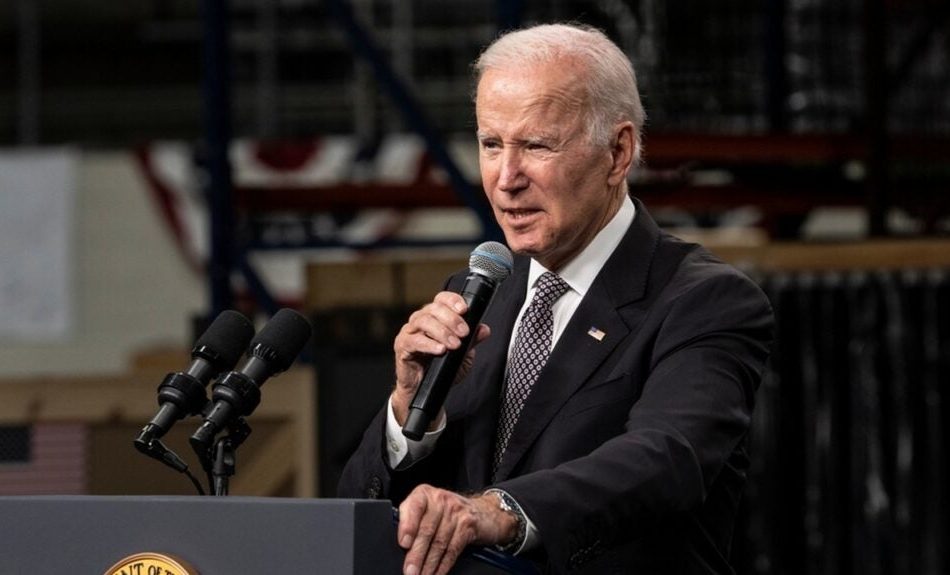

Biden The Master Oil Trader Part IV? President Loads Up On Millions Of Barrels To Refill Emergency Stash In 'One Of The Best Oil Trades In History'

President Joe Biden and his administration purchased an additional 6 million barrels of crude oil earlier this week.

The acquisition is meant to fill the Strategic Petroleum Reserve. The price tag came in at an average price of $68.56 per barrel, according to Patrick De Haan aka @GasBuddyGuy on X.

This is just the latest move in a series of oil trades executed by Biden’s administration to stabilize the market.

Read Also: Brent Crude Oil Prices Rise Amid Geopolitical Tensions

The Context: In 2022, Biden ordered the release of more than 100 million barrels of oil from the SPR after Russia invaded Ukraine. That created a supply shock in the oil markets. At the time, oil sold for more than $100 per barrel.

But, through the release of oil from the SPR, Biden’s administration managed to calm the markets, with oil returning to a more normal price of around $80 per barrel. Since then, Biden’s team has used periods of weakness in the oil markets to repurchase oil to refill the reserve after releasing a significant amount in 2022.

“DOE announces another 6 million barrels of crude oil have been purchased for the SPR, for delivery Feb thru May of 2025,” De Haan tweeted Monday. “DOE has now purchased over 55 million barrels to refill the SPR.”

Quoted: Todd Campbell, the editor-in-chief of TheStreet, responded to De Haan’s tweet, saying Biden’s move “has to be one of the best oil trades in history.”

While the administration still has not fully refilled the SPR to its pre-Russia invasion levels, the trades showcase how governments may intervene to help stabilize markets in times of uncertainty. When Biden originally released millions of barrels of oil from the SPR, gas prices were skyrocketing, putting pressure on American consumers.

The release from the SPR led to a 40-cent-per-gallon decrease in gas prices, according to the Department of Energy. Now, as gas prices have returned to relatively normal levels, the administration’s focus has shifted to refilling the SPR.

On Wednesday, the United States Oil Fund USO, a fund that roughly tracks the price of oil, fell by more than 2% intraday amid ongoing unrest and uncertainty in the Middle East. The Energy Select Sector SPDR Fund XLE also fell early in the trading day, but erased some of those losses and was in the green as of late in Wednesday’s session.

Keep Reading:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply