Why Nikola Stock Jumped More Than 25% Today

Nikola (NASDAQ: NKLA) stock hit its 52-week lows on Sept. 26 and had plunged a staggering 82% year to date by yesterday’s market close. Today, shares of the electric vehicle (EV) maker skyrocketed and were up more than 25% as of noon Wednesday after the company reported record sales for the third quarter. The emphasis on “record” is important here, as you will soon understand.

Nikola is finally selling more trucks

Nikola delivered 88 heavy-duty Class 8 hydrogen fuel-cell trucks to its dealers in Q3. It was the highest-ever third-quarter sales for the company. Deliveries also rose sequentially from 72 fuel-cell trucks in the second quarter.

Deliveries, however, were within Nikola’s Q3 guidance range of 80 to 100 fuel-cell trucks. That could make one wonder why the stock still jumped by double-digit percentages on Wednesday. The thing is, Nikola has consistently missed its financial goals, so investors perhaps see a silver lining in the company’s latest sales numbers that met management’s targets.

Is this the bottoming for Nikola stock and time to buy?

Nikola began delivering hydrogen fuel-cell trucks in the fourth quarter of 2023 after shifting focus away from battery-electric vehicles, so it’s too early to celebrate “record” sales. Simply put, if you’re an investor or looking to invest in Nikola stock, you’d want to look beyond today’s headlines.

To be sure, higher sales should lift Nikola’s revenue and help it cut losses. Nikola generated around $31 million in revenue in Q2 but reported a gross loss of nearly $55 million, although losses were down sequentially. Nikola has potential as it’s the only company commercially selling Class 8 fuel-cell EVs in North America.

The company, however, has delivered only 235 trucks so far, is burning cash rapidly, and is issuing stock to raise funds. Those are just some of the factors you’d want to keep in mind before jumping the bandwagon on Nikola stock.

Should you invest $1,000 in Nikola right now?

Before you buy stock in Nikola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nikola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,988!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why Nikola Stock Jumped More Than 25% Today was originally published by The Motley Fool

ConAgra Misses The Mark: Manufacturing Disruptions And Weak Sales Weigh Down Q1 Performance

ConAgra Brands, Inc. CAG shares are trading lower after the company reported first-quarter results.

ConAgra reported quarterly adjusted earnings per share of 53 cents, missing the analyst consensus of 60 cents. Net sales of $2.79 billion (down 3.8%) missed the street view of $2.84 billion.

The 3.5% drop in organic net sales was driven by a 1.9% negative impact from price/mix, primarily driven by the company’s strategic investments and a 1.6% decrease in volume.

Also, the company estimates that results in the quarter were impacted by approximately $27 million due to temporary manufacturing disruptions in the Hebrew National business during the key grilling season.

In the quarter under review, adjusted operating margin was 14.2%, representing a 244 basis point decrease. Adjusted gross profit decreased 9.4% to $726 million.

Also Read: Eli Lilly Nears First Trillion Pharma Title, But Investors Caution Amid Sky-High Valuation

Net sales for the Grocery & Snacks segment decreased by 1.7% to $1.2 billion in the quarter, the Refrigerated & Frozen segment decreased by 5.7% to $1.1 billion, the Foodservice segment decreased by 7.8% to $267 million, and the International segment decreased by 0.4% to $259 million.

Conagra’s quarterly dividend payment of $0.35 per share will be paid on November 27 to stockholders of record as of the close of business on October 31.

Outlook: Conagra Brands is reaffirming its fiscal 2025 guidance, projecting organic net sales to be between a decline of 1.5% and flat compared to fiscal year 2024, and expects adjusted earnings per share (EPS) to be between $2.60 and $2.65, compared to an estimated $2.61.

Price Action: CAG shares are trading lower by 3.18% to $31.68 premarket at last check Wednesday.

Image via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Geopolitical Risks May Be Biggest Threat To Markets, BoE Says

Geopolitical risks may be the biggest threat to global markets, the Bank of England (BoE) warned on Wednesday.

“Global vulnerabilities remain material, as does uncertainty around the geopolitical environment,” the BoE said. “Markets remain susceptible to a sharp correction.”

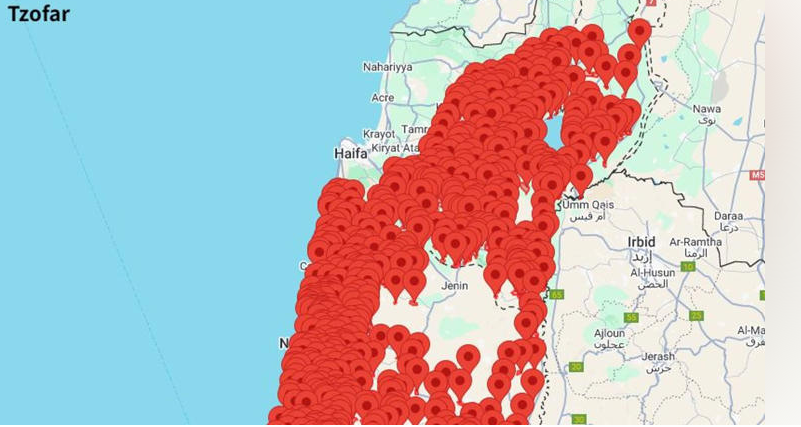

The BoE published its Financial Policy Committee Record a day after Iran launched at least 180 ballistic missiles at Israel. The barrage of missiles has increased fears of wider war in the Middle East.

A map showing the sirens sounded across Israel as the barrage began Source: msn.com

Concerns about an escalation in Mideast violence increased after Israel killed Hezbollah’s leader Hassan Nasrallah in airstrikes on September 27.

JPMorgan JPM CEO Jamie Dimon warned on September 24 that there was “a lot of war taking place right now.”

“My caution is all geopolitics,” he said in an interview with CNBC TV18 at a JPM conference in Mumbai.

Global Markets React To Geopolitical Risks

European markets and global oil prices reacted quickly to the ballistic missile attack.

The Euro Area Stoxx 600 continued its retreat from its record high, trading flat today. Germany’s DAX40 pulled back from its record level, falling 0.55% today and continuing its 1.8% retreat a high of 19,473.

Brent crude oil rose 3.19% after the attack on Tuesday, reversing most of its September slump.

The World Bank said in April severe disruption in oil supplies could push Brent oil prices above $100 per barrel.

“The geopolitically-driven increases in oil prices continue this morning,” Mohamed El-Erian, Queens’ College Cambridge president, wrote on X.

“Because there has been no actual disruption,” oil prices haven’t spiked, El-Erian, who is also a Bloomberg Opinion columnist, wrote.

A further conflagration could drive up prices of natural gas, fertilizers, and food, the World Bank said at the time.

“No oil and gas facilities have been damaged and logistics keep working,” Paul Sullivan, a John Hopkins University Lecturer, said.

“Risk premia for oil and oil transport could increase significantly if there is a directed attack” on infrastructure, he added.

Geopolitical Developments Worry ECB Officials

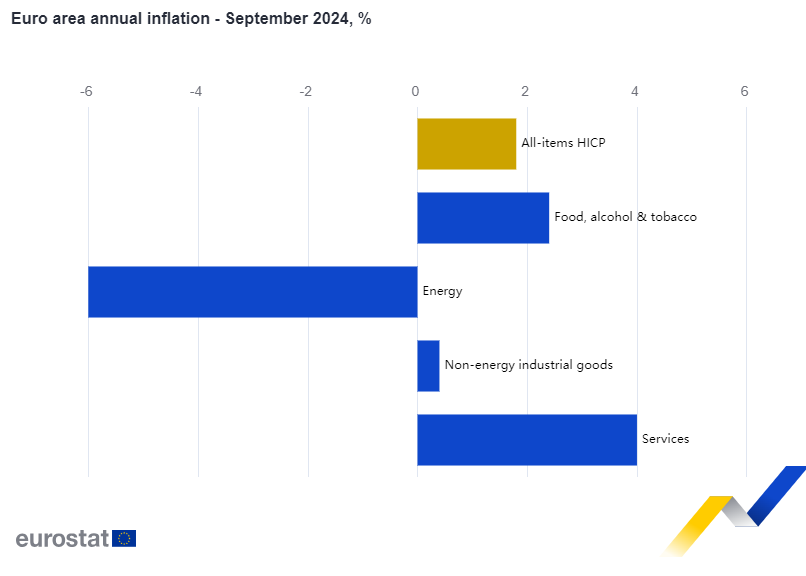

But European Central Bank (ECB) officials are concerned about the spike in geopolitical uncertainty. A spike in energy prices could reverse the slowdown in inflation reported across much of Europe.

Euro area annual inflation slowed to 1.8% in September from 2.2% in August, the EU statistical office said on Tuesday.

“We are facing huge uncertainty – not least in view of the many prevailing economic, financial and geopolitical risks,” Luis de Guindos, Vice-President of the ECB, said the same day.

The ECB official spoke at the 5th joint ECB, Bank of Canada and Federal Reserve Bank of New York Conference.

De Guindos said in Riga today that the economic revival in the euro area is likely to gain momentum.

He expressed optimism that faster growth could be achieved following a disappointing second quarter. However, he warned that risks in the bloc are still “tilted to the downside.

Geopolitical Uncertainty Main Risk

A BoE survey conducted in late July and early August echoed the prevailing concerns about geopolitical uncertainty.

The BoE found that 93% of the 55 banks that responded placed geopolitical risk as the biggest concern. That was the highest level recorded in the survey which goes back to 2008.

The elevated geopolitical uncertainty could place “further pressure on sovereign debt levels and borrowing costs, ” the BoE said today.

The UK’s central bank pointed to “structural trends, such as demographics and climate change,” as factors that could undermine markets.

Sharp market corrections “could affect the cost and availability of credit to UK households and businesses,” it said.

Disclaimer:

Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cinema Lenses Market Size to Grow to USD 2.7 Billion by 2034 at 5.2% CAGR, Fueled by Filmmakers' Demand for Specialized Storytelling Lenses| Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc., Oct. 01, 2024 (GLOBE NEWSWIRE) — The global cinema lenses market stood at US$ 1.6 billion in 2023. A CAGR of 5.2% is estimated from 2024 to 2034, with the market reaching US$ 2.7 billion in 2034. As the global film industry expands, streaming services, international markets, and production costs rise, some of these factors are driving the industry’s growth globally. Due to this expansion, cinema lenses in many formats and genres are in demand.

Through ongoing innovation in lens design, materials, coatings, and manufacturing processes, filmmakers and production companies are adopting cinema lenses with improved optical performance, durability, and dependability. Small, light lenses are commonly needed by filmmakers when shooting handheld or using a gimbal, especially for independent and documentary work. As a result, the market for tiny cinema lenses has expanded.

A wider variety of content is being produced in the film business as a result of the increased emphasis on diversity and inclusion. The desire for specialized lenses that support a variety of storytelling techniques is driven by this diversity, which also extends to the sorts of lenses used to capture various narratives and perspectives.

Request a PDF Sample of this Report Now!

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=45708

Key Findings of the Market Report

- Based on the resolution, the 4K resolution segment will likely lead to lens sales in the cinema market.

- In terms of category, a high-end-class segment is expected to expand the market for cinema lenses in the market.

- Consumers are expected to increasingly demand animated films, driving demand for cinema lenses.

- Zoom lenses accounted for the largest share of revenue in 2023.

- A share of 31% was accounted for by Asia Pacific in 2023.

Global Cinema Lenses Market: Growth Drivers

- Cinema lenses with great optical performance, resolution, and clarity are becoming more and more in demand as streaming services and high-quality video content become more prevalent.

- With advancements in camera technology like larger format cameras and higher resolution sensors, cinema lenses that can fully exploit these capabilities are needed.

- Digital cinematography is becoming more and more common, frequently taking the place of traditional film in productions. The need for cinema lenses designed for digital cinematography is fueled by the need for specialized lenses made for digital sensors, which are needed for digital cameras.

- Cinema lenses that can produce improved image quality and resolve finer details are necessary to fulfill the demands of producing ultra-high definition video as higher resolution formats like 4K and 8K become more common.

- Demand for cutting-edge optical solutions is being driven by the emergence of cinematic VR and AR experiences, which call for specialized lenses capable of capturing immersive content and offering a realistic viewing experience.

- A number of streaming services are creating original content in an effort to attract users. Therefore, cinema lenses are in high demand to produce high-quality television shows, documentaries, and other programs.

Global Cinema Lenses Market: Regional Landscape

- Cinema lenses are expected to be the largest market in Asia Pacific. Internet usage, urbanization, and rising disposable income are driving the entertainment sector in Asia Pacific to grow at an accelerated pace.

- Japan, South Korea, China, India, and China have become important hubs for the production of films in the region. The need for cinema lenses to enable the creation of a wide range of content, including feature films, television shows, and web videos, is boosted by the expansion of these businesses as well as by government incentives and infrastructural development.

- Governments and private investors are investing more in production and content creation facilities in the Asia Pacific region to meet the growing demand for entertainment material. By investing in this project, the movie lens industry will be able to offer its customers top-of-the-line optical gear to support its rapid growth.

- The popularity of regional films is growing both within the country and abroad-including K-dramas in South Korea, Bollywood in India, and anime in Japan. As a result of this trend, specialty cinema lenses designed to capture regional aesthetics are in demand.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=45708

Global Cinema Lenses Market: Competitive Landscape

A majority of cinema lens companies spend a lot of money expanding their presence abroad, primarily in prominent regions. Players operating in the market are primarily focused on launching new products.

Key Players

- Angénieux

- ARRI AG

- Canon Inc.

- Carl-Zeiss AG

- Cooke Optics Ltd.

- DZOFILM Inc.

- FUJIFILM Corporation (Fujinon)

- Laowa Lenses (Venus Optics)

- Leica Camera AG

- Samyang Optics

- Other Key Players

Key Developments

- In September 2023, Canon introduced its first seven cinema prime lenses. High-performance optics, cinema-like operability, and RF communications are all incorporated into the new lenses. Seven RF-Mount Cinema Prime Lenses represent the first phase in the development of the system.

- Aside from providing professional video production equipment for television shows, movies, and commercials, the company plans to expand its line of RF-mount-compatible equipment.

- In February 2024, ZEISS Nano Prime lenses enabled classic cinema look at an affordable price. A new set of six ZEISS Nano Prime Lenses covers six common focal lengths from wide-angle to telephoto.

Email Directly Here with Detail Information: sales@transparencymarketresearch.com

Global Cinema Lenses Market: Segmentation

Product Type

- Single Vision/Prime

- Zoom Lens

Resolution

- 2K

- 4K

- Others (6K, 8K, etc.)

Category

- Entry-class

- Medium-class

- High-end-class

Focal Length

- Wide-angle [14-35 mm]

- Normal [35 – 70 mm]

- Medium Telephoto [70-135]

- Telephoto [>135]

End User

- Amateur Users

- Professional Users

Price

Application

- Documentary Films

- Environmental Films

- Animated Films

- Short Films

- Feature Films

- Others (Experimental Films, Silent Films, etc.)

Distribution Channel

Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=45708<ype=S

More Trending Reports by Transparency Market Research –

- East Asia Pet Supplements Market – The global East Asia pet supplements market (Markt für Nahrungsergänzungsmittel für Haustiere) is projected to advance at a CAGR of 7.0% from 2024 to 2034.

- Cooking Hob Market – The global cooking hob market (Markt für Kochfelder) is projected to expand at a CAGR of 5.7% during the forecast period from 2024 to 2034.

- Europe Secondhand Electronic Products Market – The Europe secondhand electronic products market (Markt für gebrauchte elektronische Produkte) is estimated to advance at a CAGR of 12.6% from 2023 to 2031.

- Set-Top Boxes Market – The global set-top boxes market (Markt für Set-Top-Boxen) is estimated to grow at a CAGR of 6.4% from 2022 to 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Morning Bid: Markets bunker down as Iran-Israel tensions spark

By Jamie McGeever

(Reuters) – A look at the day ahead in Asian markets.

The final quarter of the year is under way, and the sense of caution that characterized its open on Tuesday could not be further removed from the ebullience and optimism that marked the end of the third quarter 24 hours earlier.

Investors fled risky assets like stocks for the safety of U.S. Treasuries, gold and the dollar as Iran fired a salvo of ballistic missiles at Israel on Tuesday in retaliation for Israel’s campaign against Tehran’s Hezbollah allies in Lebanon.

The S&P 500 and global stocks had their worst day in a month, the 10-year U.S. bond yield registered its steepest fall in a month, and oil rose 3%, after being up 5% at one stage.

On top of the escalation of tensions between Israel and Iran, the sense of gloom hanging over markets on Tuesday was heightened by the steep decline in a closely-watched tracking model estimate of U.S. GDP growth.

The Atlanta Fed’s GDPNow model estimate for third quarter U.S. GDP growth on Tuesday was cut to 2.5% from 3.1% last week. The fall of six-tenths of one percent was the biggest decline since the Q3 tracking estimates was launched in late July.

This will set the tone on Wednesday for markets across Asia. Chinese markets are closed for Golden Week, and the major economic releases will be inflation and manufacturing purchasing managers index data from South Korea, and consumer confidence from Japan.

Although oil spiked sharply on Tuesday, the deeply negative year-on-year price of oil is a major reason why inflation around the world is cooling, and much faster than many economists and policymakers had expected.

In many cases, like the euro zone, inflation is already at or even below the 2% target that many central banks aim for. Figures on Wednesday from Seoul are expected to show that annual consumer inflation in South Korea eased to 1.9% in September from 2.0% in August.

That would be the lowest, and also the first time below that 2% threshold, since March 2021.

Japan’s markets should be a little calmer on Wednesday, even though Nikkei futures point to a fall of more than 1% at the open, as the dust begins to settle on the major political upheaval of recent days.

Investors are getting used to what they might expect from new Prime Minister Shigeru Ishiba, once considered a monetary policy hawk who now appears to have softened his stance.

He said on Tuesday that he hoped the Bank of Japan would maintain loose monetary policy “as a trend”, and that his administration will carry over the economic policy of former Prime Minister Fumio Kishida and “ensure Japan fully emerges from deflation.”

Here are key developments that could provide more direction to Asian markets on Wednesday:

– South Korea inflation (September)

– South Korea manufacturing PMI (September)

– Japan consumer confidence (September)

(Reporting by Jamie McGeever)

Southern Hills Home Buyers Proudly Celebrate Achieving 5-Star Customer Reviews on Google and Facebook

Plano, TX, Oct. 02, 2024 (GLOBE NEWSWIRE) — Southern Hills Home Buyers, a cash-home buying company that specializes in helping families in Dallas and surrounding areas, such as Plano, Denton, Mesquite, and Houston, sell their homes fast, is thrilled to announce the celebration of achieving 5-star customer reviews on Google and Facebook.

This impressive achievement emphasizes Southern Hills Home Buyers’ commitment to offering a hassle-free and swift home-buying process that has been designed to enable homeowners struggling with selling their home the traditional way due to the cost of repairs, the threat of foreclosure, or dealing with the long closing times. The cash home buyers are proud of consistently delivering a high-level of customer service and a seamless experience in Dallas and hopes to continue serving the local community with a transparent cash-for-houses service.

“We are local to the Dallas Fort Worth metroplex and are family-owned and operated,” said a spokesperson for Southern Hills Home Buyers. “We pride ourselves on our heartfelt desire to help homeowners easily and hassle-free sell their Dallas homes, vacant lots, and other Dallas real estate property. We Buy Houses In Texas and use our years of real estate experience to find a solution for just about any situation or hurdle in the sales process.”

The experienced cash home buyers have become renowned for their customer-centric approach, fast closing times that can be as quick as 2-7 days and no obligation, competitive cash offers. Some of the glowing 5-star reviews received on Facebook and Google by Southern Hills Home Buyers include:

“Shannon helped to sell my parents’ house quickly and fairly. She was responsive, professional, knowledgeable, and personable. The emotional difficulty in letting go of this house was made much easier with Shannon’s help. All done from out of state and closed in a week. I would highly recommend Southern Hills Property Group,” commented Kristen W.

“I sold my mom’s home in Texas to Southern Hills Property Group. It was a tough time, and I didn’t have the patience to list her home with an agent, plus the work of repairs needed to sell it to the public. It was easy, and all went smoothly. They bought the house without any repairs and closed in 3 weeks. Very happy with them,” stated George C.

“I contacted Southern Hills Property Group. Shannon, my agent, was very friendly, attentive, and concerned, and my property was sold as is in about 4 weeks. I am and was very satisfied with her work,” said Gloria H.

With a commitment to integrity, transparency, and personalized service, Southern Hills Home Buyers has earned an impressive reputation as trusted cash home buyers in Texas’s real estate industry.

Whether homeowners are facing foreclosure, relocating, dealing with an inherited property, or simply want to sell their home quickly, Southern Hills Home Buyers are committed to making the home-selling process a positive and empowering experience and invites individuals to reach out to its highly rated team via its website today.

About Southern Hills Home Buyers

Southern Hills Home Buyers is a family-owned and operated business that, with an experienced team of investors and problem solvers, has become renowned in Texas and surrounding areas for helping homeowners sell their homes fast and hassle-free for cash.

More Information

To learn more about Southern Hills Home Buyers and its celebration of maintaining 5-star customer reviews on Google and Facebook, please visit the website at https://www.southernhillshomebuyers.com/we-buy-houses-tx/.

Southern Hills Home Buyers 700 E Park Blvd #202 Plano TX 75074 United States (214) 225-3042 https://www.southernhillshomebuyers.com/we-buy-houses-tx/

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lamb Weston Reports Q1 Results, Announces Restructuring Plan: Details

Lamb Weston Holdings, Inc. LW shares are on watch Wednesday morning after the company reported its first-quarter financial results after Tuesday’s closing bell and announced a restructuring plan.

The Details: Lamb Weston reported quarterly earnings of 73 cents per share which beat the analyst consensus estimate of 71 cents. Quarterly revenue came in at $1.65 billion which beat the consensus estimate of $1.56 billion.

Net sales for the North America segment were down 3% and volume declined 4% versus the prior year quarter, reflecting the impact of customer share losses and declining restaurant traffic in the U.S.

“We delivered first quarter financial results that were generally in line with our expectations, driven by sequentially improved volume performance, solid price/mix, and strict management of operating costs,” said Tom Werner, CEO of Lamb Weston. “However, restaurant traffic and frozen potato demand, relative to supply, continue to be soft, and we believe it will remain soft through the remainder of fiscal 2025.”

Read Next: Elon Musk, Tesla Win Dismissal Of Full-Self Driving Claims: Judge Tosses Lawsuit

The company also announced a restructuring plan aimed at improving cost efficiency and easing current supply and demand imbalances. The plan will include closing Lamb Weston’s Connell, Washington facility, temporarily curtailing production lines and schedules in North America, reducing approximately 4% of global workforce and eliminating unfilled job positions.

Outlook: Lamb Weston reaffirmed its fiscal 2025 net sales outlook of between $6.6 billion and $6.8 billion, versus the $6.615 billion estimate. The company revised its adjusted earnings per share target to between $4.15 and $4.35, versus the $4.48 estimate.

LW Price Action: According to Benzinga Pro, Lamb Weston shares are up 0.87% at $65.48 at the time of publication Wednesday.

Read Also:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

HEICO Buys Marway Power, Widens Power Distribution Solution Capacity

HEICO Corporation HEI recently signed a contract to acquire Marway Power Solutions, Inc. The acquiree provides the design and construction of power distribution solutions for mission-critical systems used in defense, aerospace, communications, test and measurement, and industrial applications on land, sea and air.

Per the deal, HEI bought 92.5% of Marway for cash. HEICO indicated that the transaction would be accretive to its earnings within one year of the buyout.

How Will the Buyout Benefit HEICO?

Marway’s acquisition is expected to strengthen HEICO’s footprint in the aerospace and defense industry, particularly in power distribution solutions for mission-critical systems. It develops and produces power distribution solutions in both standard rackmount and customized enclosures. Marway provides a variety of products, including transformers, switchgear and customized solutions adapted to specific sectors like defense, which are consistent with HEI’s value-creating approach.

The aforementioned factors will provide HEICO Corporation with an opportunity to expand its customer base, enhance its product offerings and increase its market share in power distribution solutions for mission-critical systems business area.

What’s Driving Acquisitions Among Aerospace Defense Players?

The military industry has seen a notable rise in mergers and acquisitions due to several factors, like the growing emphasis on cost-reduction initiatives, diversifying the portfolio to tackle competition and achieving economies of scale, along with operational efficiency to attain long-term goals. These transactions are becoming more significant, allowing businesses to grow as they see fit by expanding their operations, gaining access to new skills, developing technologies and producing higher-quality goods and services, as well as capturing larger market shares.

HEICO’s latest decision to acquire Marway Power Solutions also seems to have been motivated by the aforementioned factors.

Some other defense companies have recently indulged in acquisition deals to expand their operations and widen product offerings.

In August 2024, Lockheed Martin Corp. LMT agreed to acquire a manufacturer of satellite products, Terran Orbital, for $450 million, which serves the aerospace and defense industry. Through this acquisition, LMT will be able to expand its customer base, enhance its product offerings and increase its market share in the satellite-based solutions business area.

Lockheed Martin has a long-term (three to five years) earnings growth rate of 4.7%. It delivered an average earnings surprise of 7.46% in the last four quarters.

In May 2024, TransDigm Group, Inc. TDG agreed to acquire Raptor Scientific for $655 million, a manufacturer of complex test and measurement solutions serving the aerospace and defense end markets. Through this acquisition, TDG should be able to provide a wider range of products and gain a larger market share in the highly engineered aviation components industry.

TransDigm Group has a long-term earnings growth rate of 20.7%. The Zacks Consensus Estimate for its fiscal 2024 sales calls for an improvement of 19.9% from the prior-year figure.

In April 2024, Curtiss-Wright Corporation CW completed the acquisition of WSC, Inc. for $34 million. The buyout is expected to expand Curtiss-Wright’s portfolio of advanced commercial nuclear technologies utilized in the modernization of existing power plants and the design of new power plants, such as Advanced Small Modular Reactors.

Curtiss-Wright boasts a four-quarter earnings surprise of 11.52%, on average. The Zacks Consensus Estimate for CW’s 2024 sales implies an improvement of 7.1% from the prior-year figure.

HEICO Stock Price Movement

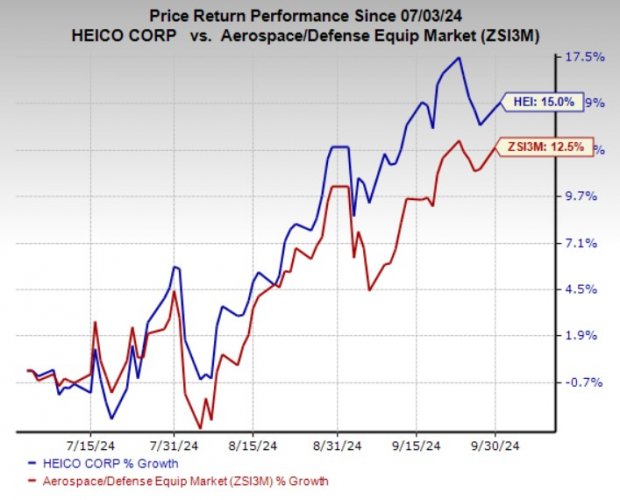

In the past three months, shares of HEICO have risen 15% compared with the industry’s growth of 12.5%.

Image Source: Zacks Investment Research

HEI’s Zacks Rank

HEI currently carries a Zacks Rank #3 (Hold).

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[Latest] Global Cloud Endpoint Protection Market Size/Share Worth USD 23.6 Billion by 2033 at a 22.7% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

Austin, TX, USA, Oct. 02, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Cloud Endpoint Protection Market Size, Trends and Insights By Component (Solutions, Services), By Organization Size (SMEs, Large Enterprises), By End User (BFSI, Telecom & IT, Retail, Healthcare, Media & Entertainment, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

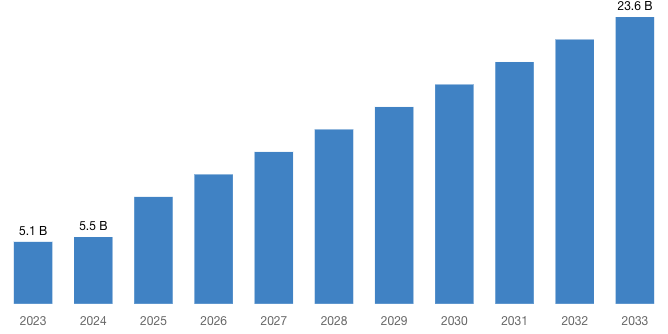

“According to the latest research study, the demand of global Cloud Endpoint Protection Market size & share was valued at approximately USD 5.1 Billion in 2023 and is expected to reach USD 5.5 Billion in 2024 and is expected to reach a value of around USD 23.6 Billion by 2033, at a compound annual growth rate (CAGR) of about 22.7% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Cloud Endpoint Protection Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=52064

Cloud Endpoint Protection Market: Overview

Cloud endpoint protection refers to the security measures and solutions specifically designed to safeguard endpoints such as laptops, desktops, mobile devices, and servers when they access and operate within cloud environments.

The cloud endpoint protection market is witnessing several key trends driven by evolving cybersecurity threats and technological advancements.

The integration of artificial intelligence (AI) and machine learning (ML) is a significant trend. These technologies enhance threat detection and response capabilities by analyzing vast amounts of data to identify patterns and anomalies that may indicate security breaches.

AI and ML enable real-time threat analysis, allowing for quicker and more effective responses to emerging threats. Endpoint detection and response (EDR) solutions are becoming more prevalent. EDR tools offer continuous monitoring and automated response to threats, providing deeper visibility into endpoint activities.

This helps in identifying and mitigating attacks before they can cause significant damage. Additionally, there is an increasing focus on cloud-native security solutions designed to protect endpoints across diverse and distributed cloud environments.

These solutions are built to handle the unique challenges posed by cloud infrastructure, offering scalability and flexibility. These trends highlight the dynamic nature of the cloud endpoint protection market, emphasizing the need for advanced, adaptable, and comprehensive security solutions.

Request a Customized Copy of the Cloud Endpoint Protection Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=52064

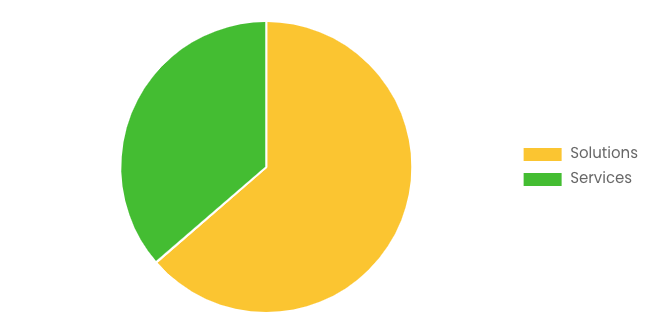

By component, the solution segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. A prominent trend in solutions is the integration of artificial intelligence and machine learning algorithms into software offerings.

This enables automation, predictive analytics, and enhanced decision-making capabilities, empowering businesses to streamline processes, personalize experiences, and gain actionable insights from data.

By organization size, the SME segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. In SMEs, there’s a notable trend towards adopting cloud-based solutions for various operations, including customer relationship management, accounting, and collaboration tools. This shift allows SMEs to streamline processes, reduce costs, and enhance scalability and flexibility in their operations.

By end user, the Telecom & IT segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. In Telecom & IT, the trend leans towards 5G network expansion, accelerating digital transformation, and increased adoption of cloud-based services.

These shifts prioritize faster connectivity, enhanced data management, and scalable infrastructure to meet growing demands for remote work and digital services.

In North America, there’s a prominent trend towards increased adoption of renewable energy sources, particularly solar and wind power. This shift is driven by environmental concerns, government incentives, technological advancements, and the growing demand for sustainable energy solutions.

IBM develops system hardware and software and offers infrastructure, hosting, and consulting services. IBM’s key areas include analytics, artificial intelligence, automation, blockchain, cloud computing, IT infrastructure, IT management, cybersecurity, and software development.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 5.5 Billion |

| Projected Market Size in 2033 | USD 23.6 Billion |

| Market Size in 2023 | USD 5.1 Billion |

| CAGR Growth Rate | 22.7% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Component, Organization Size, End User and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Cloud Endpoint Protection report is available upon request; please contact us for more information.)

Request a Customized Copy of the Cloud Endpoint Protection Market Report @ https://www.custommarketinsights.com/report/cloud-endpoint-protection-market/

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Cloud Endpoint Protection report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Cloud Endpoint Protection Market Report @ https://www.custommarketinsights.com/report/cloud-endpoint-protection-market/

CMI has comprehensively analyzed the Global Cloud Endpoint Protection market. The driving forces, restraints, challenges, opportunities, and key trends have been explained in depth to depict depth scenarios of the market. Segment wise market size and market share during the forecast period are duly addressed to portray the probable picture of this Global Cloud Endpoint Protection industry.

The competitive landscape includes key innovators, after market service providers, market giants as well as niche players are studied and analyzed extensively concerning their strengths, weaknesses as well as value addition prospects. In addition, this report covers key players profiling, market shares, mergers and acquisitions, consequent market fragmentation, new trends and dynamics in partnerships.

Key questions answered in this report:

- What is the size of the Cloud Endpoint Protection market and what is its expected growth rate?

- What are the primary driving factors that push the Cloud Endpoint Protection market forward?

- What are the Cloud Endpoint Protection Industry’s top companies?

- What are the different categories that the Cloud Endpoint Protection Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Cloud Endpoint Protection market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Cloud Endpoint Protection Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/cloud-endpoint-protection-market/

Cloud Endpoint Protection Market: Regional Analysis

By region, Cloud Endpoint Protection market is segmented into North America, Europe, Asia-Pacific, Latin America, Middle East & Africa. North America dominated the global Cloud Endpoint Protection market in 2023 with a market share of 39.1% and is expected to keep its dominance during the forecast period 2024-2033.

North America region boasts a robust IT infrastructure, with a high adoption rate of mobile devices, laptops, and other endpoints across enterprises.

Additionally, North American organizations prioritize security and compliance, leading them to invest in comprehensive UEM solutions to manage and secure their diverse endpoint environments.

Furthermore, the region’s large enterprises and multinational corporations seek scalable and efficient ways to manage their distributed workforce, driving the demand for UEM solutions that offer centralized management capabilities.

Moreover, the proliferation of cloud computing and the increasing trend of remote work has further fuelled the need for UEM solutions in North America, as organizations seek to securely manage endpoints regardless of their location or network connectivity.

Request a Customized Copy of the Cloud Endpoint Protection Market Report @ https://www.custommarketinsights.com/report/cloud-endpoint-protection-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Cloud Endpoint Protection Market Size, Trends and Insights By Component (Solutions, Services), By Organization Size (SMEs, Large Enterprises), By End User (BFSI, Telecom & IT, Retail, Healthcare, Media & Entertainment, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/cloud-endpoint-protection-market/

List of the prominent players in the Cloud Endpoint Protection Market:

- 42Gears Mobility Systems Pvt Ltd.

- BlackBerry Limited

- Citrix Systems Inc.

- IBM Corporation

- Matrix42 GmbH

- Microsoft

- Ivanti

- Sophos Ltd.

- SOTI Inc.

- Zoho Corporation Pvt. Ltd.

- VMware Inc.

- Snow Software

- Quest Software Inc.

- Kaspersky Lab

- ManageEngine

- Hexnode

- Others

Click Here to Access a Free Sample Report of the Global Cloud Endpoint Protection Market @ https://www.custommarketinsights.com/report/cloud-endpoint-protection-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Core HR Software Market: Core HR Software Market Size, Trends and Insights By Software (Benefits and Claims Management, Payroll and Compensation Management, Personnel Management, Learning Management, Pension Management, Compliance Management, Succession Planning, Others), By Deployment Type (On-Premises, Cloud, Others), By End User Industries (Government, Manufacturing, Energy and Utilities, Consumer Goods and Retail, Healthcare, Transportation and Logistics, Telecom and Information Technology (IT), Banking, Financial Services, and Insurance (BFSI), Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Computer Reservation Systems Market: Computer Reservation Systems Market Size, Trends and Insights By Type (On-Premise, Web-Based), By Application (Air travel, Hotels, Car rental, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

B2C Payment Market: B2C Payment Market Size, Trends and Insights By Payment Method (Credit/Debit Cards, Digital Wallets, Bank Transfers, Cash), By Industry Vertical (Retail, E-commerce, Travel & Hospitality, Entertainment & Media), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Influencer Marketing Platform Market: Influencer Marketing Platform Market Size, Trends and Insights By Application (Campaign Management, Search & Discovery, Analytics & Reporting, Influencer Management), By End-user (Food & Entertainment, Sports & Fitness, Travel & Holiday, Fashion & Lifestyle, Others), By Organization Size (Large Enterprises, SMEs) and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Mass Notification System Market: Mass Notification System Market Size, Trends and Insights By Component (Hardware, Software, Services), By Applications (Critical Event Management, Public Safety and Warning, Business Continuity & Disaster Management), By Enterprise Size (SMEs, Large Enterprises), By Solution (Wide-area Solutions, In-building Solutions, Distributed Recipient Solutions (DRS)), By End-use (Corporate, Education, Energy & Utilities, Healthcare & Life Sciences, Aerospace & Defense, Government, Others (Commercial, Transportation & Logistics, and IT & Telecom, among others)) and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Ultra Mobile Devices Market: Ultra Mobile Devices Market Size, Trends and Insights By Type (Premium Ultra-Mobile Devices, Basic Ultra-Mobile Devices, Utility Ultra-Mobile Devices), By Application (Healthcare, Consumer Electronics, Telecom & IT, Retail, BFSI, Education, Entertainment, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Dry Dock Services Market: Dry Dock Services Market Size, Trends and Insights By Type (Graving Docks, Floating Docks, Repair Docks, Marine Railway, Others), By Application (Hull Maintenance and Repair, Propulsion System Overhaul, Electrical and Mechanical Systems Maintenance, Safety and Compliance Inspections, Others), By End Users (Commercial Shipping Companies, Naval Forces, Passenger Cruise Lines, Offshore Oil and Gas Companies, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Security Equipment Market: Security Equipment Market Size, Trends and Insights By Product Type (Surveillance Systems, Access Control Systems, Intrusion Detection Systems, Fire Protection Systems, Others), By Application (Indoor Security, Outdoor Security, Perimeter Security, Vehicle Security, Personal Security), By Technology (Wired, Wireless, Hybrid), By End Users (Residential, Commercial, Industrial, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Cloud Endpoint Protection Market is segmented as follows:

By Component

By Organization Size

By End User

- BFSI

- Telecom & IT

- Retail

- Healthcare

- Media & Entertainment

- Others

Click Here to Get a Free Sample Report of the Global Cloud Endpoint Protection Market @ https://www.custommarketinsights.com/report/cloud-endpoint-protection-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Cloud Endpoint Protection Market Research/Analysis Report Contains Answers to the following Questions.

- What Developments Are Going On in That Technology? Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Cloud Endpoint Protection Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Cloud Endpoint Protection Market? What Was the Capacity, Production Value, Cost and PROFIT of the Cloud Endpoint Protection Market?

- What Is the Current Market Status of the Cloud Endpoint Protection Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Cloud Endpoint Protection Market by Considering Applications and Types?

- What Are Projections of the Global Cloud Endpoint Protection Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Cloud Endpoint Protection Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Cloud Endpoint Protection Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Cloud Endpoint Protection Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Cloud Endpoint Protection Industry?

Click Here to Access a Free Sample Report of the Global Cloud Endpoint Protection Market @ https://www.custommarketinsights.com/report/cloud-endpoint-protection-market/

Reasons to Purchase Cloud Endpoint Protection Market Report

- Cloud Endpoint Protection Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Cloud Endpoint Protection Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Cloud Endpoint Protection Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Cloud Endpoint Protection Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Cloud Endpoint Protection market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Cloud Endpoint Protection Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/cloud-endpoint-protection-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Cloud Endpoint Protection market analysis.

- The competitive environment of current and potential participants in the Cloud Endpoint Protection market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Cloud Endpoint Protection market should find this report useful. The research will be useful to all market participants in the Cloud Endpoint Protection industry.

- Managers in the Cloud Endpoint Protection sector are interested in publishing up-to-date and projected data about the worldwide Cloud Endpoint Protection market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Cloud Endpoint Protection products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Cloud Endpoint Protection Market Report @ https://www.custommarketinsights.com/report/cloud-endpoint-protection-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Cloud Endpoint Protection Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/cloud-endpoint-protection-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is Dogecoin's Bullish Momentum Over After 18% Retreat From Recent Highs? Not Yet, Say Analysts

Dogecoin DOGE/USD may have retraced significantly this week, but whale investors have still not given up on the king of meme coins yet.

What Happened: On Tuesday, popular blockchain research firm Santiment took to X to share its findings of Dogecoin’s recent performance. The firm noted a significant 18% drop from its recent highs on Saturday but highlighted that whales were still very active on the network.

The total number of addresses involved in DOGE transactions daily surged to 63,689 in the past three days, marking the largest 3-day growth in six months.

Additionally, more than 1,200 transactions worth over $100,000 were recorded preceding the local top on Saturday, the highest whale activity since May 26-28.

“Though they took profit just before the top, their activity remains very high on DOGE’s network,” remarked Santiment.

DOGE’s bullish potential was also underlined by widely followed cryptocurrency trader Ali Martinez. In an X post, he observed the formation of a MACD bullish crossover on the weekly chart.

Citing history, Martinez said that previous occurrences of MACD bullish crossovers preceded rallies of 90% and 180%, respectively.

The MACD is primarily used to gauge an asset’s overall trend. When the MACD line crosses above the signal line, the sentiment is bullish, and when it crosses below the signal line, the sentiment is bearish.

Why It Matters: This analysis comes in the wake of a broader slump in the cryptocurrency market after news of Iran’s missile attack on Israel heightened fears of a full-blown war and economic trouble.

Bitcoin BTC/USD and Ethereum ETH/USD were down 3% and 6%, respectively, while the total market capitalization contracted more than 4% over the last 24 hours.

A pseudonymous cryptocurrency trader, Master Kenobi, predicted last month that Dogecoin would outperform Bitcoin in the current market cycle, as it has in past cycles.

He argued that Dogecoin has been able to leverage Bitcoin’s trajectory, benefiting from the groundwork laid by the apex cryptocurrency, and stands to benefit from the “follower” effect.

Price Action: At the time of writing, Dogecoin was exchanging hands at $0.1083, down 8.6% in the last 24 hours, according to data from Benzinga Pro.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.