IONS' Rare Neurology Disorder Candidate Gets FDA's Fast Track Tag

Ionis Pharmaceuticals, Inc. IONS announced that the FDA has granted a Fast Track designation to its investigational RNA-targeted therapy zilganersen for treating Alexander disease (AxD), an ultra-rare neurological disorder.

The Fast Track designation from the FDA facilitates rapid development and expedites the review of drug candidates to treat serious conditions for which clinical data demonstrate the potential to address unmet medical needs. The goal is to make these treatments rapidly available to patients in need.

AxD is a rare neurological disease that affects a type of cell in the brain called astrocytes, which has multiple roles in the brain to support neurons and oligodendrocytes. People living with this condition experience cognitive dysfunction and progressive neurologic deterioration, including swallowing and the ability to control muscles for large movements. Per Ionis, zilganersen is the first investigational medicine in clinical development for treating AxD. There are currently no approved therapies for AxD patients.

The FDA had previously granted Orphan Drug designation and Rare Pediatric Disease designation to zilganersen for treating AxD.

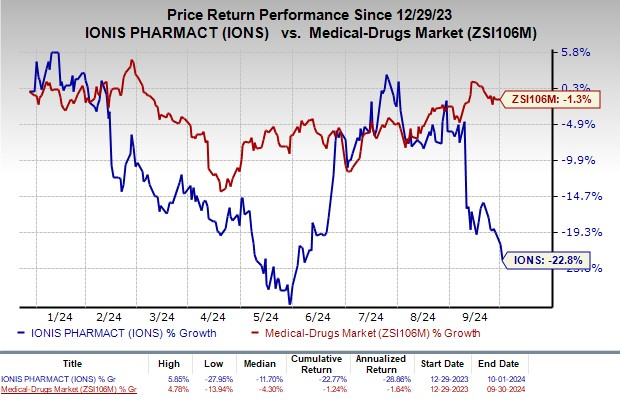

Shares of Ionis have declined 22.8% so far this year compared with the industry’s 1.3% fall.

Image Source: Zacks Investment Research

Recent Updates on IONS’ Zilganersen

Zilganersen is currently being evaluated in late-stage studies for treating adults and children living with AxD.

The company completed full patient enrollment in a pivotal phase III study on zilganersen for treating AxD in July. Top-line data from the same is expected in the second half of 2025.

The primary endpoint of the study is to check the percent change from baseline in gait speed as assessed by the 10-Meter Walk Test (10MWT) at the end of the 60-week treatment period.

Zilganersen is one of Ionis’ wholly-owned pipeline candidates. The company intends to launch it independently in the United States.

IONS’ Promising Wholly Owned Pipeline

Ionis has collaborations with leading drugmakers/biotech companies that provide it with funds in the form of license fees, upfront payments and milestone payments to invest in its internal pipeline development.

Besides zilganersen, some of its wholly-owned candidates include olezarsen for familial chylomicronemia syndrome and severe hypertriglyceridemia, donidalorsen for hereditary angioedema and ulefnersen for amyotrophic lateral sclerosis, which is in phase III study.

In April 2024, Ionis filed a new drug application (NDA) with the FDA seeking approval for olezarsen in the FCS indication. A decision from the regulatory body is due on Dec. 19, 2024.

If approved, olezarsen will be Ionis’ first medicine to be launched independently.

Also, Ionis is making preparations to file an NDA for donidalorsen with the FDA later in 2024. The company expects donidalorsen to be its second independent commercial launch upon potential approval.

IONS’ Zacks Rank & Stocks to Consider

Ionis currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are ANI Pharmaceuticals, Inc. ANIP, Krystal Biotech, Inc. KRYS and Fulcrum Therapeutics, Inc. FULC, each sporting a Zacks Rank #1 (Strong Buy) at present.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 earnings per share have moved up from $4.53 to $4.81. Earnings per share estimates for 2025 have improved from $5.38 to $5.86. Year to date, shares of ANIP have increased 7.8%.

ANIP’s earnings beat estimates in each of the trailing four quarters, with the average surprise being 31.32%.

In the past 60 days, estimates for Krystal Biotech’s 2024 earnings per share have increased from $1.91 to $2.38. Earnings per share estimates for 2025 have improved from $4.33 to $7.31. Year to date, shares of KRYS have risen 46.3%.

KRYS’ earnings beat estimates in three of the trailing four quarters while missing on the remaining occasion, with the average surprise being 45.95%.

In the past 60 days, estimates for Fulcrum Therapeutics’ 2024 loss per share have narrowed from 46 cents to 28 cents. Loss per share estimates for 2025 have narrowed from $1.67 to $1.14. Year to date, shares of FULC have plunged 46.7%.

FULC’s earnings beat estimates in each of the trailing four quarters, with the average surprise being 393.18%.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply