Is It Worth Investing in Tenet Based on Wall Street's Bullish Views?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock’s price. Do they really matter, though?

Before we discuss the reliability of brokerage recommendations and how to use them to your advantage, let’s see what these Wall Street heavyweights think about Tenet Healthcare THC.

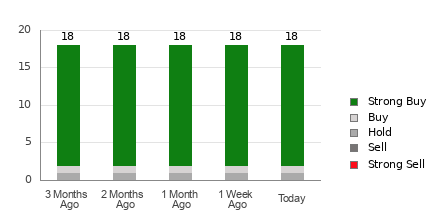

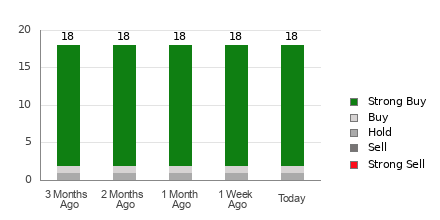

Tenet currently has an average brokerage recommendation of 1.17, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by 18 brokerage firms. An ABR of 1.17 approximates between Strong Buy and Buy.

Of the 18 recommendations that derive the current ABR, 16 are Strong Buy and one is Buy. Strong Buy and Buy respectively account for 88.9% and 5.6% of all recommendations.

Brokerage Recommendation Trends for THC

The ABR suggests buying Tenet, but making an investment decision solely on the basis of this information might not be a good idea. According to several studies, brokerage recommendations have little to no success guiding investors to choose stocks with the most potential for price appreciation.

Are you wondering why? The vested interest of brokerage firms in a stock they cover often results in a strong positive bias of their analysts in rating it. Our research shows that for every “Strong Sell” recommendation, brokerage firms assign five “Strong Buy” recommendations.

In other words, their interests aren’t always aligned with retail investors, rarely indicating where the price of a stock could actually be heading. Therefore, the best use of this information could be validating your own research or an indicator that has proven to be highly successful in predicting a stock’s price movement.

With an impressive externally audited track record, our proprietary stock rating tool, the Zacks Rank, which classifies stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), is a reliable indicator of a stock’s near -term price performance. So, validating the Zacks Rank with ABR could go a long way in making a profitable investment decision.

Zacks Rank Should Not Be Confused With ABR

In spite of the fact that Zacks Rank and ABR both appear on a scale from 1 to 5, they are two completely different measures.

The ABR is calculated solely based on brokerage recommendations and is typically displayed with decimals (example: 1.28). In contrast, the Zacks Rank is a quantitative model allowing investors to harness the power of earnings estimate revisions. It is displayed in whole numbers — 1 to 5.

It has been and continues to be the case that analysts employed by brokerage firms are overly optimistic with their recommendations. Because of their employers’ vested interests, these analysts issue more favorable ratings than their research would support, misguiding investors far more often than helping them.

In contrast, the Zacks Rank is driven by earnings estimate revisions. And near-term stock price movements are strongly correlated with trends in earnings estimate revisions, according to empirical research.

Furthermore, the different grades of the Zacks Rank are applied proportionately across all stocks for which brokerage analysts provide earnings estimates for the current year. In other words, at all times, this tool maintains a balance among the five ranks it assigns.

There is also a key difference between the ABR and Zacks Rank when it comes to freshness. When you look at the ABR, it may not be up-to-date. Nonetheless, since brokerage analysts constantly revise their earnings estimates to reflect changing business trends, and their actions get reflected in the Zacks Rank quickly enough, it is always timely in predicting future stock prices.

Is THC a Good Investment?

In terms of earnings estimate revisions for Tenet, the Zacks Consensus Estimate for the current year has increased 0.1% over the past month to $10.72.

Analysts’ growing optimism over the company’s earnings prospects, as indicated by strong agreement among them in revising EPS estimates higher, could be a legitimate reason for the stock to soar in the near term.

The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #1 (Strong Buy) for Tenet.

Therefore, the Buy-equivalent ABR for Tenet may serve as a useful guide for investors.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

China Rally Spurs $7 Billion Loss for Shorts of US-Listed Stocks

(Bloomberg) — The dramatic stimulus-fueled rally in Chinese stocks has cost traders betting against US-listed shares roughly $6.9 billion in mark-to-market losses, according to a report from S3 Partners.

Most Read from Bloomberg

The country’s benchmark CSI 300 (000300.SS) index has risen more than 27% from its Sept. 13 trough, supported by a spate of policy-easing measures, while the Nasdaq Golden Dragon (^HXC) index of US-listed Chinese stocks has surged more than 36%. That’s erased about $3.7 billion in year-to-date gains, and left shorts now nursing around $3.2 billion in paper losses, according to the market analytics firm.

“Prior to the recent rally short sellers were profitably building their positions in a falling market,” Ihor Dusaniwsky, managing director of predictive analytics at S3, said in the report. Since the rebound, however, short selling in the group has slowed, he added.

Before Beijing surprised the market with its stimulus plans, shorting Chinese stocks had been a popular strategy, with a number of market observers underweighting the sector, and some even labeling the country “uninvestable.”

Just last month in a Bank of America Corp. global fund manager survey, 19% respondents said that shorting Chinese equities was the most crowded trade, second only to going long the so-called Magnificent Seven technology stocks.

The most painful trades for short sellers have been Alibaba Group Holding Ltd. (BABA) and JD.com Inc. (JD), S3 data show. On the flip side, traders betting against Nio Inc. (NIO), Li Auto Inc. (LI), XPeng Inc. (XPEV) and PDD Holdings Inc. (PDD) are still in the black.

Even with the recent rally in US-listed Chinese equities, short sellers aren’t rushing to cover their positions just yet, the data show. Still, if the market continues to advance, S3 expects “a significant amount of short covering in the sector” to push stock prices even higher.

“BABA’s stock price might see the greatest impact if shorts begin covering in size as the stock has seen increased short selling into this rally,” Dusaniwsky said. “With short selling no longer offsetting some of the long buying pressure in the stock, buy-to-covers side-by-side with long buying may steepen the trajectory if its price moves.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Farm Equipment Rental Market to Reach $81.1 Billion, Globally, by 2033 at 4.3% CAGR: Allied Market Research

Wilmington, Delaware , Oct. 01, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Farm Equipment Rental Market by Equipment Type (Tractors, Harvesters, Sprayers, Balers and Others), Drive Type (Four-Wheel-Drive and Two-Wheel-Drive), and Power Output (<30 HP, 31-70 HP, 131-250 HP and >250 HP): Global Opportunity Analysis and Industry Forecast, 2024-2033”. According to the report, the farm equipment rental market was valued at $53.2 billion in 2023, and is estimated to reach $81.1 billion by 2033, growing at a CAGR of 4.3% from 2024 to 2033.

Prime determinants of growth

However, the rental equipment can be defective and may not completely serve the purpose, which can be prohibitive for farmers. Moreover, opportunity lies in the growing trend of precision farming and the integration of smart technologies, which can significantly enhance the effectiveness and appeal of Farm Equipment Rental.

Download PDF Sample Copy@ https://www.alliedmarketresearch.com/request-sample/A09994

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2022 | $53.2 billion |

| Market Size in 2032 | $81.1 billion |

| CAGR | 4.3% |

| No. of Pages in Report | 207 |

| Segments Covered | Equipment Type, Drive, Power Output, and Region. |

| Drivers |

|

| Opportunities |

|

| Restraint |

|

Segmental Overview

By equipment type, the tractor segment held the highest market share in the Farm Equipment Rental market in 2023. Tractors are popular among small and medium-scale farmers due to their versatility and cost-effectiveness, making them a key segment in the rental market . However, The harvester segment is expected to grow at the highest CAGR during the forecast period. This growth is driven by the increasing adoption of advanced technologies and precision agriculture, which enhances efficiency and productivity in farming operations.

Buy This Research Report (234 Pages PDF with Insights, Charts, Tables, Figures) : https://www.alliedmarketresearch.com/checkout–final/4cc3775c48e07c797f196ac1cd23ad8b

By drive type the four-wheel-drive segment of automatic Farm Equipment Rental held the highest market share in terms of revenue in 2023. The demand for four-wheel-drive equipment is driven by its superior traction and stability, which are essential for handling challenging terrains and heavy-duty tasks in modern agriculture. On the other hand, the two-wheel-drive segment is also expected to grow at the higher CAGR. This growth is driven by the increasing adoption of inexpensive and efficient far equipment by small farm owners.

By power Output, the 71-130 HP segment held the highest market share in the bandsaw machine market in 2023. Equipment in this range is versatile and suitable for various farming activities such as tilling, planting, and harvesting, making it ideal for small and medium-sized farms . However, the >250 HP is expected to grow at the highest CAGR. The demand for high-power equipment is anticipated to rise due to the increasing mechanization and scale of modern farming practices. Large farms and operations that require heavy-duty machinery for extensive tasks will drive the growth of this segment as they seek to enhance productivity and efficiency through the use of powerful, advanced equipment .

Asia-Pacific to maintain its dominance by 2033.

Asia-Pacific is expected to maintain its dominance in the Farm Equipment Rental market by 2033. The region’s rising population drives the demand for higher agricultural output, necessitating the use of advanced farm equipment to boost productivity. Countries like India and China are leading this trend by focusing on improving crop yields through better mechanization and technology adoption. Additionally, the prevalence of small and fragmented land holdings makes it economically unfeasible for many farmers to purchase expensive equipment, making rental services a cost-effective alternative

Players

- Flaman Group of Companies

- Friesen Sales & Rentals

- Messick Farm Equipment Inc.

- Pacific Tractor & Implement

- Tractors and Farm Equipment Limited

Inquire Before Buying@ https://www.alliedmarketresearch.com/purchase-enquiry/A09994

The report provides a detailed analysis of these key players in the global Farm Equipment Rental market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Trending Reports in Agriculture Industry

New, Pre-Owned, And Rental Agriculture Equipment Market is projected to reach $434.1 billion by 2032

Agriculture Equipment Market is projected to reach $192.5 billion by 2032

Agricultural Shredder Machine Market is projected to reach $2.38 billion by 2031

Automated Turf Harvester Market is expected to reach $155,947.8 thousand in 2026

Smart Harvest Market is projected to reach $36,977.1 million by 2030

Wheelbarrow Market is projected to reach $1.2 billion by 2032

About us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact us:

Wilmington, Delaware

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle, Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

5 energy stocks that will get a boost from ballooning electric demand

-

US electric demand is rising, fueled by everything from data centers to electrified transportation, says BofA.

-

By 2035, as much as 300 gigawatts of effective capacity could be required to power the nation.

-

This means upside for five national utility stocks, the bank said.

With resources flooding into infrastructure and tech, US electric demand is charging up. As the economy becomes more power-hungry, Bank of America considers momentum energized for five key utility stocks.

“There is now evidence that demand growth has returned, driven by the re-shoring of industry, the development of data and crypto mining centers and the electrification of buildings, transportation, and infrastructure,” analysts wrote on Monday.

Though power consumption has ebbed over the past two decades, the bank anticipates that the US will require 100 gigawatts of effective capacity by 2035. That indicates a 1.5% nationwide annual growth rate, compared to 0.5% between 2015 and 2024.

Under BofA’s high-case scenario, however, power demand could require as much as 300 gigawatts instead.

Among factors driving this trend is artificial intelligence. The bank previously cited that this alone could require as much as 28 gigawatts of effective capacity by 2026.

While this will vary dramatically per region, analysts listed five utility firms that stand to benefit from the acceleration: Sempra, Northwestern Energy, Pinnacle West, Entergy, and TXNM.

1. Entergy stands to gain 3.6% from current levels, based on BofA’s price objective of $138 per share. That’s based on a 2026 sum-of-the-parts analysis and expectations that the utility firm’s 15.4-times price-to-earnings ratio will rise over 5%.

In 2024, the electric distributor has soared over 30% year-to-date. It has already played a role in the emerging buildout of AI data centers and has helped expand the power-charging grid for electric vehicles.

2. Sempra will rise 13% based on the bank’s $94 share target. Goldman Sachs has similarly touted this infrastructure firm, noting the company’s significant spending to support data center growth in Texas.

3. Northwestern Energy could similarly jump over 13% to reach a $65 price target, Bofa says.

“We value NWE at an in-line multiple given improving regulatory treatment in Montana and sector-average EPS growth with no equity dilution, with upside likely occurring in 2026 onwards,” analysts wrote. “Between a more constructive regulatory construct and a strong balance sheet, we see NWE as differentiated relative to other small cap utilities.”

4. Pinnacle West will climb 4.6% under BofA’s price objective of $93 per share. The bank has previously touted PNW among high-quality, value stocks worth owning to hedge against volatility.

5. TXNM Energy is set to increase 10% from current levels, reaching a price target of $48 per share.

Read the original article on Business Insider

Nike Q1 Earnings: Revenue Miss, EPS Beat, Teams 'Energized' Amid CEO Transition — 'A Comeback At This Scale Takes Time, But We See Early Wins'

Nike Inc NKE reported first-quarter financial results after the market close on Tuesday. Here’s a rundown of the report.

Q1 Earnings: Nike reported first-quarter revenue of $11.59 billion, missing analyst estimates of $11.65 billion. The athletic footwear and apparel company reported first-quarter earnings of 70 cents per share, beating analyst estimates of 52 cents per share.

Nike has now come up short of revenue estimates in four of the past five quarters, according to Benzinga Pro.

Total revenues were down 10% year-over-year. North America sales were down about 11%, Greater China sales were down about 4%, European sales fell 13% and Asia Pacific and Latin American sales were down 7%.

Nike Direct revenues were $4.7 billion in the quarter, down 13%. Nike Brand revenues totaled $11.1 billion, down 10%, and Wholesale revenues were down 8% to $6.4 billion. Inventories came in at $8.3 billion, down 5% year-over-year. The company ended the quarter with $10.3 billion in cash, equivalents and short-term investments.

“NIKE’s first quarter results largely met our expectations. A comeback at this scale takes time, but we see early wins — from momentum in key sports to accelerating our pace of newness and innovation,” said Matthew Friend, executive vice president and CFO of Nike.

“Our teams are energized as Elliott Hill returns to lead NIKE’s next stage of growth.”

Hill, a longtime Nike veteran, is set to take over for exiting CEO John Donahoe on Oct. 14. Nike noted it will address its approach to guidance moving forward on the company’s earnings call, scheduled for 5 p.m. ET, given that its reporting earnings in the midst of a CEO transition.

Nike said it returned approximately $1.8 billion to shareholders in the first quarter, including dividends of approximately $558 million and share repurchases of approximately $1.2 billion. The company noted that a total of 99.7 million shares have been repurchased under its $18 billion buyback program for a total cost of approximately $10.2 billion.

NKE Price Action: Nike shares were down approximately 18% year-to-date heading into the print. The stock was down 2.84% in after hours, trading at $86.60 at the time of publication Tuesday, according to Benzinga Pro.

Don’t Miss:

• Iran Attacks Israel With Missiles, Middle East Tensions Escalate: S&P 500, Stocks, Bitcoin Fall As Oil, Gold Rise

Photo: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is Manual Labor Dead? 4,000 Vape Devices In One Hour: The Machine That Boosts Efficiency By 1,000%

Ispire Technology Inc. ISPR, a leader in vaping technology, is set to unveil its groundbreaking I-80 vapor device filling machine at the Benzinga Cannabis Capital Conference in Chicago on October 8-9. The I-80 promises to revolutionize cannabis production, delivering efficiency and cost savings that could transform the industry’s landscape.

“The I-80 isn’t just a machine; it’s a game-changing solution to the capacity challenges that have hindered cannabis operators for years,” said Michael Wang, co-CEO of Ispire. “We’re not just improving productivity – we’re leading a paradigm shift in cannabis production efficiency.” Wang also positioned the I-80 as the future of production efficiency in the cannabis industry.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Unmatched Speed And Efficiency

Capable of filling and sealing 4,000 vapor devices per hour, the I-80 is 2x faster than current automated systems and offers a 10x improvement in efficiency over manual production methods.

This significant boost in productivity addresses long-standing capacity challenges faced by cannabis operators, especially multi-state operators (MSOs) as well as single-state operators (SSOs).

Cost Savings And Workflow Optimization

The I-80 is designed not just for speed but for cost savings. Cannabis companies can expect to save $1,000 for every 10,000 units produced, thanks to the machine’s integrated self-sealing technology, which eliminates the need for separate capping.

This feature alone improves workflow efficiency by 1,000% over manual methods and 100% over other automated systems, giving operators a competitive edge.

Read Next: Think You Can Do It All? 20,000 Reasons Why Automation Outperforms A Broad Approach In Cannabis

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

Down -27.78% in 4 Weeks, Here's Why Braze Looks Ripe for a Turnaround

A downtrend has been apparent in Braze, Inc. BRZE lately with too much selling pressure. The stock has declined 27.8% over the past four weeks. However, given the fact that it is now in oversold territory and Wall Street analysts are majorly in agreement about the company’s ability to report better earnings than they predicted earlier, the stock could be due for a turnaround.

Here is How to Spot Oversold Stocks

We use Relative Strength Index (RSI), one of the most commonly used technical indicators, for spotting whether a stock is oversold. This is a momentum oscillator that measures the speed and change of price movements.

RSI oscillates between zero and 100. Usually, a stock is considered oversold when its RSI reading falls below 30.

Technically, every stock oscillates between being overbought and oversold irrespective of the quality of their fundamentals. And the beauty of RSI is that it helps you quickly and easily check if a stock’s price is reaching a point of reversal.

So, by this measure, if a stock has gotten too far below its fair value just because of unwarranted selling pressure, investors may start looking for entry opportunities in the stock for benefitting from the inevitable rebound.

However, like every investing tool, RSI has its limitations, and should not be used alone for making an investment decision.

Why a Trend Reversal is Due for BRZE

The RSI reading of 29.18 for BRZE is an indication that the heavy selling could be in the process of exhausting itself, so the stock could bounce back in a quest for reaching the old equilibrium of supply and demand.

The RSI value is not the only factor that indicates a potential turnaround for the stock in the near term. On the fundamental side, there has been strong agreement among the sell-side analysts covering the stock in raising earnings estimates for the current year. Over the last 30 days, the consensus EPS estimate for BRZE has increased 15.2%. And an upward trend in earnings estimate revisions usually translates into price appreciation in the near term.

Moreover, BRZE currently has a Zacks Rank #2 (Buy), which means it is in the top 20% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises. This is a more conclusive indication of the stock’s potential turnaround in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tesla, Amazon, Nike, Walmart, Alibaba: Why These 5 Stocks Are On Investors' Radars Today

Investors faced a turbulent day in the stock market, reacting to a series of events that could potentially impact the values of stocks and sectors in the coming weeks. The S&P 500 and the Nasdaq indices were affected by geopolitical tensions in the Middle East, the aftermath of Hurricane Helene, and ongoing port strikes.

The major indices closed the day lower, with the Dow Jones Industrial Average slipping 0.4% to 42,156.97 and the S&P 500 falling 0.9% to 5,708.75. The Nasdaq finished Tuesday down 1.5% at 17,910.36.

These are the top stocks that gained the attention of retail traders and investors throughout the day:

Tesla Inc. TSLA closed down 1.38% at $258.02, with an intraday high of $263.98 and low of $248.53. Tesla’s recent 24% monthly surge sets the stage for a pivotal October, with analysts closely watching the upcoming Robotaxi event on Oct. 10, anticipated to bring significant updates on full self-driving and autonomous vehicles. Key announcements on operating costs, scaling, and potential new models could shape Tesla’s next chapter.

Amazon.com Inc. AMZN ended the day down 0.64% at $185.13. The tech giant’s stock was affected by a dockworkers strike that could potentially impact holiday shopping and cost the economy $540 million daily. Tech giants are bracing for potential disruptions that may affect East Coast ports.

Nike Inc. NKE closed up 0.83% at $89.13. The company’s shares rose despite missing revenue estimates in its first-quarter financial results.

Walmart Inc. WMT ended the day up 0.64% at $81.27. The retail giant’s stock was influenced by the company’s CEO Douglas McMillon selling 29,124 shares of Walmart, as revealed in a recent SEC filing.

Alibaba Group Holding Limited BABA closed up 6.24% at $112.74. The company’s shares surged amidst speculation about Alibaba’s divestment of stake in Sun Art Retail Group.

Image via Shutterstock

Prepare for the day’s trading with top premarket movers and news by Benzinga.

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[Latest] Global Metal Strips Market Size/Share Worth USD 336.83 Billion by 2033 at a 4.9% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

Austin, TX, USA, Oct. 02, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Metal Strips Market Size, Trends and Insights By Type (Stainless Steel Strips, Copper Strips, Aluminum Strips, Iron Strips, Others), By Application (Automotive, Construction, Electronics, Aerospace, Industrial, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

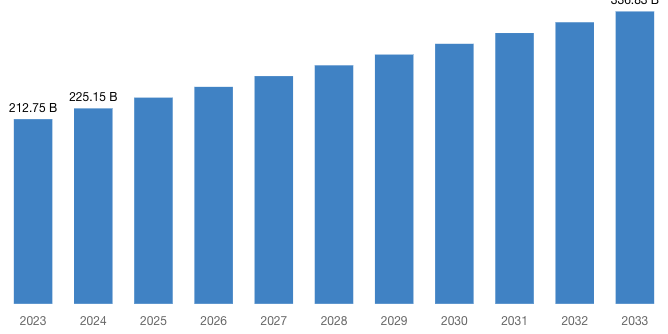

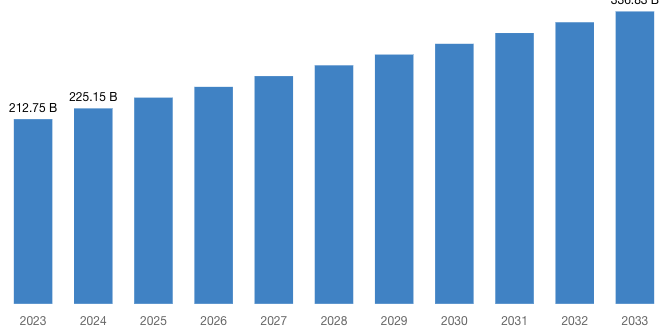

“According to the latest research study, the demand of global Metal Strips Market size & share was valued at approximately USD 212.75 Billion in 2023 and is expected to reach USD 225.15 Billion in 2024 and is expected to reach a value of around USD 336.83 Billion by 2033, at a compound annual growth rate (CAGR) of about 4.9% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Metal Strips Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=52221

Metal Strips Market: Overview

Metal strips are thin, elongated pieces of metal with a uniform width and thickness, often produced through rolling or slitting processes. These strips are used in various industries for a wide range of applications due to their versatility, strength, and malleability.

In construction, metal strips are utilized as structural components for framing, reinforcement, and support, as well as for edging and trim work. In automotive manufacturing, they serve as key components in vehicle bodies, chassis, and interior fittings.

Electrical and electronics industries utilize metal strips for wiring, connectors, and circuitry components due to their conductivity and durability. Additionally, metal strips find applications in packaging, where they provide strength and stability to containers and cartons.

In the manufacturing sector, metal strips are employed in machinery, equipment, and tools for their load-bearing capabilities and resistance to wear and tear. Overall, metal strips are integral to numerous industries, offering solutions for diverse structural, functional, and decorative needs.

Request a Customized Copy of the Metal Strips Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=52221

By type, aluminum strips segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. Aluminum strips are thin, flat pieces of aluminum with uniform width and thickness, typically produced through rolling or slitting processes.

Aluminum strips are valued for their lightweight yet durable properties, corrosion resistance, and excellent conductivity, making them suitable for a wide range of applications across various industries.

By application, the automotive segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033.

The automotive industry encompasses the design, development, manufacturing, marketing, and selling of motor vehicles, including cars, trucks, motorcycles, and other vehicles. It is a multifaceted sector that involves a wide array of companies, from automakers to parts manufacturers, dealerships, and service providers.

North America, comprising the United States, Canada, and Mexico, is a diverse region known for its economic strength, technological innovation, and cultural richness. It boasts a highly developed industrial base, with key sectors including automotive, aerospace, technology, healthcare, and finance.

Nippon Steel Corporation is Japan’s largest steelmaker, headquartered in Chiyoda-ku, Tokyo. The company has four business segments, including steelmaking, engineering, chemicals, and system solutions. It is the largest producer of crude steel in Japan and the third largest in the world.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 225.15 Billion |

| Projected Market Size in 2033 | USD 336.83 Billion |

| Market Size in 2023 | USD 212.75 Billion |

| CAGR Growth Rate | 4.9% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Type, Application and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Metal Strips report is available upon request; please contact us for more information.)

Request a Customized Copy of the Metal Strips Market Report @ https://www.custommarketinsights.com/report/metal-strips-market/

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Metal Strips report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Metal Strips Market Report @ https://www.custommarketinsights.com/report/metal-strips-market/

CMI has comprehensively analyzed the Global Metal Strips market. The driving forces, restraints, challenges, opportunities, and key trends have been explained in depth to depict an in-depth scenario of the market. Segment wise market size and market share during the forecast period are duly addressed to portray the probable picture of this Global Metal Strips industry.

The competitive landscape includes key innovators, after market service providers, market giants as well as niche players are studied and analyzed extensively concerning their strengths, weaknesses as well as value addition prospects. In addition, this report covers key players profiling, market shares, mergers and acquisitions, consequent market fragmentation, new trends and dynamics in partnerships.

Key questions answered in this report:

- What is the size of the Metal Strips market and what is its expected growth rate?

- What are the primary driving factors that push the Metal Strips market forward?

- What are the Metal Strips Industry’s top companies?

- What are the different categories that the Metal Strips Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Metal Strips market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Metal Strips Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/metal-strips-market/

Metal Strips Market: Regional Analysis

By region, the Metal Strips market is segmented into North America, Europe, Asia-Pacific, Latin America, Middle East & Africa. North America dominated the global Metal Strips market in 2023 with a market share of 39.5% and is expected to keep its dominance during the forecast period 2024-2033.

North America plays a pivotal role in driving the metal strips market through its robust industrial infrastructure, technological innovation, and diverse consumer base.

The region’s extensive manufacturing sector, encompassing automotive, aerospace, construction, electronics, and consumer goods industries, generates substantial demand for metal strips used in various applications such as structural components, automotive parts, electrical wiring, packaging materials, and decorative trim.

Moreover, North America’s leadership in technological innovation and research and development fosters continuous advancements in metal strip production processes, leading to improved quality, precision, and cost-efficiency.

Additionally, the region’s strategic geographic location and well-established trade networks facilitate the import and export of metal strips, enhancing market competitiveness and global market penetration. Furthermore, the presence of leading metal strip manufacturers and suppliers, coupled with stringent quality standards and regulatory requirements, ensures product reliability and customer satisfaction.

Overall, North America’s dynamic industrial landscape, coupled with its emphasis on innovation, quality, and market access, positions it as a driving force in the global metal strips market, shaping industry trends and driving market growth.

Request a Customized Copy of the Metal Strips Market Report @ https://www.custommarketinsights.com/report/metal-strips-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Metal Strips Market Size, Trends and Insights By Type (Stainless Steel Strips, Copper Strips, Aluminum Strips, Iron Strips, Others), By Application (Automotive, Construction, Electronics, Aerospace, Industrial, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/metal-strips-market/

List of the prominent players in the Metal Strips Market:

- Nippon Steel & Sumitomo Metal Corporation

- BlueScope Steel Limited

- JFE Steel Corporation

- Shandong Iron and Steel Group

- JSW Steel Ltd

- Hyundai Steel Co. Ltd

- Posco Co. Ltd

- Tata Steel Ltd

- Valin Xiangtan Iron and Steel Co Ltd

- Baotou Iron & Steel (Group) Co. Ltd

- Angang Steel Company Limited

- Maanshan Iron & Steel Company Limited

- Rizhao Steel Holding Group Co. Ltd

- Benxi Steel Group Corporation Limited

- Shougang Group

- China Baowu Steel Group Corporation Limited

- Wuhan Iron and Steel (Group) Corp.

- Shagang Group

- Ansteel Group Corporation

- Others

Click Here to Access a Free Sample Report of the Global Metal Strips Market @ https://www.custommarketinsights.com/report/metal-strips-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Aerosol Disinfectants Market: Aerosol Disinfectants Market Size, Trends and Insights By Product Category (Plain, Scented), By Sale Channels (Hypermarkets/Supermarkets, Convenience Stores, Online Retail Stores, Others), By Application (Residential, Commercial, Industrial), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Timber Plants Market: Timber Plants Market Size, Trends and Insights By Type (Soft, Semi-hard, Hardwoods), By Grade (CLT, Glulam), By Application (Furniture making, Construction Activities, Flooring material., Crafting veneers and plywood., Boat building, Wood carvings and sculptures., Paper and pulp products manufacturing, Others), By End User Industry (Residential, Commercial, Institutional, Industrial, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Lead Smelting and Refining Market: Lead Smelting and Refining Market Size, Trends and Insights By Technology (Pyrometallurgical Methods, Hydrometallurgical Methods, Electrometallurgical Methods), By Environmental Compliance (Standard Compliance, Advanced Compliance), By Distribution Channel (Direct Sales, Distributors, Online Sales), By Application (Lead Acid Batteries, Radiation Shielding, Cable Sheathing, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Titanium Dioxide Market: Titanium Dioxide Market Size, Trends and Insights By Grade (Rutile, Anatase), By Application (Paints & Coatings, Plastics, Paper, Cosmetics, Inks, Textiles, Food Additives, Others), By Production Process (Sulfate Process, Chloride Process), By End-Use Industry (Automotive, Construction, Packaging, Consumer Goods, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Synthetic Organic Alcohol Market: Synthetic Organic Alcohol Market Size, Trends and Insights By Types of Alcohols (Methanol, Ethanol, Isopropanol, Butanol, Others), By Application (Solvents, Disinfectants, Antifreeze, Fuel Additives, Others), By End Users (Pharmaceuticals, Cosmetics, Automotive, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

AdBlue Carrefour Market: AdBlue Carrefour Market Size, Trends and Insights By Type (Passenger Vehicles, Commercial Vehicles), By Application (Original Equipment Manufacturer (OEM), Aftermarket), By Manufacturing Process (Solution Polymerization, Emulsion Polymerization), By Raw Material (Natural Latex, Synthetic Latex), By Distribution Channel (Online, Offline), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Cycloalkanes Market: Cycloalkanes Market Size, Trends and Insights By Function (Blowing Agent & Refrigerant, Solvent & Reagent, Others), By Application (Refrigeration, Construction, Electrical & Electronics, Chemical, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Household Insecticides Market: Household Insecticides Market Size, Trends and Insights By Type Insights (Synthetic, Natural), By Purpose Insights (Mosquitoes and Flies Control, Rat and Rodent Control, Termite control, Bedbugs and Beetle Control, Others), By Packaging Insights (Small (50-200 ml), Medium (200-500 ml), Large (500 ml and above)), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Metal Strips Market is segmented as follows:

By Type

- Stainless Steel Strips

- Copper Strips

- Aluminum Strips

- Iron Strips

- Others

By Application

- Automotive

- Construction

- Electronics

- Aerospace

- Industrial

- Others

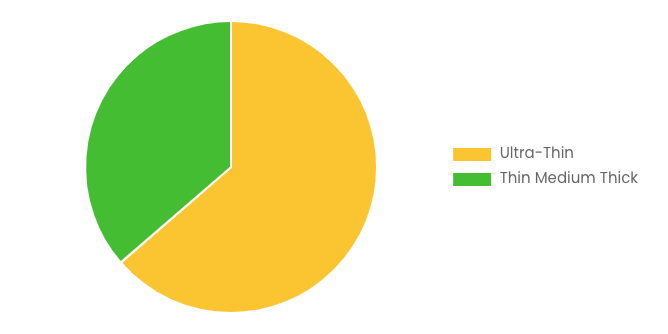

By Thickness

- Ultra-Thin

- Thin Medium Thick

By Production Process

- Hot Rolled

- Cold Rolled Others

Click Here to Get a Free Sample Report of the Global Metal Strips Market @ https://www.custommarketinsights.com/report/metal-strips-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Metal Strips Market Research/Analysis Report Contains Answers to the following Questions.

- What Developments Are Going On in That Technology? Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Metal Strips Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Metal Strips Market? What Was the Capacity, Production Value, Cost and PROFIT of the Metal Strips Market?

- What Is the Current Market Status of the Metal Strips Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Metal Strips Market by Considering Applications and Types?

- What Are Projections of the Global Metal Strips Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Metal Strips Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Metal Strips Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Metal Strips Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Metal Strips Industry?

Click Here to Access a Free Sample Report of the Global Metal Strips Market @ https://www.custommarketinsights.com/report/metal-strips-market/

Reasons to Purchase Metal Strips Market Report

- Metal Strips Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Metal Strips Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Metal Strips Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Metal Strips Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Metal Strips market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Metal Strips Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/metal-strips-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Metal Strips market analysis.

- The competitive environment of current and potential participants in the Metal Strips market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Metal Strips market should find this report useful. The research will be useful to all market participants in the Metal Strips industry.

- Managers in the Metal Strips sector are interested in publishing up-to-date and projected data about the worldwide Metal Strips market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Metal Strips products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Metal Strips Market Report @ https://www.custommarketinsights.com/report/metal-strips-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Metal Strips Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/metal-strips-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

I interned at a hedge fund when I was 16. It was the smartest decision I made as a teen, and it set me on the path to a career in finance.

-

Yi Ke Cao did her first internship at a hedge fund when she was 16.

-

Cao says the two-week stint, though brief, was a pivotal moment in her career development.

-

Besides confirming her interest in finance, the internship motivated her to attend business school.

This as-told-to essay is based on a conversation with Yi Ke Cao, 20, a sophomore at Singapore’s Nanyang Technological University. Cao started her internship journey back in secondary school when she interned at a hedge fund. The following has been edited for length and clarity. Business Insider has verified her education and employment history.

My parents both worked in finance. When I was much younger, like most kids, I didn’t have much of an idea of what my path in the working world would look like. But my folks told me stories about corporate finance and what it was like being a part of the industry. That sparked my interest in the field.

I’m not going to lie. Money was one of the key draws of the sector, though for me, it wasn’t the only thing that mattered.

When it came to looking for a job, I knew I wanted to work for an employer that could give me a positive work-life balance and hopefully a place with a good environment and great colleagues.

That said, I wasn’t dead set on working in finance from the get-go. I didn’t have any practical experience back then, but I was keen to explore what a career in finance would look like.

Joining a hedge fund as their youngest intern

Unexpectedly, an opportunity to intern at a hedge fund came to me when I was 16.

I was still a secondary-school student when I received a list of internship opportunities from my school as part of their work-experience program.

That was when I chanced upon a two-week stint with a Singapore-based hedge fund, Modular Asset Management.

This was during the COVID-19 pandemic, so most of the internships listed were remote positions. But the position with Modular Asset Management was different — it was held on-site.

I figured it would be a great opportunity for me to gain some exposure to the industry and broaden my network.

As part of my application, I sent in my résumé and a video introduction. I managed to secure the internship after I was shortlisted and passed an interview with my future mentor and supervisor.

To be honest, I don’t think I had the best résumé out of the 10 other candidates I was competing against. For instance, I didn’t have as many on-paper achievements. However, my mentor said she decided to take a chance on me because I seemed curious and willing to learn.

I started my internship in December 2020 and was the youngest intern there.

Getting over my imposter syndrome

The first few days of my internship were terrifying.

I felt overwhelmed by the new environment. I didn’t know what my colleagues were expecting from me because I had no prior knowledge or technical skills to offer.

I did try my best to contribute to the team. I had a foundational knowledge of Excel, but the learning curve was steep. I had to pick up advanced Excel techniques in a matter of days so I could help my supervisor compile profit and loss sheets.

That experience has benefited me to this day — I use the Excel techniques I learned at my internship in business school now.

And though I didn’t contribute to major projects at the hedge fund, I was still able to get a better sense of how its different departments worked together.

I got to sit in on strategic discussions between departments and witness part of their decision-making process as traders. I began to see how meticulous and exacting you have to be if you wanted to be a good portfolio manager.

Interning at the fund as a 16-year-old was a pivotal moment in my career development

Looking back, interning at the hedge fund was a pivotal moment in my life.

Besides giving me early exposure to a professional working environment, it helped me confirm my interest in a finance career and solidified my decision to go to business school.

If I could turn back the clock, I would have done more internships as a teenager. Even though the work scope would likely have been limited, it would still have been good exposure for me.

Most people don’t know what they want to do for a living at 16. But by interning earlier, I think one can gain a better understanding of the corporate world.

Read the original article on Business Insider