Black Kite Research Reveals that 80% of Manufacturing Companies Have Critical Vulnerabilities

BOSTON, Oct. 02, 2024 (GLOBE NEWSWIRE) — Black Kite, the leader in third-party cyber risk intelligence, today published the 2024 report: The Biggest Third-Party Risks in Manufacturing, which revealed that a staggering 80% of manufacturing companies have critical vulnerabilities putting them at high risk for exploitation. In creating the report, the Black Kite Research Team (BRITE) examined nearly 5,000 companies across 10 sub-categories in the manufacturing industry, exploring the third-party risk landscape and the impacts of cyberattacks within the sector.

Rapid digital transformation in recent years has made manufacturing organizations prime targets for cyber attacks. Threat actors know that defense strategies have not kept pace with the rapidly expanding attack surface and these companies play critical roles within global supply chains. Attacks within manufacturing can result in cascading operational disruption and financial and reputational damage. When considering the potential for impact and the sector’s vulnerable state, it is no surprise that, according to Black Kite data, manufacturing was the top industry victimized by ransomware attacks over the analyzed one-year time period (April 2023-March 2024), with more than 1,000 victims confirmed. Industrial machinery manufacturing tops the list of ransomware victims in the space, followed by motor vehicle parts manufacturing, and pharmaceutical and medicine manufacturing.

“Due to its critical nature, the manufacturing industry is a prime target for bad actors to exploit. Although these organizations have invested substantially in protecting physical and operational technology, their expanding digital footprints are a point of weakness that must be addressed,” said Ferhat Dikbiyik, chief research and intelligence officer at Black Kite. “Organizations in this sector need to immediately take note of their high risk and fortify their cyber defenses to mitigate the chances of becoming the next ransomware statistic.”

A significant portion of the report highlights the top risks that are most often present when companies are compromised. Some of these findings include:

- 69% of companies analyzed have exposed credentials in the last 90 days.

- A significant portion of manufacturing companies have also had vulnerabilities from the CISA known exploited vulnerabilities (KEV) catalog (67%) and broken crypto algorithms (62%).

- Most manufacturers analyzed applied good application security practices; however, 30% of companies have critical vulnerabilities in web applications that threat actors can exploit.

- Poor patch management is pervasive across the industry; 94% of companies in the furniture and related product manufacturing sub-industry scored a D or F in patch management, which means most of tier assets are running vulnerable or out-of-date products.

“It is important to note that in manufacturing, many systems are integral to the production process and cannot be easily updated without potentially impacting operations. However, this does not justify exposing these systems to the internet, where they can become easy targets for cyberattacks,” Dikbiyik said. “Unfortunately, the machines we observed were indeed exposed, heightening the security risks for these organizations.”

The report also ranks manufacturing companies’ probability of a ransomware attack occurring using Black Kite’s Ransomware Susceptibility Index® (RSI™). Black Kite collects data from open source intelligence sources (OSINT) — internet scanners, hacker forums and sources on the deep/dark web and more — and then uses machine learning to make correlations with a company’s existing security controls to approximate potential risk for ransomware attacks. With its RSI score, a company can know the likelihood of an attack in minutes on a scale that ranges from 0.0 (lowest probability) to 1.0 (highest probability).

According to the report, every sub-industry in manufacturing examined averaged a 0.4 or greater RSI score, placing them in the critical category, meaning they are 3.4 times more likely to experience a ransomware attack. The risk is significantly higher in many subcategories. For instance, more than 60% of companies in both chemical manufacturing and transportation and equipment manufacturing fell into the critical category.

To learn more, visit the blog.

About Black Kite

Black Kite gives companies a comprehensive, real-time view into cyber ecosystem risk so they can make informed risk decisions and improve business resilience while continuously monitoring more vendors, partners, and suppliers in an ever-changing digital landscape.

Through an automated process, and a combination of threat, business and risk information, Black Kite provides cyber risk intelligence that goes beyond a simple risk score or rating.

Black Kite serves more than 3,000 customers in a wide range of industries and has received numerous industry awards and recognition from customers.

Learn more at www.blackkite.com, on the Black Kite blog.

Copyright © 2024 Black Kite, Inc. All rights reserved. All other brand names, product names, or trademarks belong to their respective holders.

Media Contact:

Geena Pickering

Look Left Marketing

blackkite@lookleftmarketing.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

OLLI Expands With 7 Big Lots Stores: What More Should Investors Know?

Ollie’s Bargain Outlet Holdings, Inc. OLLI is set to enhance its retail footprint following the acquisition of seven former Big Lots store leases won through a recent bankruptcy auction. This acquisition comes as part of the ongoing restructuring efforts of Big Lots, which included the closure of 143 stores.

Details of OLLI’s Acquisition of 7 Big Lots’ Stores

Of the seven stores, Ollie’s Bargain has received the final clearance and approval for six stores from the United States Bankruptcy Court for the District of Delaware. The seventh store is expected to receive the necessary approvals soon.

What makes these stores an ideal choice is that these have the required size, situated in prime trade areas and align with OLLI’s commitment to serving value-oriented customers. Not only this but these stores also are located in the Midwest, a region where OLLI sees significant growth potential and has opened a new distribution center.

Similar to the 99 Cent Only stores’ acquisition, OLLI’s primary focus is on opening the acquired Big Lots stores while adjusting the schedule for other planned store openings in its pipeline to optimize productivity and reduce pre-opening costs. For fiscal 2024, the company anticipates 50 new stores and two planned closures.

Ollie’s Bargain’s acquisition of former Big Lots stores signifies a strategic growth initiative within the competitive retail landscape. Currently, OLLI operates 541 stores across 31 states. The company’s long-term plan is to operate 1300 stores across the United States.

What More Should Investors Know About OLLI?

Ollie’s Bargain business model of “buying cheap and selling cheap”, cost-containment efforts, focus on store productivity and expansion of customer reward program and Ollie’s Army reinforce its position in the industry. Ollie’s Army continues to be a significant sales driver in the second quarter of fiscal 2024 with the increasing membership. The company ended the quarter with 14.5 million active Ollie’s Army members, which accounted for more than 80% of sales. Collectively, these initiatives position the company for sustained growth.

OLLI delivered a strong performance in the second quarter. It emphasizes value-driven merchandise assortments, which allowed the company to seize market opportunities and meet consumer demand effectively. Comparable store sales rose 5.8% in the quarter, driven by growth in transactions and basket size. Ollie’s Bargain has now achieved nine consecutive quarters of comparable store sales growth.

The improved business performance prompted management to lift its fiscal 2024 view. OLLI now expects net sales in the range of $2.276-$2.291 billion compared with $2.257-$2.277 billion stated earlier. Ollie’s Bargain now anticipates comparable store sales to rise in the band of 2.7-3.2% compared with 1.5-2.3% previously stated. The company has revised adjusted EPS to be in the band of $3.22-$3.30, up from the earlier estimated range of $3.18-$3.28.

How is the Zacks Consensus Estimate Faring for OLLI?

Reflecting the positive sentiment around OLLI, the Zacks Consensus Estimate for EPS has seen upward revisions. In the past 60 days, analysts have increased their estimates for the current and next fiscal year by 0.3% to $3.28 and 1.1% to $3.72 per share, respectively. These estimates indicate expected year-over-year growth of 12.7% and 13.4%, respectively.

Image Source: Zacks Investment Research

Does OLLI Stock Look Attractive?

In the past six months, OLLI’s shares have gained 38.5%, outpacing the industry and the S&P 500’s growth of 6.8% and 9.9%, respectively.

Image Source: Zacks Investment Research

OLLI stock has been a strong performer, but its valuation remains a topic of debate. Currently, the stock trades at a premium relative to the industry, with a price-to-earnings ratio indicating that its growth potential may already be factored into price.

OLLI’s forward 12-month price-to-earnings ratio stands at 26.7X, higher than the industry’s ratio of 18.6X. This suggests that investors are paying a premium compared with the company’s expected earnings growth. OLLI has a Value Score of D.

Image Source: Zacks Investment Research

How to Play OLLI Stock?

Ollie’s Bargain is well-positioned to enhance its market presence, drive sales and deliver value to its customers, leading to improved financial performance in the coming quarters. Investors with a long-term horizon may stay invested in this Zacks Rank #3 (Hold) stock but potential investors should look for a better entry point, given its higher valuation.

Stocks to Consider

Here, we have highlighted three better-ranked stocks, namely Sprouts Farmers Market, Inc. SFM, Burlington Stores, Inc. BURL and Chewy, Inc. CHWY, currently carrying a Zacks Rank # 2 (Buy) each.

Sprouts Farmers engages in the retailing of fresh, natural and organic food products under the Sprouts brand in the United States. SFM has a trailing four-quarter earnings surprise of nearly 12%, on average.

The Zacks Consensus Estimate for Sprouts Farmers’ current-fiscal year’s sales and earnings indicates growth of 9.6% and 18.7%, respectively, from the year-ago reported numbers.

Burlington Stores operates as a retailer of branded merchandise in the United States. BURL has a trailing four-quarter earnings surprise of 18.4%, on average.

The Zacks Consensus Estimate for Burlington Stores’ current-financial year’s sales and earnings implies a rise of 10.1% and 30.5%, respectively, from the year-earlier reported figures.

Chewy engages in the pure-play e-commerce business in the United States. CHWY has a trailing four-quarter earnings surprise of 50.9%, on average.

The Zacks Consensus Estimate for Chewy’s current-financial year’s sales and earnings indicates an increase of 5.7% and 65.2%, respectively, from the year-ago reported numbers.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Decoding Zscaler's Options Activity: What's the Big Picture?

Whales with a lot of money to spend have taken a noticeably bearish stance on Zscaler.

Looking at options history for Zscaler ZS we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 22% of the investors opened trades with bullish expectations and 55% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $365,000 and 7, calls, for a total amount of $1,123,045.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $135.0 to $230.0 for Zscaler over the recent three months.

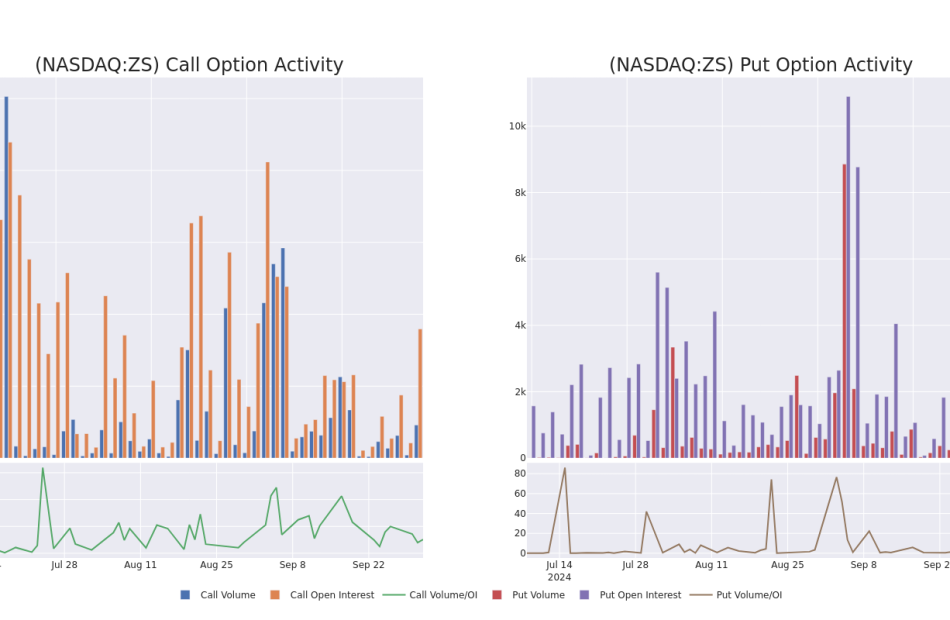

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Zscaler’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Zscaler’s substantial trades, within a strike price spectrum from $135.0 to $230.0 over the preceding 30 days.

Zscaler 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ZS | CALL | TRADE | NEUTRAL | 01/17/25 | $11.6 | $10.85 | $11.25 | $180.00 | $675.0K | 820 | 600 |

| ZS | PUT | TRADE | NEUTRAL | 09/19/25 | $11.3 | $10.65 | $11.0 | $135.00 | $275.0K | 18 | 250 |

| ZS | CALL | TRADE | BEARISH | 06/20/25 | $40.7 | $40.55 | $40.55 | $145.00 | $93.2K | 108 | 23 |

| ZS | PUT | SWEEP | BULLISH | 10/18/24 | $8.1 | $7.5 | $7.5 | $175.00 | $90.0K | 253 | 120 |

| ZS | CALL | TRADE | BEARISH | 06/20/25 | $38.0 | $37.3 | $37.3 | $150.00 | $89.5K | 2.6K | 95 |

About Zscaler

Zscaler is a software-as-a-service, or SaaS, firm focusing on providing cloud-native cybersecurity solutions to primarily enterprise customers. Zscaler’s offerings can be broadly partitioned into Zscaler Internet Access, which provides secure access to external applications, and Zscaler Private Access, which provides secure access to internal applications. The firm is headquartered in San Jose, California, and went public in 2018.

Following our analysis of the options activities associated with Zscaler, we pivot to a closer look at the company’s own performance.

Present Market Standing of Zscaler

- With a volume of 1,255,322, the price of ZS is up 1.52% at $169.53.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 54 days.

What Analysts Are Saying About Zscaler

In the last month, 5 experts released ratings on this stock with an average target price of $206.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Zscaler with a target price of $220.

* An analyst from Barclays has decided to maintain their Overweight rating on Zscaler, which currently sits at a price target of $200.

* Maintaining their stance, an analyst from Needham continues to hold a Strong Buy rating for Zscaler, targeting a price of $235.

* Consistent in their evaluation, an analyst from BTIG keeps a Buy rating on Zscaler with a target price of $205.

* An analyst from Cantor Fitzgerald has decided to maintain their Neutral rating on Zscaler, which currently sits at a price target of $170.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Zscaler, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A simple, forehead-slapping mistake on your IRA could be costing you thousands

Americans are missing out on hundreds of billions of dollars in lost retirement cash because of a simple, forehead-slapping mistake in managing their IRA accounts.

That’s the conclusion of new research by Vanguard, the investment firm, into the lackluster performance of many individual retirement accounts.

The problem comes with rollovers, the transfer of funds from an employer-sponsored retirement plan to a traditional IRA when someone leaves a job.

Looking at IRA rollovers completed in 2015, Vanguard found that 28% of savers still had their funds in cash seven years later, in 2022.

One mistake costs investors $170b in retirement wealth

That act of omission, Vanguard estimates, costs investors at least $170 billion a year in lost retirement wealth.

Here’s the problem: When someone leaves a job and rolls over a 401(k) into an IRA, the money almost always arrives as cash, or a cash equivalent, such as a money market fund. Those accounts typically earn less than 1% interest a year, although higher rates exist.

To put the money back to work, the investor has to log in to the retirement account, or pick up the telephone, and re-invest the funds in the stock and bond markets.

Failing to do so, and leaving a rollover IRA in cash, costs an individual investor at least $130,000 in lost wealth by age 65, assuming the rollover happens by age 55, according to Vanguard research.

“A lot of investors mistakenly assume that reinvestment is automatic,” said Andy Reed, head of investment behavior research at Vanguard.

“The number of experts – and by experts, I mean people with PhDs – who we’ve talked to who said, ‘I did this, or my spouse did this, or my adult child did this,’ it’s been absolutely mindboggling,” he said.

Stories of rollover IRAs wallowing in cash for decades, and missing out on hundreds of thousands of dollars in compound interest, are the stuff of nightmares, some financial advisers said.

A million dollars in lost savings: ‘I’m sure I gasped’

Michelle Crumm, a certified financial planner in Ann Arbor, Michigan, recently took on a new client. The client was in her mid-50s. She had managed to save $200,000 in retirement funds in her 20s at a high-paying job.

“And it’s been sitting in cash,” she told Crumm.

Crumm did some quick math in her head. Over 25 years, at 8% interest, the client’s $200,000 would have grown to well over $1 million.

She did not share that figure with her client: What was the point?

“I always just try to take people where they’re at. History’s history,” she said. “I’m sure I gasped.”

Rarely, advisers say, does the personal finance world offer such an easy and potentially lucrative fix:

If you have an IRA, take a look at the holdings. If they are in cash, or a money market account, consider moving them into stocks and bonds to avoid missing out on a trove of investment earnings in the years to come.

“We’re not talking about a small sum of money. We’re talking about a large chunk of money,” said Heather Winston, assistant vice president and head of product strategy at Principal Financial Group.

It might seem improbable that millions of Americans have billions of dollars in retirement savings that they forgot to invest.

The typical investor waits 9 months to invest rollover funds

But Vanguard’s research found that the typical investor waits nine months after an IRA rollover to invest the funds. Many savers wait much longer. The average young investor, ages 20 to 29, allows an IRA rollover to sit in cash for seven years.

When Vanguard surveyed investors who had left their IRA funds in cash, they found that most clients didn’t realize the funds weren’t already invested.

Investment advisers concur.

“I’ve worked with clients who kept their funds in cash for years, mistakenly thinking the account itself handled the investing,” said Spenser Liszt, a certified financial planner in Dallas.

Liz Windisch, a certified financial planner in Denver, also said she has seen IRA funds languish in cash “many, many times.”

Some clients never realized the money wasn’t invested, Windisch said, “But more often, it is someone who plans to do something and keeps kicking the can down the road, and now it’s two years later.”

Retirement savings accounts are designed to encourage workers to set aside earnings toward their post-employment years.

With a rollover IRA, the default position is usually cash

Common wisdom suggests most of the savings should be invested in the stock market, where the money can be expected to earn around 10% a year over time. Savers often invest a smaller share of their funds in bonds, which offer lower returns but provide a hedge against the volatility of stocks.

When a worker enrolls in a 401(k), the account generally has a default setting that invests the funds in some sensible mix of stocks and bonds, often keyed to the employee’s expected retirement year. That means the worker’s savings will grow, even if the employee never makes investment choices.

IRAs are different. When a worker leaves a job and rolls over a 401(k) into an IRA, the investments are usually liquidated and the funds converted to cash or some cash equivalent.

“And many investors fail to take the next step,” Reed said, “which is reinvesting.”

The same rules apply to IRA contributions. And Vanguard found the same problem when investors contribute to IRA accounts: 12 months later, many of those contributions remain in cash.

‘Let us help you with this stuff’

Solving the problem sounds simple enough. Someone – a financial adviser, ideally – needs to alert a retirement saver whose IRA is stalled in cash. But that doesn’t always happen.

“I think we, as an industry, need to do a much better job at saying, ‘Let us help you with this stuff,’” said Winston at Principal. “Firms like ours have to be prepared to make recommendations about what to do.”

Investment firms could, for example, flag an IRA account that has sat in cash for more than a year and send a message to its owner, reminding them of the benefits of investing.

Vanguard has worked on helping IRA investors find suitable investments for their cash, sending pro-active messages and simplifying the process for re-investing, a company spokesman said.

That initiative may explain why Vanguard is seeing improvement in its rollover cash problem. For rollovers initiated in 2022, only 28% of the accounts remained in cash after 12 months.

Among 2015 rollovers, by contrast, 28% remained in cash after seven years.

The Fed just cut interest rates. How will your finances be impacted?

In a recent policy paper, Vanguard urged lawmakers to change IRA regulations so rollover funds invest automatically. That way, if the saver failed to act, the funds would default into a mix of stocks and bonds.

“Uninvested cash in retirement accounts is a significant problem that hinders millions of Americans saving for retirement,” the report states. “Accordingly, a systematic solution is needed.”

This article originally appeared on USA TODAY: This IRA account mistake could be costing you thousands

RPM International Beats Q1 Earnings Estimates

RPM International RPM came out with quarterly earnings of $1.84 per share, beating the Zacks Consensus Estimate of $1.76 per share. This compares to earnings of $1.64 per share a year ago. These figures are adjusted for non-recurring items.

This quarterly report represents an earnings surprise of 4.55%. A quarter ago, it was expected that this specialty chemicals company would post earnings of $1.56 per share when it actually produced earnings of $1.56, delivering no surprise.

Over the last four quarters, the company has surpassed consensus EPS estimates two times.

RPM International, which belongs to the Zacks Paints and Related Products industry, posted revenues of $1.97 billion for the quarter ended August 2024, missing the Zacks Consensus Estimate by 2.40%. This compares to year-ago revenues of $2.01 billion. The company has topped consensus revenue estimates two times over the last four quarters.

The sustainability of the stock’s immediate price movement based on the recently-released numbers and future earnings expectations will mostly depend on management’s commentary on the earnings call.

RPM International shares have added about 7.6% since the beginning of the year versus the S&P 500’s gain of 19.7%.

What’s Next for RPM International?

While RPM International has underperformed the market so far this year, the question that comes to investors’ minds is: what’s next for the stock?

There are no easy answers to this key question, but one reliable measure that can help investors address this is the company’s earnings outlook. Not only does this include current consensus earnings expectations for the coming quarter(s), but also how these expectations have changed lately.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. Investors can track such revisions by themselves or rely on a tried-and-tested rating tool like the Zacks Rank, which has an impressive track record of harnessing the power of earnings estimate revisions.

Ahead of this earnings release, the estimate revisions trend for RPM International: mixed. While the magnitude and direction of estimate revisions could change following the company’s just-released earnings report, the current status translates into a Zacks Rank #3 (Hold) for the stock. So, the shares are expected to perform in line with the market in the near future.

It will be interesting to see how estimates for the coming quarters and current fiscal year change in the days ahead. The current consensus EPS estimate is $1.35 on $1.82 billion in revenues for the coming quarter and $5.49 on $7.48 billion in revenues for the current fiscal year.

Investors should be mindful of the fact that the outlook for the industry can have a material impact on the performance of the stock as well. In terms of the Zacks Industry Rank, Paints and Related Products is currently in the top 7% of the 250 plus Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Another stock from the same industry, Sherwin-Williams SHW, has yet to report results for the quarter ended September 2024. The results are expected to be released on October 22.

This paint and coatings maker is expected to post quarterly earnings of $3.55 per share in its upcoming report, which represents a year-over-year change of +10.9%. The consensus EPS estimate for the quarter has remained unchanged over the last 30 days.

Sherwin-Williams’ revenues are expected to be $6.26 billion, up 2.3% from the year-ago quarter.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Vows To 'Save' Silk Road Creator Ulbricht, Now 12 Years Into Sentence For Bitcoin-Fueled Dark Web Crimes

Former President Donald Trump reaffirmed his pledge to commute the sentence of Ross Ulbricht, the creator of the online illegal drug marketplace Silk Road.

What happened: In a Truth Social Post Wednesday, the Republican presidential hopeful wrote, I will save Ross Ulbricht,” in response to Ulbricht talking about the start of his 12th year in prison.

Screenshot From Donald Trump’s Account On Truth Social

Ulbricht has been serving a double life sentence since 2013 for his part in creating the infamous darknet website, which received roughly $1 billion in Bitcoin BTC/USD for the sale of heroin, cocaine, LSD, and other illegal drugs. The FBI shut down Silk Road shortly after Ross Ulbricht’s arrest.

See Also: Crypto Whale Dumped $46 Million BTC As Geopolitical Tensions Rise: What Is Going On?

The topic returned to the limelight earlier in March at the Libertarian National Convention when Trump vowed to commute Ulbricht’s sentence if voted back to power.

“And if you vote for me, on Day One, I will commute the sentence of Ross Ulbricht,” he said.

Why It Matters: Trump’s remarks were seen as a bid to court Libertarian voters, who have long lobbied for Ulbricht’s release.

It’s one of the things we wanted from his first term,” Katherine Yeniscavich, a national committee member of the party, said during the convention, as reported by Politico.

Meanwhile, in a bipartisan consensus, Trump, along with Democratic rival Kamala Harris, respective running mates Sen. JD Vance (R-Ohio.) and Minnesota Governor Tim Walz (D), featured in an ad supporting marijuana legalization in Florida.

Image via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mullen Announces Significant Revenue Increase and Reduction in Spending

For quarter ended Sept. 30, 2024, Company expects to report approximately $4.5 million in revenue compared to $65,235.00 reported in quarter ended June 30, 2024, an increase of 6791% compared to prior quarter

Mullen reported a monthly cash burn (operating and investing cashflows) of $12.8 million for the quarter ended June 30, 2024, as compared to a monthly cash burn of $18.1 million for the quarter ended March 31, 2024, representing a decrease of 30% or $5.3 million per month. Company’s monthly cash burn for the quarter ended Sept. 30, 2024, is approximately $12.7 million per month

The Company plans to continue to improve its cash burn with operating reductions throughout 2025 with the expectation to achieve breakeven on a cash basis by end of December 2025

BREA, Calif., Oct. 02, 2024 (GLOBE NEWSWIRE) — via IBN — Mullen Automotive Inc. (NASDAQ: MULN) (“Mullen” or the “Company”), an electric vehicle (“EV”) manufacturer, announces today that it expects $4.5 million in revenue for quarter ended Sept. 30, 2024, compared to $65,235.00 reported in quarter ended June 30, 2024, an increase of 6791% compared to prior quarter. The Company also provides an operational update, which includes initiatives it has recently taken to reduce overall operating expenses.

Mullen operational updates include:

- As of today, Company received $11.9 million, and expects to receive an additional $600,000 from investors, representing 25% of their additional investment right

- Company has an additional investment commitment of $150 million through the use of its equity line, which allows it to offer common stock, subject to market and other conditions

- For quarter ended Sept. 30, 2024, Company expects to report approximately $4.5 million in revenue compared to $65,235.00 reported in quarter ended June 30, 2024, an increase of 6791% compared to prior quarter

- Mullen reported a monthly cash burn (operating and investing cashflows) of $12.8 million for the quarter ended June 30, 2024, as compared to a monthly cash burn of $18.1 million for the quarter ended March 31, 2024, representing a decrease of 30% or $5.3 million per month. The Company’s monthly cash burn for the quarter ended Sept. 30, 2024, is approximately $12.7 million per month

- The Company plans to continue to improve its cash burn with operating reductions throughout 2025 with the expectation to achieve breakeven on a cash basis by December 2025

“Our revenue is up significantly, and our cash burn continues to decrease,” said David Michery, CEO and chairman of Mullen Automotive. “We are going into the remainder of 2024 with strong momentum, and I am focused on closing out the calendar year on an extremely positive trajectory.”

About Mullen

Mullen Automotive MULN is a Southern California-based automotive company building the next generation of commercial electric vehicles (“EVs”) with two United States-based vehicle plants located in Tunica, Mississippi, (120,000 square feet) and Mishawaka, Indiana (650,000 square feet). In August 2023, Mullen began commercial vehicle production in Tunica. In September 2023, Mullen received IRS approval for federal EV tax credits on its commercial vehicles with a Qualified Manufacturer designation that offers eligible customers up to $7,500 per vehicle. As of January 2024, both the Mullen ONE, a Class 1 EV cargo van, and Mullen THREE, a Class 3 EV cab chassis truck, are California Air Resource Board (“CARB”) and EPA certified and available for sale in the U.S. Recently, CARB issued HVIP approval on the Mullen THREE, Class 3 EV truck, providing up to $45,000 cash voucher at time of vehicle purchase. The Company has also recently expanded its commercial dealer network to seven dealers with the addition of Papé Kenworth. Other previously announced dealers include Pritchard EV, National Auto Fleet Group, Ziegler Truck Group, Range Truck Group, Eco Auto, and Randy Marion Auto Group, providing sales and service coverage in key Midwest, West Coast, Pacific Northwest, New England and Mid-Atlantic markets. The Company has also announced Foreign Trade Zone (“FTZ”) status approval for its Tunica, Mississippi, commercial vehicle manufacturing center. FTZ approval provides a number of benefits, including deferment of duties owed and elimination of duties on exported vehicles.

To learn more about the Company, visit www.MullenUSA.com.

Estimated Preliminary Results for the Fourth Quarter Ended Sept. 30, 2024 (Unaudited)

Set forth above are certain estimated preliminary financial results and other key business metrics for the fourth quarter ended Sept. 30, 2024. These estimates are based on the information available to us at this time. Our actual results may differ materially from the estimated preliminary results presented due to the completion of our financial closing and accounting procedures, including final adjustments, the completion of the preparation and audit of the Company’s financial statements and the subsequent occurrence or identification of events prior to the filing of the audited consolidated financial statements for the fiscal year ended Sept. 30, 2024, in its Annual Report on Form 10-K. The estimated preliminary financial results and other key business metrics have not been audited or reviewed by our independent registered public accounting firm. These estimates should not be viewed as a substitute for our full interim or annual financial statements. Accordingly, you should not place undue reliance on this preliminary data. In addition, any such statements regarding the Company’s financial performance are not necessarily indicative of the Company’s financial performance that may be expected to occur for the fiscal quarter ending Sept. 30, 2024, or for any future fiscal period.

Forward-Looking Statements

Certain statements in this press release that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Exchange Act of 1934, as amended. Any statements contained in this press release that are not statements of historical fact may be deemed forward-looking statements. Words such as “continue,” “will,” “may,” “could,” “should,” “expect,” “expected,” “plans,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential” and similar expressions are intended to identify such forward-looking statements. All forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements, many of which are generally outside the control of Mullen and are difficult to predict. Examples of such risks and uncertainties include, but are not limited to, whether the Company will be successful with cost-cutting initiatives or achieve anticipated expense reduction within expected timeframes, how long governmental incentives for electric vehicles will remain in place, and the resultant selling prices of Mullen vehicles. Additional examples of such risks and uncertainties include but are not limited to: (i) Mullen’s ability (or inability) to obtain additional financing in sufficient amounts or on acceptable terms when needed; (ii) Mullen’s ability to maintain existing, and secure additional, contracts with manufacturers, parts and other service providers relating to its business; (iii) Mullen’s ability to successfully expand in existing markets and enter new markets; (iv) Mullen’s ability to successfully manage and integrate any acquisitions of businesses, solutions or technologies; (v) unanticipated operating costs, transaction costs and actual or contingent liabilities; (vi) the ability to attract and retain qualified employees and key personnel; (vii) adverse effects of increased competition on Mullen’s business; (viii) changes in government licensing and regulation that may adversely affect Mullen’s business; (ix) the risk that changes in consumer behavior could adversely affect Mullen’s business; (x) Mullen’s ability to protect its intellectual property; and (xi) local, industry and general business and economic conditions. Additional factors that could cause actual results to differ materially from those expressed or implied in the forward-looking statements can be found in the most recent annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K filed by Mullen with the Securities and Exchange Commission. Mullen anticipates that subsequent events and developments may cause its plans, intentions and expectations to change. Mullen assumes no obligation, and it specifically disclaims any intention or obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by law. Forward-looking statements speak only as of the date they are made and should not be relied upon as representing Mullen’s plans and expectations as of any subsequent date.

Contact:

Mullen Automotive Inc.

+1 (714) 613-1900

www.MullenUSA.com

Corporate Communications:

IBN

Los Angeles, California

www.InvestorBrandNetwork.com

310.299.1717 Office

Editor@InvestorBrandNetwork.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Treasury Official Slams IMF For Being 'Too Polite' And Not A 'Ruthless Truth Teller' On China's Economic Policies

The latest development in the ongoing scrutiny of China’s economic policies has seen a senior U.S. Treasury official criticize the International Monetary Fund (IMF) for its lenient stance.

What Happened: The International Monetary Fund (IMF) has been criticized for being “too polite” regarding China’s economic policies, Reuters reported.

Brent Neiman, the Treasury’s deputy undersecretary for international finance, stated that the IMF has not applied sufficient analytical rigor to China’s industrial policies. Speaking at an event hosted by the OMFIF financial think tank, Neiman emphasized that the IMF should be a “ruthless truth teller” and more transparent about financing assurances from China and other countries.

Neiman pointed out that the IMF’s economic assessments of China do not adequately address exchange rate and industrial policies. He noted that the IMF does not publicly comment on the role of state-owned banks in managing China’s exchange rate or discrepancies in the People’s Bank of China’s balance sheet and reserve transactions.

See Also: Baidu, JD In Focus As Jim Cramer Weighs In On China’s Stock Stabilization Fund

Neiman also criticized the IMF’s lack of transparency in disclosing external financing assurances, citing recent programs for Argentina, Ecuador, and Suriname. He mentioned that such assurances were either not delivered or significantly delayed. The IMF recently approved a $7 billion program for Pakistan, which included financing assurances from China, Saudi Arabia, and the UAE, but did not provide details.

The IMF and World Bank will review various policies during their annual meetings in Washington, scheduled for the week of Oct. 21.

Why It Matters: The U.S. has been increasingly vocal about China’s opaque lending practices, particularly its emergency loans to debt-laden countries. The U.S. raised concerns about China’s secretive emergency loans, urging for greater transparency. Neiman highlighted that these loans, often provided through swap agreements, bind countries closer to China economically while imposing high interest rates. This issue was previously discussed by the Biden administration with Chinese officials in Washington.

China’s central bank facilitates these loans, allowing countries to borrow Chinese renminbi and use their U.S. dollar reserves to repay foreign debts. This arrangement has raised alarms due to the lack of transparency and the potential for deepening economic dependencies on China.

Read Next:

Photo via Shutterstock.

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Toyota had a plan for the big U.S. port strike

U.S. dockworkers on the East Coast and Gulf Coast walked off the job Tuesday, kicking off the first large-scale work stoppage among dockworkers in nearly 50 years. The move is predicted to have an enormous impact on global shipping and the automotive industry as new vehicles are slow to come in and out of America.

Now, it’s emerged that Toyota saw this coming, so began ramping up production to ride out any strike action that may hit its ability to ship cars around the world, reports Reuters. The Japanese automaker, which operates plants in places like Mississippi, Alabama, Texas and Tennessee, built up its inventory of vehicles and parts ahead of the U.S. port strikes, as Reuters reports:

Toyota, which relies on the U.S. East Coast and Gulf Coast ports to import everything from vehicle components to fully-built cars, said it was closely monitoring the situation.

Dockworkers on these coasts began a strike, their first large-scale stoppage in nearly 50 years, after negotiations for a new labor contract broke down.

“We built up some extra stock here over the last couple of weeks to help us buy a couple of days’ worth of inventory,” said Jack Hollis, chief operating officer at Toyota’s North American unit.

The company had plans that it could implement to change ports and locations, Hollis said.

“It would just be crippling to the economy if this goes on for too long,” he added.

While Toyota might claim the increased inventory was in preparation for the dockworkers strike, it did also reveal this week that sales for the third quarter of 2024 were down by “about eight percent,” according to Reuters. The drop in sales was attributed to fewer selling days last quarter, as well as “inflationary headwinds.”

Toyota posted sales of 542,872 units for Q3 of 2024, which follows similar drops in demand from automakers like Nissan and General Motors.

A version of this article originally appeared on Jalopnik’s The Morning Shift.

IMC Germany Announces Outstanding Preliminary Q3, 2024 Performance with 50% Growth Over Q2

TORONTO and GLIL YAM, Israel, Oct. 2, 2024 /PRNewswire/ — IM Cannabis Corp. IMCC IMCC (the “Company“, “IMCannabis“, or “IMC“), a leading medical cannabis company with operations in Israel and Germany, is pleased to announce that the preliminary sales results in Germany by its German subsidiary, Adjupharm GmbH (“IMC Germany“), for the third quarter of 2024 have significantly exceeded expectations, showing a remarkable 50% increase in revenue compared to the second quarter, where IMC Germany sold about CAD$ 3.5M. This outstanding growth demonstrates IMC Germany’s successful execution of its strategic initiatives and strong market demand for its products.

Since the partial legalization of cannabis in Germany came into effect in April 2024, the demand for cannabis products in pharmacies has increased significantly, emphasizing the importance of a robust, reliable supply chain.

“Since April 1st, one of our key objectives was to ensure a supply chain strong enough to meet the increase in demand. This preliminary 50% growth is testament, in part, to delivering on this objective,” said Oren Shuster, CEO of IMC. “We are thrilled with our Q3 performance, which not only surpassed our own targets but also highlights the dedication and hard work of our entire team.”

About IM Cannabis Corp.

IMC IMCC IMCC is an international cannabis company that provides premium cannabis products to medical patients in Israel and Germany, two of the largest medical cannabis markets. The Company has focused its resources to achieve sustainable and profitable growth in its highest value markets, Israel and Germany. The Company leverages a transnational ecosystem powered by a unique data-driven approach and a globally sourced product supply chain. With an unwavering commitment to responsible growth and compliance with the strictest regulatory environments, the Company strives to amplify its commercial and brand power to become a global high-quality cannabis player.

The IMC ecosystem operates in Israel through its commercial relationship with Focus Medical Herbs Ltd., which imports and distributes cannabis to medical patients, leveraging years of proprietary data and patient insights. The Company also operates medical cannabis retail pharmacies, online platforms, distribution centers, and logistical hubs in Israel that enable the safe delivery and quality control of IMC products throughout the entire value chain. In Germany, the IMC ecosystem operates through Adjupharm GmbH, where it distributes cannabis to pharmacies for medical cannabis patients.

Disclaimer for Forward-Looking Statements

This press release contains forward-looking information or forward-looking statements under applicable Canadian and U.S. securities laws (collectively, “forward-looking statements”). All information that addresses activities or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect”, “likely” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. Forward-looking statements are based on the estimates and opinions of management on the date the statements are made. In the press release, such forward-looking statements include, but are not limited to, statements relating to statements relating to compliance with Nasdaq’s continued listing requirements, and timing and effect thereof; the potential outcome of the Licensing Agreement and the effect of collaboration with Carmel in the Israeli market and the potential exclusive launch of the BLKMKTTM brand this year in Germany.

The above lists of forward-looking statements and assumptions are not exhaustive. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated or implied by such forward-looking statements due to a number of factors and risks. These include: the failure of the Company to comply with applicable regulatory requirements in a highly regulated industry; unexpected changes in governmental policies and regulations in the jurisdictions in which the Company operates; the Company’s ability to continue to meet the listing requirements of the Canadian Securities Exchange and the NASDAQ Capital Market; any unexpected failure to maintain in good standing or renew its licenses; the ability of the Company and Focus Medical (collectively, the “Group”) to deliver on their sales commitments or growth objectives; the reliance of the Group on third-party supply agreements to provide sufficient quantities of medical cannabis to fulfil the Group’s obligations; the Group’s possible exposure to liability, the perceived level of risk related thereto, and the anticipated results of any litigation or other similar disputes or legal proceedings involving the Group; the impact of increasing competition; any lack of merger and acquisition opportunities; adverse market conditions; the inherent uncertainty of production quantities, qualities and cost estimates and the potential for unexpected costs and expenses; risks of product liability and other safety-related liability from the usage of the Group’s cannabis products; supply chain constraints; reliance on key personnel; the risk of defaulting on existing debt and war, conflict and civil unrest in Eastern Europe and the Middle East.

Any forward-looking statement included in this press release is made as of the date of this press release and is based on the beliefs, estimates, expectations and opinions of management on the date such forward-looking information is made. The Company does not undertake any obligation to update forward-looking statements except as required by applicable securities laws. Investors should not place undue reliance on forward-looking statements. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

CAUTIONARY NOTE REGARDING FUTURE ORIENTED FINANCIAL INFORMATION

This press release may contain future oriented financial information (“FOFI”) within the meaning of Canadian securities legislation, about prospective results of operations, financial position or cash flows, based on assumptions about future economic conditions and courses of action, which FOFI is not presented in the format of a historical balance sheet, income statement or cash flow statement.

The FOFI has been prepared by management to provide an outlook of the Company’s activities and results and has been prepared based on a number of assumptions including the assumptions discussed under the heading above entitled “Cautionary Note Regarding Future Oriented Financial Information” and assumptions with respect to the costs and expenditures to be incurred by the Company, capital expenditures and operating costs, taxation rates for the Company and general and administrative expenses. Management does not have, or may not have had at the relevant date, firm commitments for all of the costs, expenditures, prices or other financial assumptions which may have been used to prepare the FOFI or assurance that such operating results will be achieved and, accordingly, the complete financial effects of all of those costs, expenditures, prices and operating results are not, or may not have been at the relevant date of the FOFI, objectively determinable.

Importantly, the FOFI contained in this press release and the documents incorporated by reference herein, are, or may be, based upon certain additional assumptions that management believes to be reasonable based on the information currently available to management, including those assumptions discussed under the heading “Disclaimer for Forward-Looking Statements” and assumptions about: (i) the future pricing for the Company’s products, (ii) the future market demand and trends within the jurisdictions in which the Company may from time to time conduct the Company’s business, and (iii) the Company continued ability to maintain its capital to fund its ongoing business development and future growth.

The FOFI or financial outlook contained in this press release do not purport to present the Company’s financial condition in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. The actual results of operations of the Company and the resulting financial results will likely vary from the amounts set forth in the analysis presented in any such document, and such variation may be material (including due to the occurrence of unforeseen events occurring subsequent to the preparation of the FOFI). The Company and management believe that the FOFI has been prepared on a reasonable basis, reflecting management’s best estimates and judgments as at the applicable date. However, because this information is highly subjective and subject to numerous risks including the risks discussed under the heading above entitled “Cautionary Note Regarding Future Oriented Financial Information”, FOFI or financial outlook within this in this press release should not be relied on as necessarily indicative of future results.

Company Contact:

Anna Taranko, Director Investor & Public Relations

IM Cannabis Corp.

+49 157 80554338

a.taranko@imcannabis.de

Oren Shuster, CEO

IM Cannabis Corp.

info@imcannabis.com

Logo – https://new.stockburger.news/wp-content/uploads/2024/10/IM_Cannabis_Logo.jpg

![]() View original content:https://www.prnewswire.com/news-releases/imc-germany-announces-outstanding-preliminary-q3-2024-performance-with-50-growth-over-q2-302265520.html

View original content:https://www.prnewswire.com/news-releases/imc-germany-announces-outstanding-preliminary-q3-2024-performance-with-50-growth-over-q2-302265520.html

SOURCE IM Cannabis Corp.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.