estimated 98% of AI-GPUs that were shipped to data centers in 2022 and 2023, Nvidia looks to have ceded very little market share, thus far, in 2024.

Nvidia is also getting plenty of help from its CUDA software platform. CUDA is the toolkit developers use to build large language models and maximize the computing capacity of their Nvidia AI-GPUs. The best way to think of CUDA is as the lure that keeps businesses loyal to Nvidia’s ecosystem of products and services.

But in spite of these early stage advantages, Nvidia offers a number of red flags that should give investors pause.

For instance, competition is an inevitability for Nvidia. Even if its H100 and Blackwell GPUs maintain their computing advantage, the extensive backlog for Nvidia’s hardware, coupled with cheaper price points for competing chips, could have businesses looking elsewhere for their data center needs.

Internal competition shouldn’t be overlooked, either. All four of Nvidia’s top customers by net sales are developing AI-GPUs for use in their data centers. This looks to be a clear signal that America’s most-influential businesses want to lessen their reliance on the AI kingpin’s hardware.

Another reason Nvidia’s parabolic ascent is worrisome has to do with what its insiders are telling us. Specifically, CEO Jensen Huang has been a persistent seller of his company’s stock since mid-June, and no insider has purchased shares of Nvidia on the open market since December 2020. If insiders don’t view their stock as a bargain, why should everyday investors?

Perhaps the biggest red flag with Nvidia is that no game-changing technology or innovation for 30 years has avoided a bubble-bursting event early in its existence. Put another way, the investing community has regularly overestimated the adoption/uptake of next-big-thing technologies. When these lofty expectations fail to come to fruition, the music inevitably stops for hyped innovations.

Considering that a majority of businesses still lack a clear game plan as to how they’ll generate a positive return on their AI investment, we appear to be witnessing the early stages of a bubble-bursting event play out. If and when the AI bubble burst, no company is likely to be hit harder than Nvidia.

Should you invest $1,000 in Sirius XM right now?

Before you buy stock in Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $744,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Sean Williams has positions in Sirius XM. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

1 Bargain-Basement Stock-Split Stock to Buy Hand Over Fist in the 4th Quarter and 1 Highflier to Shy Away From was originally published by The Motley Fool

Chrysler Parent Stellantis' US Sales Nosedive 20% In Q3: Details Here

Stellantis N.V. STLA shares are trading slightly lower on Wednesday.

The auto behemoth reported total U.S. sales of 305,294 vehicles in the third quarter of 2024, down 20% year over year.

“At the beginning of Q3, we introduced an aggressive incentive program across our U.S. brand portfolio that with significant competitive updates made in August and September resulted in the reduction of dealer inventory by over 50,000 units through the end of the quarter, down 11.6%,” said Matt Thompson, head of U.S. retail sales, Stellantis North America.

Stellantis was anticipated to be the lowest-performing automaker in terms of sales during the third quarter, reported CNBC. Industry forecaster Cox Automotive had estimated a sales drop of approximately 21% for the company, per the report.

Also Read: Ford’s US Sales Edge Up In Q3; EV Sales Continue To Climb

FCA US LLC’s total market share increased consecutively during the third quarter, rising from 7.2% in July to 8% in September, while inventory was reduced by 50K units.

Incentive offerings will continue through the end of the year across the U.S. brand portfolio, which includes Chrysler, Dodge, FIAT, Jeep, and Ram, Stellantis said.

“We continue to take the necessary actions to drive sales and prepare our dealer network and consumers for the arrival of 2025 models,” added Thompson.

According to Benzinga Pro, STLA stock has lost over 28% in the past year.

Price Action: STLA shares are trading lower by 0.69% to $13.62 at last check Wednesday.

Photo by Jonathan Weiss on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Specialty Coatings Company RPM Defies Market Pressure: EPS Beats Despite Sales Slump And Global Headwinds

RPM International Inc RPM shares are trading higher after the company reported first-quarter results.

Sales declined 2.1% Y/Y to $1.97 billion, missing the consensus of $2.015 billion. Despite volume growth at CPG and PCG and modestly positive pricing, foreign currency headwinds and volume declines at Consumer Group and SPG outweighed these gains.

Geographically, sales declined slightly in North America, while European sales were impacted by a weak economic environment, foreign currency headwinds, and divestitures.

Emerging markets, especially Latin America, faced foreign currency challenges, but sales grew in Asia/Pacific and Africa/Middle East, driven by infrastructure spending and high-performance building projects.

Adjusted EPS was $1.84, beating the consensus of $1.75.

In the quarter, operating cash flow stood at $248.1 million, led by higher profitability and improved working capital management.

As of August-end, total liquidity, comprising cash and committed revolving credit facilities, reached $1.44 billion, up from $1.23 billion a year ago.

The company returned $76.4 million to stockholders through cash dividends and share repurchases.

Outlook: For the second quarter, the company expects sales to be flat Y/Y and adjusted EBIT to increase in the mid-single-digit percentage range Y/Y.

For FY25, the company continues to expect sales growth in the low-single-digit percentage range Y/Y and adjusted EBIT increase in the mid-single- to low-double-digit percentage range Y/Y.

Frank C. Sullivan, RPM chairman and CEO said, “The economic outlook for the second quarter remains mixed with continued growth in high-performance building construction and renovation, and softness in residential end markets.”

”While we are optimistic that lower interest rates will eventually lead to a rebound in residential markets, it is too early to say precisely when growth will return. As we have demonstrated, no matter the economic backdrop, we will focus on controlling what we can, including executing on MAP 2025 initiatives to leverage the power of RPM to capture growth opportunities, expand margins and structurally improve cash flow.”

Investors can gain exposure to the stock via ProShares S&P MidCap 400 Dividend Aristocrats ETF REGL and First Trust Dividend Strength ETF FTDS.

Price Action: RPM shares are up 2.42% at $123.00 premarket at the last check Wednesday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cosmetic Esters Market is Anticipated to Grow at 5.8% CAGR Through 2034 | Fact.MR Report

Rockville, MD , Oct. 02, 2024 (GLOBE NEWSWIRE) — According to Fact.MR, a market research and competitive intelligence provider, the global Cosmetic Esters Market is estimated to reach a valuation of US$ 964.9 million in 2024 and is expected to grow at a CAGR of 5.8% during the forecast period of (2024 to 2034).

The cosmetic esters market experiences great growth in the beauty and personal care industry, as this category represents a wide variety of ingredients that enhance functional and sensory properties in cosmetic formulations.

These versatile ingredients find use in numerous applications within skin care, hair care, and cosmetics due to their truly exceptional emollient and moisturizing properties. Cosmetic esters are obtained by the reaction between alcohols and acids and yield components responsible for product stability, improve spreadability, and provide specific skin-feel effects.

This market is driven by consumer demand for high-performance, natural, and sustainable ingredients used in cosmetics. The manufacturers are focusing on the development of new esters that address specific skincare concerns under the principles of clean beauty. Besides, the trends toward customized cosmetic products, and the demand for multifunctional beauty products support the growth in the market.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10364

Key Takeaways from Market Study:

- The global cosmetic esters market is projected to grow at 8% CAGR and reach US$ 1,695.7 million by 2034

- The market created an opportunity of US$ 730.7 million between 2024 to 2034

- North America is a prominent region that is estimated to hold a market share of 7 % in 2024

- Skincare product under application is estimated to grow at a CAGR of 9% creating an absolute $ opportunity of US$ 356.8 million between 2024 and 2034

- North America and East Asia are expected to create an absolute $ opportunity of US$ 430.1 million collectively

“ The cosmetic esters market is poised for significant growth, driven by increasing demand for natural and sustainable ingredients. Manufacturers are focusing on developing new esters that address specific skincare concerns, while trends towards customized products and multifunctional beauty products support market expansion. We expect strong demand from North America, Europe, and Asia-Pacific,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Cosmetic Esters Market:

BASF; Croda International; Evonik Industries; Dow Chemical; Ashland Global Holdings; Lonza Group; Inolex; Koster Keunen; Estée Lauder Companies Inc.; Clariant AG; Lubrizol Corporation; Eastman Chemical Company; Innospec Inc.; Other Prominent Players.

Market Development:

Key players in the cosmetic esters market are BASF, Croda International, Evonik Industries, Dow Chemical, Ashland Global Holdings, Lonza. These companies are dedicated to R&D investments to address industry-specific challenges and deliver tailored solutions that enhance competitiveness and customer satisfaction.

Recent innovations include, The product introduction recently by Dow, featuring the innovative EcoSense™ APP-5000 and EcoSense™ APP-1000, is bound to make a quantum leap in the transformation toward a more sustainable portfolio at in-cosmetics Global 2023 in March 2023,.

In April 2024, BASF introduces new products and solutions aimed at accelerating the development of the Personal Care market towards the Sustainable Development Goals in project “The beauty of tomorrow,”.

Cosmetic Esters Industry News:

In April 2024, BASF introduces new products and solutions aimed at accelerating the development of the Personal Care market towards the Sustainable Development Goals. Name of the project: “The beauty of tomorrow,” to express the commitment to responsible practices and complete attitude towards consumption and being. Products will belong to the BASF portfolio, particularly to Care 360°-Solutions for Sustainable Life.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10364

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the global cosmetic esters market, presenting historical data for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study reveals essential insights on the basis of Source (Natural Esters, Synthetic Esters), Application (Skincare Products, Haircare Products, Oral Care, Cosmetic Products) across major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and Pacific, Middle East & Africa).

Segmentation of Cosmetic Esters Industry Research:

- By Source :

- Natural Esters

- Synthetic Esters

- By Application :

- Skincare Products

- Moisturizers

- Creams

- Lotions

- Other Skincare Products

- Haircare Products

- Shampoos

- Conditioners

- Styling products

- Other Haircare Products

- Oral Care

- Cosmetic Products

- Lip balms

- Lipsticks

- Eye creams

- Other Cosmetics

- Skincare Products

Checkout More Related Studies Published by Fact.MR Research:

Worldwide revenue from the sales of cosmetic chemicals is analyzed to reach US$ 38 billion by the end of 2034, up from US$ 24 billion in 2024. The global cosmetic chemical market size is evaluated to expand at a CAGR of 4.7% from 2024 to 2034.

Cosmetic Dropper Market Share & Trends Analysis, By Material (Plastic, Rubber, Others), By Cap Sizes (13 mm, 15 mm, Others), By Pipette Styles (Straight Tip, Bent Tip, Stub Tip, Blunt Tip) & By Region Forecast – Global Review 2021 to 2031

Cosmetic Oil Market Share & Trends Analysis, By Product Type (Coconut Oil, Almond Oil, Castor Oil, Argan Oil, Essential Oil), By Application Type(Body, Hair, Face, Nails) By Sales Channel (Offline, Online) & By Region Forecast- Global Review 2021 to 2031

The global cosmetic peptide synthesis market is projected to increase from a valuation of US$ 244.2 million in 2024 to US$ 425.6 million by 2034. The market has been forecasted to expand at a CAGR of 5.7% from 2024 to 2034.

The global cosmetic surgery and procedure market is forecasted to expand at a high-value CAGR of 9.8% from 2022 to 2030. Revenue from the market in 2022 is valued at US$ 69.2 billion and is projected to climb to US$ 146.5 billion by the end of 2030.

The global Cosmetic Thread Market size is estimated to achieve a valuation of US$ 148.8 million in 2024. According to Fact. MR’s industry survey report, the cosmetic thread industry’s net valuation in 2019 was estimated to be approximately US$ 109.3 million.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Missed Nvidia? 10 Other S&P 500 Stocks Will Make You Much Richer

It’s hard not to love Nvidia (NVDA) — given its huge run this year. But analysts think you can do much better with other S&P 500 stocks.

↑

X

Beating The Market: How To Find Outperforming Stocks

Analysts think 10 S&P 500 stocks, including Super Micro Computer (SMCI), Moderna (MRNA) and Schlumberger (SLB), will jump more than 40% in the next 12 months, says an Investor’s Business Daily analysis of data from S&P Global Market Intelligence and MarketSurge.

Not only is a 40% jump the highest in the S&P 500. It’s considerably higher than the 28.1% gain analysts predict for Nvidia in the next 12 months.

Nvidia: Make Room For Next S&P 500 Champs

Nvidia has found itself to be perfectly positioned for the AI chip boom. But it’s hardly an undiscovered gem.

The stock is up 136% this year. That makes it the No. 2 best stock of the year and gives it a 97 RS Rating. Additionally, analysts think Nvidia’s profit will rise 120% in 2025.

But even with all that going for it, analysts think the stock will trade for 149.86 in 12 months. Analysts have much higher hopes for other stocks in the S&P 500. Nvidia ranks just 25th in terms of expected upside in the stock in the index.

Big Hopes On Former S&P 500 Winners

Analysts’ bullishness on AI computing firm, Super Micro Computer, is off the charts. It’s the only stock in the S&P 500 analysts think will jump more than 100% in 12 months.

The stock is the target of a short-selling campaign questioning its accounting. Nearly 15% of its shares are controlled by short sellers.

Even so, the stock is still up nearly 43% this year. And while the RS Rating has crumbled to 16, it still has an EPS Rating of 99. And analysts are calling for 51% earnings growth in 2025.

It’s a different but similar story at vaccine maker Moderna. Analysts think the stock is due for a more than 50% rally in 12 months. But it’s more of a case of looking for a bounce. Shares are down more than 35% this year. They sport a RS Rating of just 7. But analysts expect the company’s earnings growth to return in 2025.

To be sure, analysts aren’t always right. In fact, they’re often wrong. It’s always best to use time-tested rules for buying and selling stocks.

But if analysts’ usually glowing forecasts for Nvidia are cooling, it might be worth paying attention to.

Analysts Favorite S&P 500 Stocks

Based on 12-month price targets

| Company | Ticker | Implied upside | Sector |

|---|---|---|---|

| Super Micro Computer | SMCI | 149.8% | Information Technology |

| Moderna | MRNA | 54.2% | Health Care |

| Schlumberger | SLB | 48.5% | Energy |

| Micron Technology | MU | 45.6% | Information Technology |

| Dexcom | DXCM | 45.6% | Health Care |

| Bath & Body Works | BBWI | 42.0% | Consumer Discretionary |

| Biogen | BIIB | 41.6% | Health Care |

| Walgreens Boots Alliance | WBA | 40.7% | Consumer Staples |

| Halliburton | HAL | 40.7% | Energy |

| Humana | HUM | 40.0% | Health Care |