SNPS Drops 20% From 52-Week High: Is the Stock Worth Buying on Dip?

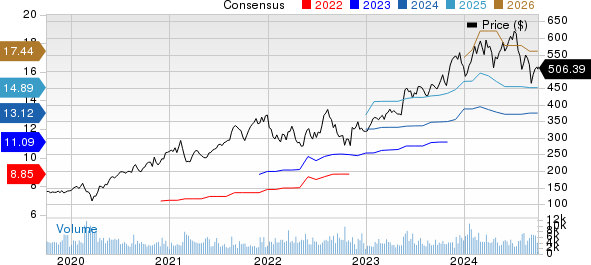

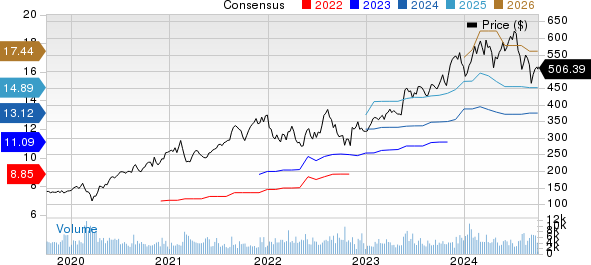

Synopsys SNPS shares have experienced a pullback in recent times, with shares now trading 19.7% below its 52-week high of $629.38 achieved on Sept. 30.

Over the past three months, Synopsys shares have plunged 16.9%, underperforming the broader Zacks Computer & Technology Sector’s decline of 1.1% and the Zacks Computer – Software industry’s fall of 2.7%.

Synopsys is currently facing several challenges, including a rise in cost of revenues and operating expenses. In the third quarter of fiscal 2024, these costs increased to $1.17 billion compared to $1.01 billion in the same period last year. This sharp rise has raised concerns about the company’s ability to manage its rising costs effectively.

SNPS faces intense competition in the semiconductor and electronic design automation (EDA) space, which has been a headwind. Delays in realizing synergies from recent acquisitions have been a concern.

Synopsys Prospects Ride on Strong Portfolio

Synopsys’ innovative product lineup is expected to boost its prospects. The shift toward hybrid working is driving demand for higher bandwidth, which bodes well for the company’s solutions. The rising demand for AI, 5G and IoT benefits SNPS’ prospects.

Synopsys reported strong revenues in the third quarter of fiscal 2024, with revenues increasing 13% year over year to $1.53 billion, in line with the Zacks Consensus Estimate.

SNPS anticipates achieving approximately 15% revenue growth for fiscal 2024. For fiscal 2024, it expects revenues between $6.105 billion and $6.135 billion.

The Zacks Consensus Estimate for revenues is pegged at $6.13 billion, indicating year-over-year growth of 4.93%.

For fiscal 2024, non-GAAP earnings are expected in the range of $13.07-$13.12 per share. The consensus mark for earnings is pegged at $13.12 per share, unchanged over the past 30 days.

For the fourth quarter of 2024, Synopsys expects revenues between $1.614 billion and $1.644 billion. The Zacks Consensus Estimate for fourth-quarter fiscal 2024 is currently pegged at 3.28 per share, up by a penny over the past 30 days.

Non-GAAP earnings are expected to be between $3.27 per share and $3.32 per share. The consensus mark for fourth-quarter fiscal 2024 revenues is pegged at $1.62 billion, indicating year-over-year growth of 1.01%.

Will Acquisitions Help SNPS Stock Rebound?

Synopsys has made several acquisitions to expand its product portfolio and drive growth. Over the past five years, it acquired more than 15 companies, including Intrinsic ID and Valtrix in 2024.

Synopsys is in the process of acquiring ANSYS ANSS, a move designed to strengthen its Silicon to Systems strategy, particularly in sectors such as automotive, aerospace and industrial. This acquisition is expected to expand Synopsys’ customer base and enhance its product offerings.

Slowing Top-Line Growth, Stiff Competition Concerns for SNPS

Synopsys’ Design Automation segment saw slower growth in the third quarter of fiscal 2024. Revenues from this segment increased a modest 6% year over year, reaching $1.06 billion. In comparison, the same segment saw 23% growth in the third quarter of fiscal 2023, reaching $1.0 billion.

This downturn was due to tough competition in the EDA market, where Synopsys competes with major players like Cadence Design Systems CDNS and Mentor Graphics.

Unfavorable forex and a challenging macroeconomic environment are major deterrents for investors.

Zacks Rank & Valuation

Synopsys currently carries a Zacks Rank #3 (Hold), suggesting that it may be wise to wait for a more favorable entry point in the stock.

Its Value Score of D indicates a stretched valuation at this moment.

In terms of forward Price/Earnings, SNPS is currently trading at 34.82X, higher than the broader sector’s 32.33X.

A Top-Ranked Stock to Consider

Progress Software PRGS is a better-ranked stock in the broader sector, sporting a Zacks Rank #1 (Strong Buy).

Long term earnings growth rate is currently pegged at 2%. Progress Software shares have appreciated 23.2% year to date.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply