Combine Harvester Market is Set to Surge at 3.9% CAGR, to Reach US$ 12.97 Billion by 2034 | Fact.MR Report

Rockville, MD , Oct. 02, 2024 (GLOBE NEWSWIRE) — According to the updated research analysis by Fact.MR, a market research and competitive intelligence provider, the global Combine Harvester Market is analyzed to reach a worth of US$ 8.85 billion in 2024. Worldwide sales of these agriculture harvesters are forecasted to rise at a CAGR of 3.9% from 2024 to 2034.

Due to its efficiency and speed in performing agricultural duties, modern harvesting equipment is becoming popular as a multipurpose solution. To ensure greater yields and preserve farming profitability, several farmers are using updated equipment. The lack of qualified manpower and growing farm labor costs are creating prospects for combine harvester enterprises.

Sales of combine harvesters are supported by the global expansion in agricultural mechanization. The increasing use of precision farming techniques, labor shortages, government policies supporting the agriculture sector, the rising global population, and the consistent release of improved agricultural equipment are contributing to an increase in the demand for combine harvesters going forward.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=516

Key Takeaway from Market Study:

- The market for combine harvesters is approximated to reach a value of US$ 12.97 billion by 2034.

- North America is approximated to capture a 22.8% share of the global market in 2024.

- Global sales of large-size combine harvesters are evaluated to rise at a CAGR of 3.9% to reach US$ 8.27 billion by 2034-end.

- Sales of combine harvesters in Japan are projected to rise at 4.1% CAGR through 2034.

- South Korea is analyzed to account for a share of 26.3% of East Asian market revenue in 2024.

- The market in East Asia is forecasted to expand at a CAGR of 4% from 2024 to 2034.

“Combine harvesters help in increased productivity, reduce environmental effects, and advance food security, all of which enhance market share,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Combine Harvester Market:

Key players in the combine harvester market are CLAAS, Iseki & Co. Ltd., AGCO Corporation, John Deere, Dewulf N.V., Mahindra & Mahindra Ltd., Zoomlion Heavy Industry Science & Technology Co. Ltd., Kuhn SA, New Holland, Yanmar Co. Ltd, Kubota Agricultural Machinery, Foton Lovol International Heavy Industry Co. Ltd., OAO Rostselmash, CNH Industrial NV, Buhler Versatile Incorporated, Gomselmash Oao.

Preference for Wheel-Type Combine Harvesters for Easy Mobility and Economic Prices:

Combine harvesters with wheels work effectively in a range of environments, including fields that are level or slightly hilly. Compared to track-type combines, which have trouble on uneven terrain, they handle these terrains rather easily. Due to their superior mobility and comparatively lower ground pressure, these machines are easier to transport on public routes, allowing farmers to conveniently travel between non-contiguous areas. In general, wheel-type combines are comparatively less expensive than their tracked equivalents. For several farmers, especially those with limited resources, this makes them a more alluring option.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=516

Combine Harvester Industry News:

- American-based John Deere is a well-known maker of agricultural equipment. Offering HarvestLab 3000 Grain Sensing for its S700 series, which combines harvesters from 2018 or contemporary models, was announced in January 2023. As harvest grains are combined, this technology allows for continuous measurement of the oil, carbohydrate, and protein content in wheat, canola, and barley. Farmers will be able to log harvest data more easily and optimize farming practices.

- Under the Swaraj brand, Mahindra & Mahindra Ltd. (M&M Ltd.) released a new wheel harvester on the domestic market in August 2023. With the greatest grain quality achievable, the Swaraj 8200 Wheel Harvester maximizes profit and harvests the largest area in a single year.

- The first specialist farm machinery unit (non-tractor) of Mahindra & Mahindra Farm Equipment Sector (FES), a division of the Mahindra Group, opened a new plant in November 2022 in Pithampur, Madhya Pradesh. The facility spans 23 acres and produces 1,200 harvesters annually.

- The Andhra Pradesh government declared in June 2022 that the huge state-level distribution of equipment, including combine harvesters, will begin as part of the YSR Yantra Seva Pathakam Scheme.

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the combine harvester market, presenting historical demand data (2019 to 2023) and forecast statistics for the period (2024 to 2034).

The study divulges essential insights into the combine harvester market based on cutting width (small size, large size), type of movement (wheel type, crawler type), power (below 150 hp, 150 to 300 hp, 301 to 450 hp, 451 to 550 hp, above 550 hp), by mechanism (hydraulic, hybrid), grain tank size (less than 250 bu, 250 to 350 bu, more than 350 bu), across seven major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and MEA).

Segmentation of Combine Harvester Market Research:

- By Cutting Width :

- By Type of Movement :

- By Power :

- Below 150 HP

- 150 to 300 HP

- 301 to 450 HP

- 451 to 550 HP

- Above 550 HP

- By Mechanism :

- By Grain Tank Size :

- Less Than 250 bu

- 250 to 350 bu

- More Than 350 bu

Check out More Related Studies Published by Fact.MR:

Compact Electric Construction Equipment Market: size is set to reach a valuation of US$ 62.12 billion in 2024 and further expand at a CAGR of 13.2% to end up at US$ 214.63 billion by the year 2034.

Water Pump Market: Size has been estimated to reach US$ 52.4 billion in 2024 and is forecasted to expand at a CAGR of 4.4% to end up at a size of US$ 80.6 billion by 2034.

Large Bore Vacuum Insulated Pipe Market: Size is forecasted to increase from a valuation of US$ 81.4 million in 2024 to US$ 169.3 million by 2034-end, expanding at a CAGR of 7.6% between 2024 and 2034.

Industrial Vending Machine Market: Size is approximated at a value of US$ 3.32 billion for 2024 and is forecasted to rise at a CAGR of 9.9% to reach US$ 8.53 billion by 2034-end.

Cryogenic Equipment Market: Size is calculated at US$ 25.25 billion for 2034. Worldwide sales of cryogenic equipment are forecasted to increase at a CAGR of 6.6% and reach US$ 47.84 billion by the end of 2034.

Broaching Machine Market: Size is evaluated at US$ 1.28 billion for 2024 and is forecast to rise at a CAGR of 4.3% to reach US$ 1.96 billion by the end of 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tesla's quarterly deliveries disappoint ahead of robotaxi unveiling

By Akash Sriram, Abhirup Roy

(Reuters) -Tesla reported a smaller-than-expected rise in third-quarter deliveries on Wednesday as incentives and financing deals failed to lure enough customers for its aging electric vehicles, sending shares down more than 6%.

That puts the EV maker – already grappling with rising competition and slowing demand for EVs – at risk of its first-ever decline in annual deliveries after years of rapid growth.

Shares of the world’s most valuable automaker were on track to erase by the end of Wednesday’s session all of the gains made so far this year. The stock had risen in recent weeks on investor hopes for Tesla’s Oct. 10 event in Los Angeles where it is expected to unveil its robotaxi product in a bid to shift focus to AI-powered autonomous technologies.

Tesla has been slashing prices and extending incentives, including insurance offers and zero-interest financing, especially in China, which accounts for a third of its sales.

That helped boost China sales in July and August, according to data from the China Passenger Car Association. Analysts believe the China strength continued in September but that U.S. and European demand was low. “We believe China showed relative strength this quarter but was offset by weakness in the US and Europe,” Dan Ives, an analyst at Wedbush Securities, said in a note.

Tesla handed over 462,890 vehicles in the July-September period, up 6.4% from a year earlier, marking its first quarterly growth after two straight quarters of falling sales. But that fell short of 469,828 deliveries expected on average by 12 analysts polled by LSEG.

While CEO Elon Musk has said he expects the company to increase deliveries in 2024 from the record 1.8 million vehicles it handed over last year, Wednesday’s numbers make that “extremely difficult,” said Sandeep Rao, a senior researcher at Leverage Shares, an investment management company with assets of about $1 billion, including in Tesla and other EV makers.

Tesla now needs a record-breaking 516,344 vehicle deliveries in the fourth quarter to prevent a drop in 2024 sales.

“There’s only so much Tesla can do with price cuts and incentives while offering no fresh vehicles for customers,” Rao said, adding that rivals, especially in China, have been launching a range of new models.

Price cuts and incentives have also squeezed the company’s profit margins – fallout that investors and analysts have said could prove detrimental in the long run.

Some analysts said that a return to growth marked a positive sign for Tesla and showed that some of the incentives it had rolled out to boost demand were working.

“Taking a step back, deliveries returning to growth were the most important thing to come from today’s numbers,” said Hargreaves Lansdown senior equity analyst Matt Britzman, who holds Tesla shares.

The company delivered 439,975 Model 3 and Model Y vehicles, and 22,915 units of other models, which include the Model S sedan, Cybertruck and Model X premium SUV. It produced 469,796 vehicles during the July-September period.

The deliveries were higher than those of rival BYD, which handed over 443,426 battery-electric vehicles in the third quarter.

(Reporting by Akash Sriram in Bengaluru and Abhirup Roy in San Francisco; Editing by Anil D’Silva, Peter Henderson and Matthew Lewis)

Ero Copper Announces Initial NI 43-101 Mineral Resource Estimate for the Furnas Copper-Gold Project

VANCOUVER, British Columbia, Oct. 02, 2024 (GLOBE NEWSWIRE) — Ero Copper Corp. EROERO (“Ero” or the “Company”) is pleased to announce an initial National Instrument 43-101 (“NI 43-101”) compliant mineral resource estimate for the Furnas Copper-Gold Project (“Furnas” or the “Project”), located in the Carajás Mineral Province (“Carajás”) in Pará State, Brazil.

The initial mineral resource estimate highlights significant potential for the Project. At a 1.00% copper equivalent (“CuEq”) cut-off grade, the mineral resource estimate, effective June 30, 2024, totals:

- Indicated Mineral Resource: 35.2 million tonnes grading 1.04% copper and 0.69 grams per tonne (“gpt”) gold (1.36% CuEq1), containing an estimated 364,700 tonnes of copper and 775,300 ounces of gold

- Inferred Mineral Resource: 61.3 million tonnes grading 1.06% copper and 0.63 gpt gold (1.36% CuEq1), containing an estimated 647,400 tonnes of copper and 1,235,600 ounces of gold

This estimate is supported by more than 90,000 meters of historic drilling on the Project, conducted by Vale S.A. and Anglo American plc, as well as a resampling and database validation program undertaken by the Company.

“We are extremely pleased with this initial mineral resource estimate for Furnas. It provides a solid foundation upon which we can focus, over the coming months, on unlocking further potential,” said David Strang, Chief Executive Officer. “Our Phase 1 drill program will target two key objectives: improving the definition of high-grade zones through infill drilling and extending known mineralization within these zones beyond the historically drilled depth of approximately 300 vertical meters from surface.

“Furnas presents a tremendous opportunity to define a major copper-gold mineral resource capable of supporting a large-scale underground mine. Our experience in underground mining in Brazil, coupled with the successful construction of our new Tucumã mine and processing plant in the Carajás, positions us well to advance this Project.

“Together with our partners at Vale Base Metals, we are committed to progressing Furnas in a manner that delivers sustainable benefits for all stakeholders and reinforces Brazil’s position as a global leader in the responsible, low-carbon production of critical minerals.”

1. CuEq grade calculated as Cu grade + (Au grade x 0.03215 x ($1,900 gold price x 61.50% gold metallurgical recovery / (0.01 x $9,259/tonne copper price x 85.00% copper metallurgical recovery)).

MINERAL RESOURCE ESTIMATE AND CUT-OFF GRADE SENSITIVITY

| Cut-Off Grade | Grade | Contained Metal | ||||||||||||||

| CuEq1 | Tonnes | Cu | Au | CuEq1 | Cu | Au | CuEq | |||||||||

| (%) | Category | (Mt) | (%) | (gpt) | (%) | (kt) | (koz) | (kt) | ||||||||

| 0.60 | Indicated | 66.4 | 0.84 | 0.55 | 1.10 | 555.3 | 1,179.9 | 730.5 | ||||||||

| Inferred | 114.8 | 0.85 | 0.51 | 1.10 | 978.9 | 1,877.3 | 1,257.6 | |||||||||

| 0.80 | Indicated | 51.2 | 0.93 | 0.60 | 1.22 | 477.9 | 984.5 | 624.1 | ||||||||

| Inferred | 88.0 | 0.96 | 0.55 | 1.22 | 840.7 | 1,558.1 | 1,072.0 | |||||||||

| 1.00 | Indicated | 35.2 | 1.04 | 0.69 | 1.36 | 364.7 | 775.3 | 479.8 | ||||||||

| Inferred | 61.3 | 1.06 | 0.63 | 1.36 | 647.4 | 1,235.6 | 830.8 | |||||||||

Note: The Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards (2014) were used for reporting Mineral Resources, which are effective as at June 30, 2024 and presented on a 100% ownership basis. All figures have been rounded to reflect the relative accuracy of the estimates. Summed amounts may not add due to rounding. Mineral resources that are not mineral reserves do not have a demonstrated economic viability. See “Notes on Mineral Resources” below for additional technical and scientific information.

1. CuEq grade calculated as Cu grade + (Au grade x 0.03215 x ($1,900 gold price x 61.50% gold metallurgical recovery / (0.01 x $9,259/tonne copper price x 85.00% copper metallurgical recovery)).

In September 2024, the Company received drilling permits from the Pará State environmental agency, allowing for the commencement of the Phase 1 drill program in October 2024. This minimum 28,000-meter program will focus on two identified high-grade zones – the NW and SE Zones – within the broader deposit. The program is designed to support a preliminary economic assessment on the Project. The drill plan comprises:

- Infill drilling to upgrade inferred mineral resources and increase continuity of the high- grade zones

- Extensional drilling to depth, where limited prior drilling suggests increasing grade and thickness

FURNAS COPPER-GOLD PROJECT DETAILS AND EARN-IN AGREEMENT

Furnas is an iron oxide copper-gold deposit located approximately 50 kilometers southeast of Vale Base Metal’s (“VBM”) Salobo operations and approximately 190 kilometers northeast of Ero’s Tucumã Operations. Covering an area of approximately 2,400 hectares, the Project sits within fifteen kilometers of extensive regional infrastructure, including paved roads, an industrial-scale cement plant, a power substation and Vale S.A.’s railroad loadout facility.

In July 2024, the Company signed a definitive earn-in agreement (“Agreement”) with Salobo Metais S.A, a subsidiary of VBM, to earn a 60% interest in the Project upon completion of several exploration, engineering and development milestones over a five-year period. In exchange for its 60% interest, Ero will solely fund a phased work program during the earn-in period and grant VBM up to an 11.0% “free carry” on future Project construction capital expenditures. For additional details on the key terms and execution of the Agreement, please refer to the Company’s press releases dated October 30, 2023 and July 22, 2024.

NOTES ON MINERAL RESOURCES

CIM Definition Standards (2014) were used for reporting mineral resources, which are effective as at June 30, 2024 and presented on a 100% ownership basis. All figures have been rounded to the relative accuracy of the estimates. Summed amounts may not add due to rounding. Mineral resources that are not mineral reserves do not have a demonstrated economic viability.

Mineral resource estimates are prepared by or under the supervision of and verified by Mr. Cid Gonçalves Monteiro Filho, SME RM (04317974), MAIG (No. 8444), FAusIMM (No. 329148). Mr. Monteiro is Resource Manager of the Company and is a “qualified person” within the meanings of NI 43-101.

Mineral resources have been estimated using a copper price of US$9,259/tonne, a gold price of US$1,900/oz, a USD:BRL foreign exchange rate of 5.10, and copper and gold metallurgical recovery rates of 85.00% and 61.50%, respectively. The estimation was constrained using Datamine’s Mineable Shape Optimizer (“MSO”) at a 0.55% break-even copper cut-off grade. Mineral resources were estimated using ordinary kriging within a 25-meter by 25-meter by 4- meter block size (X, Y, Z), with a minimum sub-block size of 6.25 meters by 6.25 meters by

2.0 meters.

QUALIFIED PERSONS AND THE NI 43-101 TECHNICAL REPORT

Mr. Cid Gonçalves Monteiro Filho, SME RM (04317974), MAIG (No. 8444), FAusIMM (No. 329148) has reviewed, verified and approved the scientific and technical information contained in this press release, including the sampling, analytical and test data underlying the information contained in this press release. Mr. Monteiro is Resource Manager of the Company and is a “qualified person” within the meanings of NI 43-101.

The Company will file the associated NI 43-101 compliant report on SEDAR+ (www.sedarplus.ca/landingpage/) and EDGAR (www.sec.gov), and publish this report on the Company’s website (www.erocopper.com), within 45 days of this press release.

QUALITY ASSURANCE & QUALITY CONTROL

Four diamond exploration drilling campaigns were previously carried out on Furnas, with control sample protocols applied to each campaign. Historical QA/QC data was evaluated, including duplicates, blanks and standard samples from the most recent drilling campaign.

In all drilling campaigns, a quarter of the recovered core sample was collected. In the first three exploration campaigns, one-meter sampling intervals were predominately used. In the fourth exploration campaign one-meter sampling intervals were predominately used in the mineralized zone and two-meter sampling intervals were used in the transition zone and in waste rock.

Physical preparation of the quarter-core samples was performed in the following laboratories: Vale/Carajás, Intertek-Parauapebas-PA, Intertek-Nova Lima-MG, SGS GEOSOL, or Lakefield-Geosol. Chemical analysis was performed by ACME, Lakefield-Geosol in Belo Horizonte/MG, and SGS Geosol Laboratories in Vespasiano/MG. The selection of analytical methods and the number of elements analyzed varied across exploration campaigns.

To verify the accuracy of older sampling campaigns, a post-mortem QA/QC program was performed on copper and gold for select assay intervals. The post-mortem program undertaken by the Company demonstrates good performance, particularly for copper and gold, allowing for the inclusion of historical exploration campaign data for the purposes of this press release.

The Company reprocessed all historical QA/QC data from the Project, according to the Company’s internal guidelines, and achieved exceptional results aligned with industry standards. Error rates for pulp and coarse duplicates remained significantly below the conventional limit of 10%, demonstrating the effectiveness of historical data preparation and analytical procedures. Global biases across all drilling phases and laboratories stayed well within acceptable parameters, confirming the analytical accuracy of the primary laboratories associated with the historical database. Additionally, the absence of significant contamination in all laboratories further validates the reliability and integrity of the reprocessed data.

ABOUT ERO COPPER CORP

Ero is a high-margin, high-growth, low carbon-intensity copper producer with operations in Brazil and corporate headquarters in Vancouver, B.C. The Company’s primary asset is a 99.6% interest in the Brazilian copper mining company, Mineração Caraíba S.A. (“MCSA”), 100% owner of the Company’s Caraíba Operations (formerly known as the MCSA Mining Complex), which are located in the Curaçá Valley, Bahia State, Brazil and include the Pilar and Vermelhos underground mines and the Surubim open pit mine, and the Tucumã Operation (formerly known as Boa Esperança), an open pit copper mine located in Pará, Brazil. The Company also owns 97.6% of NX Gold S.A. (“NX Gold”) which owns the Xavantina Operations (formerly known as the NX Gold Mine), comprised of an operating gold and silver mine located in Mato Grosso, Brazil. Additional information on the Company and its operations, including technical reports on the Caraíba Operations, Xavantina Operations and Tucumã Operation, can be found on SEDAR+ (www.sedarplus.ca/landingpage/) and on EDGAR (www.sec.gov). The Company’s shares are publicly traded on the Toronto Stock Exchange and the New York Stock Exchange under the symbol “ERO”.

FOR MORE INFORMATION, PLEASE CONTACT

Courtney Lynn, SVP, Corporate Development, Investor Relations & Sustainability

(604) 335-7504

info@erocopper.com

CAUTION REGARDING FORWARD LOOKING INFORMATION AND STATEMENTS

This press release contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation (collectively, “forward-looking statements”). Forward-looking statements include statements that use forward-looking terminology such as “may”, “could”, “would”, “will”, “should”, “intend”, “target”, “plan”, “expect”, “budget”, “estimate”, “forecast”, “schedule”, “anticipate”, “believe”, “continue”, “potential”, “view” or the negative or grammatical variation thereof or other variations thereof or comparable terminology. Forward-looking statements may include, but are not limited to, statements with respect to Ero’s ability, in partnership with VBM, to create value at and/or maximize the value of the Project; Ero’s ability to successfully design an economic high-grade underground mine or other development and operating scenario for Furnas; Ero’s ability to commence and complete the required 28,000 meters of drilling during the 18-month Phase 1 work program; and any other statement that may predict, forecast, indicate or imply future plans, intentions, levels of activity, results, performance or achievements.

Forward-looking statements are not a guarantee of future performance. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve statements about the future and are inherently uncertain, and the Company’s actual results, achievements or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to herein and in the Company’s most recent Annual Information Form under the heading “Risk Factors”.

The Company’s forward-looking statements are based on the assumptions, beliefs, expectations and opinions of management on the date the statements are made, many of which may be difficult to predict and beyond the Company’s control. In connection with the forward-looking statements contained in this press release and in the AIF, the Company has made certain assumptions about, among other things: continued effectiveness of the measures taken by the Company to mitigate the possible impact of COVID-19 on its workforce and operations; favourable equity and debt capital markets; the ability to raise any necessary additional capital on reasonable terms to advance the production, development and exploration of the Company’s properties and assets; future prices of copper, gold and other metal prices; the timing and results of exploration and drilling programs; the accuracy of any mineral reserve and mineral resource estimates; the geology of the Caraíba Operations, the Xavantina Operations and the Tucumã Project being as described in the respective technical report for each property; production costs; the accuracy of budgeted exploration, development and construction costs and expenditures; the price of other commodities such as fuel; future currency exchange rates and interest rates; operating conditions being favourable such that the Company is able to operate in a safe, efficient and effective manner; work force continuing to remain healthy in the face of prevailing epidemics, pandemics or other health risks (including COVID-19), political and regulatory stability; the receipt of governmental, regulatory and third party approvals, licenses and permits on favourable terms; obtaining required renewals for existing approvals, licenses and permits on favourable terms; requirements under applicable laws; sustained labour stability; stability in financial and capital goods markets; availability of equipment; positive relations with local groups and the Company’s ability to meet its obligations under its agreements with such groups; and satisfying the terms and conditions of the Company’s current loan arrangements. Although the Company believes that the assumptions inherent in forward-looking statements are reasonable as of the date of this press release, these assumptions are subject to significant business, social, economic, political, regulatory, competitive and other risks and uncertainties, contingencies and other factors that could cause actual actions, events, conditions, results, performance or achievements to be materially different from those projected in the forward-looking statements. The Company cautions that the foregoing list of assumptions is not exhaustive. Other events or circumstances could cause actual results to differ materially from those estimated or projected and expressed in, or implied by, the forward-looking statements contained in this press release. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Forward-looking statements contained herein are made as of the date of this press release and the Company disclaims any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or results or otherwise, except as and to the extent required by applicable securities laws.

CAUTIONARY NOTES REGARDING MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES

Unless otherwise indicated, all reserve and resource estimates included in this press release and the documents incorporated by reference herein have been prepared in accordance with National Instrument 43-101, Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (the “SEC”), and reserve and resource information included herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, this press release and the documents incorporated by reference herein use the terms “measured resources,” “indicated resources” and “inferred resources” as defined in accordance with NI 43-101 and the CIM Standards.

Further to recent amendments, mineral property disclosure requirements in the United States (the “U.S. Rules”) are governed by subpart 1300 of Regulation S-K of the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”) which differ from the CIM Standards. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system (the “MJDS”), Ero is not required to provide disclosure on its mineral properties under the U.S. Rules and will continue to provide disclosure under NI 43-101 and the CIM Standards. If Ero ceases to be a foreign private issuer or loses its eligibility to file its annual report on Form 40-F pursuant to the MJDS, then Ero will be subject to the U.S. Rules, which differ from the requirements of NI 43-101 and the CIM Standards.

Pursuant to the new U.S. Rules, the SEC recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources.” In addition, the definitions of “proven mineral reserves” and “probable mineral reserves” under the U.S. Rules are now “substantially similar” to the corresponding standards under NI 43-101. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that any measured mineral resources, indicated mineral resources, or inferred mineral resources that Ero reports are or will be economically or legally mineable. Further, “inferred mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Under Canadian securities laws, estimates of “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms under the U.S. Rules are “substantially similar” to the standards under NI 43-101 and CIM Standards, there are differences in the definitions under the U.S. Rules and CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that Ero may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had Ero prepared the reserve or resource estimates under the standards adopted under the U.S. Rules.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Arnold Goldstein Executes Sell Order: Offloads $67K In Radiant Logistics Stock

It was reported on October 1, that Arnold Goldstein, Chief Commercial Officer at Radiant Logistics RLGT executed a significant insider sell, according to an SEC filing.

What Happened: A Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday outlined that Goldstein executed a sale of 10,584 shares of Radiant Logistics with a total value of $67,843.

The latest market snapshot at Wednesday morning reveals Radiant Logistics shares up by 0.47%, trading at $6.4.

About Radiant Logistics

Radiant Logistics Inc operates as a third-party logistics company, providing multi-modal transportation and logistics services to customers based in the United States and Canada. The company offers domestic and international air and ocean freight forwarding services and freight brokerage services including truckload services, less-than-truckload (LTL) services, and intermodal services. It has two geographic operating segments: the United States and Canada. Maximum revenue is generated in the United States.

A Deep Dive into Radiant Logistics’s Financials

Revenue Challenges: Radiant Logistics’s revenue growth over 3 months faced difficulties. As of 30 June, 2024, the company experienced a decline of approximately -11.28%. This indicates a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Evaluating Earnings Performance:

-

Gross Margin: The company excels with a remarkable gross margin of 17.72%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Radiant Logistics’s EPS is below the industry average. The company faced challenges with a current EPS of 0.1. This suggests a potential decline in earnings.

Debt Management: Radiant Logistics’s debt-to-equity ratio is below the industry average at 0.28, reflecting a lower dependency on debt financing and a more conservative financial approach.

Navigating Market Valuation:

-

Price to Earnings (P/E) Ratio: Radiant Logistics’s current Price to Earnings (P/E) ratio of 39.81 is higher than the industry average, indicating that the stock may be overvalued according to market sentiment.

-

Price to Sales (P/S) Ratio: The P/S ratio of 0.39 is lower than the industry average, implying a discounted valuation for Radiant Logistics’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a below-average EV/EBITDA ratio of 11.45, Radiant Logistics presents an opportunity for value investors. This lower valuation may attract investors seeking undervalued opportunities.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Exploring Key Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Radiant Logistics’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Investors Look To Gold As Middle East Tensions Rise: How Israel-Iran Conflict Could Impact Prices

Amid the fallout from Iran’s missile attack against Israel on Tuesday, market observers are closely watching the unfolding conflict and its possible effects on gold prices.

What Happened: Iran fired 100 to 200 missiles at Israel on Tuesday. The attack came following several Israeli strikes on the Lebanon-based Hezbollah, an Iranian proxy.

Israel has been at war with Hamas, also supported by Iran, since Oct. 7, 2023, following a Hamas terrorist attack that left over 1,000 Israelis dead. Israel’s subsequent military campaign against Hamas in Gaza resulted in a reported death toll of over 40,000, according to the Gaza Health Ministry.

Iran’s most significant geopolitical rival, Saudi Arabia, has normalized relations with Israel in recent years with American support. The Iranians and Saudis have already engaged in proxy warfare in Yemen, among other countries, for decades. The most recent developments, however, point to a possible direct warfare between Middle Eastern spheres of influence.

The United States and its allies are particularly concerned with Iran’s nuclear development.

Impact On Gold: Investors flock to gold during times of economic and geopolitical uncertainty. Financial markets might experience heightened volatility during such a conflict, with investors seeking safer alternatives. A confrontation between Israel and Iran would likely increase demand for gold, driving up prices.

Further conflict in the Middle East could disrupt oil supplies, leading to higher global energy prices, which might contribute to inflation. Since gold is often seen as a hedge against inflation, this could further boost demand for gold.

While it is yet unclear whether Iran’s attack on Israel will escalate to something larger, any news seemingly pointing in that direction will send gold prices higher.

Gold Price Action: The SPDR Gold Trust GLD, iShares Gold Trust IAU and SPDR Gold MiniShares Trust GLDM are among the largest gold ETFs.

While gold prices moved higher following Iran’s military action on Tuesday, gains quickly subsided. The SPDR Gold Trust is trading just 0.44% higher than it did on Monday.

Gold’s muted price action could indicate one of two things. Investors may already have priced in the likelihood of war breaking out in the Middle East. Thus, Tuesday’s missile attack might not have surprised market observers, who are already weary of possible warfare.

Alternatively, investors could be skeptical of the likelihood of the conflict between Iran and Israel escalating further. Several scares in Middle Eastern relations in recent years have not amounted to large-scale conflict.

Regardless, gold has had a remarkable year, hovering near an all-time high price. The commodity is trading 28% higher in 2024 and has increased 44.17% in the last 12 months.

Also Read:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Strategic Play: Sarah O Moore Acquires Cracker Barrel Old Stock Options to Portfolio

A substantial acquisition of company stock options by Sarah O Moore, SVP & Chief Marketing Officer at Cracker Barrel Old CBRL was reported on September 30, based on a new SEC filing.

What Happened: In a Form 4 filing with the U.S. Securities and Exchange Commission on Monday, Moore, SVP & Chief Marketing Officer at Cracker Barrel Old, acquired stock options for 4,206 shares of CBRL. These options provide Moore with the right to purchase the company’s stock at $45.96 per share.

As of Tuesday morning, Cracker Barrel Old shares are up by 1.46%, with a current price of $46.01. This implies that Moore’s 4,206 shares have a value of $210.

Unveiling the Story Behind Cracker Barrel Old

Cracker Barrel Old Country Store Inc operates hundreds of full-service restaurants throughout the United States. Its restaurants are open for breakfast, lunch, and dinner, with menus that offer home-style country food. Cracker Barrel’s biggest input costs are beef, dairy, fruits and vegetables, pork, and poultry. The company purchases its food products from a few different vendors on a cost-plus basis. All restaurants are located in freestanding buildings and include gift shops, which contribute roughly one fourth of total company revenue. Apparel and accessories are the company’s biggest revenue generators in the retail segment of the business.

Key Indicators: Cracker Barrel Old’s Financial Health

Revenue Growth: Over the 3 months period, Cracker Barrel Old showcased positive performance, achieving a revenue growth rate of 6.89% as of 31 July, 2024. This reflects a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Exploring Profitability:

-

Gross Margin: With a high gross margin of 32.1%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Cracker Barrel Old’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 0.82.

Debt Management: Cracker Barrel Old’s debt-to-equity ratio is below the industry average. With a ratio of 2.73, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 24.78 is lower than the industry average, implying a discounted valuation for Cracker Barrel Old’s stock.

-

Price to Sales (P/S) Ratio: The P/S ratio of 0.29 is lower than the industry average, implying a discounted valuation for Cracker Barrel Old’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Cracker Barrel Old’s EV/EBITDA ratio, lower than industry averages at 12.96, indicates attractively priced shares.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

Considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Understanding Crucial Transaction Codes

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Cracker Barrel Old’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

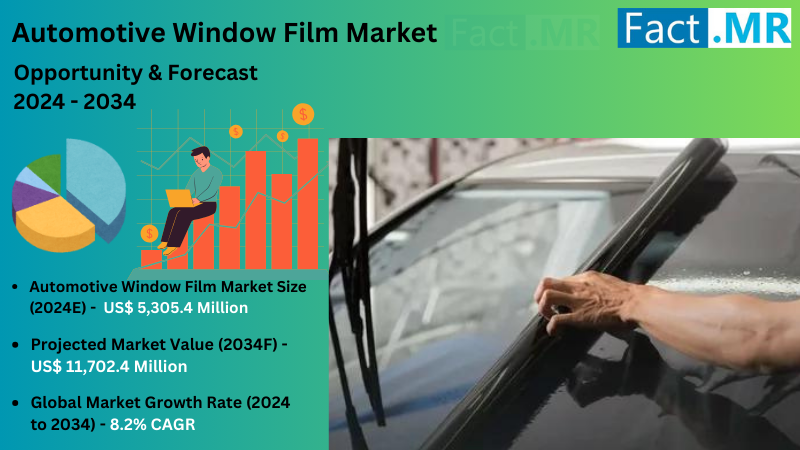

Automotive Window Film Market is Projected to Grow at a 8.2% CAGR, Reaching US$ 11,702.4 Million by 2034 | Fact.MR Report

Rockville, MD, Oct. 02, 2024 (GLOBE NEWSWIRE) — The global automotive window film market is estimated at US$ 5,305.4 million in 2024, projected to grow steadily with an 8.2% CAGR through 2034. The market is projected at a valuation of US$ 11,702.4 million by 2034. The market is experiencing significant growth driven by a convergence of consumer demands, technological innovations, and industry trends.

The surge in market adoption is notably attributed to the increasing demand in key countries, focusing on the United States and Canada. Consumers are increasingly seeking window film solutions that offer enhanced safety, comfort, and aesthetic benefits for their vehicles.

One notable trend influencing the market is the rising popularity of self-tinting films. These innovative films, also known as smart or dynamic films, allow users to adjust the tint level based on external conditions. This technology provides improved control over privacy, glare reduction, and UV protection, aligning with the modern consumer’s preference for convenience and customization.

The steady expansion of the passenger vehicles segment significantly contributes to the market’s growth. This expansion is fueled by a global increase in demand for personal transportation, driven by factors such as rising disposable incomes and the growing affluence of the middle class. Urbanization and evolving lifestyles further contribute to the preference for individual mobility, sustaining the demand for automotive window films.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=9518

Advancements in film technology play a pivotal role in the industry’s growth. Nanotechnology and ceramic coatings, among other innovations, enhance the performance, durability, and overall effectiveness of automotive window films. These technological developments not only meet consumer expectations for advanced solutions but also contribute to the market’s competitiveness.

Regulatory considerations and a growing emphasis on environmental consciousness also shape the trajectory of the market. Adherence to safety standards and regulations promoting occupant protection in vehicles encourages the adoption of window films, particularly those that prioritize compliance. With a blend of technological advancements, regulatory adherence, and consumer preferences, the global market is poised for sustained growth as the market continues to evolve.

Key Takeaways from Market Study:

- North America’s automotive window film market is expected to rise at a CAGR of 8.4% through 2034.

- The United States to hold a market share of 3% in 2024, expected to be valued at US$ 1,488.3 million.

- The industry in China is expected to rise at a CAGR of 10% through 2034.

- By technology, the self-tinting films to hold a market share of 3% in 2024.

- The passenger vehicles under the vehicle category accounted for a market share of 2% in 2024.

“The growing awareness among consumers regarding the safety benefits of automotive window films and the desire for enhanced safety, including shatter resistance and glare reduction, is significantly influencing purchasing decisions”, says a Fact MR. analyst.

Leading Players Driving Innovation in the Automotive Window Film Market:

The Key players of the automotive window film market is 3M, Purlfrost Inc., Avery Dennison Corporation, The Window Film Company Inc., Polytronix Inc., Lintec Corporation, American Standard Window Film, Eastman Chemical Company, Solar Control Films Inc., Avery Dennison.

Competitive Landscape:

Established players and innovative entrants mark the competitive landscape of the market. Major companies leverage their experience, global presence, and diversified product offerings to maintain a strong market position.

Smaller, niche players focus on specialized solutions, contributing to a dynamic market. Technological advancements, pricing strategies, and adherence to regulatory standards influence the industry’s competitiveness, reflecting a balance between industry giants and agile newcomers.

Some of the recent developments are:

- In June 2023, Toray Industries, Inc. developed a high heat-insulating solar control film, PICASUS, for advanced mobility applications.

- In February 2023, IVIOS announced the launch of a premium quality paint protection film, KAIZER Z12.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=9518

Automotive Window Film Industry News:

- Ai-Red Technology (Dalian) Co., Ltd. is a well-known manufacturer that specializes in paint protection and window film for automotive and architectural applications in the Asia Pacific region. Eastman Chemical Company purchased the company in February 2023.

- This calculated acquisition demonstrates Eastman’s commitment to supporting industry expansion in the performance film industry and bolstering its position in the growing window film and paint protection industries.

- Toray Industries, Inc. created an exceptional polyethylene terephthalate (PET) film in December 2022 that is especially suited for coatings that are solvent-free and water-based.

- This novel PET film not only solved environmental issues but also offered the possibility of removing solvent-derived carbon dioxide emissions from the atmosphere.

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the automotive window film market for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on By Technology (Self-Tinting Films, Switchable Films), By Vehicle Category (Passenger Vehicles, Commercial Vehicles), By Region (North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa)

Check out More Related Studies Published by Fact.MR:

Motorcycle Filter Market: Size is forecasted to expand at a CAGR of 5.1% to reach a valuation of US$ 6.36 billion by the end of 2034.

Tire Pressure Sensor and Airbag Sensor Market: Size is expected to grow at a compound annual growth rate (CAGR) of 6.7%, from a valuation of US$ 5.56 billion in 2024 to US$ 10.63 billion by 2034.

Automotive Battery Market: Size is expected to grow at a compound annual growth rate (CAGR) of 6.1%, from US$ 52.71 billion in 2024 to US$ 95.29 billion by 2034.

Two Wheeler Accessory Market: Size is set to reach a valuation of US$ 40.64 billion in 2024 and further expand at a CAGR of 5.1% to end up at US$ 66.83 billion by the year 2034.

Recreational Vehicle Market: Size is estimated to be valued at US$ 50.33 billion in 2024 and is forecasted to expand at a CAGR of 4.3% to reach US$ 76.68 billion by 2034.

Motorized Quadricycle Market: Size is set to reach US$ 1.21 billion in 2024 and expand at a CAGR of 14.7% to end up at US$ 4.76 billion by the end of 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.