AppLovin Unusual Options Activity For October 02

Deep-pocketed investors have adopted a bullish approach towards AppLovin APP, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in APP usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 17 extraordinary options activities for AppLovin. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 52% leaning bullish and 17% bearish. Among these notable options, 2 are puts, totaling $112,680, and 15 are calls, amounting to $579,453.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $50.0 and $132.0 for AppLovin, spanning the last three months.

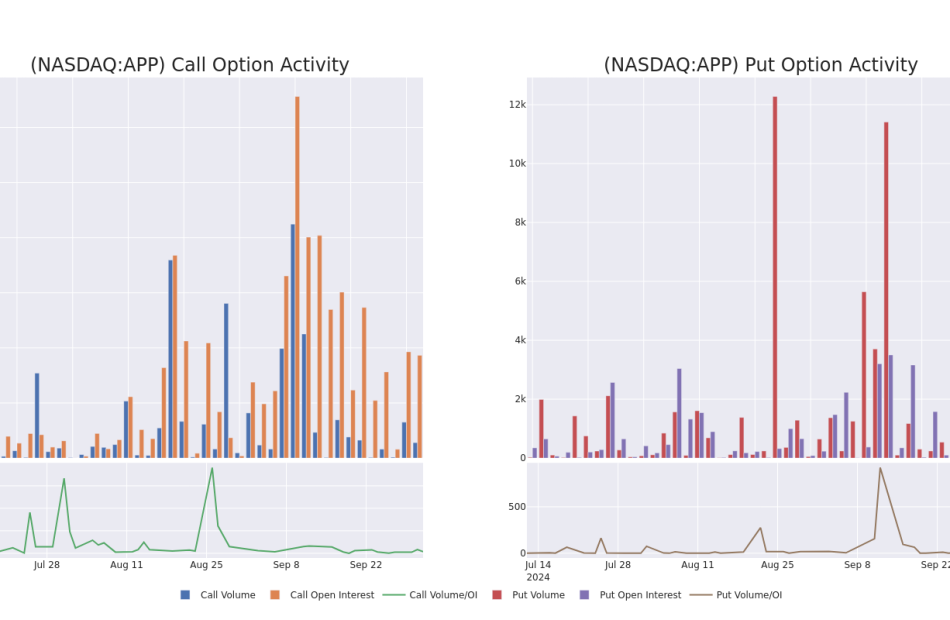

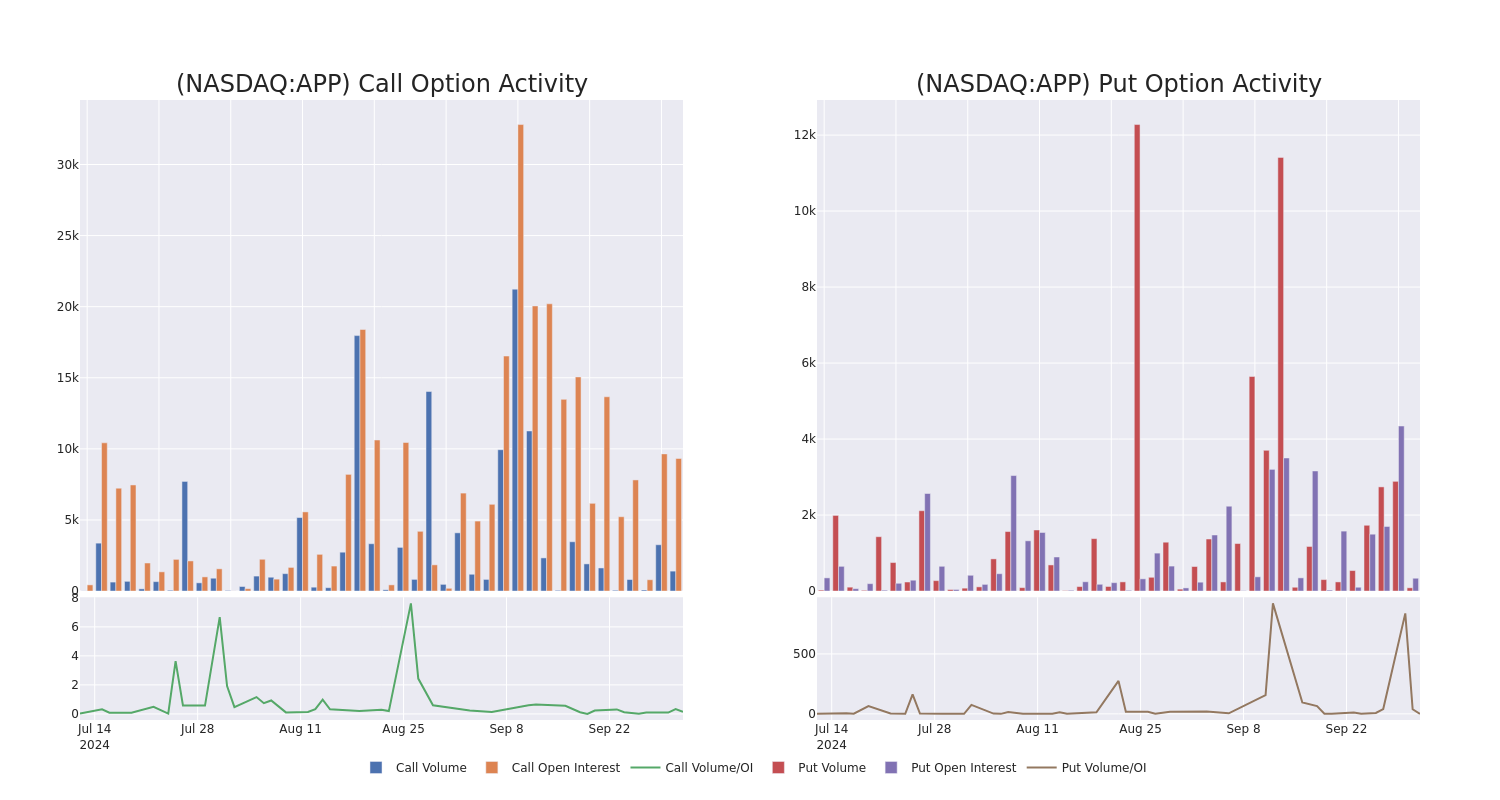

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in AppLovin’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to AppLovin’s substantial trades, within a strike price spectrum from $50.0 to $132.0 over the preceding 30 days.

AppLovin 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| APP | PUT | SWEEP | BULLISH | 03/21/25 | $15.2 | $15.0 | $15.0 | $125.00 | $87.0K | 70 | 0 |

| APP | CALL | SWEEP | BULLISH | 10/11/24 | $3.3 | $3.1 | $3.3 | $132.00 | $56.0K | 30 | 460 |

| APP | CALL | TRADE | BULLISH | 07/18/25 | $42.5 | $42.0 | $42.5 | $100.00 | $42.5K | 912 | 0 |

| APP | CALL | TRADE | BULLISH | 11/15/24 | $82.1 | $82.1 | $82.1 | $50.00 | $41.0K | 200 | 20 |

| APP | CALL | TRADE | BEARISH | 11/15/24 | $82.9 | $82.1 | $82.1 | $50.00 | $41.0K | 200 | 15 |

About AppLovin

AppLovin Corp is a mobile app technology company. It focuses on growing the mobile app ecosystem by enabling the success of mobile app developers. The company’s software solutions provide tools for mobile app developers to grow their businesses by automating and optimizing the marketing and monetization of their applications.

After a thorough review of the options trading surrounding AppLovin, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of AppLovin

- Currently trading with a volume of 925,725, the APP’s price is up by 0.74%, now at $131.62.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 35 days.

Professional Analyst Ratings for AppLovin

In the last month, 5 experts released ratings on this stock with an average target price of $135.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from UBS has elevated its stance to Buy, setting a new price target at $145.

* An analyst from B of A Securities persists with their Buy rating on AppLovin, maintaining a target price of $120.

* In a cautious move, an analyst from Macquarie downgraded its rating to Outperform, setting a price target of $150.

* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on AppLovin with a target price of $155.

* An analyst from Jefferies has decided to maintain their Buy rating on AppLovin, which currently sits at a price target of $108.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest AppLovin options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Ken Griffin Loaded Up on This High-Yield Dividend Stock. Should You?

Dividend stocks aren’t just for income investors. Want proof? Just look at Ken Griffin’s purchases for his Citadel hedge fund in the second quarter of 2024.

Griffin’s net worth is $43 billion. It’s fair to say he doesn’t need dividend income and is by no means an income investor. However, the billionaire loaded up on at least one high-yield dividend stock in Q2.

A big buy of a big pharma

Griffin went on a major buying spree in Q2. He increased Citadel’s stake by 20% or more for 35 of the hedge fund’s top-50 holdings.

Most of those purchases weren’t of high-yield dividend stocks. One notable exception, however, was Griffin’s big buy of a big pharma — Pfizer (NYSE: PFE). The drugmaker’s forward-dividend yield is a lofty 5.8%.

In Q2, Griffin bought 7.89 million additional shares of Pfizer. This increased Citadel’s stake by 63%. Pfizer now ranks as the hedge fund’s 14th-largest position and 12th-largest stock holding (the top-two overall holdings are exchange-traded funds, or ETFs).

Griffin has a long history with Pfizer. He first initiated a position in the pharma stock in 2013’s Q2. Through the years, the billionaire hedge fund manager has increased and decreased Citadel’s stake in Pfizer. Recently, though, he appears to be all aboard the big drugmaker’s bandwagon. Griffin has increased his position in Pfizer for six consecutive quarters.

Why does Griffin like Pfizer?

As far as I know, Griffin hasn’t commented publicly about why he has been aggressively adding to Citadel’s position in Pfizer. However, we can make a few educated guesses.

I’m sure he likes the company’s juicy dividend. To be sure, Griffin isn’t an income investor. But he no doubt recognizes that a dividend yield of nearly 6% gives Pfizer a nice head start on delivering market-beating total returns.

Valuation could be another top consideration for the billionaire investor. Pfizer’s share price remains roughly 50% below its peak set in late 2021. The stock’s forward price-to-earnings ratio is 10.3, much lower than the S&P 500 healthcare sector’s forward-earnings multiple of 19.6.

Griffin is big on diversification. Citadel’s portfolio includes a whopping 5,816 holdings. The addition to the position in Pfizer could have been in part to increase the hedge fund’s exposure to healthcare and, in particular, the pharmaceutical industry.

Ultimately, though, Griffin invests in specific stocks because he thinks they’ll make money. I suspect he likes Pfizer’s long-term growth prospects. Griffin is astute enough to understand the challenges the drugmaker faces, including declining sales of its COVID-19 products and a looming patent cliff with several top-selling drugs losing patent exclusivity. However, he also knows the efforts Pfizer has made to overcome these challenges, such as investing heavily in research and development and making acquisitions to bolster its pipeline.

Should you buy Pfizer stock, too?

No one should buy or sell a given stock solely to follow in the footsteps of a wealthy famous investor like Ken Griffin. However, the trades of successful investors can often provide good ideas to consider. Should you buy Pfizer stock, too?

Growth investors probably won’t find Pfizer super attractive. Although I think the big pharma company will deliver solid growth over the next few years, it likely won’t be enough to keep up with many tech stocks and other high-growth alternatives.

Highly risk-averse investors might want to remain on the sidelines with Pfizer as well. The drugmaker’s pipeline candidates could fail in clinical testing and cause the stock to drop. That’s less of a problem with a big company like Pfizer that has a deep pipeline, but it’s definitely something to keep in mind.

On the other hand, Pfizer could be a good fit for value investors. As previously mentioned, the stock is relatively cheap. If the company’s new products and late-stage pipeline programs fulfill their potential, Pfizer’s share price could rebound nicely over the rest of the decade.

And there’s one group of investors who should absolutely love Pfizer — income investors. Pfizer’s yield is exceptional. The company appears to be in a strong position to keep the dividends flowing. No, dividend stocks aren’t just for income investors. But a high-yield dividend stock with a long track record of success like Pfizer will usually be a better fit for income investors than any other type of investor.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $744,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Keith Speights has positions in Pfizer. The Motley Fool has positions in and recommends Pfizer. The Motley Fool has a disclosure policy.

Billionaire Ken Griffin Loaded Up on This High-Yield Dividend Stock. Should You? was originally published by The Motley Fool

Ford reports weak US sales for third quarter

Ford (F) on Wednesday became the latest US automaker to report weaker growth in domestic new vehicle sales in the third quarter, as buyers continued to shy away from purchases on affordability concerns.

The company’s shares fell about 2% in early trading.

Major automakers in the United States, including Toyota and General Motors, reported weaker sales for the quarter on Tuesday, with some citing affordability concerns and fewer selling days as a drag on performance.

Chrysler-parent Stellantis also reported a 20% drop in US quarterly sales on Wednesday and added that it would “continue to take the necessary actions” to drive sales and prepare for the arrival of its 2025 models.

Consumers have also shifted their preferences over the past year to favor affordable subcompact crossovers and pickup trucks instead of larger luxury models in the face of economic uncertainties.

Sales of Ford’s top-selling F-series trucks gained about 4% in the quarter, compared with last year’s nearly 13% rise. Affordable compact Maverick pickup truck’s sales jumped 33.2% to 31,883.

Ford’s overall sales in the quarter rose to 504,039 units from 500,504 a year ago. This compares to a 7.7% rise in sales for the same period last year.

Overall, US new vehicle sales in September stood at around 1.17 million units, which represents a seasonally adjusted annual rate of 15.77 million units, according to data released by Wards Intelligence on Tuesday.

(Reporting by Nathan Gomes in Bengaluru; Editing by Shreya Biswas and Maju Samuel)

These 3 Stocks Show How to Navigate Declining Consumer Confidence

Historically, investors have bet on the consumer discretionary sector when the Federal Reserve (the Fed) cuts interest rates, as these typically have a positive effect on consumer spending habits through easier and cheaper financing rates. However, this time it’s different, the state of the consumer is not what it used to be before, and that is sending money out of a few stocks in the space and into others.

Stocks in the retail industry, those that are highly dependent on domestic demand and consumer trends, will likely suffer from what’s happening behind the scenes in the economy. Lululemon Athletica Inc. LULU falls into this category, which is why price action and analyst downgrades have been working against the company lately. To avoid this pitfall, investors can look into those with much more international sales exposure.

A bigger brand like Nike Inc. with a large presence in international markets can help the financials of the business diversify across different trends and cycles. Benefitting from this same trend is Skechers Inc. SKX with over a third of its sales exposure being concentrated in European markets. Before investors dig deeper into he divergence between these names, they should understand why domestic markets are seeing lower demand.

Key Factors Behind the Recent Decline in Consumer Confidence Readings

Economists can keep thinking in black or white terms when it comes to the consumer, but the reality is that there are many more factors at play, such as psychology. The consumer today has to battle with rising unemployment rates, inflation in items like rent, groceries, and insurance.

The divergence between earning power and inflation has caused one major shift in the financial sector, one that drove Warren Buffett out of consumer credit stocks like Capital One Financial Co. COF over the past quarter. Credit card delinquencies are on the rise, and so are car repossession rates in their 23% annual spike.

Ultimately, the personal savings rate ended up negative in recent readings, meaning items like clothing and other discretionary items will likely be first to be put out of the monthly spending budget from consumers. Investors can probably guess what happens next to stocks that rely too much on domestic demand for these products, such as Lululemon.

The Trends Are Clear for Lululemon: Here Are the Key Details

Lululemon stock had been an investor favorite since the COVID-19 pandemic, when the Fed cut interest rates to a near historical low, an event that helped Lululemon see better prospects. However, today’s rate cuts come up against the weakening consumer state, which won’t probably have the same effect on the stock as they had a few years ago.

Wall Street analysts know this, and those at Raymond James, Citigroup, Deutsche Bank all downgraded Lululemon stock’s price target over the past month. This shift in sentiment serves as a warning for investors to consider, one that is weighted against these fundamental trends that also work against the stock.

More than that, bearish traders decided to raid the stock recently as well, as Lululemon stock’s short interest rose by as much as 10.8% in the past month, part of a quarterly trend higher. This new sentiment can be seen in the company’s price action lately as well.

Lululemon stock now trades at a low 50% of its 52-week high, meaning a deep bear market in the company’s value perception. The changing sentiment can also be attributed to Wall Street’s earnings per share (EPS) projections for the next 12 months.

Analysts predict that Lululemon will see only $2.85 EPS compared to today’s $3.15, calling for a net decline of 9.5% to bring the bearish thesis home. Despite the sock already trading at a low, investors should consider waiting a bit before forgiving its fall.

Why Nike and Skechers Are the Better Buys Right Now

Counting with a much bigger international presence, both Nike and Skechers are able to stay away from the potentially bigger contractions to be seen from the consumer sector in the United States, which is why Wall Street has treated both of them a bit better.

Not to mention, mega investor Bill Ackman recently took advantage of Nike’s sell-off to buy up a sizeable stake in the company, showing investors that value is in Nike rather than Lululemon stock despite both suffering from similar declines. Here’s what Wall Street had to say about Nike.

The consensus price target lies at $96.5 today, calling for up to 8% upside from where the stock trades right now. This is after the double-digit rally that Ackman’s purchase ignited as well. But that’s not all, the Healthcare of Ontario Pension Plan decided to boost their holdings by 625.4% in Nike, bringing their net investment to $5.8 million today.

All told, Nike stock now trades at 72% of its 52-week high to be significantly above Lululemon.

Skechers brings a similar thesis to the market, as the stock sits at 92% of its 52-week high to show investors bullish momentum in recent months.

Analysts at Bank of America felt comfortable boosting the stock’s price target up to $81 a share, daring it to rally by as much as 17% from where it trades today and also make a new yearly high. Short sellers are also starting to capitulate in front of this trend, as Skechers stock’s short interest declined by 9.2% in the past month.

With declining short interest and increasing analyst confidence, Skechers appears poised for continued strength. If current trends persist, the stock could soon challenge its previous highs, further supported by strong market sentiment.

Fundamentally, these two have much better upside and safety than Lululemon, which is why investors should consider them as potential buys in the middle of a weakening consumer sentiment reading.

The article “These 3 Stocks Show How to Navigate Declining Consumer Confidence” first appeared on MarketBeat.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How To Earn $500 A Month From ConocoPhillips Stock

Shares of energy companies traded higher during the session as tensions in the Middle East heightened.

Some investors may be eyeing potential gains from ConocoPhillips’ dividends. As of now, the crude oil producer offers an annual dividend yield of 2.85%. That’s a quarterly dividend of 78 cents per share ($3.12 a year).

To figure out how to earn $500 monthly from ConocoPhillips, we start with the yearly target of $6,000 ($500 x 12 months).

Next, we take this amount and divide it by ConocoPhillips’ $3.12 dividend: $6,000 / $3.12 = 1,923 shares

So, an investor would need to own approximately $210,319 worth of ConocoPhillips, or 1,923 shares to generate a monthly dividend income of $500.

Assuming a more conservative goal of $100 monthly ($1,200 annually), we do the same calculation: $1,200 / $3.12 = 385 shares, or $42,107 to generate a monthly dividend income of $100.

Note that dividend yield can change on a rolling basis, as the dividend payment and the stock price both fluctuate over time.

The dividend yield is calculated by dividing the annual dividend payment by the current stock price. As the stock price changes, the dividend yield will also change.

For example, if a stock pays an annual dividend of $2 and its current price is $50, its dividend yield would be 4%. However, if the stock price increases to $60, the dividend yield would decrease to 3.33% ($2/$60).

Conversely, if the stock price decreases to $40, the dividend yield would increase to 5% ($2/$40).

Further, the dividend payment itself can also change over time, which can also impact the dividend yield. If a company increases its dividend payment, the dividend yield will increase even if the stock price remains the same. Similarly, if a company decreases its dividend payment, the dividend yield will decrease.

Price Action: Shares of ConocoPhillips gained by 3.9% to close at $109.37 on Tuesday.

A report suggests Iran is preparing to directly attack Israel, which could create shocks to the global economy.

On Sept. 30, Truist Securities analyst Neal Dingmann maintained ConocoPhillips with a Buy rating and lowered the price target from $145 to $138.

Read More:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On Axon Enterprise

Deep-pocketed investors have adopted a bullish approach towards Axon Enterprise AXON, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AXON usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 10 extraordinary options activities for Axon Enterprise. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 80% leaning bullish and 10% bearish. Among these notable options, 4 are puts, totaling $363,329, and 6 are calls, amounting to $232,370.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $150.0 to $450.0 for Axon Enterprise during the past quarter.

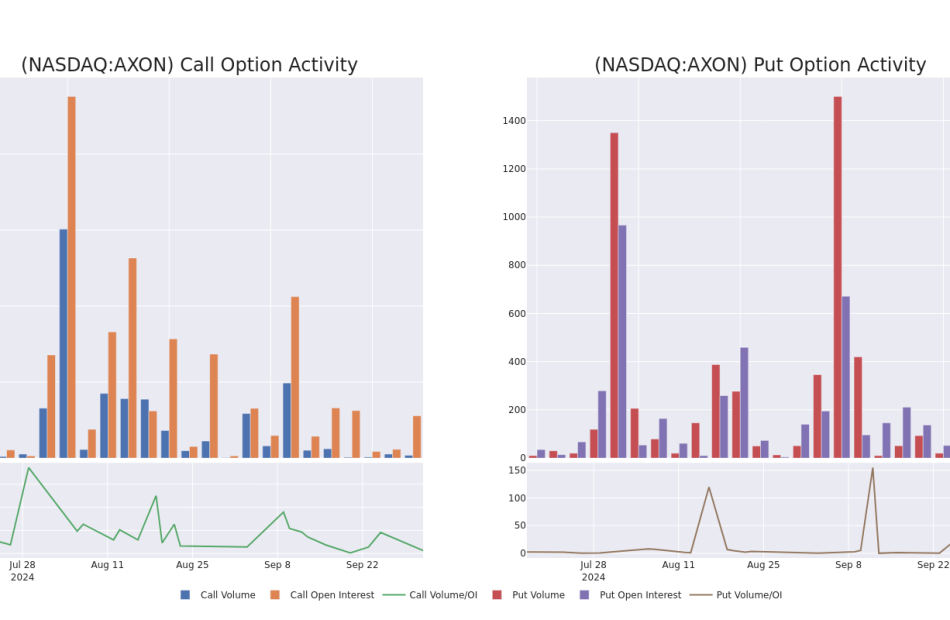

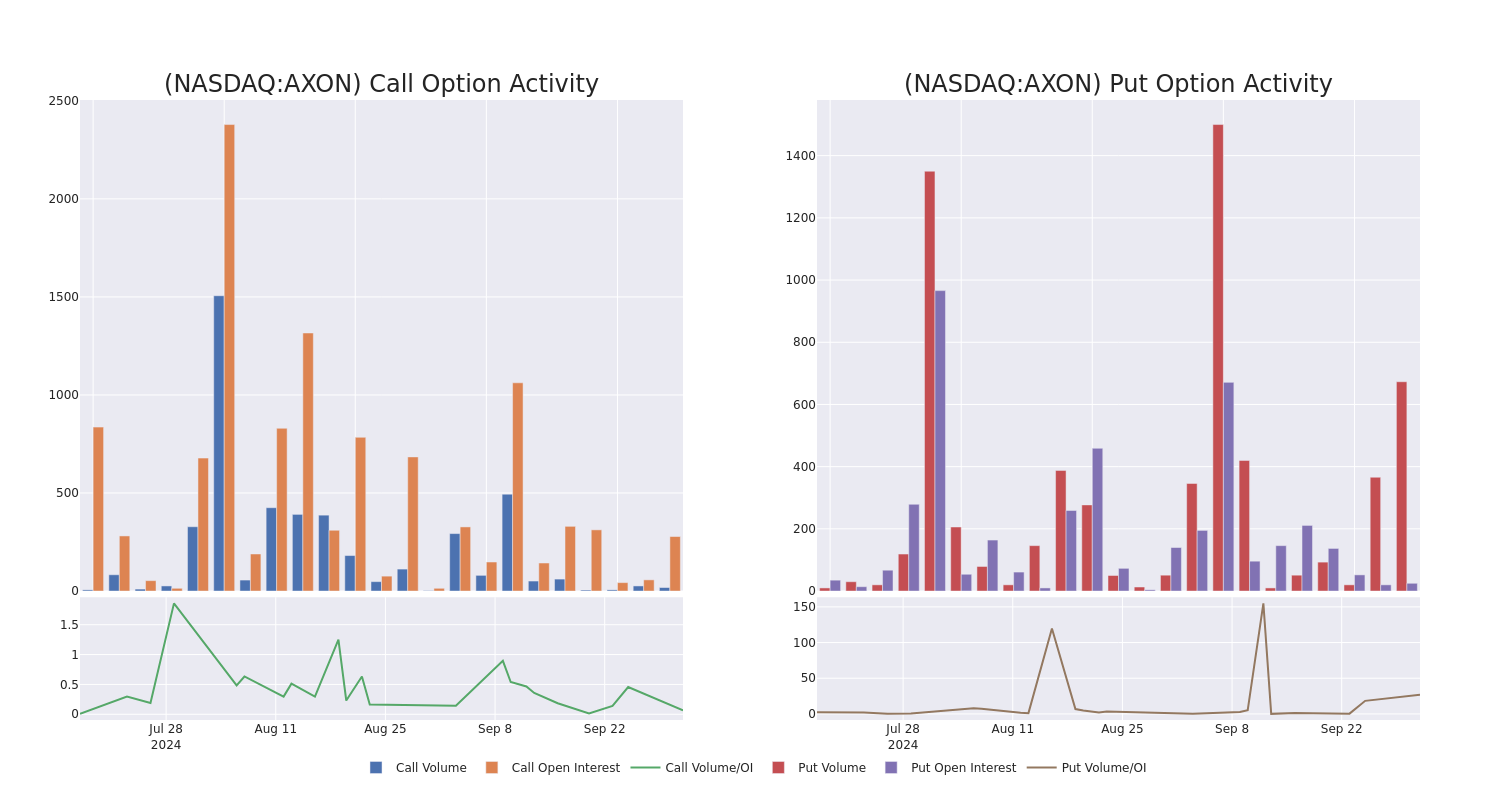

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Axon Enterprise options trades today is 43.29 with a total volume of 691.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Axon Enterprise’s big money trades within a strike price range of $150.0 to $450.0 over the last 30 days.

Axon Enterprise Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AXON | PUT | SWEEP | BEARISH | 11/15/24 | $16.3 | $16.2 | $16.2 | $390.00 | $159.9K | 25 | 227 |

| AXON | PUT | SWEEP | NEUTRAL | 11/15/24 | $16.4 | $16.3 | $16.3 | $390.00 | $140.1K | 25 | 88 |

| AXON | CALL | TRADE | BULLISH | 01/17/25 | $68.0 | $66.7 | $68.0 | $350.00 | $68.0K | 89 | 10 |

| AXON | CALL | TRADE | BULLISH | 01/16/26 | $102.0 | $99.5 | $102.0 | $350.00 | $51.0K | 106 | 5 |

| AXON | PUT | SWEEP | BULLISH | 11/15/24 | $17.1 | $16.8 | $16.8 | $390.00 | $37.1K | 25 | 249 |

About Axon Enterprise

Axon Enterprise Inc develops, manufactures, and sells conducted energy devices and cloud-based digital evidence management software designed for use by law enforcement, corrections, military forces, private security personnel, and private individuals for personal defense. The company operates in two segments: Taser and software & sensors. Taser develops and sells CEDs used for protecting users and virtual reality training. Software and sensors manufacture fully integrated hardware and cloud-based software solutions such as body cameras, automated license plate reading, and digital evidence management systems. Axon delivers its products worldwide and derives the majority of its revenue from the software & sensors segment and geographically from the United States.

After a thorough review of the options trading surrounding Axon Enterprise, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Axon Enterprise’s Current Market Status

- Trading volume stands at 194,663, with AXON’s price up by 1.32%, positioned at $404.49.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 34 days.

What The Experts Say On Axon Enterprise

3 market experts have recently issued ratings for this stock, with a consensus target price of $401.6666666666667.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Baird keeps a Outperform rating on Axon Enterprise with a target price of $400.

* Maintaining their stance, an analyst from JMP Securities continues to hold a Market Outperform rating for Axon Enterprise, targeting a price of $430.

* Reflecting concerns, an analyst from JMP Securities lowers its rating to Market Outperform with a new price target of $375.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Axon Enterprise options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Sensational Ultrahigh-Yield Dividend Stocks That Make for No-Brainer Buys in the 4th Quarter (and Beyond)

One of the best aspects of putting your money to work on Wall Street is that there’s no one-size-fits-all strategy. With thousands of publicly traded companies and exchange-traded funds (ETFs) to choose from, investors of all walks and risk tolerances can find securities that match their investing goals.

There are, however, certain strategies that generate higher returns than others. Over the last century, few strategies have been more successful than buying and holding high-quality dividend stocks.

In The Power of Dividends: Past, Present, and Future, the analysts at Hartford Funds examined the many ways income stocks have outperformed non-payers over extended timelines. In particular, Hartford Funds, in collaboration with Ned Davis Research, found that dividend stocks had more than doubled up the average annual return of non-payers (9.17% vs. 4.27%) over the last half-century and did so while being less volatile than non-payers.

But this doesn’t mean all dividend stocks are created equally. For example, ultrahigh-yield dividend stocks — i.e., companies with yields that are four or more times higher than the current yield of the S&P 500 (1.27%) — can sometimes be more trouble than they’re worth. A failing or struggling operating model and a falling share price can “trap” investors seeking a supercharged yield.

Thankfully, not all high-octane income stocks turn out to be trouble. The following three sensational ultrahigh-yield dividend stocks — sporting an average yield of 6.23% — make for no-brainer buys in the fourth quarter and likely well beyond.

Pfizer: 5.81% yield

The first outsized dividend payer that patient investors can scoop up with confidence during Q4 is pharmaceutical kingpin Pfizer (NYSE: PFE).

As I’ve pointed out previously, Pfizer has been a victim of its own success. It’s one of a small number of drug companies to have successfully developed a COVID-19 vaccine (Comirnaty), as well as an oral therapy to reduce the severity of COVID-19 symptoms (Paxlovid). After topping $56 billion in combined sales for these drugs in 2022, Comirnaty and Paxlovid are only expected to generate around $8.5 billion in cumulative sales for Pfizer this year.

But if investors take a step back, they’ll realize just how far Pfizer has come since this decade began. Since delivering $41.9 billion in full-year sales in 2020, Pfizer is pacing $61 billion in revenue for 2024 based on the midpoint of its sales guidance. That’s 46% sales growth in four years, with approximately 45% of this expansion coming from the company’s COVID-19 duo. There’s no question that Pfizer is a stronger company now than it was four years ago.

Pfizer also has inorganic growth to look forward to. In December, it closed a $43 billion deal to acquire cancer drug developer Seagen. Despite this buyout adversely impacting earnings per share (EPS) in 2024, it’s expected to lead to meaningful cost savings and will notably expand Pfizer’s cancer drug pipeline and product portfolio.

The final piece of the puzzle that should have income seekers salivating is Pfizer’s valuation. The company’s forward price-to-earnings (P/E) ratio of 10 is well below the S&P 500’s forward P/E, and it represents a 7% discount to Pfizer’s average forward-year earnings multiple over the trailing-five-year period.

Enterprise Products Partners: 7.21% yield

A second unbreakable dividend stock that income seekers can add with confidence in Q4 is energy juggernaut Enterprise Products Partners (NYSE: EPD). Enterprise has increased its base annual distribution in each of the last 26 years.

Whereas most oil and gas stocks were clobbered by the historic demand cliff that occurred during the early stages of the pandemic, Enterprise Products Partners largely avoided this disruption. It’s not-so-subtle secret is that it’s an energy middleman. Midstream companies like Enterprise are responsible for transporting and storing oil and natural gas, as well as refined product.

Enterprise’s key to success is the nature of its contracts with upstream drilling companies. Specifically, it locks in long-term contracts with drilling companies, many of which are fixed fee. This “fixed-fee” aspect removes the effects of inflation and energy commodity spot-price volatility from the equation. In short, it makes Enterprise’s operating cash flow highly predictable in pretty much any economic climate.

Something else that’s working in Enterprise Products Partners’ favor is the tight global supply for crude oil. Multiple years of capital underinvestment during the COVID-19 pandemic, combined with Russia’s invasion of Ukraine, has created supply uncertainties that have, generally, been positive for the spot price of crude oil. A higher spot price from oil should encourage domestic drilling and provide additional opportunities for the company to secure lucrative, long-term, fixed-fee contracts.

Enterprise Products Partners’ valuation also remains attractive. Shares can be picked up by opportunistic investors for 10 times forward-year earnings, which is a reasonably cheap valuation with earnings per share expected to grow by an annual average of 6.6% through 2028.

Ford Motor Company: 5.68% yield

The third sensational ultrahigh-yield dividend stock that makes for a no-brainer buy in Q4 is automaker Ford Motor Company (NYSE: F). The July tumble in Ford’s stock following the release of its Q2 operating results has sent its yield to almost 5.7%.

Ford’s recent struggles can be traced to industrywide weakness in electric vehicle (EV) sales. Everything from increasing EV competition and price wars to a lack of available infrastructure have ballooned Ford’s Model e (its EV operations) loss estimates to between $5 billion and $5.5 billion this year. EVs were supposed to be a megacatalyst for the auto industry but have predominantly weighed down the operating performance of legacy automakers.

The good news for Ford is that it has the ability to hit the accelerator or pump the brakes, as needed. Despite once-lofty spending expectations on EVs, the company announced plans to postpone $12 billion of its expected EV manufacturing investments last October.

More importantly, Ford’s internal combustion engine (ICE) vehicles are crushing it from an operating standpoint. The company’s F-Series pickup has been the best-selling truck in the U.S. for 47 straight years and the top-selling vehicle (period!) for the last 42 years. Trucks generate substantially juicier margins than smaller sedans, so maintaining momentum for its heavy duty truck line is a big win for the company.

In July, Ford lifted its adjusted free-cash-flow outlook for 2024 by $1 billion to a range of $7.5 billion to $8.5 billion. Strong sales for the company’s F-Series, coupled with abundant opportunities overseas, has Ford’s ICE vehicles firing on all cylinders.

Ford’s historically cheap valuation is the cherry on the sundae that should have income investors shifting into buy mode. Even though auto stocks are highly cyclical and consistently trade at a significant discount to the forward-year earnings multiple of the S&P 500, Ford’s forward P/E of just 5.5 is begging for investors to take notice.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $744,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

3 Sensational Ultrahigh-Yield Dividend Stocks That Make for No-Brainer Buys in the 4th Quarter (and Beyond) was originally published by The Motley Fool

Interactive Brokers Reports Y/Y Increase in September Client DARTs

Interactive Brokers Group, Inc. IBKR has released the Electronic Brokerage segment’s performance metrics for September 2024. The segment deals with the clearance and settlement of trades for individual and institutional clients globally. It reported a rise in client Daily Average Revenue Trades (DARTs).

IBKR’s September Performance Breakdown

Total client DARTs in September were 2,634,000, which increased 46.5% from September 2023 but fell 2.9% from the last month.

On an annualized basis, the Cleared Average DARTs per customer account was 190 for September 2024. The metric increased 13.1% on a year-over-year basis but declined 4% from August 2024.

IBKR’s total customer accounts rose 28.3% year over year and 1.9% from the last month to 3.1 million. Net new accounts were 58,200, witnessing a decline of 6.9% year over year and 12.7% sequentially.

Interactive Brokers’ total options contracts were 100 million in September 2024, up 32.5% year over year but down 10.5% sequentially. Future contracts declined marginally year over year and 15.5% from August to 17 million.

At the end of September 2024, client equity was $541.5 billion, which grew 46.4% year over year and 5.1% from the last month. IBKR recorded client credit balances of $116.7 billion, up 19.1% from September 2023 and 5.1% from the August 2024 level. The company’s customer margin loan balance of $55.8 billion increased 28% from the year-ago month and 1.6% from the last month.

IBKR’s Zacks Rank & Price Performance

Year to date, shares of Interactive Brokers have surged 66.8%, outperforming the industry’s growth of 17.7%.

Image Source: Zacks Investment Research

Currently, IBKR has a Zacks Rank #3 (Hold).

Two other brokerage firms, The Charles Schwab Corporation SCHW and LPL Financial Holdings Inc. LPLA, will come out with their monthly performances in the coming days.

The Zacks Consensus Estimate for SCHW 2024 earnings per share has moved marginally downward over the past 60 days while the metric has moved marginally upward for LPLA in the past month.

At present, SCHW & LPLA carry a Zacks Rank #3 each.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What the Options Market Tells Us About Visa

Whales with a lot of money to spend have taken a noticeably bearish stance on Visa.

Looking at options history for Visa V we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 10% of the investors opened trades with bullish expectations and 40% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $131,105 and 7, calls, for a total amount of $395,465.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $250.0 to $330.0 for Visa over the recent three months.

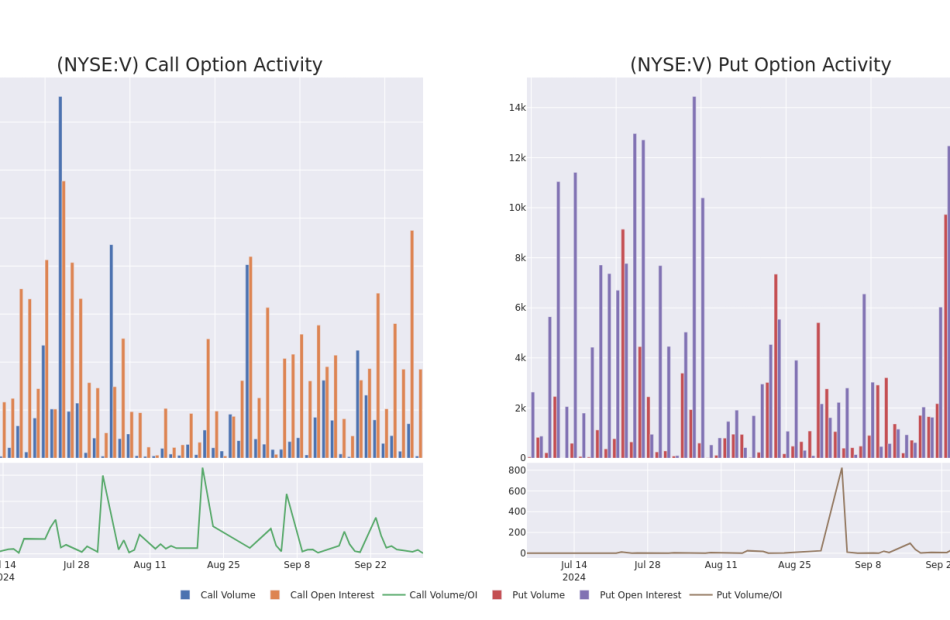

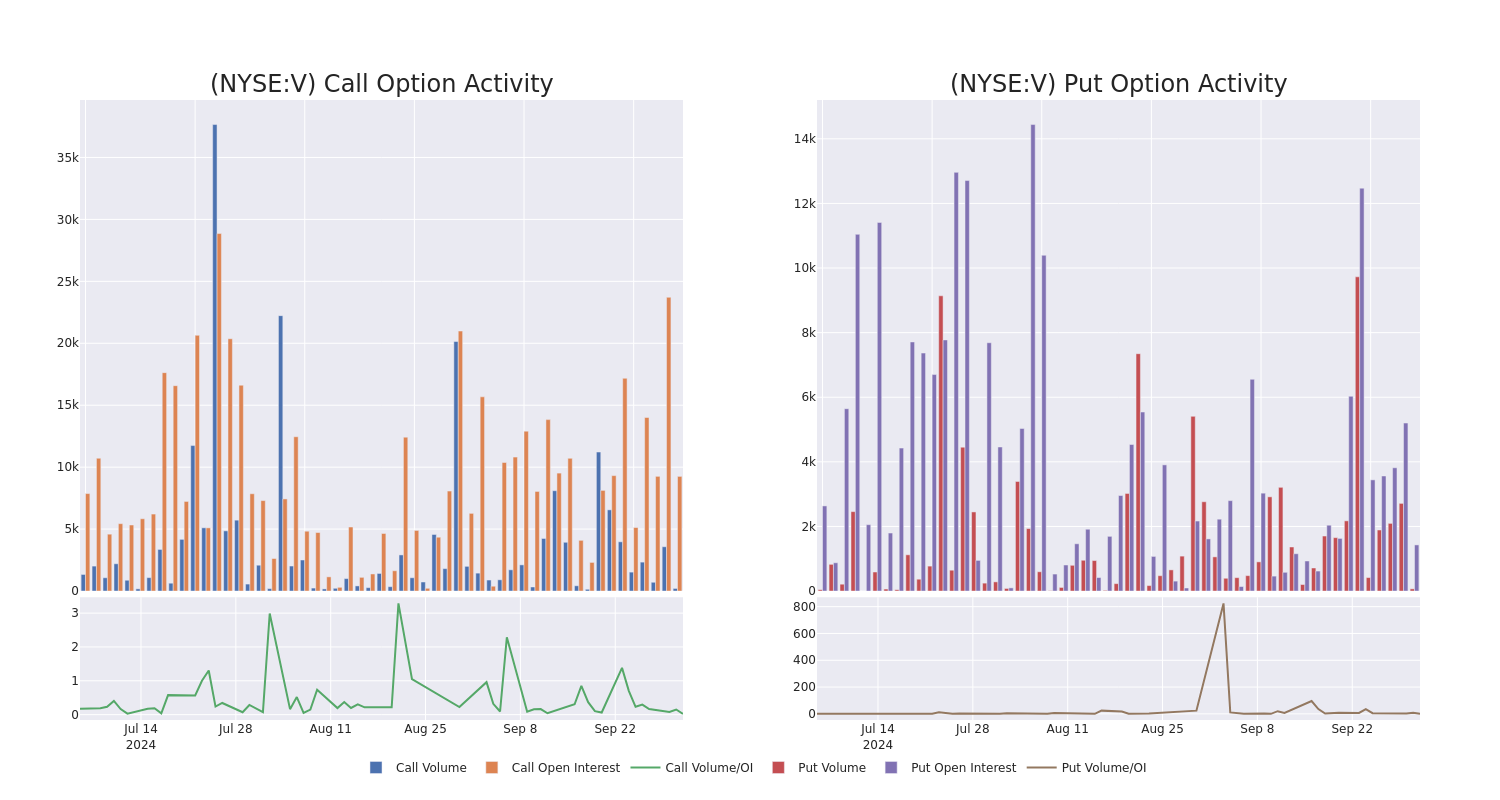

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Visa’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Visa’s significant trades, within a strike price range of $250.0 to $330.0, over the past month.

Visa Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| V | CALL | SWEEP | BULLISH | 06/20/25 | $16.4 | $16.2 | $16.4 | $290.00 | $163.9K | 988 | 1 |

| V | PUT | TRADE | NEUTRAL | 01/17/25 | $12.2 | $11.9 | $12.05 | $280.00 | $75.9K | 1.4K | 63 |

| V | CALL | TRADE | NEUTRAL | 02/21/25 | $6.4 | $6.25 | $6.33 | $300.00 | $63.3K | 348 | 100 |

| V | CALL | TRADE | BEARISH | 01/17/25 | $32.7 | $32.6 | $32.6 | $250.00 | $52.1K | 3.9K | 32 |

| V | CALL | TRADE | BEARISH | 01/17/25 | $33.05 | $32.65 | $32.65 | $250.00 | $32.6K | 3.9K | 6 |

About Visa

Visa is the largest payment processor in the world. In fiscal 2023, it processed almost $15 trillion in total volume. Visa operates in over 200 countries and processes transactions in over 160 currencies. Its systems are capable of processing over 65,000 transactions per second.

Where Is Visa Standing Right Now?

- Trading volume stands at 1,754,005, with V’s price down by -0.5%, positioned at $276.2.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 20 days.

Expert Opinions on Visa

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $315.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Visa with a target price of $322.

* An analyst from Goldman Sachs persists with their Buy rating on Visa, maintaining a target price of $317.

* An analyst from Oppenheimer has revised its rating downward to Outperform, adjusting the price target to $318.

* An analyst from Compass Point downgraded its action to Buy with a price target of $319.

* An analyst from Macquarie has decided to maintain their Outperform rating on Visa, which currently sits at a price target of $300.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Visa options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

These 3 Bargain-Bin Dividend Value Stocks Have Become Too Cheap to Ignore

The major stock market indexes continue to blast through record highs as 2024 shapes up to be another great year for investors. Since the start of 2023, the S&P 500 is up a mind-numbing 49.5%.

Despite the impressive performance, investors can still scoop up shares of quality companies without paying an exorbitant price relative to earnings. Honeywell (NASDAQ: HON), Phillips 66 (NYSE: PSX), and Delta Air Lines (NYSE: DAL) are three value stocks that pay dividends and are worth buying now.

Honeywell is making an effort to please investors with capital commitments

Daniel Foelber (Honeywell): On Sept. 27, Honeywell increased its dividend by 4.6% from $4.32 per share per year to $4.52. The increase puts Honeywell on track to deliver its 15th consecutive year of higher dividends in 2025 and is part of the company’s plan to boost shareholder value through dividends, acquisitions, capital expenditures, and buybacks.

Honeywell’s growth has been disappointing in recent years as the company has failed to convert opportunities in automation, the industrial Internet of Things, aerospace, and the energy transition into meaningful top- and bottom-line results. But there’s reason to be optimistic going forward.

Honeywell tends to be a stodgy company that is slow to change. But in June 2023, former head of Honeywell Performance Materials and Technologies, Vimal Kapur, took over as Honeywell CEO. In October 2023, Honeywell announced a strategic shift to realign its business to capitalize on its highest-conviction megatrends.

In its July investor presentation, Honeywell said it had already announced $10 billion in mergers and acquisitions (M&A) since 2023 and was on track to reduce its share count by 2% in 2024 through buybacks. The company is targeting $22 billion in share repurchases, M&A, and dividends between 2023 and 2025.

Honeywell remains in prove-it mode, but it has done a good job resetting expectations and setting a clear path toward achieving the steady earnings growth that investors were used to in years past.

As for Honeywell’s valuation, the stock’s price-to-earnings (P/E) ratio and price-to-free cash flow ratio are both below their five-year median levels, suggesting investors are less optimistic about the company’s future prospects.

Honeywell was a market darling in the 2010s, posting a total return of 499% compared to 257% for the S&P 500. But in the 2020s, Honeywell has been a market underperformer for good reason, considering its underwhelming earnings growth.

It’s too early to say the worst is over for Honeywell, but the stock’s valuation, growing dividend, and potential to accelerate its turnaround make it a worthy value stock to consider buying now.

Forget the brakes, it’s time to step on the gas with Phillips 66 stock

Scott Levine (Phillips 66): You don’t have to be an expert in energy stocks to know that when oil and gas prices decline, energy stocks are likely to also slide. This is certainly the case with Phillips 66 over the past six months. During this time period, oil-price benchmark West Texas Intermediate fell about 12.3%, and shares of Phillips 66 have plunged more than 17%. For forward-looking investors, this sell-off provides a great buying opportunity for the energy stock — along with its juicy 3.5% forward-yielding dividend.

An operator of various midstream and downstream assets, Phillips 66 has reported strong financial results so far in 2024 albeit not as high as in the same period during 2023. Through the first half of 2024, Phillips 66 reported $3.3 billion in operating cash flow, a decrease from the $4.5 billion in cash from operations that it reported during the same period in 2023.

It’s critical to recognize, however, that the inferior performance simply reflects the impact of falling commodity prices. In fact, Phillips 66 achieved $100 million in cost reductions in the first and second quarters of 2024, and in its refining segment, the company reported 98% crude utilization — the highest such rate in over five years.

Although the stock’s slide may be disconcerting for some, it by no means signals that investors should keep it off their buy lists. Energy prices will rise again, and Phillips 66 stock will likely rebound with them. Until then — and even after — investors can rake in a steady stream of passive income as management intends to return 50% of operating cash flow to investors in the form of dividends.

An excellent value stock in the transportation sector

Lee Samaha (Delta Air Lines): The airline trades at just 7.7 times its estimated 2024 earnings and represents an excellent value opportunity for investors looking for exposure to airline stocks. The low valuation is likely a reflection of the perceived risk in the stock coming from its debt profile and its exposure to the cyclical nature of the airline industry.

However, those risks look overstated. Delta Air Lines currently has $19.2 billion in net debt, but management is focused on paying it down — and with $3 billion to $4 billion in free cash flow expected in 2024, it will have resources to do so further this year.

In addition, investors recently received some good news on the “cyclicality” issue. In usual cycles, airlines have tended to build capacity as the market improves, only to overextend themselves and walk into a period of overcapacity when demand growth starts to slow. The result is usually a sharp profit slowdown, as airlines stubbornly maintain unprofitable routes while waiting for an upturn.

Investors were worried about that scenario when overcapacity reared its head in the summer. However, Delta and United Airlines‘ management spoke at a conference recently and confirmed that the industry had acted rationally and cut less-profitable routes. As such, Delta and United are improving their revenue per available seat miles (RASM) metric again, implying that the overcapacity issue has gone.

That’s good news. With interest rates set to move lower, airlines could benefit from improved consumer discretionary spending and corporate travel. As such, Delta Air Lines looks like an excellent value stock.

Should you invest $1,000 in Honeywell International right now?

Before you buy stock in Honeywell International, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Honeywell International wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,988!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Daniel Foelber has no position in any of the stocks mentioned. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool recommends Delta Air Lines. The Motley Fool has a disclosure policy.

These 3 Bargain-Bin Dividend Value Stocks Have Become Too Cheap to Ignore was originally published by The Motley Fool