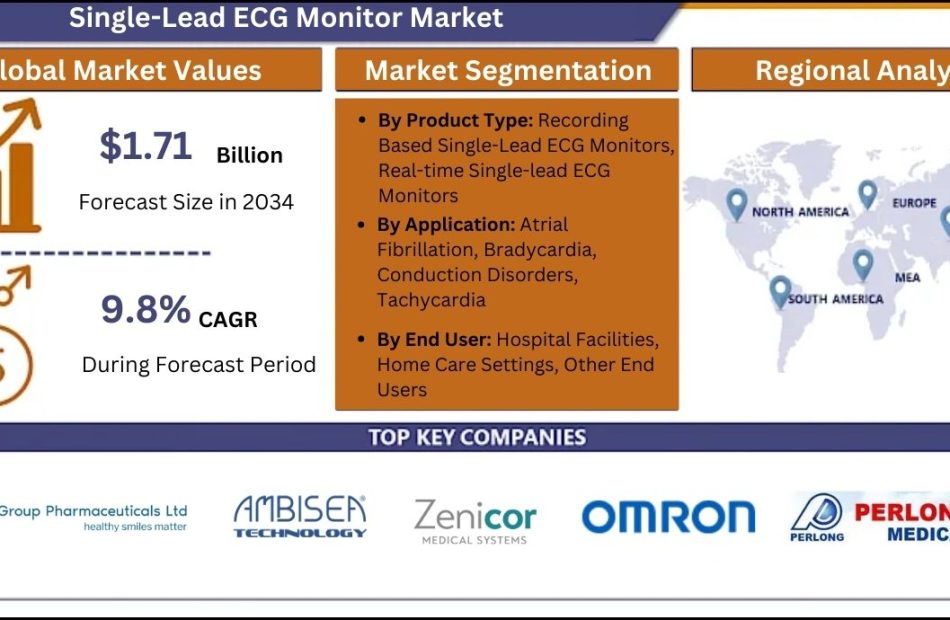

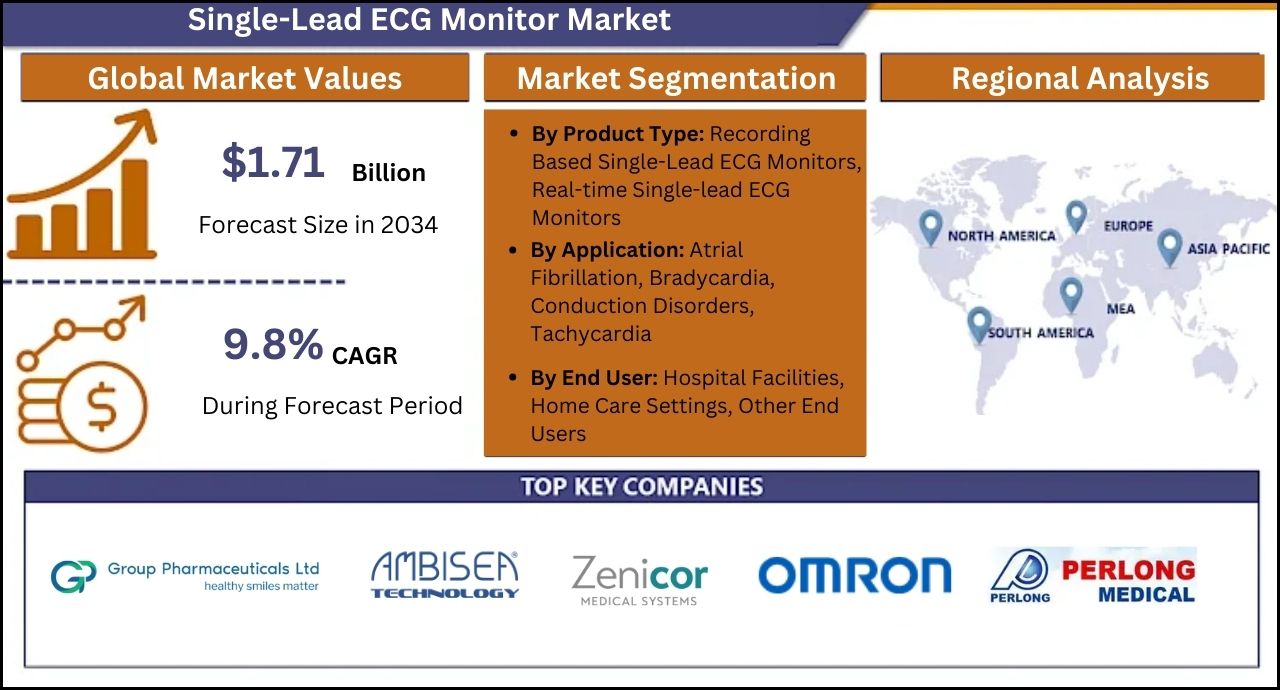

Single-Lead ECG Monitor Market is Projected to Expand at a 9.8% CAGR Through 2034, Says Fact.MR Report

Rockville, MD, Oct. 02, 2024 (GLOBE NEWSWIRE) — As per a recently published industry report by Fact.MR, the global single-lead ECG monitor market is estimated to reach a valuation of US$ 669 million in 2024 and further expand at a CAGR of 9.8% from 2024 to 2034.

Increasing prevalence of heart-related illnesses is driving up demand for single-lead ECG monitors. With portable ECGs, individuals may easily calculate their heart rate in home care settings. These types of ECGs may be carried anywhere, making it simpler for cardiac patients to seek the treatment they need at any moment.

Electrocardiography is commonly used for reliable heart rate measurement, unlike photoplethysmography. This precise analysis is then utilized as a foundation for performing cardiac procedures. The government is investing in the healthcare industry to provide the greatest facilities for citizens, which is pushing up sales of technically sophisticated single-lead ECG monitors.

For More Insights into the Market, Request a Sample of this Report-https://www.factmr.com/connectus/sample?flag=S&rep_id=10169

Key factors driving market growth include increasing use of these devices in sports activities and monitoring heart rate during exercise, growing preference for cardiac assessment during self-triaging before using complex systems, and increasing importance of homecare. Furthermore, increased R&D efforts by several manufacturers are generating a large number of prospects, supporting the growth of the market.

Key Takeaways from the Market Study

- The global single-lead ECG monitor market is projected to reach a valuation of US$ 1.71 billion by the end of 2034.

- North America is expected to hold a global market share of 41.9% in 2024. The market is calculated to expand at a CAGR of 9.9% from 2024 to 2034.

- The Latin American market is evaluated to expand at a CAGR of 10.2% through 2034.

- The United States is analyzed to hold a significant market share of 80.9% in the North American region by 2034.

- The Chile market is forecasted to expand at a CAGR of 10.4% from 2024 to 2034.

- Based on application, tachycardia is set to account for a market share of 8.6% in 2024.

“Growing importance of homecare drives demand for portable single-lead ECG monitors, which enable patients to monitor their heart health conveniently at home,” says a Fact.MR analyst.

Leading Players Driving Innovation in Single-Lead ECG Monitor Market:

Dimetek Digital Medical Technologies Ltd.; AliveCor Inc.; Tianjin Chase Sun; Pharmaceutical Group; Ambisea Technology Corp.; Zenicor Medical Systems; OMRON Corporation; Perlong Medical Equipment Co.

Incorporation of Artificial Intelligence Enabling Analysis of Complex Data to Enhance Diagnostic Speed and Accuracy

Electrocardiography is undergoing intriguing developments. As an essential tool for diagnosing and monitoring a variety of cardiac problems, new advancements such as wearable devices, AI-powered interpretation, and non-contact monitoring systems have enormous promise for enhancing ECG accuracy, accessibility, and customization.

Wearable ECG devices have transformed cardiovascular monitoring by offering a simple and noninvasive technique to assess heart activity in real-time. These revolutionary gadgets come in a variety of formats, such as smartwatches, chest straps, and adhesive patches that may be worn all day. Integration of artificial intelligence has had a substantial influence on ECG interpretation in recent years. AI-powered algorithms are being used to examine massive amounts of complicated data to enhance diagnostic speed and accuracy.

Single-Lead ECG Monitor Industry News-

- In September 2023, iRhythm Technologies, Inc. introduced its next-generation Zio® monitor and updated Zio® long-term continuous monitoring (LTCM) service in the United States. The Zio monitor is iRhythm’s smallest, lightest, and thinnest cardiac monitor, with several service features that enhance the cardiac monitoring experience for both patients and healthcare providers.

Get Customization on this Report for Specific Research Solutions-https://www.factmr.com/connectus/sample?flag=S&rep_id=10169

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the single-lead ECG monitor market for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on product type (recording-based single-lead ECG monitors, real-time single-lead ECG monitors), application (atrial fibrillation, bradycardia, conduction disorders, tachycardia), and end user (hospital facilities, home care settings, other end users), across seven major regions of the world (North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, and MEA).

Checkout More Related Studies Published by Fact.MR Research:

Worldwide sales of ECG telemetry devices are valued at US$ 2.65 billion in 2023. The global electrocardiography (ECG) telemetry devices market is forecasted to expand rapidly at a CAGR of 8% and reach a market valuation of US$ 5.72 billion by 2033.

The global ECG cable and ECG lead wires market is valued at US$ 1.5 billion in 2022 and is forecasted to climb to US$ 2.1 billion by the end of 2026, rising at a noteworthy CAGR of 5.3% from 2022 to 2026.

The global baby monitor market is expected to reach US$ 567 Million in 2022. Sales of baby monitor tests are projected to accelerate at a CAGR of 8.3% which will reach US$ 1,264 Million by 2032.

At present, the global heart rate monitor watch market accounts for a valuation of US$ 19.87 billion and is projected to surge to US$ 36.6 billion by the end of 2032.

Global demand for fetal and neonatal heart monitors stands at US$ 8.9 billion in 2023 and is predicted to increase at a healthy 5.5% CAGR over the next ten years. By 2033-end, the global fetal and neonatal heart monitor market is thus expected to secure US$ 15.2 billion in revenue.

Cardiac Patch Monitor Market By Device Type (ECG devices, Lead, Event Monitors) & By End-User (Hospitals, Clinics, Home Care Settings): Market Insights 2021-2031

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Follow Us: LinkedIn | Twitter | Blog

Contact: US Sales Office: 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583 Sales Team:sales@factmr.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

RTX's Raytheon Secures DARPA Contract To Develop Ultra-Wide Bandgap Semiconductors: Details

On Wednesday, RTX Corporation RTX said Raytheon has secured a three-year, two-phase contract from DARPA to develop foundational ultra-wide bandgap semiconductors.

These will be based on diamond and aluminum nitride technology, which revolutionizes semiconductor electronics by increasing power delivery and thermal management in sensors and other electronic applications.

In phase one of the contract, the Raytheon Advanced Technology team will develop diamond and aluminum nitride semiconductor films and integrate them into electronic devices.

Phase two will focus on optimizing and advancing this technology for larger diameter wafers intended for sensor applications.

“Raytheon has extensive proven experience developing similar materials such as Gallium Arsenide and Gallium Nitride for Department of Defense systems,” said Colin Whelan, president of Advanced Technology at Raytheon.

According to Benzinga Pro, RTX stock has gained over 74% in the past year. Investors can gain exposure to the stock via iShares U.S. Aerospace & Defense ETF ITA and First Trust Exchange-Traded Fund First Trust Indxx Aerospace & Defense ETF MISL.

Also Read: RTX Wins $1.3B Contract For F135 Engine Upgrade: Details

On Tuesday, RTX said Raytheon received a $192 million contract from the U.S. Navy to develop the Next Generation Jammer Mid-Band Expansion, an upgrade to the current Next Generation Jammer Mid-Band system.

In a separate press release yesterday, RTX said its unit Pratt & Whitney celebrated the opening of its new 845,000-square-foot facility in Oklahoma City, Oklahoma, solidifying its position as the business’ largest military engines field location.

The $255 million investment will enable Pratt & Whitney to meet the growing demands of both U.S. and global defense customers for the F135, F117, TF33, F100 and F119 engines.

“This expansion more than doubles our footprint in Oklahoma City, ensuring we have the capacity and agility to support increased workloads as military programs ramp up and new ones come online,” said Greg Treacy, vice president of Pratt & Whitney in Oklahoma City.

Price Action: RTX shares are trading lower by 0.10% to $124.26 on Wednesday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Nvidia, Micron, Broadcom, and Other Artificial Intelligence (AI) and Semiconductor Stocks Slumped on Tuesday

Some of the biggest drivers of the ongoing market rally that began early last year are the advances in artificial intelligence (AI). These next-generation algorithms and the semiconductors that power them could spark a wave of increased productivity.

The potential to profit from these advances has fueled rapid adoption of AI, which has sent purchases of semiconductors soaring. However, the chip industry could be among the first to feel the impact of the just-announced dockworkers’ strike.

With that as a backdrop, AI chip specialist Nvidia (NASDAQ: NVDA) slumped 3.9%, memory and storage chipmaker Micron Technology (NASDAQ: MU) tumbled 3.9%, semiconductor specialist Broadcom (NASDAQ: AVGO) fell 3.1%, and database and AI chipmaker Oracle (NYSE: ORCL) dropped 1.9%, as of 2:06 p.m. ET on Tuesday.

A check of all the usual suspects — financial reports, regulatory filings, and changes to analysts’ price targets — showed nothing in the way of any company-specific news to explain the falling stock prices. This suggests investors were focused on the work stoppage at some of the biggest ports in the U.S. and what that means for the semiconductor industry and the market rally in general.

Strike while the iron is hot

On Tuesday, the International Longshoremen’s Association (ILA) began its first widespread strike in almost 50 years. The union said that tens of thousands of its members have begun to hit picket lines at ports along the Atlantic and Gulf coasts beginning at 12:01 a.m. Tuesday.

The ports on those two coasts are the destination for more than half the containerized products imported into the country. If the strike extends for more than a few days, there could be a ripple effect on the supply chain and, by extension, the broader economy.

Delays of everyday products could reignite inflation, cause shortages, and drive up prices. The longer the strike lasts, the more likely the chance of economic upheaval.

Gov. Kathy Hochul of New York said that “the food supply is secure right now,” urging consumers not to stockpile items unnecessarily. While a shortage of essential goods like food and household items is still weeks away, other industries could be affected, including semiconductors.

The accelerating adoption of AI has already caused many of the most advanced chips to be in short supply. As a result, a shortage of semiconductors resulting from the dockworkers’ strike could come sooner rather than later.

Years, not weeks or months

So, what’s the potential impact on our quartet of companies? In the near term, a disruption in the semiconductor pipeline could slow revenue and profit growth. Over the long term, however, any impact would be fleeting at most.

Many AI and semiconductor stocks have been bid up since early last year as investors feared missing out on the next big trend. If a shortage of chips comes to pass due to this strike, it will likely be short-lived, and the pent-up demand will remain once the strike has passed.

Investors should stay focused on the long-term opportunity of AI, which will play out over years, not weeks or months. It takes the most advanced semiconductors to power this technology, so the future remains bright for these pillars of the chip industry.

-

Nvidia created the graphics processing units (GPUs) that provide the computational horsepower used in AI systems.

-

Broadcom creates many of the semiconductors and ancillary technology used in data centers and cloud computing, where much of AI occurs.

-

Oracle is primarily known for its database and cloud infrastructure services, but it also designs and engineers chips used for AI.

-

Micron Technology makes flash memory and storage processors, which are crucial components in the GPUs that are used for AI processing.

Some of these stocks might appear pricey at first glance, but any premium is well deserved. Nvidia, Broadcom, Oracle, and Micron are currently selling for 41 times, 35 times, 27 times, and 11 times forward earnings, respectively. However, given the accelerating adoption of AI and the corresponding accelerating growth of these companies (all of which provide components that are crucial to the AI revolution), I would rate them all buys.

That said, each of these stocks carries increased volatility, and the potential for supply chain disruption could further exacerbate that situation. Investors should hold on for a wild ride.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $744,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Danny Vena has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia and Oracle. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Why Nvidia, Micron, Broadcom, and Other Artificial Intelligence (AI) and Semiconductor Stocks Slumped on Tuesday was originally published by The Motley Fool

GM's EV Sales Rise In Q3 On The Back Of New Models: Chevrolet Equinox EV Tops Charts

General Motors GM sold 32,095 electric vehicles in the third quarter in the U.S., marking a jump of about 46% from the prior quarter, thanks to the introduction of new electric models.

What Happened: GM sold 32,095 EVs in the three months through the end of September, with the Chevrolet Equinox EV accounting for a majority of the deliveries.

GM started deliveries of the Equinox EV in May 2024. In the second quarter, the company delivered only 1,013 units of the vehicle. However, in the third quarter, delivery numbers rose to 9,772 units.

The SUV’s entry-level variant starts at about $35,000, lower than Tesla’s Model Y SUV or Ford’s Mustang Mach-E.

Other best-selling EVs in the quarter include the Cadillac Lyriq and the Blazer EV. The company also sold 387 units of the Sierra EV electric pickup truck after it commenced deliveries in August.

Bolt EV sales in the quarter, however, dropped by about 99% in the quarter after the company discontinued its production in late 2023.

| EV Model | Q3 Deliveries |

| Cadillac Lyriq | 7,224 |

| Chevrolet Blazer EV | 7,998 |

| Chevrolet Bolt EV | 168 |

| Chevrolet Equinox EV | 9,772 |

| Chevrolet Silverado EV | 1,995 |

| GMC Hummer EV | 4,305 |

| GMC Sierra EV | 387 |

| BrightDrop Zevo 400/600 | 246 |

| Total EV Deliveries | 32,095 |

Why It Matters: GM currently has the longest EV lineup among major U.S. EV players including EV giant Tesla.

Tesla’s current lineup has just five vehicles- Model 3, Model Y, Model S, Model X, and the Cybertruck.

Dearborn-based Ford Motor Co, meanwhile, has only three EV offerings in the U.S.- the Mustang Mach-E SUV, the F-150 Lightning pickup truck, and the E-transit van.

GM’s total vehicle deliveries in the quarter, however, dropped 2.2% to 659,601 units, owing to a drop in deliveries of gas-powered vehicles including the Buick Enclave and Chevrolet Silverado HD.

Price Action: GM shares closed up 0.1% at $44.88 on Tuesday. The stock is up 24.5% year-to-date, according to data from Benzinga Pro.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read More:

Photo courtesy: Chevrolet

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The North Star Capital Fund LLC Investor Return Exceeds 13.5% APR Since Inception!

The North Star Capital Fund LLC is currently open for new capital investment!

CONCORD, Calif., Oct. 2, 2024 /PRNewswire/ — For the second quarter of 2024, The North Star Capital Fund LLC (“Fund”) reported an outstanding 13.5% average APR net return since inception for its Fund Members who have reinvested or “rolled over” all their distributions. The Fund had another strong quarter, reporting a 9.1% APR net return to the Fund’s Members, well within its guidelines of 8.0-10.0%. Since inception, the average APR net return for Fund Members that take quarterly distributions has been 11.0%. “The Fund continues to outperform similar funds by close to 50%,” states John W. Simonse, President of LHJS Investments LLC (“LHJS”) and a Managing Member of the Fund. “For investors who prefer an investment secured by California real estate, one that does not rely on the unpredictability of the stock market, The North Star Capital Fund is a proven choice. The Fund managers have the combined wisdom of over one hundred years of experience in real estate. They have been through many real estate market cycles and are well-equipped to handle any problems that may arise.

“The 2025 outlook for the Fund and the economy is very positive due to the decrease in interest rates,” states Mr. Simonse. “The real estate market is highly dependent on loan interest rates. After the Fed cut interest rates half a percent at the September meeting, mortgage rates responded by dropping to 6% for 30-year fixed and 5.5% for 15-year loans. Most analysts expect the Fed to cut rates another half point by the end of the year and a full point in 2025. As rates drop, housing prices are expected to increase. For buyers who have been on the fence, the best time to buy will be around the end of the year, when there is less competition with other buyers and before home prices jump up.”

Mr. Simonse continues, “In California, single-family median home prices this year were up statewide about 5% over last year. They are predicted to be up an additional 6% next year. However, much of this growth is occurring in outlying areas, not in the big cities. For example, the housing market in San Francisco, once the bellwether of rising real estate prices, is expected to continue to decline next year, with prices dropping an additional 3-5% due to affordability problems, poor governance, and the lack of office workers. While on the other hand, prices in Los Angeles and the Greater Los Angeles area should continue to rise moderately.”

About The North Star Capital Fund LLC

The Fund provides construction, remodeling, and other business-purpose loans in the Bay Area and the greater Los Angeles area, where the demand for construction lending is extremely high.

The North Star Capital Fund is open to accredited investors only. Call now if you would like to invest in trust deeds alongside Mr. Simonse and his partners.

Contact: John W. Simonse Phone: 925-603-0433 Email: 384174@email4pr.com

![]() View original content:https://www.prnewswire.com/news-releases/the-north-star-capital-fund-llc-investor-return-exceeds-13-5-apr-since-inception-302265072.html

View original content:https://www.prnewswire.com/news-releases/the-north-star-capital-fund-llc-investor-return-exceeds-13-5-apr-since-inception-302265072.html

SOURCE The North Star Capital Fund LLC

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Decision Unfolding At Cracker Barrel Old: Christopher Bryant Edwards Exercises Options

Highlighted on September 30, it was unveiled in an SEC filing that Edwards, SVP at Cracker Barrel Old CBRL, executed a significant transaction involving the exercise of company stock options.

What Happened: The latest Form 4 filing on Monday with the U.S. Securities and Exchange Commission uncovered Edwards, SVP at Cracker Barrel Old, exercising stock options for 0 shares of CBRL. The total transaction was valued at $0.

As of Tuesday morning, Cracker Barrel Old shares are down by 0.68%, with a current price of $45.04. This implies that Edwards’s 0 shares have a value of $0.

Delving into Cracker Barrel Old’s Background

Cracker Barrel Old Country Store Inc operates hundreds of full-service restaurants throughout the United States. Its restaurants are open for breakfast, lunch, and dinner, with menus that offer home-style country food. Cracker Barrel’s biggest input costs are beef, dairy, fruits and vegetables, pork, and poultry. The company purchases its food products from a few different vendors on a cost-plus basis. All restaurants are located in freestanding buildings and include gift shops, which contribute roughly one fourth of total company revenue. Apparel and accessories are the company’s biggest revenue generators in the retail segment of the business.

Financial Milestones: Cracker Barrel Old’s Journey

Positive Revenue Trend: Examining Cracker Barrel Old’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 6.89% as of 31 July, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Exploring Profitability:

-

Gross Margin: Achieving a high gross margin of 32.1%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 0.82, Cracker Barrel Old showcases strong earnings per share.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 2.73.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 24.78, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 0.29, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 12.96 is below the industry average, indicating that it may be relatively undervalued compared to peers.

Market Capitalization Analysis: Below industry benchmarks, the company’s market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Understanding the Significance of Insider Transactions

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

The Insider’s Guide to Important Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Cracker Barrel Old’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Conagra Brands Reports First Quarter Results

CHICAGO, Oct. 2, 2024 /PRNewswire/ — Today Conagra Brands, Inc. CAG reported results for the first quarter of fiscal year 2025, which ended on August 25, 2024. All comparisons are against the prior-year fiscal period, unless otherwise noted.

Highlights

- Reported net sales decreased 3.8%; organic net sales decreased 3.5%.

- Reported operating margin was 14.4% representing a 247 basis point decrease. Adjusted operating margin was 14.2% representing a 244 basis point decrease.

- Reported diluted earnings per share (EPS) was $0.97, a 44.8% increase. Adjusted EPS was $0.53, a 19.7% decrease.

- The company is reaffirming its fiscal 2025 guidance reflecting:

- Organic net sales of (1.5)% to flat compared to fiscal 2024

- Adjusted operating margin between 15.6% and 15.8%

- Adjusted EPS between $2.60 and $2.65

- Free cash flow conversion of approximately 90%

CEO Perspective

Sean Connolly, president and chief executive officer of Conagra Brands, commented, “Our team executed well to deliver on key priorities across the business during the first quarter in what continued to be a challenging environment. Our domestic retail volume progressed in-line with expectations, we increased share across the portfolio and advanced our portfolio reshaping initiatives. Overall, we are reaffirming our guidance for fiscal 2025, reflecting confidence in the underlying momentum of our business.”

Total Company First Quarter Results

In the quarter, net sales decreased 3.8% to $2.8 billion reflecting:

- a 3.5% decrease in organic net sales,

- a 0.4% decrease from the unfavorable impact of foreign exchange; and

- a 0.1% increase from the favorable impact of M&A

The 3.5% decrease in organic net sales was driven by a 1.9% negative impact from price/mix, largely driven by the company’s strategic investments in the quarter, and a 1.6% decrease in volume. Additionally, the company estimates that results in the quarter were impacted by approximately $27 million due to temporary manufacturing disruptions in the Hebrew National business during the key grilling season.

Gross profit decreased 10.2% to $739 million in the quarter, and adjusted gross profit decreased 9.4% to $726 million. First quarter gross profit decreased as higher productivity was more than offset by the negative impacts of lower organic net sales, cost of goods sold inflation, and unfavorable operating leverage. Additionally, gross profit was negatively impacted by approximately $11 million due to the temporary manufacturing disruptions in the Hebrew National business. Gross margin decreased 189 basis points to 26.5% in the quarter, and adjusted gross margin decreased 163 basis points to 26.0%.

Selling, general, and administrative expense (SG&A), which includes advertising and promotional expense (A&P), increased 1.1% to $338 million in the quarter driven primarily by higher incentive compensation compared to the prior year quarter, partially offset by a 14.0% decrease in A&P. Adjusted SG&A, which excludes A&P, increased 7.3% to $277 million primarily driven by higher incentive compensation compared to the prior year quarter.

Net interest expense was $106 million in the quarter, a 0.1% decrease compared to the prior-year period due to a reduction in total debt.

The average diluted share count in the quarter was 480 million shares reflecting $64 million in share repurchases during the first quarter.

In the quarter, net income attributable to Conagra Brands increased 46.0% to $467 million, or $0.97 per diluted share compared to $320 million, or $0.67 per diluted share in the prior year quarter driven primarily by releasing an allowance resulting in a $210.4 million income tax benefit in the first quarter of fiscal 2025. Adjusted net income attributable to Conagra Brands decreased 20.0% to $253 million, or $0.53 per diluted share, primarily as a result of the decrease in gross profit and increase in SG&A.

Adjusted EBITDA, which includes equity method investment earnings and pension and postretirement non-service expense (income), decreased 13.8% to $528 million in the quarter, primarily driven by the decrease in adjusted operating profit.

Grocery & Snacks Segment First Quarter Results

Net sales for the Grocery & Snacks segment decreased 1.7% to $1.2 billion in the quarter, reflecting:

- a 1.9% decrease in organic net sales; and

- a 0.2% increase from the favorable impact of M&A.

The decrease in organic net sales was driven by a price/mix decrease of 0.1%, partially attributable to an increase in strategic investments, and a volume decrease of 1.8%. The company gained dollar share in snacking and staples categories including microwave popcorn, seeds, pudding, and pickles.

Operating profit for the segment decreased 3.7% to $249 million in the quarter and adjusted operating profit decreased 3.8% to $253 million as higher productivity, and lower A&P and SG&A were more than offset by the negative impacts of cost of goods sold inflation, lower organic net sales, and unfavorable operating leverage.

Refrigerated & Frozen Segment First Quarter Results

Reported and organic net sales for the Refrigerated & Frozen segment decreased 5.7% to $1.1 billion in the quarter as price/mix decreased 5.8%, primarily attributable to an increase in strategic investments, and volume increased 0.1%. Additionally, the company estimates that results in the quarter were impacted by approximately $24 million due to temporary manufacturing disruptions in the Hebrew National business during the key grilling season. The company gained dollar share in select categories such as frozen single-serve meals, frozen multi-serve meals, and frozen breakfast.

Operating profit for the segment decreased 11.6% to $176 million in the quarter. Adjusted operating profit decreased 21.0% to $159 million as higher productivity and lower A&P and SG&A were more than offset by the negative impacts of lower organic net sales, cost of goods sold inflation, and unfavorable operating leverage. Additionally, the company estimates that operating profit was negatively impacted by approximately $10 million due to the temporary manufacturing disruptions in the Hebrew National business.

International Segment First Quarter Results

Net sales for the International segment decreased 0.4% to $259 million in the quarter reflecting:

- a 3.4% decrease from the unfavorable impact of foreign exchange; and

- a 3.0% increase in organic net sales.

On an organic net sales basis, price/mix increased 2.4% and volume increased 0.6%, primarily driven by a strong performance in the company’s Global Exports business.

Operating profit for the segment increased 42.1% to $34 million in the quarter primarily due to the wrap of certain non-cash restructuring charges in the prior year period. Adjusted operating profit decreased 15.5% to $36 million as the benefits from higher organic net sales and productivity were more than offset by the negative impacts of unfavorable foreign exchange and cost of goods sold inflation.

Foodservice Segment First Quarter Results

Net sales for the Foodservice segment decreased 7.8% to $267 million in the quarter, reflecting:

- a 7.9% decrease in organic net sales; and

- a 0.1% increase from the favorable impact of M&A.

Organic net sales were driven by a price/mix increase of 3.2% and volume decrease of 11.1% due to the ongoing impact of previously disclosed lost business and ongoing softness in restaurant traffic.

Operating profit for the segment decreased 20.4% to $35 million. Adjusted operating profit decreased 13.8% to $35 million in the quarter as higher productivity was more than offset by the negative impacts of lower organic net sales, cost of goods sold inflation, unfavorable operating leverage, and one-time costs related to capital investment projects.

Additionally, the company estimates that organic net sales in the quarter were impacted by approximately $3 million and gross profit was impacted by approximately $1 million due to the temporary manufacturing disruptions in the Hebrew National business.

Other First Quarter Items

Corporate expenses increased 151.2% to $92 million in the quarter and adjusted corporate expense increased 34.1% to $85 million in the quarter driven primarily by higher incentive compensation compared to the prior year quarter.

The company incurred pension and post-retirement non-service income of $3.1 million in the quarter compared to $0.3 million of expense in the prior-year quarter, due primarily to lower interest costs.

In the quarter, equity method investment earnings decreased 18.1% to $29 million as results from the company’s joint venture, Ardent Mills, reflected slightly lower volume trends in the milling industry.

In the quarter, the effective tax rate was (42.4)% compared to 23.5% in the prior-year quarter. The effective tax rate in the first quarter reflected a $210.4 million deferred tax benefit that was related to the release of valuation allowances booked against certain deferred tax assets. The adjusted effective tax rate was 22.1% compared to 23.6% in the prior-year quarter.

In the quarter, the company paid a dividend of $0.35 per share.

Cash Flow and Debt Update

For the first quarter, the company generated $269 million in net cash flows from operating activities compared to $444 million in the prior year period, driven primarily by lower operating profit and anticipated changes in working capital. Capital expenditures were $133 million compared to $144 million in the prior year period. Additionally, our free cash flow decreased from the prior year quarter by $164 million to $136 million. Dividends paid increased 6.4% to $167 million.

The company ended the quarter with net debt of $8.6 billion, representing a 5.8% reduction in net debt versus the prior year period, resulting in a 3.60x net leverage ratio at the end of the quarter.

Outlook

The company is reaffirming its fiscal 2025 guidance reflecting:

- Organic net sales of (1.5)% to flat compared to fiscal 2024

- Adjusted operating margin between 15.6% and 15.8%

- Adjusted EPS between $2.60 and $2.65

- Free cash flow conversion of approximately 90%

- Net leverage ratio of approximately 3.2x

Additionally, the company now expects capital expenditures of approximately $450M and full year net inflation (input cost inflation including the impacts of hedging and other sourcing benefits) to be roughly 3.2%. Other guidance metrics including interest expense, the adjusted effective tax rate, Ardent Mills’ contribution, and pension income that were provided in our fourth quarter fiscal 2024 earnings release remain unchanged.

The inability to predict the amount and timing of the impacts of foreign exchange, acquisitions, divestitures, and other items impacting comparability makes a detailed reconciliation of forward-looking non-GAAP financial measures impracticable. Please see the end of this release for more information.

Items Affecting Comparability of EPS

The following are included in the $0.97 EPS for the first quarter of fiscal 2025 (EPS amounts are rounded and after tax). Please see the reconciliation schedules at the end of this release for additional details.

- Approximately $0.01 per diluted share of net expense related to restructuring plans

- Approximately $0.03 per diluted share of net benefit related to fire-related insurance recoveries

- Approximately $0.01 per diluted share of net expense related to legal matters

- Approximately $0.44 per diluted share of net benefit related to a valuation allowance adjustment

- Approximately $0.01 per diluted share of net expense related to rounding

The following are included in the $0.67 EPS for the first quarter of fiscal 2024 (EPS amounts are rounded and after tax). Please see the reconciliation schedules at the end of this release for additional details.

- Approximately $0.04 per diluted share of net expense due to restructuring plans

- Approximately $0.04 per diluted share of net benefit related to corporate hedging derivative gains

- Approximately $0.01 per diluted share of net benefit related to rounding

Please note that certain prior year amounts have been reclassified to conform with current year presentation.

Discussion of Results and Outlook

Conagra Brands will issue pre-recorded remarks prior to hosting a live Q&A conference call and webcast at 9:30 a.m. Eastern time today to discuss the company’s results and outlook. The live audio webcast Q&A conference call, pre-recorded remarks, transcript of the pre-recorded remarks, and presentation slides will be available on www.conagrabrands.com/investor-relations under Events & Presentations. The Q&A conference call may be accessed by dialing 1‑877‑883‑0383 for participants in the U.S. and 1‑412‑902‑6506 for all other participants and using passcode 7095043. Please dial in 10 to 15 minutes prior to the call start time. A replay of the Q&A conference call will be available on www.conagrabrands.com/investor-relations under Events & Presentations until October 2, 2025.

About Conagra Brands

Conagra Brands, Inc. CAG, is one of North America’s leading branded food companies. We combine a 100-year history of making quality food with agility and a relentless focus on collaboration and innovation. The company’s portfolio is continuously evolving to satisfy consumers’ ever-changing food preferences. Conagra’s brands include Birds Eye®, Duncan Hines®, Healthy Choice®, Marie Callender’s®, Reddi-wip®, Slim Jim®, Angie’s® BOOMCHICKAPOP®, and many more. As a corporate citizen, we aim to do what’s right for our business, our employees, our communities and the world. Headquartered in Chicago, Conagra Brands generated fiscal 2024 net sales of more than $12 billion. For more information, visit www.conagrabrands.com.

Note on Forward-Looking Statements

This document contains forward-looking statements within the meaning of the federal securities laws. Examples of forward-looking statements include statements regarding the company’s expected future financial performance or position, results of operations, business strategy, plans and objectives of management for future operations, and other statements that are not historical facts. You can identify forward-looking statements by their use of forward-looking words, such as “may”, “will”, “anticipate”, “expect”, “believe”, “plan”, “should”, or comparable terms. Readers of this document should understand that these statements are not guarantees of performance or results. Forward-looking statements provide our current expectations and beliefs concerning future events and are subject to risks, uncertainties, and factors relating to our business and operations, all of which are difficult to predict and could cause our actual results to differ materially from the expectations expressed in or implied by such forward-looking statements. These risks, uncertainties, and factors include, among other things: risks associated with general economic and industry conditions, including inflation, reduced consumer confidence and spending, recessions, increased energy costs, supply chain challenges, labor shortages, and geopolitical conflicts; risks related to our ability to deleverage on currently anticipated timelines, and to continue to access capital on acceptable terms or at all; risks related to the company’s competitive environment, cost structure, and related market conditions; risks related to our ability to execute operating and value creation plans and achieve returns on our investments and targeted operating efficiencies from cost-saving initiatives, and to benefit from trade optimization programs; risks related to the availability and prices of commodities and other supply chain resources, including raw materials, packaging, energy, and transportation, weather conditions, health pandemics or outbreaks of disease, actual or threatened hostilities or war, or other geopolitical uncertainty; risks related to our ability to respond to changing consumer preferences and the success of our innovation and marketing investments; risks associated with actions by our customers, including changes in distribution and purchasing terms; risks related to the effectiveness of our hedging activities and ability to respond to volatility in commodities; disruptions or inefficiencies in our supply chain and/or operations; risks related to the ultimate impact of, including reputational harm caused by, any product recalls and product liability or labeling litigation, including litigation related to lead-based paint and pigment and cooking spray; risks related to the seasonality of our business; risks associated with our co-manufacturing arrangements and other third-party service provider dependencies; risks associated with actions of governments and regulatory bodies that affect our businesses, including the ultimate impact of new or revised regulations or interpretations including to address climate change or implement changes to taxes and tariffs; risks related to the company’s ability to execute on its strategies or achieve expectations related to environmental, social, and governance matters, including as a result of evolving legal, regulatory, and other standards, processes, and assumptions, the pace of scientific and technological developments, increased costs, the availability of requisite financing, and changes in carbon pricing or carbon taxes; risks related to a material failure in or breach of our or our vendors’ information technology systems and other cybersecurity incidents; risks related to our ability to identify, attract, hire, train, retain and develop qualified personnel; risk of increased pension, labor or people-related expenses; risks and uncertainties associated with intangible assets, including any future goodwill or intangible assets impairment charges; risk relating to our ability to protect our intellectual property rights; risks relating to acquisition, divestiture, joint venture or investment activities; the amount and timing of future dividends, which remain subject to Board approval and depend on market and other conditions; the amount and timing of future stock repurchases; and other risks described in our reports filed from time to time with the Securities and Exchange Commission.

We caution readers not to place undue reliance on any forward-looking statements included in this document, which speak only as of the date of this document. We undertake no responsibility to update these statements, except as required by law.

Note on Non-GAAP Financial Measures

This document includes certain non-GAAP financial measures, including adjusted EPS, organic net sales, adjusted gross profit, adjusted operating profit, adjusted SG&A, adjusted corporate expenses, adjusted gross margin, adjusted operating margin, adjusted effective tax rate, adjusted net income attributable to Conagra Brands, free cash flow, net debt, net leverage ratio, and adjusted EBITDA. Management considers GAAP financial measures as well as such non-GAAP financial information in its evaluation of the company’s financial statements and believes these non-GAAP financial measures provide useful supplemental information to assess the company’s operating performance and financial position. These measures should be viewed in addition to, and not in lieu of, the company’s diluted earnings per share, operating performance and financial measures as calculated in accordance with GAAP.

Organic net sales excludes, from reported net sales, the impacts of foreign exchange, divested businesses and acquisitions, as well as the impact of any 53rd week. All references to changes in volume and price/mix throughout this release are on an organic net sales basis.

Free cash flow is net cash from operating activities less additions to property, plant and equipment. Free cash flow conversion is free cash flow divided by adjusted net income attributable to Conagra Brands, Inc.

References to adjusted items throughout this release refer to measures computed in accordance with GAAP less the impact of items impacting comparability. Items impacting comparability are income or expenses (and related tax impacts) that management believes have had, or are likely to have, a significant impact on the earnings of the applicable business segment or on the total corporation for the period in which the item is recognized, and are not indicative of the company’s core operating results. These items thus affect the comparability of underlying results from period to period.

References to earnings before interest, taxes, depreciation, and amortization (EBITDA) refer to net income attributable to Conagra Brands before the impacts of discontinued operations, income tax expense (benefit), interest expense, depreciation, and amortization. References to adjusted EBITDA refer to EBITDA before the impacts of items impacting comparability.

Hedge gains and losses are generally aggregated, and net amounts are reclassified from unallocated corporate expense to the operating segments when the underlying commodity or foreign currency being hedged is expensed in segment cost of goods sold. The net change in the derivative gains (losses) included in unallocated corporate expense during the period is reflected as a comparability item, Corporate hedging derivate gains (losses).

Note on Forward-Looking Non-GAAP Financial Measures

The company’s fiscal 2025 guidance includes certain non-GAAP financial measures (organic net sales growth, adjusted operating margin, adjusted EPS, net leverage ratio, and adjusted effective tax rate) that are presented on a forward-looking basis. Historically, the company has calculated these non-GAAP financial measures excluding the impact of certain items such as, but not limited to, foreign exchange, acquisitions, divestitures, restructuring expenses, the extinguishment of debt, hedging gains and losses, impairment charges, legacy legal contingencies, and unusual tax items. Reconciliations of these forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures are not provided because the company is unable to provide such reconciliations without unreasonable effort, due to the uncertainty and inherent difficulty of predicting the timing and financial impact of such items. For the same reasons, the company is unable to address the probable significance of the unavailable information, which could be material to future results.

|

Conagra Brands, Inc. Consolidated Statements of Earnings (in millions) (unaudited)

|

||||||||

|

FIRST QUARTER |

||||||||

|

Thirteen Weeks Ended |

Thirteen Weeks Ended |

|||||||

|

August 25, 2024 |

August 27, 2023 |

Percent Change |

||||||

|

Net sales |

$ |

2,794.9 |

$ |

2,904.0 |

(3.8) % |

|||

|

Costs and expenses: |

||||||||

|

Cost of goods sold |

2,055.6 |

2,080.9 |

(1.2) % |

|||||

|

Selling, general and administrative expenses |

337.7 |

334.1 |

1.1 % |

|||||

|

Pension and postretirement non-service income (expense) |

3.1 |

(0.3) |

N/A |

|||||

|

Interest expense, net |

105.8 |

106.0 |

(0.1) % |

|||||

|

Equity method investment earnings |

29.1 |

35.5 |

(18.1) % |

|||||

|

Income before income taxes |

$ |

328.0 |

$ |

418.2 |

(21.6) % |

|||

|

Income tax expense (benefit) |

(138.9) |

98.3 |

N/A |

|||||

|

Net income |

$ |

466.9 |

$ |

319.9 |

45.9 % |

|||

|

Less: Net income attributable to noncontrolling interests |

0.1 |

0.2 |

(62.6) % |

|||||

|

Net income attributable to Conagra Brands, Inc. |

$ |

466.8 |

$ |

319.7 |

46.0 % |

|||

|

Earnings per share – basic |

||||||||

|

Net income attributable to Conagra Brands, Inc. |

$ |

0.97 |

$ |

0.67 |

44.8 % |

|||

|

Basic weighted average shares outstanding |

478.8 |

478.2 |

0.1 % |

|||||

|

Earnings per share – diluted |

||||||||

|

Net income attributable to Conagra Brands, Inc. |

$ |

0.97 |

$ |

0.67 |

44.8 % |

|||

|

Diluted weighted average shares outstanding |

480.3 |

479.8 |

0.1 % |

|||||

|

Conagra Brands, Inc. Consolidated Balance Sheets (in millions) (unaudited)

|

||||||

|

August 25, 2024 |

May 26, 2024 |

|||||

|

ASSETS |

||||||

|

Current assets |

||||||

|

Cash and cash equivalents |

$ |

128.7 |

$ |

77.7 |

||

|

Receivables, less allowance for doubtful accounts of $2.2 and $3.0 |

933.4 |

871.8 |

||||

|

Inventories |

2,220.6 |

2,083.0 |

||||

|

Prepaid expenses and other current assets |

133.5 |

85.0 |

||||

|

Current assets held for sale |

— |

32.0 |

||||

|

Total current assets |

3,416.2 |

3,149.5 |

||||

|

Property, plant and equipment, net |

2,877.0 |

2,875.5 |

||||

|

Goodwill |

10,758.0 |

10,582.7 |

||||

|

Brands, trademarks and other intangibles, net |

2,756.4 |

2,708.4 |

||||

|

Other assets |

1,419.0 |

1,435.6 |

||||

|

Noncurrent assets held for sale |

21.2 |

110.6 |

||||

|

$ |

21,247.8 |

$ |

20,862.3 |

|||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||

|

Current liabilities |

||||||

|

Notes payable |

$ |

1,266.4 |

$ |

928.4 |

||

|

Current installments of long-term debt |

20.2 |

20.3 |

||||

|

Accounts and other payables |

1,537.7 |

1,493.7 |

||||

|

Accrued payroll |

108.2 |

193.3 |

||||

|

Other accrued liabilities |

714.3 |

591.3 |

||||

|

Current liabilities held for sale |

— |

14.8 |

||||

|

Total current liabilities |

3,646.8 |

3,241.8 |

||||

|

Senior long-term debt, excluding current installments |

7,485.6 |

7,492.6 |

||||

|

Other noncurrent liabilities |

1,419.8 |

1,614.7 |

||||

|

Noncurrent liabilities held for sale |

— |

1.9 |

||||

|

Total stockholders’ equity |

8,695.6 |

8,511.3 |

||||

|

$ |

21,247.8 |

$ |

20,862.3 |

|

Conagra Brands, Inc. and Subsidiaries Condensed Consolidated Statements of Cash Flows (in millions)

|

||||||

|

Thirteen Weeks Ended |

Thirteen Weeks Ended |

|||||

|

August 25, 2024 |

August 27, 2023 |

|||||

|

Cash flows from operating activities: |

||||||

|

Net income |

$ |

466.9 |

$ |

319.9 |

||

|

Adjustments to reconcile net income to net cash flows from operating activities: |

||||||

|

Depreciation and amortization |

99.1 |

96.6 |

||||

|

Asset impairment charges |

0.1 |

15.2 |

||||

|

Equity method investment earnings in excess of distributions |

(5.2) |

(6.7) |

||||

|

Stock-settled share-based payments expense (benefit) |

20.6 |

(2.7) |

||||

|

Contributions to pension plans |

(2.9) |

(3.1) |

||||

|

Pension expense (benefit) |

(0.8) |

2.8 |

||||

|

Other items |

11.6 |

10.5 |

||||

|

Change in operating assets and liabilities excluding effects of business acquisitions and dispositions: |

||||||

|

Receivables |

(60.1) |

(11.1) |

||||

|

Inventories |

(112.5) |

(161.8) |

||||

|

Deferred income taxes and income taxes payable, net |

(165.9) |

90.6 |

||||

|

Prepaid expenses and other current assets |

(43.0) |

(35.6) |

||||

|

Accounts and other payables |

67.7 |

81.4 |

||||

|

Accrued payroll |

(83.7) |

(49.0) |

||||

|

Other accrued liabilities |

84.4 |

95.4 |

||||

|

Litigation accruals |

(7.7) |

1.1 |

||||

|

Net cash flows from operating activities |

268.6 |

443.5 |

||||

|

Cash flows from investing activities: |

||||||

|

Additions to property, plant and equipment |

(133.0) |

(143.6) |

||||

|

Sale of property, plant and equipment |

0.3 |

0.2 |

||||

|

Purchase of marketable securities |

— |

(0.7) |

||||

|

Sale of marketable securities |

— |

0.7 |

||||

|

Purchase of business, net of cash acquired |

(230.4) |

— |

||||

|

Proceeds from divestitures, net of cash divested |

76.8 |

— |

||||

|

Other items |

— |

5.0 |

||||

|

Net cash flows from investing activities |

(286.3) |

(138.4) |

||||

|

Cash flows from financing activities: |

||||||

|

Issuances of short-term borrowings, maturities greater than 90 days |

35.1 |

43.5 |

||||

|

Repayment of short-term borrowings, maturities greater than 90 days |

(35.3) |

(54.8) |

||||

|

Net issuance (repayment) of other short-term borrowings, maturities less than or equal to 90 days |

336.4 |

(117.0) |

||||

|

Issuance of long-term debt |

— |

500.0 |

||||

|

Repayment of long-term debt |

(14.9) |

(504.3) |

||||

|

Debt issuance costs |

— |

(2.8) |

||||

|

Repurchase of Conagra Brands, Inc. common shares |

(64.0) |

— |

||||

|

Cash dividends paid |

(167.3) |

(157.4) |

||||

|

Exercise of stock options and issuance of other stock awards, including tax withholdings |

(19.8) |

(13.7) |

||||

|

Other items |

(0.1) |

(0.6) |

||||

|

Net cash flows from financing activities |

70.1 |

(307.1) |

||||

|

Effect of exchange rate changes on cash and cash equivalents |

(2.7) |

1.4 |

||||

|

Net change in cash and cash equivalents, including cash balances classified as assets held for sale |

49.7 |

(0.6) |

||||

|

Less: Net change in cash balances classified as assets held for sale |

(1.3) |

1.0 |

||||

|

Net change in cash and cash equivalents |

51.0 |

(1.6) |

||||

|

Cash and cash equivalents at beginning of period |

77.7 |

93.3 |

||||

|

Cash and cash equivalents at end of period |

$ |

128.7 |

$ |

91.7 |

||

|

Conagra Brands, Inc. Reconciliation of Q1 FY25 Organic Net Sales by Segment – YOY Change (in millions)

|

|||||||||||||||

|

Refrigerated & |

Total Conagra |

||||||||||||||

|

Q1 FY25 |

Grocery & Snacks |

Frozen |

International |

Foodservice |

Brands |

||||||||||

|

Net Sales |

$ |

1,182.7 |

$ |

1,086.4 |

$ |

259.1 |

$ |

266.7 |

$ |

2,794.9 |

|||||

|

Impact of foreign exchange |

— |

— |

9.0 |

— |

9.0 |

||||||||||

|

Net sales from acquired businesses |

(2.7) |

— |

— |

(0.2) |

(2.9) |

||||||||||

|

Organic Net Sales |

$ |

1,180.0 |

$ |

1,086.4 |

$ |

268.1 |

$ |

266.5 |

$ |

2,801.0 |

|||||

|

Year-over-year change – Net Sales |

(1.7) % |

(5.7) % |

(0.4) % |

(7.8) % |

(3.8) % |

||||||||||

|

Impact of foreign exchange (pp) |

— |

— |

3.4 |

— |

0.4 |

||||||||||

|

Net sales from acquired businesses (pp) |

(0.2) |

— |

— |

(0.1) |

(0.1) |

||||||||||

|

Organic Net Sales |

(1.9) % |

(5.7) % |

3.0 % |

(7.9) % |

(3.5) % |

||||||||||

|

Volume (Organic) |

(1.8) % |

0.1 % |

0.6 % |

(11.1) % |

(1.6) % |

||||||||||

|

Price/Mix |

(0.1) % |

(5.8) % |

2.4 % |

3.2 % |

(1.9) % |

||||||||||

|

Refrigerated & |

Total Conagra |

||||||||||||||

|

Q1 FY24 |

Grocery & Snacks |

Frozen |

International |

Foodservice |

Brands |

||||||||||

|

Net Sales |

$ |

1,202.9 |

$ |

1,151.6 |

$ |

260.2 |

$ |

289.3 |

$ |

2,904.0 |

|||||

|

Net sales from divested businesses |

— |

— |

— |

— |

— |

||||||||||

|

Organic Net Sales |

$ |

1,202.9 |

$ |

1,151.6 |

$ |

260.2 |

$ |

289.3 |

$ |

2,904.0 |

|||||

|

Conagra Brands, Inc. Reconciliation of Q1 FY25 Adj. Operating Profit by Segment – YOY Change (in millions)

|

||||||||||||||||||

|

Grocery & |

Refrigerated & |

Corporate |

Total Conagra |

|||||||||||||||

|

Q1 FY25 |

Snacks |

Frozen |

International |

Foodservice |

Expense |

Brands |

||||||||||||

|

Operating Profit |

$ |

249.1 |

$ |

176.0 |

$ |

33.6 |

$ |

35.1 |

$ |

(92.2) |

$ |

401.6 |

||||||

|

Restructuring plans |

4.2 |

0.1 |

(0.1) |

— |

0.1 |

4.3 |

||||||||||||

|

Legal matters |

— |

— |

— |

— |

3.4 |

3.4 |

||||||||||||

|

Fire related insurance recoveries |

— |

(17.0) |

— |

— |

— |

(17.0) |

||||||||||||

|

Consulting fees on tax matters |

— |

— |

— |

— |

2.0 |

2.0 |

||||||||||||

|

Loss on sale of business |

— |

— |

2.3 |

— |

— |

2.3 |

||||||||||||

|

Corporate hedging derivative losses (gains) |

— |

— |

— |

— |

1.3 |

1.3 |

||||||||||||

|

Adjusted Operating Profit |

$ |

253.3 |

$ |

159.1 |

$ |

35.8 |

$ |

35.1 |

$ |

(85.4) |

$ |

397.9 |

||||||

|

Operating Profit Margin |

21.1 % |

16.2 % |

13.0 % |

13.2 % |

14.4 % |

|||||||||||||

|

Adjusted Operating Profit Margin |

21.4 % |

14.6 % |

13.8 % |

13.2 % |

14.2 % |

|||||||||||||

|

Year-over-year % change – Operating Profit |

(3.7) % |

(11.6) % |

42.1 % |

(20.4) % |

151.2 % |

(17.9) % |

||||||||||||

|

Year-over year % change – Adjusted Operating Profit |

(3.8) % |

(21.0) % |

(15.5) % |

(13.8) % |

34.1 % |

(17.8) % |

||||||||||||

|

Year-over-year bps change – Operating Profit |

(44) bps |

(110) bps |

388 bps |

(209) bps |

(247) bps |

|||||||||||||

|

Year-over-year bps change – Adjusted Operating Profit |

(48) bps |

(284) bps |

(247) bps |

(92) bps |

(244) bps |

|||||||||||||

|

Grocery & |

Refrigerated & |

Corporate |

Total Conagra |

|||||||||||||||

|

Q1 FY24 |

Snacks |

Frozen |

International |

Foodservice |

Expense |

Brands |

||||||||||||

|

Operating Profit |

$ |

258.7 |

$ |

199.2 |

$ |

23.7 |

$ |

44.1 |

$ |

(36.7) |

$ |

489.0 |

||||||

|

Restructuring plans |

4.8 |

0.6 |

18.6 |

— |

0.4 |

24.4 |

||||||||||||

|

Acquisitions and divestitures |

— |

— |

— |

— |

0.2 |

0.2 |

||||||||||||

|

Fire related costs (insurance recoveries), net |

— |

1.6 |

— |

(3.3) |

— |

(1.7) |

||||||||||||

|

Corporate hedging derivative losses (gains) |

— |

— |

— |

— |

(27.6) |

(27.6) |

||||||||||||

|

Adjusted Operating Profit |

$ |

263.5 |

$ |

201.4 |

$ |

42.3 |

$ |

40.8 |

$ |

(63.7) |

$ |

484.3 |

||||||

|

Operating Profit Margin |

21.5 % |

17.3 % |

9.1 % |

15.3 % |

16.8 % |

|||||||||||||

|

Adjusted Operating Profit Margin |

21.9 % |

17.5 % |

16.3 % |

14.1 % |

16.7 % |

|||||||||||||

|

Conagra Brands, Inc. Reconciliation of Q1 FY25 Adj. Gross Margin, Adj. Gross Profit, Adj. SG&A, Adj. Net Income, and Adj. EPS – YOY Change (in millions) |

|||||||||||||||||||||||

|

Q1 FY25 |

Gross profit |

Selling, |

Operating |

Income |

Income tax |

Income tax |

Net income |

Diluted EPS |

|||||||||||||||

|

Reported |

$ |

739.3 |

$ |

337.7 |

$ |

401.6 |

$ |

328.0 |

$ |

(138.9) |

(42.4) % |

$ |

466.8 |

$ |

0.97 |

||||||||

|

% of Net Sales |

26.5 % |

12.1 % |

14.4 % |

||||||||||||||||||||

|

Restructuring plans |

2.1 |

2.2 |

4.3 |

4.3 |

1.1 |

3.2 |

0.01 |

||||||||||||||||

|

Loss on sale of business |

— |

2.3 |

2.3 |

2.3 |

0.8 |

1.5 |

— |

||||||||||||||||

|

Corporate hedging derivative losses (gains) |

1.3 |

— |

1.3 |

1.3 |

0.1 |

1.2 |

— |

||||||||||||||||

|

Advertising and promotion expenses 2 |

— |

50.4 |

— |

— |

— |

— |

— |

||||||||||||||||

|

Fire related insurance recoveries |

(17.0) |

— |

(17.0) |

(17.0) |

(4.2) |

(12.8) |

(0.03) |

||||||||||||||||

|

Consulting fees on tax matters |

— |

2.0 |

2.0 |

2.0 |

0.5 |

1.5 |

— |

||||||||||||||||

|

Legal matters |

— |

3.4 |

3.4 |

3.4 |

0.8 |

2.6 |

0.01 |

||||||||||||||||

|

Valuation allowance adjustment |

— |

— |

— |

— |

211.4 |

(211.4) |

(0.44) |

||||||||||||||||

|

Rounding |

— |

— |

— |

— |

— |

— |

0.01 |

||||||||||||||||

|

Adjusted |

$ |

725.7 |

$ |

277.4 |

$ |

397.9 |

$ |

324.3 |

$ |

71.6 |

22.1 % |

$ |

252.6 |

$ |

0.53 |

||||||||

|

% of Net Sales |

26.0 % |

9.9 % |

14.2 % |

||||||||||||||||||||

|

Year-over-year % of net sales |

(189) bps |

58 bps |

(247) bps |

||||||||||||||||||||

|

Year-over-year % of net sales |

(163) bps |

102 bps |

(244) bps |

||||||||||||||||||||

|

Year-over-year change – reported |

(10.2) % |

1.1 % |

(17.9) % |

(21.6) % |

N/A |

46.0 % |

44.8 % |

||||||||||||||||

|

Year-over-year change – adjusted |

(9.4) % |

7.3 % |

(17.8) % |

(21.6) % |

(26.4) % |

(20.0) % |

(19.7) % |

||||||||||||||||

|

Q1 FY24 |

Gross profit |

Selling, |

Operating |

Income |

Income tax |

Income tax |

Net income |

Diluted EPS |

|||||||||||||||

|

Reported |

$ |

823.1 |

$ |

334.1 |

$ |

489.0 |

$ |

418.2 |

$ |

98.3 |

23.5 % |

$ |

319.7 |

$ |

0.67 |

||||||||

|

% of Net Sales |

28.3 % |

11.5 % |

16.8 % |

||||||||||||||||||||

|

Restructuring plans |

4.3 |

20.1 |

24.4 |

24.4 |

6.3 |

18.1 |

0.04 |

||||||||||||||||

|

Acquisitions and divestitures |

— |

0.2 |

0.2 |

0.2 |

— |

0.2 |

— |

||||||||||||||||

|

Corporate hedging derivative losses (gains) |

(27.6) |

— |

(27.6) |

(27.6) |

(6.8) |

(20.8) |

(0.04) |

||||||||||||||||

|

Advertising and promotion expenses 2 |

— |

58.7 |

— |

— |

— |

— |

— |

||||||||||||||||

|

Fire related costs (insurance recoveries), net |

1.6 |

(3.3) |

(1.7) |

(1.7) |

(0.4) |

(1.3) |

— |

||||||||||||||||

|

Rounding |

— |

— |

— |

— |

— |

— |

(0.01) |

||||||||||||||||

|

Adjusted |

$ |

801.4 |

$ |

258.4 |

$ |

484.3 |

$ |

413.5 |

$ |

97.4 |

23.6 % |

$ |

315.9 |

$ |

0.66 |

||||||||

|

% of Net Sales |

27.6 % |

8.9 % |

16.7 % |

||||||||||||||||||||

|

1 Operating profit is derived from taking Income before income taxes, adding back Interest expense, net and removing Pension and postretirement non-service income and Equity method investment earnings. |

|

2 Advertising and promotion expense (A&P) has been removed from adjusted selling, general and administrative expense because this metric is used in reporting to management, and management believes this adjusted measure provides useful supplemental information to assess the company’s operating performance. Please note that A&P is not removed from adjusted profit measures. |

|

Conagra Brands, Inc. Reconciliation of Free Cash Flow, Net Debt, and Net Leverage Ratio (in millions) |

||||||||

|

Q1 FY25 |

Q1 FY24 |

% Change |

||||||

|

Net cash flows from operating activities |

$ |

268.6 |

$ |

443.5 |

(39.4) % |

|||

|

Additions to property, plant and equipment |

(133.0) |

(143.6) |

(7.4) % |

|||||

|

Free cash flow |

$ |

135.6 |

$ |

299.9 |

(54.8) % |

|||

|

August 25, 2024 |

August 27, 2023 |

|||||

|

Notes payable |

$ |

1,266.4 |

$ |

509.3 |

||

|

Current installments of long-term debt |

20.2 |

1,015.4 |

||||

|

Senior long-term debt, excluding current installments |

7,485.6 |

7,745.1 |

||||

|

Total Debt |

$ |

8,772.2 |

$ |

9,269.8 |

||

|

Less: Cash |

128.7 |

91.7 |

||||

|

Net Debt |

$ |

8,643.5 |

$ |

9,178.1 |

|

FY24 |

Q1 FY24 |

Q1 FY25 |

Q1 FY25 TTM |

|||||||||

|

(a) |

(b) |

(c) |

(a)-(b)+(c) |

|||||||||

|

Net Debt1 |

$ |

8,643.5 |

||||||||||

|

Net income attributable to Conagra Brands, Inc. |

$ |

347.2 |

$ |

319.7 |

$ |

466.8 |

$ |

494.3 |

||||

|

Add Back: Income tax expense (benefit) |

262.5 |

98.3 |

(138.9) |

25.3 |

||||||||

|

Income tax expense attributable to noncontrolling interests |

(0.2) |

— |

— |

(0.2) |

||||||||

|

Interest expense, net |

430.5 |

106.0 |

105.8 |

430.3 |

||||||||

|

Depreciation |

347.3 |

83.1 |

85.7 |

349.9 |

||||||||

|

Amortization |

53.6 |

13.5 |

13.4 |

53.5 |

||||||||

|

Earnings before interest, taxes, depreciation, and amortization (EBITDA) |

$ |

1,440.9 |

$ |

620.6 |

$ |

532.8 |

$ |

1,353.1 |

||||

|

Restructuring plans2 |

51.5 |

21.0 |

2.9 |

33.4 |

||||||||

|

Acquisitions and divestitures |

0.2 |

0.2 |

— |

— |

||||||||

|

Impairment of business held for sale |

36.4 |

— |

— |

36.4 |

||||||||

|

Corporate hedging derivative losses (gains) |

(16.1) |

(27.6) |

1.3 |

12.8 |

||||||||

|

Goodwill and brand impairment charges |

956.7 |

— |

— |

956.7 |

||||||||

|

Legal matters, net of recoveries |

34.8 |

— |

3.4 |

38.2 |

||||||||

|

Fire related insurance recoveries, net |

(8.7) |

(1.7) |

(17.0) |

(24.0) |

||||||||

|

Loss on sale of business |

— |

— |

2.3 |

2.3 |

||||||||

|

Pension settlement and valuation adjustment |

(11.5) |

— |

— |

(11.5) |

||||||||

|

Consulting fees on tax matters |

— |

— |

2.0 |

2.0 |

||||||||

|

Adjusted EBITDA |

$ |

2,484.2 |

$ |

612.5 |

$ |

527.7 |

$ |

2,399.4 |

||||

|

Net Debt to Adjusted EBITDA3 |

3.60 |

|

1 As of August 25, 2024. |

|

2 Excludes comparability items related to depreciation. |

|

3 The company defines its net debt leverage ratio as net debt divided by adjusted EBITDA for the trailing twelve month (TTM) period. |

|

Conagra Brands, Inc. Reconciliation of Q1 FY25 EBITDA – YOY Change (in millions)

|

||||||||

|

Q1 FY25 |

Q1 FY24 |

% Change |

||||||

|

Net income attributable to Conagra Brands, Inc. |

$ |

466.8 |

$ |

319.7 |

46.0 % |

|||

|

Add Back: Income tax expense (benefit) |

(138.9) |

98.3 |

||||||

|

Interest expense, net |

105.8 |

106.0 |

||||||

|

Depreciation |

85.7 |

83.1 |

||||||

|

Amortization |

13.4 |

13.5 |

||||||

|

Earnings before interest, taxes, depreciation, and amortization |

$ |

532.8 |

$ |

620.6 |

(14.1) % |

|||

|

Restructuring plans 1 |

2.9 |

21.0 |

||||||

|

Acquisitions and divestitures |

— |

0.2 |

||||||

|

Corporate hedging derivative losses (gains) |

1.3 |

(27.6) |

||||||

|

Fire related insurance recoveries, net |

(17.0) |

(1.7) |

||||||

|

Consulting fees on tax matters |

2.0 |

— |

||||||

|

Legal matters |

3.4 |

— |

||||||

|

Loss on sale of business |

2.3 |

— |

||||||

|

Adjusted Earnings before interest, taxes, depreciation, and amortization |

$ |

527.7 |

$ |

612.5 |

(13.8) % |

|||

|

1 Excludes comparability items related to depreciation. |

For more information, please contact:

MEDIA: Mike Cummins

312‑549‑5257

Michael.Cummins@conagra.com

INVESTORS: Melissa Napier

312‑549‑5738

IR@conagra.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/conagra-brands-reports-first-quarter-results-302264862.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/conagra-brands-reports-first-quarter-results-302264862.html

SOURCE Conagra Brands, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stellantis sales plunge in the U.S. as the CEO tries to fix his 'arrogant' mistakes

On Wednesday, Stellantis (STLA) reported another quarter of plunging sales as the company behind brands such as Jeep and Chrysler attempts to fix its so-called “disaster.”

The automaker sold 305,294 vehicles in the U.S. between June and September, a 20% decline compared with a year earlier. That follows a second quarter marked by a similar 21% year-over-year decline. The last time Stellantis had a quarterly sales increase was in the second quarter of 2023.

By volume, sales are down at all but one of Stellantis’ brands compared with a year earlier. Dodge and Chrysler reported the biggest hits, with sales down 47% and 43%, respectively, while sales for Ram, Alfa Romeo, and Jeep were down by smaller margins. Fiat’s sales grew by 118% to 316 units.

Stellantis’ performance in North America has been rough in recent months, plagued by big recalls, plummeting profits, quality issues, and executive departures. Although, the company noted, its market share grew to 8% from 7.2% a quarter earlier.

“We continue to take the necessary actions to drive sales and prepare our dealer network and consumers for the arrival of 2025 models,” Stellantis’ head of U.S. retail sales, Matt Thompson, said in a statement.