ROSEN, LEADING INVESTOR COUNSEL, Encourages Starbucks Corporation Investors to Secure Counsel Before Important Deadline in Securities Class Action – SBUX

NEW YORK, Oct. 03, 2024 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of Starbucks Corporation SBUX between November 2, 2023 and April 30, 2024, both dates inclusive (the “Class Period”), of the important October 28, 2024 lead plaintiff deadline.

SO WHAT: If you purchased Starbucks securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the Starbucks class action, go to https://rosenlegal.com/submit-form/?case_id=28350 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than October 28, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, during the Class Period, defendants provided investors with material information concerning Starbucks’ fiscal year revenue for 2023 and expected guidance for the fiscal year 2024. Defendants’ statements included, among other things, confidence in Starbucks’ Reinvention and diversification of its global portfolio, which relies largely on both Rewards customers and more occasional consumers. Defendants provided these overwhelmingly positive statements to investors while, at the same time, disseminating materially false and misleading statements and/or concealing material adverse facts related to Starbucks’ Reinvention strategy, comprising: a roadmap and clear plan for success outside of the US, including opening new stores; positive same-store sales; and strong local innovation in foreign economies. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the Starbucks class action, go to https://rosenlegal.com/submit-form/?case_id=28350 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1101 White Cliff, LLC Completes $21 Million Acquisition of Vistas at Red Creek in San Angelo, TX

SAN ANGELO, Texas, Oct. 3, 2024 /PRNewswire/ — 1101 White Cliff, LLC announced the acquisition of residential property, Vistas at Red Creek in San Angelo, TX, for $21 million. This modern living community, located at 5751 Green Hill Road, was acquired on September 26, 2024, with a total Real Property value of $21,100,000.

Featuring one-, two- and three-bedroom apartment options, Vistas at Red Creek’s contemporary, open floor plans with high ceilings bring added space and light. Each apartment is equipped with custom cabinetry, modern bathroom, a stackable washer and dryer and a balcony or patio. Step outside the apartment and experience a tranquil, resort-style community complete with large pool, sundeck, BBQ area, fitness center and a spacious clubhouse and business center.

“Vistas at Red Creek offers a welcoming environment, where residents can enjoy in-home and community amenities,” said Joe Hooker, Acquisitions Manager, 1101 White Cliff, LLC. “It’s an easy place relax and feel at home.”

Surrounding Vistas at Red Creek, residents will find San Angelo State Park’s hiking trails, access to O C Fisher Lake and other recreational amenities, Goodfellow Air Force Base, San Angelo State University and shopping, dining and entertainment options in downtown San Angelo.

For more information about Vistas at Red Creek, visit the website – https://www.vistas-at-red-creek.com. See photos of the property HERE.

![]() View original content:https://www.prnewswire.com/news-releases/1101-white-cliff-llc-completes-21-million-acquisition-of-vistas-at-red-creek-in-san-angelo-tx-302266771.html

View original content:https://www.prnewswire.com/news-releases/1101-white-cliff-llc-completes-21-million-acquisition-of-vistas-at-red-creek-in-san-angelo-tx-302266771.html

SOURCE 1101 White Cliff, LLC

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chief Financial Officer Of Omega Healthcare Invts Makes $905K Sale

A substantial insider sell was reported on October 2, by ROBERT STEPHENSON, Chief Financial Officer at Omega Healthcare Invts OHI, based on the recent SEC filing.

What Happened: STEPHENSON’s decision to sell 22,542 shares of Omega Healthcare Invts was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the sale is $905,962.

In the Wednesday’s morning session, Omega Healthcare Invts‘s shares are currently trading at $40.39, experiencing a down of 0.0%.

About Omega Healthcare Invts

Omega Healthcare Investors Inc is a healthcare facility real estate investment trust that invests in the United States real estate markets. Omega’s portfolio focuses on long-term healthcare facilities. Omega has one reportable segment consisting of investments in healthcare-related real estate properties located in the United States and the United Kingdom. Its core business is to provide financing and capital to the long-term healthcare industry with a particular focus on skilled nursing facilities (SNFs), assisted living facilities (ALFs), and to a lesser extent, independent living facilities (ILFs), rehabilitation and acute care facilities (specialty facilities) and medical office buildings (MOBs).

Omega Healthcare Invts: Delving into Financials

Revenue Growth: Omega Healthcare Invts’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 1.02%. This signifies a substantial increase in the company’s top-line earnings. When compared to others in the Real Estate sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Profitability Metrics:

-

Gross Margin: The company maintains a high gross margin of 98.52%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 0.46, Omega Healthcare Invts showcases strong earnings per share.

Debt Management: Omega Healthcare Invts’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.26.

Financial Valuation Breakdown:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 30.6 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 10.65 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 17.0 is below the industry average, indicating that it may be relatively undervalued compared to peers.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

Insider transactions serve as a piece of the puzzle in investment decisions, rather than the entire picture.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Essential Transaction Codes Unveiled

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Omega Healthcare Invts’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Gen Z bets big while boomers play it safe: A generational breakdown of market returns

Listen and subscribe to Stocks in Translation on Apple Podcasts, Spotify, or wherever you find your favorite podcasts.

It’s a Goldilocks moment for investors.

As the books are closed on September, the S&P 500 (^GSPC) has delivered a solid 20% return so far this year. Meanwhile, bonds are up a respectable 4.7%. And cash is yielding a similar percentage return — even after the Fed began cutting rates a few weeks ago.

But new research from Jack Manley at JPMorgan Asset Management uncovers hidden pitfalls, particularly for those entering their investment years during periods of high cash yields (much like the present). His findings suggest that all investors, regardless of generation, are heavily shaped by the market environment they grew up in.

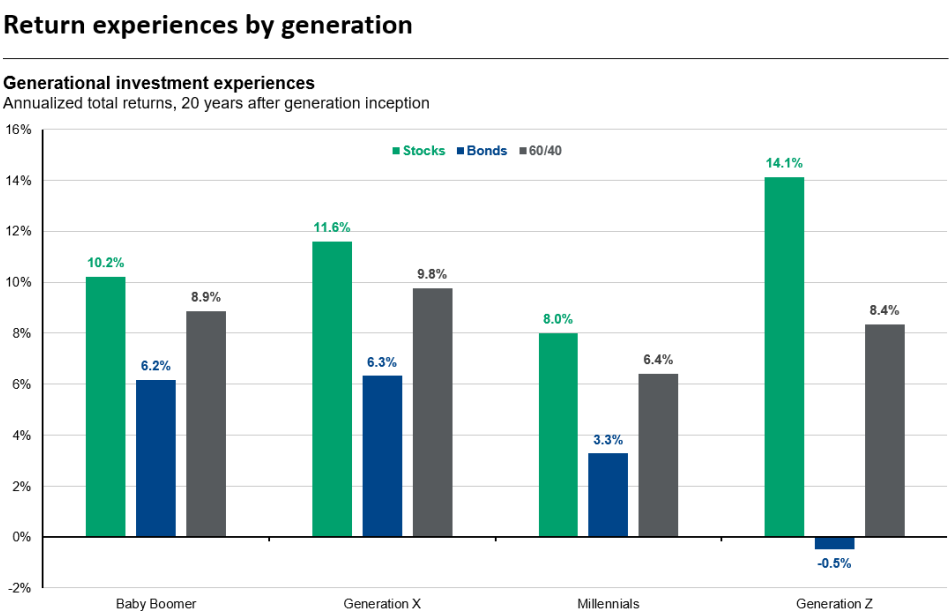

Manley’s methodology, rooted in demographic and behavioral analysis, assumes individuals begin investing 20 years after their generation’s inception. For example, baby boomers started investing around 1966, Gen X in 1985, millennials in 2001, and Gen Z in 2017.

Over the decades, boomers have weathered all sorts of market turmoil, from the inflation crises of the 1970s to multiple tech booms later in life. With average annual stock returns around 10.2% and bond returns of 6.2%, their experience reflects a period of high growth and volatility.

As Manley explained in an episode of Stocks in Translation, “the Fed paid pathological attention” to the inflation crisis, and the entire experience had a profound effect in shaping boomers’ cautious and diversified approach to investing — despite the strong returns.

For Generation X, the journey has been one of boom-bust cycles. But the older cohort of this group largely began investing amid a secular boom in markets. Entering adulthood during the 1980s, they witnessed the rise of tech but also faced brutal recessions, from the dot-com bubble to the 2008 financial crisis.

With returns hovering around 11.6% for stocks, their approach is cautious but optimistic. As Manley noted about the current market environment, “strong balance sheets are very important right now.” This may resonate with Gen X’s preference for financial resilience in uncertain times.

Millennials are the most educated generation, as measured by the percentage with bachelor’s degrees or higher. But they have not fared as well in stock market returns, averaging around 8.0%, according to Manley.

When millennials came of investing age in 2001, the S&P 500 peaked, ushering in the dot-com bust. After stocks roared back amid a housing boom, the global financial crisis created a double top in the benchmark in 2007 that would not be eclipsed until 2013 — leaving millennial investors underwater for a dozen years.

Their outcomes, as Manley highlights, are the worst among the four generations in both stocks and a 60/40 blended portfolio. This underperformance has driven some to believe that traditional investing is “pointless” unless they make “large, risky bets,” such as in cryptocurrencies.

This lack of faith in financial markets has led millennials to embrace higher-risk strategies at the expense of diversification, reflecting their desire for outsized returns.

Gen Z has had the best generational stock market performance (14.1%) but the worst bond returns (-0.5%), which combine to stoke the risk engine that modern markets seem to have become.

Coming of age in a rather eventless year, 2017, they would soon face Volmageddon (2018), a pandemic (2020), stimulus checks, the Reddit/GameStop retail revolution (2021), NFTs (2021), the near-death of cryptocurrencies (2022), and the most aggressive Fed hiking in four decades (2022-2023).

“Generation Z has had a very lopsided experience,” wrote Manley, explaining further that it “may lead to a lack of interest in diversification and a lack of experience with true bear markets, which could result in panic if fortunes turn in the other direction.”

With their portfolios concentrated heavily in high-risk assets like crypto, Gen Z has yet to experience the full brunt of a secular bear market (like millennials faced) — making them particularly vulnerable when economic conditions shift.

The current moment has had an unusual influence on cash as well. One of the key trends Manley discusses in his research is its rising popularity, driven by peak CD rates recently nearing 5%.

“Because of the strong yield and minimal risk associated with CDs today, many investors have decided to allocate more heavily to cash,” said Manley. But he warned, “[I]nvesting at peak CD rates in the past has resulted in underperformance relative to other fixed income instruments.”

Historical data shows that during previous rate hikes, investing heavily in CDs underperforms against stocks or bonds.

Manley advised considering the opportunity cost of cash in a portfolio, adding, “[T]here may be better options for deploying excess capital than in CDs.” Allocating too much to cash can hinder long-term growth, especially in a diversified portfolio.

While what we invest in often make up the bulk of the investing conversation, Manley emphasizes the banal (but underrated) importance of tax strategy, especially for younger generations like millennials and Gen Z. As many advisors point out, the government is every investor’s silent partner.

On Yahoo Finance’s podcast Stocks in Translation, Yahoo Finance editor Jared Blikre cuts through the market mayhem, noisy numbers, and hyperbole to bring you essential conversations and insights from across the investing landscape, providing you with the critical context needed to make the right decisions for your portfolio. Find more episodes on our video hub or watch on your preferred streaming service.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Netanyahu May Have Bugged My Toilet, Says Former UK PM Boris Johnson: 'They Found A Listening Device In The Thunderbox'

Former United Kingdom Prime Minister Boris Johnson has alleged the discovery of a “listening device” in his personal bathroom, subsequent to a visit from Israeli Prime Minister Benjamin Netanyahu in 2017.

What Happened: Johnson, who was serving as a foreign secretary at the time, disclosed in an interview with The Telegraph that the device was unearthed during a routine security sweep. “Later, when they (security) were doing a regular sweep for bugs, they found a listening device in the thunderbox,” he revealed.

Further details were withheld by Johnson, who directed readers to his forthcoming book “Unleashed” for more information. “Everything you need to know about that episode is in the book,” he commented.

As reported by The Telegraph, it is still uncertain whether Israel was confronted or reprimanded about the incident. Around the same time, Israel was suspected of planting surveillance devices near the White House and other sensitive locations in the US capital. “Washington concluded that Israel was likely behind the placement of cellphone surveillance devices,” The Telegraph reported.

The Hill has reached out to the Israeli Embassy in London for a comment on the allegations.

Why It Matters: This allegation comes amidst a backdrop of escalating tensions in the Middle East. In September, the Israeli military initiated a localized operation against Hezbollah targets in southern Lebanon.

This was followed by Iran launching a missile attack against Israel in early October, in response to the killing of Hezbollah leader Hassan Nasrallah.

Israeli Prime Minister Benjamin Netanyahu promised retaliation against Iran for the missile attack, leading to heightened fears of a broader conflict.

Amidst these tensions, discussions between the U.S. and Israel about a potential attack on Iran’s oil facilities were confirmed by President Joe Biden.

Photo by Ververidis Vasilis on Shutterstock

Check This Out:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Brett A. Cope Of Powell Industries Shows Optimism, Buys $564K In Stock

A significant insider buy by Brett A. Cope, President & CEO at Powell Industries POWL, was executed on October 2, and reported in the recent SEC filing.

What Happened: Cope demonstrated confidence in Powell Industries by purchasing 3,100 shares, as reported in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the transaction is $564,634.

As of Thursday morning, Powell Industries shares are up by 2.69%, currently priced at $237.84.

Get to Know Powell Industries Better

Powell Industries Inc is a United States-based company that develops, designs, manufactures, and services custom-engineered equipment and systems for electrical energy distribution, control, and monitoring. The company’s principal products comprise integrated power control room substations, custom-engineered modules, electrical houses, traditional and arc-resistant distribution switchgear and control gear, and so on. These products are applied in oil and gas refining, offshore oil and gas production, petrochemical, pipeline, terminal, mining and metals, light-rail traction power, electric utility, pulp and paper, and other heavy industrial markets. The company generates the majority of its sales from the United States.

Powell Industries: A Financial Overview

Revenue Growth: Powell Industries’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 49.8%. This indicates a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Navigating Financial Profits:

-

Gross Margin: With a low gross margin of 28.37%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): Powell Industries’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 3.85.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.0.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 21.64 is lower than the industry average, implying a discounted valuation for Powell Industries’s stock.

-

Price to Sales (P/S) Ratio: The P/S ratio of 2.98 is lower than the industry average, implying a discounted valuation for Powell Industries’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 15.05 is below the industry average, indicating that it may be relatively undervalued compared to peers.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Important

Considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Cracking Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Powell Industries’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Every Super Micro Computer Stock Investor Should Keep an Eye on This Number

Super Micro Computer (NASDAQ: SMCI) stock is still up more than 1,000% over the last three years, thanks to rising demand for its high-performance rack servers tied to artificial intelligence (AI). Its share price is also down 66% from the lifetime high it reached earlier this year.

While a wide range of factors will play a role in shaping the server specialist’s future stock performance, investors should pay particular attention to one key metric.

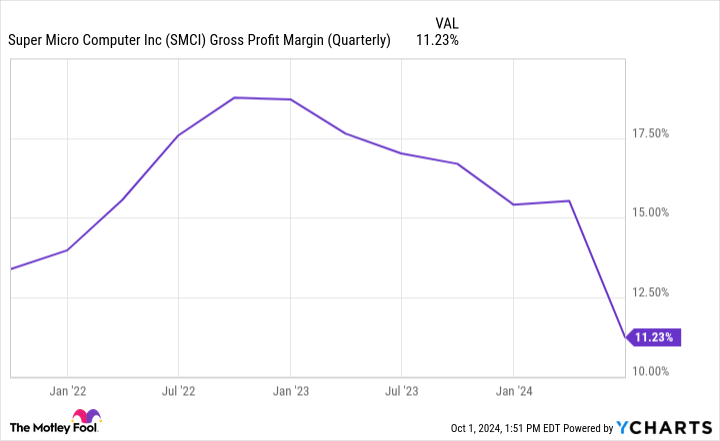

Gross profit margins will be central to Supermicro’s stock performance

Gross profit is calculated by subtracting the cost to produce a product from the revenue generated on the sale of that product. Gross profit margins are a key indicator of pricing power and have a major impact on the overall profitability of a business. Notably, Supermicro’s gross profit margins have been on a downward trend lately.

The company’s gross margin slipped to 11.2% in the fourth quarter of its 2024 fiscal year, which ended June 30. That performance was down from a gross margin of 15.5% in last year’s third quarter and a gross margin of 17% in Q4 of fiscal 2023.

Supermicro’s high-performance rack servers are built around graphics processing units (GPUs) from Nvidia and hardware from other providers. On the heels of a sales and margin surge driven by AI-related demand, reliance on third-party hardware may have set the stage for gross margin contraction.

Supermicro is betting on strong pricing power and differentiating its products through liquid-cooling technologies. Packing and running a group of high-powered GPUs and other hardware together can generate a lot of heat, and overheating can lead to system failures and permanent hardware damage.

If Supermicro’s liquid-cooling technologies for servers prove to be a major selling point, that could bolster the business’s gross margins and power strong stock performance. If not, competitive pressures and moderating demand may drag the company’s gross margins and share price lower.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $728,325!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Every Super Micro Computer Stock Investor Should Keep an Eye on This Number was originally published by The Motley Fool

All Social Security Retirees Should Do This on Oct. 10

Are Social Security benefits an important piece of your retirement income? If so, you might want to keep your eyes and ears open on Thursday, Oct. 10. That’s when the cost-of-living adjustment for the coming year’s monthly payments will be announced. These increases are intended to maintain retirees’ buying power by keeping pace with inflation.

Of course, sometimes they’re still not quite enough.

To this end, it wouldn’t be wrong to start thinking about your bigger financial picture for the coming year. Whether or not the impending increase in Social Security’s payments is fair and reasonable, there are some strategic actions investors may want to consider taking in the meantime.

Retirees, mark your calendars

If you’re a retiree who’s feeling a bit cash-strapped these days, you’re not alone. Although the Social Security Administration upped its average payout by 3.2% in January of this year (roughly $58 per month), prices have continued to rise in the meantime. The Bureau of Labor Statistics reports that consumers’ costs have grown on the order of 2% since the end of 2023. For elderly individuals who may spend more than younger people do on services like healthcare, costs are up closer to 3%.

If you’re on a budget, these nickels and dimes add up.

Fortunately, this inflation is more or less in line with the expected cost-of-living adjustment (or COLA) increase. While the Social Security Administration doesn’t provide any official forecasts, The Senior Citizens League’s most recent prediction suggests the COLA for 2025’s Social Security payments will be a respectable 2.5%. That expected increase is down slightly from projections made earlier in the year although inflation has cooled a bit in the meantime.

Whatever the final increase ends up being, the Social Security Administration will be reporting it at its website on Thursday, Oct. 10. There’s little doubt that most of the financial media industry will be widely sharing the news shortly thereafter.

Of course, as a retired (or soon-to-be retired) investor, your goal is to not need to sweat this particular number too much either way. You should aim to do even better with your own income-generating investments. On that note:

3 things every retiree should do regardless

Social Security was never meant to be the entirety of anyone’s retirement income. With an average monthly payment of just over $1,900, it’s almost unlivable on its own. You’ll likely want (and need) to supplement this income. That means saving and investing money in your working years, and then making the most of it when the time comes.

If you’re watching for these annual COLA numbers then you’re likely already at least semi-retired, and probably not adding any meaningful amount of money to your retirement nest egg. That doesn’t mean you shouldn’t take a fresh look at the money you’ve got saved up, though. You might want to think about doing the following no matter what the Social Security Administration announces on Thursday.

1. Lock in interest rates on bonds before interest rates sink any further

Bond investors living on their interest income should first and foremost build what’s called a bond ladder. That just means arranging the maturity dates on all of your fixed-income investments (Treasuries, CDs, corporate bonds, etc.) so they’re evenly staggered from the next few weeks to the next several years. Such a structure hedges your bond portfolio’s unique risks while also insuring your net interest payments remain relatively stable over time.

On the flip side, the Federal Reserve has plainly said it foresees at least 100 basis points’ worth of reduction in the federal funds rate between now and next year, with less aggressive rate cuts in the cards the year after that. Although interest rates on the aforementioned fixed-income instruments have already fallen thanks to last month’s 50 basis point cut, they’ll likely be falling again soon.

It wouldn’t be wrong to overload certain maturity rungs of your bond ladder with more higher-yielding holdings than you might normally choose to hold. (Just don’t go crazy — basic diversification is still important.)

2. Re-examine all of your dividend-paying stocks

It’s easy to conclude the stock market’s higher-yielding stocks are the best choice for income-minded investors. That’s not necessarily the case, though. It’s not uncommon for higher-yielding dividend stocks to log anemic increases in their payouts — presuming they offer any actual dividend growth at all. For instance, while Kraft Heinz boasts a healthy forward-looking dividend yield of 4.5%, the consumer staples company hasn’t raised its quarterly per-share payment of $0.40 since the beginning of 2020. Patient shareholders are actually losing buying power.

Then there are the less obvious ill-advised decisions. Take Coca-Cola and PepsiCo as examples. While Coca-Cola tends to be the preferred investment of the two due to its greater stature, PepsiCo’s forward-looking dividend yield of 3.2% is actually better than Coke’s dividend yield of 2.7%. PepsiCo also boasts stronger dividend growth than its bigger rival.

Given how Social Security’s inflation-matching cost-of-living adjustments mean no recipient ever makes any actual net progress in terms of the spendable income it provides, investors will only be able to achieve this on their own — with their own savings. It pays to make the most of it.

3. Compare your spending to your portfolio’s income-generating potential

Last but not least, you’ll want to figure out how much money you’ll actually be spending next year, and then determine if your current portfolio is even capable of generating that amount (without compromising its ability to do the same in the future).

Yes, holding the right stocks and bonds is part of the equation. But it’s not the only part. The allocation is a factor as well. Can you meet your near-term goals and still reach your long-term goals with fewer stocks and more bonds? Is it possible you need more capital appreciation from your dividend-paying stocks?

There’s still more to the story. Given that Social Security’s COLAs don’t always seem to fully keep pace with retirees’ actual increases in living costs, you may need to rethink and reset your retirement spending plans as well. Are you really watching all of those streaming channels on a regular basis? Perhaps its time to make a call about your automobile insurance options. Maybe you can forego one of your regular restaurant visits. As was noted above, the nickels and dimes can add up over the course of a year.

Whatever you need to do, just be ready for the big news on Oct. 10.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

James Brumley has positions in Coca-Cola. The Motley Fool recommends Kraft Heinz. The Motley Fool has a disclosure policy.

All Social Security Retirees Should Do This on Oct. 10 was originally published by The Motley Fool

Fernway Reports 2024 Q3 Results & Planned Entry into Connecticut

NORTHAMPTON, Mass., Oct. 3, 2024 /PRNewswire/ — Fernway, the leading Northeastern US cannabis brand, today reported its 2024 Q3 financial results and an update on its planned entry into Connecticut.

For the quarter ended September 30, 2024 (Q3), Fernway generated $11.1M in wholesale revenue and an estimated annualized retail gross merchandise value (GMV) of $95M+. This represents +133% year over year growth. With the US national cannabis market growing at approximately +12% per year according to MJBizDaily, Fernway continues to significantly outperform the national cannabis market.

Fernway’s year over year growth has been bolstered by its entry into the New Jersey cannabis market in late 2023 as well as the New York cannabis market in early 2024 through its partnership with UrbanXtracts, a New York based cultivation and manufacturing business.

Fernway signed an agreement to license the distribution of its brand to Rodeo, a Connecticut-based cultivation and manufacturing business, and Fernway expects its products to be available in Connecticut in early 2025. Fernway continues to evaluate distribution agreements in other US states.

Fernway Co-Founders Kit Gallant (CEO) & David Van Vlierbergen (CFO) will be participating in the upcoming Benzinga Capital Conference in Chicago on October 8-9, 2024. Feel free to reach out to Fernway to arrange a meeting.

About Fernway

Fernway, the leading independent cannabis brand in the Northeastern US, believes cannabis makes the good life even better. The brand name is inspired by fernweh – the longing for faraway places. It’s at the heart of why we love cannabis. Because life’s an adventure, and we want you to savor every moment of it.

Fernway at its core is a brand and product innovation business focused on delighting consumers. The company was founded in 2018, and is available for sale in Massachusetts, New Jersey and New York.

The company’s four co-founders continue to lead & manage the business day-to-day: Kit Gallant, David Van Vlierbergen, Liam O’Brien and Kevin Wu.

About UrbanXtracts

urbanXtracts is a leader in New York’s regulated cannabis market. Offering cultivation, processing, manufacturing and distribution services, the company is on a mission to establish and maintain a sustainable ecosystem that can support the state’s emerging cannabis businesses.

As evidence of its commitment, urbanXtracts revitalized the site of the former Orange County correctional facility – which was originally built as a New York State reform school established in the 1930s by then-First Lady Eleanor Roosevelt.

About Rodeo

Rodeo Cannabis Co. is Connecticut’s first operational Social Equity Cultivator, with a 250,000 square foot canopy.

The company has a state-of-the-art manufacturing facility capable of processing flower from its cultivation site and from growers across the state, packaging, and distributing products statewide.

Focused on bringing top industry brands to Connecticut, Rodeo’s wholesale products are currently available in every dispensary statewide.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/fernway-reports-2024-q3-results–planned-entry-into-connecticut-302266204.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/fernway-reports-2024-q3-results–planned-entry-into-connecticut-302266204.html

SOURCE Fernway

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.