Chinese Stocks Snap 13-Day Rally, Yen Weakens: Markets Wrap

(Bloomberg) — US stocks churned as traders weighed a positive reading on US services activity against the prospect of escalating conflict in the Middle East. Crude oil and the dollar extended gains.

Most Read from Bloomberg

The S&P 500 was down 0.3% while the Nasdaq 100 slipped 0.1% after a report that President Joe Biden was “discussing” if he would support Israel striking Iran’s oil facilities. Global equities remain on course for their first weekly loss in four as the world awaits Israel’s response to a missile strike by Iran. Israel’s warplanes bombed Beirut overnight, after eight of its soldiers were killed in southern Lebanon in battles against Hezbollah

A September reading showing the US services sector expanded at the fastest pace since February 2023 briefly helped equities erase losses. The Institute for Supply Management’s index of services jumped to 54.9, beating estimates. Readings above 50 indicate expansion.

Treasury yields and the US dollar rose to session high after the data on bets the Federal Reserve’s next move may not be the bold interest-rate cut traders have been hoping for.

Earlier data showed applications for US unemployment benefits rose slightly last week to a level that is consistent with limited number of layoffs. Continuing claims, a proxy for the number of people receiving benefits, were little changed at 1.83 million in the previous week, according to Labor Department data released Thursday.

Initial jobless claims “on balance continue to look quite low, which is a good sign for the job market,” according to JPMorgan Chase & Co.’s Abiel Reinhart. Amid the geopolitical uncertainty, investors are looking for further signals on the health of the US economy, with the key monthly payrolls report due on Friday.

To Michael Metcalfe, head of macro strategy at State Street Global Markets, international conflict has returned as a driver for markets. “There might be a pressure to rebalance, because markets are stretched and I don’t see that as being particularly positive for US equities,” he said.

Fed officials will see fresh labor market data Friday. The unemployment rate is forecast to hold steady at 4.2% in September while payrolls are expected to rise by 150,000.

“I am of course nervous heading into tomorrow’s jobs report,” Kallum Pickering, chief economist at Peel Hunt, said on Bloomberg Television. “If the unemployment rate ticks up, I wouldn’t be surprised that markets would shift back toward expecting 50 basis points and then it is a question of how the Fed may react.”

Among single stocks, Levi Strauss shares slumped after the apparel company lowered its revenue growth outlook for the full year. Bloomberg’s dollar index gained for a fourth day, bolstered by the rise in Treasury yields.

Crude oil rose for a third day. Brent crude traded above $75 a barrel, on course for the longest run of daily gains since August, while West Texas Intermediate hovered around $72. Investors are concerned that, should Israel strike key Iranian assets, the Islamic Republic will lash out and escalate their conflict, dragging in more countries and potentially disrupting global energy shipments.

“The question has been about how aggressive Israel’s response will be and whether energy infrastructure will be impacted,” said Jun Rong Yeap, a market strategist at IG Asia Pte.

Key events this week:

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 0.3% as of 10:26 a.m. New York time

-

The Nasdaq 100 fell 0.2%

-

The Dow Jones Industrial Average fell 0.5%

-

The Stoxx Europe 600 fell 1%

-

The MSCI World Index fell 0.3%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.3%

-

The euro fell 0.1% to $1.1030

-

The British pound fell 1.2% to $1.3114

-

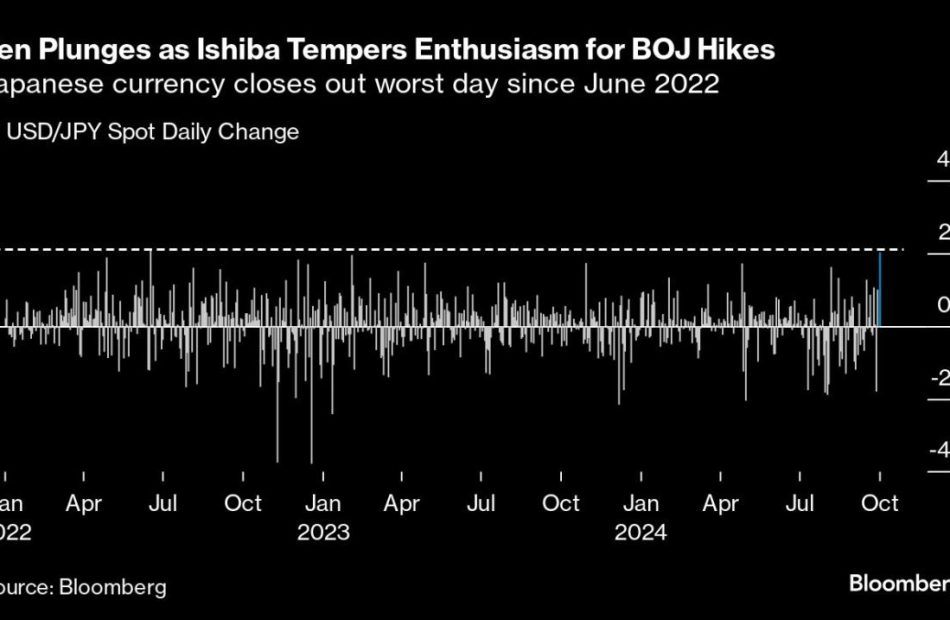

The Japanese yen fell 0.1% to 146.68 per dollar

Cryptocurrencies

-

Bitcoin fell 1.2% to $60,164.14

-

Ether fell 2.3% to $2,330.32

Bonds

-

The yield on 10-year Treasuries advanced four basis points to 3.82%

-

Germany’s 10-year yield advanced five basis points to 2.14%

-

Britain’s 10-year yield was little changed at 4.02%

Commodities

-

West Texas Intermediate crude rose 4.1% to $72.94 a barrel

-

Spot gold fell 0.4% to $2,649.14 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Hsu, John Cheng, Chiranjivi Chakraborty, Robert Brand, Margaryta Kirakosian and Sujata Rao.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Leave a Reply