Boston-Based Developer Announces Completion of Phase I at World-Class Advanced Manufacturing Campus 44 Middlesex

Ownership to unveil design concept for second building, commencing Phase II in 2025.

BOSTON, Oct. 1, 2024 /PRNewswire/ — Camber Development and Wheelock Street Capital announce the completion of Phase I at 44 Middlesex–a new, world-class advanced manufacturing campus being developed in Bedford, Massachusetts. In completing Phase I of the project, the partnership marks the delivery of the first of two, 147,000-square-foot, unmatched advanced manufacturing and biomanufacturing spaces to the Greater Boston submarket. Newmark Executive Managing Directors Richard Ruggiero, Matt Adams, Torin Taylor, Rory Walsh and Tyler McGrail were retained as the exclusive leasing agents for the property.

“We congratulate ownership on achieving this milestone in the project as it marks the delivery of a best-in-class facility within a market with little existing supply and robust tenant demand,” said Taylor. “We are confident that through our collaborative partnership with Camber Development and Wheelock Street Capital, we will swiftly identify a complementary fit for this space.”

Phase II of the development will encompass the delivery of a second, 147,000-square-foot building, which has been successfully entitled and is pad-ready. Construction is slated to begin in 2025, with a one-year construction duration–targeting a completion date in 2026.

“We are proud to introduce 44 Middlesex to the market and partner with leading companies in Greater Boston to create an optimal location for its business to thrive” remarked Tucker Kelton, Founder and Managing Partner at Camber. “The depth and breadth of impactful technological advancement in the life science, climate technology and robotics industries taking place throughout Massachusetts is unrivaled and inspires our team to continue investing in and developing best-in-class innovative industrial real estate like 44 Middlesex.”

Totaling 294,000 square feet, the two-building life science and advanced manufacturing campus offers unmatched physical specifications including 8,600 Amps of power, 36′ clear heights, six loading docks, robust structural capacity for rooftop equipment and interior mezzanine, and a large outdoor amenity area with a fire feature, Ipe decking, and synthetic lawn. The campus’ highly functional and flexible design is equipped to accommodate cutting-edge technology and practices. Each of Buildings 1 and 2 will be two-story structures, featuring 105,000 square feet on the ground floor and a 42,000-square-foot mezzanine space on the second floor.

44 Middlesex is situated in the innovation and manufacturing hub of Bedford, MA–the preeminent location for life science manufacturing and R&D users seeking a location central to executive and R&D talent, and the manufacturing talent pool clustered to the north and west of Boston. The campus will also benefit from the highly amenitized surrounding area–five major retail centers within a 10-minute drive, thus, 400+ individual stores and a roster of dining options such as Row 34, Tuscan Kitchen, The Bancroft, Capital Grille, King’s and Yard House. Additionally, the campus benefits from its proximate location to approximately 2.5 million square feet of future retail space in Burlington, Massachusetts, which offers a vast amount of entertainment options close by.

About Camber Development

Camber Development is a Boston-based real estate investor and developer with an entrepreneurial spirit and institutional capital support. With a focus on logistics, advanced manufacturing and life science properties, Camber strives to capitalize on the convergence of these industries within it growing portfolio and facilitate the growth and operations of its customers. The firm was founded in 2020 and has acquired nearly 3 million square feet of innovative industrial real estate, including approximately 600,000 square feet currently under development. For more information visit camberdev.com.

About Wheelock Street Capital

Wheelock Street Capital was formed in 2008 by Rick Kleeman and Jonathan Paul, two veteran real estate private equity investors, each with over 30 years of broad real estate transaction experience across all major asset classes. Wheelock has raised over $5 billion in capital commitments from well-known institutional investors and focuses on real estate investment opportunities throughout the United States, in both public and private markets. Wheelock is currently deploying its seventh fund in its value-added series, Wheelock Street Real Estate Fund VII and its first perpetual life fund, Wheelock Street Long Term Value Fund. Wheelock’s investment team benefits from extensive experience from top-tier institutional investment firms and highly regarded real estate operating companies and has produced a 15-year track record of demonstrated and consistent outperformance over industry benchmarks. For more information visit wheelockst.com.

About Newmark

Newmark Group, Inc. NMRK, together with its subsidiaries (“Newmark”), is a world leader in commercial real estate, seamlessly powering every phase of the property life cycle. Newmark’s comprehensive suite of services and products is uniquely tailored to each client, from owners to occupiers, investors to founders, and startups to blue-chip companies. Combining the platform’s global reach with market intelligence in both established and emerging property markets, Newmark provides superior service to clients across the industry spectrum. For the year ended December 31, 2023, Newmark generated revenues of approximately $2.5 billion. As of March 31, 2024, Newmark’s company-owned offices, together with its business partners, operate from approximately 170 offices with 7,600 professionals around the world. To learn more, visit nmrk.com or follow @newmark.

![]() View original content:https://www.prnewswire.com/news-releases/boston-based-developer-announces-completion-of-phase-i-at-world-class-advanced-manufacturing-campus-44-middlesex-302264791.html

View original content:https://www.prnewswire.com/news-releases/boston-based-developer-announces-completion-of-phase-i-at-world-class-advanced-manufacturing-campus-44-middlesex-302264791.html

SOURCE Camber Development

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Strategic Sale: Scott Robinson Decides To Exercise Options Worth $1.55M At Donaldson

On September 30, it was revealed in an SEC filing that Scott Robinson, Chief Financial Officer at Donaldson DCI executed a significant exercise of company stock options.

What Happened: Robinson, Chief Financial Officer at Donaldson, made a strategic move by exercising stock options for 83,600 shares of DCI as detailed in a Form 4 filing on Monday with the U.S. Securities and Exchange Commission. The transaction value amounted to $1,551,494.

As of Tuesday morning, Donaldson shares are down by 0.0%, with a current price of $73.7. This implies that Robinson’s 83,600 shares have a value of $1,551,494.

Unveiling the Story Behind Donaldson

Donaldson is a leading manufacturer of filtration systems and replacement parts (including air filtration systems, liquid filtration systems, and dust, fume, and mist collectors). The company serves a diverse range of end markets, including construction, mining, agriculture, truck, and industrial. Its business is organized into three segments: mobile solutions, industrial solutions, and life sciences. Donaldson generated approximately $3.6 billion in revenue and $544 million in operating income in its fiscal 2024.

Unraveling the Financial Story of Donaldson

Revenue Growth: Donaldson’s remarkable performance in 3 months is evident. As of 31 July, 2024, the company achieved an impressive revenue growth rate of 6.36%. This signifies a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Industrials sector.

Holistic Profitability Examination:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 35.79%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): Donaldson’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 0.91.

Debt Management: With a below-average debt-to-equity ratio of 0.36, Donaldson adopts a prudent financial strategy, indicating a balanced approach to debt management.

Navigating Market Valuation:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 21.8 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: The P/S ratio of 2.52 is lower than the industry average, implying a discounted valuation for Donaldson’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 13.93 is below the industry average, indicating that it may be relatively undervalued compared to peers.

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

Insider transactions serve as a piece of the puzzle in investment decisions, rather than the entire picture.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

Transaction Codes Worth Your Attention

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Donaldson’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

These 2 Vanguard ETFs Are a Retiree's Best Friend

Not all investors are the same. What is appropriate for investors in their 20s is unlikely to fit the goals and risk tolerance for investors in their 60s, 70s, or 80s. Similarly, not all retirees are the same. Some are focused squarely on income generation, while others might need a more aggressive mix of income and growth.

Here, I’ll explore two Vanguard exchange-traded funds (ETFs) that provide a helpful mix of both income and growth.

Vanguard Real Estate ETF

Let’s start with the Vanguard Real Estate ETF (NYSEMKT: VNQ). This fund retirees a cheap and easy way to invest in real estate investment trusts (REITs). REITs are companies that own, finance, or operate real estate properties that generate income. By law, REITs must invest at least 75% of their assets into real estate and distribute 90% or more of their annual-taxable income to shareholders.

There are many varieties of REITs. For example, Public Storage owns and operates self-storage facilities. Meanwhile, VICI Properties operates leisure, gaming, and hospitality properties, including iconic locations on the Las Vegas strip like Caesars Palace and The Venetian.

This Vanguard fund counts both of those REITs among its holdings, along with many others. The fund could be particularly appealing to retirees who don’t have direct exposure to real estate — in other words, for those who do not own a house, apartment, condo, etc. By investing in this fund, retirees gain some exposure to the real estate market and can benefit from rising prices while not taking on the risk and costs of directly owning a real estate property.

The fund has a current dividend yield of 3.6% and a low expense ratio of 0.12%. Over the past 10 years, the fund has achieved a compound annual growth rate (CAGR) of 7.2%, meaning that $10,000 invested in 2014 would be worth $20,350 today.

Vanguard Utilities ETF

Next up is the Vanguard Utilities ETF (NYSEMKT: VPU). What’s compelling about this fund is its focus on a commonly underappreciated sector. Simply put, the utility industry is critical to the American economy. However, given its nature as a highly regulated, slow-growth industry, it’s often overlooked by investors.

Yet, that’s changing, especially when it comes to electricity producers. That’s because the world is desperate for more power. In particular, advancements in artificial intelligence (AI) and electrical vehicles (EVs) have led to greater demands on the power grid. In response, some utility providers are boosting supply by opening new facilities or reopening shuttered power plants.

In any event, what retirees should know is this this Vanguard fund is a great way to capitalize on such trends. The ETF boasts holdings in large regional utilities, including Duke Energy, Southern Company, and Dominion Energy, among many others.

The fund’s low expense ratio of 0.10% means that investors only pay $10 per year for every $10,000 invested in the fund. Moreover, its dividend yield of 2.8% provides a solid amount of annual payments for income-seeking retirees.

Finally, the fund’s 10-year performance is excellent. It has generated a 10-year CAGR of 10.1%, meaning a $10,000 investment made in 2014 would have grown to $26,100 today.

In summary, these two ETFs offer retirees a blend of income and growth — something that’s worth considering for many in this stage of life.

Should you invest $1,000 in Vanguard World Fund – Vanguard Utilities ETF right now?

Before you buy stock in Vanguard World Fund – Vanguard Utilities ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard World Fund – Vanguard Utilities ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $744,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Jake Lerch has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard Real Estate ETF. The Motley Fool recommends Dominion Energy, Duke Energy, and Vici Properties. The Motley Fool has a disclosure policy.

These 2 Vanguard ETFs Are a Retiree’s Best Friend was originally published by The Motley Fool

East Coast Dockworkers Strike: How Labor Dispute Impacts Economy, Logistics Companies

The labor contract between the International Longshoremen’s Association and U.S. Maritime Alliance expired overnight on Tuesday. The ILA — whose members comprise dockworkers on the East Coast — is now officially on strike.

Supply chain disruptions stemming from a prolonged strike may affect several companies and the U.S. economy as a whole.

What Happened: The dispute stems from two fundamental disagreements between the stevedores and port employers.

In their collective bargaining agreement, the ILA proposed a 77% pay raise over the next six years. The USMX countered with 50%.

“Our offer would increase wages by nearly 50 percent, triple employer contributions to employee retirement plans, strengthen our health care options, and retain the current language around automation and semi-automation,” the association said in a statement.

ILA President Harold Daggett urged the USMX to agree to a larger wage increase to address inflation.

“USMX claims to offer industry-leading wages. However, their interpretation of ‘leading wages’ is polar opposite to ours. Inflation has completely eaten into any raises and wages,” Daggett said.

Another fundamental disagreement comes from efforts to automate several port functions.

“USMX is trying to fool you with promises of workforce protections for semi-automation,” Daggett said. “Let me be clear: we don’t want any form of semi-automation or full automation. We want our jobs—the jobs we have historically done for over 132 years.”

President Joe Biden told reporters on Monday that he would not intervene in the matter, reiterating support for collective bargaining.

The closure will affect several U.S. ports, including Baltimore, Boston, New York and Philadelphia.

Economic Impact: RSM economist Joseph Brusuelas said the strike implies a modest impact on the U.S. economy.

“Labor action by port workers along the East and Gulf coast of the United States will provide a modest hit to GDP of a little greater than 0.1 percentage points per week or roughly $4.3 billion in lost exports and imports. If sustained that would result in roughly 0.5% percentage points shaved from overall GDP in the final quarter of 2024,” Brusuelas said.

“Given that the American economy is on a 3% growth path at this time, we do not expect the strike to derail the trajectory of the domestic economy or present a risk to an early and unnecessary end to the current economic expansion.”

The economist said the continued operation of ports in the western U.S. would likely lessen much of the strike’s economic impact.

When will the Strike End?: In a note published Monday, Morgan Stanley logistics analyst Ravi Shanker expressed a belief that the strike will end sooner rather than later.

“…in the event of a work stoppage, we believe it is highly unlikely to be prolonged,” Shanker said.

Affected Companies: ZIM Integrated Shipping Services Ltd ZIM, A P Moller Maersk AMKBY, XPO Inc XPO are publicly traded logistics companies likely to be affected by a sustained supply chain disruption.

Walmart Inc WMT and Target Corp TGT, two of the largest U.S. retailers, could face increased supply chain costs and inventory shortages if the dockworker strike persists.

Additionally, an agreement between the ILA and USMX on automation protection would likely affect companies manufacturing the equipment.

ABB Ltd ABBNY and Cargotec Corp CGCBV are among the largest distributors of dock automation technology.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

New Report Unveils Critical Gaps in Rural Water Sector and Calls for Urgent Action

CHARLESTON, S.C., Oct. 01, 2024 (GLOBE NEWSWIRE) — Global Water Center (GWC), in collaboration with the Centre for Affordable Water and Sanitation Technology (CAWST) and the Rural Water Supply Network (RWSN), is proud to announce the release of the “Rural Water Capacity Needs Assessment” report. This comprehensive report, based on a thorough analysis of 280 responses, sheds light on the critical gaps and challenges in the rural water sector.

The majority of people without access to safe water live in rural areas, but there is limited data about the rural water workforce around the world. According to Lisa Mitchell, GWC’s Senior Director of Learning Services, “This report provides direction to organizations serving the rural water sector by highlighting key gaps within the rural workforce and what we need to do to address them.”

Jeremiah Ouko, trainer with Aqua Clara Kenya (CAWST training partner) counting colonies as part of an Introduction to Drinking Water Quality Workshop in Kampala, Uganda.

The report reveals significant competency gaps in water supply technologies and water quality and safety. It also highlights the barriers to building a sustainable rural water workforce, such as job scarcity, limited incentives, insufficient personnel, and inadequate materials. Another important finding is that the infrastructure/maintenance technician is the hardest position to fill.

“Key to solving the existing and emerging world’s water crisis is building the capacity of local water, sanitation, and hygiene workers. The findings of this report help focus attention on roles that need to be filled, or need additional skill development,” says Shauna Curry, CEO of CAWST. “By attracting talent and supporting others to be more effective in their work, together we can reach the scale of impact needed to reach the billions of people living without access to safely managed water and sanitation.”

To address these challenges, the report provides actionable recommendations focused on prioritizing the recruitment and development of rural water technicians, enhancing capacity development with a focus on workforce issues, and adopting interactive, peer-based learning approaches. The need for standardized job titles and responsibilities is also emphasized to streamline capacity development efforts across the sector.

This report marks a significant step forward in understanding and addressing the rural water sector’s capacity needs. According to Sean Furey, RWSN Secretariat Director, “The long-term success of rural water services hinges on the talent and passion of the people behind the pipes. Investing in human capital is the key to achieving inclusive rural water services. Skilled workers not only maintain critical infrastructure but also help adapt solutions to meet local needs to ensure that safe water reaches every household, no matter how remote. This important work spotlights some of the systematic challenges, but more importantly, shows us a way forward.”

GWC, CAWST, and RWSN are committed to taking action based on the report’s findings, and they call on other organizations to join in these efforts to improve the quality and sustainability of rural water services worldwide.

Read the full report: Rural Water Capacity Needs Assessment

About Global Water Center

Global Water Center believes everyone deserves access to safely managed water. Our three-pronged approach of education, innovation, and collaboration focuses on making rural water projects more sustainable. As the go-to resource for the rural water sector, our safe water resources have reached people in 131 countries. In addition to education, we also use innovative technology to make water projects more effective and reliable. All of our efforts are rooted in collaboration with non-profits, governments, and other entities. Together, we are solving the global water crisis.

About Centre for Affordable Water and Sanitation Technology (CAWST)

CAWST is a Canadian charity and licensed not-for-profit professional engineering consultancy. We teach people how to bring safe drinking water, sanitation and hygiene into their homes, schools and clinics, using simple, affordable technologies. CAWST transfers knowledge and skills to organizations and individuals in low- and middle-income countries through workshops, open content training resources and consulting services. To learn more about CAWST and our mission to make water knowledge common knowledge, visit cawst.org.

About Rural Water Supply Network (RWSN)

RWSN is professional knowledge network, with more that 15,000 members in 160 countries, that provides a convening space for individual professionals and organisations to share experiences, collaborate, develop guidelines and standards, curate knowledge, and promote lifelong learning in the rural water sector. RWSN’s vision is that of a world in which all people enjoy safely managed water services that are resilient and sustainable, and we look to improve the quality of rural water services and their management through our members and partners. RWSN also works to inspire and support more women to become active at all levels of decision-making.

Media Contact: Alyson Rockhold

Director of Global Engagement

Global Water Center

+1 346.273.9148 arockhold@globalwatercenter.org

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b65329fd-348c-419b-9a2d-fbda0efe1228

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

General Motors to Pay $1.5M Penalty for Failing a Crash Disclosure

General Motors‘ GM autonomous vehicle division, Cruise, is set to pay a $1.5 million fine after failing to fully report a crash involving a pedestrian, per the National Highway Traffic Safety Administration (NHTSA). The incident, which occurred in October 2023 in San Francisco, involved a robotaxi that dragged a pedestrian for 20 feet after she got hit by another vehicle. It led Cruise to halt its driverless operations nationwide after California regulators deemed its vehicles a public safety risk. As a result, the California Department of Motor Vehicles revoked Cruise’s license to operate without human drivers in San Francisco.

The U.S. Department of Justice and the Securities and Exchange Commission are still investigating the incident. A GM-commissioned report revealed that Cruise employees attempted to dissuade the NHTSA from launching an investigation into the pedestrian’s injuries and failed to disclose that the pedestrian had been dragged.

Per Reuters, the NHTSA pointed out that Cruise filed incomplete reports for multiple crashes involving its automated driving systems, which includes two reports related to the October 2023 accident. The California Public Utilities Commission also fined GM $112,500 for not providing full details about the crash.

One month after the incident, Cruise recalled all 950 of its vehicles to update software. Under a consent order with NHTSA, Cruise is required to submit a corrective action plan outlining how it will improve compliance with regulations for crashes involving automated driving systems. The consent order lasts two years and the NHTSA holds the option to extend it for a third year.

Per Steve Kenner, Cruise’s chief safety officer, the agreement with NHTSA marks a positive step in a new phase for Cruise, reflecting the company’s advancements under new leadership, enhanced processes and culture and a strong commitment to increased transparency with regulators. The company is committed to working closely with the NHTSA to enhance road safety. Cruise will meet quarterly with the NHTSA to review the periodic reporting and development toward the requirements of the consent order. Cruise will submit a final report summarizing its compliance and operations 90 days before the consent order’s term ends.

General Motors’ Zacks Rank & Key Picks

GM currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the auto space are Dorman Products, Inc. DORM, Blue Bird Corporation BLBD and BYD Company Limited BYDDY, each sporting a Zacks Rank #1 (Strong Buy) at present.

The consensus estimate for DORM’s 2024 sales and earnings suggests year-over-year growth of 3.71% and 35.46%, respectively. EPS estimates for 2024 and 2025 have improved 51 cents and 37 cents, respectively, in the past 60 days.

The Zacks Consensus Estimate for BLBD’s 2024 sales and earnings suggests year-over-year growth of 17.58% and 215.89%, respectively. EPS estimates for 2024 and 2025 have improved 65 cents and 80 cents, respectively, in the past 60 days.

The Zacks Consensus Estimate for BYDDY’s 2024 sales and earnings suggests year-over-year growth of 21.88% and 17.12%. EPS estimates for 2024 and 2025 have each improved by a penny in the past 60 days.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

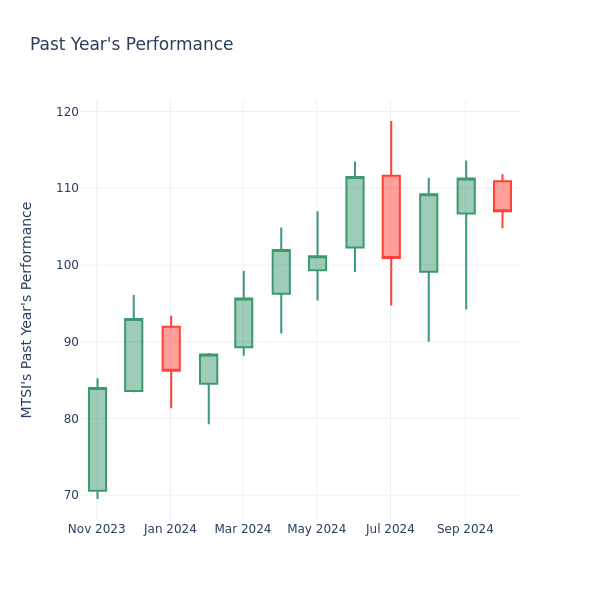

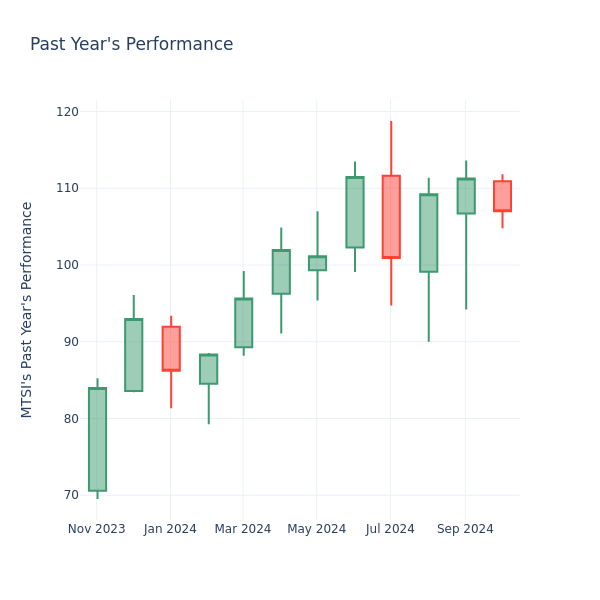

A Look Into MACOM Technology Solns Inc's Price Over Earnings

In the current market session, MACOM Technology Solns Inc. MTSI stock price is at $107.00, after a 3.83% decrease. However, over the past month, the company’s stock spiked by 9.22%, and in the past year, by 31.98%. Shareholders might be interested in knowing whether the stock is overvalued, even if the company is not performing up to par in the current session.

Comparing MACOM Technology Solns P/E Against Its Peers

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

MACOM Technology Solns has a better P/E ratio of 112.43 than the aggregate P/E ratio of 69.28 of the Semiconductors & Semiconductor Equipment industry. Ideally, one might believe that MACOM Technology Solns Inc. might perform better in the future than it’s industry group, but it’s probable that the stock is overvalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company’s market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company’s stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Are You A 'Rich' Retiree? Here's The Net Worth And Income You Need To Be In The Top 10%

Retirement looks different for everyone, but what does it take to be in the top 10% of wealthy retirees?

It’s not about flashy yachts or endless vacations. The top tier is defined by solid financial planning, diverse income streams and a clear understanding of stretching wealth beyond Social Security checks.

If you’re curious about where you stand, here’s how to tell if you’re among the top retirees of 2024.

Don’t Miss:

The Top 10% Net Worth: What’s the Magic Number?

To crack the top 10% of retirees, your net worth needs to hit around $1.9 million, according to Federal Reserve Board survey data. For those aged 65-74, that figure jumps to about $2.63 million; for retirees 75 and older, it climbs even higher to $2.86 million. This sharply contrasts the average retiree, whose net worth is much lower – closer to $280,000 on average. If you’ve crossed that $2 million line, you’re likely looking at a very different retirement experience from the average.

Trending: One trailblazing female with an expertise in renewable energy built a company that’s bringing the EV revolution to disadvantaged communities — here’s how you can invest at just $500

Top Retiree Earnings – Without a Salary

Here’s where things get interesting. Wealthy retirees aren’t just sitting on a pile of money. They’ve built multiple streams of income that continue to flow well into retirement.

While Social Security might pay a max of $58,476 annually (if you’re lucky), top retirees are pulling in much more – without even breaking a sweat. Their income comes from investments, rental properties, pensions and sometimes businesses they’ve built or invested in.

See Also: The average American couple has saved this much money for retirement — How do you compare?

The average retiree earns around $75,000 annually, but the top 10% bring in significantly more. For those aged 65 to 69, the top 10% have an annual income of $200,000.

They earn income from a combination of dividends, rental properties and strategic portfolios, which allows them to live comfortably without draining their principal savings.

Portfolio Strategy: What Do Top Retirees Do Differently?

Wealthy retirees approach investing with a long-term mindset. It’s not about playing it safe; it’s about balance. A typical portfolio for someone in the top 10% might hold around 60% stocks, 35% bonds and just 5% cash or cash-like investments. They’re still looking for growth even in retirement, rather than shifting entirely to conservative investments.

This keeps their wealth growing while also providing income. They may dial down the risk as they age, but you won’t see these retirees parking all their money in low-yield savings accounts.

Trending: This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

How Location Plays Into Wealth Perception

One factor that often goes overlooked in retirement is where you live. Retirees in certain cities will see their income stretch further. While retirees in high-income areas may bring in around $90,000 a year, someone in a lower-cost city might live just as well with less. For top 10% retirees, maintaining a high quality of life often comes from flexibility in where they choose to retire.

Retiring in the top 10% isn’t just about luck – it results from smart planning, diverse income sources and a solid investment strategy. Understanding what it takes can help you aim higher if you’re not there yet. It’s always a good idea to consult a financial advisor to ensure you’re on the right track.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Are You A ‘Rich’ Retiree? Here’s The Net Worth And Income You Need To Be In The Top 10% originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nike stock tumbles as company withdraws guidance amid CEO change

Nike (NKE) stock sank about 5% in Wednesday’s premarket trading after the company reported fiscal first quarter revenue that missed estimates and withdrew its outlook for the year amid a CEO transition.

The shoe giant reported first quarter earnings per share of $0.70, higher than Wall Street’s estimate of $0.52 and a 26% decline from the year-earlier period. Meanwhile, Nike’s revenue of $11.59 billion fell short of analyst estimates of $11.65 billion and marked a 10% decline from the year-earlier period.

Nike saw sales slump in both its direct-to-consumer business and its wholesale division. Nike Direct revenues were $4.7 billion, a 13% decline from the same quarter a year ago. Wholesale revenues were $6.4 billion, down 8% from the same period a year ago.

“A comeback at this scale takes time, and while there are some early wins, we have yet to turn the corner,” Nike CFO Matthew Friend said on the company’s earnings call Tuesday night.

Morningstar equity analyst David Swartz told Yahoo Finance that Nike’s report was “pretty much what people expected.”

“Nike has really been warning us since late last year, December of 2023, that the sportswear market was not very strong and that its innovation cycle was not looking particularly good for the beginning of the fiscal year 2025 either,” Swartz said. “Right now, Nike is in a situation where it doesn’t have a lot of new products coming out, and it is pulling back on some other products.”

The quarterly report is Nike’s first since the company announced a CEO change amid lackluster sales growth. Elliott Hill, a former Nike executive who retired in 2020, will replace John Donahoe as CEO on Oct. 14. The news initially sent Nike stock up as much as 10%.

Nike stock has slumped this year, falling more than 25% prior to the CEO changeup announcement on Sept. 19 amid concerns over slowing sales growth and pressure from rising competitors in the space like On (ONON) and Deckers’ (DECK) Hoka brand.

“This industry in sportswear is much more competitive now than it was five years ago,” Swartz said. “Donahoe didn’t understand that until it was a little bit too late.”

Friend said Nike expects revenue to fall in a range of 8% to 10% for the current quarter, weaker than Wall Street’s initial expectations for a 6.7% decline.

“Revenue expectations have moderated since the start of the year, given traffic trends on Nike, digital retail sales trends across the marketplace, and final order books for spring,” Friend said.

Tuesday’s print marked the sixth straight quarter Nike has reported single-digit revenue growth, or worse. The company also announced on Tuesday that its upcoming investor day has been postponed with no future date announced.

In a note to clients on Monday morning, Jefferies analyst Randal Konik wrote he doesn’t expect Hill to have an impact on Nike’s performance until the fiscal year 2026. Therefore, Konik believes shares are in “no man’s land and likely remain range-bound for a number of quarters.”

Josh Schafer is a reporter for Yahoo Finance. Follow him on X @_joshschafer.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

'Diversification For Idiots?' – Valuation Guru Challenges Charlie Munger's Thoughts on Putting All Your Eggs in One Basket on CNBC

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Charlie Munger’s comments on stock portfolio diversification have made waves in the investing world for decades. The late legendary investor repeatedly said that diversification is for “idiots” who don’t know what they are doing.

During a shareholder meeting in 2019, while answering a question, Munger said:

“The idea of diversification makes sense to a point – if you don’t know what you’re doing. If you want the standard result and don’t want to end up embarrassed, then of course, you should widely diversify. But nobody is entitled to a lot of money for holding this view. It’s like knowing two plus two is four. Any idiot can diversify a portfolio.”

Check It Out:

During a 2017 event, Munger said:

“Diversification is for those who don’t know anything. Warren (Warren Buffett) calls them know-nothing investors. If you are capable of figuring out something that will work better, you’re just hurting yourself looking for 50 (stocks) when three will suffice. Hell, one will suffice if you do it right.”

Are Charlie Munger’s Thoughts on Diversification Relevant Today?

Charlie Munger died in November 2023 and at the time of his death, he was worth about $2.6 billion. Munger was a genius and his stock-picking skills, wisdom and life will remain a topic of interest for generations to come. However, his blunt thoughts on diversification aren’t shared by many. Not everyone can bet their life savings on two or three stocks, especially beginners with a limited budget.

The “Dean of Valuation” and Finance Guru’s Counterargument

Aswath Damodaran, famously known as the “Dean of Valuation” on Wall Street, is a professor of finance at the Stern School of Business at New York University. The valuation guru is a nine-time “Professor of the Year” winner at NYU and has written several notable books, including Investment Valuation, The Little Book of Valuation and The Corporate Lifecycle: Business, Investment and Management Implications, among many others.

Talking about Apple in a recent CNBC program, Damodaran was asked why Berkshire Hathaway is selling the iPhone maker’s shares. The professor said he believes it was a portfolio “concentration issue.”

“When you have a third of your portfolio trapped in one company, it’s a very dangerous place for anybody to be. So I think the pruning reflected that overconcentration.”

The program host then reminded Damodaran about Charlie Munger’s thoughts on diversification and his advice to put all your eggs in one basket and watch it carefully. She referred to the famous quote often attributed to Buffett and Munger, where they said you should keep all your eggs in one basket but watch that basket closely.

Damodaran responded by countering Munger’s idea, asking:

“Would you take 30% of your money now and buy any one stock, no matter how great it is? And I’d wager he’d say no.”

Damodaran emphasized the need for consistency in investing approaches.

“It almost seems like there are two sets of rules: One for investments we are going to make and one for investments we’ve already made. I think we need to be consistent.”

See Also:

Charlie Munger’s Thoughts on Finance Professors and Portfolio Theory

If only Charlie Munger were here today to share his thoughts on the professor’s argument.

However, Munger was always critical of modern portfolio theory at universities and was skeptical of finance professors. At the Wesco Annual Meeting in 2009, while discussing the issue of portfolio diversification, Munger said:

“By and large, I don’t think too much of finance professors. It is a field with witchcraft. I think a lot of physics and engineering professors. They try to teach it like physics, but it doesn’t yield to that. I never went to university with finance professors. Finance professors all believe in diversification, while we try to beat the average. If you buy a dob of everything, that is different from buying something you know something about. That is a different fountain than I want to drink in.”

Interest Rates Are Falling, But These Yields Aren’t Going Anywhere

Lower interest rates mean some investments won’t yield what they did in months past, but you don’t have to lose those gains. Certain private market real estate investments are giving retail investors the opportunity to capitalize on these high-yield opportunities and Benzinga has identified some of the most attractive options for you to consider.

Arrived Homes, the Jeff Bezos-backed investment platform, offers a Private Credit Fund. This fund provides access to a pool of short-term loans backed by residential real estate with a target of 7% to 9% net annual yield paid to investors monthly. The best part? Unlike other private credit funds, this one has a minimum investment of only $100.

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

This article ‘Diversification For Idiots?’ – Valuation Guru Challenges Charlie Munger’s Thoughts on Putting All Your Eggs in One Basket on CNBC originally appeared on Benzinga.com