This Is What Whales Are Betting On New Fortress Energy

Whales with a lot of money to spend have taken a noticeably bullish stance on New Fortress Energy.

Looking at options history for New Fortress Energy NFE we detected 29 trades.

If we consider the specifics of each trade, it is accurate to state that 51% of the investors opened trades with bullish expectations and 41% with bearish.

From the overall spotted trades, 19 are puts, for a total amount of $1,551,134 and 10, calls, for a total amount of $560,290.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $7.0 to $25.0 for New Fortress Energy over the last 3 months.

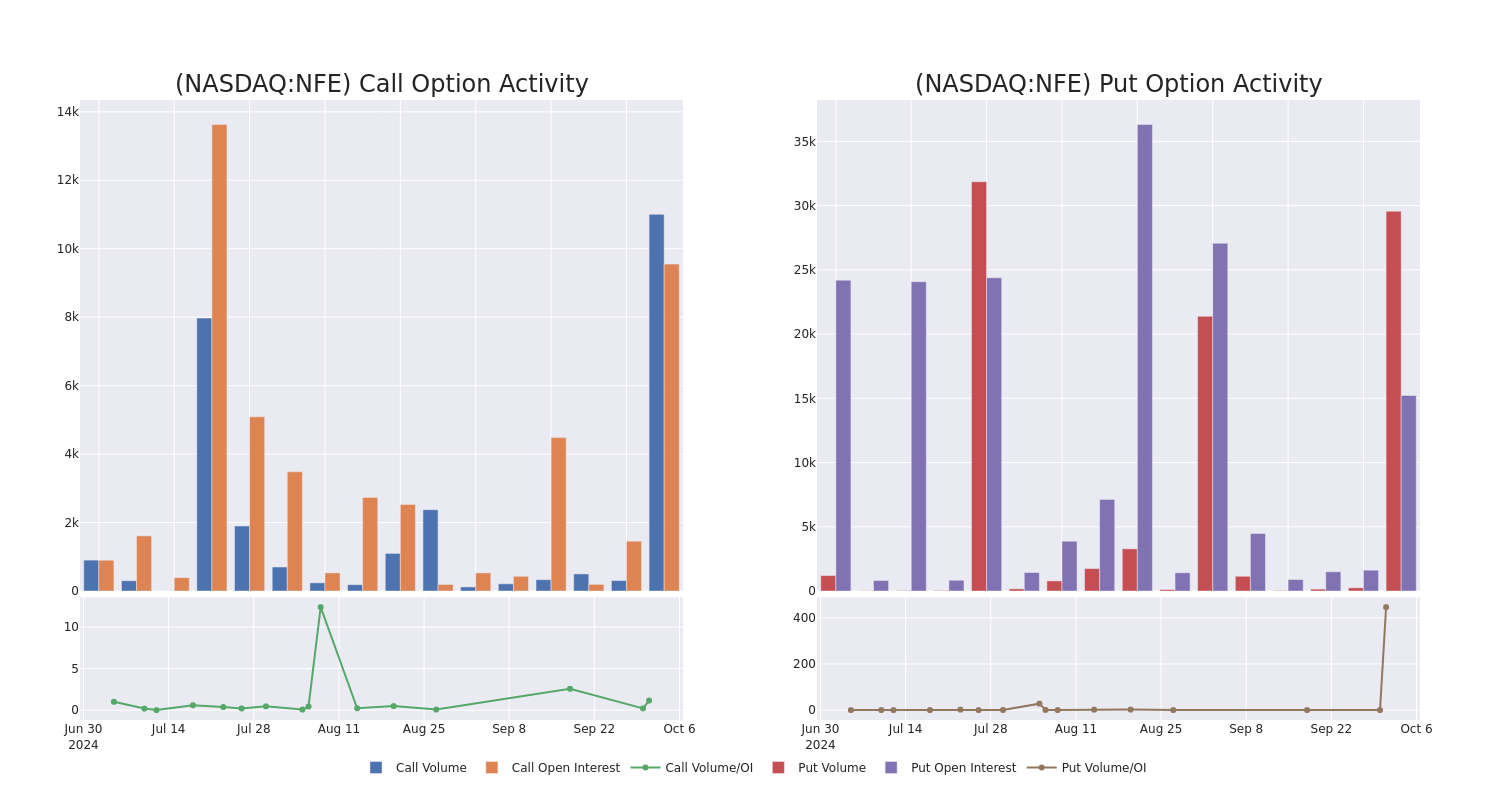

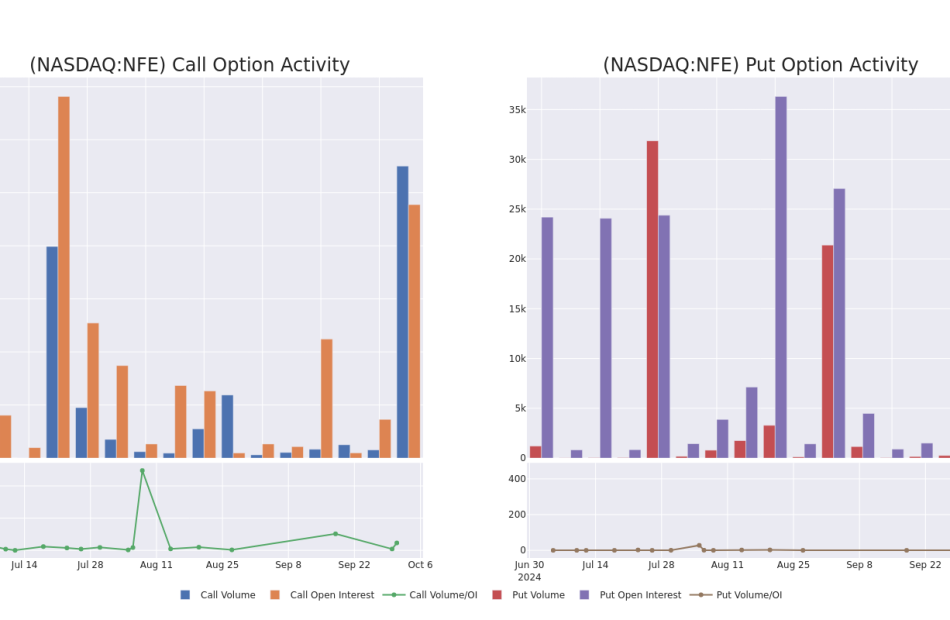

Volume & Open Interest Development

In today’s trading context, the average open interest for options of New Fortress Energy stands at 2064.67, with a total volume reaching 40,473.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in New Fortress Energy, situated within the strike price corridor from $7.0 to $25.0, throughout the last 30 days.

New Fortress Energy Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NFE | PUT | SWEEP | BULLISH | 11/15/24 | $1.5 | $1.3 | $1.34 | $9.00 | $340.0K | 5.0K | 2.4K |

| NFE | PUT | TRADE | BEARISH | 11/15/24 | $1.5 | $1.25 | $1.42 | $9.00 | $284.0K | 5.0K | 400 |

| NFE | CALL | SWEEP | BEARISH | 01/16/26 | $7.0 | $4.2 | $4.22 | $10.00 | $238.0K | 1.7K | 860 |

| NFE | PUT | SWEEP | BULLISH | 11/15/24 | $1.35 | $1.3 | $1.3 | $9.00 | $184.4K | 5.0K | 6.4K |

| NFE | PUT | TRADE | BEARISH | 12/20/24 | $10.2 | $9.9 | $10.1 | $20.00 | $101.0K | 4.8K | 401 |

About New Fortress Energy

New Fortress Energy is an integrated gas-to-power company. Its business model spans the entire production and delivery chain from natural gas procurement and liquefaction to logistics, shipping, terminals, and conversion or development of a natural gas-fired generation. It has invested in floating, liquefied natural gas vessels to both lower the cost of acquiring gas while securing a long-term supply for its terminals. Its segments include terminals and infrastructure, or T&I, and ships.

In light of the recent options history for New Fortress Energy, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of New Fortress Energy

- Currently trading with a volume of 26,151,255, the NFE’s price is up by 6.27%, now at $9.66.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 36 days.

Professional Analyst Ratings for New Fortress Energy

1 market experts have recently issued ratings for this stock, with a consensus target price of $15.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from BTIG keeps a Buy rating on New Fortress Energy with a target price of $15.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for New Fortress Energy with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply