Wall Street Analysts Think Archrock Inc. Is a Good Investment: Is It?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock’s price, do they really matter?

Let’s take a look at what these Wall Street heavyweights have to say about Archrock Inc. AROC before we discuss the reliability of brokerage recommendations and how to use them to your advantage.

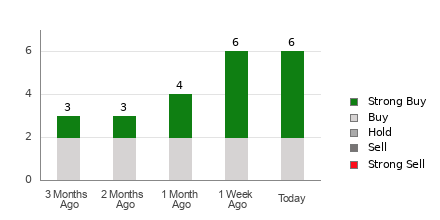

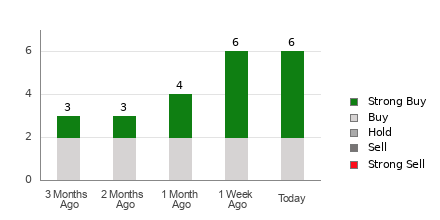

Archrock Inc. currently has an average brokerage recommendation of 1.33, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by six brokerage firms. An ABR of 1.33 approximates between Strong Buy and Buy.

Of the six recommendations that derive the current ABR, four are Strong Buy and two are Buy. Strong Buy and Buy respectively account for 66.7% and 33.3% of all recommendations.

Brokerage Recommendation Trends for AROC

The ABR suggests buying Archrock Inc., but making an investment decision solely on the basis of this information might not be a good idea. According to several studies, brokerage recommendations have little to no success guiding investors to choose stocks with the most potential for price appreciation.

Do you wonder why? As a result of the vested interest of brokerage firms in a stock they cover, their analysts tend to rate it with a strong positive bias. According to our research, brokerage firms assign five “Strong Buy” recommendations for every “Strong Sell” recommendation.

In other words, their interests aren’t always aligned with retail investors, rarely indicating where the price of a stock could actually be heading. Therefore, the best use of this information could be validating your own research or an indicator that has proven to be highly successful in predicting a stock’s price movement.

With an impressive externally audited track record, our proprietary stock rating tool, the Zacks Rank, which classifies stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), is a reliable indicator of a stock’s near -term price performance. So, validating the Zacks Rank with ABR could go a long way in making a profitable investment decision.

Zacks Rank Should Not Be Confused With ABR

Although both Zacks Rank and ABR are displayed in a range of 1-5, they are different measures altogether.

The ABR is calculated solely based on brokerage recommendations and is typically displayed with decimals (example: 1.28). In contrast, the Zacks Rank is a quantitative model allowing investors to harness the power of earnings estimate revisions. It is displayed in whole numbers — 1 to 5.

Analysts employed by brokerage firms have been and continue to be overly optimistic with their recommendations. Since the ratings issued by these analysts are more favorable than their research would support because of the vested interest of their employers, they mislead investors far more often than they guide.

In contrast, the Zacks Rank is driven by earnings estimate revisions. And near-term stock price movements are strongly correlated with trends in earnings estimate revisions, according to empirical research.

Furthermore, the different grades of the Zacks Rank are applied proportionately across all stocks for which brokerage analysts provide earnings estimates for the current year. In other words, at all times, this tool maintains a balance among the five ranks it assigns.

Another key difference between the ABR and Zacks Rank is freshness. The ABR is not necessarily up-to-date when you look at it. But, since brokerage analysts keep revising their earnings estimates to account for a company’s changing business trends, and their actions get reflected in the Zacks Rank quickly enough, it is always timely in indicating future price movements.

Is AROC a Good Investment?

In terms of earnings estimate revisions for Archrock Inc., the Zacks Consensus Estimate for the current year has increased 3.4% over the past month to $1.04.

Analysts’ growing optimism over the company’s earnings prospects, as indicated by strong agreement among them in revising EPS estimates higher, could be a legitimate reason for the stock to soar in the near term.

The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #1 (Strong Buy) for Archrock Inc.

Therefore, the Buy-equivalent ABR for Archrock Inc. may serve as a useful guide for investors.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Vance Vs. Walz: Flash Poll Picks This Candidate As Tuesday's Debate Winner, But He Falls Short In Favorability Rating

In the debate between vice presidential nominees, Minnesota Governor Tim Walz and Sen. J.D. Vance (R-Ohio) held late Tuesday, the latter was slightly ahead, flash polls by CNN showed.

What Happened: Fifty-one percent of the registered voters who watched the debate picked Vance as the winner of Tuesday’s debate, the CNN instant poll by SSRS showed. A more modest 49% opined that Walz won the face-off.

The poll was conducted by text message with 574 registered voters who said they watched the debate, and the results for the full sample of debate watchers have a margin of sampling error of plus or minus 5.3 percentage points.

Fifty-nine percent of debate watchers said they had a favorable view of the Democratic vice presidential candidate Walz and only 22% viewed him unfavorably, giving him a net positive favorability rating of 37 points. Ahead of the debate, he had a net positive positive favorability rating of 14 points (46% favorable and 32% unfavorable).

Meanwhile, debate watchers had a net negative favorability rating of three points for Republican nominee Vance (41% favorable and 44% unfavorable). This marked a solid improvement from the net negative 22-point favorability rating for him ahead of the debate (30% favorable, 52% unfavorable).

The pollster noted that debate watchers contacted were three points likelier to be Democratic-aligned than Republican-aligned, which is about five points more Democratic-leaning than all registered voters nationally. The composition is different from the audience of the two presidential debates this year, with both GOP-leaning than the potential American electorate overall.

When asked whether either of the candidates was qualified to serve as president if needed, 65% said Walz would fit the bill and 58% said Vance had credentials to serve as president. The proportion who felt the same about both were 62% and 50%, respectively, ahead of the debate.

Why It’s Important: The presidential election is just a little over a month away, and ever since Vice President Kamala Harris replaced President Joe Biden on the Democratic ticket, she has pushed slightly ahead in the race. Given a second debate between Trump and Harris is unlikely, the outcome of the vice presidential debate was keenly watched.

A post by X handle @EndTribalism summed up the debate as “America won.” “The amount of times the words ‘I agree with just about all of that but..’ were said tonight was beautiful,” the post said. “The main takeaway is that most Americans agree on what the issues of America are, we just slightly disagree on how to solve them.”

Following the debate, Trump applauded his running mate on the Truth Social platform. “JD crushed it! Walz was a Low IQ Disaster – Very much like Kamala. Our Country would never be able to recover from an Administration of these two,” the former president said. “Can you imagine them representing us with sharp, fierce Foreign Leaders? I can’t!”

Did You Know?

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Richman Group and Brilliant Corners Announce Grand Opening of Las Palmas Apartments

New apartment community provides 53 units of supportive housing to Wilmington neighborhood

LOS ANGELES, Oct. 1, 2024 /PRNewswire/ — The Richman Group of California, an innovator in multifamily development, and Richman Property Services, a national leader in multifamily management, in partnership with Brilliant Corners, a leading supportive housing developer and services provider in California, today celebrated the grand opening of Las Palmas Apartments, a new supportive housing community in the Wilmington neighborhood of Los Angeles. The development is financed in part by HHH Challenge funds from the Los Angeles Housing Department and California Department of Housing and Community Development No Place Like Home funding, administered by the Los Angeles County Development Authority (LACDA) and the Los Angeles County Department of Mental Health.

Designed by award-winning architecture firm KFA, Las Palmas Apartments successfully reuses unique architectural features of the original structure — a vacant single-story grocery store — and blends them with a new four-story residential wing. The 54-unit adaptive reuse project will provide 53 units of permanent supportive housing for people who have experienced homelessness, as well as an onsite manager’s unit.

The grand opening featured a proclamation from Los Angeles County Fourth District Supervisor, Janice Hahn, who represents the Wilmington neighborhood, remarks from Carrie Esparza, Mental Health Program Manager IV for the Los Angeles County Department of Mental Health, and the presentation of a certificate by Lynn Katano, Director of the Housing Investment and Finance Division for the Los Angeles County Development Authority (LACDA). The event also provided an opportunity for attendees to tour the site and write welcome cards for new residents.

“The development of Las Palmas was an intensive, collaborative effort, and we’re so proud of the work from our team, our development partners, and municipal leaders to see this essential community to the finish line,” said Rick Westberg, Executive Vice President at The Richman Group — co-developer, co-owners and on-site property manager for Las Palmas. “The redevelopment of this site required the cooperation and support of numerous organizations, city departments and offices, but the results speak for themselves and represent an important step toward addressing the local affordable and supportive housing need.”

Las Palmas is the first development partnership between The Richman Group and Brilliant Corners.

“The opening of Las Palmas Apartments marks a significant milestone for Brilliant Corners, representing our first multifamily permanent supportive housing development in LA County,” said William F. Pickel, Chief Executive Officer at Brilliant Corners. “Through adaptive reuse projects like Las Palmas, we are utilizing the existing built environment to provide much-needed housing and supportive services to our new residents. We are immensely grateful to our partners and everyone who made this project possible.”

Located at 1355 N. Avalon Blvd., Las Palmas features fully furnished homes with a mix of 37 studio apartments, 16 one-bedroom homes and a two-bedroom manager’s unit. The property includes a central open-air courtyard, community room, bike storage room, laundry facility and resident services rooms. All utilities are included. Residents will receive onsite case management services from Brilliant Corners.

“For dozens of people who have reached the end of their ropes and find themselves living on our streets, this place is going to be that lifeline they so desperately need,” said Los Angeles County Fourth District Supervisor, Janice Hahn. “These 53 beautiful apartments and the welcoming environment that I know everyone here will provide is a far cry from where these residents are coming from. Here they’ll know they’re safe and, most importantly, cared about.”

Connectivity is uncompromised at Las Palmas. The location also puts residents in close proximity to LA DASH bus routes and other public transit options for easy access to downtown LA and the metro region.

“The LACDA is honored to be part of the team that contributed to the creation of 53 fully furnished housing units for individuals who have experienced homelessness,” said Emilio Salas, LACDA Executive Director. “Once a vacant, single-story grocery store, Las Palmas Apartments now offers beautiful housing with access to transportation to help its residents manage their everyday needs.”

“The Los Angeles County Department of Mental Health is dedicated to supporting every person’s journey of recovery and wellbeing,” said Dr. Lisa H. Wong, Director of the Los Angeles County Department of Mental Health (LACDMH). “Our investment in Las Palmas demonstrates our commitment to ensuring each individual in our care has a place they can call their own, and a community to call home while they start new chapters of their lives with renewed hope and support.”

About The Richman Group

The Richman Group is one of the nation’s leading real estate development, investment, and property management firms, specializing in the creation of premier residential communities. With a portfolio spanning luxury apartments, affordable housing, and mixed-use developments, The Richman Group is committed to delivering innovative and sustainable living solutions. Our dedication to quality, resident satisfaction, and community enhancement has made us a trusted name in the industry. From groundbreaking developments to thoughtful property management, we strive to elevate the standard of living for our residents across the United States. For more information, please visit www.TheRichmanGroup.com.

About Brilliant Corners

Brilliant Corners is a supportive housing nonprofit providing innovative housing and housing-related services to individuals transitioning from or at risk of homelessness or institutional involvement. Our supportive housing programs and properties create rapid access to housing resources through landlord engagement, rent subsidy administration, and supportive service integration strategies. We develop, own and managed state-of-the-art licensed residential care homes, as well as multifamily permanent supportive housing. With over 17,000 people housed and served to date, Brilliant Corners offers a variety of innovative supportive housing models that meet the unique needs of each individual we serve. Learn more at brilliantcorners.org.

Media Contact:

Marlena DeFalco

LinnellTaylor Marketing

marlena@linnelltaylor.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/the-richman-group-and-brilliant-corners-announce-grand-opening-of-las-palmas-apartments-302264875.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/the-richman-group-and-brilliant-corners-announce-grand-opening-of-las-palmas-apartments-302264875.html

SOURCE The Richman Group

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Company TerrAscend Secures Second And Final $26M Loan, Reduces Debt In Michigan

TerrAscend Corp. TSNDF cannabis company announced that it has completed the second and final draw of $26 million as part of its $140 million senior secured term loan.

The loan, managed by FocusGrowth Asset Management, LP, was initially announced in August 2024. The new funds were used to pay down higher-interest debt in Michigan, helping the company strengthen its financial position.

Earlier this year, Jason Wild, executive chairman of TerrAscend said that by closing this financing, the company has “no other material debt maturing until late 2027”

Key Financial Details

The loan, which carries a 12.75% interest rate and matures in August 2028, had no prepayment penalties. TerrAscend initially received $114 million from the same loan in August, bringing the total to $140 million. The loan is backed by TerrAscend’s assets in Pennsylvania, California, Michigan and certain entities in Maryland.

Ventum Capital Markets acted as the exclusive financial advisor for the transaction.

Read Also: Cannabis Company TerrAscend Posts Q1 2024 Gains In Revenue And Operational Efficiency

What This Means For TerrAscend

The funds will assist in the reduction of high-interest debt, especially in Michigan, where TerrAscend continues to expand its presence. It carries an interest rate of 12.75%, up until August 2028, contains no prepayment penalties, and is guaranteed by the Company and TerrAscend USA, Inc.

No warrants were issued as part of the Loan.

TSNDF Price Action

TerrAscend’s shares traded 3.82% lower at $1.26 per share at the time of writing on Tuesday evening.

Cover: AI Generated Image

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

Chinese Stocks Soar More Than 8% in Hong Kong on Stimulus Bets

(Bloomberg) — Chinese shares listed in Hong Kong jumped the most in almost two years, adding to their stimulus-induced euphoria as traders returned from a public holiday.

Most Read from Bloomberg

The Hang Seng China Enterprises (^HSCE) Index climbed as much as 8.5%, extending its winning streak to 13 straight days. Property developers led gains with a gauge tracking the sector leaping as much as 35%, a record intraday advance, while an index of brokerage shares, a barometer of risk sentiment, jumped 32%. Mainland Chinese markets remain shut until Oct. 8 for a week-long holiday.

“Hedge funds and mutual funds, which had previously been underexposed, are now moving into Chinese assets,” said Billy Leung, an investment strategist at Global X Management in Sydney. “These moves are being supported by a broader reversal in key markets such as copper and Asia Pacific currencies, driven by renewed optimism in China’s growth.”

Sentiment toward equities in the world’s second-biggest economy has seen a dramatic turnaround since the start of last week as the authorities unveiled a range of stimulus measures that included interest-rate cuts, freeing-up of cash for banks, and liquidity support for stocks. Four major cities also eased home-buying curbs and the central bank moved to lower mortgage rates.

There’s growing optimism the blitz of stimulus has brought an end to the three-year slide in Chinese shares that was driven by the stuttering economy and multi-year property crisis. Still, there have been a number of false dawns, most recently a rally that started in February, so investors have ample reason to remain cautious.

So far, the attractive valuations of Chinese stocks after their prolonged decline are helping to lure investors.

Even with the recent surge, the Hang Seng China Enterprises Index is still trading at below nine times estimated earnings for the next 12 months, less than half that of the S&P 500 (^GSPC), data compiled by Bloomberg show.

Brokerages powered ahead Wednesday amid optimism they will be among the key beneficiaries of the stock trading frenzy as they make a commission in every trade. China Merchants Securities Co. gained as much as 76%, and Guolian Securities Co. rose almost 50%.

Hedge funds are piling into Chinese stocks at an unprecedented pace, according to Goldman Sachs Group Inc. Leveraged funds made record net purchases of Asian stocks in September, led by China and Hong Kong, based on data from the investment bank’s prime brokerage desk.

Billionaire investor David Tepper is buying more of “everything” related to China, while the world’s biggest money manager, BlackRock Inc., is now overweight Chinese shares. US-based Mount Lucas Management has entered into bullish positions on China exchange-traded funds, while Singapore’s GAO Capital is buying Chinese large cap stocks.

“If subsequent policies can exceed expectations, I think the bull market can last three months to half a year,” said Bo Pei, an equity research analyst at US Tiger Securities Inc. “A correction amid such a sharp rise isn’t unusual. What’s important is whether it can continue to rise after the correction. I personally am quite confident.”

The impact of the stock rally is also being seen in the currency market.

A gauge measuring the one-month borrowing costs in Hong Kong dollars climbed for a eighth day to the highest since August, a sign liquidity is becoming tighter amid seasonal demand for cash and a surge in stocks. Hong Kong’s currency rose to trade close to the strong end of its trading band and the offshore yuan also strengthened.

The stock rally has been so powerful that in just eight days, China has regained the weighting in emerging-market indexes that it lost over the previous 10 months.

The country’s share in MSCI Inc.’s benchmark for developing-nation equities rose to 27.8% at the end of September, the highest since November 2023, according to data compiled by Bloomberg based on those stocks listed on mainland, Hong Kong and overseas markets.

Chinese shares are leading gains in global equity benchmarks over the past month. The Hang Seng China Enterprises Index is the top performer with a gain of 31%, while the Hang Seng Index is second at 28%.

“We are turning more positive on China’s economic outlook,” Sylvia Sheng, global multi-asset strategist at JP Morgan Asset Management, wrote in a client note. “Positive signals from the Chinese government and regulators, and their increased focus on supporting economic growth and stabilizing the property sector should help put a floor on market prices and propel momentum in the equity markets.”

—With assistance from John Cheng and Tian Chen.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Wall Street Analysts Think Arista Networks Is a Good Investment: Is It?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock’s price, but are they really important?

Before we discuss the reliability of brokerage recommendations and how to use them to your advantage, let’s see what these Wall Street heavyweights think about Arista Networks ANET.

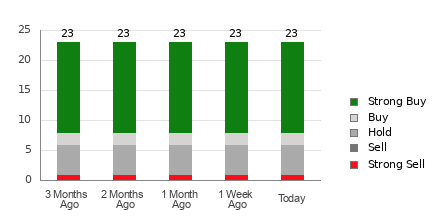

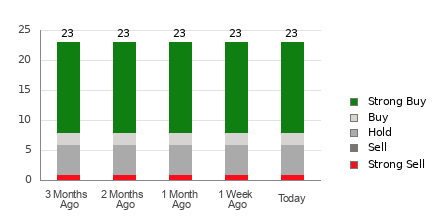

Arista Networks currently has an average brokerage recommendation of 1.67, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by 23 brokerage firms. An ABR of 1.67 approximates between Strong Buy and Buy.

Of the 23 recommendations that derive the current ABR, 15 are Strong Buy and two are Buy. Strong Buy and Buy respectively account for 65.2% and 8.7% of all recommendations.

Brokerage Recommendation Trends for ANET

While the ABR calls for buying Arista Networks, it may not be wise to make an investment decision solely based on this information. Several studies have shown limited to no success of brokerage recommendations in guiding investors to pick stocks with the best price increase potential.

Do you wonder why? As a result of the vested interest of brokerage firms in a stock they cover, their analysts tend to rate it with a strong positive bias. According to our research, brokerage firms assign five “Strong Buy” recommendations for every “Strong Sell” recommendation.

In other words, their interests aren’t always aligned with retail investors, rarely indicating where the price of a stock could actually be heading. Therefore, the best use of this information could be validating your own research or an indicator that has proven to be highly successful in predicting a stock’s price movement.

Zacks Rank, our proprietary stock rating tool with an impressive externally audited track record, categorizes stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), and is an effective indicator of a stock’s price performance in the near future. Therefore, using the ABR to validate the Zacks Rank could be an efficient way of making a profitable investment decision.

ABR Should Not Be Confused With Zacks Rank

Although both Zacks Rank and ABR are displayed in a range of 1-5, they are different measures altogether.

The ABR is calculated solely based on brokerage recommendations and is typically displayed with decimals (example: 1.28). In contrast, the Zacks Rank is a quantitative model allowing investors to harness the power of earnings estimate revisions. It is displayed in whole numbers — 1 to 5.

It has been and continues to be the case that analysts employed by brokerage firms are overly optimistic with their recommendations. Because of their employers’ vested interests, these analysts issue more favorable ratings than their research would support, misguiding investors far more often than helping them.

In contrast, the Zacks Rank is driven by earnings estimate revisions. And near-term stock price movements are strongly correlated with trends in earnings estimate revisions, according to empirical research.

In addition, the different Zacks Rank grades are applied proportionately to all stocks for which brokerage analysts provide current-year earnings estimates. In other words, this tool always maintains a balance among its five ranks.

There is also a key difference between the ABR and Zacks Rank when it comes to freshness. When you look at the ABR, it may not be up-to-date. Nonetheless, since brokerage analysts constantly revise their earnings estimates to reflect changing business trends, and their actions get reflected in the Zacks Rank quickly enough, it is always timely in predicting future stock prices.

Is ANET a Good Investment?

In terms of earnings estimate revisions for Arista Networks, the Zacks Consensus Estimate for the current year has remained unchanged over the past month at $8.24.

Analysts’ steady views regarding the company’s earnings prospects, as indicated by an unchanged consensus estimate, could be a legitimate reason for the stock to perform in line with the broader market in the near term.

The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #3 (Hold) for Arista Networks.

It may therefore be prudent to be a little cautious with the Buy-equivalent ABR for Arista Networks.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Verizon Makes a $3.3 Billion Deal to Help Protect Its Towering Dividend

Verizon (NYSE: VZ) pays a towering dividend. The telecom giant’s payout yields more than 6%, making it the highest-yielding member of the Dow Jones Industrial Average (and a top-10 payer in the S&P 500). One factor driving its elevated yield is concerns that the company’s hefty debt level might impact its ability to sustain that payout over the long term.

The company’s debt is on track to balloon further after it agreed to buy Frontier Communications (NASDAQ: FYBR) in a $20 billion all-cash deal. However, it recently made a counter move to cash in the value of its tower assets, which will bring in $3.3 billion to help enhance its financial flexibility.

Starting from a position of strength

Verizon ended the second half of this year with $149.3 billion of total debt (and $122.8 billion of net debt). While that’s a lot of debt on an absolute basis, the telecom behemoth can handle that level. Its net-debt ratio was 2.5 times, which is lower than telecom rival AT&T (NYSE: T). Even though AT&T had a similar debt load ($126.9 billion of net debt), it had a higher-leverage ratio of nearly 2.9 times. AT&T aims to get its leverage ratio down to the 2.5 times range in the first half of next year. Meanwhile, Verizon set an even lower long-term leverage target of 1.75 times to 2.0 times, which it also initially aimed to achieve by next year.

Verizon’s stronger balance sheet recently empowered it to make a move aimed at improving its competitive positioning versus AT&T in fiber. The company’s proposed $20 billion deal for Frontier will increase its scale by adding 2.2 million fiber customers. It will also enhance its ability to grow its fiber business, which will be able to reach 25 million premises. The deal should also boost Verizon’s earnings, given the expected $500 million in cost synergies it expects to capture.

However, the deal will delay Verizon’s ability to achieve its leverage target. Credit rating agency Fitch expects Verizon’s leverage ratio to be around 2.3 times by the time it closes the Frontier acquisition next year. It will then jump back up into the mid-2.0 times range before steadily falling back toward its long-term target.

A debt-reduction accelerant

Verizon could have de-leveraged its balance sheet solely with post-dividend free cash flow and earnings growth. However, it is taking a step to accelerate its ability to eventually achieve its leverage target by cashing in on some of its tower assets.

The company agreed to give Vertical Bridge the exclusive rights to lease, operate, and manage 6,339 wireless communications towers across the U.S. for $3.3 billion. The deal’s structure is a prepaid lease with upfront proceeds of about $2.8 billion in cash. Verizon will lease back the capacity on the towers for at least 10 years. Meanwhile, Vertical Bridge will have the ability to sign leases with additional tenants on those towers.

That upfront cash payment will help reduce Verizon’s debt level ahead of the Frontier acquisition. It will put the company in an even stronger position to handle that transaction, accelerating its ability to eventually achieve its long-term leverage target.

Verizon could sell other non-core assets in the future, including additional cell towers and some non-core fiber assets. That would further hasten its ability to reach its targeted leverage level.

A smart move

Verizon has been a great dividend stock over the years. It recently delivered its 18th straight annual-dividend increase, extending the currently longest dividend-growth streak in the U.S. telecom sector. While the Frontier deal has caused concerns that a reelevation in its debt level could jeopardize its dividend-growth streak, its tower transaction should help ease those worries. It enhances the thesis that Verizon can continue to pay a towering dividend that should keep growing.

Should you invest $1,000 in Verizon Communications right now?

Before you buy stock in Verizon Communications, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Verizon Communications wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Matt DiLallo has positions in Verizon Communications. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

Verizon Makes a $3.3 Billion Deal to Help Protect Its Towering Dividend was originally published by The Motley Fool

O'Reilly Automotive, Inc. Announces Dates for Its Third Quarter 2024 Earnings Release and Conference Call

- Earnings Release Date – Wednesday, October 23, 2024, after 3:30 p.m. Central Time

- Conference Call Date – Thursday, October 24, 2024, at 10:00 a.m. Central Time

SPRINGFIELD, Mo., Oct. 01, 2024 (GLOBE NEWSWIRE) — O’Reilly Automotive, Inc. (the “Company” or “O’Reilly”) ORLY, a leading retailer in the automotive aftermarket industry, announces the release date for its third quarter 2024 results as Wednesday, October 23, 2024, with a conference call to follow on Thursday, October 24, 2024.

The Company’s third quarter 2024 results will be released after 3:30 p.m. Central Time on Wednesday, October 23, 2024, and can be viewed, at that time, on the Company’s website at www.OReillyAuto.com by clicking on “Investor Relations” and then “News Room.”

Investors are invited to listen to the Company’s conference call discussing the financial results for the third quarter of 2024, on Thursday, October 24, 2024, at 10:00 a.m. Central Time, via webcast on the Company’s website at www.OReillyAuto.com by clicking on “Investor Relations” and then “News Room.” Interested analysts are invited to join the call. The dial-in number for the call is (888) 506-0062 and the conference call identification number is 560004. A replay of the conference call will be available on the Company’s website through October 23, 2025.

About O’Reilly Automotive, Inc.

O’Reilly Automotive, Inc. was founded in 1957 by the O’Reilly family and is one of the largest specialty retailers of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States, serving both the do-it-yourself and professional service provider markets. Visit the Company’s website at www.OReillyAuto.com for additional information about O’Reilly, including access to online shopping and current promotions, store locations, hours and services, employment opportunities, and other programs. As of June 30, 2024, the Company operated 6,244 stores across 48 U.S. states, Puerto Rico, Mexico, and Canada.

For further information contact: Investor Relations Contacts Mark Merz (417) 829-5878 Eric Bird (417) 868-4259 Media Contact Sonya Cox (417) 829-5709

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MAA Announces Date of Third Quarter 2024 Earnings Release, Conference Call

GERMANTOWN, Tenn., Oct. 1, 2024 /PRNewswire/ — MAA MAA announced today that the Company expects to release its third quarter 2024 results on Wednesday, October 30, 2024, after market close and will hold a conference call on Thursday, October 31, 2024, at 9:00 a.m. Central Time. During the conference call, company officers will review third quarter 2024 performance and conduct a question-and-answer session.

The conference call-in number is (800) 715-9871 (Domestic) or +1 (646) 307-1963 (International). A replay of the conference call will be available from October 31, 2024 through November 14, 2024 by dialing (800) 770-2030 (Domestic) or +1 (609) 800-9909 (International) and using Conference ID 5215035.

A live webcast of the conference call will be available on the “For Investors” page of the Company’s website at www.maac.com and an audio archive of the call will be posted on the Company’s website following the call’s conclusion.

About MAA

MAA, an S&P 500 company, is a self-administered real estate investment trust (REIT) focused on delivering strong, full-cycle investment performance for shareholders through the ownership, management, acquisition, development and redevelopment of apartment communities primarily in the Southeast, Southwest and Mid-Atlantic regions of the United States. For further details, please refer to www.maac.com or contact Investor Relations at investor.relations@maac.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/maa-announces-date-of-third-quarter-2024-earnings-release-conference-call-302264686.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/maa-announces-date-of-third-quarter-2024-earnings-release-conference-call-302264686.html

SOURCE MAA

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Options Exercise Update At Harmony Biosciences: Jeffrey Dierks Engages

A large exercise of company stock options by Jeffrey Dierks, Chief Commercial Officer at Harmony Biosciences HRMY was disclosed in a new SEC filing on September 30, as part of an insider exercise.

What Happened: The latest Form 4 filing on Monday with the U.S. Securities and Exchange Commission uncovered Dierks, Chief Commercial Officer at Harmony Biosciences, exercising stock options for 200 shares of HRMY. The total transaction was valued at $3,529.

The Tuesday morning market activity shows Harmony Biosciences shares up by 4.12%, trading at $41.65. This implies a total value of $3,529 for Dierks’s 200 shares.

Get to Know Harmony Biosciences Better

Harmony Biosciences Holdings Inc is a commercial-stage pharmaceutical company focused on developing and commercializing therapies for patients living with rare neurological diseases who have unmet medical needs. The company’s product WAKIX (pitolisant), is a molecule with a novel mechanism of action specifically designed to increase histamine signaling in the brain by binding to H3 receptors and used for the treatment of cataplexy in adult patients with narcolepsy.

Unraveling the Financial Story of Harmony Biosciences

Revenue Growth: Harmony Biosciences’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 28.76%. This indicates a substantial increase in the company’s top-line earnings. When compared to others in the Health Care sector, the company excelled with a growth rate higher than the average among peers.

Holistic Profitability Examination:

-

Gross Margin: Achieving a high gross margin of 81.4%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): With an EPS below industry norms, Harmony Biosciences exhibits below-average bottom-line performance with a current EPS of 0.2.

Debt Management: With a below-average debt-to-equity ratio of 0.35, Harmony Biosciences adopts a prudent financial strategy, indicating a balanced approach to debt management.

Navigating Market Valuation:

-

Price to Earnings (P/E) Ratio: Harmony Biosciences’s P/E ratio of 20.51 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The P/S ratio of 3.58 is lower than the industry average, implying a discounted valuation for Harmony Biosciences’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 10.05, Harmony Biosciences’s EV/EBITDA ratio reflects a below-par valuation compared to industry averages signalling undervaluation

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Important

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Deciphering Transaction Codes in Insider Filings

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Harmony Biosciences’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.